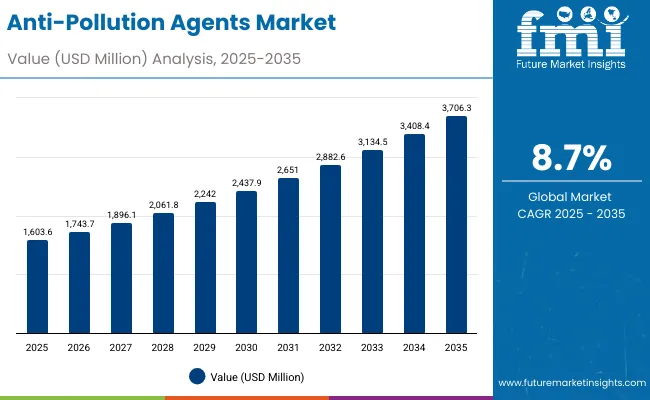

The Anti-Pollution Agents Market is expected to record a valuation of USD 1,603.6 million in 2025 and USD 3,706.3 million in 2035, with an increase of USD 2,102.7 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 8.7% and a 2.3X increase in market size.

Anti-Pollution Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Anti-Pollution Agents Market Estimated Value in (2025E) | USD 1,603.6 million |

| Anti-Pollution Agents Market Forecast Value in (2035F) | USD 3,706.3 million |

| Forecast CAGR (2025 to 2035) | 8.7% |

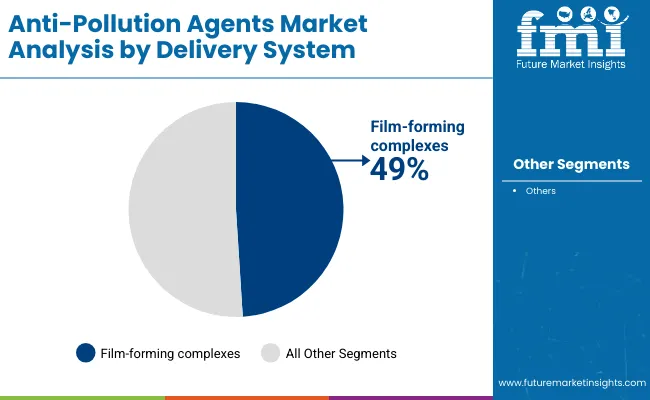

During the first five-year period from 2025 to 2030, the market increases from USD 1,603.6 million to USD 2,437.9 million, adding USD 834.3 million, which accounts for nearly 40% of the total decade growth. This phase records steady adoption in skincare and sun care, with anti-adhesion particulate barriers gaining traction as urban dust and PM2.5 defense claims become mainstream in day creams and serums. Film-forming complexes dominate this period as they cater to over 49% of applications requiring long-lasting protective films on skin and hair.

The second half from 2030 to 2035 contributes USD 1,268.4 million, equal to about 60% of total growth, as the market jumps from USD 2,437.9 million to USD 3,706.3 million. This acceleration is powered by widespread deployment of biotechnology-derived actives, encapsulated systems for time-release protection, and advanced sun-hair-skin hybrid solutions. Haircare and color cosmetics increasingly integrate anti-pollution claims, while Asia and Europe lead in adopting PM shield films. Polymeric barrier systems and antioxidant/anti-carbonylation systems together capture a larger share above 60% by the end of the decade. Cloud-connected ingredient testing and AI-based product validation further accelerate innovation, increasing the role of R&D-led suppliers.

From 2020 to 2024, the Anti-Pollution Agents Market grew from below USD 1,200 million to around USD 1,550 million, driven by skincare-centric adoption in premium day creams and sunscreens. During this period, the competitive landscape was dominated by European suppliers controlling nearly 60% of revenue, with leaders such as Croda, Givaudan, and Symrise focusing on botanical and biotechnology-derived solutions tailored to anti-dust and anti-smog performance. Competitive differentiation relied on innovation in bio-actives and delivery systems, while mineral and clay-based offerings remained niche. Service-based digital claims testing had minimal traction, contributing less than 5% of the total market value.

Demand for anti-pollution actives will expand to USD 1,603.6 million in 2025, and the revenue mix will shift as encapsulated and film-forming systems grow to over 50% share. Traditional botanical and mineral suppliers face rising competition from polymeric and biotechnology-driven players offering multifunctional agents with antioxidant, detoxifying, and anti-carbonylation properties. Major incumbents are pivoting to hybrid models, integrating microbiome-balancing and encapsulated delivery to retain relevance. Emerging entrants specializing in PM2.5 protection, AI-tested efficacy validation, and AR/VR-enabled consumer education are gaining share. The competitive advantage is moving away from raw ingredient supply alone to ecosystem strength, consumer trust, and differentiated scientific validation.

Advances in anti-pollution actives have improved efficacy, enabling long-lasting protection against urban dust, heavy metals, and carbonyl stressors. Anti-adhesion particulate barriers and polymeric shield films are gaining popularity due to their suitability for daily skincare and haircare products. The rise of biotechnology-derived systems has contributed to precision formulation and microbiome protection. Industries such as premium skincare, sun care, and color cosmetics are driving demand for solutions that integrate seamlessly into lightweight formulations with proven clinical claims.

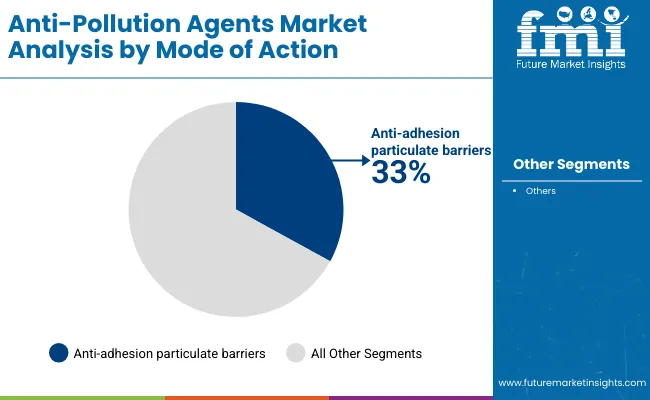

Expansion of encapsulated systems and film-forming complexes has fueled market growth. Innovations in botanical detox actives, mineral-based chelation, and polymeric film technologies are expected to open new application areas. Segment growth is expected to be led by film-forming complexes in delivery systems, polymeric barrier systems in source categories, and anti-adhesion particulate barriers in mode of action, due to their proven efficiency in consumer adoption across both mass and premium channels.

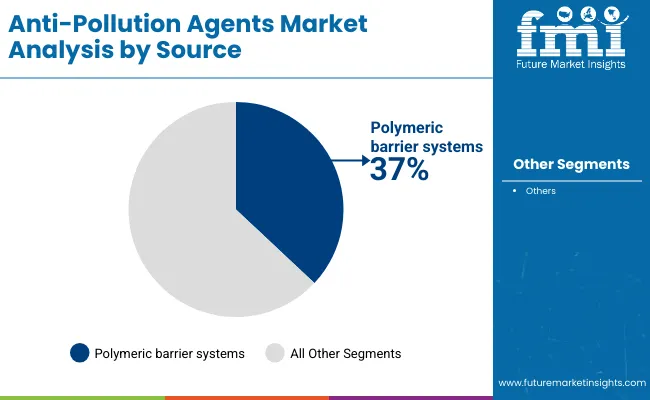

The market is segmented by mode of action, source, delivery system, physical form, application, end use, and geography. Mode of action includes anti-adhesion particulate barriers, metal chelation/detox systems, antioxidant/anti-carbonylation systems, and PM/urban dust shield films, each catering to specific pollution stressors. Sources range from botanical and biotechnology-derived to mineral/clay and polymeric systems, reflecting a blend of natural and synthetic strategies. Delivery systems span free form, film-forming complexes, and encapsulated solutions, providing flexibility for product formulators.

Physical form segmentation covers solutions/concentrates, powders, and dispersions/gels. Applications include day creams and serums, facial mists, sunscreens, and hair and scalp protectors. End use spans skincare, sun care, haircare, and color cosmetics. Geographically, the market covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa, with USA, China, India, Japan, UK, and Germany as leading growth centers.

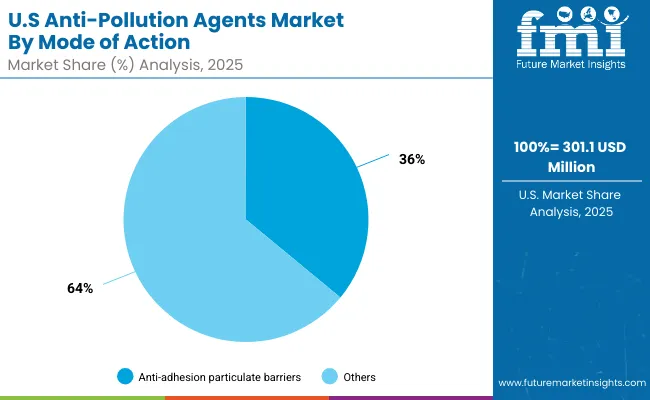

| Mode of Action | Value Share% 2025 |

|---|---|

| Anti-adhesion particulate barriers | 33% |

| Others | 67.0% |

The anti-adhesion particulate barriers segment is projected to contribute 33% of the Anti-Pollution Agents Market revenue in 2025, maintaining its lead as the dominant mode of action category. This is driven by the rising need for protective agents that form a barrier between skin and harmful airborne particles, particularly in urban environments where PM2.5 levels are high. Skincare and sun care formulations increasingly highlight anti-adhesion claims as consumers demand visible and proven efficacy against daily pollution exposure.

The segment’s growth is further supported by its integration into multifunctional products such as day creams, sunscreens, and facial mists. Formulators are adopting barrier technologies that can be combined with antioxidant and detoxifying actives, enhancing product positioning across premium and mass-market lines. As consumer awareness of urban pollution risks grows, anti-adhesion particulate barriers are expected to remain the backbone of anti-pollution product development globally.

| Source | Value Share% 2025 |

|---|---|

| Polymeric barrier systems | 37% |

| Others | 63.0% |

The polymeric barrier systems segment is forecasted to hold 37% of the market share in 2025, led by its effectiveness in forming protective films on skin and hair to shield against particulate matter, heavy metals, and carbonyl stressors. These systems are favored for their high stability, compatibility with a wide range of formulations, and ability to enhance sensory feel, making them particularly valuable in day creams, sunscreens, and hybrid skincare-color cosmetic products.

Their versatility has facilitated widespread adoption by formulators seeking reliable and scalable solutions. Growth is bolstered by the development of innovative polymers that combine film-forming capabilities with moisturizing or antioxidant properties, offering multifunctionality. As the anti-pollution trend shifts from niche to mainstream, polymeric barrier systems are expected to solidify their dominance in the market by delivering proven efficacy with consumer-friendly textures.

| Delivery System | Value Share% 2025 |

|---|---|

| Film-forming complexes | 49% |

| Others | 51.0% |

The film-forming complexes segment is projected to account for 49% of the Anti-Pollution Agents Market revenue in 2025, establishing it as the leading delivery system type. These complexes are designed to create a breathable yet long-lasting layer on the skin or hair, enabling extended protection against particulate matter and urban dust. Their ability to improve active retention, reduce wash-off, and enhance consumer-perceived effectiveness makes them highly attractive across skincare, sun care, and haircare formulations.

Ongoing innovations in encapsulation combined with film-forming matrices are further strengthening this segment. Advanced complexes not only provide pollution defense but also incorporate cosmetic benefits such as smoother texture, hydration retention, and enhanced sensory feel. As consumers increasingly seek long-lasting, clinically proven protection from pollution damage, film-forming complexes are expected to remain the preferred delivery system, offering formulators both performance and versatility.

Rising Consumer Demand for Multifunctional Skincare with Pollution Defense

One of the strongest growth drivers is the integration of anti-pollution actives into multifunctional skincare and sun care products. Consumers, particularly in urban centers of Asia and Europe, are looking for single formulations that offer hydration, UV defense, and particulate protection. Day creams and sunscreens containing polymeric barrier systems and film-forming complexes are gaining traction because they align with consumer demand for efficiency and convenience. Brands are leveraging anti-adhesion particulate barriers as a key marketing claim, often highlighted alongside SPF and antioxidant benefits. This convergence not only drives adoption but also increases willingness to pay for premium products. As a result, multifunctionality is accelerating anti-pollution agent penetration into both mid-tier and luxury categories.

Biotechnology-Derived Actives and Microbiome Protection

The surge in biotechnology-derived anti-pollution agents is another powerful driver. Formulators are shifting away from purely botanical or mineral ingredients to bio-engineered actives that can target pollution-induced oxidative stress and carbonylation at the cellular level. Biotechnology allows for encapsulation of peptides, polysaccharides, and bioferments that provide long-lasting protection and restore microbiome balance disrupted by urban pollutants. For instance, encapsulated anti-carbonylation systems not only prevent pollutant adhesion but also actively repair skin barrier integrity. These innovations are reshaping consumer perception, as biotech solutions position themselves as "science-driven" rather than just cosmetic add-ons, fueling market growth in premium dermocosmetics.

High Formulation Costs and Limited Scalability of Advanced Systems

A major restraint is the elevated cost of advanced polymeric barrier systems and encapsulated complexes. While these delivery systems offer superior efficacy, their production involves specialized equipment, stability testing, and high-grade excipients. This limits adoption in mass-market skincare and haircare segments, especially in cost-sensitive regions such as Latin America and parts of South Asia. For manufacturers, the scalability of biotechnology-derived actives remains a challenge, as fermentation processes or bioengineered compounds demand significant R&D investment. Consequently, affordability constraints slow market penetration in mid- to low-income demographics, restricting the global reach of premium formulations.

Regulatory Ambiguity Around Pollution-Defense Claims

Another restraint stems from the lack of standardized global regulations on anti-pollution efficacy claims. Unlike SPF or "dermatologically tested" labels, pollution-defense claims such as "PM2.5 shield" or "anti-carbonylation" lack harmonized testing protocols across regions. Regulatory bodies in Europe are stricter, requiring extensive clinical validation, while other markets permit looser claim substantiation. This discrepancy creates hurdles for cross-border launches and increases compliance costs for multinationals. Smaller brands, in particular, face barriers in proving the effectiveness of anti-pollution actives, leading to cautious adoption. The result is market fragmentation and slower consumer trust-building in regions without clear standards.

Expansion into Haircare and Color Cosmetics Beyond Skincare

While the market has been largely skincare-driven, a major trend is the extension of anti-pollution actives into haircare and color cosmetics. Hair and scalp protectors are increasingly formulated with film-forming complexes that prevent particulate deposition, addressing rising consumer concerns about scalp irritation and hair weakening caused by pollutants. Similarly, color cosmetics such as foundations, primers, and setting sprays are adopting polymeric and antioxidant systems to market themselves as dual-purpose beauty products. This cross-category expansion reflects a shift in consumer behavior pollution protection is no longer confined to skincare, but is becoming a mainstream expectation across all beauty routines.

Rise of Urban Dust Shield Films as a Premium Differentiator

Another trend shaping the market is the emergence of PM/urban dust shield films as a premium differentiator. Unlike traditional anti-oxidative or chelation systems, these shield films provide a visible and demonstrable layer that consumers perceive as "protective armor." They are marketed not only on efficacy but also on experiential claims such as improved skin texture and breathable comfort. Early adoption is seen in East Asian markets like China, Korea, and Japan, where urban smog awareness is high, and consumer trust in tangible, film-forming products is stronger. By 2030, urban dust shield films are expected to capture a greater share of premium formulations, especially in sunscreens and hybrid skincare-makeup products.

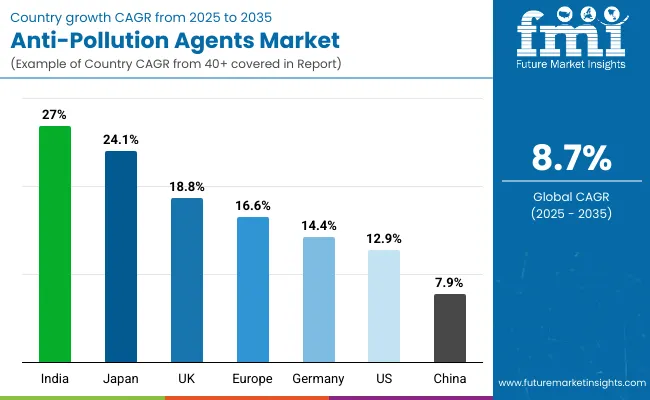

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 7.9% |

| USA | 12.9% |

| India | 27.0% |

| UK | 18.8% |

| Germany | 14.4% |

| Japan | 24.1% |

| Europe | 16.6% |

The country-wise growth outlook of the Anti-Pollution Agents Market between 2025 and 2035 reveals striking regional contrasts shaped by consumer awareness, product innovation, and regulatory environments. India (27.0% CAGR) and Japan (24.1% CAGR) stand out as the fastest-growing markets, reflecting distinct consumer drivers. In India, high urban pollution levels and growing middle-class spending power are fueling adoption of affordable skincare, sun care, and haircare solutions infused with botanical and polymeric barrier systems.

Japan’s growth, on the other hand, is fueled by premium dermocosmetics, where biotech-derived actives, microbiome-balancing formulations, and film-forming complexes are embraced by highly informed consumers who prioritize clinically validated solutions. These two markets demonstrate how both affordability-driven mass adoption and innovation-led premiumization are propelling strong double-digit growth.

Meanwhile, mature economies such as the USA (12.9% CAGR), UK (18.8% CAGR), and Germany (14.4% CAGR) are driving expansion through regulatory-backed safety claims, advanced formulations, and the integration of anti-pollution benefits into mainstream skincare and color cosmetics. The USA market is particularly influenced by dermocosmetic brands leveraging anti-adhesion particulate barriers and antioxidant systems to differentiate in crowded skincare categories.

Europe, with an overall CAGR of 16.6%, reflects steady momentum as regional markets respond to urban air quality concerns and EU regulatory emphasis on sustainable, safe cosmetic actives. China, growing at 7.9%, is slower relative to peers but remains significant due to its sheer market size, with adoption concentrated in Tier-1 cities where awareness of urban dust shield films and premium sunscreen innovations is rising. Together, these trends underline how varying pollution profiles, consumer sophistication, and income levels shape country-specific growth trajectories within the Anti-Pollution Agents Market.

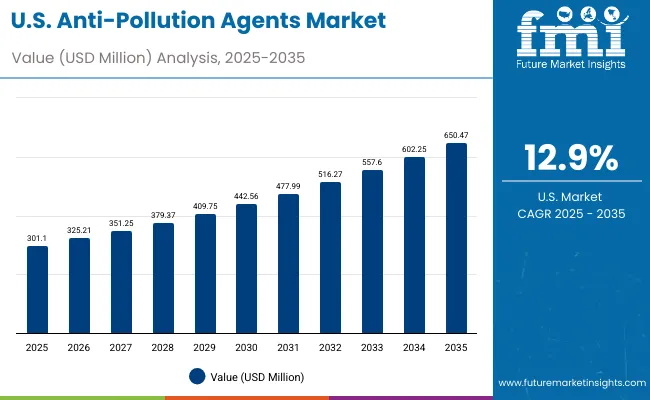

| Year | USA Anti-Pollution Agents Market (USD Million) |

|---|---|

| 2025 | 301.10 |

| 2026 | 325.21 |

| 2027 | 351.25 |

| 2028 | 379.37 |

| 2029 | 409.75 |

| 2030 | 442.56 |

| 2031 | 477.99 |

| 2032 | 516.27 |

| 2033 | 557.60 |

| 2034 | 602.25 |

| 2035 | 650.47 |

The Anti-Pollution Agents Market in the United States is projected to grow at a CAGR of 12.9%, supported by premium skincare, sun care, and color cosmetics integrating anti-adhesion particulate barriers and film-forming complexes. Dermatology-led innovation and high demand for clinically proven products are fueling strong adoption. Haircare products with pollution defense claims are also gaining visibility, particularly in scalp health solutions. Increasing consumer awareness of urban pollution and its link to skin aging is prompting multinational and indie brands alike to prioritize protective actives in new launches.

The Anti-Pollution Agents Market in the United Kingdom is expected to grow at a CAGR of 18.8%, driven by innovations in hybrid products such as sunscreens with antioxidant and pollution-barrier systems, as well as the integration of PM/urban dust shield films into everyday skincare routines. The UK consumer base is increasingly adopting biotech-derived solutions that highlight microbiome protection and long-term skin health. High visibility of air quality issues in major cities like London has intensified the demand for protective formulations in both mass and luxury segments.

India is witnessing rapid growth in the Anti-Pollution Agents Market, which is forecast to expand at a CAGR of 27.0% through 2035, the fastest among all major countries. Increasing affordability of skincare and haircare products, along with heightened consumer awareness of the health impacts of urban dust and smog, are driving demand. Tier-2 and Tier-3 cities are witnessing rising adoption as mass-market brands launch affordable anti-pollution solutions using botanical and mineral-based systems. Urban youth are particularly driving sales of facial mists and sunscreens with protective claims, while Ayurvedic and herbal formulations incorporating detox actives are also seeing rapid uptake.

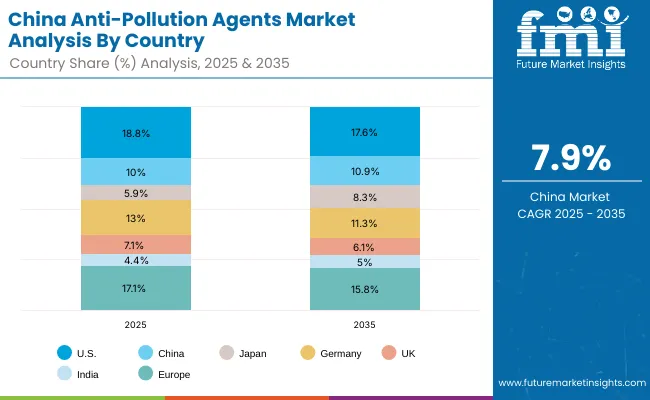

| Countries | 2025 Share (%) |

|---|---|

| USA | 18.8% |

| China | 10.0% |

| Japan | 5.9% |

| Germany | 13.0% |

| UK | 7.1% |

| India | 4.4% |

| Europe | 17.1% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.6% |

| China | 10.9% |

| Japan | 8.3% |

| Germany | 11.3% |

| UK | 6.1% |

| India | 5.0% |

| Europe | 15.80% |

The Anti-Pollution Agents Market in China is expected to grow at a CAGR of 7.9%, slower than India or Japan, but substantial given its large base. Growth is led by demand in Tier-1 cities where smog and PM2.5 awareness remain high. Local brands are actively launching sunscreens and skincare products with polymeric barrier systems, often marketed alongside whitening and brightening claims. At the same time, premium international brands are introducing PM shield films and antioxidant complexes to capture the growing luxury segment. Mass-market penetration remains limited in rural regions, but e-commerce channels are widening accessibility.

| USA by Mode of Action | Value Share% 2025 |

|---|---|

| Anti-adhesion particulate barriers | 36% |

| Others | 64.0% |

The Anti-Pollution Agents Market in the United States is projected at USD 301.1 million in 2025, expanding at a CAGR of 12.9% through 2035. Anti-adhesion particulate barriers contribute 36%, while other systems such as antioxidant/anti-carbonylation and detox actives hold the remaining 64%. This reflects a strong preference among USA consumers for clinically proven anti-adhesion technologies that provide visible protective layers against PM2.5 and urban dust. Dermatology-driven innovation and premium skincare brands dominate adoption, supported by a growing ecosystem of sun care and color cosmetics integrating pollution-defense claims.

Growth is also influenced by rising awareness of scalp and hair damage caused by pollutants, creating a market pull for haircare products with detoxifying and barrier-enhancing properties. The integration of film-forming complexes into multifunctional sunscreens is accelerating consumer adoption, as these solutions extend both UV and pollution defense in a single application. With consumers increasingly willing to pay for premium dermocosmetics backed by scientific validation, the USA market is set to remain a leader in anti-pollution innovation.

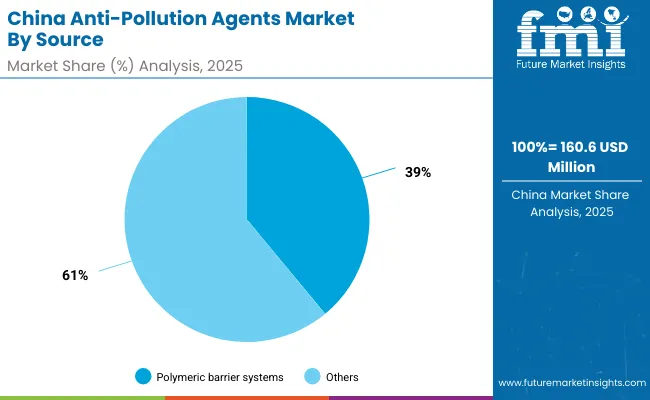

| China by source | Value Share% 2025 |

|---|---|

| Polymeric barrier systems | 39% |

| Others | 61.0% |

The Anti-Pollution Agents Market in China is valued at USD 160.6 million in 2025, growing at a CAGR of 7.9% through 2035. Polymeric barrier systems lead with 39% share, driven by their strong film-forming capabilities and compatibility with multifunctional skincare products. Local brands are combining these barrier technologies with brightening and whitening claims to align with consumer preferences for even-toned, luminous skin. At the same time, premium international players are expanding with antioxidant and encapsulated actives marketed for high-efficacy urban pollution protection.

While adoption is most concentrated in Tier-1 cities where smog awareness is high, e-commerce platforms are enabling wider distribution to emerging regions. The dominance of polymeric barrier systems reflects a consumer preference for tangible shield effects that enhance product trust. Growth will be supported by innovations that combine pollution defense with hydration, skin tone correction, and anti-aging benefits, positioning China as a critical market for multifunctional anti-pollution solutions.

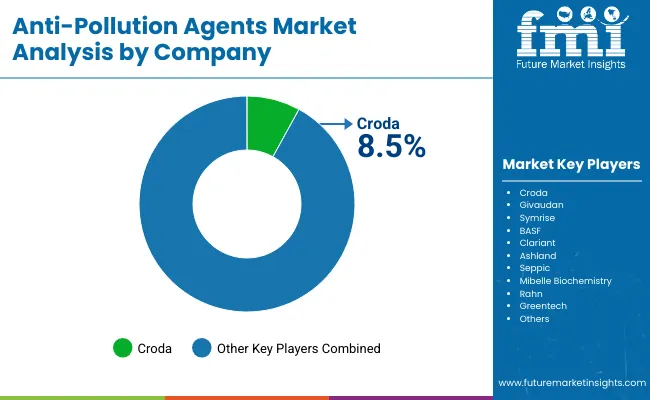

The Anti-Pollution Agents Market is moderately consolidated, with leading chemical and ingredient suppliers competing on efficacy, formulation flexibility, and consumer trust. Global leaders such as Croda, Givaudan, Symrise, BASF, and Clariant hold significant share, driven by their strong portfolios in polymeric barrier systems, antioxidant complexes, and biotech-derived actives. Their strategies emphasize hybrid delivery systems, film-forming complexes, and encapsulated actives that enable longer-lasting protection and premium positioning.

Established mid-sized innovators such as Ashland, Seppic, and Mibelle Biochemistry are accelerating adoption by introducing multifunctional botanical actives, microbiome-balancing solutions, and clean-label detox systems. These companies bridge the gap between natural and synthetic approaches, appealing to both mass and premium brands. Specialized providers such as Rahn and Greentech focus on niche offerings like algae-derived antioxidants and encapsulated botanical complexes, tailored for regional preferences and indie brand formulations.

Competitive differentiation is shifting from single-function actives toward integrated ecosystems combining pollution defense with hydration, anti-aging, and sensory benefits. Suppliers with strong testing protocols, clinical validation, and ability to co-develop tailored solutions with beauty brands are gaining a competitive edge. The market is moving steadily toward premiumization, where partnerships with both multinational beauty houses and indie startups define the growth trajectory.

Key Developments in Anti-Pollution Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Mode of Action | Anti-adhesion particulate barriers, Metal chelation/detox systems, Antioxidant/anti-carbonylation systems, PM/urban dust shield films |

| Source | Botanical, Biotechnology-derived, Mineral/clay, Polymeric barrier systems |

| Delivery System | Free form, Film-forming complexes, Encapsulated |

| Physical Form | Solution/concentrate, Powder, Dispersion/gel concentrate |

| Application | Day creams & serums, Facial mists, Sunscreens, Hair & scalp protectors |

| End Use | Skincare, Sun care, Haircare, Color cosmetics |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Croda, Givaudan, Symrise, BASF, Clariant, Ashland, Seppic, Mibelle Biochemistry, Rahn, Greentech |

| Additional Attributes | Dollar sales by mode of action and delivery system, adoption trends in multifunctional skincare and sun care, rising demand for film-forming complexes and polymeric barrier systems, sector-specific growth in dermocosmetics, haircare, and hybrid color cosmetics, biotechnology-derived and botanical actives driving clean-label innovations, encapsulation technologies improving efficacy and long wear, regional growth influenced by pollution awareness and regulatory frameworks, and advances in microbiome-protective and antioxidant/anti-carbonylation solutions. |

The Anti-Pollution Agents Market is estimated to be valued at USD 1,603.6 million in 2025.

The market size for the Anti-Pollution Agents Market is projected to reach USD 3,706.3 million by 2035.

The Anti-Pollution Agents Market is expected to grow at a CAGR of 8.7% between 2025 and 2035.

The key product types in the Anti-Pollution Agents Market are anti-adhesion particulate barriers, metal chelation/detox systems, antioxidant/anti-carbonylation systems, and PM/urban dust shield films.

In terms of source, polymeric barrier systems are projected to command a 37% share in the Anti-Pollution Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Matting Agents Market Size and Share Forecast Outlook 2025 to 2035

Healing Agents Market (Skin Repair & Soothing Actives) Market Size and Share Forecast Outlook 2025 to 2035

Foaming Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Botox-Like Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Firming Agents Market Growth – Product Innovations & Applications from 2025 to 2035

Raising Agents Market Trends – Growth & Industry Forecast 2024 to 2034

Weighing Agents Market Size and Share Forecast Outlook 2025 to 2035

Draining Agents Market Size and Share Forecast Outlook 2025 to 2035

Flatting Agents Market Size and Share Forecast Outlook 2025 to 2035

Clouding Agents Market Trends - Growth Factors & Industry Analysis

Cognitive Agents Market Size and Share Forecast Outlook 2025 to 2035

Anti-Acne Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Leavening Agents Market Analysis - Size, Growth, and Forecast 2025 to 2035

Market Share Breakdown of Anti-Slip Agents Manufacturers

Coalescing Agents Market Size and Share Forecast Outlook 2025 to 2035

Mattifying Agents Market Size and Share Forecast Outlook 2025 to 2035

Biocontrol Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA