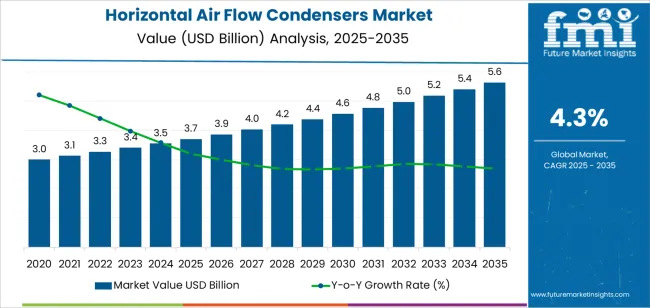

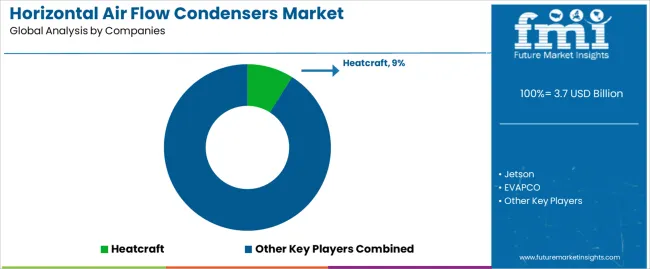

The global horizontal air flow condensers market is valued at USD 3.7 billion in 2025 and is projected to reach USD 5.7 billion by 2035, reflecting a CAGR of 4.3%. The market is expected to generate an absolute dollar opportunity of USD 2.0 billion during the forecast period. Rolling CAGR assessment indicates stable growth supported by increasing adoption of energy-efficient cooling systems across industrial, commercial, and HVAC applications. These condensers are preferred for their compact design, operational efficiency, and adaptability in installations where vertical space is limited.

Manufacturers are focusing on optimizing coil geometry, enhancing air distribution, and integrating variable-speed fan systems to improve thermal performance and reduce power consumption. The use of corrosion-resistant materials, such as coated aluminum and stainless steel, is expanding to extend service life in high-humidity and industrial environments. Additionally, the integration of smart monitoring and control systems is enabling predictive maintenance and performance tracking.

Asia Pacific dominates global demand, driven by expanding industrial infrastructure and growing investments in energy and manufacturing facilities. North America and Europe continue to adopt advanced condenser technologies to meet environmental efficiency regulations. Through 2035, design innovation, production cost efficiency, and compliance with evolving emission standards will guide long-term competitiveness in the horizontal air flow condensers market.

Between 2025 and 2030, the Horizontal Air Flow Condensers Market will move through the growth and early maturity stages of its adoption cycle. The market is expected to expand from USD 3.7 billion to USD 4.6 billion, representing a 24.3% increase and reflecting rising adoption driven by energy efficiency requirements and the modernization of HVAC and industrial cooling systems. During this phase, adoption will accelerate as manufacturers transition toward advanced aluminum finned tube designs, variable-speed fan technologies, and low-noise operation systems. Emerging industries such as data centers, food processing, and renewable power plants are expected to be major contributors to growth. The focus will be on optimizing thermal performance, reducing maintenance costs, and achieving regulatory compliance on emissions and refrigerant standards.

From 2030 to 2035, the market will transition toward the mature and technology optimization phase, expanding from USD 4.6 billion to USD 5.7 billion, 23.9% increase. At this stage, product adoption will stabilize as technology saturation and standardization set in across developed markets. Innovation will shift from hardware improvements to intelligent system integration, including IoT-enabled condition monitoring, predictive maintenance algorithms, and smart airflow management for industrial and commercial cooling. Competitive differentiation will rely on efficiency optimization, life-cycle cost reduction, and modular design adaptability. The market will demonstrate steady replacement demand, reflecting a balance between system upgrades, retrofitting, and sustainability-driven redesigns.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 3.7 billion |

| Market Forecast Value (2035) | USD 5.7 billion |

| Forecast CAGR (2025–2035) | 4.3% |

The horizontal air flow condensers market is growing as industries and commercial facilities adopt energy-efficient heat exchange systems designed for compact installations and high-capacity thermal regulation. These condensers, configured for horizontal air movement, offer uniform heat dissipation and reduced noise levels, making them suitable for industrial refrigeration, power generation, and large-scale HVAC systems. Manufacturers emphasize aluminum fin and copper tube construction to improve thermal conductivity and corrosion resistance while optimizing coil geometry for consistent airflow distribution. Expanding infrastructure projects and the modernization of cooling networks in data centers, cold storage facilities, and food processing plants strengthen global product demand.

Growth is also driven by stricter environmental regulations that promote eco-friendly refrigerants and high-efficiency condensation systems. The shift toward modular, low-maintenance designs supports integration into compact plant layouts, reducing operational complexity and energy consumption. Continuous development of variable-speed fans, electronic expansion valves, and digital monitoring controls further enhances system reliability and performance tracking. Regional manufacturing expansion in Asia-Pacific and increased retrofitting of outdated cooling infrastructure in North America and Europe sustain steady market activity. Despite higher initial investment costs, operational savings and improved heat transfer efficiency ensure long-term adoption. The emphasis on sustainable industrial cooling solutions continues to reinforce horizontal air flow condenser deployment worldwide.

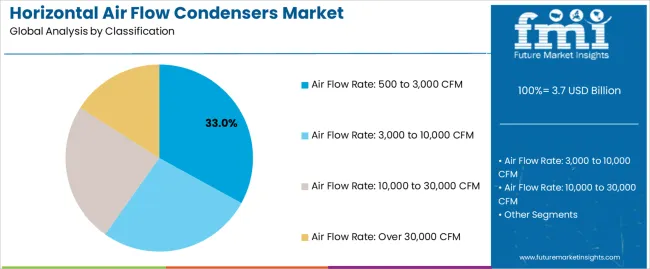

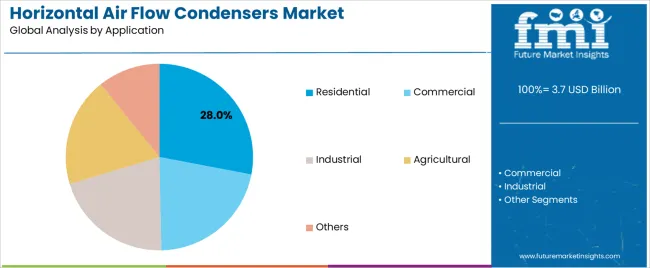

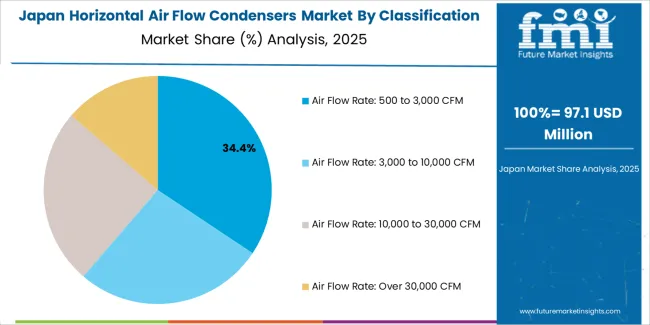

The horizontal air flow condensers market is segmented by classification, application, and region. By classification, the market is divided into air flow rate: 500 to 3,000 CFM, 3,000 to 10,000 CFM, 10,000 to 30,000 CFM, and over 30,000 CFM. Based on application, it is categorized into residential, commercial, industrial, agricultural, and others. Regionally, the market is segmented into North America, Europe, East Asia, South Asia, Latin America, and the Middle East & Africa. These segments define airflow capacity ranges, usage environments, and regional adoption trends across diverse building and industrial cooling systems.

The air flow rate: 500 to 3,000 CFM segment accounts for approximately 33.0% of the global horizontal air flow condensers market in 2025, representing the leading classification category. This dominance is supported by widespread use in small-scale and mid-capacity cooling systems, particularly in residential and light commercial applications. Condensers within this airflow range provide reliable thermal transfer efficiency while maintaining compact dimensions suitable for installation in confined spaces.

These units are favored for their operational flexibility, low energy consumption, and ease of integration into standard HVAC systems. Manufacturers continue to enhance performance efficiency through improved fin geometry, optimized coil designs, and corrosion-resistant materials, ensuring consistent operation under variable ambient conditions. The segment benefits from stable demand in residential construction and small building projects, especially across East Asia and North America. As energy efficiency standards and system design compactness become key selection criteria, condensers in this airflow range remain the preferred option for decentralized cooling installations. The air flow rate: 500 to 3,000 CFM category maintains its leadership through a combination of performance reliability, manageable maintenance, and broad applicability in distributed HVAC networks.

The residential segment represents about 28.0% of the total horizontal air flow condensers market in 2025, making it the largest application category. This dominance reflects the consistent need for air conditioning and refrigeration units in housing and small building projects, where horizontal airflow condensers are widely utilized for space-efficient and energy-optimized cooling. Residential systems typically employ these condensers for split-unit air conditioners, heat pumps, and compact outdoor systems requiring low noise and high reliability.

The segment’s growth is supported by ongoing urbanization and housing development, particularly in East Asia and South Asia, where demand for affordable and efficient cooling systems continues to expand. Advancements in microchannel condenser technology, inverter-driven compressors, and environmentally compliant refrigerants further enhance system efficiency and durability. Regional regulations emphasizing low-noise and low-emission residential HVAC systems contribute to sustained adoption. The residential segment’s steady demand is reinforced by replacement cycles and modernization of existing air conditioning infrastructure. Its continued leadership in the market reflects the enduring importance of energy-efficient and space-saving cooling solutions within global residential construction and renovation sectors.

The horizontal air flow condenser market is gaining momentum as industries seek efficient cooling solutions that reduce water use and maintain performance in demanding environments. Horizontal configurations offer ease of installation, accessible maintenance and flexible placement compared with vertical designs, making them well-suited to power plants, chemical processing and heavy industrial applications. Growth is supported by stricter environmental regulation, expansion of thermal and renewables-based power generation and rising demand for modular cooling systems. Nevertheless, high upfront capital costs, complex retrofits in existing plants and competition from wet-cooling systems limit widespread adoption. Manufacturers are responding with improved heat-transfer materials, smarter fan controls and modular unit designs to address both performance and cost issues.

Which regulatory and operational drivers are pushing demand for horizontal air flow condensers?

Adoption is primarily driven by the need to comply with environmental regulations and water scarcity concerns that make air-cooled solutions increasingly attractive. Industries such as power generation, petrochemicals and large-scale manufacturing increasingly favour air flow condensers to minimise water intake, reduce thermal discharge and lower lifecycle costs. For system integrators and equipment specifiers, a compelling USP lies in horizontal units designed for rapid deployment, space-efficient installation and adaptable mounting—reducing scheduling risk and site disruption when upgrading existing infrastructure.

What factors are restraining market growth in horizontal air flow condenser installations?

Several constraints impede growth, including the high initial investment relative to conventional wet-cooling systems and the complexity of retrofitting in established facilities. Horizontal air flow condensers often require large structural support, extensive ducting and careful alignment of fans and coils to achieve desired performance, which can strain budgets and timelines. Furthermore, in some high-heat or humid environments performance may fall compared with water-based systems, reducing the perceived value proposition. For cost-sensitive buyers, a relevant USP is modular single-fan units that allow phased investment and minimise risk in large-scale upgrades.

What emerging trends are shaping the future of horizontal air flow condenser technologies?

Key trends include adoption of digital controls, modular design and advanced materials to enhance efficiency and reliability. Sensors and predictive-maintenance systems enable real-time monitoring of fan speed, vibration, temperature and airflow to optimise energy use and detect issues early. Expanded use of high-efficiency fin-tube bundles made of lightweight alloys improves thermal performance and reduces fan power consumption. In terms of product strategy, manufacturers emphasise pre-fabricated modules and horizontal units with factory-tested performance to accelerate field commissioning. As infrastructure investment rises in Asia-Pacific and Latin America, these trends support an increasingly global deployment model.

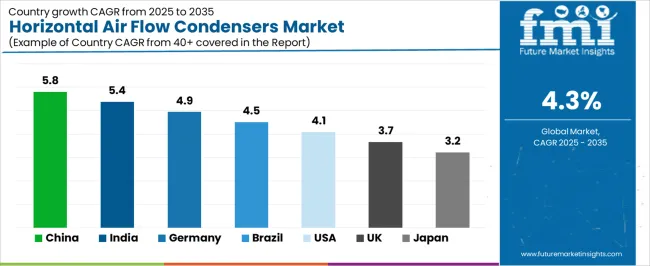

| Country | CAGR (%) |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| Brazil | 4.5% |

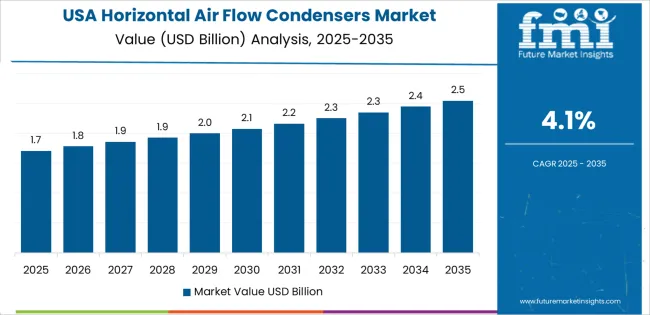

| U.S. | 4.1% |

| U.K. | 3.7% |

| Japan | 3.2% |

The Horizontal Air Flow Condensers Market is experiencing steady global growth, with China leading at a 5.8% CAGR through 2035, supported by rapid industrial expansion, HVAC system modernization, and strong manufacturing capability in heat exchange components. India follows at 5.4%, driven by growing power generation infrastructure, commercial building development, and adoption of energy-efficient cooling solutions. Germany records 4.9%, leveraging advanced thermal engineering and strong demand from automotive and industrial sectors. Brazil grows at 4.5%, reflecting investments in industrial cooling systems and manufacturing upgrades. The U.S., at 4.1%, remains a mature market focused on technological innovation and environmental compliance, while the U.K. (3.7%) and Japan (3.2%) emphasize compact design innovation, sustainability, and enhanced operational efficiency in condenser systems.

China is demonstrating robust growth in the horizontal air flow condensers market, projected to rise at a CAGR of 5.8% through 2035. Expanding commercial and industrial HVAC infrastructure continues to fuel strong demand for high-capacity air-cooled condensers. The shift toward energy-efficient cooling solutions aligns with national green development goals, encouraging manufacturers to adopt optimized fin designs and eco-friendly refrigerant compatibility. Local production capacity expansion and export competitiveness further strengthen the country’s position as a key global supplier.

India is witnessing steady growth in the horizontal air flow condensers market, expanding at a CAGR of 5.4%, driven by modernization of industrial cooling systems and rising construction activity. The adoption of air-cooled condensers across manufacturing plants and large-scale commercial facilities is increasing as water conservation becomes a national focus. Domestic manufacturers are improving system efficiency through enhanced tube materials and corrosion-resistant coatings. Expanding cold storage and food processing infrastructure further strengthens long-term market growth.

Across Germany, the horizontal air flow condensers market is advancing at a CAGR of 4.9%, supported by engineering precision, energy efficiency regulations, and continuous innovation in HVAC component design. Manufacturers emphasize low-noise operation, optimized airflow geometry, and modular configurations suitable for varied industrial and commercial installations. Adoption of digital monitoring systems enhances system control and maintenance efficiency. Demand remains stable across food processing, power generation, and climate control facilities.

Brazil is experiencing consistent progress in the horizontal air flow condensers market, projected to grow at a CAGR of 4.5% through 2035. Expanding industrial zones and rising demand for energy-efficient air conditioning systems are driving adoption. Local producers are emphasizing affordable solutions with durable construction suited to high-humidity environments. Increasing investments in data centers and refrigerated logistics facilities are contributing to stable demand. Collaboration with global suppliers supports technology transfer and design enhancement.

In the United States, the horizontal air flow condensers market is growing at a CAGR of 4.1%, supported by stringent energy efficiency regulations and expanding industrial retrofitting activity. Manufacturers are integrating variable speed fans and advanced coil materials to optimize thermal transfer. Increased adoption of low-GWP refrigerants is influencing product redesigns for environmental compliance. Rising demand from HVAC retrofits and new commercial developments continues to sustain equipment sales nationwide.

Across the United Kingdom, the horizontal air flow condensers market is advancing at a CAGR of 3.7%, supported by design innovation and modernization of commercial cooling systems. Manufacturers are focusing on lightweight, space-efficient units that meet urban installation constraints. Increased emphasis on sustainability is driving the use of recyclable materials and high-efficiency fin geometries. Growth in food distribution networks and HVAC upgrades within existing infrastructure sustains long-term market engagement.

Japan is growing steadily in the horizontal air flow condensers market, projected to expand at a CAGR of 3.2% through 2035. Domestic manufacturers prioritize compact design, low noise output, and high reliability to serve advanced cooling applications in electronics, automotive, and building systems. Innovation in heat exchanger materials and airflow control continues to improve system performance. The preference for energy-efficient, low-maintenance condensers supports stable adoption across both industrial and commercial segments.

The global horizontal air flow condensers market exhibits moderate concentration, driven by manufacturers specializing in industrial heat exchange and cooling system technology. Heatcraft maintains a leading position through its wide range of air-cooled condenser systems designed for commercial refrigeration, HVAC, and industrial applications. Jetson and EVAPCO follow with strong market presence, emphasizing energy-efficient condenser designs and modular construction suited for variable operational conditions. Tranter and Holtec compete through engineering expertise in thermal management solutions and customized condenser configurations for heavy industrial processes. Skypeak and Kaltra contribute to product diversification with compact, corrosion-resistant systems designed for commercial and process cooling operations requiring reliable performance under high thermal loads.

High Tech Exchangers and SPG Dry Cooling strengthen competitiveness by integrating advanced air distribution and coil design technologies that enhance heat transfer efficiency. Shenglin M&E Technology represents the expanding Asian manufacturing base, supplying cost-effective condenser units for regional and export markets. Competition in this market is shaped by thermal performance, airflow optimization, and system durability. Strategic differentiation relies on reduced energy consumption, low-noise operation, and corrosion-resistant materials suited for outdoor industrial environments. Long-term competitiveness depends on the integration of digital monitoring systems, compliance with environmental efficiency standards, and innovation in fan technology to support global demand for sustainable air-cooled condenser solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Type (Classification) | Air Flow Rate: 500 to 3,000 CFM, Air Flow Rate: 3,000 to 10,000 CFM, Air Flow Rate: 10,000 to 30,000 CFM, Air Flow Rate: Over 30,000 CFM |

| Application | Residential, Commercial, Industrial, Agricultural, Others |

| Regions Covered | North America, Europe, East Asia, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, USA, Germany, Brazil, UK, Japan, and 40+ countries |

| Key Companies Profiled | Heatcraft, Jetson, EVAPCO, Tranter, Holtec, Skypeak, Kaltra, High Tech Exchangers, SPG Dry Cooling, Shenglin M&E Technology |

| Additional Attributes | Dollar sales by classification and application segments; regional demand trends across industrial, residential, and commercial cooling systems; analysis of airflow capacity and thermal performance by CFM category; regulatory compliance with refrigerant standards; efficiency benchmarking for fin geometry and coil design; material and corrosion-resistance innovation; integration of digital monitoring and predictive maintenance systems; modular design adoption; competitive landscape assessment of condenser manufacturers and HVAC suppliers; long-term trends in air-cooled heat exchange solutions supporting sustainable and water-efficient cooling infrastructure. |

The global horizontal air flow condensers market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the horizontal air flow condensers market is projected to reach USD 5.6 billion by 2035.

The horizontal air flow condensers market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in horizontal air flow condensers market are air flow rate: 500 to 3,000 cfm, air flow rate: 3,000 to 10,000 cfm, air flow rate: 10,000 to 30,000 cfm and air flow rate: over 30,000 cfm.

In terms of application, residential segment to command 28.0% share in the horizontal air flow condensers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Horizontal Premade Pouch Packing Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Form Fill Seal (HFFS) Machines Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Cartoning Machines Market Size and Share Forecast Outlook 2025 to 2035

Horizontal Strapping Machine Market Trends and Forecast 2025 to 2035

Horizontal Flow Wrapping Machines Market Size and Share Forecast Outlook 2025 to 2035

Large-flow Horizontal Sand Mill Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Turbo Generators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA