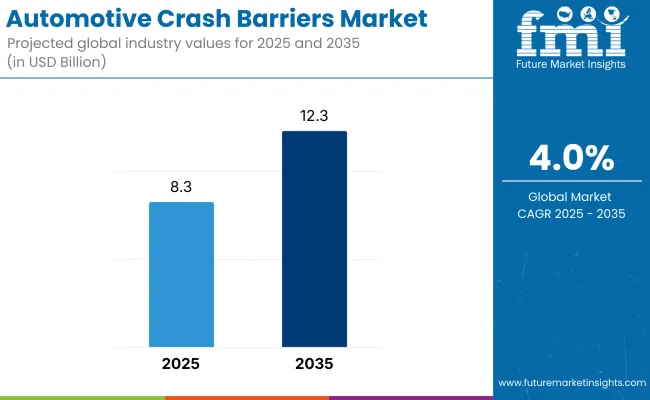

The automotive crash barriers market is set to grow from USD 8.3 billion in 2025 to USD 12.3 billion by 2035, marking a compound annual growth rate (CAGR) of 4.0%. This growth is driven by rising investments in road infrastructure, urban traffic management, and highway safety programs across both developed and emerging economies.

Automotive crash barriers-also known as safety barriers or guardrails-are critical components used to prevent vehicles from straying off roads, thereby reducing the impact of road accidents and improving overall safety.

As governments aim to reduce road fatalities and accident-related injuries, the demand for effective crash containment systems has intensified. The global trends that provide the perspectives for the crash barriers to be installed in highways, tunnels, and bridges, such as smart highway initiatives, the addition of fast roadways, and public-private partnerships in infrastructure projects, have made that happen.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.3 billion |

| Industry Value (2035F) | USD 12.3 billion |

| CAGR (2025 to 2035) | 4.0% |

The rapidly expanding vehicular and pedestrian safety consciousness market development, the adoption of stringent safety protocols, and the increase in highway vehicular density are market drivers. The new modular, energy-absorbing, and low-maintenance crash barriers are also the application potential in different places.

Driven by the robust infrastructure development and the strict federal safety and health guidelines, North America stands out in the automotive crash barrier market. In the United States, the Federal Highway Administration (FHWA) and the American Association of State Highway and Transportation Officials (AASHTO) have set up some of the most comprehensive standards for the safety of roadside, thus, promoting the wide-ranging installation of certified crash barriers.

Steel guardrails, concrete barriers, and cable-based systems are being widely used, thanks to the ongoing investment in interstate highway modernization and urban roadway expansion, along with bridge rehabilitation. Theregion's dedication to vehicle-to-infrastructure (V2I) safety integration as part of the smart city setup has paved the way for the implementation of sensor-enabled barrier technologies.

Europe's regulatory framework has made it a foremost player in the market, the driving force being the Vision Zero objectives, mandatory transport safety across the EU, and national policies for decreasing traffic deaths. Top-ranking countries like Germany, France, and the UK are putting in advance crash barriers on high-speed corridors, tunnel systems, and accident-prone areas.

The European market is taking a turn to ecological and recyclable materials, such as zinc-coated steel, polymer composites, and flexible impact-resistant modules. EU funding for intermodal transport networks with rail-road integration is causing the demand for robust crash containment systems to increase at transport terminals.

Asia-Pacific is the most blossoming territory due to the immense road-building projects, skyrocketing vehicle ownership, and rising public awareness about road safety. Government officials in India, China, Indonesia, and Thailand are massively pouring their dollars in rebuilding national highway links, smart city roadways, and expressway safety enhancements that have car crash barriers as one of the predominant solutions.

China, for example, is deploying high-performance steel and concrete barriers along the toll roads and mountain roads, while India is focusing on roadside crash barriers on sections, river bridges, and urban bypass roads. The movement for safer transport corridors in the Southeast Asian countries is also a booster for the market to expand.

In the Middle East & Africa, the phenomena of increasing urbanization alongside the establishment of smart infrastructure are responsible for the steady growth one can witness in crash barrier installations. Gulf countries, including UAE, Saudi Arabia, and Qatar, are increasing the length of highways, investing in urban integrated transport projects, and constructing port access roads that are all causes for a new demand for robust and modular crash barriers.

Africa, on the other hand, has been introducing crash barriers slowly but surely, often with the support of development agencies from abroad aiming to improve safety in economic corridors and trade routes. Government initiatives informing the public about the new low-cost impact-absorbing barrier systems are substantially helping in key market growth areas.

Challenges

High Installation and Maintenance Costs

High upfront costs of installation of the systems, as well as the propitious long-term maintenance, have been influencing adversely the automotive crash barrier market in the main. In the lower-income areas where money is scant, people often choose cheaper options that though perform not at the same level of quality and durability.

Also, crash barriers, which are located in the extreme conditions like coastal areas, the mountainous area, or regions with heavy snowfall, require regular maintenance, corrosion-resistant materials, and so on, which can collectively elevate the lifecycle cost. To deal with this issue, manufacturers are working on cost-effective barrier systems with durability and minimal maintenance needs incorporated in them.

Lack of Standardization in Emerging Economies

In some underdeveloped nations, the situation is dire as the road safety laws and barrier design specification are either very old or there very few who follow them. This leads to situations where barrier performances vary widely, the design is not robust enough to carry out the work, and using the procured materials adds to the problem, which is the loss of the project's effectiveness.

The shortage of national testing centers, qualified personnel, and monitoring frameworks has resulted in low quality control and sluggish market growth. Stakeholders should direct their efforts towards data and risk management processes while at the same time seek to address the issues of proper technology transfer and policy alignment to the end of pushing boundaries on safety standards and to expand demand for compliant crash barrier systems.

Opportunities

Integration of Smart and Sensor-Based Crash Barriers

The development of smart infrastructure and the connected vehicles entails possibilities for the installation of digital-enabled crash barriers. The state-of-the-art IoT-integrated barriers, real-time impact sensors, and automatic incident reporting systems that are being deliberated over and tested in smart cities as well as in high-speed corridors are the forerunners of technology potential in this area.

They will provide instant alerts when a vehicle crash occurs, thus, facilitating an immediate response from emergency services and enabling more efficient traffic management. As V2I communication increases in popularity, smart crash barriers with built-in electronics and remote monitoring capabilities will see a larger number of installations.

Increased Road Safety Investments in Developing Nations

As road accidents results are climbing and the economic losses are rising, the developing countries are allocating more funds to the highway safety improvements through the collaboration of various organizations and the PPP model. This is a significant opportunity for the durable and affordable, high-performance crash barriers to be deployed in areas including South Asia, Southeast Asia, and Sub-Saharan Africa.

The main-spread activities like India's National Road Safety Programme, ASEAN's road infrastructure upgrades, and Africa's corridor development will further bolster the market. The global collaboration in terms of para testing protocols, localized manufacturing, and trainings will contribute to the expansion of the opportunities for the global player.

In the period of 2020 to 2024, the crash barrier market saw huge growth thanks to increased government expenditure on road safety works, higher vehicle traffic, and the worldwide efforts to end fatalities on highways and urban roads.

Barriers that are used for shock absorption and misthrow prevention of vehicles on highways, bridges, overbridges, etc. got massive usage in these years. New technical solutions in construction include improvements to concrete, steel and composite barrier systems. But however, the progress has been hindered as developing countries block resources for maintenance, stagnant budgets, and infrastructure delivery failures as a result of the pandemic.

The future automotive crash barrier market will be characterized by smart sensor-integrated barriers, energy-absorbing designs, and the use of sustainable materials. With the advent of autonomous and electric vehicles, crash barrier technologies will be re-adapted to the smart mobility environments and will support real-time traffic joanna, lane management, and predictive crash prevention analytics. The government will fuel more of the AI embedded road safety initiatives while at the same time the manufacturers of barriers alter their product line to modular, recyclable, and low-carbon barriers.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Government Road Safety Initiatives | Investment in highway crash barriers and bridge parapets for accident prevention. |

| Barrier Materials & Construction | Dominated by steel guardrails, concrete barriers, and plastic water-filled systems. |

| Design & Functionality | Focused on impact resistance, energy absorption, and durability under collisions. |

| Urban Mobility Integration | Deployed primarily on highways, industrial roads, and bridges. |

| Sensor & Smart Technology Inclusion | Minimal digital integration; some pilot projects with reflectors and cameras. |

| Maintenance & Inspection | Manual inspection and reactive replacement post-damage. |

| Sustainability & Environmental Goals | Growing interest in recyclable and low-VOC coating materials. |

| Market Growth Drivers | Growth driven by urbanization, rising vehicle numbers, and national infrastructure plans. |

| Market Shift | 2025 to 2035 |

|---|---|

| Government Road Safety Initiatives | Widespread adoption of smart crash barrier systems with real-time diagnostics and impact alerts. |

| Barrier Materials & Construction | Emergence of recyclable composites, carbon fiber -reinforced barriers, and AI-tested modular systems. |

| Design & Functionality | Development of energy-dispersing, shape-memory materials that adjust upon impact and reset post-collision. |

| Urban Mobility Integration | Expanded use in autonomous vehicle lanes, bike/e-scooter zones, and smart city corridors. |

| Sensor & Smart Technology Inclusion | Introduction of sensor-embedded barriers with vehicle-to-infrastructure (V2I) communication and data logging. |

| Maintenance & Inspection | AI-assisted damage detection, automated drones for inspection, and predictive repair planning. |

| Sustainability & Environmental Goals | Full-scale use of green steel, carbon-neutral production processes, and decommissioned barrier recycling. |

| Market Growth Drivers | Expansion driven by smart mobility networks, climate-resilient infrastructure, and autonomous traffic systems. |

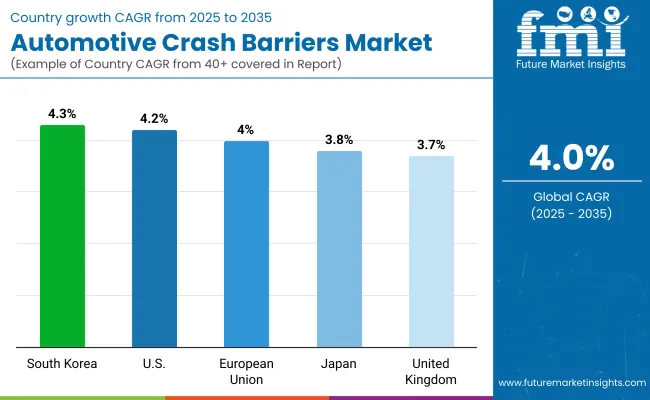

The automotive crash barrier market in the United States is flourishing, mainly due to the rise in government funding government in road and safety initiatives, highway renovations, and continual awareness to curtail traffic fatality crashes. The Federal Highway Administration (FHWA) firmly backs up the campaigns that enforce the installation of crash-tested roadside barriers on national highways.

Urban expansion, the add of work zone safety and the replacement of outdated barriers are the major drivers of the market. The ratio of vehicles to the high United States of America impact on crash standards encourages the use of advanced steel and concrete barrier systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

The UK automotive crash barrier market is forecasted to grow slightly, with packages like the government's double vision “Vision Zero” road-user deaths, smart motorways, and the progressive use of high-containment traffic barrier for separation. It is also the concrete and steel type Benefits highlighting the crash-test and safety factor in project areas in motorways and high-risk zones in the UK.

The focus is also on the reversible and modular crash barriers that are needed in temporary setups.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.7% |

The European Union automotive crash barrier sector is experiencing constant growth, thanks to enduring EU road safety mandates, improvements in the Trans-European Transport Network (TEN-T) corridors, and initiatives towards the objectives set in the EU Road Safety Strategy 2030. An example of this is the activities of Germany, France, and Italy, where they are actively substituting W-beam guardrails with high-confinement steel and hybrid crash barrier systems.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.0% |

The automotive crash barrier market in Japan experiences stable growth, mainly driven by the need for better protection from landslide-prone roads, road infrastructure improvement and the recent trend towards environmentally friendly traffic safety engineering. The government is investing in energy-absorbing and anti-corrosion crash barriers for highways, especially in areas prone to landslides and coastal regions.

Japan is also successful in developing hybrid safety systems, combining crash cushions, fencing, and pedestrian protection elements. Intelligent transportation systems (ITS) traffic barrier integration is also being promoted for future infrastructure upgrades.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

The South Korean automotive crash barrier market is rapidly expanding due to the smart city concept, the urban highway's lengthening, and the high spending earmarked for advanced road safety technologies. The country is a pioneer in using multi-use crash barriers, which are both safety devices and aesthetic objects in cities and tourist corridors.

There’s also a bigger emphasis on the energy-absorbing barriers, more so at the accident-prone intersections and expressways. South Korean companies are creative applying compact, lightweight and gadget configurations which can be implemented on short notice in construction zones or disaster relief missions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Roadside Barriers Top the Stake of the Automotive Crash Barrier Market thanks to Their Widespread Installation on Urban and Rural Roads, National Roads, and High-Speed Corridors. These Barriers are Installed in Specific Locations that Prevent Vehicles from Driving Off the Road, Lessen the Risk of Fatal Rollovers and are Especially Effective in Parked Sidewalks, Bank Slopes and for Car Drivers.

Roadside Barriers, which are used to prevent vehicles resulting from accidents from veering off the road, are the first defense line in road safety maintenance compared to median or bridge barriers, which cover only a small part of accident scenarios. Nations and state highway administrations, and, in particular, fast motorizing nations like India, Indonesia, and Brazil, are committed to upgrading infrastructure and mitigating roadside hazards.

This, in turn, is the area inside which demand is primarily generated for long roadside barriers built of steel, reinforced concrete, and hybrids produced materials, which are intended to deflect upon impact while guiding the vehicle back to the road.

The deployment of crash-tested roadside that comply with standards such as EN 1317 and MASH is projected to increase increasing goods taken aboard for you and promoted by the UN Decade of Action for Road Safety and Vision Zero.

Bridge barriers are experiencing growing demand, especially in the elevated structures, flyovers, and viaducts, where fall protection and impact containment are crucial. These barriers are engineered to resist higher impact forces, offering reinforced rigidity and vehicle containment capability, while also addressing aesthetic and aerodynamic considerations.

Compared to roadside or work zone barriers, bridge barriers are often custom-fitted and constructed using precast concrete, steel-reinforced parapets, or hybrid materials that combine strength and flexibility. They also serve a dual purpose-preventing vehicles from leaving the bridge structure and protecting pedestrians and cyclists in shared mobility corridors.

As urban transportation projects and multimodal bridges expand in cities across Europe, the Middle East, and Southeast Asia, the demand for bridge-specific crash barrier solutions-integrating anti-glare features, sound barriers, and modular designs-is rising steadily. Theretrofitting older bridges with modern crash-tested safety barriers is becoming a key area of public infrastructure spending.

Among the various barrier technologies, W-beam steel barriers hold the largest market share, owing to their proven effectiveness, widespread acceptance in global safety standards, and relative cost efficiency. These semi-rigid barriers are constructed from galvanized steel beams mounted on posts and are designed to absorb and redistribute crash energy, thereby minimizing vehicle damage and passenger injury.

Compared to rigid concrete or flexible cable barriers, W-beam barriers strike a balance between performance, ease of installation, and repairability. They are commonly used along high-speed expressways, rural highways, and roadside hazard zones, and are preferred by highway agencies for longitudinal road safety upgrades.

As road safety budgets expand in both developed and developing countries, demand for MASH- and EN-certified W-beam systems is increasing. The market is also seeing a shift toward hot-dip galvanized and powder-coated W-beams for enhanced durability and corrosion resistance, especially in coastal or high-humidity environments.

Governments in countries like the USA, Germany, Saudi Arabia, and Japan are increasingly using concrete median and roadside barriers in areas with high commercial traffic or elevated security concerns. Thesmart concrete barriers integrated with sensors for impact detection and traffic data collection are emerging as part of the intelligent transport infrastructure wave.

The global automotive crash barrier market is driven by the increasing focus on road safety infrastructure, expanding highway construction, and stringent regulatory standards related to vehicle and passenger safety.

Crash barriers, also Referred to as safety barriers or guardrails, they recorded as primary element of road safety systems, which absorbs and holds the kinetic energy to mitigate the impact during vehicle collision thus preventing from going into the opposite lane? In other words, guardrails can stop vehicles from off-bridging or side-on roadside hazards.

Technological advances in barrier systems have emerged, such as the development of energy-absorbing materials, modular designs, and composite reinforcements, which result in the increase of the efficiency of these barriers to saving lives and limbs.

The fact that North America, Europe, and Asia-Pacific governments are still making advancements in smart cities, highway modernization, and urban traffic management drives demand for crash barriers.

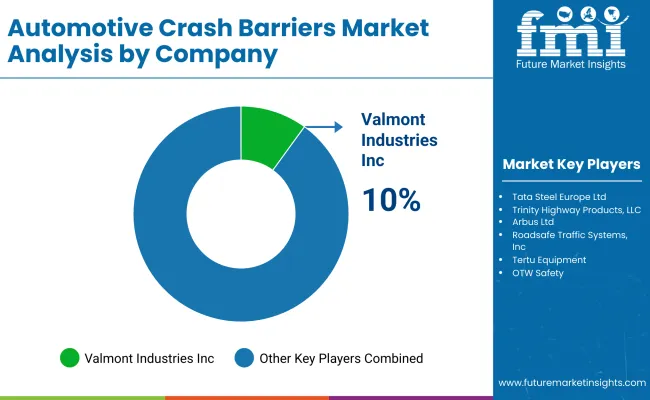

The market is moderately fragmented, with the top five companies accounting for approximately 40-45% of the global market share. These companies offer innovative, compliant, and region-specific barrier solutions, maintaining strong ties with transportation departments, EPC contractors, and road safety authorities.

Market Share Analysis by Company

| Company Name | Estimated Market Share(%) |

|---|---|

| Valmont Industries, Inc. | 10-12% |

| Tata Steel Europe Ltd. | 8-10% |

| Trinity Highway Products, LLC | 7-9% |

| Arbus Ltd. | 6-7% |

| Roadsafe Traffic Systems, Inc. | 6-7% |

| Other Companies (combined) | 55-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Valmont Industries, Inc. | Offers W-beam, Thrie -beam, and steel-post guardrail systems ; involved in highway safety, urban traffic, and bridge edge protection projects globally. |

| Tata Steel Europe Ltd. | Manufactures corrosion-resistant, hot-dip galvanized crash barriers designed to meet EN 1317 and NCHRP 350 compliance for European and global roads. |

| Trinity Highway Products, LLC | Supplies guardrail terminals, cable barriers, and end treatments under brands like ET Plus® and SafeGuard ® , with presence in North America and LATAM. |

| Arbus Ltd. | Specializes in modular, high-absorption crash barriers , especially for temporary work zone and urban applications , including mobile steel barriers. |

| Roadsafe Traffic Systems, Inc. | Focuses on temporary and permanent roadside safety barriers , traffic control devices, and EPC services across USA road and bridge projects. |

Key Company Insights

Valmont Industries, Inc.

Valmont is among the leading brands in the global automotive crash barrier market, with a product line including roadside safety systems, bridge railings, and end terminals. The company offers W-beam and Thrie-beam guardrails that are produced according to USA MASH-compliance and European EN 1317 standards. Besides, Valmont promotes infrastructure initiatives in North America, Europe, and the Middle East through modular systems, high-durability coatings, and green steel sourcing.

Tata Steel Europe Ltd.

Tata Steel is a company that builds high-performance steel crash barriers and is recognized for the long-lasting performance of galvanization, precise engineering, and proven energy absorption features. Their infrastructure projects involve motorways, elevated roads, and ring roads in Europe, India, and the GCC. Tata Steel dedicates itself to environmental sustainability through the use of materials that are recyclable and has joined forces in smart mobility partnerships for the implementation of an innovative infrastructure for the roads.

Trinity Highway Products, LLC

Trinity Highway is a leading player in the USA for the safety hardware of roads, offering wreath posts, end terminals, crash cushions, and cable barriers. The company's ET Plus® guardrail end terminal system, which is applied in main interstate and county roads, is known for its federal endorsement and certification that has passed crash tests. Trinity is also expanding its rental portable barrier product line for event venues, urban congestion control, and temporary work zones.

Arbus Ltd.

Arbus is the focus point of temporary and modular steel barriers that are designed for rapid deployment and reusability in construction zones and in high-traffic urban settings. Their systems are the easiest to install, provide the highest resistance to impact, and are highly flexible in configuration, thus they meet EN 1317 containment standards. Arbus has a close relationship with municipal governments, contractors, and urban planners, particularly in Eastern Europe and the Asia-Pacific region.

Roadsafe Traffic Systems, Inc.

Roadsafe Traffic Systems is a USA-based company that designs and manufactures temporary roadside safety units and permanent roadside safety solutions like concrete barriers, crash attenuators, and mobile steel barriers. It is an active partner in projects supported by DOT that include bridge construction and utility work and is offering a complete service that entails barrier rental, installation, and traffic control planning.

The market is segmented into Movable/Portable Barriers Systems and Immovable/Fixed Barriers Systems.

The industry includes Roadside Barriers, Median Barriers, Bridge Barriers, Work Zone Barriers, and Others.

The market includes Crash Cushions, Gating and Non-Gating End Treatments, Water and Sand Filled Plastic Barriers, Guardrails Energy Absorbent Terminals (GEAT), and Others.

The report covers applications in Highways, Urban Roads, Bridges & Flyovers, Construction Zones, and Toll Plazas.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The global automotive crash barrier market is projected to reach USD 8.3 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 4.0% over the forecast period.

By 2035, the automotive crash barrier market is expected to reach USD 12.3 billion.

The Rigid Barriers segment, particularly Pre-Cast Concrete Barriers, is expected to dominate due to their high impact resistance, durability, and preference in high-traffic highway installations.

Key players in the market include Tata Steel Limited, Lindsay Corporation, Trinity Highway Products, Valmont Industries, Inc., Nucor Corporation, Hill & Smith Holdings PLC, and Arbus Ltd.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA