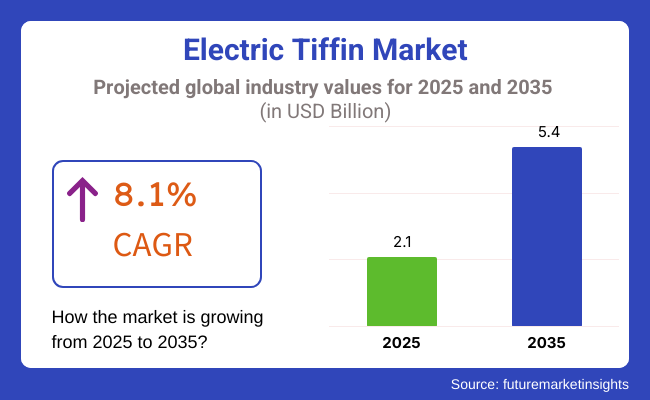

The electric tiffin market is projected to witness strong growth from 2025 to 2035, driven by increasing demand for portable, energy-efficient, and smart food heating solutions. The market is expected to expand from USD 2.1 billion in 2025 to USD 5.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 8.1% over the forecast period.

The growth is driven by the escalating number of consumers looking for portable and handy food-warming devices. These tiffins are able to heat and preserve food temperature on their own by using electricity and have recently become an attractive option among those who work in offices, students, and sightseers. The trend towards a healthier diet and home-cooked meals is pushing the growth even further.

The major driver of growth is the surprisingly fast adoption of electric lunch boxes instead of conventional food storage solutions. Customers are looking for energy-efficient and user-friendly gadgets that make it possible for them to eat hot food while traveling. The multiplication of food safety and hygiene concerns, especially in schools and offices, is also a factor that is driving their demand.

The evolution of smart and novel kitchen appliances has also had an impact on the growth. Manufacturers are now adding various technologies like temperature control, USB charging, and multiple compartments just to make the experience better for the customers. Moreover, the introduction of environmentally friendly and BPA-free tiffins is another plus for eco-oblivious consumers who really care about food safety and sustainability.

Battery-powered and insulated tiffins have also seen technological progress, which has led to an increase in innovation. It is the proliferation of e-commerce through their respective sites and the direct sending of manufacturers to customers that have solved the product-access issue for urban and semi-urban areas.

There are some challenges as well. Electric tiffins are not only a relatively new product, but they are also more expensive than traditional tiffin containers, and they are not yet widespread in less developed areas. Concerns related to product durability, battery efficiency, and safety are also key factors that are affecting consumer adoption. Alternative food-warming solutions, such as thermal flasks and insulated lunch bags, which are also insulated, compete with electric tiffins.

Despite the above difficulties, opportunities still present themselves for widespread growth. The rapid spread of portable and smart food storage products in corporate and academic settings is, in part, indeed responsible for innovation. The preference for rechargeable and efficient energy tiffins is another factor that will further promote product acceptance.

The industry is expanding fast due to the rising demand for easy-to-use, portable, and energy-saving food-heating appliances. Office professionals and students are the largest consumer segment, opting for lightweight, compact, and USB-operated models. Easy heating, portability, and low costs make economy models the preference in this space.

For tourists, battery-powered electric tiffins are becoming popular, providing warm food on the move. In the business world, large tiffins for food delivery outlets and cloud kitchens are rearing their head as the latest solution, enabling businesses to offer hot meals quickly.

The industry is also experiencing a transition to smart tiffins with temperature regulation, app connectivity, and rechargeability. Sustainability is shaping buying behavior, with BPA-free, stainless steel, and environmentally friendly materials becoming differentiators. With growing urbanization and hectic lifestyles, the industry will grow steadily in the future.

There was a notable growth between 2020 and 2024, fueled by increasing demand for convenient and portable food solutions. As urbanization and busy lifestyles increased, consumers sought easy-to-use options for carrying and heating meals on the go. Electric tiffins that possessed fast heating technology, multi-compartment designs, and energy-saving features gained momentum.

Higher work-from-home and hybrid work cycles also aided growth, as the demand for homemade food increased compared to fast food. Enhanced battery longevity and the presence of USB-plug-in and rechargeable tiffins enhanced convenience.

However, high prices of commodities and poor battery life delayed large-scale adoption. Sustainability became a concern point, and corporations started considering environmentally friendly materials as well as low-energy technology.

The market shall shift in the upcoming near term between 2025 and 2035 through the integration of smart technology along with increased energy efficiency. Intelligent AI-based tiffins will have features like temperature control, meal monitoring, and app connectivity for suggested meal recommendations on an individual level.

Wireless charging and solar power will make them more portable and environmentally friendly. BPA-free plastics and biodegradable composites will meet increasing customer demand for environment-friendly products.

Thin and light weights will be trendy among professionals and students with busy lifestyles, and self-cleaning features and adjustable compartments will be used to provide the utmost convenience. Increasing demand for healthy eating and meal preparation will also fuel the demand for nutritional monitoring and portion control functions.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Producers brought out BPA-free, food-grade plastic, and stainless steel tiffins. Heat-proof and leak-free designs increased durability. | High-tech self-heating tiffins with graphene-based heating elements boost efficiency. Fully biodegradable and eco-friendly materials have gained popularity. |

| USB-charged and rechargeable battery-operated models have gained popularity. Tiffins with multiple compartments and even heating distribution have become common. | Temperature control systems based on AI provide maximum heating. Solar-charged and energy-saving models grab most of the share. |

| Growth through increasing demand for convenient and on-the-go foods. North America and Asia-Pacific led sales due to a growing urban working population. | Growth in emerging markets fueled by increasing middle-class incomes. Demand doubles for intelligent lunch solutions with IoT features. |

| Companies introduced recyclable packages and effective heating devices. Environment-conscious consumers opted for reusable and modular ones. | Circular economy principles come in the form of repairable and long-lasting electric tiffins. Plant-based and biodegradable packaging is standard. |

| App-activated smart tiffins with heating control and timers gain popularity. Heat retention was perfected through improved insulating technology. | Identification of meals through AI and programmed heating enhances convenience. Wireless charging and nutrition tracking as a built-in feature are standard. |

| Increased demand for hip, lightweight, and portable designs. Office workers commuting to work and students drove sales of lightweight, fast-heating tiffins. | User-liked temperature control in tiffins has become more popular. Health-conscious customers drive demand for precise heating and freshness-sustaining features. |

The expansion of sales is primarily attributed to the increasing consumer demand for convenient, energy-efficient meal-heating devices. Nonetheless, the adherence to extremely strict requirements on electronic appliance safety, energy efficiency, and food-grade materials presents challenges for compliance. Businesses must guarantee to comply with global safety standards and secure the relevant certifications necessary to establish customer confidence.

The unstable procurement chain, due to the variations in the price of raw materials, the lack of semiconductors, and logistical hiccups, has had a negative impact on production stability. The reliance on specialized heating elements, robust insulation, and battery parts poses a greater risk. However, companies need to diversify their suppliers, consider different materials, and work on better manufacturing approaches to decrease these hazards.

The increased competition between microwaveable containers and insulated lunch boxes is a tough obstacle to growth. The case is that consumers primarily look for compact, lighter, and quick-heating solutions. Given the current state, innovative enterprises should prioritize introducing intelligent features like app-based controlled heating, energy-saving modes, and multi-compartment designs for better functionality.

Consumer concerns regarding the product's durability, overheating risks, and the possible health effects of components made of plastic have a drastic effect on their buying decisions. Openness in the choice of materials, third-party safety testing, and straightforward user instructions are vital for fostering trust and achieving long-term success.

The negative impact of the recession, the growing trend of the use of environmentally friendly and BPA-free materials, and the introduction of work-from-home trends that evolve constitute factors that affect the industry dynamic.

To secure long-term growth, enterprises should be focused on the development of sustainable products, affordability, and a strategic marketing plan that contains convenience, energy efficiency, and the impact of storing meals in a health-conscious way.

With two distinct categories of tiffin, multi-layered and single-layered, the industry is evolving, with consumers following the demand for portable, healthy, and hassle-free eating habits. Multi-layered tiffins are anticipated to lead in share with 45.0% in 2025. Working professionals, students, and health-conscious individuals who want to heat multiple dishes at once use these models to transport food.

Companies like Milton, Jaypee Plus, and Signoraware have capitalized on this trend by offering stainless steel, BPA-free, and energy-saving multi-layered options. Previously, the growth was fueled largely by urbanization, which created, from a growing base of apartment housing units, a demand for space-saving designs and products.

The transition to work environment and hybrid work models is also driving more demand from these countries for these product types in major urban centers in India, China, and Southeast Asia. However, single-layer tiffins are affordable, compact, and easy to carry, which can be one of the reasons for them to hold a major segment (35.0% share in 2025).

They're great for short commutes or light meals, and they draw students and people who don't have much to microwave. Brands like Borosil and Cello focus on this segment with features such as fast heating, lightweight bodies, and insurance to hit an affordable price range.

The trend towards home-cooked food and increasing health consciousness, as well as the rising penetration of digital retail through platforms like Amazon and Flipkart, is one of the common trends driving the two categories, while the shift towards multi-layered variants for their multi-functional and cost-benefits is another.

In the dynamic industry, online and hypermarket/supermarket distribution channels lead the way in consumer preferences, fueled by increasing demand for one-stop shopping experiences, product variety, and competitive pricing.

Further, online stores are expected to have the highest share, 56.3%, in 2025, indicating an increasing trend towards e-commerce because of its ease, diverse product range, and pricing. Electric tiffins are purchased online through e-commerce websites such as Amazon, Flipkart, Walmart, etc., which offer tiffins at discounts, product reviews, and direct-to-home delivery, motivating consumers to purchase electric tiffins through websites.

Apart from that, brands like Milton, Cello, and Signoraware have managed to create a good digital presence, offering specific deals and combo packs exclusively available to online shoppers. Urbanization and tech-savvy younger consumers also play a critical role, further driving this trend among populous Asian countries, as well as in North America.

20.0% of the share will be accounted for by hypermarkets and supermarkets in 2025. Physical outlets like Reliance Smart, Big Bazaar, and Tesco are not out of vogue because they offer in-store product testing, immediate purchase options, and the confidence of a quality test before the actual purchase. Touching the product before purchasing is still preferred by many customers in tier-2 cities and underdeveloped areas.

The electric lunches trend must be the latest trend on the distribution levels because they are spending more on electric lunches and electric lunches. Its online sales make up a large portion of this segment, but brick-and-mortar locations are still an important part of the value chain for many; keeping the traditional way of shopping alive only adds value and contributes to a healthy retail ecosystem.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.1% |

| UK | 5.9% |

| France | 5.7% |

| Germany | 6.2% |

| Italy | 5.6% |

| South Korea | 6.4% |

| Japan | 5.8% |

| China | 7.8% |

| Australia | 5.5% |

| New Zealand | 5.3% |

The USA is showing increased sales, with more consumers adopting portable food-heating products. Healthy eating practices have been on the rise and boosting demand for high-performance, power-efficient lunchbox solutions.

Crock-Pot and HotLogic are among the luxury self-heating tiffin containers one may spot professionals, students, and corporate commuters using. With smart and app-based kitchen appliances becoming mainstream, companies are introducing features like automated heating timers and temperature control to make the user's life easier.

Online shopping portals have also been key drivers of sales expansion, with direct consumer sales escalating at a phenomenal rate. The American market also reflects a shift towards battery-operated and USB-operated versions, as consumers would rather use green power sources.

In the UK, sales are increasing as there is more emphasis on green, recyclable food boxes. Shoppers are seeking environmentally friendly alternatives in the form of BPA-free and stainless-steel lunchboxes that are inspiring innovation by companies like Black+Blum, Sistema, and Joseph Joseph. They are developing design-led, leakproof, and multi-compartment heating options for office workers and students who place a premium on healthy home food.

With urban dwellers adopting meal-prepping cultures, the industry has seen increased vacuum-insulated and heat-retention technologies. Secondly, developments in local factory plants have made it possible for brands to customize products to appeal to environmentally conscious consumers. As consumers increasingly adopt plant-based meal lifestyles and cook at home, the need for efficient food-warming systems keeps increasing, confirming the market direction.

France is showing high sales, with an increasing trend of home-cooked meals and cafeteria dining solutions spurring demand. French consumers prefer rugged, fashionable, and high-quality meal containers, and this has encouraged players like Tefal and Seb to come up with state-of-the-art, high-end electric lunchboxes with high-end heating functions.

Most products focus on preserving food texture and taste, which appeals well to France's gourmet-sensitive population. While King convenience rules everywhere else in the world, French consumers are troubled by a mixture of appearance and performance.

Branding that takes a fashion clue focuses on lighter, slimmer, and fashionable products that also follow the country's focus on lifestyle products. Aside from these, more nature-conscious consumers shop for energy-conserving and returnable tiffins, and businesses need to innovate with green-friendly materials and simple packs.

Germany's electric tiffin market flourishes in the wake of demand for reliable, high-performance, and technology-driven food containers for storage. WMF, Emsa, and Severin are such German companies whose businesses are run on strict engineering principles, durable materials, and temperature-controlled conditions achieved with automation.

These brands cater to the needs of office workers and outdoor lovers alike, who value consistency and efficiency in their lunch pack storage. Intelligent and eco-friendly kitchen appliances are the consumer's shopping joy in Germany, which is generating technologies such as induction cooking and food warmers that use lithium-ion battery power.

Eco-friendly and local production is driving the business engine, with businesses using recyclable materials and energy-efficient manufacturing technologies. Online platforms and direct sales have also driven the penetration of these kinds of products across Germany and the entire continent.

In Italy, the popularity of home and traditional food has made electric tiffins very popular. Italian consumers value the quality and freshness of food, and companies such as Bialetti and Guzzini have created quality, insulated food containers that enhance heat retention. The products are attractive to individuals who must transport authentic Italian food to the office, school, or on the move.

Italy's innovative manufacturing industry contributes by allowing the creation of fashion-forward, long-lasting, and energy-efficient solutions for lunch. The trend towards dual-compartment heating tiffins with independent temperature control for each half of the meal has also fueled customer demand. Expansion of e-commerce, especially through Amazon and other local retailers, is also propelling products into use.

The South Korean electric tiffin market is growing because of urbanization, increased working hours, and greater use of smart home appliances. Consumers are looking for increasingly technologically advanced, multi-functional food warmers with intelligent controllers, and so LocknLock and Cuchen launched AI heating products. The products are available to be controlled remotely using mobile apps, which attract consumers looking for technology.

Besides, strong meal preparation and cafe culture in South Korea fuel the adoption of stylish and ergonomic lunchboxes. Consumers are mostly attracted by pleasant, lightweight, and compact designs to suit their lifestyles. Local manufacturers include BPA-free materials and heat-resistant designs for extended product and food safety life.

Japan's electric tiffin market takes advantage of its already existing bento culture, in which consumers enjoy tidy, neat, and heat-insulating food boxes. Industry giants Zojirushi and Tiger Corporation have introduced vacuum-insulated, electrically heated lunchboxes that keep food at the perfect temperature for a few hours. These products are in great demand among working professionals as well as students who enjoy healthy home-cooked meals.

There is growing interest in ultra-lightweight, high-technology food storage, and Japanese companies have created self-cleaning and UV-sanitizing electric tiffins. Increased environmentally conscious consumers have also motivated companies to use biodegradable and recyclable materials, further fueling industry trends.

China's electric tiffin market is also thriving with increasing disposable incomes, fast urbanization, and technophile consumer demands. Chinese companies Xiaomi, Bear, and Joyoung are industry leaders as their innovation-driven, multi-functional, and phone-enabled food warmers are indicated by their more than one heating mode, rechargeable battery, and mobile-phone connectivity for managing them.

In contrast to other industries, China greatly emphasizes affordability with advanced functionality. Domestic manufacturers deliver most of the cheap but quality electric tiffins, making them affordable for consumers in a broad segment. Online platforms of e-commerce and live streaming, in particular, provide an additional boost to the adoption of the product in the country.

Australia's tiffin market for electricity is growing, with more and more people looking for portable, energy-saving food storage. Solar-heated and battery-powered tiffins are demanded by the nation's outdoor culture and tourism lifestyle, with brands like Décor and Avanti providing rugged, insulated ones that can handle extreme weather.

New Zealand also derives impetus from improving awareness of health in Australia as consumers increasingly prefer home meals. Companies incorporate heat retention features and leakproofing to appeal to working professionals, students, and sports persons who value convenience along with durability.

The New Zealand market is slowly opening up as consumers seek quality, green food-heating products. The increasing need for green packaging has encouraged companies such as Sistema to bring BPA-free, recyclable electric tiffins into the market. Consumers opt for light, easy-to-use, and energy-efficient models that suit their busy lifestyles.

As the nation's interest is now concentrated on protecting the environment, business firms have transitioned to environmentally friendly products and minimal packaging. The internet and specialty food stores are good locations for sales, with the product being stocked in towns and cities.

The industry is growing because of urbanization and busy lifestyles. Most consumers now require portable means of energy-efficient, ready-to-eat meal solutions. Mostly among working professionals as well as students, most people are looking for lunchboxes that are compact but temperature-controlled to keep their contents hot for longer periods.

The top brands like Milton, Cello, Borosil, LifeEase, and Vaya come with innovative heating technology mechanisms, multi-compartment, and durability. However, these startups and niche players gain prominence by making the products USB-enabled, rechargeable, or have app-connected features for tech-savvy consumers.

Product improvements are based on faster heating elements or longer-life batteries and may include eco-friendly materials. Further, emphasis is on the use of BPA-free plastics, stainless steel internals, and spill-proof designs.

Some key factors impacting growth are affordability, portability, and energy efficiency of products enhanced with widespread online retail channels. Given the rise in preference for home meals over fast food, households are targeted by building health consciousness and ergonomically based smart and travel-ready designs to ward off competition.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Milton | 20-25% |

| Cello World | 15-20% |

| Borosil | 12-16% |

| LifeEase | 10-14% |

| Vaya Life | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Milton | Offers a range of electric lunchboxes with rapid heating and multi-layered insulation. Focuses on durability and energy efficiency. |

| Cello World | Provides advanced temperature-controlled lunchboxes with eco-friendly and BPA-free materials. Expanding into smart lunchbox technology. |

| Borosil | Specializes in high-quality stainless steel tiffins with food-grade safety certifications and enhanced heat retention. |

| LifeEase | Develops compact, portable USB-powered tiffins designed for urban professionals and students. |

| Vaya Life | Innovates in smart tiffin technology with auto-heating, app-controlled features, and stylish designs. |

Key Company Insights

Milton (20-25%)

Milton dominates with a strong presence in India and a growing global presence. The brand's tiffins are popular for their quick heating technology and long-lasting designs, appealing to office professionals and students.

Cello World (15-20%)

Cello has acquired a competitive advantage by concentrating on eco-friendly and BPA-free electric lunch boxes. Its cutting-edge insulation technology keeps food warm for a long time, making it highly sought after by working professionals.

Borosil (12-16%)

Borosil capitalizes on its goodwill for quality kitchenware by launching high-end stainless steel tiffins with food-grade safety features. Borosil is growing its presence online to reach a larger population.

LifeEase (10-14%)

LifeEase is making inroads with urban professionals and students through its small, USB-driven electric lunch boxes. Its emphasis on cost-effectiveness and mobility has deepened its grip.

Vaya Life (8-12%)

Vaya Life differentiates itself through its intelligent tiffin technology with app-based heating and high-end, designer looks. Its products are attractive to the modern consumer who wants high-end solutions.

Other Key Players (30-40% Combined)

The segmentation is into Single-Layer, Multi-Layer, Insulated, and Smart Electric Tiffin.

The segmentation is into stainless steel, plastic, glass, and other materials.

The segmentation is into supermarkets/hypermarkets, specialty stores, online stores, departmental stores, and others.

The segmentation is into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Electric Tiffin industry is projected to witness a CAGR of 8.1% between 2025 and 2035.

The Electric Tiffin industry stood at USD 950 million in 2024.

The Electric Tiffin industry is anticipated to reach USD 5.4 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 8.1% in the assessment period.

The key players operating in the Electric Tiffin industry include Milton, Cello, Borosil, Vaya, Zojirushi, and others.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Types, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Types, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Types, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Types, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Types, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Types, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Types, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Types, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Types, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Types, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Types, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Types, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Types, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Types, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Types, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Types, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Types, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Types, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Types, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Types, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Types, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Types, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Types, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Types, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Types, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Types, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Types, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Types, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Types, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA