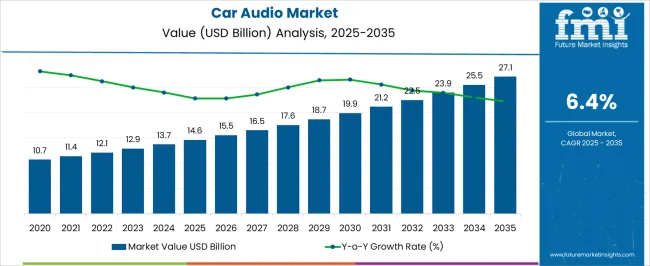

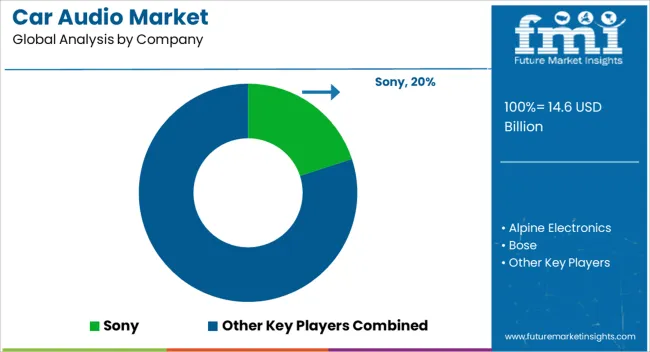

The car audio market is estimated to be valued at USD 14.6 billion in 2025 and is projected to reach USD 27.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period. A peak-to-trough analysis reveals consistent growth with fluctuations driven by technological advancements and shifting consumer preferences. Between 2025 and 2030, the market grows from USD 14.6 billion to USD 19.9 billion, contributing USD 5.3 billion in growth, with a CAGR of 6.9%. This early-phase growth is driven by the increasing integration of advanced audio technologies, such as surround sound systems, connectivity features, and smartphone compatibility in vehicles. As consumer demand for enhanced in-car entertainment continues to rise, the market experiences a peak at USD 19.9 billion in 2030.

From 2030 to 2032, the market experiences a deceleration, growing from USD 19.9 billion to USD 21.2 billion, contributing USD 1.3 billion in growth, with a slower CAGR of 3.2%. This slowdown reflects the market nearing maturity, where the adoption of standard audio systems stabilizes. From 2032 to 2035, the market picks up momentum again, expanding from USD 21.2 billion to USD 27.1 billion, contributing USD 5.9 billion in growth, with a higher CAGR of 8.5%. This acceleration is driven by innovations in smart audio systems and the increasing demand for integrated, high-quality sound systems in electric vehicles. The analysis shows strong early growth followed by a stable phase, with renewed momentum as technology evolves.

| Metric | Value |

|---|---|

| Car Audio Market Estimated Value in (2025 E) | USD 14.6 billion |

| Car Audio Market Forecast Value in (2035 F) | USD 27.1 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

Rising demand for immersive driving experiences and improved connectivity has been shaping the current market landscape, as indicated by recent automotive press releases and technology product launches. Automakers are increasingly integrating advanced sound systems to enhance vehicle value and align with consumer lifestyle preferences.

Voice-enabled controls, customizable audio zones, and compatibility with smartphone platforms are contributing to this transformation. Regulatory developments related to driver safety and hands-free operations are also influencing design choices, particularly in sound management and control components. Future growth is likely to be driven by the integration of AI and edge computing within vehicle electronics, enabling smarter and more responsive sound environments.

Automotive OEMs and Tier 1 suppliers are investing in modular audio architectures and embedded software updates to provide scalable and sustainable solutions.

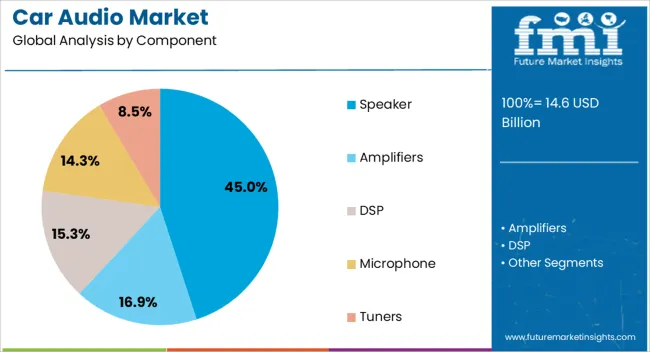

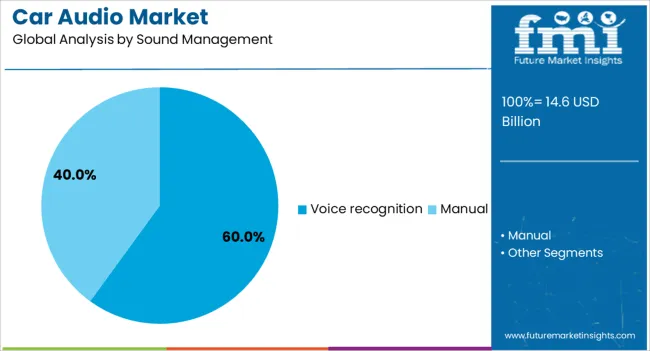

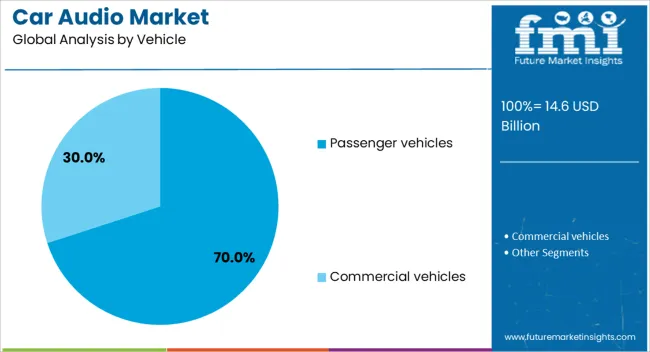

The car audio market is segmented by component, sound management, vehicle, sales channel, and geographic regions. By component, the car audio market is divided into speakers, Amplifiers, DSPs, microphones, and Tuners. In terms of sound management, the car audio market is classified into Voice recognition and Manual. Based on vehicle, the car audio market is segmented into Passenger vehicles and Commercial vehicles. By sales channel, the car audio market is segmented into OEM and Aftermarket. Regionally, the car audio industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The speaker component segment is projected to hold 45.0% of the Car Audio market revenue share in 2025, positioning it as the leading segment within the component category. This dominant share is being supported by its essential role in delivering the core audio output across all vehicle classes. Advances in speaker materials and design, as noted in automotive audio engineering journals, have improved sound fidelity and energy efficiency.

Automakers are increasingly adopting high-performance speaker systems to differentiate interior experiences and align with premium branding strategies. The growth of electric and hybrid vehicles has further encouraged the use of lightweight speaker components to enhance overall energy management.

Widespread integration of surround sound and multi-channel speaker systems in both economy and luxury models has solidified the segment’s market position The segment's dominance is also being reinforced by continued investments in in-cabin acoustic innovation, enabling personalized and spatially aware soundscapes that meet the evolving expectations of consumers globally.

The voice recognition segment within sound management is expected to account for 60.0% of the Car Audio market revenue share in 2025, making it the most prominent segment under this category. The rising adoption of voice-enabled interfaces has been driven by the need for safer, hands-free operation and compliance with in-vehicle distraction regulations. As outlined in OEM connectivity strategies and industry conference discussions, automakers are increasingly integrating voice command features to control audio, navigation, and vehicle functions without requiring manual input.

Technological advancements in natural language processing and AI-based noise cancellation have significantly improved accuracy and user experience. The expansion of connected car ecosystems and digital assistants has further strengthened the relevance of voice recognition systems.

These solutions are being embedded not only in luxury vehicles but also in mid-range models, as part of standard infotainment packages. This widespread integration and regulatory alignment are key reasons for the segment’s sustained growth in the Car Audio market.

The passenger vehicles segment is forecasted to contribute 70.0% of the Car Audio market revenue share in 2025, making it the dominant segment by vehicle type. This position is being sustained by the consistently high volume of passenger vehicle production globally, coupled with increasing consumer demand for enhanced in-cabin experiences. Press statements from automotive manufacturers have emphasized the role of audio systems in brand differentiation and buyer decision-making, particularly in the compact and SUV categories.

Rising adoption of infotainment technologies in entry-level and mid-range passenger cars has expanded the market reach of car audio components. Furthermore, integration of personalized entertainment features, connectivity with smartphones, and embedded voice controls has made car audio systems a key value-added feature in this segment. Automakers are prioritizing software-defined features that allow post-sale upgrades, contributing to sustained growth.

The car audio market is evolving with advancements in technology, offering enhanced sound systems and multimedia solutions for in-car entertainment. The demand for high-quality audio experiences, coupled with the integration of smart technologies such as voice recognition, Bluetooth connectivity, and smartphone integration, is driving market growth. The increasing adoption of electric and autonomous vehicles is creating new opportunities for the integration of advanced audio systems. As consumer preferences shift toward enhanced in-car experiences, the market for car audio is expected to grow in the coming years.

The growth of advanced car audio systems is hindered by several challenges despite the increasing demand for high-quality in-car entertainment. One of the primary obstacles is the high production cost of premium audio systems, particularly those that include advanced technologies such as surround sound, noise cancellation, and seamless connectivity. These systems are often limited to higher-end vehicle segments, excluding a broader consumer base. Additionally, as technology advances at a rapid pace, manufacturers are under constant pressure to innovate, driving up research and development costs. The integration of audio systems into evolving vehicle designs, such as electric and autonomous vehicles, also presents a challenge. These vehicles often feature more complex and unique interior configurations, requiring audio systems that can adapt to new environments. Furthermore, the wide variety of consumer preferences and audio system requirements adds complexity, making it difficult to offer a one-size-fits-all solution, thereby fragmenting the market.

The increasing demand for enhanced in-car entertainment experiences, particularly from tech-savvy consumers, is one of the primary drivers. With the growing use of smartphones, Bluetooth technology, and voice-activated features, consumers now expect seamless integration between their devices and car audio systems. The rise of electric and autonomous vehicles is creating new opportunities for audio system manufacturers. These vehicles prioritize advanced in-car experiences and are more likely to integrate high-quality sound systems, as passengers spend more time inside the vehicle. Technological advancements in sound quality, such as noise cancellation and personalized audio settings, are also contributing to the growing demand. As consumers continue to seek greater comfort and convenience in their vehicles, the desire for premium, customizable audio systems is pushing the market toward more sophisticated and integrated solutions.

The in-car audio sector presents numerous growth opportunities, especially with the growing demand for more innovative and integrated technologies. The rise of voice-controlled audio systems, customizable sound profiles, and enhanced connectivity features like smartphone integration are all driving demand for more advanced solutions. Additionally, the transition to electric and autonomous vehicles is creating new avenues for growth, as these vehicles often feature more flexible interior layouts and extended cabin time, offering a perfect environment for immersive audio experiences. The growing popularity of streaming services and mobile content is influencing consumer preferences for digital-ready audio systems. Manufacturers now have the opportunity to develop solutions tailored to the increasing consumption of digital music, podcasts, and audiobooks. Additionally, opportunities exist to create smarter systems that integrate with other in-car technologies, such as navigation and climate control, further enhancing the user experience and offering new revenue streams for manufacturers.

The increasing adoption of voice-activated and Bluetooth-connected systems provides consumers with greater ease of use and a seamless experience. As consumers demand more personalized audio experiences, advancements in noise-canceling technology and customizable sound settings are becoming more prevalent, allowing users to tailor their in-car sound to their preferences. Another significant trend is the integration of in-car audio systems with electric and autonomous vehicles, as these types of vehicles provide more flexible space and longer travel times, allowing for enhanced entertainment experiences. The trend toward digital and mobile connectivity continues to grow, with streaming services gaining popularity among consumers. This shift is influencing the development of audio systems that are optimized for digital content consumption, leading manufacturers to create more advanced, efficient, and user-friendly audio systems for modern vehicles.

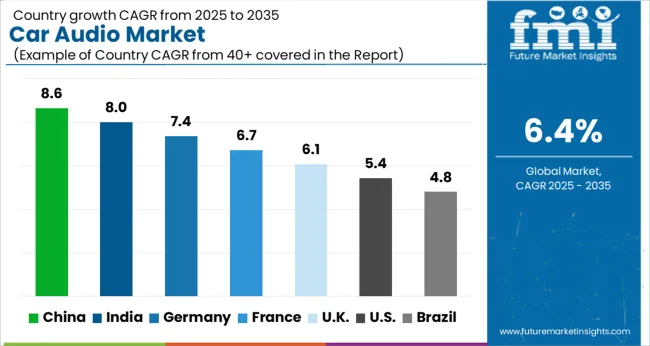

The car audio market is projected to grow at a CAGR of 6.4% from 2025 to 2035. China leads at 8.6%, followed by India at 8.0%, and Germany at 7.4%, while the United Kingdom records 6.1% and the United States posts 5.4%. These rates translate to a growth premium of +35% for China, +25% for India, and +5% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Increasing adoption of advanced car audio systems in China and India due to rising consumer interest in connected car technologies, while more mature markets like the United States and the United Kingdom experience more moderate growth due to established infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

Demand for car audio systems in China is growing at an 8.6% CAGR through 2035. China’s rapidly expanding automotive sector, driven by the increasing demand for connected and electric vehicles, is fueling the adoption of advanced car audio systems. With rising consumer disposable incomes and the growing interest in in-car entertainment, China’s car audio market is poised for significant expansion. The integration of smart features like voice control, navigation, and connectivity in car audio systems is accelerating demand. The rise of e-commerce and retail distribution networks further increases accessibility to car audio solutions.

Sale of car audio systems in India is projected to grow at an 8.0% CAGR through 2035. India’s growing automotive sector, combined with rising disposable incomes and changing consumer preferences, is driving the adoption of advanced car audio systems. The increasing popularity of connected and premium vehicles is contributing to the demand for high-quality audio solutions. Additionally, India’s rising middle class and their growing interest in in-car entertainment and connectivity are fueling the market. The rapid growth of the e-commerce sector and retail networks in India also supports the availability of car audio products.

The car audio market in Germany is growing at a 7.4% CAGR through 2035. Germany’s well-established automotive industry, particularly in the luxury car segment, is a key driver for the demand for premium car audio solutions. As consumer preferences shift toward high-quality in-car entertainment and connectivity, there is a growing market for advanced car audio systems in the country. The rise in demand for electric vehicles and the integration of smart technologies in cars also contribute to the market expansion. Germany’s focus on technological innovation and sustainability further accelerates the growth of the car audio market.

The UK car audio market is expected to grow at a 6.1% CAGR through 2035. The market is driven by increasing consumer interest in premium in-car audio solutions, with a focus on high-quality sound and connectivity. The UK’s growing automotive sector, along with rising consumer demand for connected car technologies, is contributing to the market expansion. The shift toward electric and hybrid vehicles in the UK is driving demand for advanced car audio systems that offer integration with smart technologies. Retail distribution channels and e-commerce platforms further support market growth.

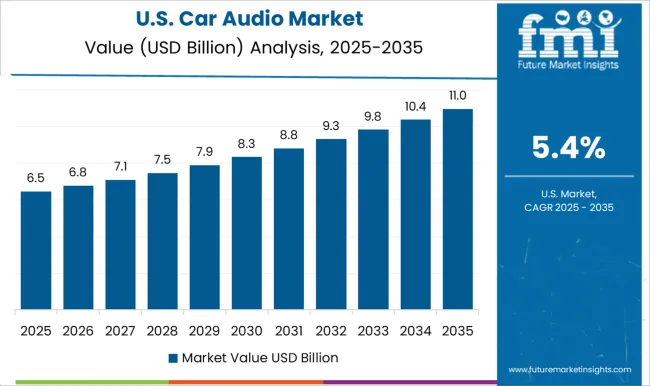

Demand for car audio systems in the USA is projected to grow at a 5.4% CAGR through 2035. The USA market for car audio systems is driven by increasing demand for in-car entertainment, especially in the premium vehicle segment. The growing popularity of connected and electric vehicles is contributing to the market’s expansion. As consumer preferences evolve toward high-performance audio systems with advanced features like voice control and connectivity, the demand for car audio solutions continues to rise. The USA automotive industry’s technological advancements and the growth of e-commerce platforms further support the adoption of car audio systems.

The car audio market is driven by leading companies offering high-performance audio systems designed to enhance in-car entertainment experiences. Sony is a market leader, known for its premium car audio systems, offering a wide range of products that include car stereos, speakers, and amplifiers, emphasizing high sound quality, smart connectivity, and advanced features such as smartphone integration. Alpine Electronics provides high-quality car audio products, including head units and premium speakers, focusing on delivering excellent sound reproduction and user-friendly interfaces tailored to a wide range of vehicle types. Bose is recognized for its premium sound solutions, offering high-fidelity, noise-canceling audio systems that cater to luxury and high-performance vehicles, focusing on creating an immersive in-car audio experience. Clarion Co. offers advanced car audio products that combine innovation and functionality, providing solutions such as multimedia receivers, speakers, and amplifiers for automotive audio enthusiasts.

Harman delivers premium audio systems for both OEM and aftermarket installations, known for its JBL, Harman Kardon, and Infinity brands, offering superior sound quality and integration with in-car connectivity systems. JVCKenwood provides high-quality audio systems and accessories, focusing on user experience with products like touchscreen receivers, amplifiers, and speakers, catering to a variety of automotive needs. NXP Semiconductors plays a crucial role in the market by supplying automotive-grade audio chips that enable high-performance audio processing and seamless connectivity. Panasonic provides automotive sound systems that prioritize clarity, bass response, and smart connectivity, offering products for both mass-market and luxury vehicles. Pioneer delivers a wide range of car audio products, focusing on user customization and sound quality, offering both basic and advanced solutions for different consumer needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.6 Billion |

| Component | Speaker, Amplifiers, DSP, Microphone, and Tuners |

| Sound Management | Voice recognition and Manual |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sony, Alpine Electronics, Bose, Clarion Co., Harman, JVCKenwood, NXP Semiconductors, Panasonic, Pioneer, and Premium Sound Solutions |

| Additional Attributes | Dollar sales by product type (head units, amplifiers, speakers, subwoofers, receivers) and end-use segments (OEM, aftermarket, luxury vehicles, electric vehicles). Demand dynamics are influenced by growing consumer preference for high-quality, customizable in-car audio systems, the rise of smart connectivity features, and the increasing integration of voice assistants and smartphone apps in vehicle entertainment. Regional trends show strong growth in North America and Europe, driven by increasing consumer demand for premium and high-tech audio systems, while Asia-Pacific is expanding rapidly due to rising car sales and adoption of advanced car technologies. |

The global car audio market is estimated to be valued at USD 14.6 billion in 2025.

The market size for the car audio market is projected to reach USD 27.1 billion by 2035.

The car audio market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in car audio market are speaker, 2-way, 3-way, 4-way , amplifiers, DSP, microphone and tuners.

In terms of sound management, voice recognition segment to command 60.0% share in the car audio market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cardiology Information System Market Size and Share Forecast Outlook 2025 to 2035

Cardiopulmonary Functional Testing Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Car Bushing Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Card Printer Ribbon Market Size and Share Forecast Outlook 2025 to 2035

Caramel Malt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carpet Spot Remover Market Size and Share Forecast Outlook 2025 to 2035

Cardiovascular CT Systems Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carpet and Rug Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carob Market Size and Share Forecast Outlook 2025 to 2035

Cargo Vans Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Cars Market Size and Share Forecast Outlook 2025 to 2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Carboy Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA