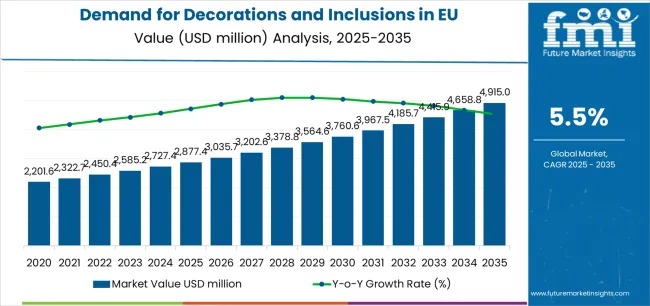

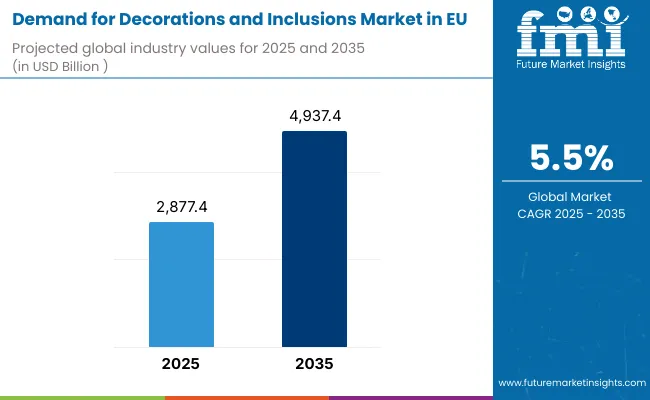

European Union decorations and inclusions sales are projected to grow from USD 2,877.4 million in 2025 to approximately USD 4,915 million by 2035, recording an absolute increase of USD 2,060 million over the forecast period. This translates into total growth of 71.6%, with demand forecast to expand at a compound annual growth rate (CAGR) of 5.5% between 2025 and 2035. The overall industry size is expected to grow by approximately 1.7X during the same period, supported by the accelerating premiumization of bakery and confectionery products, increasing demand for visual appeal and texture enhancement in food manufacturing, and developing applications across artisanal bakeries, industrial food processing, frozen desserts, and premium confectionery throughout European regions.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2,877.4 million |

| Market Forecast Value (2035) | USD 4915 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

Between 2025 and 2030, EU decorations and inclusions demand is projected to expand from USD 2,877.4 million to USD 3,763.3 million, resulting in a value increase of USD 885.9 million, which represents 43% of the total forecast growth for the decade. This phase of development will be shaped by rising consumer expectations for visually appealing food products, increasing availability of diverse decoration formats across chocolate shapes, fruit pieces, and caramelized nuts, and growing mainstream acceptance of premium decorations across retail bakeries, artisan confectioners, and foodservice channels. Manufacturers are expanding their product portfolios to address evolving preferences for clean-label formulations, natural colorants, responsibly sourced ingredients, and allergen-free options comparable to conventional decoration products.

From 2030 to 2035, sales are forecast to grow from USD 3,763.3 million to USD 4915 million, adding another USD 1,174.1 million, which constitutes 57% of the overall ten-year expansion. This period is expected to be characterized by further expansion of industrial food manufacturing applications, integration of advanced coating technologies for improved adhesion and stability, and development of premium specialty decoration products targeting gourmet applications and health-positioned food categories. The growing emphasis on Instagram-worthy food presentation and increasing consumer willingness to pay premium prices for aesthetically superior bakery and confectionery products will drive demand for innovative decoration and inclusion solutions that deliver exceptional visual appeal, authentic taste, and functional performance.

Between 2020 and 2025, EU decorations and inclusions sales experienced steady expansion at a CAGR of 4.5%, growing from USD 2,309 million to USD 2,877.4 million. This period was driven by increasing artisan bakery proliferation across European cities, rising consumer appreciation for handcrafted pastries and premium desserts, and growing recognition of decorations' role in product differentiation and perceived value. The industry developed as specialized decoration manufacturers and major chocolate companies recognized the commercial potential of value-added inclusions for food manufacturers and artisan bakers. Product innovations, improved stability characteristics, and enhanced color fastness began establishing customer confidence and accelerating mainstream acceptance of diverse decoration formats.

Industry expansion is being supported by the rapid increase in premiumization across European bakery and confectionery sectors and the corresponding demand for visually distinctive, texturally diverse, and high-quality decoration products with proven performance in both artisan and industrial applications. Modern bakeries and food manufacturers rely on decorations and inclusions as essential elements for product differentiation, visual merchandising appeal, texture enhancement, and flavor complexity across celebration cakes, artisan pastries, gourmet chocolates, ice cream formulations, and premium snack bars. Even minor product enhancement opportunities, such as adding visual interest to plain cakes, creating textural contrast in ice cream, or developing signature product aesthetics, can drive comprehensive adoption of specialized decorations to achieve competitive positioning and premium pricing power.

The growing influence of social media food culture and increasing recognition of visual presentation's impact on purchase decisions are driving demand for decoration solutions from certified suppliers with appropriate food safety credentials and consistent quality standards. Regulatory authorities are increasingly establishing clear guidelines for food decoration labeling, allergen declarations, colorant approvals, and quality requirements to maintain consumer safety and ensure product consistency. Consumer research studies and behavior analyses are providing evidence supporting decorations' contribution to perceived product value and purchase intent, requiring specialized manufacturing methods and standardized production protocols for color stability under light exposure, moisture resistance in humid conditions, and appropriate adhesion properties for reliable application across diverse food surfaces including chocolate, fondant, and cream-based products.

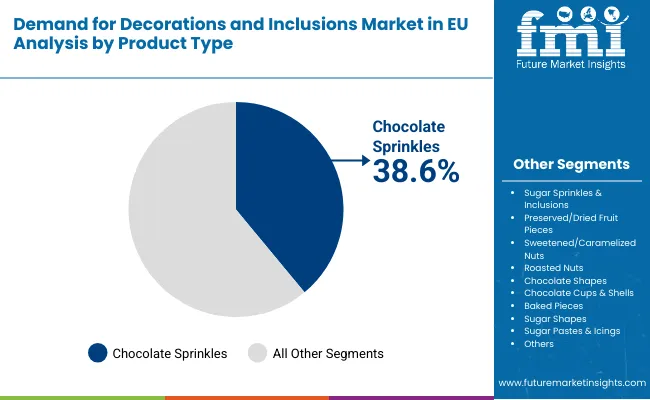

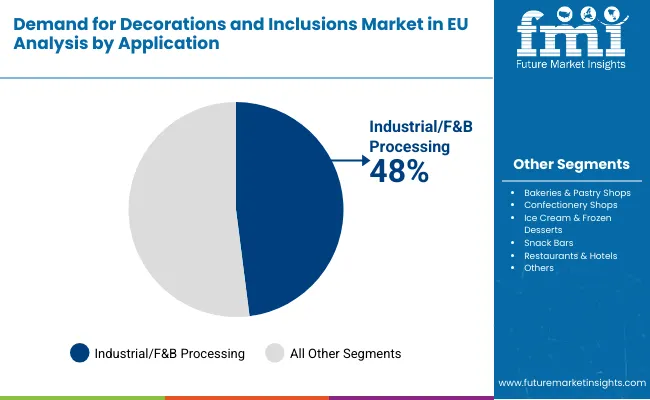

Sales are segmented by product type, application (end use), distribution channel, nature, and country. By product type, demand is divided into chocolate sprinkles and inclusions, sugar sprinkles and inclusions, preserved/dried fruit pieces, sweetened/caramelized nuts, roasted nuts, chocolate shapes, chocolate cups and shells, baked pieces, sugar shapes, and sugar pastes and icings. Based on application, sales are categorized into industrial/F&B processing, bakeries and pastry shops, confectionery shops, ice cream and frozen desserts, snack bars, and restaurants and hotels. In terms of distribution channel, demand is segmented into direct B2B, brick and mortar retailers, online retailers, and intermediate/bulk distributors. By nature, sales are classified into conventional and clean-label/natural. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The chocolate sprinkles and inclusions segment is projected to account for 38.6% of EU decorations and inclusions sales in 2025, gradually declining to 36% by 2035 as diversification toward fruit pieces and nut inclusions accelerates. This dominant position is fundamentally supported by chocolate's universal appeal across European consumers, superior taste profile enhancing virtually any bakery or confectionery application, and versatile functionality enabling use across cakes, cookies, ice cream, pastries, and chocolate bars. The chocolate sprinkles format delivers exceptional versatility, providing food manufacturers and bakers with decoration solutions that contribute indulgent flavor, visual appeal through color contrast, and textural interest supporting premium product positioning.

This segment benefits from mature manufacturing infrastructure within Europe's established chocolate industry, extensive supplier networks from major chocolate manufacturers including Barry Callebaut and ICAM, and comprehensive application know-how supporting reliable performance across diverse processing conditions. Additionally, chocolate sprinkles offer format diversity across mini chips, standard sprinkles, large chunks, and specialty shapes, supported by proven coating technologies that address traditional challenges in heat resistance during baking and moisture protection for extended shelf life.

The chocolate segment's declining share reflects increasing consumer interest in fruit-based and nut-based inclusions perceived as healthier alternatives rather than diminished absolute chocolate demand, with the segment maintaining clear leadership position throughout the forecast period given chocolate's entrenched position in European bakery and confectionery culture.

Key advantages include:

The industrial and F&B processing application is positioned to represent 48% of total decorations and inclusions demand across European regions in 2025, growing to 49% by 2035, reflecting the segment's dominance as the primary usage category within the overall industry ecosystem. This commanding share directly demonstrates that large-scale food manufacturing represents the largest single application, with manufacturers incorporating decorations and inclusions into packaged bakery products, industrial ice cream production, confectionery manufacturing, cereal bars, and frozen desserts requiring consistent quality, reliable supply chains, and functional performance guarantees supporting automated production processes.

Modern food manufacturers increasingly view decorations and inclusions as essential ingredients for product differentiation in competitive retail environments, driving demand for products optimized for automated application equipment, heat stability during processing, moisture resistance preventing migration or bleeding, and consistent particle size distribution ensuring uniform appearance across production batches. The segment benefits from continuous product innovation focused on improved adhesion to various substrates, enhanced stability under frozen storage conditions, and development of clean-label formulations supporting natural ingredient declarations appealing to health-conscious consumers.

The segment's growing share reflects increasing industrialization of European food production and consolidation among major bakery and confectionery brands requiring standardized decoration solutions supporting national and pan-European distribution strategies with consistent quality standards.

Key advantages include:

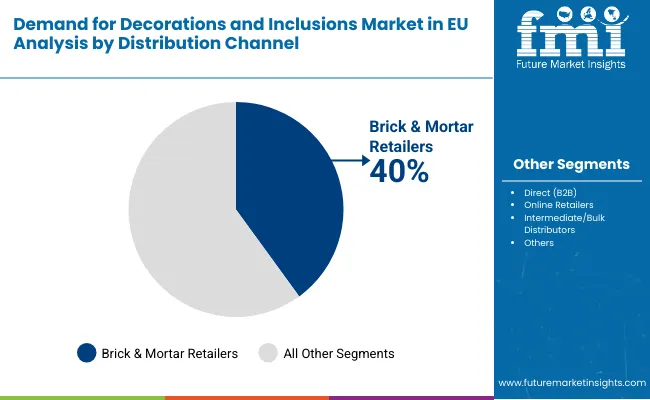

Brick and mortar retailers are strategically estimated to control 40% of total European decorations and inclusions sales in 2025, declining to 36% by 2035 as online channels gain substantial share. This dominant position reflects traditional retail importance for home baking supplies, particularly in countries with strong home baking cultures including Germany, Netherlands, and Poland, where consumers purchase decorations alongside flour, sugar, and other baking ingredients through supermarkets, hypermarkets, and specialty baking supply stores.

The segment provides essential accessibility through widespread physical presence, immediate product availability for last-minute baking needs, and browsing opportunities enabling impulse purchases and discovery of seasonal decoration offerings. Major European retailers including Tesco, Carrefour, Lidl, and specialized chains such as Action and Flying Tiger systematically expand baking decoration sections, often dedicating seasonal displays to celebration-themed products supporting holiday baking and special occasion preparation.

Key advantages include:

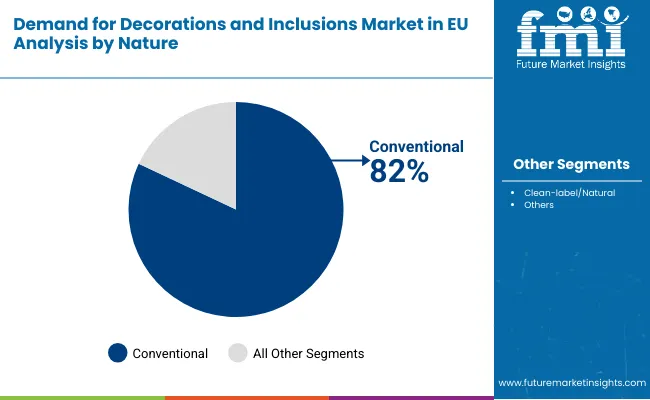

Conventional decorations and inclusions products are strategically positioned to contribute 82% of total European sales in 2025, declining to 75% by 2035 as clean-label and natural alternatives gain momentum. Conventional products represent decorations produced through standard manufacturing methods potentially incorporating artificial colors, synthetic stabilizers, and non-organic ingredients, successfully delivering vibrant colors, consistent quality, and competitive pricing supporting mass-production bakery and confectionery applications.

Conventional production serves cost-sensitive food manufacturers, industrial bakeries, and mainstream consumers prioritizing visual impact and affordability over natural ingredient credentials. The segment derives significant competitive advantages from established supply chains, extensive colorant approval portfolios enabling vibrant hues not achievable with natural alternatives, and proven stability systems ensuring extended shelf life and reliable performance across diverse environmental conditions.

Key advantages include:

EU decorations and inclusions sales are advancing steadily due to increasing premiumization across bakery and confectionery sectors, growing social media influence driving food aesthetics focus, expanding artisan bakery proliferation, and rising celebration culture emphasizing visually impressive cakes and desserts. However, the industry faces challenges, including cocoa price volatility affecting chocolate-based product costs, consumer concerns about artificial colorants driving reformulation pressures, competition from fresh fruit alternatives in health-positioned products, and margin pressures from increasing raw material costs. Continued innovation in natural colorants, responsible sourcing, and functional performance optimization remains central to industry development.

The rapidly accelerating development of natural colorant technologies is fundamentally transforming decorations manufacturing from synthetic dye reliance to plant-based color systems, enabling clean-label positioning that resonates with health-conscious European consumers demanding recognizable ingredients. Advanced colorant platforms featuring vegetable extracts, fruit concentrates, and mineral-based pigments allow manufacturers to create decorations with natural ingredient declarations, non-GMO certifications, and organic compatibility supporting premium product positioning without sacrificing visual appeal.

These clean-label innovations prove particularly transformative for retail bakery decorations, organic confectionery applications, and children's food products where parents increasingly scrutinize ingredient lists and prioritize natural alternatives. Major decoration manufacturers invest heavily in natural colorant research, stability optimization addressing light and heat sensitivity challenges, and sensory evaluation ensuring acceptable taste profiles without off-notes sometimes associated with plant-based colorants, recognizing that clean-label positioning represents competitive differentiation and premium pricing justification.

Modern decoration manufacturers systematically incorporate responsible cocoa sourcing through certification programs including Rainforest Alliance and Fairtrade, ethical nut procurement supporting smallholder farmer communities, and transparent supply chains enabling traceability from origin to final product. Strategic integration of responsible sourcing credentials enables manufacturers to position decorations as conscious choices where environmental stewardship and social responsibility prove increasingly important to European consumers, retailers, and food manufacturers evaluating supplier partnerships.

These ethical sourcing improvements prove essential for premium positioning, as conscious consumers demand verification of responsible practices, food manufacturers require documentation supporting corporate responsibility reporting, and retailers establish supplier qualification standards including environmental and social performance metrics. Companies implement comprehensive certification programs, supply chain mapping initiatives, and farmer support programs targeting specific outcomes including cocoa agroforestry, reduced pesticide usage, and fair labor practices throughout agricultural supply chains.

European bakeries and food manufacturers increasingly prioritize decoration products featuring enhanced functional properties including improved heat stability for baking applications, moisture resistance preventing color bleeding and texture degradation, controlled melting behavior for ice cream inclusions, and optimal adhesion characteristics ensuring decorations remain attached during handling and distribution. This functional focus enables manufacturers to differentiate offerings through performance guarantees supporting specific application requirements rather than competing solely on price or appearance.

The development of advanced coating technologies, microencapsulation systems protecting sensitive colorants and flavors, and customized fat systems optimizing melting profiles expands manufacturers' abilities to create application-specific decorations delivering reliable performance across challenging conditions including high-humidity environments, extended frozen storage, and high-temperature baking processes. Brands collaborate with food technologists, application laboratories, and bakery equipment manufacturers to develop optimized solutions addressing technical challenges and enabling successful decoration integration across diverse product formats.

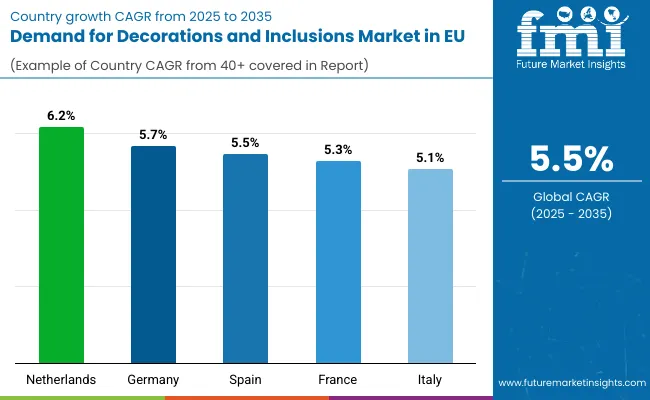

| Country | CAGR % |

|---|---|

| Netherlands | 6.2% |

| Germany | 5.7% |

| Spain | 5.5% |

| France | 5.3% |

| Italy | 5.1% |

EU decorations and inclusions sales demonstrate varied growth across major European economies, with the Netherlands leading expansion at 6.2% CAGR through 2035, driven by chocolate manufacturing excellence and food ingredient innovation. Rest of Europe shows strong 5.9% CAGR supported by emerging Eastern European development and expanding bakery sectors. Germany maintains leadership with 5.7% CAGR through established bakery culture and confectionery manufacturing. Spain demonstrates 5.5% growth supported by expanding foodservice sector. France exhibits 5.3% CAGR reflecting sophisticated pastry culture. Italy shows steady 5.1% growth driven by gelato applications and artisan confectionery heritage.

Revenue from decorations and inclusions in Germany is projected to exhibit robust growth with a CAGR of 5.7% through 2035, driven by exceptionally well-developed bakery infrastructure, strong confectionery manufacturing sector, and cultural emphasis on celebration cakes and seasonal bakery specialties throughout the country. Germany's sophisticated bakery culture featuring over 10,000 specialized bakeries and internationally recognized excellence in baking traditions are creating substantial demand for diverse decoration products across all application segments from industrial manufacturing to artisan operations.

Major food manufacturers including Dr. Oetker, Bahlsen, and Ritter Sport, alongside specialized bakery decoration suppliers such as Ulmer Schokoladen, systematically expand decoration portfolios, often dedicating extensive development resources to seasonal product innovation and technical performance optimization. German demand benefits from strong home baking culture creating retail decoration opportunities, substantial celebration culture supporting special occasion bakery products, and technical sophistication enabling functional performance requirements including heat stability and moisture resistance.

Key drivers include:

Revenue from decorations and inclusions in France is expanding at a CAGR of 5.3%, substantially supported by sophisticated pastry culture, prestigious culinary heritage, and growing artisan bakery sector despite France's traditional emphasis on minimalist cake decoration compared to other European regions. France's exceptional pastry craftsmanship and internationally recognized pâtisserie excellence are systematically driving demand for premium decorations supporting gourmet positioning and artisan differentiation.

Major confectionery companies including Valrhona, and artisan pastry suppliers strategically incorporate specialized decorations into product offerings, particularly within premium chocolate applications, artisan pastry shops, and celebration cake segments. French sales particularly benefit from sophisticated consumer expectations demanding superior taste and quality standards, driving premium decoration formulations prioritizing authentic flavor profiles, natural ingredient positioning, and elegant aesthetic appeal over bold visual impact.

Key drivers include:

Revenue from decorations and inclusions in Italy is growing at a CAGR of 5.1%, fundamentally driven by strong gelato manufacturing sector, traditional confectionery excellence, and artisan pastry culture throughout Italian cities and tourist destinations. Italy's renowned gelato heritage is gradually expanding decoration usage as gelaterias incorporate textural elements, crunchy inclusions, and visual toppings enhancing traditional flavors and attracting younger consumers seeking Instagram-worthy presentations.

Major confectionery manufacturers including Ferrero and specialized gelato suppliers strategically invest in inclusion applications for frozen desserts, chocolate products, and festive confections. Italian sales particularly benefit from gelato sector providing natural adoption pathway for crunchy inclusions, caramelized nuts, and chocolate decorations delivering textural contrast, combined with strong celebration culture supporting elaborate cake decorations for weddings and religious celebrations.

Key drivers include:

Demand for decorations and inclusions in Spain is projected to grow at a CAGR of 5.5%, substantially supported by expanding foodservice sector, tourism industry driving dessert innovation, and modernizing bakery infrastructure incorporating international decoration trends. Spanish bakery culture traditionally emphasizing simple presentations is gradually embracing decorative elements as younger pastry chefs introduce modern techniques and visually elaborate desserts.

Major food manufacturers and bakery suppliers systematically expand decoration offerings, with particular emphasis on chocolate decorations for pastry applications, sugar decorations for celebration cakes, and fruit inclusions for artisan bread products. Spain's substantial tourism industry exposes domestic bakers to international decoration trends, normalizing elaborate cake decorations and encouraging adoption of premium inclusions supporting differentiation in competitive hospitality environments.

Key drivers include:

Demand for decorations and inclusions in the Netherlands is expanding at a CAGR of 6.2%, the highest growth rate among major EU countries, fundamentally driven by exceptional chocolate manufacturing expertise, leadership in food ingredient innovation, and sophisticated food technology infrastructure supporting advanced decoration production. Dutch chocolate industry's international reputation featuring specialized manufacturers including Dobla creates optimal environment for decoration development.

Netherlands sales significantly benefit from presence of specialized decoration manufacturers including Dobla focusing on premium chocolate decorations for professional bakeries, combined with sophisticated food technology research infrastructure and extensive ingredient innovation ecosystem. The country serves as innovation testing ground for European decoration applications, with successful Dutch formulation technologies and production innovations often expanding to broader European regions through licensing agreements and technology partnerships.

Key drivers include:

Demand for decorations and inclusions in the Rest of Europe region is projected to grow at a robust CAGR of 5.9%, the second-highest growth rate, driven by emerging development in Eastern European countries including Poland, Czech Republic, Romania, and Hungary, increasing retail penetration of premium bakery products, and growing celebration culture across smaller European territories including Belgium, Austria, Portugal, and Nordic countries. These areas benefit from improving economic conditions, expanding middle-class consumer base, and increasing exposure to Western European bakery trends through retail expansion and foodservice modernization.

The Rest of Europe region demonstrates particularly strong growth potential as decoration adoption accelerates from relatively lower baseline compared to mature Western European areas. Regional bakery chains and international food manufacturers increasingly recognize opportunities to introduce premium decorations addressing growing consumer interest in celebration cakes, artisan pastries, and visually impressive desserts supporting social media sharing and gift-giving occasions.

Key drivers include:

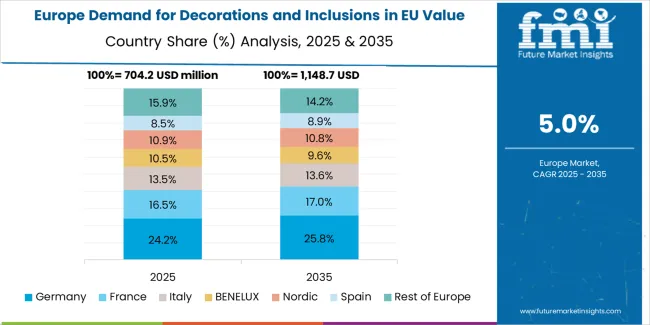

EU decorations and inclusions sales are projected to grow from USD 2,877.4 million in 2025 to USD 4915 million by 2035, registering a CAGR of 5.5% over the forecast period. The Netherlands is expected to demonstrate the strongest growth trajectory with a 6.2% CAGR, supported by advanced food processing infrastructure and strong chocolate manufacturing heritage. Rest of Europe follows with 5.9% CAGR, attributed to emerging development in Eastern European countries. Germany maintains the largest share at 24% in 2025, valued at USD 690.6 million, growing at 5.7% CAGR. France holds 18% share at USD 517.9 million with 5.3% CAGR. Italy accounts for 12% with 5.1% CAGR, Spain contributes 10% growing at 5.5% CAGR, and Netherlands holds 5% share with the highest individual country growth rate.

EU decorations and inclusions sales are defined by competition among major chocolate manufacturers, specialized decoration suppliers, and diversified ingredient companies. Companies are investing in natural colorant technologies, responsible sourcing programs, functional performance optimization, and application development services to deliver high-quality, visually appealing, and technically reliable decoration solutions. Strategic partnerships with industrial food manufacturers, technical support for artisan bakeries, and clean-label reformulation capabilities are central to strengthening competitive position.

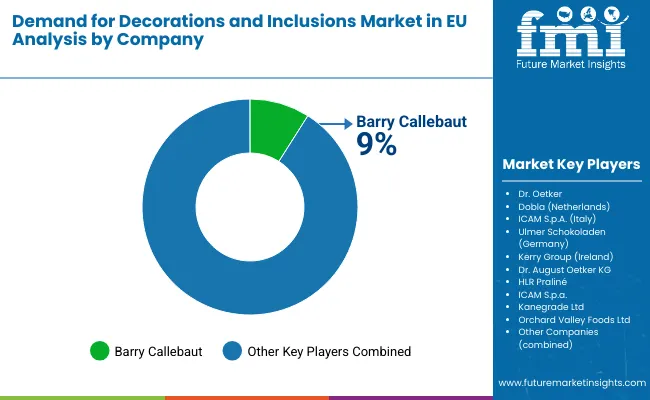

Barry Callebaut holds an estimated 9% share, leveraging its comprehensive pan-European chocolate manufacturing footprint, extensive inclusions and decorations portfolio, established distribution networks, and technical expertise supporting consistent supply to industrial food manufacturers and professional bakeries. Barry Callebaut benefits from vertical integration across cocoa processing and chocolate decoration production, combined with extensive application laboratories providing formulation support and customization services.

Dr. Oetker accounts for approximately 6% share, emphasizing retail brand strength in baking decorations, comprehensive product portfolio spanning sugar decorations and chocolate sprinkles, and strong distribution through European supermarket chains. Dr. Oetker's success in developing consumer-friendly packaging, seasonal product innovation, and trusted brand positioning creates strong retail presence and consumer loyalty among home baking enthusiasts.

Dobla (Netherlands) represents roughly 4.5% share through its position as premium chocolate decoration specialist, providing extensive shape variety, custom decoration capabilities, and technical quality supporting professional bakery and confectionery applications. The company benefits from Dutch chocolate manufacturing heritage, innovation in decoration design and production technology, and strong positioning among quality-focused artisan customers requiring reliable performance and visual consistency.

ICAM S.p.A. (Italy) holds approximately 3.5% share, supporting growth through Italian chocolate inclusions expertise, organic and clean-label product focus, and strong positioning in premium confectionery applications. ICAM leverages responsible cocoa sourcing credentials, bean-to-bar manufacturing capabilities, and quality positioning attracting chocolate manufacturers and artisan confectioners seeking premium inclusions with ethical sourcing verification.

Ulmer Schokoladen (Germany) accounts for around 3% share through its specialized B2B focus, German manufacturing precision, and comprehensive inclusions portfolio serving industrial food manufacturers. Ulmer provides technical reliability, consistent quality standards, and application support enabling food manufacturers to specify decorations meeting stringent functional requirements including heat stability and moisture resistance.

Kerry Group (Ireland) represents approximately 3% share, supporting growth through clean-label coating expertise, natural colorant technologies, and comprehensive EU reach. Kerry leverages food ingredient science capabilities, natural color innovation, and technical support services, attracting food manufacturers seeking clean-label decoration alternatives and responsible sourcing documentation.

Other companies and regional specialists collectively hold 71% share, reflecting high fragmentation in European decorations and inclusions sales, where numerous regional manufacturers, specialized artisan suppliers, private label producers, and emerging clean-label brands serve local territories, specific application niches, and custom decoration requirements. This fragmentation provides opportunities for differentiation through specialized formats including custom shapes and seasonal designs, proprietary coating technologies, regional flavor preferences, and premium positioning resonating with artisan bakeries and health-conscious consumers seeking natural ingredient alternatives.

| Item | Value |

|---|---|

| Quantitative Units | USD 4915 million |

| Product Type | Chocolate Sprinkles & Inclusions, Sugar Sprinkles & Inclusions, Preserved/Dried Fruit Pieces, Sweetened/Caramelized Nuts, Roasted Nuts, Chocolate Shapes, Chocolate Cups & Shells, Baked Pieces, Sugar Shapes, Sugar Pastes & Icings |

| Application (End Use) | Industrial/F&B Processing, Bakeries & Pastry Shops, Confectionery Shops, Ice Cream & Frozen Desserts, Snack Bars, Restaurants & Hotels |

| Distribution Channel | Direct (B2B), Brick & Mortar Retailers, Online Retailers, Intermediate/Bulk Distributors |

| Nature | Conventional, Clean-label/Natural |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Barry Callebaut, Dr. Oetker, Dobla, ICAM S.p.A., Ulmer Schokoladen, Kerry Group, Regional specialists |

| Additional Attributes | Dollar sales by product type, application (end use), distribution channel, and nature; regional demand trends across major European countries; competitive landscape analysis with established chocolate manufacturers and specialized decoration suppliers; customer preferences for various decoration formats and functional specifications; integration with natural colorant technologies and responsible sourcing programs; innovations in functional performance optimization and clean-label formulations; adoption across industrial food manufacturing and artisan bakery sectors; regulatory framework analysis for food colorant approvals and allergen labeling requirements; supply chain strategies; and penetration analysis for professional customers and home baking consumers. |

The global demand for decorations and inclusions market in EU is estimated to be valued at USD 2,877.4 million in 2025.

The market size for the demand for decorations and inclusions market in EU is projected to reach USD 4,915.0 million by 2035.

The demand for decorations and inclusions market in EU is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in demand for decorations and inclusions market in EU are chocolate sprinkles & inclusions, sugar sprinkles & inclusions, preserved/dried fruit pieces, sweetened/caramelized nuts, roasted nuts, chocolate shapes, chocolate cups & shells, baked pieces, sugar shapes and sugar pastes & icings.

In terms of application (end use), industrial/f&b processing segment to command 48.0% share in the demand for decorations and inclusions market in EU in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Decorations and Inclusions Market Size and Share Forecast Outlook 2025 to 2035

Chocolate Inclusions and Decorations Market Analysis by Type, End Use, and Region Through 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Europe Polyvinyl Alcohol Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Europe Cruise Market Forecast and Outlook 2025 to 2035

Europium Market Forecast and Outlook 2025 to 2035

Eucommia Leaf Extract Market Size and Share Forecast Outlook 2025 to 2035

Europe Massage Therapy Service Market Size and Share Forecast Outlook 2025 to 2035

Europe Cement Market Analysis Size and Share Forecast Outlook 2025 to 2035

European Union Tourism Industry Size and Share Forecast Outlook 2025 to 2035

Europe Injection Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

Europe Injection Moulders Market Size and Share Forecast Outlook 2025 to 2035

Europe and MENA Generic Oncology Drug Market Size and Share Forecast Outlook 2025 to 2035

Europe Masking Tapes Market Size and Share Forecast Outlook 2025 to 2035

Europe Liners Market Size and Share Forecast Outlook 2025 to 2035

Europe Dermal Fillers Market Size and Share Forecast Outlook 2025 to 2035

Europe Trolley Bus Market Size and Share Forecast Outlook 2025 to 2035

EU Battery Passport Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Protease Market Size and Share Forecast Outlook 2025 to 2035

Europe Luxury Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA