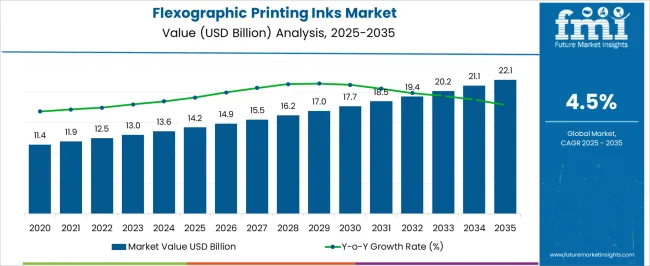

The flexographic printing inks market is estimated to be valued at USD 14.2 billion in 2025 and is projected to reach USD 22.1 billion by 2035, growing at a CAGR of 4.5% during the forecast period. Growth is supported by the increasing use of flexible packaging across food, beverage, and pharmaceutical industries, where flexographic printing delivers high-quality results on a wide range of substrates. Water-based and UV-curable inks are gaining momentum due to regulatory pressure on volatile organic compounds, as well as the rising preference for eco-friendly packaging solutions. The shift from gravure to flexographic printing in emerging markets has also boosted demand, thanks to cost-effectiveness, faster turnaround times, and versatility in short- and medium-run printing. E-commerce expansion is encouraging higher output in corrugated packaging, further fueling ink consumption. Technological advancements in ink formulations are enabling improved adhesion, faster drying, and enhanced print durability. With brand owners focusing on vibrant packaging designs for consumer engagement, demand for specialty inks in metallic, fluorescent, and high-opacity finishes is also increasing, shaping the market’s forward outlook.

| Metric | Value |

|---|---|

| Flexographic Printing Inks Market Estimated Value in (2025 E) | USD 14.2 billion |

| Flexographic Printing Inks Market Forecast Value in (2035 F) | USD 22.1 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The flexographic printing inks market is experiencing steady expansion, driven by growing demand from the packaging industry and continuous advancements in printing technologies. Industry developments and corporate updates have highlighted a shift toward eco-friendly formulations, aligning with sustainability regulations and brand commitments to reduce environmental impact. Water-based and UV-curable inks have gained popularity due to their lower volatile organic compound (VOC) emissions and compliance with stringent environmental standards.

The increasing consumption of packaged food, beverages, and consumer goods has further fueled the need for high-quality, durable, and versatile printing inks suitable for diverse substrates. Additionally, innovation in ink performance—such as improved adhesion, faster drying times, and enhanced color vibrancy—has strengthened market adoption across multiple applications.

With brand owners and converters focusing on sustainable packaging solutions, the market is expected to see sustained growth, led by demand for water-based inks and the dominance of flexible packaging applications.

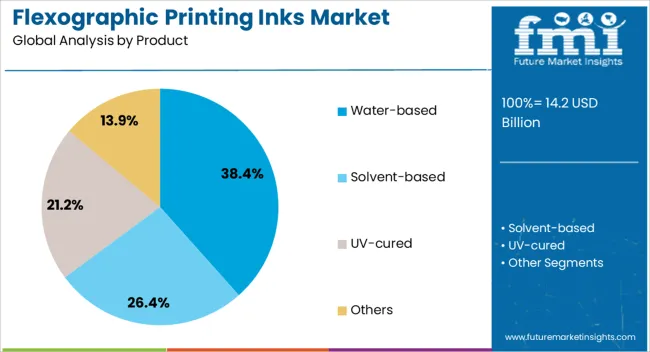

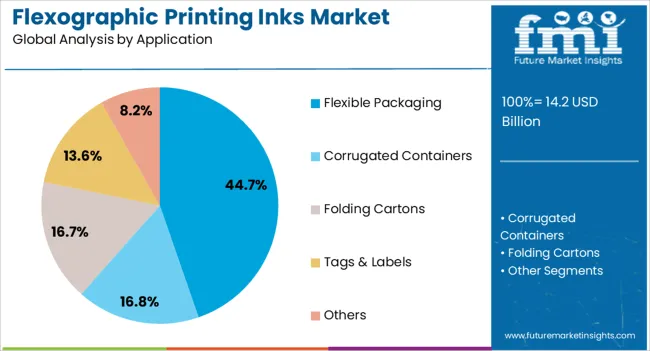

The flexographic printing inks market is segmented by product, application, and geographic regions. By product, flexographic printing inks market is divided into Water-based, Solvent-based, UV-cured, and Others. In terms of application, flexographic printing inks market is classified into Flexible Packaging, Corrugated Containers, Folding Cartons, Tags & Labels, and Others. Regionally, the flexographic printing inks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Water-based segment is projected to account for 38.4% of the flexographic printing inks market revenue in 2025, maintaining its leadership in product adoption. This segment’s growth has been influenced by regulatory trends favoring low-VOC printing solutions and increasing consumer preference for environmentally responsible packaging.

Water-based inks offer strong adhesion on porous substrates, reduced odor, and safer handling, making them suitable for food and beverage packaging. Printing companies have increasingly transitioned toward these inks to meet both client sustainability targets and compliance requirements in key markets.

Technological advancements have improved the durability and print quality of water-based inks, enabling their use in high-speed printing processes without compromising performance. As environmental compliance becomes a core requirement for packaging suppliers, the Water-based segment is expected to remain a critical driver of market revenue.

The Flexible Packaging segment is projected to capture 44.7% of the flexographic printing inks market revenue in 2025, securing its position as the largest application category. The segment’s growth is being propelled by the rapid expansion of packaged food, beverages, personal care, and pharmaceutical products, where flexible packaging offers convenience, lightweight design, and extended shelf life.

Flexographic inks are widely preferred for this application due to their compatibility with various substrates, including films, foils, and laminates, as well as their ability to deliver vibrant, high-resolution prints. Flexible packaging producers have increasingly adopted flexographic printing for its cost-effectiveness in large-volume runs and capability to support sustainable packaging initiatives.

Market adoption has also been supported by continuous advancements in ink formulations, which enhance print durability and resistance to moisture, heat, and abrasion. With consumer preference shifting toward convenient, visually appealing, and eco-friendly packaging formats, the Flexible Packaging segment is expected to maintain its dominant share in the market.

The flexographic printing inks market is expanding steadily as packaging producers and brand owners seek inks that deliver superior print quality, versatility, and compliance with evolving safety and environmental standards. Flexographic inks are valued for their ability to adhere to diverse substrates, including paper, films, and corrugated boards, while offering vibrant colors and durability. Rising demand for flexible packaging in food, beverage, and pharmaceutical industries supports strong growth. Manufacturers are investing in advanced formulations, including water-based and UV-curable inks, to meet regulatory requirements and address consumer preferences for eco-friendly solutions. Continuous improvements in print performance, drying speed, and shelf-life stability are helping to broaden adoption across industries.

Brand owners prioritize packaging that enhances shelf appeal and ensures consistent product presentation, driving demand for high-quality flexographic inks. These inks provide sharp graphics, uniform coverage, and adaptability across various substrates. They are widely used in corrugated packaging, food labels, and retail-ready packaging formats. The ability to support both long production runs and customized short runs further enhances their relevance. Rising adoption in emerging economies, coupled with strong growth in e-commerce packaging, is strengthening ink consumption. Flexographic printing also benefits from advancements in presses and an increasing preference for quick turnaround production cycles, making it a favored choice in high-volume packaging applications.

Environmental concerns have pushed manufacturers to develop inks that minimize volatile organic compound emissions and comply with stringent regulatory standards. Water-based inks are gaining traction due to their low toxicity and safety in food-contact applications, while UV-curable inks are being adopted for their quick-drying properties and reduced energy use. Industry leaders are exploring bio-based formulations using renewable raw materials, which appeal to environmentally conscious buyers. These innovations allow companies to combine print performance with sustainability, catering to both consumer expectations and government mandates. Packaging converters are increasingly aligning with sustainability goals by integrating recyclable and eco-friendly ink systems into their production processes.

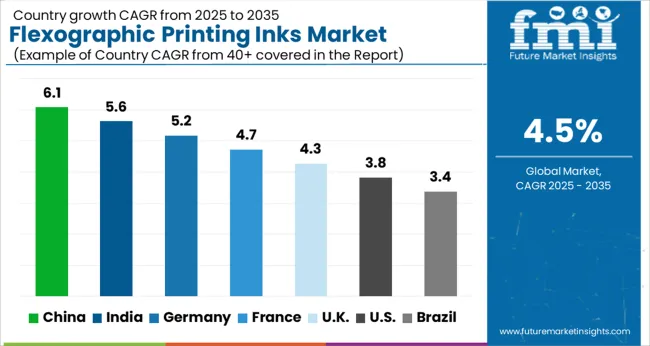

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

China’s flexographic printing inks market is projected to expand at a CAGR of 6.1%, supported by the country’s large packaging industry and growing consumer goods sector. Rising demand for flexible packaging in food, beverages, and pharmaceuticals is driving usage of water-based and UV-curable inks. Domestic converters are investing in modern flexographic presses, enabling high-speed and high-quality output. International suppliers have expanded partnerships with local producers to strengthen distribution and adapt formulations to regional regulations. The government’s emphasis on environmentally safe materials has accelerated the adoption of low-VOC and eco-friendly inks. Growth is further supported by the booming e-commerce sector, which requires durable and vibrant packaging solutions.

Food, beverage, and pharma packaging drive demand

Investments in modern presses strengthen adoption

Eco-friendly ink formulations gain rapid traction

India’s flexographic printing inks market is forecast to grow at a CAGR of 5.6%, fueled by rising consumption of packaged foods, pharmaceuticals, and household products. The expansion of organized retail and e-commerce platforms has boosted demand for corrugated and flexible packaging, enhancing ink consumption. Local converters increasingly prefer water-based inks due to their compatibility with food-contact materials and regulatory safety. Mid-tier packaging firms are investing in automated presses, encouraging use of premium ink formulations. International players are entering through partnerships, focusing on cost-efficient yet high-quality inks tailored for Indian market conditions. Government initiatives promoting domestic manufacturing and exports also contribute to increased packaging volumes, supporting steady demand.

Packaged food and pharma sectors lead growth

Water-based inks adopted for food-contact safety

E-commerce expansion increases corrugated packaging demand

Germany’s flexographic printing inks market is set to grow at a CAGR of 5.2%, supported by stringent quality standards and a strong focus on eco-friendly packaging. The country’s food and beverage sector remains a primary consumer, with high emphasis on packaging safety and durability. Manufacturers are innovating with bio-based and UV-curable inks to comply with EU environmental regulations and meet brand owners’ sustainability goals. Advanced printing technologies in Germany allow converters to achieve sharp, high-resolution graphics, enhancing ink demand. The pharmaceutical and cosmetics sectors also contribute to steady growth, as labeling regulations demand high clarity and durability. Local suppliers and global firms alike continue to invest in specialty inks with improved adhesion and rapid curing capabilities.

EU regulations encourage bio-based ink adoption

Food and beverage packaging drives consumption

Advanced presses support high-resolution applications

France’s flexographic printing inks market is expected to expand at a CAGR of 4.7%, driven by demand for safe, visually appealing packaging in food, beverages, and cosmetics. French converters are adopting multilayer packaging formats, which require specialized inks for durability and flexibility. Water-based inks are widely used to meet regulatory standards, while UV-curable inks are gaining adoption for premium packaging segments. Consumer preferences for vibrant designs and eco-friendly packaging encourage ongoing innovation in ink formulations. Distribution networks are expanding to ensure access to high-performance inks across both large and mid-sized printing firms. Seasonal demand spikes linked to retail promotions and product launches also support market growth.

Multilayer packaging formats require specialized inks

Water-based inks dominate in regulated applications

Vibrant designs and eco-friendly options drive adoption

The United Kingdom’s flexographic printing inks market is projected to grow at a CAGR of 4.3%, supported by strong demand in retail-ready packaging, labels, and corrugated cartons. Converters are investing in UV-curable and LED-curable inks to meet growing requirements for fast-drying and durable print solutions. Food packaging continues to dominate consumption, particularly with rising demand for private-label and convenience products. Retail chains emphasize packaging consistency and safety, reinforcing the need for high-quality inks. Sustainability initiatives are pushing converters to shift toward low-VOC and recyclable ink systems. E-commerce growth has also contributed to increased use of corrugated packaging, further stimulating demand for flexographic inks across the UK market.

UV-curable inks gain traction in premium packaging

Private-label food packaging drives steady adoption

Sustainability goals promote recyclable ink systems

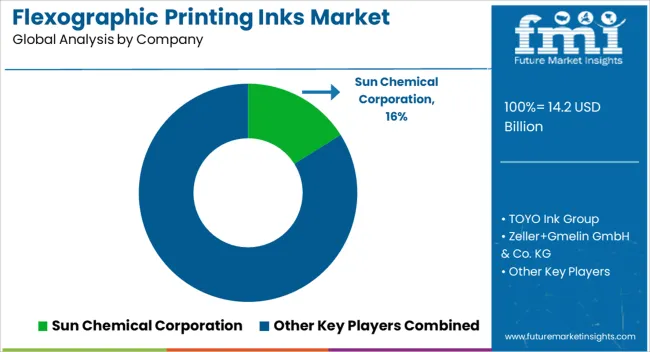

The flexographic printing inks landscape is shaped by global suppliers, regional converters, and niche specialists focused on packaging performance. Dominant players include Flint Group, Siegwerk, Sun Chemical, DIC, Toyo Ink, and Wikoff, supported by broad portfolios across water-based, solvent-based, UV, and LED curable systems. Scale advantages in resin sourcing, pigment dispersion, and technical service are used to secure multi-year contracts with large converters.

Regional challengers win on responsiveness, custom colors, and short lead times. Differentiation is achieved through low VOC water-based lines for food contact, fast-curing UV systems for high-speed presses, and ink sets tuned for film, paper, and corrugated. Co-development with press makers and plate suppliers strengthens print consistency. Pricing power depends on pigment volatility and specialty grades such as high opacity whites and metallics. Private labels pressure entry tiers, which pushes branded suppliers toward value adds like on-press ink management, color control software, and trial support. Consolidation continues as firms seek geographic reach, raw material leverage, and shared R&D to accelerate eco-friendly and migration-safe formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.2 Billion |

| Product | Water-based, Solvent-based, UV-cured, and Others |

| Application | Flexible Packaging, Corrugated Containers, Folding Cartons, Tags & Labels, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sun Chemical Corporation, TOYO Ink Group, Zeller+Gmelin GmbH & Co. KG, T&K TOKA Co., Ltd, INX International Corporation, Wikoff Color Corporation, Siegwerk Druckfarben AG & Co. KGaA, ALTANA AG, Flint Group, RUCO Druckfarben A.M. Ramp & Co GmbH, Zhongshan DIC Colour Co., Ltd., XSYS Print Solutions (Shanghai) Ltd, Jiangmen Toyo Ink Co. Ltd., Tercel Ink Group, and Taiyuan Coates Lorilleux Inks Chemical Ltd. |

| Additional Attributes | Dollar sales vary by ink type, including water-based, solvent-based, and UV-curable inks; by application, such as food packaging, labels, flexible packaging, and corrugated cartons; by end-use industry, spanning packaging, publishing, and industrial printing; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by rising demand for sustainable inks, flexible packaging, and high-quality printing solutions. |

The global flexographic printing inks market is estimated to be valued at USD 14.2 billion in 2025.

The market size for the flexographic printing inks market is projected to reach USD 22.1 billion by 2035.

The flexographic printing inks market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in flexographic printing inks market are water-based, solvent-based, uv-cured and others.

In terms of application, flexible packaging segment to command 44.7% share in the flexographic printing inks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flexographic Ink Market - Growth & Demand 2025 to 2035

Flexographic Printing Plate Market Size and Share Forecast Outlook 2025 to 2035

Flexographic Printing Machine Market Analysis, Size, Share & Forecast 2024 to 2034

Flexographic Printing Market Growth – Trends & Forecast 2024-2034

Washable Flexographic Printing Plate Market Size and Share Forecast Outlook 2025 to 2035

Water-based Flexographic Printing Market Trends & Forecast 2024-2034

Printing Paper Market Size and Share Forecast Outlook 2025 to 2035

Printing Machinery Market Size and Share Forecast Outlook 2025 to 2035

Printing Toners Market Size and Share Forecast Outlook 2025 to 2035

Printing Supplies Market Analysis by Application, Technology, and Region Forecast Through 2035

Printing Plate Market

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printing Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Automotive Market Size and Share Forecast Outlook 2025 to 2035

3D Printing In Construction Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Dental Devices Market Growth - Trends & Forecast 2025 to 2035

3D Printing Photopolymers Market Trends, Analysis & Forecast by Material, Application and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA