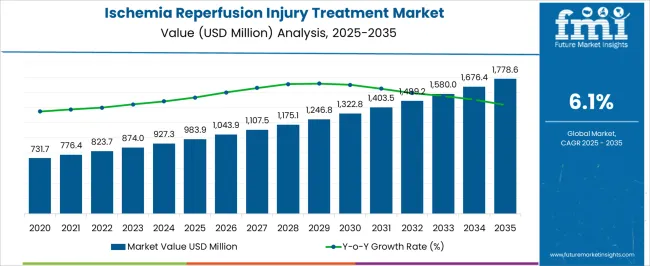

The Ischemia Reperfusion Injury Treatment Market is estimated to be valued at USD 983.9 million in 2025 and is projected to reach USD 1778.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

| Metric | Value |

|---|---|

| Ischemia Reperfusion Injury Treatment Market Estimated Value in (2025 E) | USD 983.9 million |

| Ischemia Reperfusion Injury Treatment Market Forecast Value in (2035 F) | USD 1778.6 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The ischemia reperfusion injury treatment market is expanding due to increasing prevalence of cardiovascular disorders, advancements in surgical interventions, and a growing focus on improving patient recovery outcomes. Rising cases of heart attacks, organ transplants, and stroke related complications are driving demand for effective therapies that mitigate cellular and tissue damage caused by reperfusion.

Pharmaceutical companies and research institutions are investing in novel drug candidates, biologics, and targeted therapies that address oxidative stress and inflammation linked to reperfusion injury. Additionally, technological improvements in surgical procedures and critical care have accelerated the need for advanced treatment options.

Regulatory support and clinical trial advancements are also strengthening the pathway for innovative therapies. The overall outlook remains positive as hospitals and healthcare providers increasingly adopt evidence based approaches to minimize complications, improve survival rates, and enhance patient quality of life.

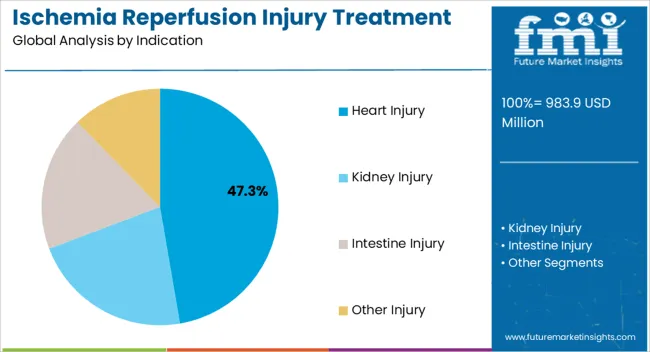

The heart injury indication segment is projected to hold 47.30% of total market revenue by 2025, making it the largest within the indication category. This dominance is being supported by the high global burden of cardiovascular diseases, rising surgical interventions, and increasing rates of myocardial infarction.

Heart tissues are highly susceptible to reperfusion injury, which has accelerated research and therapeutic adoption targeting cardiac protection. The demand for cardioprotective drugs and advanced therapeutic approaches has further boosted the segment.

Continuous innovation in biologics and small molecule drugs along with rising clinical focus on reducing post surgical complications have reinforced the leading position of this indication segment.

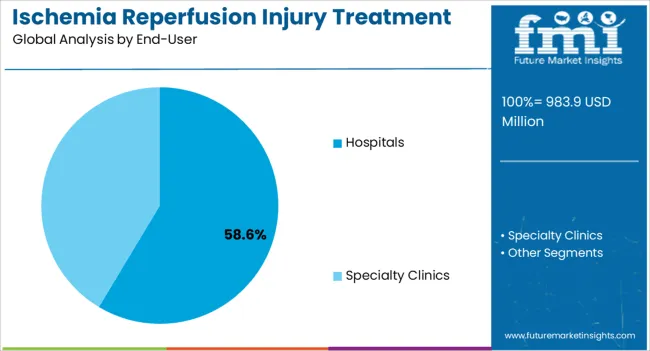

The hospitals segment is expected to contribute 58.60% of total revenue by 2025, establishing it as the dominant end user category. The dominance is attributed to hospitals being the primary centers for cardiac surgeries, transplants, and emergency treatments where reperfusion injury is most prevalent.

Hospitals possess the infrastructure, skilled professionals, and advanced technologies required for timely diagnosis and therapeutic intervention. Rising patient admissions for acute heart conditions and organ transplantation procedures have intensified the reliance on hospitals for treatment.

Moreover, collaborations between hospitals and research institutions are enhancing clinical trials and access to new therapies. This combination of resources, expertise, and patient volume ensures that hospitals maintain a leading role in the ischemia reperfusion injury treatment market.

According to market research and competitive intelligence provider Future Market Insights- the market for Ischemia reperfusion injury treatment reflected a value of 3.4% during the historical period, 2020 to 2025.

Factors driving the growth of the ischemia reperfusion injury treatment market during this period include an increase in the incidence of ischemia-related disorders such as heart attacks, strokes, and organ transplants, as well as the development of new and innovative therapies to address these conditions.

Additionally, the market has seen an increase in collaborations and partnerships between pharmaceutical and medical device companies, as well as increased investment in research and development to advance the development of new therapies and technologies.

Thus, the market for Ischemia reperfusion injury treatment is expected to register a CAGR of 6.1% in the forecast period 2025 to 2035.

Increasing incidence of ischemia-related disorders driving market growth

The rising prevalence of conditions such as heart attacks, strokes, and organ transplants has led to an increased demand for effective ischemia reperfusion injury treatments. Technological advances have led to the development of new and innovative therapies for ischemia reperfusion injury, such as hypothermia and gene therapy.

Pharmaceutical and medical device companies are investing heavily in research and development to develop new and more effective treatments for ischemia reperfusion injury. Increased collaboration between pharmaceutical and medical device companies has led to the development of new therapies and technologies that can effectively treat ischemia reperfusion injury.

Governments around the world are providing favorable policies and funding to support the development of new treatments for ischemia reperfusion injury, which is driving market growth.

Availability of treatments shaping landscape for ischemia reperfusion injury treatment

Pharmacological therapies: This involves the use of medications such as anti-inflammatory drugs, antioxidants, and free radical scavengers to prevent or reduce the damage caused by ischemia reperfusion injury.

Mechanical interventions: This involves the use of devices such as intra-aortic balloon pumps or extracorporeal membrane oxygenation (ECMO) to improve blood flow and oxygen delivery to the affected tissues or organs.

Surgical procedures: Revascularization procedures such as coronary artery bypass grafting (CABG), carotid endarterectomy, and organ transplantation can be used to restore blood flow to the affected area.

Hypothermia: Inducing mild hypothermia can help to reduce the metabolic rate of the affected tissues or organs, which can reduce the damage caused by ischemia reperfusion injury.

Gene therapy: This involves introducing genes into the affected tissues or organs to enhance their ability to tolerate ischemia and reperfusion.

Lack of awareness and expensive nature of treatment derailing market growth

A significant challenge in the ischemia reperfusion injury treatment market is the lack of awareness among patients and healthcare professionals about the condition and available treatment options. This can lead to a delay in diagnosis and treatment, resulting in poorer patient outcomes.

The cost of treating ischemia reperfusion injury can be high, particularly for complex cases that require advanced medical interventions. This can limit access to treatment, especially in developing countries where healthcare budgets are limited.

Currently, there are limited treatment options available for ischemia reperfusion injury, which can make it difficult to manage and treat the condition effectively. This underscores the need for continued research and development of new therapies.

Some of the treatment options for ischemia reperfusion injury, such as reperfusion therapy, can have adverse effects on the patient, including bleeding, clotting, and arrhythmias. This can make it challenging for healthcare professionals to balance the potential benefits of treatment with the risks of complications.

The regulatory environment surrounding the development and approval of new therapies for ischemia reperfusion injury can be complex and time-consuming. This can delay the availability of new treatments and limit the options available to patients.

Presence of major key players creating lucrative opportunities for treatment of ischemic disorders

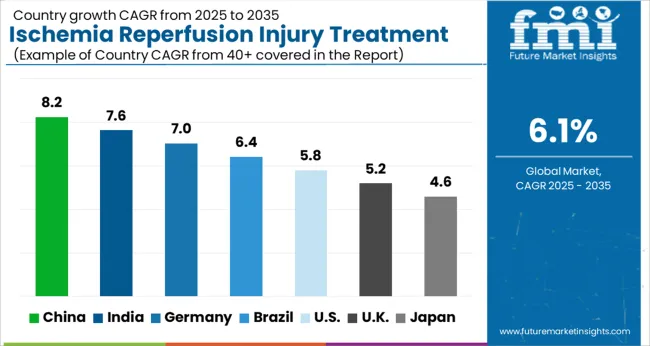

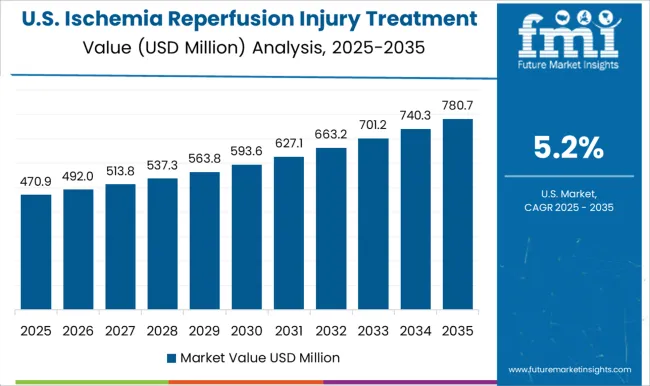

The North America ischemia reperfusion injury treatment market is one of the largest in the world, with the United States and Canada being the major markets in the region.

The market growth is driven by the increasing prevalence of ischemic disorders such as heart attacks, strokes, and organ transplants, as well as the presence of well-established healthcare infrastructure and a high level of healthcare spending in the region. The increasing adoption of new and innovative therapies, such as hypothermia, gene therapy, and stem cell therapy, will further drive the market growth in the coming years.

Some of the major players in the North America ischemia reperfusion injury treatment market include Pfizer, Inc., Merck & Co., Inc., F. Hoffmann-La Roche Ltd, Abbott Laboratories, and Novartis AG. These companies are investing heavily in research and development to develop new and more effective treatments for ischemia reperfusion injury, which is expected to further drive market growth in the region. Thus, North America is expected to possess 47% market share for ischemia reperfusion injury treatment market in 2025.

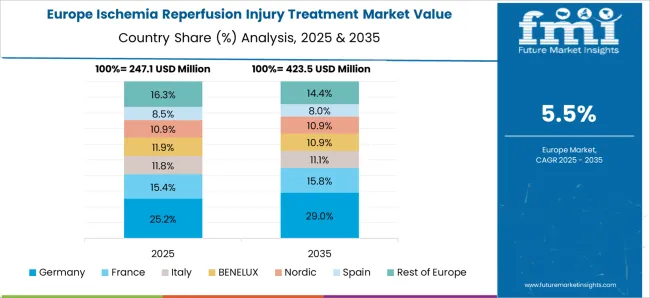

Well-established healthcare infrastructure favoring market growth in Europe

The Europe ischemia reperfusion injury treatment market is experiencing growth due to several factors. One of the main drivers of the market is the increasing prevalence of ischemic disorders such as heart attacks, strokes, and organ transplants, which are contributing to the demand for ischemia reperfusion injury treatments in the region. Additionally, the region's well-established healthcare infrastructure, high healthcare spending, and favorable government initiatives are also driving the market growth.

In addition, the increasing adoption of innovative therapies such as hypothermia, gene therapy, and stem cell therapy as a significant factor driving the market growth in the region. In order to drive market growth in the region, Furthermore, key companies are making significant investments in research and development aimed at creating novel and more efficient therapies for ischemia reperfusion injury. Thus, Europe is expected to possess 41% market share for ischemia reperfusion injury treatment market in 2025.

Presence of emergency care increasing popularity of ischemia reperfusion injury treatment

Hospitals typically have access to advanced medical equipment and technology, which is necessary for the diagnosis and treatment of ischemia reperfusion injury. This includes tools like imaging equipment, cardiac monitors, and specialized surgical instruments.

Hospitals typically have multidisciplinary teams of healthcare professionals, including doctors, nurses, and other specialists, who work together to provide comprehensive care to patients with ischemia reperfusion injury.

Emergency care: In cases where ischemia reperfusion injury is caused by a medical emergency, such as a heart attack or stroke, hospitals are equipped to provide emergency care quickly and efficiently, which can be critical in improving patient outcomes.

After initial treatment, patients with ischemia reperfusion injury may require ongoing follow-up care to manage their condition and prevent complications. Hospitals typically have the resources and expertise to provide this type of care. Thus, hospitals are expected to possess 53% market share for ischemia reperfusion injury treatment market in 2025.

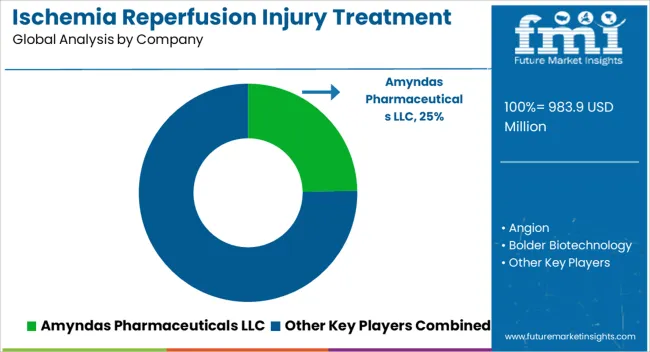

Key players in the ischemia reperfusion injury treatment market are Amyndas Pharmaceuticals LLC, Angion, Bolder Biotechnology, Opsona Therapeutics Ltd., Pharming Group NV, Prolong Pharmaceuticals, Prothix BV, Stealth BioTherapeutics, Inc., Zealand Pharma A/S, Faraday Pharmaceuticals and SBI Pharmaceuticals

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 983.9 million |

| Market Value in 2035 | USD 1778.6 million |

| Growth Rate | CAGR of 6.1% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Indication, End User, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Profiled | USA, Canada, Brazil, Mexico, Rest of Latin America, Germany, United kingdom, France, Spain, Italy, Rest of Europe, India, Malaysia, Singapore, Thailand, Rest of South Asia, China, Japan, South Korea, Austria, New Zealand, GCC countries, South Africa, Israel, Rest of MEA |

| Key Companies Profiled | Amyndas Pharmaceuticals LLC; Angion; Bolder Biotechnology; Opsona Therapeutics Ltd.; Pharming Group NV; Prolong Pharmaceuticals; Prothix BV; Stealth BioTherapeutics, Inc.; Zealand Pharma A/S; Faraday Pharmaceuticals; SBI Pharmaceuticals |

| Customization | Available Upon Request |

The global ischemia reperfusion injury treatment market is estimated to be valued at USD 983.9 million in 2025.

The market size for the ischemia reperfusion injury treatment market is projected to reach USD 1,778.6 million by 2035.

The ischemia reperfusion injury treatment market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in ischemia reperfusion injury treatment market are heart injury, kidney injury, intestine injury and other injury.

In terms of end-user, hospitals segment to command 58.6% share in the ischemia reperfusion injury treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Kids Sports Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

White Matter Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Acute Kidney Injury Treatment Market Growth - Trends & Forecast 2025 to 2035

Winter Sports Injury Treatment Market Size and Share Forecast Outlook 2025 to 2035

Cutaneous Radiation Injury Treatment Market

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA