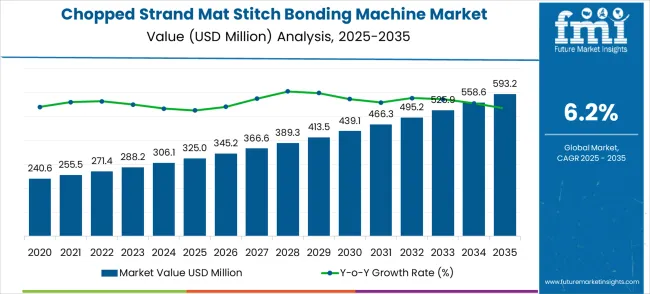

The global chopped strand mat stitch bonding machine market is projected to grow from USD 325.0 million in 2025 to approximately USD 593.2 million by 2035, recording an absolute increase of USD 268.2 million over the forecast period. This translates into a total growth of 82.5%, with the market forecast to expand at a CAGR of 6.2% between 2025 and 2035. The overall market size is expected to grow by nearly 1.83X during the same period, supported by the rising adoption of advanced nonwoven manufacturing technologies and increasing demand for high-performance composite materials across various industries.

Between 2025 and 2030, the chopped strand mat stitch bonding machine market is projected to expand from USD 325.0 million to USD 439.1 million, resulting in a value increase of USD 114.1 million, which represents 42.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of automated nonwoven manufacturing equipment in composite production facilities, increasing demand for high-performance fiber reinforcement solutions, and growing adoption of advanced stitching bonding technologies. Equipment manufacturers are expanding their stitch bonding capabilities to address the growing complexity of modern composite manufacturing requirements.

From 2030 to 2035, the market is forecast to grow from USD 439.1 million to USD 593.2 million, adding another USD 154.1 million, which constitutes 57.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of intelligent manufacturing systems, development of enhanced production efficiency features, and advancement of automated quality control systems. The growing adoption of lightweight composite materials in aerospace and automotive industries will drive demand for more sophisticated stitch bonding solutions and specialized technical capabilities.

As manufacturers prioritize reducing vehicle weight to improve fuel efficiency and meet emission standards, composite materials are becoming more widely adopted. Chopped strand mats produced by stitch bonding machines offer excellent reinforcement properties and compatibility with a wide range of resins. The continued shift toward lightweight materials in electric vehicles, aircraft components, and industrial equipment is expected to propel demand for advanced bonding machines that can support high-volume production with consistent quality.

Technological advancements in stitch bonding machines are further driving market expansion. Innovations such as automated fiber distribution, high-speed stitching systems, and digital control technologies allow for faster production rates and improved precision. Modern machines also offer enhanced energy efficiency, reduced downtime, and lower operational costs. The integration of smart features, including real-time monitoring, predictive maintenance, and automated tension control, improves reliability and helps manufacturers meet strict quality standards in composite production.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 325.0 million |

| Market Forecast Value (2035) | USD 593.2 million |

| Market Forecast CAGR | 6.2% |

Market expansion is being supported by the rapid increase in composite material manufacturing worldwide and the corresponding need for efficient production equipment that provides superior bonding performance and operational reliability. Modern composite manufacturing facilities rely on consistent material quality and production efficiency to ensure optimal performance characteristics including automotive components, aerospace structures, and construction materials. Even minor production inefficiencies can require comprehensive manufacturing protocol adjustments to maintain optimal material standards and operational performance.

The growing complexity of composite manufacturing requirements and increasing demand for high-productivity nonwoven processing solutions are driving demand for stitch bonding equipment from certified manufacturers with appropriate technical capabilities and engineering expertise. Material processing companies are increasingly requiring documented production efficiency and equipment reliability to maintain product quality and cost effectiveness. Industry specifications and performance standards are establishing standardized composite manufacturing procedures that require specialized equipment technologies and trained operators.

The automotive industry's shift towards lightweight materials for fuel efficiency and emissions reduction is significantly contributing to market growth. Electric vehicle manufacturers particularly demand advanced composite materials that require sophisticated stitch bonding processes to achieve optimal strength-to-weight ratios. Similarly, the aerospace sector's continuous pursuit of high-performance materials with superior mechanical properties is driving innovation in stitch bonding technologies.

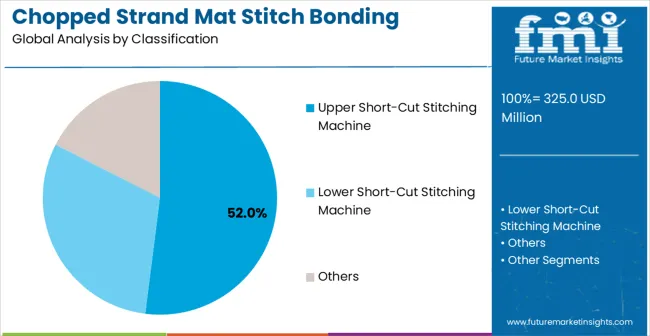

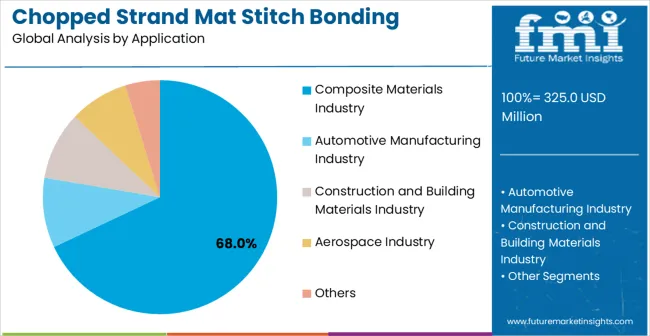

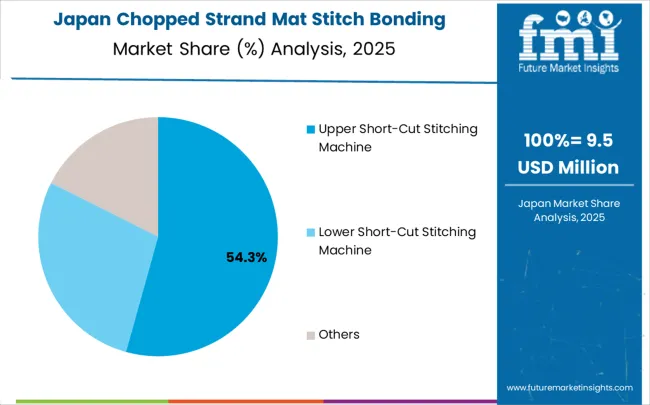

The market is segmented by product type, application, and region. By machine type, the market is divided into upper short-cut stitching machines, lower short-cut stitching machines, and others. Based on application, the market is categorized into composite materials industry, automotive manufacturing industry, construction and building materials industry, aerospace industry, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the upper short-cut stitching machine segment is projected to capture around 52% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of precision stitching equipment that delivers superior bonding quality and operational efficiency, catering to a wide variety of composite manufacturing applications. The upper short-cut stitching machine is particularly favored for its ability to deliver consistent material integrity and high-speed processing capabilities, ensuring production flexibility across diverse material specifications.

Composite manufacturers, automotive suppliers, aerospace contractors, and construction material producers increasingly prefer this technology, as it meets demanding production requirements without imposing excessive operational costs or extensive training requirements. The availability of well-established product lines, along with comprehensive accessory options and technical support from leading manufacturers, further reinforces the segment's market position. This technology category benefits from consistent demand across regions, as it is considered a reliable solution for facilities requiring high-quality composite production. The combination of precision, performance, and versatility makes upper short-cut stitching machines a dependable choice, ensuring their continued popularity in the nonwoven manufacturing equipment market.

The composite materials industry segment is expected to represent 68% of chopped strand mat stitch bonding machine demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique production requirements of composite manufacturing environments, where consistent material bonding and structural integrity are critical to final product performance. Composite material facilities often feature continuous production processes that demand reliable and efficient manufacturing equipment capable of maintaining consistent quality standards throughout extended operating cycles.

Stitch bonding machines are particularly well-suited to these environments due to their ability to deliver superior material reinforcement quickly and effectively, even during high-volume production runs. As composite materials expand across industries and emphasize improved performance standards, the demand for advanced stitch bonding machines continues to rise. The segment also benefits from heightened competition within the composite materials industry, where manufacturers are increasingly prioritizing production efficiency and material quality as differentiators to attract and retain customers.

With composite producers investing in automation and quality enhancement, stitch bonding machines provide an essential solution to maintain high-performance manufacturing. The growth of advanced composite applications, coupled with increased focus on lightweight material solutions, ensures that the composite materials industry will remain the largest and most stable demand driver for chopped strand mat stitch bonding machines in the forecast period.

The Chopped Strand Mat Stitch Bonding Machine market is advancing robustly due to increasing composite material demand and growing recognition of automated manufacturing advantages over manual processes. The market faces challenges including higher initial equipment investments compared to conventional manufacturing methods, a need for specialized technical expertise in operation and maintenance, and varying quality standards across different geographic regions. Technology advancement efforts and automation integration programs continue to influence equipment development and market adoption patterns.

The growing development of smart manufacturing technologies is enabling higher production efficiency with improved quality control and reduced operational variability. Enhanced automation systems and optimized process controls provide superior manufacturing performance while maintaining consistent material quality requirements. These technologies are particularly valuable for large-scale manufacturers who require reliable equipment performance that can support extensive production operations with predictable results and minimal human intervention.

Modern chopped strand mat stitch bonding machine manufacturers are incorporating advanced quality monitoring features and automated control improvements that enhance production efficiency and equipment effectiveness. Integration of real-time monitoring systems and optimized process parameters enables superior product quality and comprehensive production control capabilities. Advanced equipment features support operation in diverse manufacturing environments while meeting various quality requirements and operational specifications, ensuring consistent output across different production scenarios.

The Chopped Strand Mat Stitch Bonding Machine market is entering a new phase of growth, driven by demand for efficient composite manufacturing, industrial automation expansion, and evolving quality and standards. By 2035, these pathways together can unlock USD 180–220 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Precision Manufacturing Leadership (Upper Short-Cut Systems) The upper short-cut stitching segment already holds the largest share due to its superior precision and efficiency capabilities. Expanding automation features, intelligent controls, and modular configurations can consolidate leadership. Opportunity pool: USD 55–70 million.

Pathway B -- High-Growth Industrial Applications (Composite & Automotive) Composite materials and automotive manufacturing account for the majority of demand. Growing lightweight material adoption, especially in electric vehicles and aerospace applications, will drive higher adoption of advanced stitch bonding machines. Opportunity pool: USD 45–60 million.

Pathway C -- Manufacturing Automation & Industry 4.0 Integration Smart manufacturing initiatives and Industry 4.0 adoption are expanding rapidly. Machines with IoT connectivity, predictive maintenance, and automated quality control can capture significant growth in technology-advanced facilities. Opportunity pool: USD 25–35 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Middle East, and Latin America present growing demand due to rising manufacturing infrastructure. Targeting distribution networks and cost-effective product configurations will accelerate adoption. Opportunity pool: USD 20–30 million.

Pathway E -- Energy Efficiency With stricter environmental regulations and energy costs, there is an opportunity to promote energy-efficient machines and manufacturing process innovations. Opportunity pool: USD 15–20 million.

Pathway F -- Premium Technology Features Machines with advanced automation, multi-layer processing capabilities, and adaptive control systems offer premium positioning for aerospace, automotive, and high-performance applications. Opportunity pool: USD 10–15 million.

Pathway G -- Service, Parts & Lifecycle Value. Recurring revenue from maintenance contracts, spare parts, and technical support services creates a long-term revenue stream with high-margin opportunities. Opportunity pool: USD 8–12 million.

Pathway H -- Digital Integration & Data Analytics Digital dashboards, production analytics, and remote monitoring capabilities can elevate stitch bonding machines into "smart manufacturing" equipment while strengthening customer relationships. Opportunity pool: USD 4–8 million.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

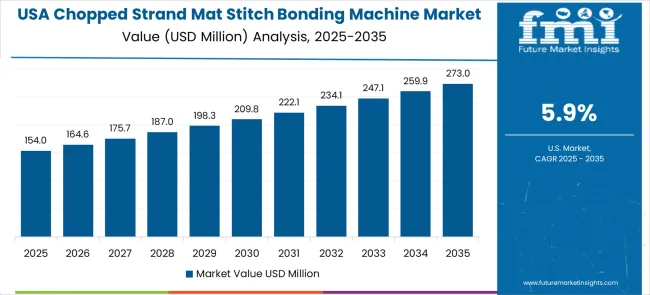

| United States | 5.9% |

| United Kingdom | 5.3% |

| Japan | 4.7% |

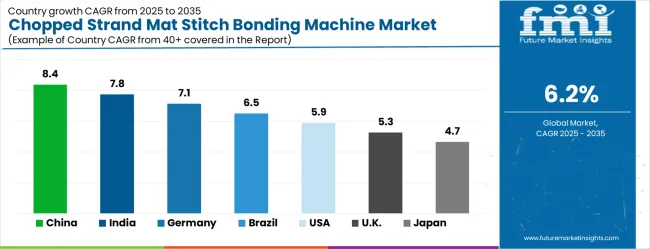

The chopped strand mat stitch bonding machine market is growing rapidly, with China leading at an 8.4% CAGR through 2035, driven by strong manufacturing infrastructure development and increasing adoption of automated composite production equipment. India follows at 7.8%, supported by rising industrial manufacturing development and growing awareness of advanced nonwoven processing solutions. Germany grows strongly at 7.1%, integrating stitch bonding technology into its established composite manufacturing infrastructure. Brazil records 6.5%, emphasizing manufacturing modernization and equipment upgrade initiatives. The United States shows solid growth at 5.9%, focusing on technology advancement and production efficiency. The United Kingdom demonstrates steady progress at 5.3%, maintaining established composite manufacturing applications. Japan records 4.7% growth, concentrating on precision engineering and quality optimization.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from chopped strand mat stitch bonding machines in China is projected to exhibit the highest growth rate with a CAGR of 8.4% through 2035, driven by rapid expansion of composite manufacturing infrastructure and increasing demand for automated production equipment. The country's growing automotive and aerospace sectors, combined with expanding construction material manufacturing, are creating significant demand for efficient nonwoven processing solutions. Major equipment manufacturers are establishing comprehensive service networks to support the increasing requirements of composite producers and material processing companies across industrial regions.

Government manufacturing upgrade initiatives are supporting establishment of modern production facilities and automated manufacturing complexes, driving demand for advanced stitch bonding equipment throughout major industrial zones. Industrial modernization programs are facilitating adoption of intelligent manufacturing systems that enhance production efficiency and quality standards across manufacturing networks.

Revenue from chopped strand mat stitch bonding machines in India is expanding at a CAGR of 7.8%, supported by increasing industrial sector development and growing awareness of automated manufacturing equipment benefits. The country's expanding composite materials industry and rising manufacturing standards are driving demand for advanced nonwoven processing solutions. Manufacturing facilities and material processing companies are gradually implementing automated production equipment to maintain quality standards and operational efficiency.

Industrial sector growth and manufacturing infrastructure development are creating opportunities for equipment suppliers that can support diverse production requirements and operational specifications. Technical training and service programs are building expertise among manufacturing personnel, enabling effective utilization of stitch bonding technology that meets industrial production standards and performance requirements.

Demand for chopped strand mat stitch bonding machines in Germany is projected to grow at a CAGR of 7.1%, supported by the country's focus on manufacturing quality standards and advanced production technology adoption. German composite manufacturers are implementing sophisticated stitch bonding systems that meet stringent performance requirements and operational specifications. The market is characterized by a focus on equipment precision, operational efficiency, and compliance with comprehensive manufacturing standards.

Manufacturing industry investments are prioritizing advanced automation technology that demonstrates superior performance and reliability while meeting German quality and operational standards. Professional certification programs ensure comprehensive technical expertise among equipment operators, enabling specialized manufacturing capabilities that support diverse industrial applications and production requirements.

Revenue from chopped strand mat stitch bonding machines in Brazil is growing at a CAGR of 6.5%, driven by increasing industrial facility development and growing recognition of advanced manufacturing equipment advantages. The country's expanding automotive and construction sectors are gradually integrating automated production equipment to enhance manufacturing efficiency and product quality. Industrial facilities and material processing companies are investing in stitch bonding technology to address evolving market demands and production standards.

Manufacturing modernization is facilitating adoption of advanced production technologies that support comprehensive material processing capabilities across industrial regions. Professional development programs are enhancing technical capabilities among manufacturing personnel, enabling effective utilization of the stitch bonding machine that meets evolving industrial standards and operational requirements.

Demand for chopped strand mat stitch bonding machines in the USA is expanding at a CAGR of 5.9%, driven by established composite manufacturing industries and growing focus on production efficiency enhancement. Large manufacturing companies and material processing providers are implementing comprehensive automation capabilities to serve diverse industrial requirements. The market benefits from established equipment distribution networks and technical training programs that support various manufacturing applications.

Manufacturing industry leadership is enabling standardized equipment utilization across multiple production facilities, providing consistent quality and comprehensive operational coverage throughout regional markets. Professional development and certification programs are building specialized technical expertise among equipment operators, enabling effective stitch bonding machine utilization that supports evolving manufacturing requirements.

Demand for chopped strand mat stitch bonding machines in the UK is projected to grow at a CAGR of 5.3%, supported by established industrial sectors and growing focus on automated manufacturing capabilities. British manufacturing companies and material processing providers are implementing stitch bonding equipment that meets industry quality standards and operational requirements. The market benefits from established manufacturing infrastructure and comprehensive training programs for production professionals.

Industrial facility investments are prioritizing advanced manufacturing equipment that supports diverse processing applications while maintaining established quality and operational standards. Professional development programs are building technical expertise among manufacturing personnel, enabling specialized stitch bonding machine operation capabilities that meet evolving facility requirements and quality standards.

Revenue from chopped strand mat stitch bonding machines in Japan is growing at a CAGR of 4.7%, driven by the country's focus on manufacturing technology innovation and precision enhancement applications. Japanese composite manufacturers are implementing advanced stitch bonding systems that demonstrate superior precision, reliability, and operational efficiency. The market is characterized by focus on technological excellence, quality assurance, and integration with established manufacturing workflows.

Technology industry investments are prioritizing innovative manufacturing solutions that combine advanced automation technology with precision engineering while maintaining Japanese quality and reliability standards. Professional development programs ensure comprehensive technical expertise among equipment operators, enabling specialized manufacturing capabilities that support diverse industrial applications and production requirements.

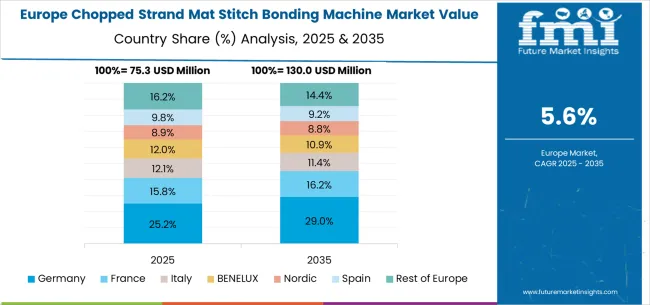

The chopped strand mat stitch bonding machine market in Europe is forecast to expand from USD 89.8 million in 2025 to USD 163.7 million by 2035, registering a CAGR of 6.2%. Germany will remain the largest market, holding a 28.5% share in 2025, easing to 27.8% by 2035, supported by strong composite manufacturing infrastructure and advanced automation adoption. The United Kingdom follows, rising from 16.2% in 2025 to 16.8% by 2035, driven by aerospace applications and automotive manufacturing.

France is expected to maintain stability at around 14.5%, supported by aerospace and construction industries. Italy maintains growth from 12.8% to 13.2%, supported by automotive and industrial manufacturing, while Spain grows from 9.5% to 10.1% with expanding composite materials and construction demand. BENELUX markets remain stable at around 6.5%, while the remainder of Europe moves from 12.0% to 12.8%, balancing emerging Eastern European growth against mature Nordic markets.

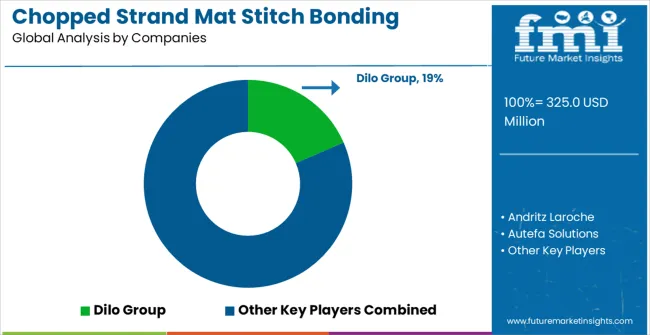

The chopped strand mat stitch bonding machine market comprises 10–12 specialized manufacturers, with the top five companies accounting for nearly 58–63% of global market share. Demand is driven by the expansion of composites, fiberglass reinforcement materials, automotive lightweighting, wind energy components, marine structures, and construction panels. Competition centers on machine throughput, fiber-laying precision, stitch consistency, adaptability to various mat weights, and long-term mechanical reliability, rather than price alone. Dilo Group leads the market with an 19% share, supported by its strong engineering heritage, advanced web-forming technology, and leadership in high-performance bonding systems for technical textiles and composite reinforcement.

Other top manufacturers including Andritz Laroche, Autefa Solutions, A.Celli Nonwovens, and Techno Plants maintain strong competitive positions through their sophisticated automation features, multi-needle stitching technologies, and turnkey solutions that cater to large composite material producers. Their expertise in high-capacity lines, fiber-opening systems, and tension-controlled bonding ensures consistent mat quality for demanding end-use sectors such as wind blade production and automotive SMC/BMC processes.

Challengers such as Progressive Technologies, Jiangsu Yingyang Nonwoven Machinery, and Zhentai Nonwoven Machinery focus on cost-competitive machinery with strong regional support, appealing to mid-scale composite manufacturers. Additional players, including Qingdao Textile Machinery and Changzhou Runyuan Warp Knitting Machinery, leverage flexible machine configurations and rapid customization capabilities, strengthening their presence in Asia’s fast-growing fiberglass and reinforcement materials industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 325.0 million |

| Product Type | Upper Short-Cut Stitching Machine, Lower Short-Cut Stitching Machine, Others |

| Application | Composite Materials Industry, Automotive Manufacturing Industry, Construction and Building Materials Industry, Aerospace Industry, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, the United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Dilo Group, Andritz Laroche, Autefa Solutions, A.Celli Nonwovens, Techno Plants, Progressive Technologies, Jiangsu Yingyang Nonwoven Machinery, Zhentai Nonwoven Machinery, Qingdao Textile Machinery, and Changzhou Runyuan Warp Knitting Machinery |

| Additional Attributes | Dollar sales by product type and application segment, regional demand trends across major markets, competitive landscape with established equipment manufacturers and emerging technology providers, customer preferences for different stitching machine configurations and automation levels, integration with manufacturing execution systems and quality control protocols, innovations in automation technology and intelligent manufacturing capabilities, and adoption of Industry 4.0 features with enhanced production efficiency for improved operational workflows. |

The global chopped strand mat stitch bonding machine market is estimated to be valued at USD 325.0 million in 2025.

The market size for the chopped strand mat stitch bonding machine market is projected to reach USD 593.2 million by 2035.

The chopped strand mat stitch bonding machine market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in chopped strand mat stitch bonding machine market are upper short-cut stitching machine, lower short-cut stitching machine and others.

In terms of application, composite materials industry segment to command 68.0% share in the chopped strand mat stitch bonding machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Strand Displacement Amplification Market - Growth & Outlook 2025 to 2035

4-strand Fan-shaped Strand Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Compacted Strand Surface Contact Wire Rope Market Size and Share Forecast Outlook 2025 to 2035

Prestressed Concrete Wire and Strand Market Growth – Trends & Forecast 2024-2034

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA