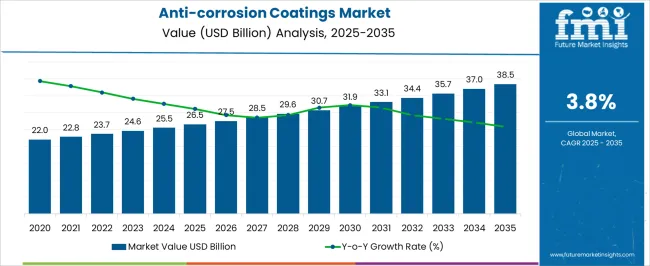

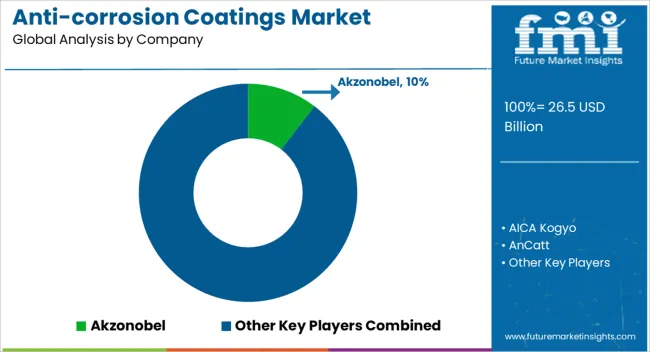

The anti-corrosion coatings market is estimated to be valued at USD 26.5 billion in 2025 and is projected to reach USD 38.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

Analysis of the growth rate volatility index highlights fluctuations in annual growth and the stability of market expansion over the decade. From 2021 to 2025, the market rises from USD 22.0 billion to 26.5 billion, with yearly increments of USD 22.8 billion, 23.7 billion, 24.6 billion, and 25.5 billion. This phase exhibits moderate volatility, reflecting uneven adoption across infrastructure, marine, and industrial applications, influenced by varying raw material costs and regulatory changes. Between 2026 and 2030, the market grows from USD 26.5 billion to 31.9 billion, passing through USD 27.5 billion, 28.5 billion, 29.6 billion, and 30.7 billion. Growth rate volatility during this period stabilizes slightly as larger industrial players standardize protective coatings, while long-term projects and retrofitting programs drive consistent demand.

From 2031 to 2035, values advance from USD 31.9 billion to 38.5 billion, with intermediate values of USD 33.1 billion, 34.4 billion, 35.7 billion, and 37.0 billion. The volatility index indicates minimal fluctuations in this stage, reflecting mature adoption, optimized production, and broader regulatory compliance. Overall, the growth rate volatility index demonstrates that while the market experiences some early variability due to cost and project-dependent factors, it achieves stable and predictable expansion in the latter half of the decade, supporting sustained opportunities for manufacturers, service providers, and end-users.

| Metric | Value |

|---|---|

| Anti-corrosion Coatings Market Estimated Value in (2025 E) | USD 26.5 billion |

| Anti-corrosion Coatings Market Forecast Value in (2035 F) | USD 38.5 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The anti-corrosion coatings market is driven by five parent markets that collectively define its growth, adoption, and applications across industrial, commercial, and infrastructure sectors. The industrial coatings market contributes the largest share, about 25-30%, as anti-corrosion coatings protect machinery, pipelines, storage tanks, and heavy equipment from rust, chemical exposure, and environmental degradation. The oil and gas market adds approximately 20-24%, since pipelines, offshore rigs, refineries, and storage facilities require specialized coatings to prevent corrosion and ensure operational safety and longevity.

The marine and shipping market contributes around 15-18%, with anti-corrosion coatings applied on ship hulls, offshore platforms, and port infrastructure to protect against saltwater, humidity, and biofouling. The construction and infrastructure market accounts for roughly 12-15%, where coatings safeguard steel structures, bridges, towers, and industrial buildings against environmental corrosion and wear. Finally, the automotive and transportation market represents about 8-10%, as anti-corrosion coatings are used on vehicles, chassis, and components to enhance durability, appearance, and resistance to moisture and chemicals.

The anti-corrosion coatings market is showing steady growth, supported by rising investments in infrastructure maintenance, industrial facility upgrades, and asset protection measures in high-risk corrosion environments. Industrial publications and corporate updates have highlighted increased adoption of advanced coatings to extend the service life of metal structures, pipelines, and equipment.

Stringent regulatory requirements on corrosion prevention in sectors such as oil and gas, marine, and automotive have driven innovation in coating formulations. Manufacturers are focusing on high-performance materials that provide superior adhesion, chemical resistance, and long-term durability under harsh operational conditions.

Technological developments in coating application methods have also enhanced efficiency and reduced environmental impact. With industries placing greater emphasis on operational reliability and lifecycle cost reduction, demand for specialized anti-corrosion solutions is expected to rise. The market outlook remains positive as new products with enhanced protective capabilities, environmentally compliant solvents, and faster curing times gain traction across industrial applications.

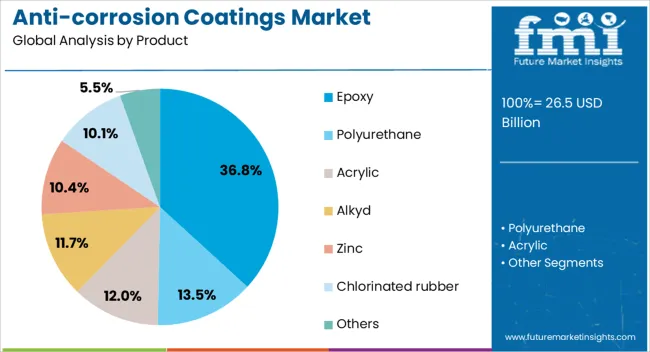

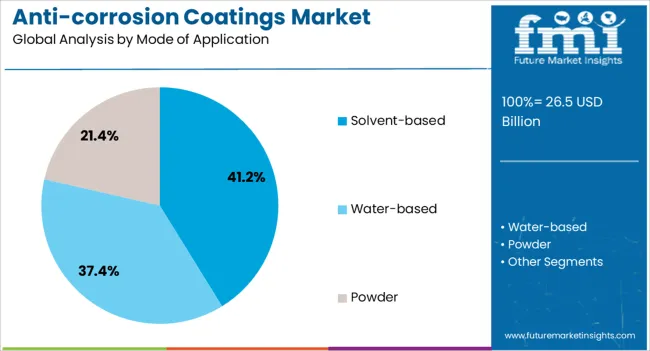

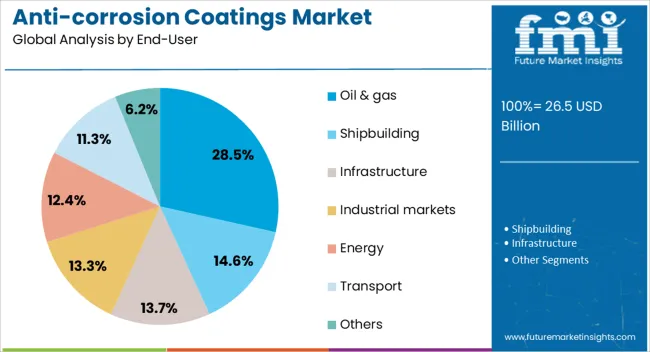

The anti-corrosion coatings market is segmented by product, mode of application, end-user, and geographic regions. By product, anti-corrosion coatings market is divided into epoxy, polyurethane, acrylic, alkyd, zinc, chlorinated rubber, and others. In terms of mode of application, anti-corrosion coatings market is classified into solvent-based, water-based, and powder. Based on end-user, anti-corrosion coatings market is segmented into oil & gas, shipbuilding, infrastructure, industrial markets, energy, transport, and others. Regionally, the anti-corrosion coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The epoxy segment is projected to hold 36.8% of the anti-corrosion coatings market revenue in 2025, securing its position as the leading product category. Growth in this segment has been fueled by epoxy’s excellent adhesion to metal surfaces, high mechanical strength, and superior chemical resistance, making it a preferred choice for protecting assets exposed to corrosive environments. Epoxy coatings are widely used in industries such as oil and gas, marine, and infrastructure due to their proven ability to withstand immersion and abrasion. Advances in epoxy formulation have further enhanced performance, enabling longer maintenance cycles and reduced downtime. The balance between cost-effectiveness and robust protection has cemented epoxy’s role as a go-to solution for critical corrosion prevention needs. As industries continue to prioritize durability and reliability, the Epoxy segment is expected to maintain its strong market position.

The solvent-based segment is projected to account for 41.2% of the anti-corrosion coatings market revenue in 2025, maintaining its dominance in application methods. Its leadership is driven by superior surface wetting properties, excellent film formation, and versatility across a wide range of environmental conditions. Solvent-based coatings are particularly valued for their performance in high-humidity or variable temperature settings, where water-based alternatives may face limitations. Industries such as shipbuilding, offshore infrastructure, and heavy machinery rely on solvent-based systems for consistent protection in demanding environments. Additionally, advancements in low-VOC and compliant solvent-based formulations have enabled manufacturers to meet environmental regulations without compromising on performance. The segment’s continued preference is supported by its reliability, ease of application, and compatibility with existing coating processes.

The oil & gas segment is projected to contribute 28.5% of the anti-corrosion coatings market revenue in 2025, remaining a key driver of demand. This segment’s growth is underpinned by the critical need to protect pipelines, storage tanks, rigs, and processing facilities from severe corrosion caused by exposure to saltwater, chemicals, and extreme temperatures. Corrosion-related maintenance in the oil and gas industry carries significant operational and financial risks, prompting investment in high-performance protective coatings. Epoxy, polyurethane, and multi-layer coating systems are commonly deployed to safeguard assets and extend operational lifespans. Ongoing exploration projects, refinery upgrades, and offshore developments continue to create substantial opportunities for specialized coating applications. As the sector focuses on minimizing downtime, enhancing safety, and reducing replacement costs, the Oil & Gas segment is expected to sustain robust demand for advanced anti-corrosion solutions.

The anti-corrosion coatings market is growing due to rising demand from industrial, marine, automotive, and energy sectors requiring protection against corrosion, abrasion, and chemical damage. Adoption is fueled by industrialization, infrastructure development, and harsh environmental conditions. Challenges include raw material price fluctuations, regulatory compliance, and technical issues such as adhesion, chemical resistance, and uniform application. Opportunities exist in high-performance coatings, retrofitting, and specialized applications for marine vessels, oil and gas, and power generation equipment. Manufacturers offering certified, technically supported, and durable coatings are best positioned to capture market growth across Asia-Pacific, North America, and Europe.

The anti-corrosion coatings market is expanding as industries and infrastructure sectors prioritize asset protection and longevity. These coatings are widely used in oil and gas pipelines, marine vessels, automotive components, power generation equipment, and industrial machinery to prevent corrosion, wear, and chemical damage. Growth is driven by rapid industrialization, urban infrastructure development, and increasing adoption in harsh environmental conditions across Asia-Pacific, North America, and Europe. Manufacturers focus on high-performance coatings that offer chemical resistance, abrasion protection, and long-term durability. Increasing investments in energy, transportation, and heavy industries further fuel demand. Advancements in coating chemistry, including epoxy, polyurethane, zinc-rich, and ceramic-based solutions, enhance protection and performance, positioning anti-corrosion coatings as critical for reducing maintenance costs and extending equipment lifespan in industrial applications globally.

Production processes require compliance with environmental and safety regulations such as VOC limits and REACH in Europe, TSCA in the United States, and local industrial standards. Technical challenges include achieving uniform film thickness, adhesion, chemical resistance, and long-term durability under extreme conditions. Supply chain disruptions may impact timely delivery of coatings to industrial sites. Buyers increasingly demand certified products with verified performance and technical support for surface preparation, application, and maintenance. Companies investing in process optimization, quality control, and compliance management are better positioned to address operational challenges, minimize defects, and ensure consistent coating performance across global markets.

Anti-corrosion coatings are increasingly adopted in marine vessels, offshore platforms, automobiles, power generation equipment, and industrial machinery. Growth in shipbuilding, oil and gas exploration, automotive manufacturing, and renewable energy infrastructure is driving demand for advanced protective coatings. Asia-Pacific, particularly China, Japan, and India, is witnessing rapid adoption due to industrial expansion and harsh environmental conditions. Manufacturers providing high-performance, long-lasting coatings with technical support for specialized applications gain a competitive advantage. Opportunities also exist in retrofitting aging industrial equipment and infrastructure. Collaboration with OEMs, industrial contractors, and maintenance service providers allows coating companies to offer tailored solutions, ensuring asset longevity and performance while expanding market penetration in industrial and commercial sectors globally.

Technological trends in the anti-corrosion coatings market include development of epoxy, polyurethane, zinc-rich, ceramic, and nano-coatings offering superior corrosion protection. Advanced formulations provide resistance to chemicals, abrasion, and extreme temperatures while reducing maintenance cycles. Integration with surface preparation technologies and automated application systems enhances efficiency and consistency. Growth in smart coatings with self-healing properties and improved adhesion is shaping the competitive landscape. Manufacturers are also focusing on eco-friendly, low-VOC products to comply with regulatory requirements. Companies providing technically advanced, certified, and application-ready coatings are well-positioned to meet evolving industry demands. Trends in innovation, application support, and high-performance solutions drive market growth across industrial, marine, and infrastructure sectors globally.

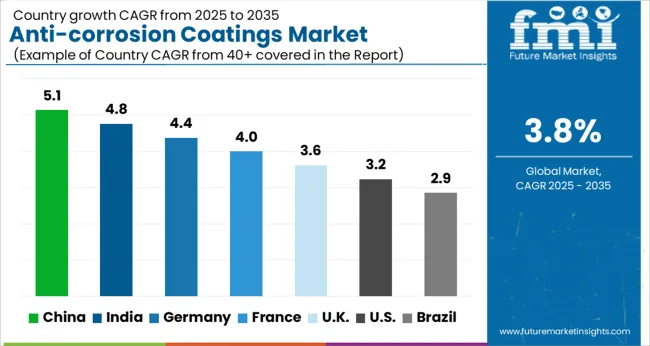

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| U.S. | 3.2% |

| Brazil | 2.9% |

The global anti-corrosion coatings market is projected to expand at a CAGR of 3.8% from 2025 to 2035. China (5.1%) and India (4.8%) are the fastest-growing markets, driven by industrialization, infrastructure development, and rising demand in construction, energy, and manufacturing sectors. Germany (4.4%) emphasizes high-performance, technologically advanced coatings for automotive and industrial applications, while France (4.0%) and the UK (3.6%) see steady growth from industrial maintenance and infrastructure projects. The U.S. (3.2%) experiences moderate adoption across energy, construction, and transportation sectors. Growth is fueled by modernization, pipeline expansion, industrial upgrades, and advanced coating formulations enhancing durability and efficiency. The analysis spans over 40+ countries, with the leading markets shown below.

The anti-corrosion coatings market in China is projected to expand at a CAGR of 5.1% from 2025 to 2035, driven by rapid industrialization, infrastructure development, and rising demand in construction, energy, automotive, and manufacturing sectors. Increasing investments in bridges, ports, pipelines, and industrial plants are creating substantial demand for coatings that protect metal surfaces from corrosion. Manufacturers are focusing on advanced formulations, high durability, and cost-effective solutions tailored for large-scale applications. The growing use of pipelines and machinery in energy and chemical industries further boosts market adoption. Technological innovations in coating application methods, along with the expansion of both e-commerce and traditional retail channels, enhance market accessibility.

The anti-corrosion coatings market in India is expected to grow at a CAGR of 4.8% from 2025 to 2035, supported by expanding industrial, construction, and energy sectors. Rising demand for protective coatings is fueled by large-scale pipeline projects, bridges, industrial machinery, and infrastructure modernization. Manufacturers are introducing high-performance, easy-to-apply, and long-lasting coatings tailored to India’s diverse industrial needs. Government initiatives supporting industrial development, smart city projects, and urban expansion are creating new opportunities for coatings application. Increasing awareness of corrosion prevention, coupled with the adoption of modern application techniques, is enhancing efficiency and reducing maintenance costs. Online and offline distribution channels are improving product accessibility across urban and semi-urban regions.

The anti-corrosion coatings market in Germany is projected to expand at a CAGR of 4.4% from 2025 to 2035, primarily driven by the automotive, industrial manufacturing, and construction sectors. The country’s focus on high-quality infrastructure, long-lasting machinery, and technologically advanced industrial systems increases the need for protective coatings. Manufacturers are introducing premium coatings with superior adhesion, corrosion resistance, and advanced chemical formulations to meet industrial requirements. Investments in energy, transportation, and chemical processing facilities also support demand. Renovation of aging infrastructure and modernization of manufacturing plants further drive adoption. Collaborations between coating manufacturers and engineering firms facilitate customized solutions for specialized industrial applications, while environmental compliance regulations ensure the adoption of performance-driven coating technologies.

The UK anti-corrosion coatings market is expected to grow at a CAGR of 3.6% from 2025 to 2035, fueled by industrial maintenance, construction, and transportation applications. Protective coatings are increasingly applied to machinery, pipelines, vehicles, and metal structures to extend their service life and reduce operational costs. Manufacturers are emphasizing high-performance, durable, and technologically advanced coatings to meet sector-specific requirements. Growth is supported by industrial plant modernization, infrastructure expansion, and adoption of efficient application methods. Increased awareness of corrosion prevention and rising demand from automotive, energy, and chemical industries also contribute to market expansion.

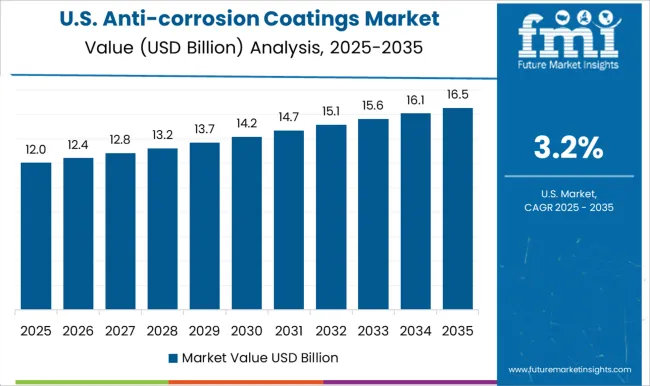

The U.S. market is projected to grow at a CAGR of 3.2% from 2025 to 2035, driven by industrial maintenance, energy, construction, and transportation sectors. Pipelines, bridges, machinery, and vehicles are increasingly coated to prevent corrosion and reduce repair costs. Manufacturers focus on premium performance, long-lasting formulations, and ease of application. Growth is further supported by infrastructure modernization, industrial facility upgrades, and adoption of advanced application techniques. The market benefits from heightened awareness of operational efficiency, regulatory compliance, and quality standards. Expansion of distribution channels, including online and specialty suppliers, improves product accessibility. Technological innovations in coating materials and enhanced service capabilities are expected to drive steady adoption across industrial and commercial segments.

Competition in the anti-corrosion coatings market is defined by performance, chemical resistance, and industry-specific certifications. AkzoNobel maintains a strong position through high-performance protective coatings for marine, industrial, and infrastructure applications, emphasizing long-term durability and compliance with global standards. AICA Kogyo competes with solvent-free and waterborne anti-corrosion solutions designed for steel structures and industrial equipment. AnCatt differentiates through customized coatings for harsh environments, targeting oil, gas, and chemical processing sectors. Ashland focuses on specialty polymer-based coatings, offering chemical resistance and adhesion solutions for metal substrates.

Axalta Coating leverages advanced powder and liquid coating technologies, emphasizing corrosion protection and finish quality across automotive and industrial applications. BASF integrates anti-corrosion solutions into broader industrial coatings portfolios, highlighting primer systems, high-durability topcoats, and metal pretreatment products. Chugoku Marine Paints, Hempel, and Jotun focus on marine and offshore applications, providing anti-fouling and high-resistance coatings for ships, platforms, and port infrastructure. Kansai Paints and Nippon Paints emphasize corrosion-resistant primers and industrial coatings for heavy machinery and structural steel, leveraging global distribution and local manufacturing. PPG Industries, RPM International, Sokema, The Sherwin-Williams Company, Tnemec, and Valspar compete across construction, automotive, and industrial segments with solvent- and water-based systems, offering high adhesion, chemical resistance, and extended service life.

Strategies in the market focus on product innovation, compliance with ISO and ASTM standards, and tailored solutions for harsh operating environments. Product brochures highlight epoxy, polyurethane, and zinc-rich coatings, primers, topcoats, anti-fouling systems, and heat- and chemical-resistant formulations. Emphasis is placed on corrosion protection for steel, aluminum, and other metal substrates, with performance metrics such as salt spray resistance, adhesion, and weathering durability. Collectively, these players demonstrate a market where technological differentiation, regulatory compliance, and application-specific solutions drive competitiveness and long-term growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.5 billion |

| Product | Epoxy, Polyurethane, Acrylic, Alkyd, Zinc, Chlorinated rubber, and Others |

| Mode of Application | Solvent-based, Water-based, and Powder |

| End-User | Oil & gas, Shipbuilding, Infrastructure, Industrial markets, Energy, Transport, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Akzonobel, AICA Kogyo, AnCatt, Ashland, Axalta Coating, BASF, Chugoku Marine Paints, Hempel, Jotun, Kansai Paints, Nippon Paints, PPG Industries, RPM International, Sokema, The Sherwin-Williams Company, Tnemec, and Valspar |

| Additional Attributes | Dollar sales by coating type (epoxy, polyurethane, zinc-rich, waterborne), substrate application (steel, aluminum, concrete), and industry application (marine, automotive, industrial, infrastructure). Demand is driven by industrial growth, harsh environmental exposure, and regulatory mandates for protective coatings. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, fueled by infrastructure expansion and industrial modernization. |

The global anti-corrosion coatings market is estimated to be valued at USD 26.5 billion in 2025.

The market size for the anti-corrosion coatings market is projected to reach USD 38.5 billion by 2035.

The anti-corrosion coatings market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in anti-corrosion coatings market are epoxy, polyurethane, acrylic, alkyd, zinc, chlorinated rubber and others.

In terms of mode of application, solvent-based segment to command 41.2% share in the anti-corrosion coatings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coatings and Application Technologies for Robotics Market Outlook – Trends & Innovations 2025-2035

UV Coatings Market Growth & Forecast 2025 to 2035

2K Coatings Market Growth – Trends & Forecast 2025 to 2035

Coil Coatings Market Size and Share Forecast Outlook 2025 to 2035

Pipe Coatings Market Size and Share Forecast Outlook 2025 to 2035

Wood Coatings Market Size, Growth, and Forecast for 2025 to 2035

Smart Coatings Market Size and Share Forecast Outlook 2025 to 2035

Green Coatings Market Analysis by Technology, Application, and Region Forecast through 2035

Marine Coatings Market Size and Share Forecast Outlook 2025 to 2035

Filter Coatings Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Stealth Coatings Market Size and Share Forecast Outlook 2025 to 2035

Medical Coatings Market Growth & Demand 2025 to 2035

Barrier Coatings for Packaging Market Trends - Growth & Forecast 2025 to 2035

Sputter Coating Market Growth – Trends & Forecast 2022 to 2032

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

Food Can Coatings Market Size and Share Forecast Outlook 2025 to 2035

Ablative Coatings Market Size and Share Forecast Outlook 2025 to 2035

Polyurea Coatings Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA