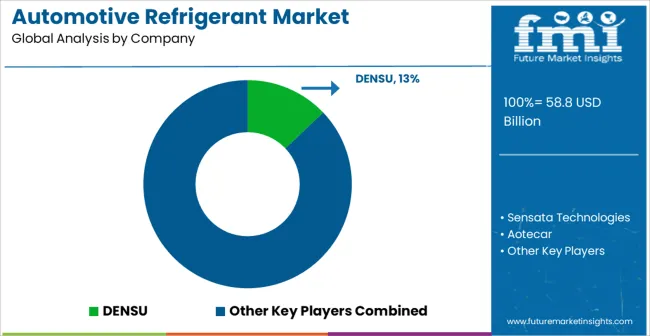

The Automotive Refrigerant Market is estimated to be valued at USD 58.8 billion in 2025 and is projected to reach USD 112.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Refrigerant Market Estimated Value in (2025 E) | USD 58.8 billion |

| Automotive Refrigerant Market Forecast Value in (2035 F) | USD 112.8 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The Automotive Refrigerant market is showing strong growth momentum, supported by the rising demand for air conditioning systems in passenger and commercial vehicles. Increasing consumer preference for comfort, coupled with stringent climate regulations, is pushing manufacturers to adopt efficient and eco-friendly refrigerants. The market is witnessing a transition from traditional refrigerants toward alternatives with lower global warming potential, in line with international environmental standards.

Rapid urbanization, growing disposable incomes, and rising vehicle ownership rates are further contributing to demand across both developed and emerging economies. Technological advancements in automotive HVAC systems, including compact and energy-efficient designs, are enhancing refrigerant consumption. In addition, regulatory initiatives such as the Kigali Amendment are prompting automakers and suppliers to invest in sustainable refrigerant solutions.

Expanding aftermarket sales of refrigerants, due to frequent servicing and maintenance requirements, are adding to revenue growth As automakers aim to balance performance, cost, and environmental compliance, the market for automotive refrigerants is expected to maintain long-term expansion, with opportunities for innovation in synthetic and alternative refrigerant technologies.

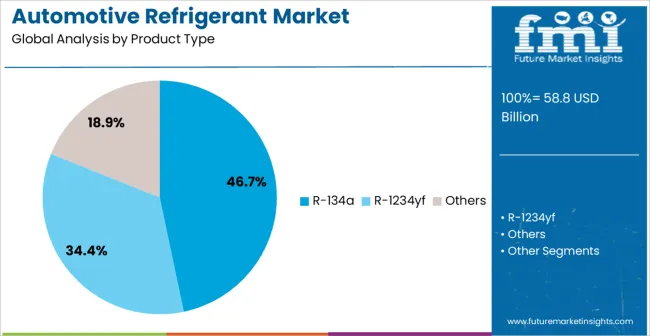

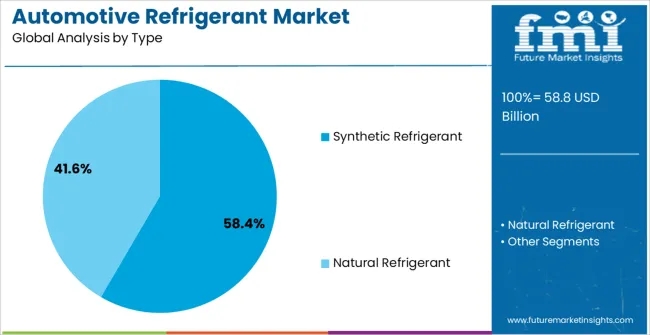

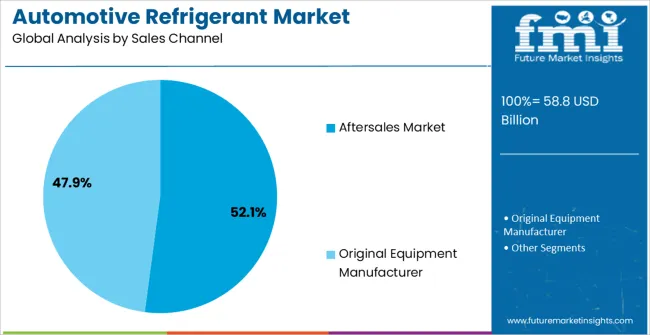

The automotive refrigerant market is segmented by product type, type, sales channel, and geographic regions. By product type, automotive refrigerant market is divided into R-134a, R-1234yf, and Others. In terms of type, automotive refrigerant market is classified into Synthetic Refrigerant and Natural Refrigerant. Based on sales channel, automotive refrigerant market is segmented into Aftersales Market and Original Equipment Manufacturer. Regionally, the automotive refrigerant industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The R-134a product type segment is projected to hold 46.7% of the Automotive Refrigerant market revenue in 2025, making it the leading product type. The dominance of R-134a is largely due to its widespread use in automotive air conditioning systems, where it has been established as a reliable and cost-effective refrigerant for decades. Its favorable thermodynamic properties, availability, and proven performance under varied operating conditions have reinforced its position in the market.

Despite regulatory pressure to reduce high global warming potential refrigerants, R-134a continues to be widely used, particularly in regions where regulatory transitions are slower. The strong aftermarket demand for R-134a, driven by regular servicing of older vehicles, further supports its large share.

Affordability compared to some newer alternatives also adds to its continued preference As automotive manufacturers transition to environmentally friendly options, R-134a is expected to gradually lose share but will remain significant during the forecast period, sustained by its entrenched use and extensive global distribution networks.

The synthetic refrigerant segment is anticipated to account for 58.4% of the Automotive Refrigerant market revenue in 2025, positioning it as the leading refrigerant type. Synthetic refrigerants are preferred due to their engineered stability, consistent performance, and suitability across a wide range of automotive HVAC systems. Their ability to meet diverse operational requirements, including cooling efficiency and reliability under extreme temperatures, has supported their dominance.

Automotive manufacturers continue to favor synthetic refrigerants for their compatibility with existing infrastructure and established servicing practices. Advances in synthetic formulations are enabling improved energy efficiency and lower emissions, aligning with evolving environmental standards. Additionally, the availability of synthetic refrigerants through extensive supply networks and their adaptability for both new and older vehicle models are enhancing adoption.

The higher demand in regions with mature automotive industries and large vehicle fleets is further driving the segment As regulations encourage innovation, synthetic refrigerants are expected to maintain their leading share by offering a practical balance of performance, availability, and compliance.

The aftersales market sales channel segment is expected to hold 52.1% of the Automotive Refrigerant market revenue in 2025, securing its position as the leading sales channel. This dominance is primarily due to the recurring demand for refrigerant refills and servicing in vehicle air conditioning systems. As vehicles age, refrigerant leakage and degradation necessitate regular maintenance, driving high volumes of aftermarket sales.

The extensive presence of service centers, garages, and distribution networks ensures easy access to refrigerants, supporting steady demand in the aftersales market. Rising vehicle ownership globally and the trend of keeping vehicles for longer periods further amplify this requirement. Consumers often prefer aftersales channels due to competitive pricing, availability of multiple refrigerant options, and convenience.

The continued use of traditional refrigerants like R-134a in older vehicles also sustains aftermarket volumes, even as newer eco-friendly refrigerants penetrate the OEM market With strong replacement cycles and recurring demand patterns, the aftersales segment is expected to retain its leadership, supported by its critical role in vehicle maintenance and longevity.

Refrigerants in automobiles are used in the air conditioning system to absorb and release the heat. As being the essential part of the automotive air conditioning system, growing demand for automobiles all over the world is increasing the demand for automotive refrigerant as well.

The types of refrigerant used in the automobile are now changing as the rising concern about global warming is promoting the reduction of harmful emission to a significant extent. Chlorofluorocarbons (CFC) were replaced by Hydrofluorocarbons (HFC) in 1990s. Following the concern, the automotive manufacturers are now engaged in using more efficient and ecofriendly refrigerants in the air conditioning system.

The most common refrigerant used is R-134a, also known as 1,1,1,2 - Tetrafluroethane. The latest on going refrigerant used in the automotive industry is R-1234yf refrigerant, also known 2,3,3,3-Tetrafluoropropene. R-123yf being non-toxic, non-corrosive and non-flammable in its nature.

This colorless gas is being introduced as a replacement for R-134 refrigerant maintaining a global warming potential rating 1/335 of R-134 which is estimated to be only four times higher than that of CO2. Introduction of new refrigerants in the market with salient features is increasing the demand for automotive refrigerant resulting in the significant growth of the market over the forecast period.

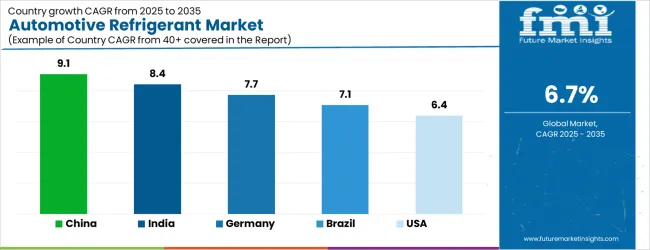

| Country | CAGR |

|---|---|

| China | 9.1% |

| India | 8.4% |

| Germany | 7.7% |

| Brazil | 7.1% |

| USA | 6.4% |

| UK | 5.7% |

| Japan | 5.0% |

The Automotive Refrigerant Market is expected to register a CAGR of 6.7% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.1%, followed by India at 8.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 5.0%, yet still underscores a broadly positive trajectory for the global Automotive Refrigerant Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.7%. The USA Automotive Refrigerant Market is estimated to be valued at USD 20.4 billion in 2025 and is anticipated to reach a valuation of USD 20.4 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 2.7 billion and USD 1.8 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.8 Billion |

| Product Type | R-134a, R-1234yf, and Others |

| Type | Synthetic Refrigerant and Natural Refrigerant |

| Sales Channel | Aftersales Market and Original Equipment Manufacturer |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DENSU, Sensata Technologies, Aotecar, Highly, VAQOUNG, Arkema Group, Air International thermal system, Hitachi Ltd, Keleng, Calsonic Kansei Corporation, Hanon System, The Keihin Corporation, Valeo, MAHLE GmBH, and Sanden |

The global automotive refrigerant market is estimated to be valued at USD 58.8 billion in 2025.

The market size for the automotive refrigerant market is projected to reach USD 112.8 billion by 2035.

The automotive refrigerant market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in automotive refrigerant market are r-134a, r-1234yf and others.

In terms of type, synthetic refrigerant segment to command 58.4% share in the automotive refrigerant market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA