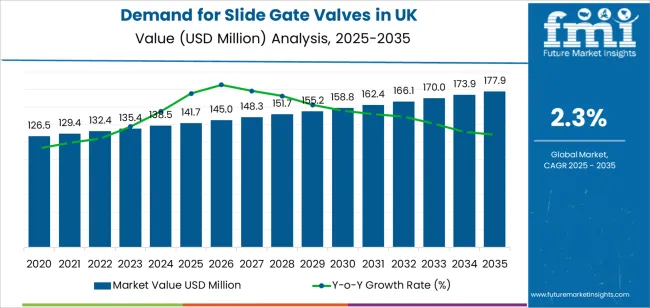

The demand for slide gate valves in UK is projected to grow from USD 141.7 million in 2025 to approximately USD 177.9 million by 2035, recording an absolute increase of USD 43 million over the forecast period. This translates into total growth of 30.3%, with demand forecast to expand at a compound annual growth rate (CAGR) of 2.3% between 2025 and 2035.

Overall sales are expected to grow by nearly 1.30X during the same period, supported by expanding industrial processing applications, increasing automation in manufacturing facilities, and growing demand for precise material flow control systems across bulk handling operations, advanced manufacturing integration, and specialized processing environments. UK, characterized by established industrial engineering heritage and proven precision manufacturing capabilities, continues to demonstrate consistent growth potential driven by facility modernization requirements and operational excellence standards.

Between 2025 and 2030, sales of UK slide gate valves are projected to expand from USD 141.7 million to USD 159.2 million, resulting in a value increase of USD 17.5 million, which represents 40.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising industrial automation initiatives across UK, particularly in processing facilities where flow control adoption and operational efficiency standards are accelerating slide gate valve deployment.

Increasing integration of automated manufacturing systems in commercial processing applications and growing adoption of precision control technologies continue to drive demand. Industrial processors are expanding their automation capabilities to address the growing complexity of modern manufacturing requirements and regulatory specifications, with UK operations leading investments in advanced flow control systems.

From 2030 to 2035, demand is forecast to grow from USD 159.2 million to USD 177.9 million, adding another USD 25.5 million, which constitutes 59.3% of the overall ten-year expansion. This period is expected to be characterized by expansion of next-generation processing technologies, integration of automated monitoring systems and process control networks, and development of specialized valve applications across different manufacturing sectors. The growing adoption of operational optimization principles and enhanced flow control requirements, particularly in Midlands and Northern England regions, will drive demand for more sophisticated valve systems and specialized actuation mechanisms.

Between 2020 and 2025, UK slide gate valve demand experienced steady expansion, driven by increasing precision manufacturing requirements in processing sectors and growing awareness of flow control benefits for operational enhancement and process reliability improvement. The sector developed as industrial processors and equipment companies, especially in major manufacturing corridors, recognized the need for proven valve solutions and reliable material handling systems to achieve operational targets while meeting manufacturing excellence expectations and quality compliance requirements. Equipment suppliers and valve manufacturers began emphasizing proper performance optimization and application integration to maintain operational efficiency and commercial viability.

| Metric | Value |

|---|---|

| UK Slide Gate Valves Sales Value (2025) | USD 141.7 million |

| UK Slide Gate Valves Forecast Value (2035) | USD 177.9 million |

| UK Slide Gate Valves Forecast CAGR (2025-2035) | 2.3% |

Demand expansion is being supported by the accelerating emphasis on industrial processing precision and operational optimization nationwide, with UK maintaining its position as an industrial engineering and manufacturing innovation leadership region, and the corresponding need for effective material flow control systems for bulk handling, particle management, and process reliability integration. Modern industrial processors rely on slide gate valve technologies to ensure operational competitiveness, regulatory compliance, and optimal pathway achievement toward precision-focused manufacturing operations. Advanced processing requirements necessitate comprehensive valve solutions including specialized actuation systems, flow control capabilities, and operational enhancement infrastructure to address diverse application needs and performance specifications.

The growing emphasis on automation adoption and increasing national and regional-level manufacturing regulations, particularly precision processing commitments across UK, are driving demand for flow control systems from proven valve suppliers with appropriate engineering expertise and quality management capabilities. Industrial processors and manufacturing companies are increasingly investing in valve technology sourcing and integrated material handling solutions to enhance operational profiles, access efficiency optimization trends, and demonstrate equipment leadership in competitive industrial environments. Manufacturing policies and quality compliance requirements are establishing standardized flow control pathways that require valve systems and performance assurance, with UK processing operations often pioneering large-scale implementation of advanced valve technologies.

The slide gate valve demand in UK is positioned for consistent expansion, growing from USD 141.7 million in 2025 to USD 177.9 million by 2035, reflecting a 2.3% CAGR. Rising adoption of precision flow control systems in industrial processing, automated manufacturing operations, and specialized production applications is driving growth as processors seek reliable material handling solutions that maximize efficiency and comply with operational standards. Additionally, demand from pharmaceutical manufacturing and chemical processing strengthens opportunities for both specialized valve designs and automated control solutions.

Manufacturers focusing on manual valve systems, automated actuation technologies, and process integration capabilities stand to gain from evolving manufacturing standards and customer expectations for flow control, reliability, and operational optimization.

Industrial processors face increasing demands for precise material handling environments in advanced manufacturing production. Slide gate valves enable accurate flow control and material management without disrupting sensitive processing operations. Solutions targeting modern facilities, automated production systems, and advanced packaging operations can achieve strong adoption rates through efficiency improvements and process reliability. Estimated revenue opportunity: USD 7.8--11.7 million.

The growth in pharmaceutical production, specialized drug manufacturing, and biotechnology applications creates robust demand for slide gate valves ensuring precision in pharmaceutical processing operations. Manufacturers offering flow control solutions for pharmaceutical materials can build relationships with drug manufacturers and equipment suppliers. Estimated revenue opportunity: USD 5.2--7.8 million.

Industrial processors are increasingly adopting automated valve systems for consistent flow control. Collaborations with equipment manufacturers for integrated valve solutions can unlock large-volume supply contracts and long-term partnerships in precision processing applications. Estimated revenue opportunity: USD 4.6--6.9 million.

Operational requirements and cost considerations are driving preference for manual valve systems with proven reliability and simplified maintenance. Suppliers offering high-performance manual valves with superior flow control can differentiate offerings and attract cost-conscious processors. Estimated revenue opportunity: USD 5.8--8.7 million.

Critical processing applications require specialized valves with exceptional material properties and enhanced durability characteristics. Manufacturers investing in stainless steel valve development can secure advantages in serving quality-critical processing applications. Estimated revenue opportunity: USD 4.3--6.5 million.

Comprehensive service networks offering installation, maintenance, and process optimization support create recurring revenue opportunities. Companies building strong technical support capabilities can capture ongoing relationships and enhance customer satisfaction across industrial processing facilities. Estimated revenue opportunity: USD 3.4--5.1 million.

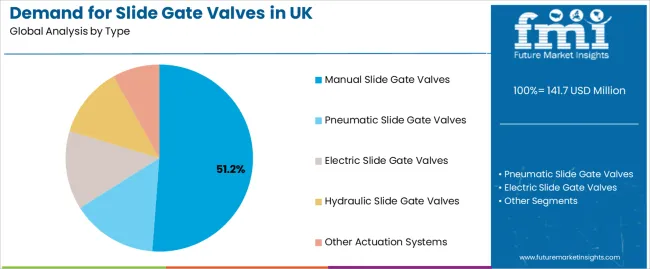

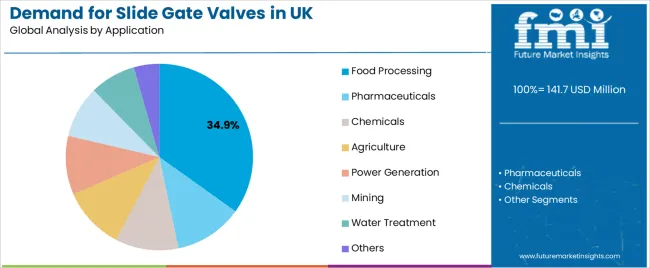

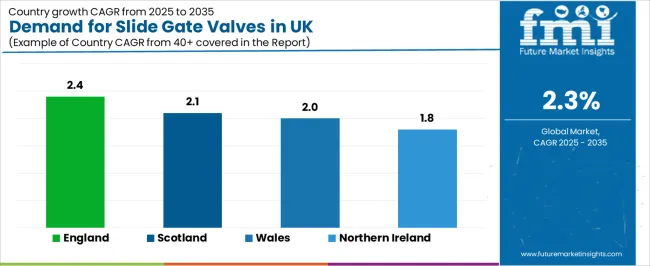

Demand is segmented by type, application, and region. By type, sales are divided into manual slide gate valves, pneumatic slide gate valves, electric slide gate valves, hydraulic slide gate valves, and other actuation systems. In terms of application, sales are segmented into food processing, pharmaceuticals, chemicals, agriculture, power generation, mining, water treatment, and others. Regionally, demand is divided into England, Scotland, Wales, and Northern Ireland, with England representing a key growth and innovation hub for slide gate valve technologies.

The manual slide gate valves segment is projected to account for 51.2% of UK slide gate valve demand in 2025, making it the leading type category across the sector. This dominance reflects the operational reliability and cost-effectiveness of manual valve systems for existing industrial processing facilities and manufacturing applications where flow control is optimized through proven mechanical actuation processes. In UK, where substantial processing infrastructure requires flow control integration without complete system replacement, manual valves provide practical pathways for operational enhancement while maintaining equipment compatibility continuity.

Continuous innovations are improving actuation reliability, material durability characteristics, and maintenance parameters, enabling processors to achieve high performance standards while minimizing operational complexity. The segment's strong position is reinforced by the extensive existing processing infrastructure requiring valve adoption and growing availability of manual valve technology suppliers with proven commercial experience.

Food processing applications are expected to represent 34.9% of UK slide gate valve demand in 2025, highlighting the critical importance of material handling requiring specialized flow control solutions. Food processing facilities including ingredient handling systems, packaging operations, specialty processing, and commercial manufacturing applications generate consistent demand for valve systems that are technically and economically favorable for food-grade material control applications. The segment benefits from flow control characteristics that often provide superior material handling compared to conventional valve alternatives, reducing operational complexity and costs.

Food processing also accesses enhanced operational performance through flow control positioning that improve process reliability and manufacturing appeal. In UK, where food processing innovation represents substantial portions of manufacturing industry development, flow control deployment requires slide gate valve integration across diverse food processing operations. In Midlands and Northern England regions, where food processing concentrations are significant, slide gate valve demand is elevated by emphasis on maintaining operational excellence while achieving efficiency optimization integration targets.

UK slide gate valve demand is advancing steadily due to increasing industrial processing precision and growing recognition of flow control necessity for manufacturing development, with England region serving as a key driver of innovation and application development. However, the sector faces challenges including competition from alternative valve technologies, need for specialized installation infrastructure development, and ongoing concerns regarding system integration complexity and cost considerations. National manufacturing guidelines and regional-level precision initiatives, particularly processing programs in Midlands and Northern England regions, continue to influence valve technology selection and deployment timelines.

The enhancement of industrial processing regulations, gaining particular significance through manufacturing industry efficiency guidelines and quality campaigns, is enabling valve suppliers to achieve differentiation without prohibitive development costs, providing predictable demand patterns through processing requirements and operational preferences. Enhanced efficiency optimization standards offering substantial opportunities for flow control systems and valve applications provide foundational dynamics while allowing suppliers to secure manufacturing agreements and application partnerships. These trends are particularly valuable for first-mover suppliers and premium valve development that require substantial technology investments without immediate cost advantages.

Modern valve suppliers and industrial processors are establishing advanced flow control networks and centralized material handling facilities that improve operational efficiency through valve standardization and economies of scale. Integration of automated actuation systems, real-time flow monitoring, and coordinated process management enables more efficient valve operation across multiple processing sources. Advanced valve concepts also support next-generation processing applications including specialized manufacturing integration, technology cluster optimization, and regional valve supply networks that optimize system-level economics while enabling comprehensive flow control across industrial processing regions, with UK developments increasingly adopting collaborative valve models to reduce individual processor costs and accelerate deployment.

| Region | CAGR (2025-2035) |

|---|---|

| England | 2.4% |

| Scotland | 2.1% |

| Wales | 2% |

| Northern Ireland | 1.8% |

UK slide gate valve demand is witnessing consistent growth, supported by rising industrial processing precision, expanding flow control requirements, and the deployment of advanced valve technologies across regions. England leads the nation with a 2.4% CAGR, reflecting progressive manufacturing trends, substantial processing technology innovation, and early adoption of premium flow control systems. Scotland follows with a 2.1% CAGR, driven by extensive industrial processing infrastructure, favorable technology demographics, and concentration of precision operations that enhance application development. Wales grows at 2%, as manufacturing modernization and technology efficiency opportunities increasingly drive valve deployment. Northern Ireland demonstrates growth at 1.8%, supported by expanding processing facilities and regional manufacturing initiatives.

Demand for slide gate valves in England is projected to exhibit exceptional growth with a CAGR of 2.4% through 2035, driven by progressive industrial processing preferences, substantial technology development creating premium valve opportunities, and concentration of innovation across London and surrounding manufacturing regions. As the dominant region with extensive processing infrastructure and precision-focused operational policies, England's emphasis on comprehensive manufacturing excellence and equipment leadership is creating significant demand for advanced slide gate valve systems with proven performance and reliable application potential. Major industrial processors and valve suppliers are establishing comprehensive flow control development programs to support technology innovation and premium valve deployment across diverse applications.

Demand for slide gate valves in Scotland is expanding at a CAGR of 2.1%, supported by extensive industrial processing facilities including advanced manufacturing production, precision operations, and technology establishments generating concentrated demand favorable for flow control systems. The region's operational characteristics, featuring substantial processing operations and precision requirements ideal for valve integration, provide natural advantages. Manufacturing industry expertise concentrated in Edinburgh, Glasgow, and regional technology corridors facilitates application development and operational management. Valve suppliers and processors are implementing comprehensive flow control strategies to serve expanding precision-focused requirements throughout Scotland.

Demand for slide gate valves in Wales is growing at a CAGR of 2%, driven by substantial processing facilities from industrial operations, precision engineering, and regional technology requiring flow control pathways. The region's manufacturing base, supporting critical technology operations, is increasingly adopting valve technologies to maintain competitiveness while meeting precision expectations. Processors and valve suppliers are investing in flow control integration systems and regional supply infrastructure to address growing material handling requirements.

Demand for slide gate valves in Northern Ireland is advancing at a CAGR of 1.8%, supported by expanding industrial processing facilities, regional technology development including specialized applications, and growing emphasis on flow control solutions across the region. Manufacturing modernization and technology facility expansion are driving consideration of valve systems as operational enhancement pathways. Technology companies and valve suppliers are developing regional capabilities to support emerging flow control deployment requirements.

UK slide gate valve demand is defined by competition among specialized valve manufacturers, industrial equipment companies, and flow control providers, with major precision engineering corporations maintaining significant influence through supply chain resources and technology development capabilities. Companies are investing in valve technology advancement, supply chain optimization, distribution network structures, and comprehensive application services to deliver effective, reliable, and scalable flow control solutions across UK industrial processing and manufacturing applications. Strategic partnerships, technology infrastructure development, and first-mover application execution are central to strengthening competitive positioning and presence across industrial processing, food manufacturing, and chemical processing valve applications.

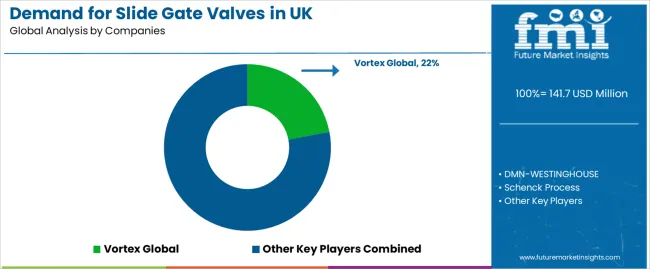

Vortex Technology, internationally recognized valve leader, leads with 22% share, offering comprehensive slide gate valve supply including manufacturing, technology, and distribution services with focus on industrial applications, performance reliability, and cost optimization across UK operations. DMN-WESTINGHOUSE, operating with extensive UK distribution, provides integrated flow control solutions leveraging engineering expertise, quality assurance development, and precision manufacturing capabilities.

Schenck Process delivers full-service slide gate valve processing including valve technology, performance testing, and supply management serving UK and international processing projects. Klinger emphasizes comprehensive engineering solutions with integrated valve design, quality control, and distribution capabilities leveraging industrial sector expertise. Ebro Armaturen offers slide gate valve application development and quality assurance operations for processing and manufacturing applications across UK operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 177.9 million |

| Type | Manual Slide Gate Valves, Pneumatic Slide Gate Valves, Electric Slide Gate Valves, Hydraulic Slide Gate Valves, Other Actuation Systems |

| Application | Food Processing, Pharmaceuticals, Chemicals, Agriculture, Power Generation, Mining, Water Treatment, Others |

| Regions Covered | England, Scotland, Wales, Northern Ireland |

| Key Companies Profiled | Vortex Global, DMN-WESTINGHOUSE, Schenck Process, Klinger, Ebro Armaturen, Schubert & Salzer, Flomatic Valves, ACS Valves, DeZURIK, ORBINOX |

| Additional Attributes | Sales by type and application segment, regional demand trends across England, Scotland, Wales, and Northern Ireland, competitive landscape with established valve suppliers and specialized flow control manufacturers, industrial operator preferences for manual versus automated valve technologies, integration with manufacturing precision programs and flow control policies particularly advanced in England region |

The global demand for slide gate valves in uk is estimated to be valued at USD 141.7 million in 2025.

The market size for the demand for slide gate valves in uk is projected to reach USD 177.9 million by 2035.

The demand for slide gate valves in uk is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types in demand for slide gate valves in uk are manual slide gate valves, pneumatic slide gate valves, electric slide gate valves, hydraulic slide gate valves and other actuation systems.

In terms of application, food processing segment to command 34.9% share in the demand for slide gate valves in uk in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Japan Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA