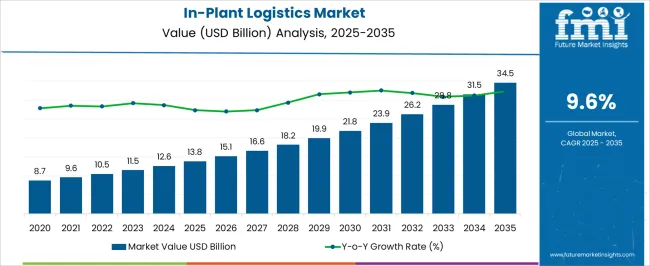

The in-plant logistics market is projected to grow from USD 9.6 billion in 2025 to USD 34.5 billion by 2035, with a compound annual growth rate (CAGR) of 9.6%. A growth contribution index analysis highlights the key periods of growth across this trajectory. In 2024, the market starts at USD 8.7 billion, marking the baseline of growth. The market expands steadily over the next few years, reaching USD 9.6 billion in 2025 and USD 10.5 billion in 2026 as industries increasingly adopt efficient logistics solutions to streamline operations. The market accelerates after 2027, with a significant jump to USD 11.5 billion, reflecting the adoption of advanced technologies in logistics operations. By 2028, the market continues its upward momentum, reaching USD 12.6 billion, driven by rising demand for automation and digitalization in manufacturing and distribution facilities. From 2029 to 2035, the market shows strong growth, reaching USD 18.2 billion in 2029, USD 19.9 billion in 2030, and USD 21.8 billion in 2032. This is fueled by continuous improvements in operational efficiency and the shift toward more integrated logistics systems. By 2039, the market is projected to reach USD 34.5 billion, reflecting sustained expansion and increased demand for in-plant logistics services across industries.

| Metric | Value |

|---|---|

| In-Plant Logistics Market Estimated Value in (2025 E) | USD 13.8 billion |

| In-Plant Logistics Market Forecast Value in (2035 F) | USD 34.5 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

The in-plant logistics market is undergoing a rapid transformation as industries prioritize agility, resource optimization, and automation within their internal supply chains. A growing focus on reducing downtime and streamlining operations has prompted organizations to integrate advanced material flow systems, autonomous vehicles, and warehouse control software across facility floors.

The surge in smart manufacturing practices, coupled with advancements in robotics and Industrial Internet of Things, is driving a broader adoption of in-plant logistics solutions across various sectors. Rising labor costs and the need for just-in-time delivery within production environments are influencing the demand for customized, efficient logistics frameworks.

Sustainability mandates and energy efficiency goals are further encouraging the use of electric and automated material handling equipment Future market growth is expected to be shaped by the integration of digital twins, AI-powered routing algorithms, and modular warehouse infrastructure, enabling manufacturers to maintain supply chain resilience and real-time visibility in dynamic operating environments.

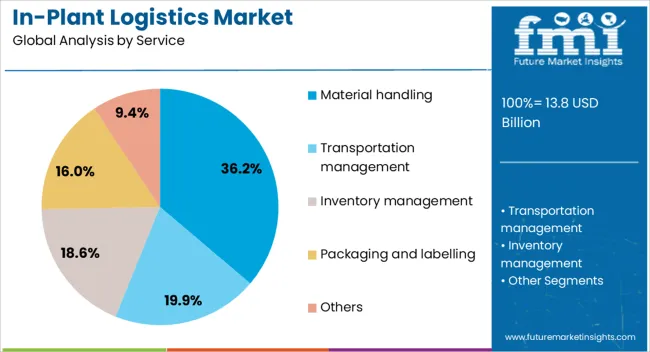

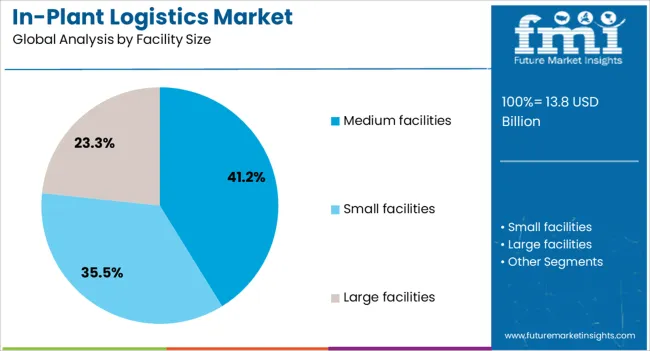

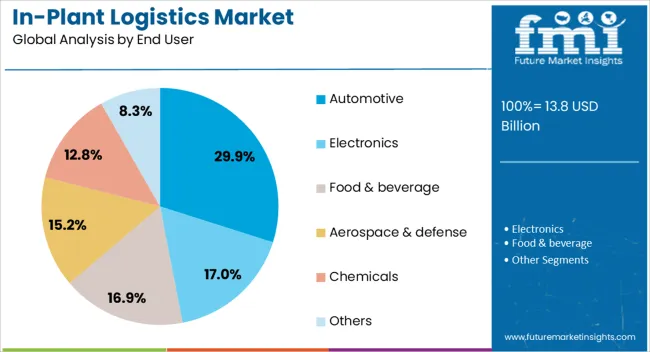

The in-plant logistics market is segmented by service, facility size, end user, and geographic regions. By service, in-plant logistics market is divided into Material handling, Transportation management, Inventory management, Packaging and labelling, and Others. In terms of facility size, in-plant logistics market is classified into Medium facilities, Small facilities, and Large facilities. Based on end user, in-plant logistics market is segmented into Automotive, Electronics, Food & beverage, Aerospace & defense, Chemicals, and Others. Regionally, the in-plant logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The material handling segment is projected to contribute 36.2% of the total revenue share in the in-plant logistics market in 2025, emerging as the leading service category. This dominance is being driven by the critical role material handling plays in ensuring seamless movement, storage, and control of components and finished goods within production facilities.

Increased demand for lean manufacturing and continuous flow production has resulted in the adoption of advanced material handling systems, including automated guided vehicles, conveyor networks, and vertical lift modules. The integration of real-time tracking and smart sensors has enhanced the efficiency of these systems, reducing operational errors and downtime.

The ability to remotely monitor and optimize handling operations through warehouse execution software is also contributing to this segment’s growth The scalability and customization of modern material handling solutions have made them essential in complex production environments where flexibility and precision are prioritized, leading to their strong market presence.

Medium facilities are expected to account for 41.2% of the total revenue share in the in-plant logistics market in 2025, marking them as the most significant facility size category. The segment’s growth is being driven by the increasing number of mid-sized manufacturing and assembly units that demand tailored logistics solutions to enhance productivity and manage space efficiently.

Medium facilities benefit from in-plant logistics systems that offer a balance between scalability and cost-efficiency, making them attractive for industries transitioning toward semi-automated production. The deployment of modular conveyor systems, mobile robots, and real-time inventory platforms has become more accessible and effective within these environments.

Furthermore, medium-sized operations often require rapid changeovers and agile resource allocation, which is effectively supported by software-defined logistics workflows The ongoing digitalization and need for competitive throughput within this facility size have reinforced its dominance in the market, particularly in sectors experiencing mid-volume, high-variability production demands.

The automotive segment is projected to capture 29.9% of the in-plant logistics market’s revenue share in 2025, positioning it as the leading end-use industry. This leadership is being supported by the complex and high-volume nature of automotive manufacturing, which requires precise coordination of thousands of components across multiple production stages. In-plant logistics systems have become critical to synchronizing just-in-time and just-in-sequence delivery models, which are foundational to automotive assembly lines.

The increased integration of automation, including autonomous mobile robots and robotic palletizing, has enabled real-time part delivery and optimized workflow across workstations. Enhanced connectivity between logistics software and manufacturing execution systems has further improved traceability and minimized production bottlenecks.

Additionally, the transition toward electric vehicles and modular vehicle architectures is demanding more agile and software-enabled logistics solutions within plants As automotive manufacturers continue to emphasize efficiency, traceability, and lean practices, their reliance on advanced in-plant logistics is expected to grow steadily.

The in-plant logistics market is experiencing robust growth, driven by the increasing demand for efficient material handling and inventory management within manufacturing facilities. Advancements in automation technologies, such as automated guided vehicles (AGVs), robotics, and real-time tracking systems, are reshaping the landscape of internal logistics operations. Industries are recognizing the need to streamline internal supply chains to enhance productivity, reduce operational costs, and improve overall efficiency. The integration of these technologies enables manufacturers to achieve seamless material flow, minimize downtime, and respond swiftly to production demands. As businesses strive to stay competitive in a rapidly evolving market, the adoption of advanced in-plant logistics solutions is becoming increasingly pivotal.

The increasing complexity of manufacturing processes and the need for real-time inventory management are driving the demand for advanced logistics solutions. Industries such as automotive, electronics, pharmaceuticals, and consumer goods are recognizing the significance of optimizing their internal logistics to enhance productivity and reduce operational costs. The adoption of automation technologies, including AGVs, robotics, and automated storage and retrieval systems (ASRS), is enabling manufacturers to achieve greater efficiency and accuracy in material handling. The integration of real-time tracking systems and warehouse management systems (WMS) allows for improved visibility and control over inventory, leading to better decision-making and reduced lead times. The growing need to streamline internal logistics operations to support fast-paced production is accelerating the shift toward automated solutions.

The high initial investment required for implementing advanced logistics systems can be a significant barrier, particularly for small and medium-sized enterprises (SMEs). The complexity of integrating new technologies with existing infrastructure poses technical challenges and may require specialized training for personnel. The rapid pace of technological advancements necessitates continuous investment in research and development to stay competitive, which can strain resources for companies operating in the market. The need for seamless interoperability between various equipment and platforms adds to the complexity of in-plant logistics deployments. Concerns related to data security and the potential for cyber threats in interconnected systems require careful consideration and mitigation strategies.

The integration of emerging technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) offers the potential to revolutionize internal logistics operations. AI and machine learning can enable predictive analytics for demand forecasting, route optimization, and maintenance scheduling, leading to improved efficiency and reduced downtime. IoT devices can provide real-time monitoring of equipment and inventory, enhancing visibility and control over logistics processes. The adoption of cloud-based solutions allows for scalable and flexible logistics management, facilitating remote monitoring and data analysis. Moreover, the growing trend towards smart manufacturing and Industry 4.0 is driving the demand for intelligent and automated logistics systems. Companies that invest in these technologies can gain a competitive edge by offering more efficient and responsive logistics solutions.

The shift towards automation and robotics is transforming traditional material handling processes, enabling faster and more accurate operations. Collaborative robots (cobots) are being increasingly utilized to work alongside human operators, enhancing productivity and safety. The adoption of real-time tracking systems and advanced analytics is providing manufacturers with valuable insights into their logistics operations, facilitating data-driven decision-making. Additionally, the rise of e-commerce is driving the need for agile and scalable logistics systems to meet the demands of fast-paced order fulfillment. The integration of digital technologies and the Internet of Things is enabling the creation of smart factories with interconnected logistics systems that can adapt to changing production requirements. These trends indicate a dynamic and evolving market, with continuous advancements driving the adoption and capabilities of in-plant logistics technologies across various industries.

| Country | CAGR |

|---|---|

| China | 13.0% |

| India | 12.0% |

| Germany | 11.0% |

| France | 10.1% |

| UK | 9.1% |

| USA | 8.2% |

| Brazil | 7.2% |

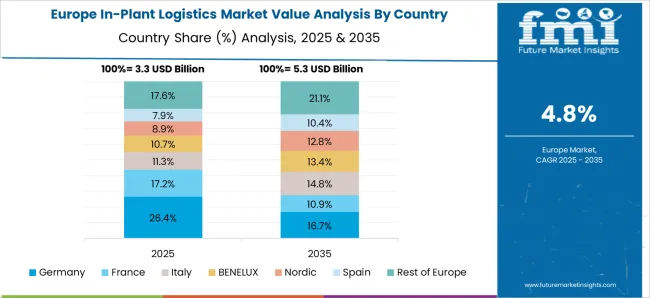

The global in-plant logistics market is projected to grow at a CAGR of 9.6% from 2025 to 2035. Among the key markets, China leads with a growth rate of 13.0%, followed by India at 12.0%, and France at 10.1%. The United Kingdom and the United States show more moderate growth rates of 9.1% and 8.2%, respectively. This growth is driven by the increasing demand for advanced logistics solutions in the manufacturing, automotive, and distribution sectors. Emerging markets like China and India are experiencing rapid growth due to expanding industrial sectors, while developed markets like the USA and the UK are focusing on automation and supply chain optimization. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the global in-plant logistics market, growing at a projected CAGR of 13.0% from 2025 to 2035. The country’s rapid industrialization, combined with the expansion of manufacturing sectors like automotive, electronics, and consumer goods, is driving the demand for efficient in-plant logistics solutions. As China continues to embrace automation and digital technologies in supply chain management, the demand for advanced logistics services, including material handling, inventory management, and automation systems, is expected to increase. China’s commitment to improving infrastructure and reducing operational costs in factories will continue to drive the growth of the in-plant logistics market.

The in-plant logistics market in India expected to grow at a CAGR of 12.0% from 2025 to 2035. The growing demand for efficient material handling and inventory management in the country’s expanding manufacturing sector is a key driver. India’s strong presence in industries such as automotive, textiles, and electronics, coupled with an increasing focus on automation and smart supply chain solutions, is expected to propel market growth. Furthermore, government initiatives supporting manufacturing growth under programs like “Make in India” will continue to foster the demand for in-plant logistics services, positioning the country for steady expansion in the market.

The in-plant logistics market in France is projected to grow at a CAGR of 10.1% from 2025 to 2035. The country’s robust industrial base, particularly in automotive, aerospace, and machinery manufacturing, is driving the demand for efficient in-plant logistics solutions. France’s increasing focus on automation and robotics in supply chain management is further accelerating the market growth. The need for energy-efficient logistics solutions is pushing the adoption of innovative technologies and systems. As France continues to modernize its manufacturing facilities, the in-plant logistics market is poised to experience steady growth.

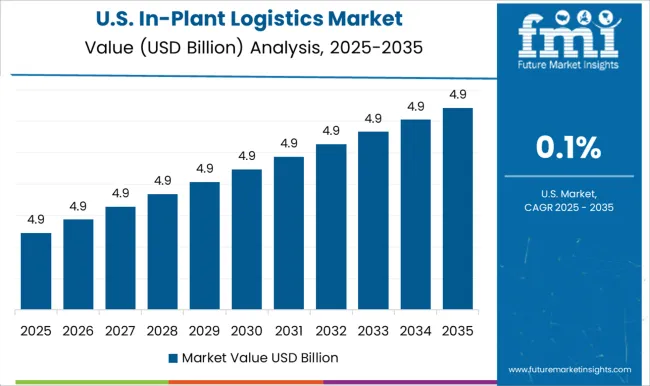

The in-plant logistics market in the United States is projected to grow at a CAGR of 8.2% from 2025 to 2035. The country’s increasing focus on supply chain optimization and the integration of automation technologies in manufacturing facilities are driving the market for in-plant logistics solutions. The demand for inventory management, material handling systems, and robotics is increasing as companies focus on improving operational efficiency and reducing costs. The USA government’s support for advanced manufacturing technologies and automation systems is expected to further fuel market growth, positioning the country as a leader in the in-plant logistics space.

The in-plant logistics market in the United Kingdom is projected to grow at a CAGR of 9.1% from 2025 to 2035. The UK’s growing manufacturing and distribution sectors are driving the demand for advanced logistics solutions to improve operational efficiency. As industries focus on optimizing their supply chains, in-plant logistics services, including inventory management and automation, are becoming critical. The increasing adoption of lean manufacturing practices and the rise of Industry 4.0 technologies are contributing to market growth. With continued investments in smart factory solutions, the in-plant logistics market in the UK is set for steady growth.

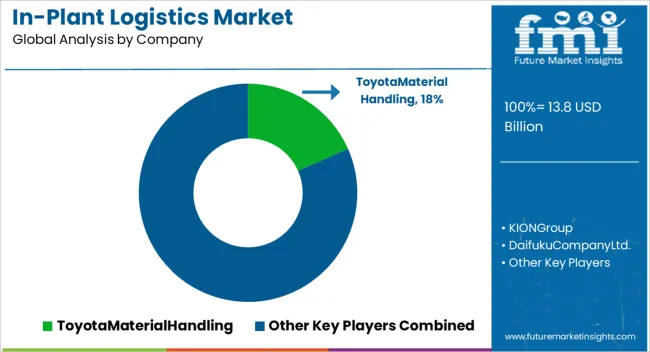

The in-plant logistics market is characterized by a wide range of companies offering advanced solutions for internal material handling, warehouse automation, and supply chain optimization in manufacturing facilities. Key players in the market include Toyota Material Handling, known for its comprehensive portfolio of forklifts and automated material handling solutions. KION Group, a German multinational, specializes in industrial trucks and warehouse automation, providing high-quality solutions for various industries.

Daifuku Company Ltd., a Japanese leader, offers highly efficient automated material handling systems that help streamline production and logistics. Jungheinrich AG, another German giant, provides a broad range of intralogistics solutions and warehouse equipment, positioning itself as a top player in Europe and globally. Honeywell Intelligrated, a U.S.-based company, delivers automated material handling solutions and advanced warehouse execution systems, enhancing operational efficiency for businesses.

These companies set themselves apart through continuous innovation, superior product quality, and exceptional customer support. KION Group is recognized for its financial strength and operational resilience. Jungheinrich AG stands out as a leader in material handling and warehousing, ranking highly in both Europe and globally.

Toyota Material Handling

KION Group

Daifuku Co., Ltd.

Jungheinrich AG

Honeywell Intelligrated

Mitsubishi Logisnext Co., Ltd.

SSI SCHÄFER

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Service | Material handling, Transportation management, Inventory management, Packaging and labelling, and Others |

| Facility Size | Medium facilities, Small facilities, and Large facilities |

| End User | Automotive, Electronics, Food & beverage, Aerospace & defense, Chemicals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Material Handling, KION Group, Daifuku Co., Ltd., Jungheinrich AG, Honeywell Intelligrated, Mitsubishi Logisnext Co., Ltd., SSI SCHÄFER |

| Additional Attributes | Dollar sales by product type (automated guided vehicles, conveyor systems, robotic arms, warehouse management systems) and end-use segments (automotive, electronics, pharmaceuticals, consumer goods). Demand dynamics are driven by the increasing adoption of Industry 4.0 technologies, the need for efficient material handling solutions, and the rise of e-commerce. Regional trends show strong growth in Asia-Pacific, North America, and Europe, fueled by investments in smart manufacturing, automation, and logistics infrastructure. |

The global in-plant logistics market is estimated to be valued at USD 13.8 billion in 2025.

The market size for the in-plant logistics market is projected to reach USD 34.5 billion by 2035.

The in-plant logistics market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in in-plant logistics market are material handling, transportation management, inventory management, packaging and labelling and others.

In terms of facility size, medium facilities segment to command 41.2% share in the in-plant logistics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Logistics Robots Market Size and Share Forecast Outlook 2025 to 2035

Logistics Visibility Software Market Size and Share Forecast Outlook 2025 to 2035

Key Players & Market Share in the Logistics Packaging Industry

Logistics Outsourcing Market Analysis - Growth & Forecast 2025 to 2035

Logistics Packaging Market from 2024 to 2034

Logistics Visualization System Market

Logistics Automation Market

Cash Logistics Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Intralogistics Automation Solutions Market Size and Share Forecast Outlook 2025 to 2035

Drone Logistics & Transportation Market Size and Share Forecast Outlook 2025 to 2035

Smart Logistics Services Market Size and Share Forecast Outlook 2025 to 2035

Green Logistics Market Size and Share Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Cloud Logistics Market Insights – Demand & Growth Forecast 2025 to 2035

Timber Logistics Market Size and Share Forecast Outlook 2025 to 2035

Retail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Secure Logistics Market Size and Share Forecast Outlook 2025 to 2035

Sea Air Logistics Market Size and Share Forecast Outlook 2025 to 2035

Defence Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA