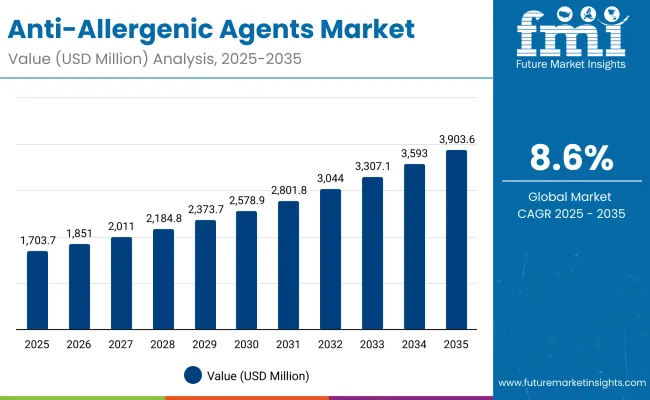

A valuation of USD 1,703.7 million in 2025 has been projected for the Anti-Allergenic Agents Market, which is anticipated to rise to USD 3,903.6 million by 2035. This growth reflects an addition of more than USD 2,199.9 million, representing a 2.3X increase in market size over the decade. A compound annual growth rate of 8.6% has been indicated, confirming the sector’s upward trajectory as skin sensitivity and allergen-free formulations continue to be prioritized by formulators.

Anti-Allergenic Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Allergenic Agents Market Estimated Value in (2025E) | USD 1,703.7 Million |

| Anti-Allergenic Agents Market Forecast Value in (2035F) | USD 3,903.6 Million |

| Forecast CAGR (2025 to 2035) | 8.60% |

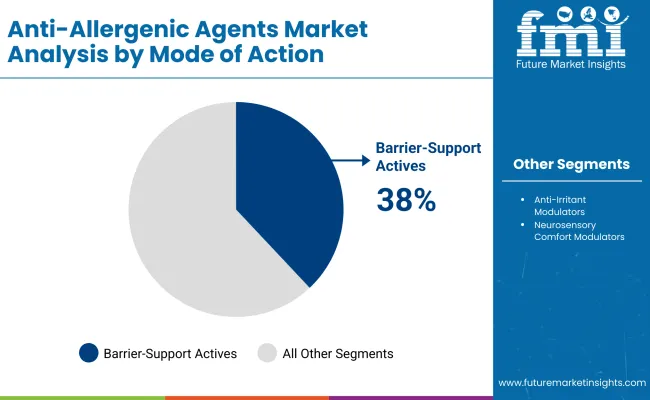

During the first half of the forecast period, from 2025 to 2030, the market is estimated to expand from USD 1,703.7 million to USD 2,578.9 million, contributing USD 875.2 million, which accounts for nearly 40% of total decade growth. This initial momentum is expected to be shaped by adoption of barrier-support actives, anticipated at 38.0% share in 2025, and the strong pull for botanical ingredients, capturing 62.0% share in 2025. These segments are projected to dominate ingredient sourcing and formulation pipelines as sustainability and efficacy remain key B2B purchase drivers.

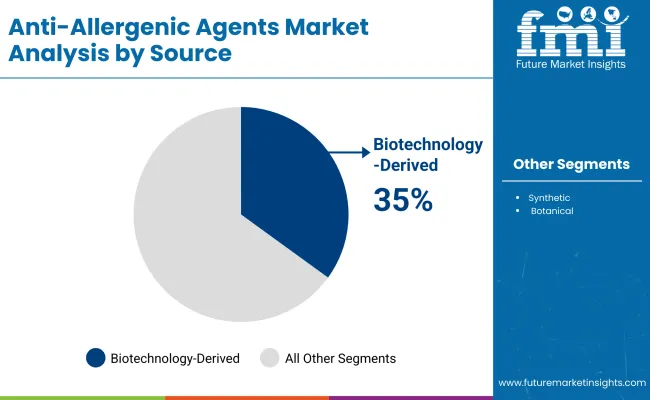

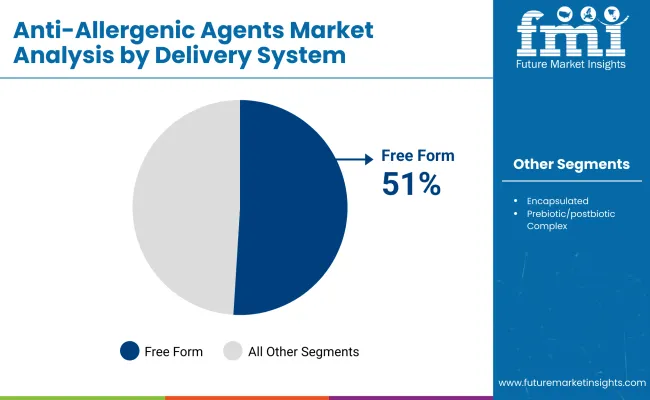

The second half of the period, from 2030 to 2035, is expected to deliver a sharper increase of USD 1,324.7 million, nearly 60% of total decade growth, as the market advances from USD 2,578.9 million to USD 3,903.6 million. This acceleration is anticipated to be powered by expanded adoption of biotechnology-derived actives and greater use of encapsulation systems. Free-form ingredients, leading with 51.0% share in 2025, are predicted to sustain their dominance, while encapsulated formats gain traction in premium formulations.

From 2025 to 2035, the market is expected to more than double in size, rising from USD 1,703.7 million to USD 3,903.6 million. Growth is projected to be driven by demand for allergen-free formulations, rising sensitivity concerns, and the shift toward sustainable sourcing. Botanical actives are anticipated to maintain dominance with 62.0% share in 2025, supported by strong consumer preference for plant-based raw materials. Biotechnology-derived agents are expected to accelerate in adoption as formulation houses seek higher purity, reproducibility, and regulatory compliance.

Regionally, the USA is projected to retain leadership in value terms, while Asia is expected to contribute disproportionately to growth, led by China, India, and Japan. Europe is anticipated to maintain a strong share, underpinned by regulatory-driven product innovation. The competitive landscape is expected to remain fragmented, with Symrise leading at 8.1% share in 2025 and other global and regional suppliers competing on innovation, botanical traceability, and delivery system technologies. Long-term advantage is projected to be captured by suppliers capable of integrating biotech, encapsulation, and clinical validation into their portfolios.

Growth in the Anti-Allergenic Agents Market is being driven by rising consumer awareness of allergen-induced skin sensitivities and the increasing demand for scientifically validated solutions in skincare and dermo cosmetics. The market is being supported by advancements in biotechnology-derived actives, which are offering higher purity and reproducibility for formulation houses. Botanical ingredients are being preferred as clean-label expectations continue to influence procurement decisions, while encapsulation technologies are enabling enhanced stability and targeted delivery of sensitive actives. Expansion of hypoallergenic product lines across skincare, baby care, and scalp care is reinforcing steady adoption in both developed and emerging regions. Regulatory pressures and retailer ingredient restrictions are compelling brands to adopt safer, clinically backed inputs, further elevating the role of anti-allergenic agents in new formulations. Over the forecast period, accelerated penetration in Asia-Pacific and rising dermo cosmetic consumption globally are expected to strengthen market growth momentum.

The Anti-Allergenic Agents Market has been segmented across multiple dimensions to capture the evolving procurement priorities of formulation houses. Key segments include mode of action, source, and delivery system, each shaping growth trajectories in distinct ways. Mode of action highlights the critical role of barrier-support actives and their contribution to skin defense against allergen triggers. Source-based classification underscores the rising importance of biotechnology-derived agents, driven by consistency and sustainability, alongside the continued dominance of botanical inputs. Delivery system segmentation emphasizes the balance between free form actives, valued for versatility, and encapsulated forms, which are gaining traction for targeted efficacy. Together, these segments reveal how innovation, clinical validation, and consumer-led demand for allergen-free solutions are expected to guide ingredient adoption through 2035.

| Mode of Action | Market Value Share, 2025 |

|---|---|

| Barrier-support actives | 38% |

| Others | 62.0% |

Barrier-support actives are estimated to contribute 38.0% of the Anti-Allergenic Agents Market in 2025, valued at USD 588.9 million. Their dominance is being supported by the growing reliance on barrier-repair solutions as the first line of defense against allergen triggers. Formulation houses are increasingly incorporating these agents to reinforce skin resilience and reduce sensitivity. Adoption is expected to rise as clinical validation continues to highlight their efficacy in reducing trans-epidermal water loss and improving tolerance in sensitive skin types. Competitive advantage is likely to be driven by suppliers capable of demonstrating reproducible results and compatibility with broader dermo cosmetic formulations. Over the forecast period, barrier-support actives are projected to remain essential to sensitive-skin product pipelines, sustaining strong demand growth globally.

| Source | Market Value Share, 2025 |

|---|---|

| Biotechnology-derived | 35% |

| Others | 65.0% |

Biotechnology-derived ingredients are projected to account for 35.0% share of the Anti-Allergenic Agents Market in 2025, valued at USD 566.7 million. Their adoption is being supported by higher purity, consistency, and reproducibility compared with conventional sources. Brands are increasingly prioritizing biotech-derived inputs to address regulatory scrutiny, minimize allergenic residues, and achieve standardized performance across product batches. Demand is expected to accelerate as biotech innovations enable novel prebiotic and postbiotic complexes that align with microbiome-friendly claims. Expansion of fermentation technologies is also likely to strengthen supply scalability and reduce cost volatility. Over the forecast period, biotechnology-derived actives are anticipated to capture a greater share as clean-label positioning, sustainability credentials, and clinical validation converge to shape procurement priorities among formulators.

| Delivery System | Market Value Share, 2025 |

|---|---|

| Free form | 51% |

| Others | 49.0% |

Free form actives are expected to hold 51.0% 2025,the largest share of the Anti-Allergenic Agents Market, corresponding to USD 533.3 million. Their dominance is being supported by their adaptability in a wide range of formulations and compatibility with different end-use categories such as skincare, baby care, and scalp care. Ease of integration without complex processing steps has positioned free form actives as the preferred choice for formulators seeking flexibility and speed to market. While encapsulated and advanced delivery formats are gaining ground, free form actives are anticipated to retain relevance due to their cost efficiency and broad-spectrum applicability. The segment’s leadership is projected to continue as formulators balance innovation with scalable, reliable ingredient solutions.

Complex formulation requirements and heightened regulatory oversight are challenging anti-allergenic ingredient adoption, even as formulation houses intensify efforts to integrate advanced botanical and biotech actives that enable hypoallergenic claims, clinical substantiation, and scalable supply across sensitive-skin and dermo cosmetic product pipelines.

Clinical Validation as a Procurement Catalyst

A significant driver is being observed in the growing emphasis on clinical validation as a prerequisite for ingredient adoption. Procurement decisions are increasingly being shaped by the ability of suppliers to provide patch-test data, multi-ethnic tolerance studies, and measurable reductions in stinging or erythema. These data-driven proof points are not only enabling marketing claims but are also being demanded by global retailers and regulators who require substantiated safety profiles. As brands reposition themselves around dermatological efficacy, ingredients backed by reproducible clinical datasets are expected to secure preferential specification. This trend is anticipated to strengthen supplier-formulator collaboration, ensuring that raw materials with verified outcomes are prioritized in the next generation of hypoallergenic product launches.

Supply Chain Vulnerability in Botanical Sourcing

A key restraint is being observed in the supply volatility of botanical actives that dominate current market share. Climatic variability, agricultural yield uncertainty, and the complexity of maintaining consistent allergen-residual profiles are creating procurement challenges for large-scale formulators. As traceability and sustainability become central to brand positioning, any fluctuation in quality or availability is expected to undermine formulator confidence. Regulatory tightening on contaminants and residues is also amplifying the need for standardized extracts, which adds cost and operational complexity for suppliers. Unless robust dual-sourcing strategies and controlled cultivation practices are implemented, reliance on botanicals could limit scalability, creating risks for global product rollouts that require uniform ingredient performance.

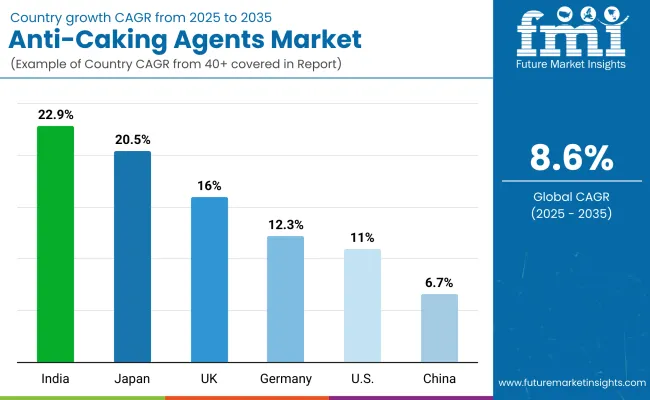

| Country | CAGR |

|---|---|

| China | 6.7% |

| USA | 11.0% |

| India | 22.9% |

| UK | 16.0% |

| Germany | 12.3% |

| Japan | 20.5% |

The Anti-Allergenic Agents Market demonstrates significant variations in growth dynamics across countries, shaped by regulatory environments, consumer sensitivity trends, and the scale of dermocosmetic adoption. India is projected to lead with a CAGR of 22.9% from 2025 to 2035, driven by expanding middle-class consumption, rising dermatological awareness, and rapid growth of organized retail formats. Japan follows with a robust CAGR of 20.5%, reflecting strong consumer emphasis on sensitive-skin solutions and a preference for clinically validated ingredients. The USA market is expected to expand at 11.0% CAGR, supported by advanced dermocosmetic adoption, retailer-driven ingredient standards, and the sustained momentum of premium skincare launches. Europe presents steady growth at 10.4%, with Germany (12.3%) and the UK (16.0%) reinforcing regional leadership through stringent compliance frameworks and innovation in hypoallergenic formulations. China, at 6.7% CAGR, is anticipated to witness moderate but steady growth, shaped by increasing consumer awareness and gradual expansion of biotech-driven sourcing.

This divergence highlights how Asia, led by India and Japan, is projected to anchor the fastest expansion, while the USA and Europe sustain strong value-driven growth. The interplay of regulation, consumer preference, and supplier innovation is expected to determine how each market shapes future procurement strategies.

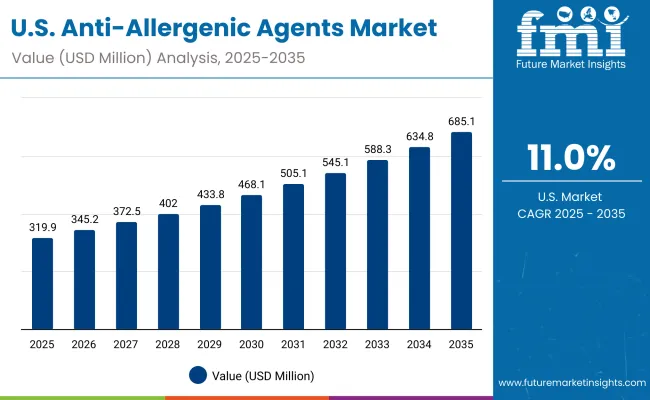

| Year | USA Anti-Allergenic Agents Market (USD Million) |

|---|---|

| 2025 | 319.90 |

| 2026 | 345.21 |

| 2027 | 372.53 |

| 2028 | 402.01 |

| 2029 | 433.82 |

| 2030 | 468.15 |

| 2031 | 505.19 |

| 2032 | 545.17 |

| 2033 | 588.31 |

| 2034 | 634.86 |

| 2035 | 685.10 |

The Anti-Allergenic Agents Market in the United States is projected to expand at a CAGR of 11.0% between 2025 and 2035, underpinned by the growing prominence of sensitive-skin and hypoallergenic formulations. Strengthened retailer standards and consumer demand for allergen-free claims are compelling formulation houses to prioritize barrier-support actives and clinically validated ingredients. Biotech-derived actives are expected to gain share due to higher reproducibility and compliance alignment, while botanical actives maintain strong adoption for clean-label positioning.

The Anti-Allergenic Agents Market in the United Kingdom is projected to expand at a CAGR of 16.0% through 2035, supported by strong consumer emphasis on skin health and an evolving regulatory environment that prioritizes allergen-free formulations. Growth is being reinforced by premium skincare adoption and the rapid penetration of dermocosmetic ranges across retail and e-commerce channels.

The Anti-Allergenic Agents Market in India is anticipated to register the fastest growth globally, advancing at a CAGR of 22.9% between 2025 and 2035. Rising middle-class consumption, coupled with dermatological awareness and rapid expansion of organized retail, is projected to support adoption of anti-allergenic formulations across mass and premium categories.

The Anti-Allergenic Agents Market in China is expected to expand at a moderate CAGR of 6.7% from 2025 to 2035, shaped by rising consumer awareness and the gradual scaling of biotech-sourced actives. Growth is being tempered by pricing pressures and reliance on botanical supply chains, though innovation in sensitive-skin formulations is steadily increasing.

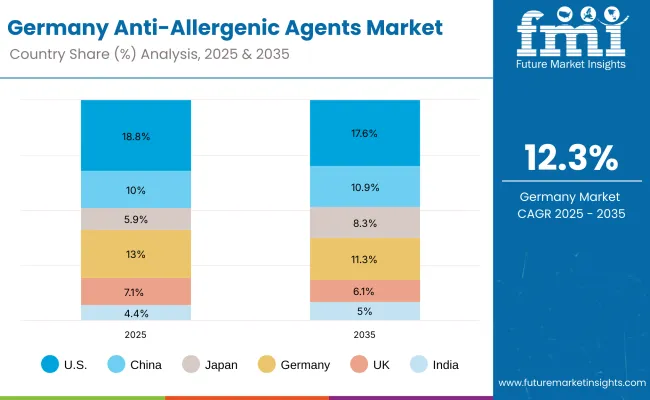

| Country | 2025 |

|---|---|

| USA | 18.8% |

| China | 10.0% |

| Japan | 5.9% |

| Germany | 13.0% |

| UK | 7.1% |

| India | 4.4% |

| Country | 2035 |

|---|---|

| USA | 17.6% |

| China | 10.9% |

| Japan | 8.3% |

| Germany | 11.3% |

| UK | 6.1% |

| India | 5.0% |

The Anti-Allergenic Agents Market in Germany is forecast to grow at a CAGR of 12.3% through 2035, driven by stringent regulatory oversight, rising consumer preference for hypoallergenic products, and the prominence of dermocosmetic adoption across pharmacies and specialist retail. Germany is projected to remain a cornerstone of European market expansion.

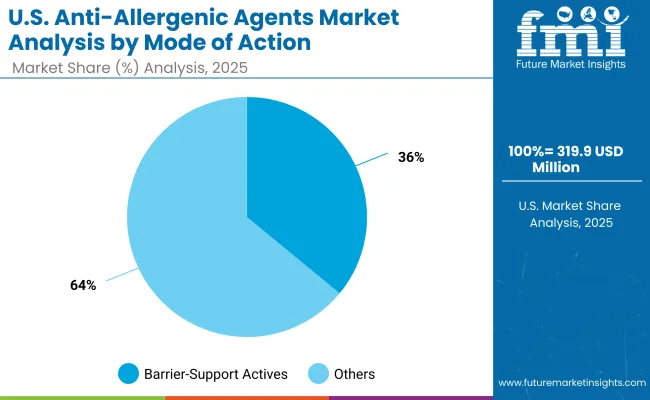

| USA by Mode of Action | Market Value Share, 2025 |

|---|---|

| Barrier-support actives | 36% |

| Others | 64.0% |

The Anti-Allergenic Agents Market in the United States is projected at USD 319.9 million in 2025. Barrier-support actives contribute 36% of this value, while other modes of action hold 64%, highlighting a broader reliance on diversified formulations beyond barrier reinforcement alone. This structural composition reflects the growing role of neurosensory comfort modulators and anti-irritant agents in delivering fast-relief benefits that resonate with consumer expectations. The preference for multiple functional pathways indicates that formulators are prioritizing not just barrier health but also sensory comfort and irritation modulation, offering a more holistic approach to sensitive-skin care.

A transition toward biotech-driven actives within the “Others” segment is anticipated, as reproducibility and compliance emerge as decisive factors for USA procurement teams. Clinical validation will further reinforce the trust in these diversified actives, enabling brands to substantiate strong hypoallergenic claims.

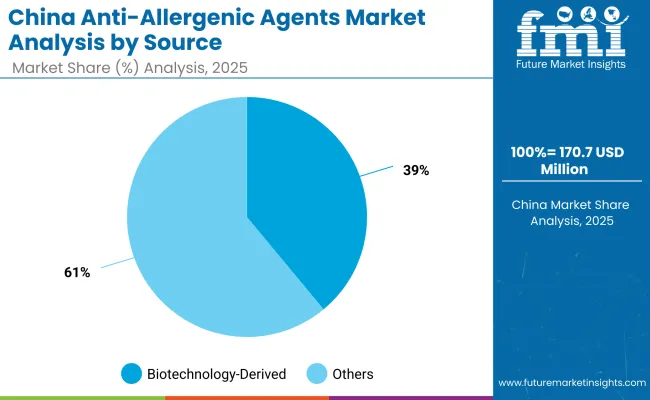

| China by Source | Market Value Share, 2025 |

|---|---|

| Biotechnology-derived | 39% |

| Others | 61.0% |

The Anti-Allergenic Agents Market in China is projected at USD 170.7 million in 2025. Biotechnology-derived actives account for 39% of this value, equal to USD 66.6 million, while other sources contribute 61%, valued at USD 104.1 million. The prominence of biotech-derived inputs reflects the rising importance of controlled production methods that ensure reproducibility, purity, and compliance with both domestic and international standards. This segment is expected to expand further as precision fermentation and microbial technologies are scaled to meet demand for hypoallergenic, residue-free formulations.

The continued strength of other sources underscores the dominance of botanical and synthetic inputs in Chinese formulations, especially as natural-positioned claims retain strong consumer appeal. However, reliance on agricultural outputs exposes the market to quality inconsistencies, prompting formulators to explore biotech alternatives as a risk mitigation strategy. Over the forecast period, a gradual rebalancing is anticipated, with biotech-derived actives securing greater weight in procurement portfolios.

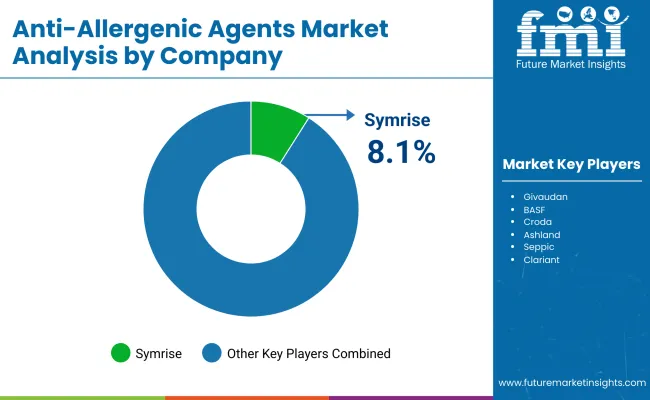

| Company | Global Value Share 2025 |

|---|---|

| Symrise | 8.1% |

| Others | 91.9% |

The Anti-Allergenic Agents Market is moderately fragmented, with global leaders, diversified chemical groups, and niche specialists competing to supply formulation ingredients for dermocosmetic, baby care, and scalp care applications. Global ingredient leaders such as Symrise, Givaudan, BASF, Croda, Ashland, Seppic, Clariant, Evonik, DSM-Firmenich, and Greentech are recognized as the key players in this market. Among these, Symrise has emerged as the dominant supplier, holding 8.1% of the global value share in 2025, while all other competitors collectively account for 91.9%.

Symrise’s leadership is being reinforced by its strong botanical and biotechnology-driven ingredient portfolios, along with its emphasis on hypoallergenic and sensitive-skin actives supported by clinical validation. Competitors such as Givaudan, BASF, and DSM-Firmenich are leveraging broad ingredient pipelines and research collaborations to expand market reach, while mid-sized players including Seppic and Greentech are focusing on plant-derived actives with sustainability credentials.

Differentiation is increasingly shifting toward innovation in encapsulation systems, biotechnology sourcing, and evidence-based claim support, rather than scale alone. Strategic partnerships with dermocosmetic and personal care brands are being prioritized, as suppliers seek to expand relevance in premium formulations. Over the forecast period, suppliers with proven safety data, transparent sourcing, and microbiome-compatible innovations are expected to consolidate stronger positions in this competitive landscape.

Key Developments in Anti-Allergenic Agents Market

| Item | Value |

|---|---|

| Market Size (2025E) | USD 1,703.7 Million |

| Market Size (2035F) | USD 3,903.6 Million |

| Forecast CAGR (2025-2035) | 8.60% |

| Segmentation - Mode of Action | Barrier-support actives; Anti-irritant modulators; Neurosensory comfort modulators |

| Segmentation - Source | Synthetic; Botanical; Biotechnology-derived |

| Segmentation - Delivery System | Free form; Encapsulated; Prebiotic/postbiotic complex |

| Segmentation - Physical Form | Solution/concentrate; Powder; Dispersion |

| Segmentation - Application | Sensitive face care; Baby care; Body care; Scalp care |

| Segmentation - End Use | Skincare; Hair & scalp care; Dermocosmetic |

| Regions Covered | North America; Europe; East Asia; South Asia & Pacific; Latin America; Middle East & Africa |

| Countries Covered | United States; China; India; Japan; United Kingdom; Germany |

| Key Companies Profiled | Symrise; Givaudan; BASF; Croda; Ashland; Seppic; Clariant; Evonik; DSM-Firmenich; Greentech |

| Additional Attributes | 2025 shares: Botanical 62.0% (USD 1,056.3 Million); Biotechnology-derived 35.0% (USD 566.7 Million); Free form 51.0% (USD 533.3 Million); Barrier-support actives 38.0% (USD 588.9 Million). Coverage includes supplier innovation in encapsulation, microbiome-friendly actives, clinical validation for hypoallergenic claims, and region-specific compliance drivers shaping procurement. |

The global Anti-Allergenic Agents Market is estimated to be valued at USD 1,703.7 million in 2025.

The market size for the Anti-Allergenic Agents Market is projected to reach USD 3,903.6 million by 2035.

The Anti-Allergenic Agents Market is expected to grow at a CAGR of 8.6% between 2025 and 2035.

The key product types in the Anti-Allergenic Agents Market are barrier-support actives, anti-irritant modulators, neurosensory comfort modulators, and microbiome-support actives.

In terms of source, botanical ingredients are projected to command 62.0% share in the Anti-Allergenic Agents Market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA