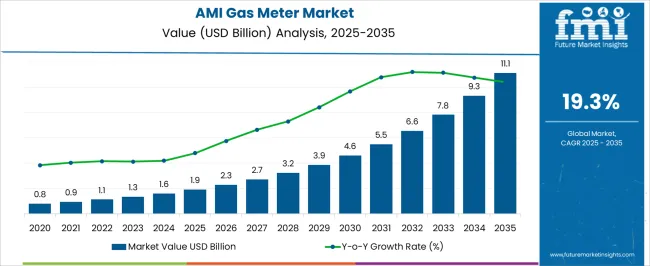

The AMI gas meter market, valued at USD 1.9 billion in 2025 and projected to reach USD 11.1 billion by 2035 with a CAGR of 19.3%, illustrates a market in a rapid growth phase that is transitioning from early adoption to mainstream deployment. In the initial stage, adoption was primarily driven by utilities seeking enhanced operational efficiency, real-time consumption monitoring, and remote data collection capabilities.

As the market progresses, the adoption lifecycle enters the growth phase characterized by accelerated installation of smart meters across residential, commercial, and industrial segments. Technological enhancements, such as advanced communication modules, integration with IoT platforms, and improved data analytics capabilities, have contributed to increased customer confidence and wider acceptance. Standardization of communication protocols and regulatory incentives in multiple regions further support the expansion, enabling utilities to implement large-scale deployments while reducing operational expenditure. By the mid-2020s, the market exhibits characteristics of early majority adoption, with utilities prioritizing large-scale rollouts to meet energy efficiency and regulatory compliance targets. The later years toward 2035 are expected to see maturation of the market as penetration reaches near-saturation in developed regions, while emerging markets continue high-growth adoption. The market demonstrates a typical S-curve adoption lifecycle, where early adoption is followed by rapid growth and eventual stabilization, with technology innovation and regulatory support acting as primary drivers.

| Metric | Value |

|---|---|

| AMI Gas Meter Market Estimated Value in (2025 E) | USD 1.9 billion |

| AMI Gas Meter Market Forecast Value in (2035 F) | USD 11.1 billion |

| Forecast CAGR (2025 to 2035) | 19.3% |

The AMI gas meter market represents a specialized segment within the global smart metering and utility management industry, emphasizing automated data collection, real-time monitoring, and operational efficiency. Within the broader gas metering and measurement sector, it accounts for about 5.5%, driven by adoption across residential, commercial, and industrial consumers. In the advanced metering infrastructure (AMI) and smart grid segment, it holds nearly 4.9%, reflecting integration with network management, demand response, and billing automation systems. Across the utility management and energy efficiency services market, the share is 4.3%, supporting accurate consumption tracking, leak detection, and predictive maintenance.

Within the IoT-enabled infrastructure and smart city solutions category, it represents 3.8%, highlighting adoption for remote monitoring, data analytics, and enhanced operational control. In the energy services and digital utility management sector, it secures 3.4%, emphasizing enhanced service delivery, compliance, and system reliability. Recent developments in this market have focused on digitalization, IoT integration, and advanced analytics. Innovations include wireless-enabled meters, cloud-based monitoring, and predictive maintenance tools for improved network performance. Key players are collaborating with utility providers, IoT technology firms, and energy management solution vendors to enhance operational efficiency and reduce manual intervention. Adoption of real-time consumption tracking, remote shutoff capabilities, and integration with demand-side management platforms is gaining traction to optimize energy usage and reduce losses. The secure communication protocols, modular designs, and interoperability with existing grid infrastructure are being deployed to ensure seamless integration and data accuracy.

The market growth is being driven by rising energy consumption, the need for accurate billing, and the growing emphasis on energy conservation and efficiency.

Technological advancements in metering infrastructure, including enhanced communication protocols and real-time data monitoring, are further accelerating adoption. Utilities and municipalities are progressively investing in smart grid technologies to improve operational efficiency and customer service.

The future outlook is positive, with increased government support and regulations promoting smart metering initiatives. Integration with IoT platforms and data analytics solutions is expected to open new avenues for growth by enabling predictive maintenance and advanced usage analytics.

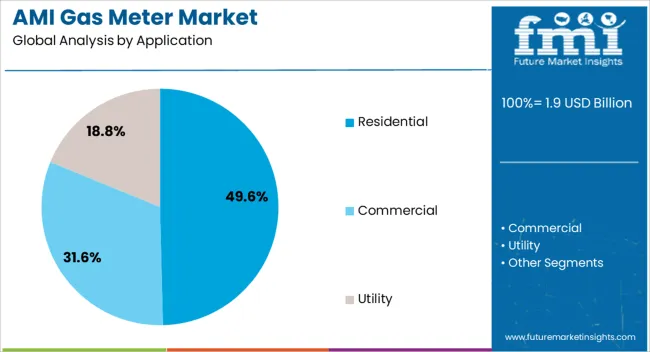

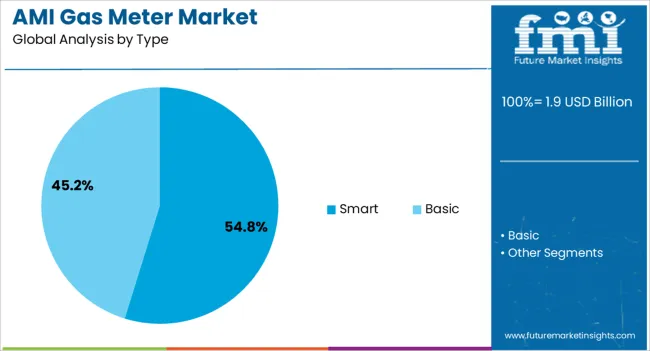

The AMI gas meter market is segmented by application, type, and geographic regions. By application, the AMI gas meter market is divided into Residential, Commercial, and Utility. In terms of type, the AMI gas meter market is classified into Smart and Basic. Regionally, the AMI gas meter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The residential application segment is estimated to hold 49.6% of the AMI Gas Meter market revenue in 2025, making it the dominant application area. This leadership is attributed to the growing preference for automated metering in residential sectors aimed at improving billing accuracy and reducing manual intervention.

The increased deployment of smart meters in homes supports enhanced energy management and consumer awareness, contributing to demand. Additionally, government mandates encouraging the adoption of smart meters in residential properties have bolstered this segment.

The ability of AMI gas meters to provide real-time consumption data and facilitate remote monitoring has been pivotal in expanding their use in residential environments, where efficient resource management and cost savings are key priorities.

The smart type segment is anticipated to account for 54.8% of the overall AMI Gas Meter market revenue in 2025, positioning it as the leading meter type. This prominence is due to the advanced capabilities of smart gas meters to deliver accurate, real-time data transmission and two-way communication between utilities and end-users.

The segment’s growth has been encouraged by increasing investments in smart grid infrastructure and the rising need for remote monitoring and automated meter reading. The ability to detect leaks, monitor consumption patterns, and enable dynamic pricing models has made smart meters preferable over conventional mechanical meters.

As utilities seek to enhance operational efficiency and comply with regulatory requirements, the adoption of smart meters continues to gain momentum, reinforcing this segment’s market dominance.

The market has witnessed significant growth as utilities and consumers adopt advanced metering infrastructure to enhance operational efficiency, accuracy, and energy management. AMI gas meters enable two-way communication between utility providers and end users, allowing real time monitoring of consumption, automated billing, and leak detection. Rising emphasis on smart grid modernization, energy conservation, and digitalization has accelerated adoption globally. Integration with IoT platforms and cloud-based analytics provides actionable insights for predictive maintenance and demand management. Regulatory support, particularly in developed regions, encourages utilities to replace legacy meters with AMI systems.

The deployment of AMI gas meters has been closely linked with smart grid initiatives and modernization programs. Utility providers integrate AMI systems to optimize gas distribution, reduce operational losses, and improve billing accuracy. Two-way communication capabilities allow utilities to detect anomalies, manage peak loads, and remotely control metering devices. Smart grid integration ensures enhanced network efficiency, reduced energy theft, and improved customer service. The adoption of digital twin models and cloud-based data analytics has enabled predictive maintenance and load forecasting. Residential, commercial, and industrial sectors benefit from accurate consumption tracking, cost optimization, and improved transparency, which collectively drive the demand for AMI gas meters.

Continuous innovation in sensor technology, communication protocols, and data analytics has enhanced the reliability and performance of AMI gas meters. Modern meters employ ultrasonic or diaphragm-based measurement techniques to improve accuracy and reduce mechanical wear. Integration with IoT platforms enables remote diagnostics, automated reporting, and energy usage insights. Advanced cybersecurity measures ensure safe transmission of sensitive consumption data. Metering solutions are increasingly compatible with smart home systems, cloud analytics, and mobile applications, allowing real time monitoring for both utilities and end users. These technological enhancements increase operational efficiency, reduce maintenance costs, and provide scalability for large network deployments, reinforcing the attractiveness of AMI gas meters.

Government policies and energy regulations have played a pivotal role in driving the AMI gas meter market. Mandates for accurate metering, emission monitoring, and energy efficiency encourage utilities to replace traditional meters with advanced systems. Subsidies, tax incentives, and grants for smart grid infrastructure reduce upfront deployment costs, making AMI systems economically viable. Regulatory frameworks in North America, Europe, and parts of Asia promote interoperability, standardization, and performance verification, increasing consumer confidence. Policy support ensures long term commitment from utilities and accelerates technology adoption, while aligning with national energy conservation and decarbonization targets, strengthening the overall market outlook.

Despite significant advantages, the meter market faces challenges related to high initial deployment costs, integration complexity, and infrastructure limitations. Retrofitting existing gas networks with advanced meters requires substantial investment in hardware, software, and training. Compatibility with legacy infrastructure can present technical difficulties, while remote or rural regions may face connectivity constraints. Data security and privacy concerns also necessitate robust cybersecurity protocols. Utilities must balance cost recovery with regulatory compliance and customer acceptance.

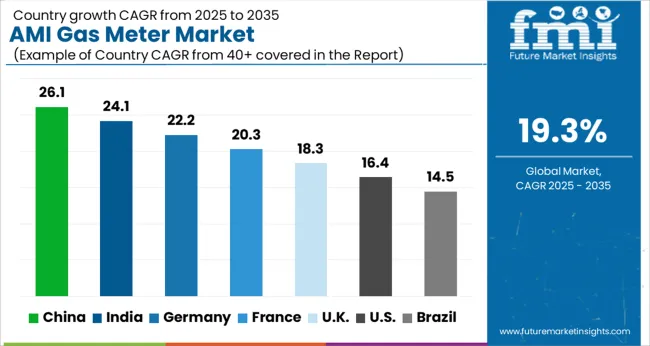

| Country | CAGR |

|---|---|

| China | 26.1% |

| India | 24.1% |

| Germany | 22.2% |

| France | 20.3% |

| UK | 18.3% |

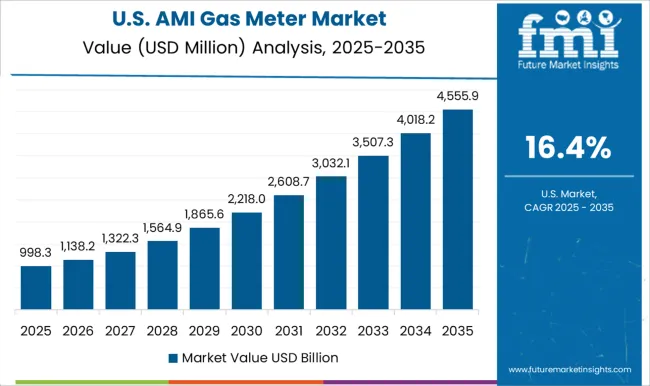

| USA | 16.4% |

| Brazil | 14.5% |

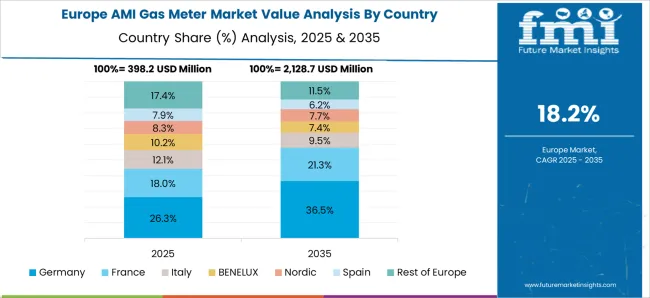

The market is set to experience significant growth at a CAGR of 19.3% from 2025 to 2035, reflecting rising adoption of smart metering solutions and utility modernization efforts. Germany recorded 22.2%, driven by regulatory mandates and infrastructure upgrades, while India follows with 24.1%, supported by rapid urban expansion and smart city initiatives. China leads with 26.1%, reflecting large-scale deployments and government-backed digital metering programs. The United Kingdom at 18.3 and the United States at 16.4% are progressing steadily, driven by advanced analytics integration and energy efficiency initiatives. These nations collectively illustrate global trends in deploying connected, efficient, and automated gas metering technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to grow at a CAGR of 26.1%, driven by smart city initiatives, digital metering programs, and energy efficiency regulations. Adoption has been reinforced by government mandates for automatic meter reading, integration with IoT platforms, and expansion of urban gas infrastructure. Domestic manufacturers focus on advanced communication modules, real time monitoring, and reliable data collection to optimize consumption tracking. Investments in smart grids and industrial gas management further accelerate market demand. The outlook remains robust as China continues to modernize energy distribution and promote smart metering across residential and commercial sectors.

India is expected to record a CAGR of 24.1%, supported by government programs promoting smart metering, energy conservation, and digital utility management. Adoption has been reinforced by demand from urban gas distribution networks and industrial sectors seeking accurate consumption tracking. Domestic and international manufacturers focus on communication enabled meters, integration with utility management systems, and secure data transmission. The market is anticipated to expand as smart city initiatives and urban gas expansion continue across India, increasing both residential and industrial adoption of AMI gas meters.

Germany is projected to grow at a CAGR of 22.2%, driven by adoption in industrial facilities, residential utilities, and municipal smart metering programs. Implementation has been reinforced by strict energy efficiency regulations and integration of gas metering with advanced utility management platforms. German manufacturers focus on high precision measurement, digital communication, and long term reliability. Market growth is further supported by replacement of traditional meters and expansion of industrial gas networks, ensuring consistent adoption across both residential and commercial segments.

The United Kingdom market is expected to grow at a CAGR of 18.3%, supported by demand for automated metering, energy management, and accurate billing solutions. Adoption has been reinforced by utility programs replacing conventional meters with AMI systems, with emphasis on real time monitoring and integration with home energy management. Imported smart meters are widely deployed alongside domestic solutions to meet residential and commercial requirements. The market is anticipated to expand steadily as utility providers continue to modernize gas distribution networks across the U K.

The United States market is projected to expand at a CAGR of 16.4%, driven by modernization of gas distribution networks, smart grid integration, and industrial facility adoption. Implementation has been reinforced by utilities seeking efficient consumption monitoring, automated billing, and data analytics capabilities. Leading manufacturers such as Itron, Sensus, and Landis+Gyr provide high accuracy meters with advanced communication modules. Market growth is expected to continue as both residential and industrial sectors increasingly adopt smart metering for energy optimization.

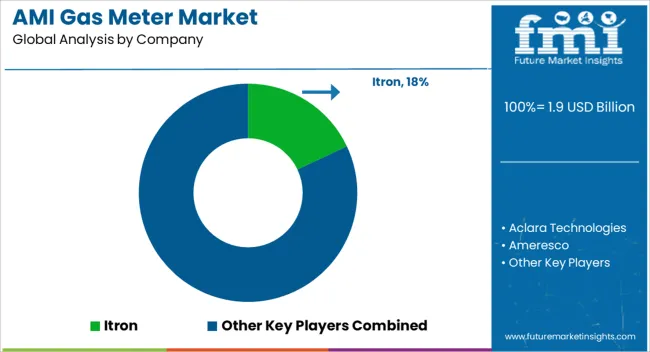

The market is characterized by strong competition among global smart metering technology providers, utility solution integrators, and industrial electronics companies. Major players such as Itron, Honeywell International, Landis+Gyr, Siemens, and Schneider Electric dominate through advanced metering infrastructure solutions, extensive distribution networks, and integrated software platforms that enable real-time consumption monitoring and energy management. Specialized smart metering companies, including Aclara Technologies, Apator, Zenner International, and Osaki Electric, compete by offering precision sensors, automated data collection, and compatibility with diverse gas distribution networks.

Companies like Azbil Kimmon, Chint Group, Core & Main, Diehl Stiftung & Co. KG, Holly Technology, Neptune Technology Group, Raychem RPG, Sensus, Waltero, and Wasion Group differentiate through regional expertise, tailored utility services, and support for IoT-enabled metering. Technological innovation, interoperability, cybersecurity features, and compliance with local and international regulatory standards influence market competitiveness. Strategic partnerships with utilities, investment in R&D for low-power and wireless communication technologies, and focus on customer support and service contracts are key factors enabling players to sustain and expand their market presence in the evolving smart gas metering landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Billion |

| Application | Residential, Commercial, and Utility |

| Type | Smart and Basic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Itron, Aclara Technologies, Ameresco, Apator, Azbil Kimmon, Chint Group, Core & Main, Diehl Stiftung & Co. KG, Holly technology, Honeywell International, Landis+Gyr, Neptune Technology Group, Osaki Electric, Raychem RPG, Schneider Electric, Sensus, Siemens, Waltero, Wasion Group, and Zenner International |

| Additional Attributes | Dollar sales by meter type and application, demand dynamics across residential, commercial, and industrial sectors, regional trends in smart metering adoption, innovation in real-time monitoring, remote connectivity, and data analytics, environmental impact of improved energy efficiency and reduced operational losses, and emerging use cases in demand response, predictive maintenance, and integration with smart grid infrastructure. |

The global AMI gas meter market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the AMI gas meter market is projected to reach USD 11.1 billion by 2035.

The AMI gas meter market is expected to grow at a 19.3% CAGR between 2025 and 2035.

The key product types in AMI gas meter market are residential, commercial and utility.

In terms of type, smart segment to command 54.8% share in the AMI gas meter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Amine Market Size and Share Forecast Outlook 2025 to 2035

Amine Based Carbon Capture Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Amino Resin Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amine Hardener Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amino Acids Premixes Market

Amine Additives in Paints and Coatings Market

Amino Acid Metabolism Disorders Treatment Market Growth – Trends & Forecast 2024-2034

AMI Water Meter Market Size and Share Forecast Outlook 2025 to 2035

AMI Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Gaming Simulators Market Size and Share Forecast Outlook 2025 to 2035

Gaming Laptop Market Size and Share Forecast Outlook 2025 to 2035

Laminar Airflow Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Gaming Console Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA