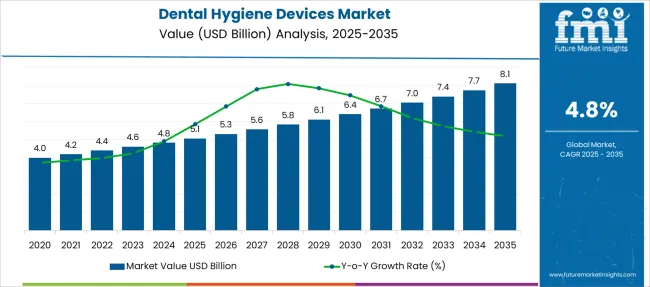

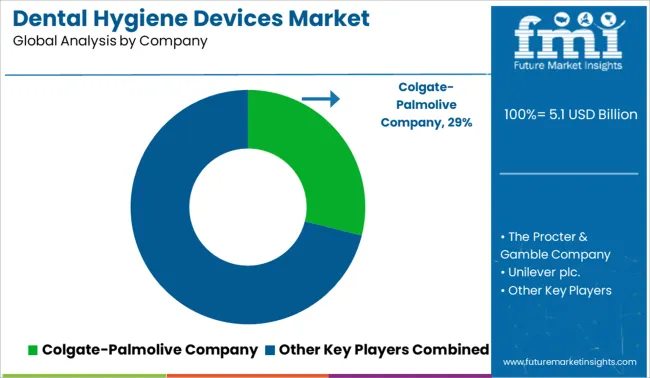

The Dental Hygiene Devices Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 8.1 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Dental Hygiene Devices Market Estimated Value in (2025 E) | USD 5.1 billion |

| Dental Hygiene Devices Market Forecast Value in (2035 F) | USD 8.1 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The dental hygiene devices market is experiencing stable growth due to increasing awareness regarding oral health, rising incidence of dental disorders, and strong promotional efforts from dental associations and healthcare providers. Technological advancements in device design, including electric and pressure-sensitive brushing technologies, have elevated consumer expectations and demand.

Public health campaigns promoting preventive dental care are further encouraging regular use of hygiene devices. Urbanization and rising disposable incomes are also influencing consumers to invest in advanced dental care tools beyond basic necessities.

With growing consumer interest in home-based dental care and an expanding geriatric population with specific oral health needs, the market is poised for continued expansion across both developed and emerging economies.

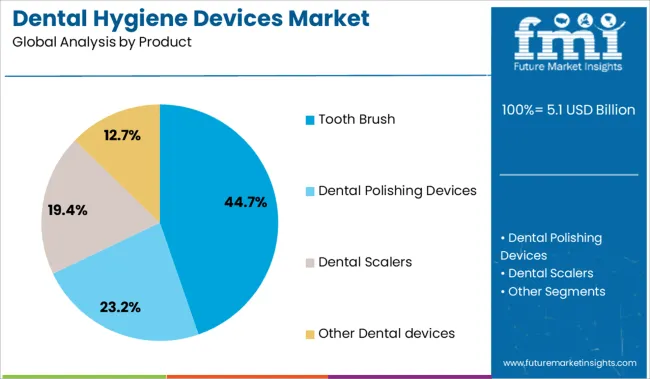

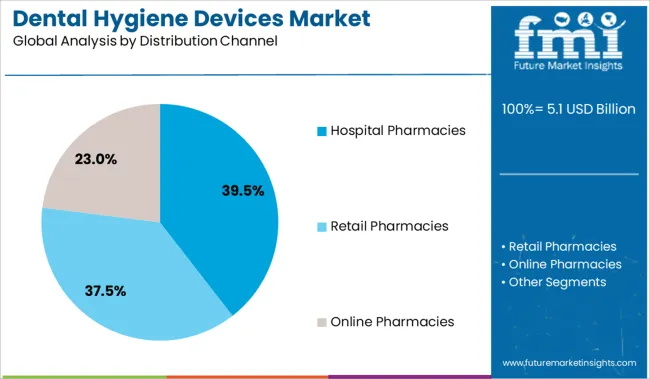

The market is segmented by Product and Distribution Channel and region. By Product, the market is divided into Tooth Brush, Dental Polishing Devices, Dental Scalers, and Other Dental devices. In terms of Distribution Channel, the market is classified into Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tooth brush segment is projected to contribute 44.70% of total market revenue by 2025 within the product category, establishing itself as the leading segment. This prominence is driven by widespread product availability, ease of daily use, and consistent demand for replacement and upgraded variants such as electric or sonic toothbrushes.

Increasing consumer preference for ergonomic designs, pressure control features, and plaque detection technologies is also supporting segment growth. Moreover, educational campaigns by dental associations highlighting proper brushing techniques and frequency are reinforcing the importance of toothbrush use.

The affordability and accessibility of toothbrushes, coupled with growing oral care consciousness across all age groups, have positioned this product type as the dominant revenue generator in the dental hygiene devices market.

The hospital pharmacies segment is anticipated to hold 39.50% of the total revenue in the distribution channel category by 2025, marking it as the primary channel. This share is supported by strong consumer trust in hospital-based purchases, particularly for medically recommended dental devices.

Hospital pharmacies often stock clinically approved and specialist-recommended tools, enhancing consumer confidence and compliance. Additionally, patients receiving post-procedural oral care guidance are more likely to procure dental hygiene devices from hospital pharmacies for assured quality and effectiveness.

The integration of dental consultations and pharmacy services within hospital infrastructure also ensures greater uptake of products, reinforcing the dominance of this distribution channel in the market.

| Particulars | Details |

|---|---|

| H1, 2024 | 4.87% |

| H1, 2025 Projected | 4.82% |

| H1, 2025 Outlook | 4.72% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 10 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 15 ↓ |

The comparative analysis and market growth rate pf global dental hygiene devices market is studied by Future Market Insights. A negative BPS change is expected to be showcased by the market in H1, 2025 (O) over H1, 2024 duration with 15 Basis Point Share (BPS).

The variation between the BPS values observed in the market in H1, 2025 - Outlook over H1, 2025 Projected reflects a decline of 10 units. The reasons for the downfall in the market is due to increasing product recalls of dental hygiene devices and poor returns associated with oral care in developing economies.

According to FMI analysis, slight dwindle in BPS is attributed to factors like lack of health policies about dental care in developed as well as developing countries. Many health insurance policies do not cover oral health and this is a major restraining factor which hampers the dental hygiene devices market growth. In developing regions, economic burden of dental treatment restricts people’s access to oral health.

Despite these negative aspects, there are some plus points such as development for advanced dental hygiene devices, including expansion of the potential market to new customers or new users thus changing trends of utilization of dental hygiene products and in-turn favouring the market growth in the forecast period.

The market value for dental hygiene devices holds nearly 13.2% of the overall USD 4.8 Billion oral care market in 2024.

The growing instances of dental illness are rising and is a prime leading factor for the growth of dental hygiene devices market globally. Dental illness encompasses periodontal diseases, cavities, dental caries and plaque. This has further led to the increasing demand of dental professionals and dental hygiene services over the globe, particularly in the developed regions of the world.

Technological advancements in dental care, such as the adoption of intraoral scanning are expected to give rise to the adoption of oral hygiene. This growth is associated with the efficacy of these advancements in providing outcomes with enhanced quality in reduced time and thus, would lead to cost-effectiveness along with lesser pain associated with standard dental services. Intraoral scanning is also expected to be a crucial trend in the dental hygiene devices market fostering its growth throughout the forecast period.

The increasing geriatric population with high prevalence of dental problems and the increasing incidence of cavities and periodontal diseases are some of the other factors contributing to the growth of the dental hygiene devices market.

Additionally, the developing healthcare infrastructure over the globe, especially in developed countries, and the rising awareness regarding dental hygiene practices is set to project a boost in the growth of the dental hygiene devices market over the next decade.

Advanced product innovations owing to the expiry of patents and the development of generics for devices such as dental scalers and polishing devices will further aid the sales growth of dental hygiene devices market over the forecast period.

The global dental hygiene devices market expanded at 4.2% CAGR over the past 8 years from 2013 to 2024. The market is expected to expand at a considerable growth rate over the next six years at a CAGR of close to 4.8%.

The expansion of dental hygiene devices market sales is expected to be attributed to factors including, but not limited to: a large number of population with untreated dental problems, growing new product development, rising instances of product upgrade strategies for maintaining patented technology by key companies, growing global healthcare expenditure and rising awareness among the general population regarding dental diseases.

The penetration of dental hygiene devices in the market, such as toothbrush and dental floss have opened an opportunistic pathway for dental hygiene devices market growth. The growth is supported by the large volume of sales with existing dental hygiene devices compared to the total target market as a conviction of growth observed. Although, similar analysis cannot be justified for advanced dental hygiene devices such as dental polishing devices and others.

Furthermore, the dental hygiene devices market is expected to witness a lucrative growth opportunity because of pricing pressure on basic dental hygiene devices and large price premium on high-end dental hygiene devices.

Introduction of electric toothbrush represents another market opportunity owing to their limited market presence. Imbibing the strategy of market development for advanced dental hygiene devices, which includes expansion of the potential market to new customers or new uses, thus changing trends of utilization of dental hygiene products is another major factor expected to influence a boost in the growth of the dental hygiene devices market.

There have been instances of product recalls within the dental hygiene devices market space which is a major restrictive factor for growth in demand of advanced dental hygiene devices.

For instance, Sunstar America Inc. recalled their Paroex Chlorhexidine Gluconate Oral Rinse 0.12% product due to possible contamination with Burkholderia lata bacteria in October 2024.

Prevalence factors such as poverty and established social groups have given rise to a highly differential rate of dental diseases. These factors have restrained the growth of dental hygiene devices market, as social determinants are largely impacted by varied array of factors inclusive of economic and social policies.

Additionally, poor return on investments in the market is another restraint to the growth of dental hygiene devices leading to over capacity for dental devices such as toothbrushes. Moreover, the rise of developing nations and countries such as China are restraining the growth of the market owing to poor labour practices, thus creating price competition.

These factors cumulatively cause a restrain on the market size.

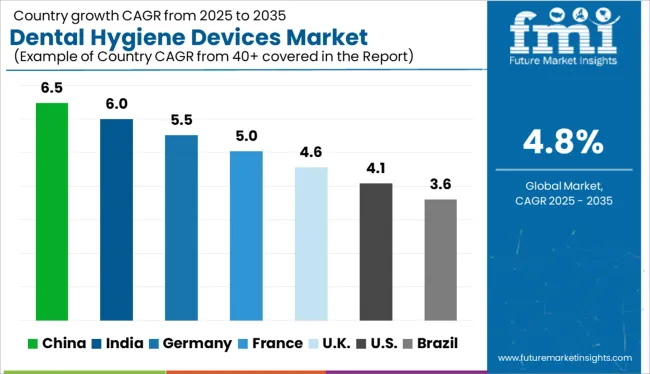

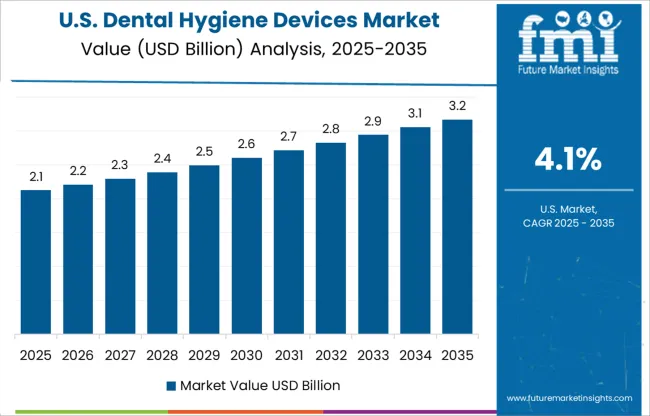

The USA dominates the North American region with a total market share of over 77.2% in 2024, and is projected to continue experiencing high growth throughout the forecast period. The growth of this market is driven by the growing instances of dental problems or illness, which include plaque, cavities, tooth decay, and periodontal diseases. This has led to an increase in demand for dentists and dental hygiene services in developed countries like the USA

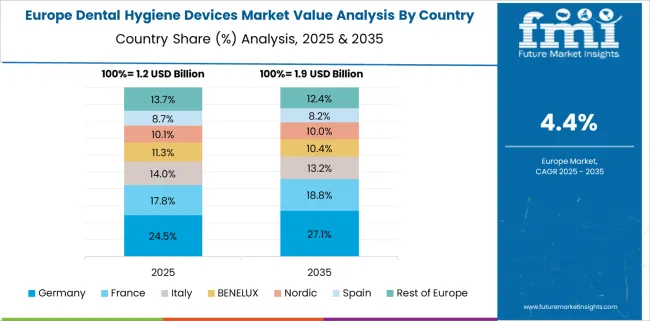

Germany exhibited a market value share growth of nearly 22.3% in the Western Europe dental hygiene devices market in 2024 and is expected to hold a market value share of 20.9% by the end of 2035. The growth is associated with the rising geriatric population and growing concerns related to their oral health. Subsequently, the country has also witnessed a rise in the number of dental practitioners in the previous 5 years. These factors contribute to the growth of dental hygiene devices market in Germany.

China holds 10.5% share in the global dental hygiene devices market in 2024, and is projected to grow at a lucrative rate of CAGR 7.6% during the forecast period. The growth of dental hygiene devices market in the country is attributed to factors such as: increasing awareness among the general population on oral hygiene, rise in disposable income and increasing collaboration between Europe and China to develop and deliver advanced dental hygiene products in the country, as well as internationally.

Tooth brushes in dental hygiene devices market project a lucrative growth at a CAGR of 5.0% till the end of the forecast period, with the current market share of around 57.9% in 2024. This dominant market value is associated with the growing incidence of dental diseases such as oral cancer and an increased risk associated with poor dental hygiene.

Retail pharmacies hold current global dental hygiene devices market value share of 58.2% in 2024, and are projected to achieve an estimated growth CAGR of 5.1% by the end of the forecast period. This growth is owed to greater number and larger distribution and reach. However the online pharmacies are growing at the fastest rate owing to spread of ecommerce. The over the counter nature of most dental hygiene devices is driving a large market growth.

Key players in the dental hygiene devices market utilize strategies of product expansion across the globe and through large product portfolio and consumer base. The companies are also actively involved in established partnerships, acquisitions and mergers to retain their market presence.

Similarly, recent developments related to companies manufacturing dental hygiene devices market services and technologies have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2013 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia-Pacific and Middle East and Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Germany, UK, France, Italy, Spain, Russia, Poland, China, Japan, India, Australia, New Zealand, South Africa and GCC Countries |

| Key Market Segments Covered | Product, Distribution Channel and Region |

| Key Companies Profiled | Colgate-Palmolive Company; The Procter & Gamble Company; Koninklijke Philips N.V.; Unilever plc.; GlaxoSmithKline plc; Ultradent Products; Johnson & Johnson; 3M Company; Dabur India Ltd.; Dentsply Sirona |

| Pricing | Available upon Request |

Hospital Pharmacies

The global dental hygiene devices market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the dental hygiene devices market is projected to reach USD 8.1 billion by 2035.

The dental hygiene devices market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in dental hygiene devices market are tooth brush, dental polishing devices, dental scalers and other dental devices.

In terms of distribution channel, hospital pharmacies segment to command 39.5% share in the dental hygiene devices market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Articulators Market Size and Share Forecast Outlook 2025 to 2035

Dental Fluoride Varnish Market Size and Share Forecast Outlook 2025 to 2035

Dental Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA