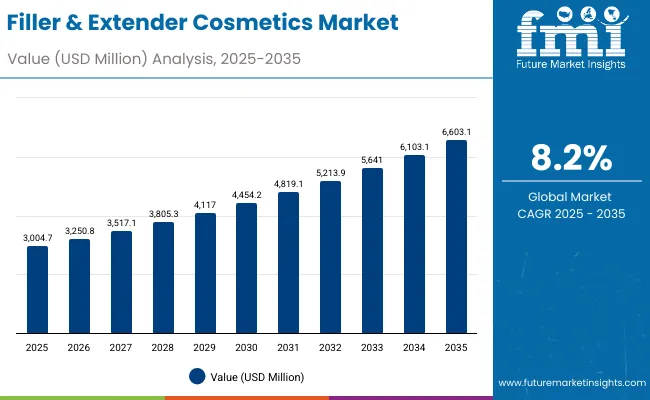

The Filler & Extender Cosmetics Market is expected to record a valuation of USD 3,004.7 million in 2025 and USD 6,603.1 million in 2035, with an increase of USD 3,598.4 million, which equals a growth of nearly 193% over the decade. The overall expansion represents a CAGR of 8.2% and a 2X increase in market size.

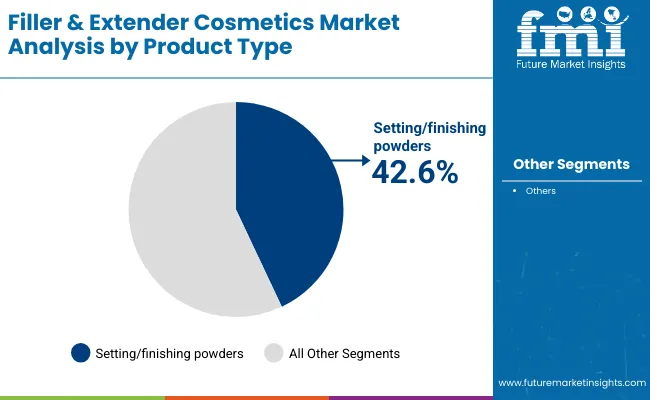

During the first five-year period from 2025 to 2030, the market increases from USD 3,004.7 million to USD 4,454.2 million, adding USD 1,449.5 million, which accounts for about 40% of the total decade growth. This phase records steady adoption driven by the rising use of setting and finishing powders and blur balms in professional makeup and everyday cosmetic routines. Setting and finishing powders dominate this period as they cater to over 42.6% of the total market, owing to their effectiveness in delivering long-lasting, oil-free coverage and smooth skin texture.

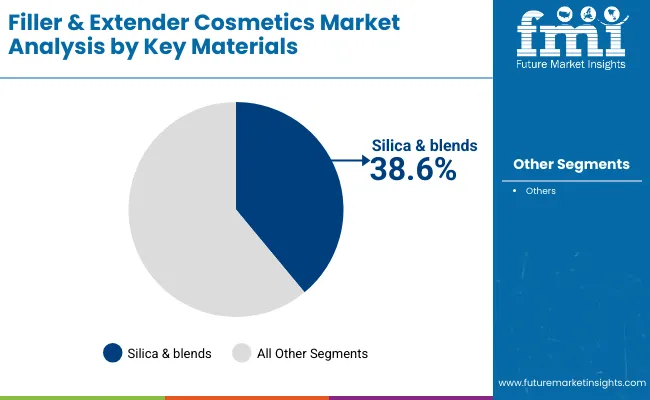

The second half, from 2030 to 2035, contributes an additional USD 2,148.9 million, equal to 60% of total growth, as the market advances from USD 4,454.2 million to USD 6,603.1 million. This acceleration is powered by the widespread adoption of polymeric microspheres and advanced silica blends in pore-blurring and texture-smoothing formulations. Polymeric microspheres lead the materials segment with a 57.4% share in 2025, driven by their superior light diffusion and airbrushed-finish properties. The transition toward eco-formulated, hybrid cosmetic bases and the rise of digital-first beauty brands are further expected to fuel demand across e-commerce and specialty retail channels globally.

Filler & Extender Cosmetics Market Key Takeaways

| Metric | Value |

|---|---|

| Filler & Extender Cosmetics Market Estimated Value (2025E) | USD 3,004.7 million |

| Filler & Extender Cosmetics Market Forecast Value (2035F) | USD 6,603.1 million |

| Forecast CAGR (2025 to 2035) | 8.2% |

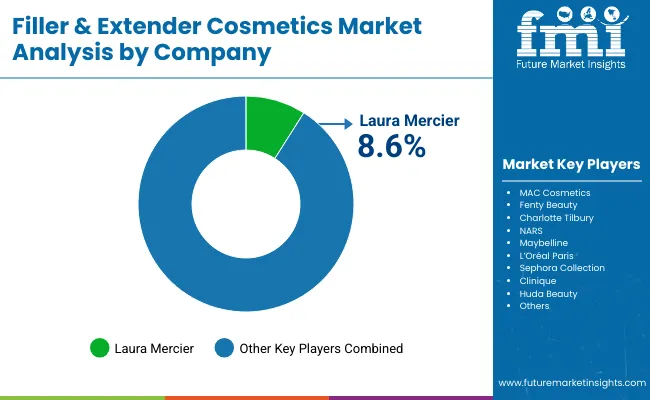

From 2020 to 2024, the Filler & Extender Cosmetics Market expanded steadily as consumer demand for blurring, oil-control, and skin-smoothing formulations increased globally. During this period, the market was led by premium brands such as Laura Mercier and MAC Cosmetics, collectively holding over 8% of the global share. These brands strengthened their presence through professional-grade finishing powders and translucent products, while mass-market players like Maybelline and L’Oréal Paris captured volume share through affordable primer and powder lines.

By 2025, global demand is projected to reach USD 3.0 billion, marking the beginning of an accelerated decade of growth. The competitive landscape is evolving as emerging digital-first beauty brands emphasize hybrid skincare-makeup solutions, eco-friendly ingredients, and advanced polymeric microspheres for superior texture and diffusion. The competitive advantage is shifting from traditional powder innovation toward ingredient transparency, sustainability, and omnichannel presence, with strong gains expected from e-commerce-driven distribution models.

Consumers are increasingly seeking multifunctional cosmetics that combine skin-care benefits with visible texture enhancement. Products such as primers, blurring balms, and soft-focus foundations are gaining traction for their ability to minimize pores, smooth texture, and control oil while providing natural coverage. This shift toward hybrid formulations is fueling consistent demand for advanced filler and extender ingredients, particularly silica and polymeric microspheres that deliver lightweight, flawless finishes.

The market’s growth is accelerated by the rapid proliferation of online beauty platforms and specialty retail channels that enhance accessibility to premium cosmetic brands. E-commerce enables global reach for niche and indie labels offering cruelty-free, clean, and high-performance filler-infused cosmetics. Simultaneously, beauty retailers are focusing on digital-first marketing and personalized shade-matching tools, expanding consumer adoption across emerging economies and reinforcing double-digit growth through 2035.

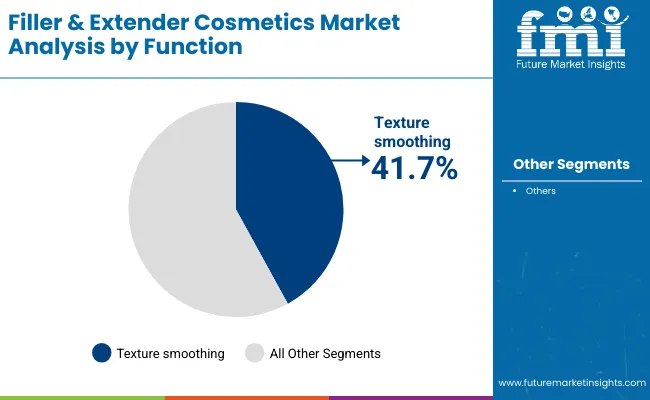

The Filler & Extender Cosmetics Market is segmented by product type, key materials, function, distribution channel, end user, and region. Product types include setting and finishing powders, primers and blur balms, and soft-focus foundations, which represent the core applications enhancing skin smoothness, radiance, and longevity of makeup wear. By key materials, the market is classified into silica and blends, polymeric microspheres, mica/talc, and titanium dioxide composites, reflecting ingredient innovation aimed at achieving light diffusion and oil absorption.

Functional segmentation includes texture smoothing, pore-blurring, oil absorption, and light diffusion, which define performance differentiation among brands. Based on channel, the market spans e-commerce, specialty beauty retail, mass retail, and department stores, emphasizing the rise of digital-first distribution. End users are categorized as everyday consumers, professional makeup artists, and event or bridal users, highlighting the market’s dual appeal across routine and professional applications. Regionally, the study covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with China, India, and Japan emerging as high-growth clusters through 2035.

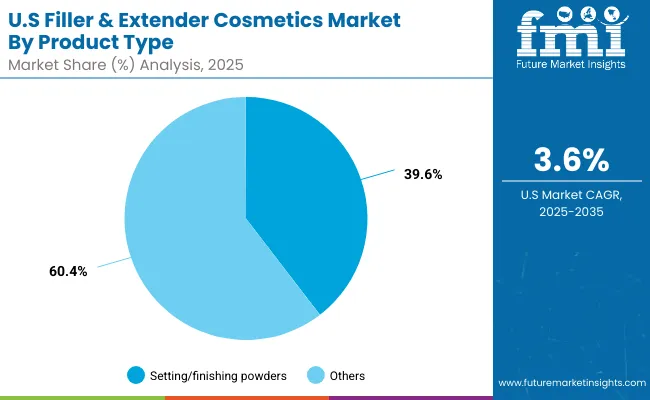

| Product Type | Value Share % 2025 |

|---|---|

| Setting/finishing powders | 42.6% |

| Others | 57.4% |

The ‘Others’ segment, which includes primers, blur balms, and soft-focus foundations, is projected to contribute 57.4% of the Filler & Extender Cosmetics Market revenue in 2025, maintaining its lead as the dominant product category. Growth is primarily driven by rising consumer interest in hybrid formulations that combine skincare benefits with advanced blurring and texturizing effects. These products cater to the growing demand for radiant, filter-like finishes without heavy coverage.

The segment’s expansion is further supported by continuous innovation in lightweight emulsions and silicone-polymer blends that enhance spreadability and comfort. With increasing use in both professional and everyday makeup applications, this segment will remain the cornerstone of cosmetic filler formulations through 2035.

| Key Materials | Value Share % 2025 |

|---|---|

| Silica & blends | 38.6% |

| Others | 61.4% |

The polymeric microspheres segment is forecasted to hold 61.4% of the market share in 2025, leading the filler and extender materials category. These microspheres are highly valued for their ability to create a soft-focus optical effect, smooth fine lines, and reduce the appearance of pores. Their unique light-scattering properties and compatibility with water- and oil-based formulations make them a preferred ingredient in face primers, blurring powders, and tinted bases.

The segment’s growth is also reinforced by advancements in polymer chemistry, which improve texture consistency, matte control, and sensory performance. As consumer focus shifts toward flawless, camera-ready skin finishes, polymeric microspheres will continue to dominate the market.

| Function | Value Share % 2025 |

|---|---|

| Texture smoothing | 41.7% |

| Others | 58.3% |

The pore-blurring function segment is projected to account for over 61% of the Filler & Extender Cosmetics Market revenue in 2025, solidifying its position as the leading application category. This function enhances skin texture by minimizing pores and diffusing light for a natural, airbrushed appearance. It is widely adopted in setting powders, primers, and liquid foundations targeting matte and semi-matte finishes.

The segment benefits from the growing popularity of HD-ready makeup formulations and social media trends emphasizing filter-free skin looks. With continuous ingredient optimization and inclusion of hydrating and skin-calming additives, pore-blurring solutions will remain integral to new product launches throughout the forecast period.

Surge in Demand for Hybrid Makeup Formulations Combining Skincare Benefits

The global beauty industry is witnessing a strong shift toward multifunctional products that merge skincare efficacy with aesthetic enhancement. Consumers now prefer primers, blurring balms, and finishing powders enriched with hydrating actives such as hyaluronic acid and niacinamide. According to the Personal Care Products Council (2024), nearly 65% of consumers prioritize skin-health benefits when choosing makeup. This evolution has driven the adoption of filler and extender ingredients like polymeric microspheres and silica blends that deliver both visual perfection and comfort. As brands invest in clean-label and dermatologically safe hybrid cosmetics, this trend will continue fueling growth through 2035.

Expanding E-commerce Platforms and Premium Retail Networks

Digital transformation is reshaping the global beauty landscape, with e-commerce now accounting for over 40% of filler-infused cosmetic sales. Online retail platforms provide extensive product visibility, customization, and influencer-led marketing that accelerates consumer reach. Specialty beauty retailers are also expanding exclusive product lines, offering high-margin filler-based cosmetics to both professional artists and general consumers. The synergy of digital accessibility and premium in-store experiences is expected to sustain market growth and broaden product penetration globally.

High Formulation Costs and Ingredient Supply Chain Volatility

One of the major challenges limiting market scalability is the high production cost associated with advanced filler ingredients such as polymeric microspheres, titanium dioxide blends, and treated silica. Supply chain disruptions and raw material price fluctuations since 2023 have increased formulation expenses, particularly for mid-tier cosmetic brands. Additionally, compliance with global safety standards (EU REACH, FDA, and ASEAN Cosmetic Directive) increases R&D costs, restricting smaller brands’ entry. The limited availability of cost-efficient natural alternatives also constrains broader adoption, slowing mass-market penetration.

Rise of Clean Beauty and Sustainable Filler Formulations

A defining trend shaping the Filler & Extender Cosmetics Market is the growing emphasis on sustainability, clean labeling, and eco-friendly formulation chemistry. Brands are increasingly replacing microplastics and non-biodegradable fillers with plant-based or mineral substitutes such as natural silica, mica, and biodegradable polymeric spheres. The Clean Beauty Initiative (2024) reported that 72% of new cosmetic launches highlight "eco-safe" or "non-toxic" attributes. This transition is transforming ingredient sourcing and packaging, creating new opportunities for sustainable innovation and ethical brand differentiation.

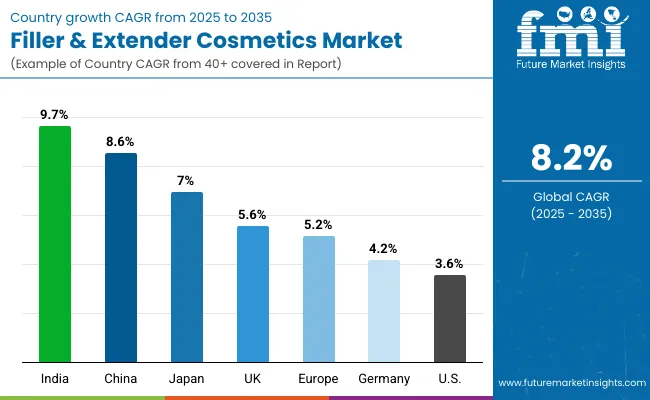

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 8.6% |

| USA | 3.6% |

| India | 9.7% |

| UK | 5.6% |

| Germany | 4.2% |

| Japan | 7.0% |

| Europe | 5.2% |

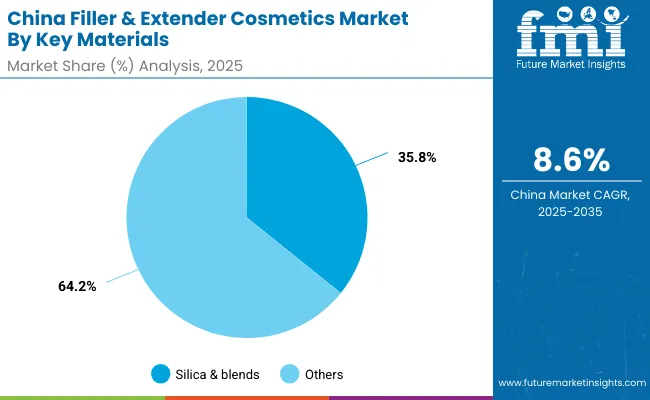

The Filler & Extender Cosmetics Market demonstrates significant variation in growth patterns across key global economies, reflecting differences in beauty consumption behavior, technological adoption, and consumer spending capacity. Asia-Pacific stands as the fastest-growing region, spearheaded by India (9.7% CAGR) and China (8.6% CAGR). India’s rapid expansion is driven by its youthful population, increased penetration of color cosmetics, and growing influence of digital beauty platforms. China’s market strength is supported by domestic innovation in hybrid formulations and the dominance of e-commerce channels that amplify reach for both premium and indie brands.

Japan (7.0% CAGR) continues to evolve as a leader in skin-centric cosmetics, with demand rising for light-diffusing and pore-blurring products that complement minimalist beauty trends. In Europe, moderate yet steady growth is observed, led by the UK (5.6%) and Germany (4.2%), where clean-label and sustainability-driven products dominate new launches. European regulatory standards for ingredient transparency and safety drive ongoing innovation in mineral and polymeric filler formulations.

Meanwhile, North America, led by the USA (3.6% CAGR), reflects market maturity with sustained demand from professional makeup artists and premium retail channels. However, growth remains steady as brands focus on expanding inclusive shade ranges, oil-free formulas, and advanced mattifying textures. Collectively, these markets highlight a global transition toward performance-driven, skin-healthy, and eco-conscious filler and extender cosmetic solutions through 2035.

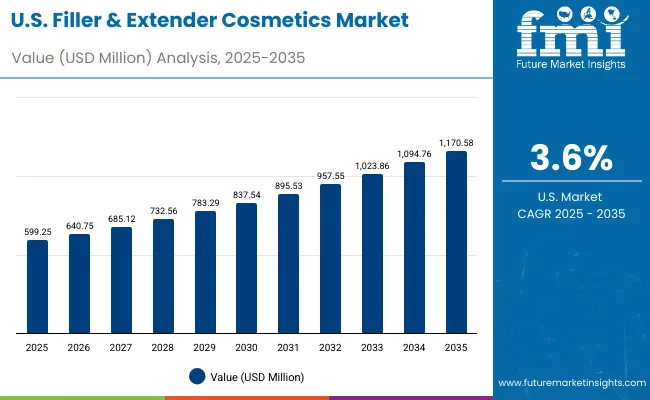

| Year | USA Filler and Extender Cosmetics Market (USD Million) |

|---|---|

| 2025 | 599.25 |

| 2026 | 640.75 |

| 2027 | 685.12 |

| 2028 | 732.56 |

| 2029 | 783.29 |

| 2030 | 837.54 |

| 2031 | 895.53 |

| 2032 | 957.55 |

| 2033 | 1023.86 |

| 2034 | 1094.76 |

| 2035 | 1170.58 |

The Filler & Extender Cosmetics Market in the United States is projected to grow at a CAGR of 7.1%, supported by a rising shift toward professional-grade finishing products and texture-enhancing formulations. Growth is led by the premiumization of cosmetic routines, with consumers investing in setting powders, primers, and pore-blurring products for camera-ready skin. The adoption of silica- and polymer-based microsphere technologies is rising, particularly among luxury and clean beauty brands emphasizing non-comedogenic, oil-absorbing properties. Digital beauty retail platforms and influencer-led product launches continue to expand brand visibility across Gen Z and millennial consumers.

The Filler & Extender Cosmetics Market in the United Kingdom is expected to grow at a CAGR of 5.6%, driven by the rapid consumer shift toward sustainable, inclusive, and performance-oriented cosmetics. British consumers are embracing filler-infused formulations particularly silica- and polymer-based powders and primers that offer a soft-focus, airbrushed finish aligned with the growing "skinimalism" trend.

Premium beauty brands are investing heavily in research collaborations with dermatologists and cosmetic chemists to create skin-safe, eco-certified fillers. The retail landscape continues to evolve through digital transformation, where AR-based beauty apps and virtual try-on tools enhance the online shopping experience. Furthermore, strong public-private initiatives supporting sustainable packaging and ethical sourcing are fostering innovation among domestic and European brands targeting clean beauty positioning.

The Filler & Extender Cosmetics Market in India is expected to grow at a CAGR of 9.7% through 2035, making it one of the fastest-growing markets globally. Growth is fueled by a booming beauty and personal care sector, increasing middle-class spending power, and rising awareness of skin-enhancing cosmetic products. Tier-2 and tier-3 cities are emerging as strong consumption hubs, driven by affordable product launches and aggressive digital marketing campaigns. Domestic brands are introducing primers, blur balms, and mattifying powders suited to India’s humid climate and diverse skin tones. E-commerce and influencer-driven retail strategies are enabling faster penetration across younger demographics, while beauty training academies are incorporating advanced filler-based cosmetic techniques in their curricula.

The Filler & Extender Cosmetics Market in China is projected to grow at a CAGR of 8.6%, the highest among major global economies. The rapid expansion is fueled by China’s thriving beauty and personal care sector, the rise of "new-age" cosmetics, and the growing influence of K-beauty and J-beauty formulations. Domestic brands are aggressively innovating with silica, polymeric microspheres, and mica-based filler formulations to achieve pore-blurring, soft-focus, and long-lasting effects. Online platforms such as Tmall and Douyin are accelerating product reach through social commerce and live-streaming channels, making premium and affordable cosmetics accessible nationwide. Increasing consumer preference for lightweight, breathable, and natural-finish makeup especially among younger women is shaping product development across both local and global brands.

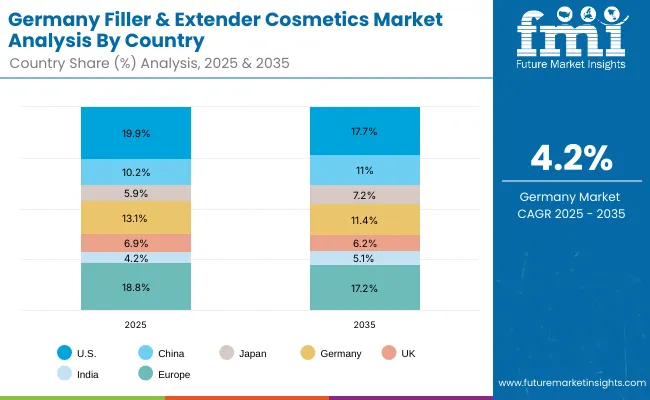

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.9% |

| China | 10.2% |

| Japan | 5.9% |

| Germany | 13.1% |

| UK | 6.9% |

| India | 4.2% |

| Europe | 18.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.7% |

| China | 11.0% |

| Japan | 7.2% |

| Germany | 11.4% |

| UK | 6.2% |

| India | 5.1% |

| Europe | 17.2% |

The Filler & Extender Cosmetics Market in Germany is projected to grow at a CAGR of 4.2%,underpinned by its leadership in precision engineering and industrial automation. Factory floors are integrating inline 3D scanners with robotic arms for dimensional inspection and live QA monitoring. CNC workshops are using structured light scanning to check complex geometries during milling operations. Dental and orthopedic labs are shifting to digital modeling using intraoral and handheld scanners. Compliance with EU manufacturing standards and growing demand for sustainable prototyping are further pushing scanner usage in traditional and additive manufacturing sectors.

| USA By Product Type | Value Share % 2025 |

|---|---|

| Setting/finishing powders | 39.6% |

| Others | 60.4% |

The Filler & Extender Cosmetics Market in Germany is projected to grow at a CAGR of 4.2%, supported by the country’s strong cosmetic manufacturing ecosystem and commitment to sustainable product innovation. Germany remains one of Europe’s leading hubs for clean, dermatologically tested, and eco-certified cosmetics. Local brands are emphasizing the use of silica, mica, and titanium dioxide blends to enhance texture, transparency, and mattifying effects while adhering to stringent EU cosmetic safety regulations.

The demand for vegan and cruelty-free filler-infused products continues to expand across both drugstore and premium retail segments. Additionally, German manufacturers are investing in R&D partnerships with biotechnology firms to develop bio-derived polymeric microspheres that improve texture smoothing and pore-blurring performance. The convergence of sustainability, science-backed ingredients, and precision manufacturing is shaping Germany’s long-term leadership in high-quality filler and extender cosmetic solutions.

| China By Key Materials | Value Share % 2025 |

|---|---|

| Silica & blends | 35.8% |

| Others | 64.2% |

The Filler & Extender Cosmetics Market in China is poised for strong expansion, driven by rising urban beauty consumption, digital-first retail ecosystems, and innovation-led domestic brands. The market is projected to grow steadily through 2035, with polymeric microspheres and silica blends accounting for more than 64.2% of the 2025 material value share. These ingredients are preferred for achieving pore-blurring, lightweight, and translucent finishes aligned with Asian beauty standards.

China’s social commerce ecosystem, led by platforms such as Tmall and Douyin, continues to reshape product discovery, allowing direct-to-consumer access and influencer-led promotions. Local cosmetic manufacturers are also investing in AI-powered personalization tools, virtual try-on systems, and biodegradable filler technologies, reflecting the nation’s strong alignment with sustainability and digital innovation trends.

As the government promotes green chemistry and eco-certified ingredients, Chinese suppliers are emerging as global leaders in environmentally safe filler formulations. Continued investments in localized R&D, ingredient transparency, and clean-label formulations are expected to position China as a key hub for next-generation filler and extender cosmetics production.

The Filler & Extender Cosmetics Market is moderately consolidated, featuring a mix of established global brands, luxury innovators, and emerging indie labels. Laura Mercier leads the segment with an 8.6% global share, owing to its dominance in translucent setting powders and soft-focus finishing products. Other major players, including MAC Cosmetics, Fenty Beauty, Charlotte Tilbury, NARS, L’Oréal Paris, and Clinique, maintain a strong foothold across both premium and mass-market categories through product diversification and digital marketing excellence.

Competition is increasingly defined by ingredient innovation, skin inclusivity, and sustainable formulation design rather than sheer product variety. Premium brands are leveraging polymeric microspheres and silica blends for texture blurring and oil absorption, while mass-market players focus on affordable, long-wear mattifying solutions. E-commerce giants like Sephora and Ulta are enabling direct consumer engagement and influencer-led visibility, further intensifying brand rivalry. The competitive advantage is shifting toward clean beauty positioning, refillable packaging, and hybrid skincare-makeup offerings, reinforcing the industry’s sustainability and transparency focus.

Key Developments in Filler & Extender Cosmetics Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,004.7 Million |

| Product Type | Setting/finishing powders, Primers & blur balms, Soft-focus foundations, Mattifying compacts |

| Key Materials | Silica & blends, Polymeric microspheres, Mica/talc, Titanium dioxide blends |

| Function | Texture smoothing, Pore-blurring, Oil absorption, Light diffusion |

| Channel | E-commerce, Specialty beauty retail, Mass retail, Department stores |

| End User | Everyday consumers, Professional makeup artists, Event/bridal users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Laura Mercier, MAC Cosmetics, Fenty Beauty, Charlotte Tilbury, NARS, Maybelline, L’Oréal Paris, Sephora Collection, Clinique, Huda Beauty |

| Additional Attributes | The Filler & Extender Cosmetics Market is defined by attributes such as dollar sales by product type and key material composition, evolving adoption trends in hybrid skincare makeup formulations, and rising consumer demand for lightweight, breathable, and long-wear blurring products. Market performance is influenced by segment-specific growth across everyday cosmetics, professional makeup, and event/bridal use. Additional attributes include distribution channel evolution driven by e-commerce, social media retailing, and influencer collaborations. Regionally, adoption trends reflect Asia’s dominance in innovation and Europe’s leadership in sustainable formulation standards. Technological attributes include AI-powered personalization, AR-based virtual try-on systems, and formulation advancements in silica, polymeric microspheres, and mineral extenders. The market’s competitive structure is further shaped by ingredient innovation, sustainable packaging design, and consumer preference for eco-safe, non-comedogenic, and dermatologically tested filler formulations. |

The global Filler & Extender Cosmetics Market is estimated to be valued at USD 3,004.7 million in 2025.

The market size for the Filler & Extender Cosmetics Market is projected to reach USD 6,603.1 million by 2035.

The Filler & Extender Cosmetics Market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in the Filler & Extender Cosmetics Market are Setting/Finishing Powders, Primers & Blur Balms, Soft-Focus Foundations, and Mattifying Compacts.

In terms of product composition, the polymeric microspheres segment is projected to command the largest share of approximately 57.4% in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fillers & Extenders Market Size and Share Forecast Outlook 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Lip Filler Market Analysis Size and Share Forecast Outlook 2025 to 2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Cup Filler Market

WiFi Extenders Market Size and Share Forecast Outlook 2025 to 2035

Sack Fillers Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Market Share Breakdown of Nutricosmetics Manufacturers

Halal Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Pouch Filler Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Vegan Cosmetics Market Analysis - Trends, Growth & Forecast 2025 to 2035

Auger Filler Market Growth - Trends & Forecast 2025 to 2035

Global Wound Filler Market Analysis – Size, Share & Forecast 2024-2034

Paper Filler Market Trends & Industry Growth Forecast 2024-2034

Colour Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Dermal Fillers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Tinted Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Dermal Fillers and Botulinum Toxin Market Outlook - Size, Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA