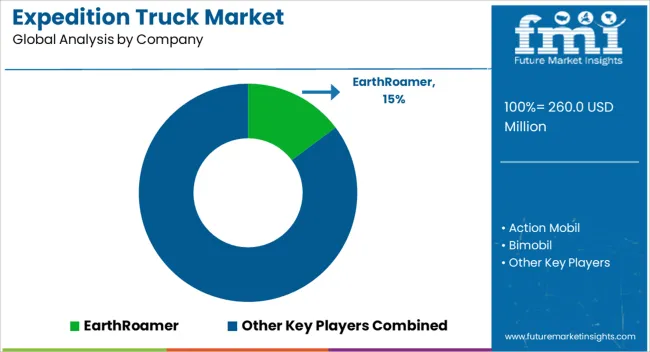

The expedition truck market is advancing steadily, reaching USD 260.0 million in 2025 and projected at USD 456.8 million by 2035, growing at a CAGR of 5.8%. Expansion is influenced by heightened interest in off-grid travel, rising popularity of overland tourism, and consumer preference for durable vehicles equipped with integrated living facilities. Manufacturers are diversifying offerings with modular interiors, all-terrain drivetrains, and advanced navigation systems to cater to niche adventurers and long-haul explorers.

Demand has also been shaped by the increasing popularity of outdoor recreational activities in North America and Europe, as well as the emerging adoption of cross-border expeditions in Asia. Partnerships between vehicle converters, OEMs, and rental operators are reinforcing accessibility and market penetration across commercial and private user groups.

| Metric | Value |

|---|---|

| Expedition Truck Market Estimated Value in (2025 E) | USD 260.0 million |

| Expedition Truck Market Forecast Value in (2035 F) | USD 456.8 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Expedition Truck Market is experiencing steady expansion, supported by rising consumer interest in off-grid travel, adventure tourism, and self-sustained mobility solutions. The growing demand for robust vehicles capable of navigating challenging terrains while offering residential features is influencing adoption across developed and emerging markets.

Manufacturers are responding to evolving consumer preferences with modular interiors, integrated digital systems, and fuel-efficient powertrains that extend range and autonomy. As more individuals seek remote experiences and long-distance travel opportunities, the market is witnessing increased investment in product innovation and durable vehicle platforms.

This trend is further reinforced by a rising number of expedition enthusiasts and digital nomads prioritizing mobility without sacrificing comfort In the years ahead, the market is expected to benefit from advances in lightweight materials, drivetrain technologies, and sustainable design practices aimed at optimizing performance and livability across varied environments.

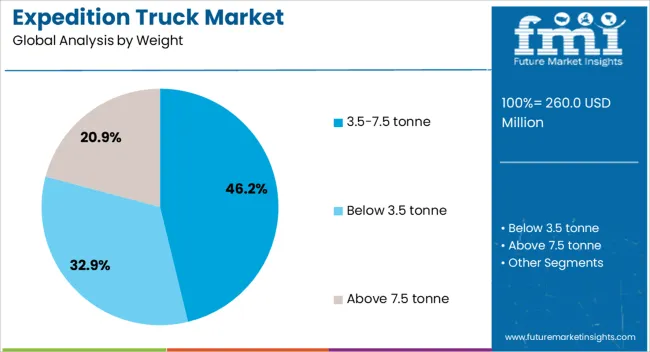

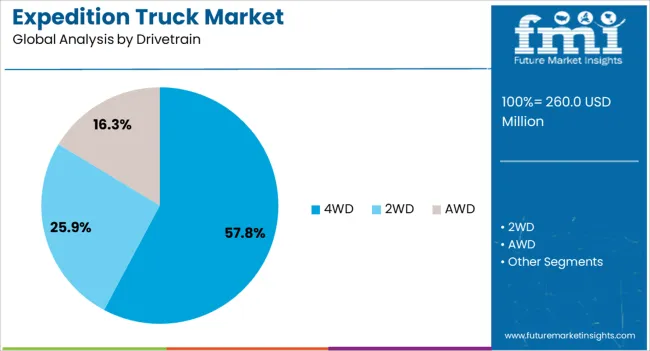

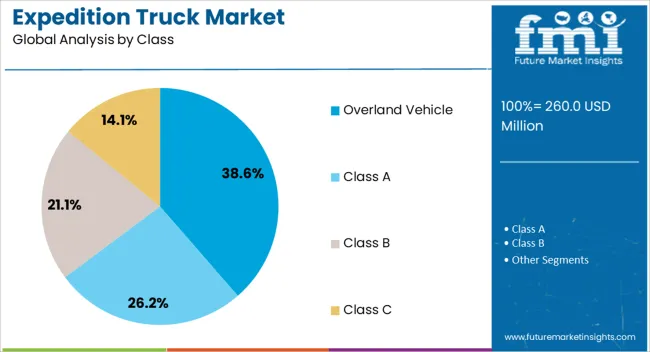

The expedition truck market is segmented by weight, drivetrain, class, application, and geographic regions. By weight, the expedition truck market is divided into 3.5-7.5 tonne, below 3.5 tonne, and above 7.5 tonne. In terms of drivetrains, the expedition truck market is classified into 4WD, 2WD, and AWD. Based on class, the expedition truck market is segmented into Overland Vehicle, Class A, Class B, and Class C. By application, the expedition truck market is segmented into Personal and Commercial. Regionally, the expedition truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 3.5-7.5 tonne weight segment is anticipated to account for 46.2% of the overall Expedition Truck Market revenue in 2025, making it the leading weight category. This dominance is being driven by its balance between off-road capability and payload capacity, making it suitable for long-distance expeditions without the need for special driving licenses in many countries.

The segment has gained preference due to its adaptability for custom-built living quarters, storage solutions, and integrated power systems. Its manageable size ensures better maneuverability through narrow trails and remote access routes while still supporting essential amenities for extended journeys.

The combination of vehicle versatility, lower operational costs, and growing availability through specialty manufacturers has contributed to its expanding demand. The segment is also benefiting from increased use in both recreational travel and commercial expedition services that require durable yet accessible vehicle configurations.

The 4WD drivetrain segment is projected to hold 57.8% of the Expedition Truck Market revenue in 2025, positioning it as the most dominant drivetrain configuration. This leading share is attributed to its proven performance in navigating varied terrain conditions such as mud, snow, gravel, and sand, which are frequently encountered during expedition travel.

The preference for 4WD is being strengthened by increasing demand for vehicles that can maintain traction and control in remote and rugged environments. Enhanced off-road mobility, coupled with the integration of advanced suspension systems and torque distribution technologies, has improved reliability and driver confidence in challenging conditions.

The segment’s growth is also being supported by consumer demand for vehicles that combine adventure functionality with everyday usability, making 4WD an optimal choice for both short-term off-road trips and long-haul international expeditions.

The overland vehicle class is expected to account for 38.6% of the Expedition Truck Market revenue in 2025, emerging as the largest vehicle class in this market. This leadership is being driven by growing consumer interest in long-term, self-reliant travel and the ability to traverse remote regions without dependence on traditional infrastructure.

Overland vehicles are being designed to function as both transportation and accommodation units, offering users the freedom to live and explore independently for extended periods. This segment has gained traction among adventure seekers, retirees, and content creators seeking immersive travel experiences.

The capability to customize living quarters, integrate solar power systems, and utilize water filtration units has further added to the appeal. As preferences shift toward sustainable and experiential travel, the overland vehicle class is expected to maintain its dominance by meeting the expectations of travelers who prioritize autonomy, durability, and comfort on the road.

The Expedition Truck Market is driven by increasing demand in adventure tourism, military applications, and remote exploration needs. Customization and luxury features are boosting consumer interest, ensuring growth in the sector.

The Expedition Truck Market is seeing increased demand, particularly driven by the growing popularity of off-road travel and adventure tourism. Overlanding, a type of self-sufficient, long-distance travel in remote regions, has gained traction as an alternative to conventional vacationing. Adventure-seekers are investing in robust expedition trucks capable of handling extreme conditions. These vehicles are specially designed to operate in rugged terrains, making them the ideal choice for travelers seeking to explore remote areas. The market benefits from a growing interest in outdoor exploration, with vehicles offering unique capabilities such as off-grid power systems and adaptable living spaces for long journeys.

Expedition trucks are widely used in military and defense sectors, where reliability and durability in extreme environments are critical. These vehicles are designed for logistics and troop transport in harsh, off-road conditions, particularly in conflict zones and remote areas. As defense budgets continue to increase globally, the demand for expedition trucks in military operations is rising. These trucks offer tactical advantages, such as their ability to navigate difficult terrains while providing essential mobility and protection. Expanding military operations in remote regions, along with the increasing focus on mobile command units, is expected to further drive demand for these trucks.

With a surge in interest for remote exploration, expedition trucks have become increasingly popular among enthusiasts and organizations that require long-distance capabilities. The need for self-sufficient, mobile vehicles is essential for exploration in areas where traditional infrastructure and resources are scarce. These vehicles are often equipped with specialized features such as water filtration systems, solar panels, and food storage options. The rising interest in exploration tourism, along with private individuals seeking to explore isolated locations, is creating a niche demand. This trend is further driven by the growing number of overland expeditions and expedition-based events.

Customization is a key driver of the Expedition Truck Market, as consumers seek vehicles that fit their specific needs for long journeys and off-grid living. These trucks are often built to provide both functionality and luxury, with options for off-road capabilities combined with high-end interiors. Luxury expedition trucks cater to affluent travelers looking for premium amenities such as full kitchens, bathrooms, and sleeping areas, offering a more comfortable and enjoyable travel experience. Manufacturers are responding to the demand by providing tailored designs and interiors, while some companies offer bespoke modifications for customers who prioritize unique specifications.

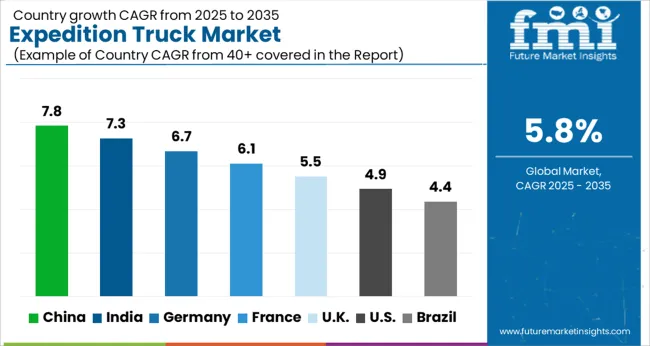

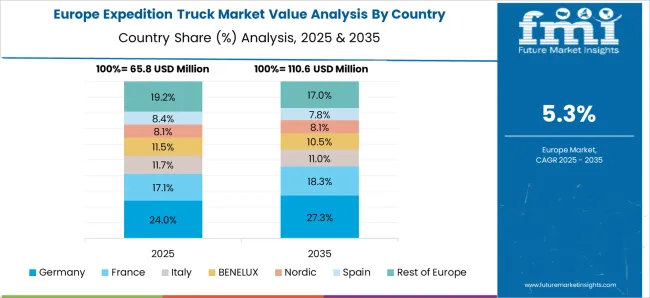

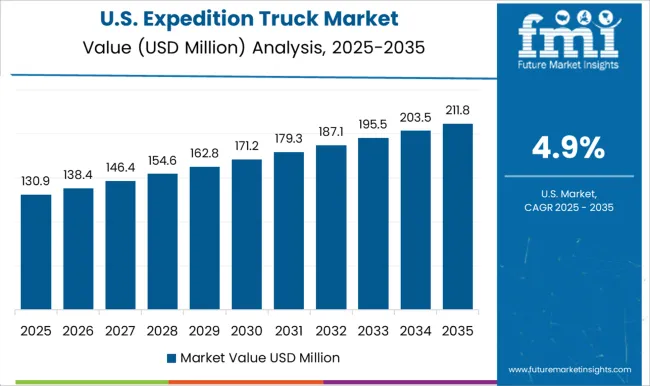

The expedition truck market is projected to grow globally at a CAGR of 5.8% from 2025 to 2035, driven by increasing demand for off-road vehicles in both adventure tourism and military applications. China leads with a CAGR of 7.8%, supported by growing interest in overlanding, large-scale infrastructure projects, and the expansion of off-road tourism. India follows at 7.3%, benefiting from the increasing number of adventure travelers and expanding remote infrastructure projects. France records a CAGR of 6.1%, fueled by rising demand for expedition vehicles for exploration and leisure travel in remote areas. The UK grows at 5.5%, with more individuals investing in off-grid travel solutions. The United States, growing at 4.9%, sees steady demand from adventure seekers and military applications. This analysis highlights the key growth drivers, including the rise in outdoor exploration, adventure tourism, and military demand, shaping the future of the expedition truck market. These regions are setting strategic benchmarks for innovation, customization, and integration of luxury features in expedition trucks to meet diverse consumer needs.

China is projected to achieve a CAGR of 7.8% during 2025–2035, up from 6.4% during 2020–2024. This growth is driven by the expanding interest in overland adventure tourism and the rise of luxury expedition vehicles. Demand is further fueled by the country's increasing infrastructure development and growing military requirements for off-road vehicles. The interest in adventure tourism and off-road exploration has surged, especially among urban populations with disposable income. The increasing demand for eco-friendly and off-grid travel solutions also plays a role. As the government supports tourism initiatives in remote areas, China is positioned to outpace the global average growth rate.

India is expected to achieve a CAGR of 7.3% during 2025–2035, rising from 6.1% in 2020–2024. The demand surge can be attributed to growing interest in off-grid travel, expanding rural infrastructure, and increasing military demand. India’s expanding tourism sector, especially adventure and eco-tourism, is driving demand for expedition trucks, which are essential for traveling to remote areas.The Indian military's need for rugged vehicles capable of operating in diverse and challenging terrains is supporting market expansion. The market is also benefiting from improved vehicle financing options and a growing middle class interested in off-road exploration.

France is projected to grow at a CAGR of 6.1% from 2025 to 2035, an increase from 5.4% during 2020 to 2024. This rise is driven by the increasing popularity of adventure tourism and exploration in rural and remote areas. The French government's initiatives promoting eco-friendly tourism have contributed to growing demand for expedition trucks. As affluent consumers seek luxury overland travel solutions, manufacturers are responding with vehicles that combine off-road capability with comfort. Increasing infrastructure development in remote areas of France has created a more favorable environment for expedition truck usage.

The UK is projected to experience a CAGR of 5.5% during 2025–2035, up from 4.4% in 2020–2024. This growth is driven by rising interest in off-road adventure travel and increasing demand for luxury expedition trucks. The UK is witnessing a shift towards more recreational vehicles as individuals seek self-sufficient travel experiences. Military applications requiring robust, all-terrain vehicles are driving demand. The market has gained momentum due to higher disposable incomes and growing preferences for off-grid, adventure-based tourism. The government's focus on improving infrastructure, including the expansion of remote road networks, further supports market growth.

The USA is expected to achieve a CAGR of 4.9% during 2025–2035, up from 4.3% during 2020–2024. The growth is primarily driven by the increasing demand for adventure tourism and recreational off-road exploration. While the earlier period saw steady growth, the acceleration is attributed to a surge in interest from affluent consumers seeking luxury expedition vehicles with high-performance features for overland journeys. Additionally, military and defense sector requirements for durable and reliable vehicles capable of operating in rugged terrains contribute to market expansion. The rise in off-road adventure events, combined with a growing middle class seeking immersive travel experiences, positions the USA market for significant growth.

The expedition truck market is led by a mix of global vehicle manufacturers and specialized overland vehicle builders such as EarthRoamer, Action Mobil, Bimobil, Bliss Mobil, EarthCruiser, Global Expedition Vehicles (GXV), Krug Expedition, Suncamper 4x4, Unicat, and Ziegler Adventure. These companies compete on the basis of custom-built, high-performance vehicles designed for remote exploration, adventure tourism, and specialized military applications. EarthRoamer and Action Mobil are prominent for their luxury expedition trucks, combining off-road capability with high-end living features. Bimobil and Bliss Mobil focus on rugged, self-sufficient vehicles for global expeditions. Unicat and Krug Expedition offer a variety of overland vehicles designed for both short-term adventures and long-distance travels in challenging environments.

Global Expedition Vehicles (GXV) provides custom vehicles with advanced technological features for autonomous exploration. These players differentiate themselves based on their design customization, vehicle durability, fuel efficiency, and specialized off-road features. Their product offerings are tailored to meet the unique needs of their clientele, from luxury travelers to military units, ensuring performance in extreme weather conditions, rough terrains, and long journeys. Strategic initiatives within the market involve enhancing vehicle technologies, expanding customization options, and leveraging materials to increase energy efficiency and vehicle lifespan. Future market positioning will depend on the ability to balance luxury features with functional performance while meeting the growing demand for adventure tourism and military expedition vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 260.0 Million |

| Weight | 3.5-7.5 tonne, Below 3.5 tonne, and Above 7.5 tonne |

| Drivetrain | 4WD, 2WD, and AWD |

| Class | Overland Vehicle, Class A, Class B, and Class C |

| Application | Personal and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EarthRoamer, Action Mobil, Bimobil, Bliss Mobil, EarthCruiser, Global Expedition Vehicles (GXV), Krug Expedition, Suncamper 4x4, Unicat, and Ziegler Adventure |

| Additional Attributes | Dollar sales trends, market share by region, growth projections for adventure tourism, and military applications. |

The global expedition truck market is estimated to be valued at USD 260.0 million in 2025.

The market size for the expedition truck market is projected to reach USD 456.8 million by 2035.

The expedition truck market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in expedition truck market are 3.5-7.5 tonne, below 3.5 tonne and above 7.5 tonne.

In terms of drivetrain, 4wd segment to command 57.8% share in the expedition truck market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Truck with Mast Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA