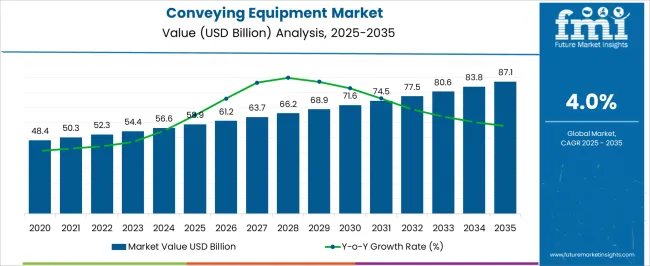

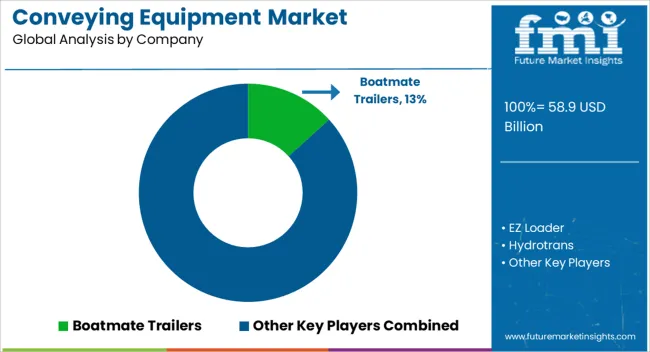

The conveying equipment market is estimated to be valued at USD 58.9 billion in 2025 and is projected to reach USD 87.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

This steady growth trajectory is being attributed to the persistent demand across industries where bulk materials, components, and finished products require efficient transfer. In this opinion, the market is being driven by industrial operators focusing on enhanced throughput, labor reduction, and improved reliability of their production lines. Year-on-year expansion from USD 61.2 billion in 2026 to USD 71.6 billion in 2030 illustrates how consistent investment is being funneled into advanced material handling solutions that strengthen operational efficiency.

By 2035, the conveying equipment market is expected to surpass USD 87.1 billion, highlighting the rising integration of systems in sectors such as food processing, automotive, chemicals, and logistics. In this opinion, the CAGR of 4% reflects that while growth is measured, it is being reinforced by long-term infrastructure expansion and the focus on safe, cost-effective, and time-saving movement of goods. Market adoption is being supported by companies emphasizing modularity, automation compatibility, and lower maintenance solutions that resonate strongly with manufacturers seeking competitive advantages. As industries continue to prioritize output consistency and efficiency, the conveying equipment market is being positioned as a critical enabler of productivity across both established economies and emerging markets.

The conveying equipment market secures a sizeable presence within its parent industries, given its essential role in optimizing operations and improving material flow across sectors. In the material handling equipment market, conveying systems account for nearly 25-28% of the overall share, reflecting their indispensable contribution to moving bulk goods efficiently.

Within the industrial machinery market, conveyors represent about 15-18%, as they are integrated into a wide range of production and assembly lines. In the mining equipment market, conveying equipment captures close to 20-22% of the share, largely because belt conveyors and screw conveyors are central to mineral and ore transportation.

The food processing equipment market records around 18-20% contribution from conveying systems, since conveyors are vital for maintaining consistency and hygiene in food manufacturing chains. In the automotive manufacturing equipment market, conveyors represent nearly 22-25% of the total, as they are the backbone of assembly lines and high-volume production systems. These percentages emphasize the vital role of conveying systems in ensuring productivity, cost efficiency, and consistency across industries.

While the market faces headwinds from high initial investments and maintenance demands, its strong foothold across diverse end-user markets highlights why conveying equipment is not merely auxiliary but a central pillar in industrial operations. The trajectory of this market suggests that its relevance will continue to expand as industries demand greater reliability, throughput, and integration of automated production flows.

| Metric | Value |

|---|---|

| Conveying Equipment Market Estimated Value in (2025 E) | USD 58.9 billion |

| Conveying Equipment Market Forecast Value in (2035 F) | USD 87.1 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The conveying equipment market is experiencing stable growth, supported by increasing automation across manufacturing and material handling operations. Industry updates and corporate announcements have pointed to rising investments in production efficiency, which have directly fueled demand for advanced conveying systems.

The expansion of global trade and the need for faster, more reliable material movement have also strengthened the market. Technological advancements in conveyor design, including improved energy efficiency and load-handling capacity, are enhancing operational productivity in multiple industries.

The market has additionally benefited from the push toward Industry 4.0 integration, where conveying equipment is combined with smart sensors and monitoring systems for optimized workflow. Growth is further reinforced by the replacement of outdated equipment in mature markets and the installation of high-capacity systems in emerging economies. The most significant segmental momentum is seen in bulk handling equipment, belt conveyors, and durable manufacturing applications due to their high operational utility and demand consistency.

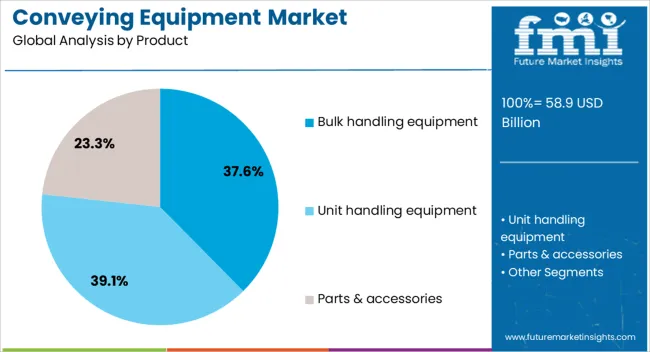

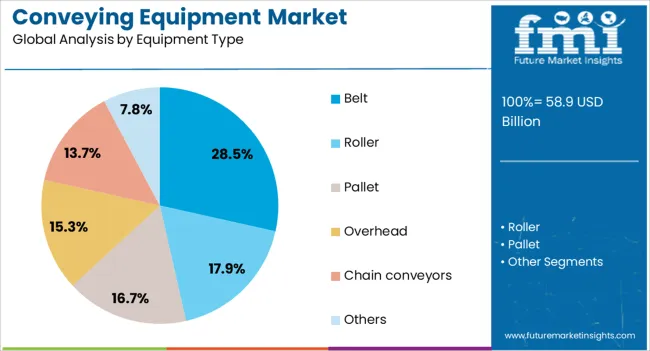

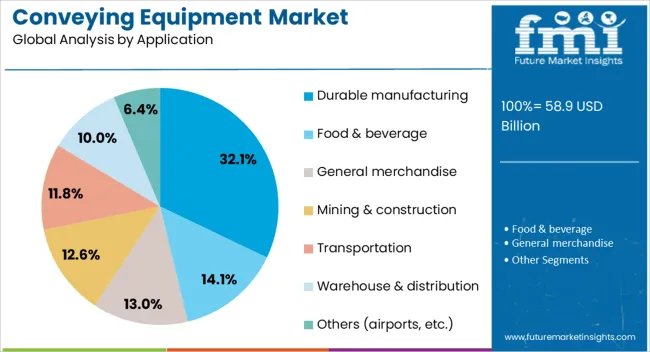

The conveying equipment market is segmented by product, equipment type, application, distribution channel, and geographic regions. By product, conveying equipment market is divided into bulk handling equipment, unit handling equipment, and parts & accessories. In terms of equipment type, conveying equipment market is classified into belt, roller, pallet, overhead, chain conveyors, and others. Based on application, conveying equipment market is segmented into durable manufacturing, food & beverage, general merchandise, mining & construction, transportation, warehouse & distribution, and others (airports, etc.). By distribution channel, conveying equipment market is segmented into direct and indirect. Regionally, the conveying equipment industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The bulk handling equipment segment is expected to account for 37.6% of the conveying equipment market revenue in 2025, maintaining its leadership position. Growth in this segment is driven by its essential role in moving large volumes of materials such as grains, minerals, and industrial goods efficiently. Industries including mining, agriculture, and construction rely heavily on bulk handling systems to reduce manual labor and increase throughput. Manufacturers have been investing in durable, corrosion-resistant materials and automated control systems to extend the lifespan and performance of bulk handling conveyors. Furthermore, the expansion of global commodity trade has increased the need for high-capacity handling systems at ports, warehouses, and processing plants. These factors combined have solidified bulk handling equipment’s strong presence in the market.

The belt segment is projected to hold 28.5% of the conveying equipment market revenue in 2025, standing out as the most widely used equipment type. Its popularity is attributed to its versatility, cost-effectiveness, and ability to transport a wide range of goods across short and long distances. Belt conveyors are used extensively in manufacturing, logistics, mining, and food processing due to their simple design and low maintenance requirements. Recent innovations, such as energy-efficient motors and modular belt designs, have enhanced operational reliability and reduced downtime. The adaptability of belt conveyors to handle varying load sizes and shapes has also made them indispensable in modern automated production lines.

The durable Manufacturing segment is set to contribute 32.1% of the conveying equipment market revenue in 2025, leading among application areas. Growth in this segment is supported by increased production volumes in industries such as automotive, aerospace, electronics, and machinery manufacturing. Durable goods producers require reliable and precise conveying systems to move components and finished products through different production stages without damage. The rise in customized manufacturing and just-in-time production has further increased the need for flexible, high-speed conveyors. Additionally, manufacturers are adopting conveyors with integrated quality inspection systems to ensure defect-free output. The combination of operational efficiency, product safety, and scalability has ensured durable manufacturing remains a primary driver of conveying equipment demand.

The conveying equipment market is growing as manufacturing, logistics, and e-commerce sectors adopt automation to enhance efficiency. Opportunities lie in smart automation, modular systems, and energy-efficient solutions. Trends highlight compact, flexible, and digitally monitored conveyors, while high upfront costs and complex maintenance remain key challenges. Overall, the market is expected to expand steadily as industries prioritize scalable, efficient, and reliable material handling equipment to optimize productivity across global supply chains.

The conveying equipment market is witnessing steady demand as industries prioritize automation, efficiency, and productivity in material handling. Manufacturing plants, e-commerce warehouses, and logistics hubs rely on conveyor systems to streamline operations, reduce manual labor, and ensure consistent throughput. Increased consumption of packaged goods, expansion of distribution networks, and rising global trade further support adoption. Sectors like food processing, automotive, and mining are expanding their reliance on robust and customizable conveying solutions to meet operational demands, driving continuous market growth across both developed and emerging economies.

Significant opportunities exist in the integration of IoT-enabled, AI-driven, and energy-efficient conveyor solutions. Smart sensors, predictive maintenance tools, and real-time tracking systems enhance reliability and reduce downtime in industrial operations. Energy-saving drives and modular conveying designs appeal to companies aiming to cut operational costs while meeting environmental goals. Growth in emerging markets, where industrial automation is expanding rapidly, provides additional scope for suppliers. Companies offering scalable, customized, and sustainable solutions are well-positioned to secure contracts in sectors ranging from retail warehouses to large-scale industrial manufacturing.

A strong trend shaping the market is the growing preference for modular and compact conveyor designs that allow quick installation, scalability, and adaptability to space-constrained facilities. Flexible conveyor systems are increasingly deployed in warehouses and e-commerce operations where demand fluctuations require rapid layout changes. The integration of digital monitoring platforms and advanced control systems supports precise operation and real-time efficiency tracking. Industry preference for cost-effective yet adaptable conveyors is shifting the market toward more versatile designs that align with the dynamic needs of manufacturing and logistics ecosystems.

The conveying equipment market faces challenges due to high initial investment costs, ongoing maintenance requirements, and technical complexities. Small and mid-sized enterprises often struggle with the capital needed for advanced automated systems. Frequent maintenance, parts replacement, and downtime can hinder productivity, particularly in sectors requiring continuous operation. Fluctuating raw material prices and supply chain disruptions may also impact equipment manufacturing costs. To overcome these challenges, companies must focus on providing cost-efficient, durable solutions with reliable after-sales services and advanced diagnostics to ensure long-term operational stability.

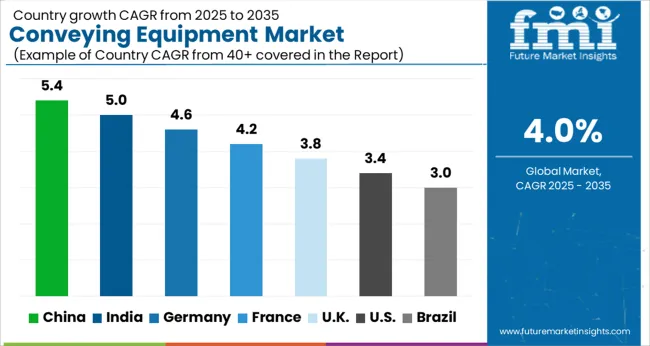

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global conveying equipment market is projected to grow at a CAGR of 4% between 2025 and 2035. China leads the market with 5.4% growth, followed by India at 5%, while France, the UK, and the USA show steady expansion between 3.4% and 4.2%. Growth is driven by industrial automation, rising demand in manufacturing, and expansion of logistics infrastructure. Emerging economies such as China and India experience rapid adoption due to increasing industrial output and government-backed industrialization programs.

Developed regions such as France, the UK, and the USA focus on upgrading material handling systems, energy efficiency, and smart conveying technologies. The global market outlook remains positive as conveying equipment becomes a critical enabler for productivity improvements across multiple industries including automotive, food and beverage, mining, and logistics. This report includes insights on 40+ countries; the top markets are shown here for reference.

The conveying equipment market in China is projected to grow at a CAGR of 5.4%. Rapid industrialization, growth in the manufacturing sector, and expansion of logistics and e-commerce industries are fueling demand. Investments in automated material handling systems, coupled with government support for industrial modernization, enhance adoption. Industries such as mining, automotive, and food processing heavily rely on advanced conveying solutions to improve efficiency and reduce labor costs. China’s strong presence in global supply chains and high-scale production facilities further boost market demand. Technological integration and focus on automation strengthen China’s leadership in this sector.

The conveying equipment market in India is forecasted to expand at a CAGR of 5%. Growth is supported by expanding industrial output, government initiatives promoting manufacturing, and the increasing role of logistics in trade. Adoption of automation in warehouses and factories enhances efficiency and reduces costs. Rising e-commerce penetration and development of industrial corridors drive higher demand for material handling equipment. Local manufacturers focus on cost-effective solutions, while global players invest in advanced systems tailored to Indian industries. Growing emphasis on productivity and infrastructure development positions India as a significant market for conveying equipment in the Asia-Pacific region.

The conveying equipment market in France is expected to grow at a CAGR of 4.2%. Demand is influenced by modernization of manufacturing facilities, adoption of energy-efficient systems, and expansion in food processing and automotive sectors. French industries increasingly rely on smart and automated conveying systems to maintain competitiveness in global markets. The presence of strong logistics infrastructure and adoption of Industry 4.0 practices further strengthen equipment utilization. Companies in France focus on sustainability and efficiency, incorporating intelligent controls and eco-friendly solutions. The combination of technological innovation and sector-specific adoption drives steady growth of the market in the country.

The conveying equipment market in the United Kingdom is forecasted to grow at a CAGR of 3.8%. Growth is fueled by modernization of production processes, adoption of smart technologies, and demand for efficiency in material handling. Sectors such as logistics, food and beverage, and automotive are increasingly investing in automated conveying systems. The UK market benefits from a strong emphasis on digitalization and robotics integration, improving supply chain operations. Companies are focusing on flexible and modular conveying solutions that align with dynamic industry needs. Despite economic challenges, demand remains stable due to the necessity of efficiency and productivity improvements.

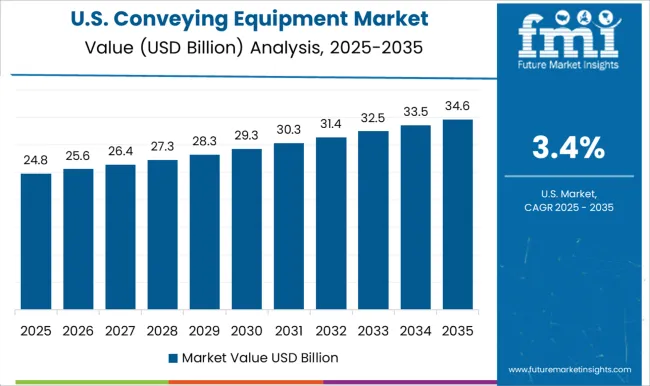

The conveying equipment market in the United States is projected to grow at a CAGR of 3.4%. Growth is driven by steady demand in manufacturing, logistics, and mining sectors. Companies emphasize automation, energy efficiency, and digital monitoring to improve productivity. The rise of e-commerce and expansion of warehouse facilities create strong opportunities for conveying systems adoption. USA industries are focusing on upgrading legacy equipment to smart, automated solutions for higher throughput. While growth is moderate compared to emerging markets, innovation and technological adoption ensure consistent market performance. Strong industrial infrastructure and presence of leading players strengthen the country’s market outlook.

The conveying equipment market with players such as Boatmate Trailers, EZ Loader, and Karavan Trailers is characterized by strong emphasis on durability, load efficiency, and versatility across applications. Competitors like Load Rite Trailers, Magic Tilt Trailers, and Venture Trailers showcase their differentiation in brochures through corrosion resistance, lightweight structures, and custom-fit solutions that align with both recreational and industrial hauling needs. Kropf Industrial and Hydrotrans focus on heavy-duty equipment, appealing to operators requiring robust designs for demanding operations. Marketing strategies revolve around highlighting cost savings through longevity, ease of maintenance, and adaptability for varied transport environments.

Companies such as Midwest and TRIGANO strengthen competition by leveraging wide product portfolios and distribution networks. Their brochures stress innovation in braking systems, ease of towing, and ergonomic features, aligning with customer expectations for safety and reliability. Across the market, promotional material places importance on efficiency, eco-friendly finishes, and streamlined designs to capture interest from commercial fleets and private buyers alike. Competition remains intense as players invest in product refinement, localized customization, and strong aftersales support. The conveying equipment market thus evolves on performance credibility, branding, and practical solutions presented in concise brochures aimed at decision-makers.

| Item | Value |

|---|---|

| Quantitative Units | USD 58.9 billion |

| Product | Bulk handling equipment, Unit handling equipment, and Parts & accessories |

| Equipment Type | Belt, Roller, Pallet, Overhead, Chain conveyors, and Others |

| Application | Durable manufacturing, Food & beverage, General merchandise, Mining & construction, Transportation, Warehouse & distribution, and Others (airports, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Boatmate Trailers, EZ Loader, Hydrotrans, Karavan Trailers, Kropf Industrial, Load Rite Trailers, Magic Tilt Trailers, Midwest, TRIGANO, and Venture Trailers |

| Additional Attributes | Dollar sales by equipment type (belt, roller, overhead, pallet) and application (manufacturing, mining, food & beverage, logistics) are key metrics. Trends include rising demand for automated material handling systems, growth in e-commerce logistics, and preference for energy-efficient equipment. Regional adoption, technological advancements, and industry-specific requirements are driving market growth. |

The global conveying equipment market is estimated to be valued at USD 58.9 billion in 2025.

The market size for the conveying equipment market is projected to reach USD 87.1 billion by 2035.

The conveying equipment market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in conveying equipment market are bulk handling equipment, unit handling equipment and parts & accessories.

In terms of equipment type, belt segment to command 28.5% share in the conveying equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fluidized Conveying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Galley Equipment Market Analysis and Forecast by Fit, Application, and Region through 2035

Sorting Equipment Market Size and Share Forecast Outlook 2025 to 2035

General Equipment Rental Services Market Size and Share Forecast Outlook 2025 to 2035

Bagging Equipment Market Size and Share Forecast Outlook 2025 to 2035

RF Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Medical Equipment Covers Market Size and Share Forecast Outlook 2025 to 2035

Telecom Equipment Market Size and Share Forecast Outlook 2025 to 2035

Welding Equipment And Consumables Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA