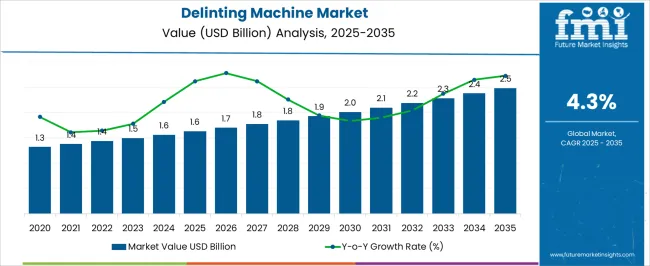

The Delinting Machine Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The Delinting Machine market is witnessing notable growth, driven by the increasing demand for efficient seed processing technologies across the agricultural sector. These machines play a critical role in removing lint from cottonseed and other similar seeds, improving their quality and suitability for further processing or planting. The rising focus on enhancing seed purity and germination rates is fueling the adoption of advanced delinting systems among seed producers and cotton processing units.

Technological advancements such as automated control systems, optimized blade configurations, and energy-efficient designs are enhancing operational productivity and reducing maintenance requirements. The expansion of cotton cultivation areas in emerging economies, coupled with government support for modernizing agricultural practices, is further propelling market growth.

Additionally, the growing preference for high-quality seeds in textile and oil production industries is driving investments in high-capacity delinting machinery As agricultural mechanization continues to progress globally, the Delinting Machine market is expected to witness sustained growth, supported by innovation, automation, and the increasing focus on productivity and cost efficiency.

| Metric | Value |

|---|---|

| Delinting Machine Market Estimated Value in (2025 E) | USD 1.6 billion |

| Delinting Machine Market Forecast Value in (2035 F) | USD 2.5 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

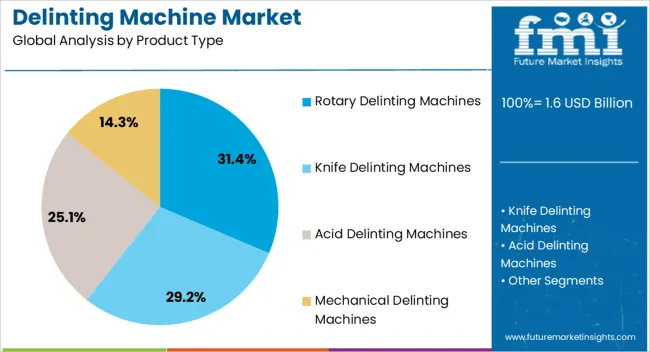

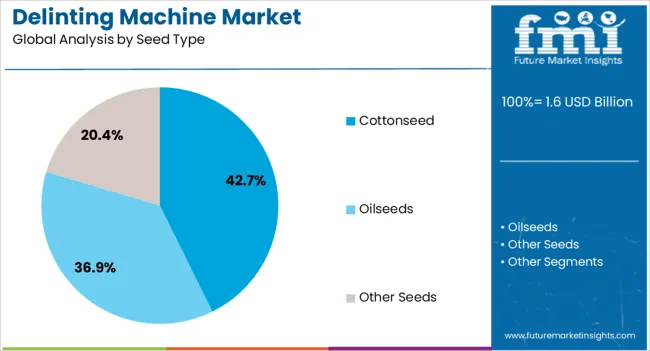

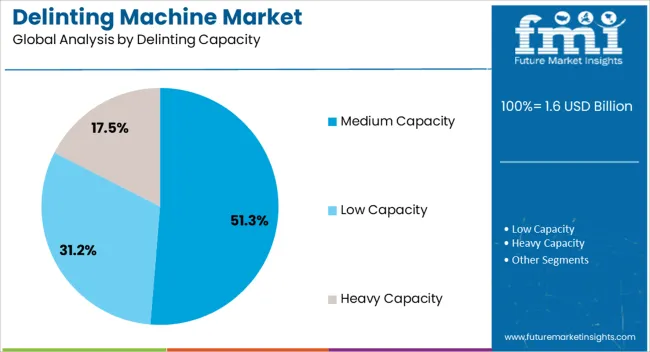

The market is segmented by Product Type, Seed Type, Delinting Capacity, Delinting Technology, and End-User and region. By Product Type, the market is divided into Rotary Delinting Machines, Knife Delinting Machines, Acid Delinting Machines, and Mechanical Delinting Machines. In terms of Seed Type, the market is classified into Cottonseed, Oilseeds, and Other Seeds. Based on Delinting Capacity, the market is segmented into Medium Capacity, Low Capacity, and Heavy Capacity.

By Delinting Technology, the market is divided into Roller Delinting Machines, Saw Delinting Machines, and Air Jet Delinting Machines. By End-User, the market is segmented into Agricultural Sector, Seed Processing Industry, and Research Institutes. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The rotary delinting machines segment is projected to hold 31.4% of the market revenue share in 2025, positioning it as a leading product type. This segment’s growth is primarily driven by its ability to provide high-speed, consistent, and efficient seed delinting performance. Rotary delinting machines are widely preferred for their robust construction, reduced lint loss, and uniform seed treatment, making them ideal for large-scale operations.

Their automated mechanisms allow for continuous processing, minimizing manual intervention and operational downtime. Additionally, these machines are designed to handle various seed types, offering enhanced versatility for seed producers. The ability to integrate rotary delinting systems with dust collection and purification units ensures cleaner and safer working environments.

Continuous technological improvements, including precision controls and energy-efficient motor designs, are further enhancing machine performance As demand rises for reliable, durable, and high-output equipment, rotary delinting machines are expected to retain a strong market presence, supported by their proven efficiency and adaptability to diverse agricultural applications.

The cottonseed segment is anticipated to account for 42.7% of the market revenue share in 2025, emerging as the dominant seed type. The segment’s leadership is attributed to the extensive cultivation of cotton globally and the necessity to process seeds for both replanting and oil extraction. Cottonseed delinting enhances seed cleanliness, germination rates, and oil recovery efficiency, making it an essential step in the value chain.

The increasing demand for high-quality cottonseed in the textile and biofuel industries further strengthens this segment’s position. Automated delinting machines optimized for cottonseed applications are being widely adopted to improve processing throughput and consistency. Advancements in blade design, seed separation, and lint removal technology are helping achieve superior output with minimal wastage.

The focus on maintaining purity standards for hybrid and genetically modified cottonseed varieties also supports market expansion As global cotton production continues to rise, the demand for reliable and efficient delinting equipment dedicated to cottonseed processing is expected to remain strong throughout the forecast period.

The medium capacity delinting segment is projected to capture 51.3% of the market revenue share in 2025, positioning it as the leading capacity category. This segment’s prominence is driven by the balance it offers between productivity, energy efficiency, and operational flexibility. Medium-capacity machines are well-suited for small to mid-sized seed processing facilities, providing sufficient throughput without requiring large capital investments.

They are designed for continuous operation, ensuring steady performance while maintaining optimal energy consumption levels. The growing adoption of modular and scalable designs enables manufacturers to customize machine capacity based on production needs. Furthermore, these systems are easier to maintain and operate, making them highly attractive for regional seed producers in developing economies.

Technological innovations, including digital control panels and automated feed systems, are improving precision and reducing operational downtime As agricultural businesses aim to enhance profitability and streamline seed processing operations, the demand for medium-capacity delinting machines is expected to remain dominant, supported by their cost-effectiveness and reliability.

Market to Rise Over 1.5x through 2035

The global delinting machinery market is predicted to rise over 1.5x through 2035, amid a 0.8% increase in expected CAGR compared to the historical one. This is due to the increasing demand for efficient, reliable, and economical devices in agricultural sector.

The market is further projected to grow due to technological innovations, agricultural expansion, resurgence of the textile industry, and focus on sustainable practices. By 2035, the total market revenue is set to reach USD 2,380.6 million.

South Asia and Pacific to Remain a Promising Market

As per the latest analysis, South Asia & Pacific are expected to dominate the global delinting machine market during the forecast period. It is set to hold around 26% of the worldwide market share in 2025.

South Asia & Pacific region comprises countries like India, Australia, and New Zealand, which have significant agricultural sectors. Increasing demand for cotton and other crops that need a delinting process pushes the country's need for delinting machines.

Several countries in South Asia & Pacific are undergoing agricultural modernization. They are adopting advanced technologies and machinery to improve productivity and efficiency. Delinting machines play an important role in optimizing the process for delinting of seeds.

Government support and initiatives for promoting agricultural mechanization and enhancing crop yields contribute to growth of the delinting machine market in the region. Subsidies with favorable policies encourage farmers to invest in advanced machinery like delinting machines.

Cotton is a key crop in South Asia & Pacific. Increasing demand for cotton and related applications enhances cotton production and is expected to push the adoption of delinting machines to process cotton seeds efficiently.

Growing demand for cottonseed oil, a key component in cooking, cosmetics, and biofuels, is propelling the need for efficient cutting consumption machinery such as delinting machines. Cottonseed oil is a promising renewable energy source and increasing emphasis on agri-food safety necessitates delinting machinery for processing several crops, including cottonseed.

Integration of sensors and real-time monitoring systems ensures maximum machine efficiency and minimal yield waste, further highlighting the machine's importance. Significant growth is expected across Asia Pacific due to growing textile industry in countries such as China, India, and Bangladesh.

In North America, growth of the cottonseed oil industry and government initiatives promoting domestic agriculture & food processing are set to boost the market. There has been an increasing emphasis on sustainable practices, which further boosts demand for delinting machines to optimize cottonseed processing and reduce waste.

Global sales of delinting machines grew at a CAGR of 3.5% between 2020 and 2025. The market revenue reached USD 1,499.6 million in 2025. In the forecast period, the worldwide delinting machine industry is set to thrive at a CAGR of 4.3%.

| Historical CAGR (2020 to 2025) | 3.5% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.3% |

The global delinting machine market witnessed moderate growth between 2020 and 2025. The worldwide cotton output was boosted by development of unique delinting machines, which maximize and raise the efficiency of processing huge quantities of cotton seeds.

The pandemic underscored the importance of a robust and efficient supply chain network for the textile sector. This further led to significant investments in delinting machines for the cotton processing pipeline.

Over the forecast period, the global delinting machine market is anticipated to reach USD 2,380.6 million by 2035. This growth is augmented by increased government focus on agriculture and food processing to ensure food security. Innovations in delinting machine technology that offer automation and improved production efficiency would also aid demand.

The delinting machine market holds immense promise for the future of agriculture and food production sector. Delinting machines are set to substantially contribute to cottonseed processing by providing effective and eco-friendly solutions.

Innovative delinting technology has the potential to minimize seed damage and optimize cottonseed processing, ultimately leading to reduced waste and enhanced resource utilization. Cottonseed oil is a valuable food source for several regions, and its efficient processing is set to pave the way for a more dependable and sustainable supply.

Interconnection between Delinting Machines and the Textile Industry

Increasing demand for delinting machines is directly linked to the textile industry, as cotton is the primary raw material. As the textile sector experiences a boost worldwide, especially with growing economies, demand for delinting machines is surging.

The textile industry's expansion creates a ripple effect, intensifying the demand for delinting machines by playing an important role in preparing cotton for further processing. This surging demand boosts the need for standardization of operations to meet the required demand from the textile market. Manufacturers seek advanced and robust solutions like delinting machines to increase production capacity and maintain competitiveness in the evolving textile landscape.

Increasing cotton production due to favorable agriculture conditions and government incentives are set to accelerate the dependency on delinting machines. These machines ensure the removal of lint and impurities from cotton fibers, increasing production and maintaining quality. This interdependence between the delinting machine and the textile sector highlights the important role played by delinting machine in increasing demand for cotton-based textiles.

High Demand for Delinting Machines Amid Increased Cotton Production

The textile industry relies on cotton, the most important raw material, emphasizing the need for improved delinting techniques for the cotton process to increase production. Introduction of genetically modified cotton, advanced agricultural practices, and favorable weather conditions are increasing cotton yield, leading to a surge in demand for delinting machines.

As technological innovations continue to rise across the delinting machinery sector, manufacturers are developing more advanced solutions that fulfill the required demand and are following sustainability standards & regulatory requirements.

Innovations in Delinting Machine Technology Fueling Growth

Continued improvement of delinting machines, with automation and increased efficiency, catalyzes market expansion. Companies are investing heavily in research & development to create innovative delinting machines that promise high production speed, reduced energy consumption, and superior output quality.

Integrating automation into delinting machinery makes processes easy & productive and minimizes human intervention. Precision engineering techniques make the function of delinting machines optimized and consistent in delinting operations.

Innovations in delinting machine technology address existing challenges and unlock new possibilities in the delinting industry. This empowers manufacturers to meet evolving demands for higher productivity, cost-effectiveness, and superior product quality. As innovation continues to push the sector, the trajectory of delinting machine technology promises sustained growth and a competitive edge in the market.

Delinting Machinery in Agriculture to Enhance Seed Quality and Germination Rates

In the agricultural domain, delinting machines play an important role in seed processing, especially for cotton seeds, which aim to improve seed quality and boost germination rates. As the agricultural sector grows for the fulfillment of global food requirements, there will always be a surging demand for delinting machines. Delinting machines are essential in modern agriculture for maintaining seed quality and enhancing productivity & sustainability.

Lack of Awareness in Underdeveloped Countries

Acquiring delinting machines entails a substantial upfront financial commitment. Initial costs include procurement and installation of these machine and establishing infrastructure like storage units and transportation systems. These expenses pose formidable barriers, especially for smaller companies or farmers constrained by their capital.

The financial burden of delinting machines is set to be worrisome for enterprises aiming to integrate such technology into their operations. Along with the initial purchase, maintenance, repairs, and operational overhead expenses further increase the challenge for investment. This leads to low adoption of delinting machines by smaller-scale companies or agricultural ventures.

High Maintenance Cost

In addition to the initial capital cost, farmers and stakeholders must go through the operating costs associated with delinting equipment. Investing in delinting equipment requires a comprehensive analysis beyond the subsequent investment. It involves an analysis of the entire economic situation, weighing not only the initial capital outlay but also the long-term effects of operating costs.

Maintenance requirements necessary for the product to operate smoothly require regular distribution of resources. Energy consumption, a perennial need, adds to the financial burden while purchasing raw materials is an important factor affecting cost and efficiency.

Navigating these costs requires foresight and strategic planning, especially for stakeholders aiming for sustainable growth and profitability. While delinting machinery is undeniably appealing, prudent consideration of all operating expenses is necessary to ensure informed decision-making and lasting success in the business.

The table shows the estimated growth rates of the top five countries. India, China, and United States are set to record high CAGRs of 4.9%, 3.8%, and 2.2%, respectively, through 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| India | 4.9% |

| China | 3.8% |

| United States | 2.2% |

| Brazil | 3.4% |

| Australia | 2.0% |

| Turkiye | 1.8% |

China's delinting machine market is set to rise at 3.8% CAGR through 2035. Increasing demand for cotton and cotton-based products in China's industrial landscape is expected to fuel the market. Prominent players in the textile and agriculture sector continue to use delinting machines to process raw cotton efficiently.

Delinting machines help to enhance efficiency and productivity and reduce labor costs, stimulating market growth in China. Automation, precision engineering, and sustainability features propel adoption among manufacturers seeking to optimize their production processes. This transformation promises to meet the evolving needs of China's industrial sector and help the country position itself at the top of the delinting machine market.

Over the forecast period, delinting machine demand in the country is set to increase at a robust CAGR of 2.2%. The flourishing United States cottonseed oil industry, a key application for delinting machines, is anticipated to fuel the market. Furthermore, growing focus on domestic agriculture and food processing in the United States will push the need for efficient delinting technology.

Brazil's delinting machine market is expected to grow at a CAGR of 3.4% during the assessment period. Demand for delinting machines in Brazil is propelled by the textile industry's need to increase cotton production.

Delinting machines facilitate efficient lint removal, allowing manufacturers to process large quantities of cotton quickly and remain profitable among their competitors. Furthermore, delinting machines minimize chemical usage and waste generation, promoting sustainable practices in the cotton industry.

By 2035, delinting machine demand in Australia is projected to rise at 2.0% CAGR. Booming agriculture sector in Australia necessitates efficient cotton processing machinery. Delinting machines improve cotton seed quality by removing debris and lint, benefiting the textile industry in Australia.

Growth of delinting machines in Australia leads to increased cotton yield per acre, economic benefits for farmers, and a competitive edge in the market. Delinting machine also contributes to resource efficiency and environmental stewardship across Australia.

The section below shows rotary delinting machines segment dominating based on product type. It is forecast to thrive at 2.8% CAGR between 2025 and 2035.

Based on end-users, the agricultural sector segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 3.0% during the forecast period.

| Top Segment (Product Type) | Rotary Delinting Machines |

|---|---|

| Value CAGR (2025 to 2035) | 2.8% |

Rotary delinting machines are environmentally friendly, cost-effective, and efficient due to their low chemical usage, automation, and uniform delinting action. They also offer improved delinting processes, including maintenance and downtime, and contribute to growth of the cotton processing industry.

Based on product type, rotary delinting machines are expected to surge at a CAGR of 2.8% by 2035. This dominance stems from their high efficiency and productivity, capable of swiftly processing large volumes of cotton seeds, appealing particularly to commercial-scale delinting operations. Rotary delinting machines are favored by farmers and agricultural companies due to their long-term cost-effectiveness, efficient operation, and low maintenance requirements.

| Top Segment (End-user) | Agricultural Sector |

|---|---|

| Value CAGR (2025 to 2035) | 3.0% |

Deliting machines increase efficiency, and help reduce labor costs along with lowering seed wastage and optimizing work. It makes the machine a more attractive investment for the agriculture sector.

Use of delinting machines in the agricultural sector is increasing productivity and profitability for cotton farmers. The automation and streamlined delinting process allows farmers and companies to meet growing demand for cotton and its by-products, enhancing their competitiveness in the market.

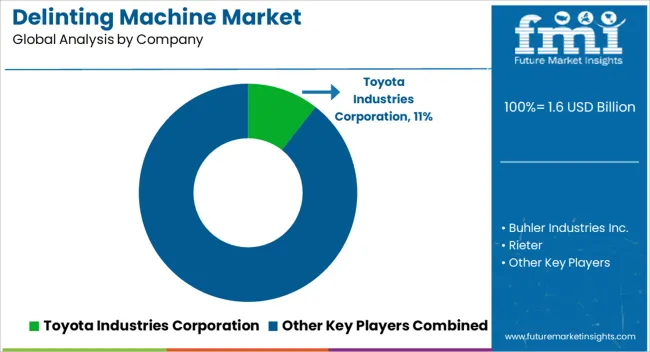

Bajaj Steel Industries Limited, Continental Eagle Corporation, JSC "Kubanzernoprodukt, Toyota Industries Corporation, Rieter, Lummus Novo, and Buhler Industries Inc. are the leading manufacturers and suppliers of delinting machines listed in the report.

Key delinting machine companies are investing in continuous research for producing new products and increasing their production capacity to meet end-user demand. They are also inclined toward adopting strategies to strengthen their footprint, including acquisitions, partnerships, mergers, and facility expansions.

Leading companies in the market:

The global delinting machine market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the delinting machine market is projected to reach USD 2.5 billion by 2035.

The delinting machine market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in delinting machine market are rotary delinting machines, knife delinting machines, acid delinting machines and mechanical delinting machines.

In terms of seed type, cottonseed segment to command 42.7% share in the delinting machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Machine Glazed Paper Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Kraft Paper Market Forecast and Outlook 2025 to 2035

Machine Condition Monitoring Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Asia Pacific Forecast Outlook 2025 to 2035

Machine Vision Camera Market Size and Share Forecast Outlook 2025 to 2035

Machine Tool Oils Market Size and Share Forecast Outlook 2025 to 2035

Machine Vision System And Services Market Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Machine Glazed Paper Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Machine Tool Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Machine Tool Touch Probe Market Analysis - Size, Growth, and Forecast 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Machine Control System Market Growth – Trends & Forecast 2025 to 2035

Machine Automation Controller Market Growth – Trends & Forecast 2025 to 2035

Machine-to-Machine (M2M) Connections Market – IoT & Smart Devices 2025 to 2035

Machine Safety Market Analysis by Component, Industry, and Region Through 2035

Key Players & Market Share in Machine Glazed Paper Industry

Machine Vision Market Insights – Growth & Forecast 2024-2034

Machine Learning As A Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA