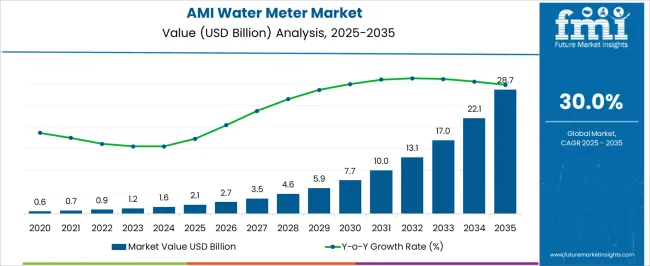

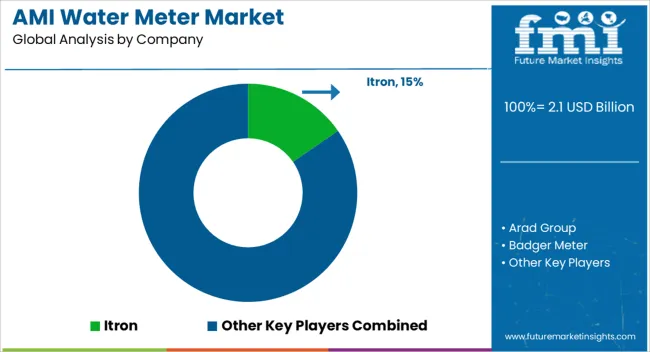

In 2025, the AMI water meter market is valued at USD 2.1 billion and is projected to reach USD 28.7 billion by 2035, growing at a CAGR of 30.0%. The absolute dollar opportunity over this period is USD 26.6 billion, representing the additional market potential from 2025 to 2035. This exceptional growth reflects the rapid adoption of advanced metering infrastructure and the increasing demand for efficient water management solutions.

Companies can capture this opportunity by expanding manufacturing capacity, establishing distribution networks, and targeting high-growth regions. The substantial market expansion offers a clear financial incentive for strategic investment over the next decade. From a business perspective, the USD 26.6 billion absolute dollar opportunity underscores immense revenue potential for both new entrants and established players. With the market increasing from USD 2.1 billion in 2025 to USD 28.7 billion in 2035 at a CAGR of 30.0%, firms can plan phased investments and scale operations strategically. This rapid growth allows companies to optimize supply chains, expand regional coverage, and increase product offerings to capture incremental revenue. By aligning business strategies with market demand, stakeholders can maximize returns and establish a strong competitive position throughout the ten-year growth trajectory.

| Metric | Value |

|---|---|

| AMI Water Meter Market Estimated Value in (2025 E) | USD 2.1 billion |

| AMI Water Meter Market Forecast Value in (2035 F) | USD 28.7 billion |

| Forecast CAGR (2025 to 2035) | 30.0% |

A breakpoint analysis for the AMI water meter market identifies critical thresholds where growth accelerates or strategic adjustments become essential. With the market valued at USD 2.1 billion in 2025 and projected to reach USD 28.7 billion by 2035 at a CAGR of 30.0%, early breakpoints appear around USD 5.9–7.7 billion. These levels represent the initial phase of rapid adoption, where rising demand for advanced metering infrastructure drives revenue opportunities. Recognizing these breakpoints enables companies to prioritize production expansion, strengthen distribution networks, and target high-growth regions to capture maximum incremental revenue during this accelerated growth period. Later-stage breakpoints occur between USD 17.0–22.1 billion as the market approaches maturity and competition intensifies.

Surpassing these thresholds may require firms to refine operational efficiency, optimize pricing strategies, and enhance customer engagement to sustain growth momentum. Monitoring these breakpoints allows businesses to anticipate shifts in market dynamics and adjust investments, marketing, and distribution strategies accordingly.

The AMI Water Meter market is experiencing robust expansion driven by the increasing global emphasis on efficient water management and resource conservation. The current scenario highlights a growing adoption of advanced metering infrastructure that enables real-time monitoring, accurate billing, and leak detection across residential and commercial sectors.

Rising urbanization, water scarcity concerns, and regulatory pressures to reduce water loss have accelerated the deployment of smart water meters. Investments in digital water networks and infrastructure modernization are further enhancing market growth prospects.

The market outlook remains positive as utilities and municipalities focus on sustainability goals and improved customer service through automated meter reading and data analytics. Future opportunities are expected from integration with IoT platforms and enhanced software capabilities that allow predictive maintenance and demand forecasting.

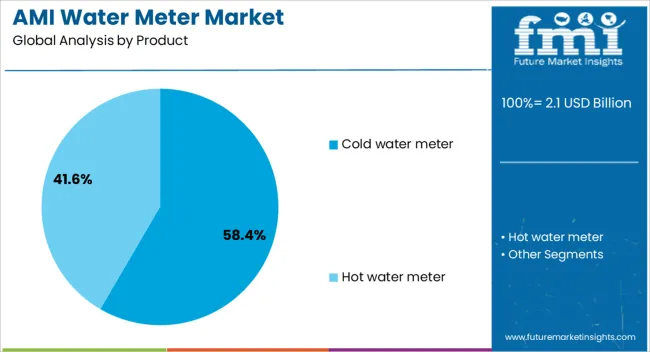

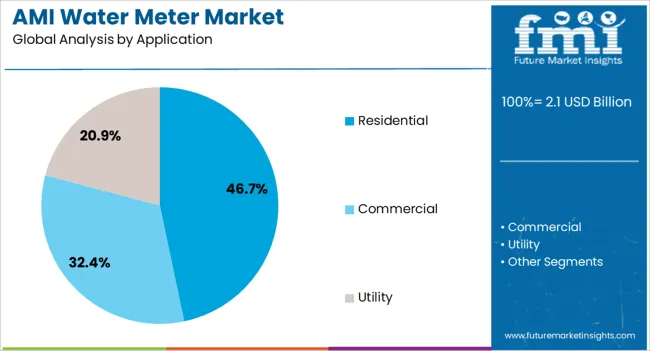

The ami water meter market is segmented by product, application, and geographic regions. By product, ami water meter market is divided into Cold water meter and Hot water meter. In terms of application, ami water meter market is classified into Residential, Commercial, and Utility. Regionally, the ami water meter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cold water meter product segment is expected to hold 58.4% of the AMI Water Meter market revenue in 2025, establishing it as the dominant product type. This leadership is driven by the widespread use of cold water in residential, commercial, and industrial applications, which requires precise measurement and monitoring.

Cold water meters are favored due to their reliability, ease of installation, and compatibility with existing water distribution systems. The growth of this segment has been supported by increasing replacement of traditional mechanical meters with smart alternatives that offer better accuracy and remote data collection.

Additionally, regulatory mandates aimed at enhancing water conservation have encouraged utilities to adopt cold water meters equipped with automated reading technologies The segment’s continued expansion is further enabled by technological advancements in sensor design and communication protocols that improve data transmission and meter lifespan.

The residential application segment is projected to account for 46.7% of the overall AMI Water Meter market revenue in 2025, making it the leading end-use category. This prominence is attributed to rising household water demand coupled with the growing need for accurate consumption monitoring and billing transparency.

Residential customers increasingly prefer smart water meters that provide timely data, enabling them to manage usage and detect leaks promptly. The push by water utilities to modernize aging infrastructure in residential areas has accelerated market penetration.

Moreover, government initiatives promoting water conservation and efficient resource management in urban and suburban communities have supported growth in this segment. The ability to monitor consumption patterns and implement tiered pricing models remotely is further driving the adoption of smart meters in residential settings, positioning this segment for sustained market leadership.

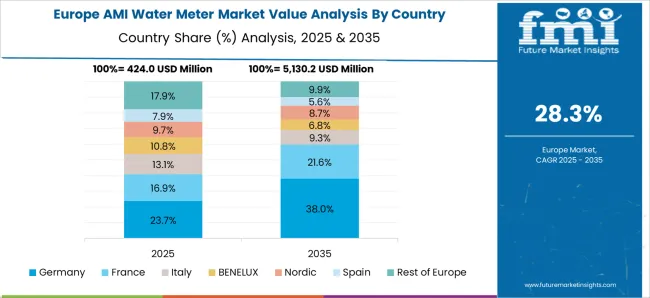

The AMI water meter market is growing due to rising urbanization, smart city initiatives, and the need for efficient water management. Europe and North America lead with advanced AMI systems integrating real-time monitoring, remote reading, and leak detection. Asia-Pacific shows rapid growth driven by expanding municipal water networks and government investments. Manufacturers differentiate through data accuracy, communication protocols, and durability. Market growth is fueled by regulatory mandates, aging infrastructure upgrades, and rising water conservation awareness, with regional adoption influenced by network scale, cost sensitivity, and technological readiness.

AMI water meters vary in measurement precision, communication protocols, and compatibility with utility management systems. Europe and North America prioritize high-accuracy meters with IoT-enabled communication, remote reading capabilities, and integration into existing SCADA systems. Asia-Pacific often adopts cost-efficient meters suitable for expanding municipal networks, balancing affordability with accuracy. Differences in meter technology affect billing accuracy, leak detection, and operational efficiency. Leading global suppliers focus on smart, durable, and reliable meters, while regional producers offer budget-friendly options. These contrasts influence regional adoption rates, procurement decisions, and the ability of utilities to optimize water distribution and detect losses efficiently.

The success of AMI water meters depends on integration with smart grids, automated systems, and data analytics platforms. North America and Europe focus on high-throughput networks compatible with advanced utility management software, providing real-time analytics and predictive maintenance. Asia-Pacific markets are gradually integrating meters into smart city initiatives, often prioritizing rapid deployment and cost optimization. Differences in integration capabilities affect network scalability, data accuracy, and decision-making efficiency. Suppliers providing seamless integration with monitoring systems gain advantages in premium municipal projects, while regional manufacturers cater to emerging urban centers with simpler, modular solutions. Integration contrasts determine adoption speed, network efficiency, and long-term competitiveness in global and regional markets.

Water meter performance is affected by environmental conditions, including temperature fluctuations, water quality, and pressure variations. Europe and North America prioritize meters with high durability, corrosion resistance, and freeze protection for long service life. Asia-Pacific regions often deploy meters in variable environmental conditions, requiring robustness but at lower costs. Differences in durability affect maintenance costs, operational reliability, and replacement frequency. Leading manufacturers develop meters that withstand harsh environments while ensuring accurate readings, whereas regional producers focus on cost-effective designs with sufficient resilience. Durability and environmental adaptability influence adoption decisions, brand credibility, and long-term utility satisfaction.

Capital expenditure, installation complexity, and operational costs are key factors influencing AMI meter deployment. North America and Europe invest in high-performance, integrated systems with premium accuracy, accepting higher upfront costs for long-term efficiency. Asia-Pacific utilities prioritize affordable, modular solutions to expand coverage across large populations, balancing cost and performance. Differences in deployment budgets affect the selection of meter types, communication modules, and network scale. Suppliers offering flexible financing, scalable solutions, and low-maintenance designs gain competitive advantages, while regional producers target cost-conscious municipal projects. These contrasts determine market penetration, adoption rates, and the long-term growth trajectory of AMI water meter systems globally.

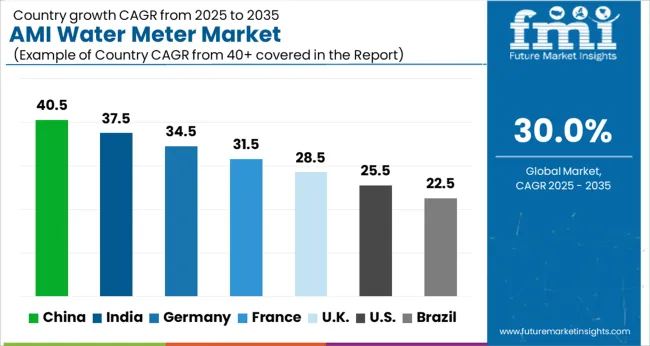

| Country | CAGR |

|---|---|

| China | 40.5% |

| India | 37.5% |

| Germany | 34.5% |

| France | 31.5% |

| UK | 28.5% |

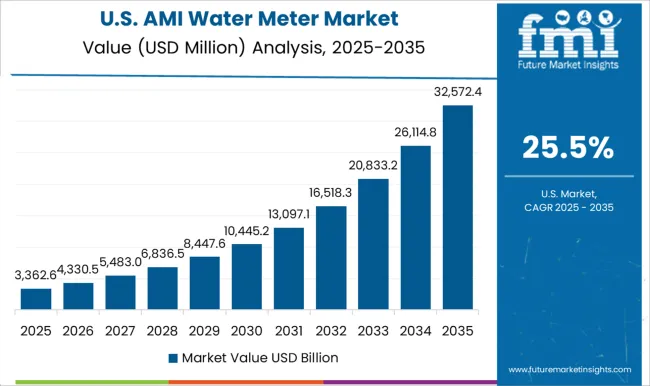

| USA | 25.5% |

| Brazil | 22.5% |

The global AMI (Advanced Metering Infrastructure) water meter market was projected to grow at a 30.0% CAGR through 2035, driven by demand in smart water management, utility monitoring, and residential and commercial metering applications. Among BRICS nations, China recorded 40.5% growth as large-scale production and deployment facilities were commissioned and compliance with metering and safety standards was enforced, while India at 37.5% growth saw expansion of manufacturing units to meet rising regional adoption. In the OECD region, Germany at 34.5% maintained substantial output under strict industrial and utility regulations, while the United Kingdom at 28.5% relied on moderate-scale operations for smart water management projects. The USA, expanding at 25.5%, remained a mature market with steady demand across residential, commercial, and municipal segments, supported by adherence to federal and state-level safety and quality standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

AMI water meter market in China is growing at a CAGR of 40.5%. Between 2020 and 2024, growth was driven by increasing urbanization, water management initiatives, and smart city projects. Governments and municipalities focused on digital water metering solutions to enhance efficiency, reduce wastage, and enable remote monitoring. Manufacturers developed advanced smart meters with real-time data transmission, leak detection, and automated billing integration. In the forecast period 2025 to 2035, growth is expected to accelerate with deployment of IoT-enabled, high-accuracy, and energy-efficient AMI systems across urban and semi-urban areas. Rising adoption of sustainable water management practices, government support for smart infrastructure, and expansion of industrial water monitoring will further drive market growth. China remains a global leader due to large population, rapid urban development, and advanced smart city initiatives.

The sodium hydrosulfite market in India is growing at a CAGR of 5.0%. From 2020 to 2024, market growth was supported by increasing demand in textile dyeing, paper bleaching, and water treatment applications. Domestic manufacturers focused on improving product quality and reducing production costs. The expansion of the textile and chemical processing industries created a steady demand. In the forecast period 2025 to 2035, growth is expected to continue with wider adoption of environmentally friendly and high-efficiency hydrosulfite products. Increasing regulatory standards, industrial modernization, and rising exports of treated products will further support market development. India is projected to maintain strong growth as an emerging market for sodium hydrosulfite in Asia.

AMI water meter market in the United Kingdom is growing at a CAGR of 28.5%. During 2020 to 2024, adoption was driven by urban water management modernization, residential smart metering programs, and regulatory compliance.

Manufacturers focused on high-accuracy, reliable, and remotely monitored meters with automated billing capabilities. In the forecast period 2025 to 2035, market growth is expected to continue moderately with deployment of IoT-enabled, predictive, and energy-efficient AMI systems across urban and suburban areas. Expansion of smart city initiatives, growing sustainability focus, and increasing water scarcity awareness will further support adoption. The United Kingdom market demonstrates stable growth with emphasis on technology integration, reliability, and environmental sustainability.

AMI water meter market in Germany is growing at a CAGR of 34.5%. Between 2020 and 2024, growth was supported by modernization of municipal water networks, industrial monitoring requirements, and environmental regulations. Manufacturers focused on high-accuracy, durable, and energy-efficient smart water meters with real-time data reporting and automated billing. In the forecast period 2025 to 2035, growth is expected to continue steadily with deployment of IoT-integrated, fully automated, and predictive maintenance-enabled AMI systems. Increasing sustainability initiatives, technological innovation, and government mandates for efficient water management will further support adoption. Germany remains a key European market due to advanced infrastructure, environmental focus, and strong regulatory standards.

AMI water meter market in the United States is growing at a CAGR of 25.5%. Historical period 2020 to 2024 saw growth fueled by municipal infrastructure upgrades, smart city programs, and increasing industrial water monitoring requirements. Manufacturers focused on high-performance, remotely monitored, and energy-efficient smart meters with real-time data analytics. In the forecast period 2025 to 2035, growth is expected to continue steadily with adoption of automated, IoT-integrated, and predictive maintenance-enabled systems. Growing adoption of digital water management, government initiatives for water efficiency, and industrial demand will further support market expansion. The United States market demonstrates consistent growth with emphasis on reliability, technology integration, and sustainable water management.

The AMI water meter market is supplied by Itron, Arad Group, Badger Meter, Diehl Stiftung & Co. KG, Honeywell International, Kamstrup, Landis+Gyr, Ningbo Water Meter, Sensus, Siemens, Sontex, and ZENNER International. Competition is defined by meter accuracy, communication protocols, durability, and data analytics integration. Itron and Kamstrup brochures highlight smart metering solutions with real-time data transmission and leak detection capabilities. Badger Meter and Sensus emphasize modular designs and compatibility with multiple network types. Diehl Stiftung & Co. KG and ZENNER datasheets specify flow measurement ranges, AMR/AMI compatibility, and robust housing for residential, commercial, and industrial applications.

Observed trends include remote monitoring, predictive maintenance, and enhanced customer billing efficiency. Supplier strategies focus on technological differentiation, network integration, and customer support. Siemens and Honeywell prioritize scalable solutions for municipal utilities and large industrial installations. Landis+Gyr and Arad Group target interoperability with existing infrastructure and standardized communication protocols. Kamstrup and Itron invest in cloud-based platforms, analytics dashboards, and automated alerts. Observed practices include leveraging partnerships with utility providers, offering installation services, and ensuring compliance with international metering standards to increase adoption across regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.1 Billion |

| Product | Cold water meter and Hot water meter |

| Application | Residential, Commercial, and Utility |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Itron, Arad Group, Badger Meter, Diehl Stiftung & Co. KG, Honeywell International, Kamstrup, Landis+Gyr, Ningbo Water Meter, Sensus, Siemens, Sontex, and ZENNER International |

| Additional Attributes | Dollar sales vary by meter type, including ultrasonic, electromagnetic, and mechanical AMI water meters; by communication technology, such as RF, PLC, and cellular; by application, spanning residential, commercial, and industrial water monitoring; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising water conservation initiatives, smart city developments, and demand for real-time consumption monitoring. |

The global AMI water meter market is estimated to be valued at USD 2.1 billion in 2025.

The market size for the AMI water meter market is projected to reach USD 28.7 billion by 2035.

The AMI water meter market is expected to grow at a 30.0% CAGR between 2025 and 2035.

The key product types in AMI water meter market are cold water meter and hot water meter.

In terms of application, residential segment to command 46.7% share in the AMI water meter market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Amine Market Size and Share Forecast Outlook 2025 to 2035

Amine Based Carbon Capture Market Size and Share Forecast Outlook 2025 to 2035

Amine Oxide Market Size and Share Forecast Outlook 2025 to 2035

Amino Resin Market Growth - Trends & Forecast 2025 to 2035

Amino Acids Market Growth - Trends & Forecast 2025 to 2035

Amidoamine Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amine Hardener Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Amino Acids Premixes Market

Amine Additives in Paints and Coatings Market

Amino Acid Metabolism Disorders Treatment Market Growth – Trends & Forecast 2024-2034

AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

AMI Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

Laminated Busbar Market Forecast and Outlook 2025 to 2035

Laminated Tubes Market Size and Share Forecast Outlook 2025 to 2035

Gaming Simulators Market Size and Share Forecast Outlook 2025 to 2035

Gaming Laptop Market Size and Share Forecast Outlook 2025 to 2035

Laminar Airflow Cabinet Market Size and Share Forecast Outlook 2025 to 2035

Laminated Glass Market Size and Share Forecast Outlook 2025 to 2035

Gaming Console Market Size and Share Forecast Outlook 2025 to 2035

Family Entertainment Center (FEC) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA