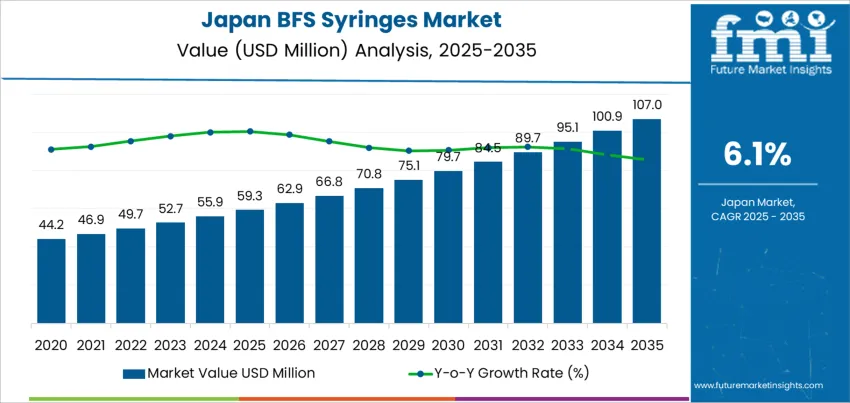

The Japan BFS syringes demand is valued at USD 59.3 million in 2025 and is forecasted to reach USD 107.0 million by 2035, reflecting a CAGR of 6.1%. Growth is supported by increasing use of sterile, single-dose packaging formats in hospital and outpatient care settings. Blow-Fill-Seal technology reduces contamination risk, supports stable dosing accuracy, and eliminates secondary sterilization steps. Expanding immunization programmes, higher utilization in emergency medicine, and rising preference for ready-to-use parenteral products further reinforce demand. Syringes within the 1–3 ml capacity range lead consumption, driven by their suitability for vaccines, ophthalmic doses, anaesthetics, and pediatric formulations that require low-volume precision. Adoption is reinforced by stronger pharmacovigilance and the need for packaging formats compatible with strict sterility and shelf-life requirements.

Kyushu & Okinawa, Kanto, and Kansai record the highest usage due to the concentration of pharmaceutical manufacturers, hospital networks, and logistics hubs supporting temperature-controlled medical supply distribution. Increased automation in fill-finish lines, together with regulatory support for sterile primary packaging systems, contributes to continued uptake across these regions. Key suppliers include Otsuka Pharmaceutical Factory, Inc., Nippon Steel Packaging (NSP), Toyo Seikan Group Holdings, Ltd., Daikoku Seisakusho Co., Ltd., and Showa Denko Packaging Co., Ltd. Their capabilities span BFS aseptic moulding, high-purity plastics, secure luer-lock interfaces, and integrated packaging solutions used in pharmaceuticals and clinical care.

Demand for BFS (Blow-Fill-Seal) syringes in Japan demonstrates a stronger growth contribution in the later portion of the forecast period. Early growth remains tied to established uses in hospitals and clinics where sterile, single-use formats support routine injections and small-volume medication delivery. Adoption is steady but moderated by procurement discipline, existing syringe inventories, and controlled transition schedules within public healthcare systems.

Later-period expansion gains momentum as BFS platforms align with infection-prevention priorities, pre-filled drug programs, and automation of injectable packaging. Aging-population trends widen the administration base for chronic-disease therapies, increasing the appeal of accurate unit-dose delivery. Pharmaceutical manufacturers drive additional demand through localized sterile filling capacity and compliance with contamination-risk reduction standards. These elements raise the annual growth contribution relative to the earlier years.

The comparison indicates a shift from baseline medical consumption to broader integration with pharmaceutical supply chains. As BFS availability expands and regulatory alignment improves, the latter decade delivers a larger portion of cumulative growth, marking a transition from gradual adoption toward more sustained volume advancement in Japan’s sterile-packaging ecosystem.

| Metric | Value |

|---|---|

| Japan BFS Syringes Sales Value (2025) | USD 59.3 million |

| Japan BFS Syringes Forecast Value (2035) | USD 107.0 million |

| Japan BFS Syringes Forecast CAGR (2025-2035) | 6.1% |

Demand for BFS syringes in Japan is increasing because healthcare providers require sterile, ready-to-use packaging solutions that support accurate dosing and reduce contamination risk. Blow-fill-seal technology forms, fills and seals syringes in a closed system, which supports infection control in hospitals, clinics and home-care settings. Japan’s ageing population drives higher use of injectable medications for chronic conditions, vaccinations and supportive therapies, leading to greater demand for reliable single-dose syringe formats.

Pharmaceutical companies value BFS syringes for biologics, ophthalmic drugs and pediatric formulations where minimal preservatives and precise dosing are essential. The format improves product integrity during storage and distribution, which aligns with strict regulatory requirements in Japan. Adoption in emergency response kits and outpatient services is also increasing because BFS syringes are lightweight, portable and reduce preparation steps for healthcare workers. Constraints include higher production cost compared with conventional syringe filling and limited availability of domestic BFS capacity for specialized formulations. Integration of BFS packaging into existing drug supply chains may require additional qualification and validation efforts, which can slow transitions for smaller manufacturers.

Demand for Blow-Fill-Seal (BFS) syringes in Japan is strengthened by sterile manufacturing standards, reduced contamination risks, and pre-filled medication preferences in hospitals and home-care settings. Growth aligns with increasing vaccination needs, biologics use, and single-dose drug delivery solutions. Manufacturers emphasize tamper-resistant packaging and automation efficiency that reduces human handling errors in Japanese pharmaceutical production. Expansion in self-administration devices and elderly-care medicines continues to support BFS syringe consumption across retail and institutional supply chains.

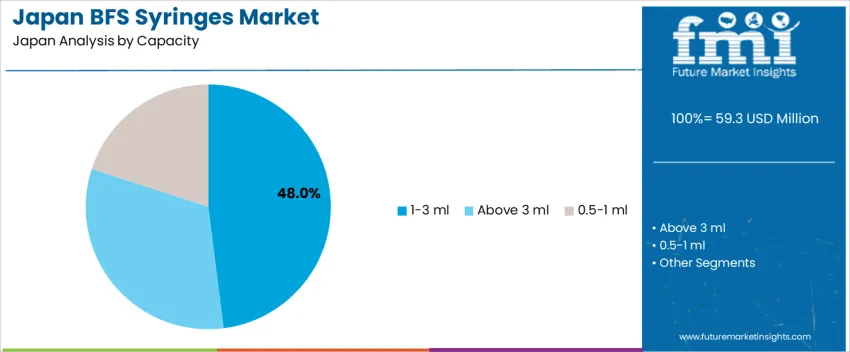

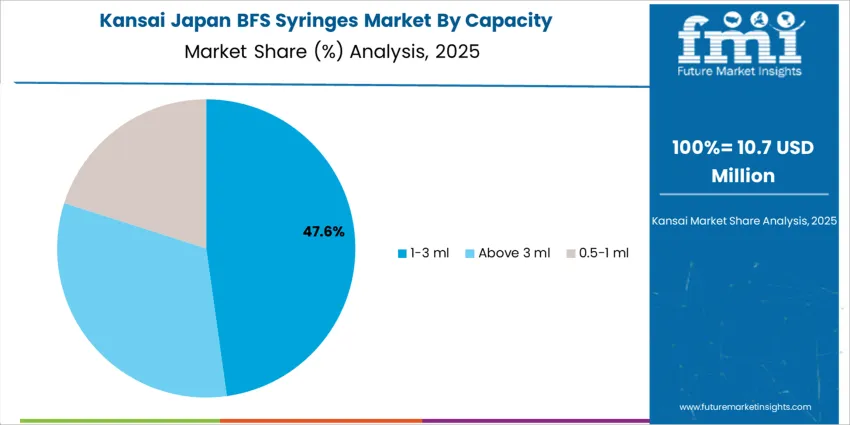

The 1–3 ml range accounts for 48.0%, widely used for vaccines, biologics, and injectable therapies that require accurate unit dosing in Japan’s clinical environment. These syringes offer optimal fill volume for routine patient care, including chronic disease treatments administered in hospitals and ambulatory settings. Syringes above 3 ml represent 32.0%, particularly suitable for antibiotic infusions, fluid therapies, and applications requiring higher dose volume. The 0.5–1 ml segment holds 20.0%, supporting pediatric and vaccine applications where minimal dosing accuracy is essential. Demand distribution aligns with Japan’s aging demographic, high vaccination coverage, and rising preference for pre-filled single-use formats minimizing medical waste and needle-related infections.

Key Points:

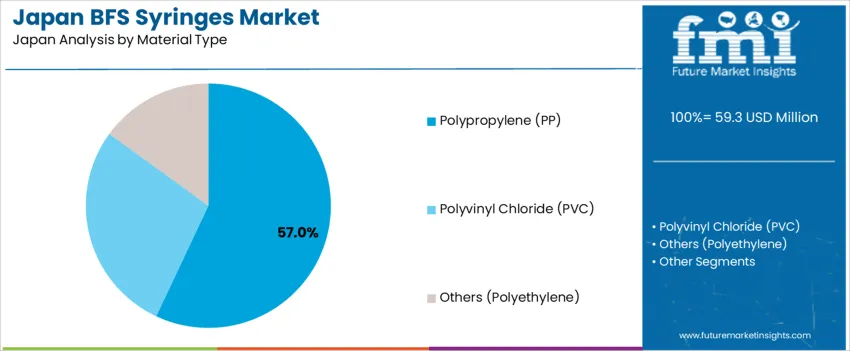

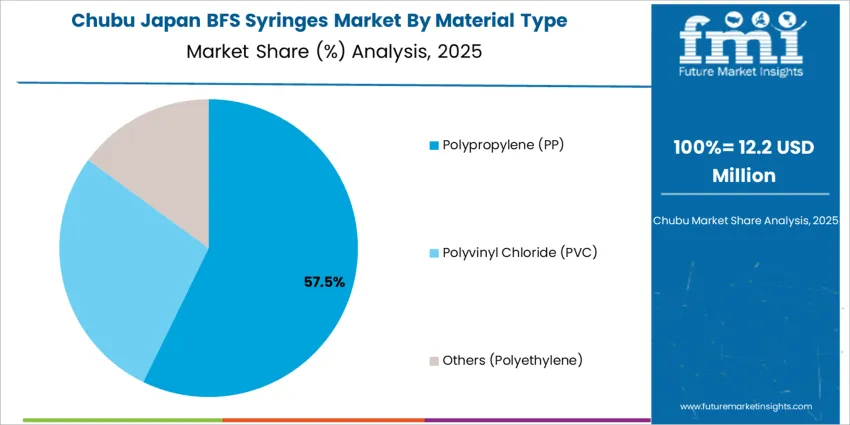

Polypropylene (PP) represents 57.0%, favored for strong chemical resistance, thermal stability, and compatibility with sterile BFS production. PP syringes ensure durability, transparency, and safety for injectable biologics, ophthalmics, and vaccine formulations. Polyvinyl chloride (PVC) holds 28.0%, mainly in cost-sensitive applications but limited by concerns over plasticizer leaching. Other materials including polyethylene account for 15.0%, offering flexibility for niche use cases requiring softer syringe bodies. Material preferences reflect Japan’s stringent pharmaceutical packaging policies emphasizing patient safety, drug stability, and environmentally compliant waste handling.

Key Points:

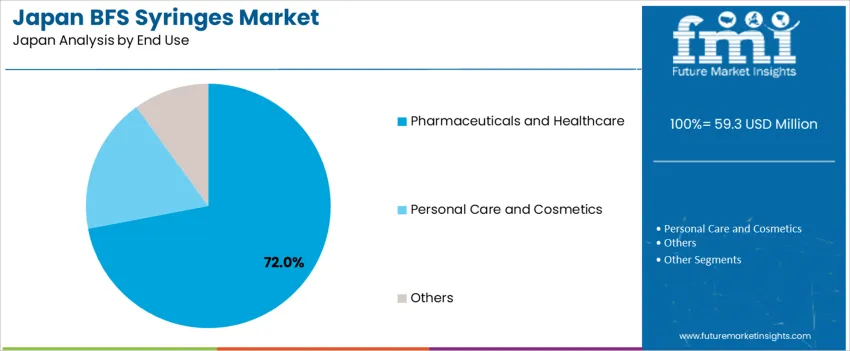

Pharmaceuticals and healthcare dominate with 72.0%, driven by rising hospital injections, biologics delivery, and emergency care needs. BFS syringes ensure sterility for ophthalmic drugs, anesthetic preparations, and vaccines administered across Japan’s medical network. Personal care and cosmetics represent 18.0%, supported by precise micro-dose dispensing for serums and skincare formulations. Other categories account for 10.0%, including veterinary and laboratory use. End-use trends reflect Japan’s focus on medical quality control, unit-dose efficiency, and infection-prevention protocols in high-volume therapeutic settings.

Key Points:

Expansion of prefilled pharmaceutical formats, increased infection-control standards and demand for precise pediatric and vaccine dosing are driving demand.

In Japan, blow-fill-seal (BFS) syringes gain adoption as healthcare providers prefer sterile, ready-to-use delivery systems that reduce preparation time in hospitals and clinics. Vaccine and biologic manufacturers use BFS syringes for accurate unit dosing in national immunization programs, especially in pediatric care where safety and volume precision are critical. Home healthcare services for chronic conditions are growing among older adults, creating demand for syringes that support safe self-administration. Contract manufacturing sites supporting domestic pharma companies seek BFS technologies to reduce contamination risks, improve batch consistency and streamline aseptic production. These performance and workflow benefits support consistent procurement.

High regulatory compliance requirements, capital expenditure for BFS equipment and limited awareness in smaller medical facilities restrain adoption.

Pharmaceutical producers must meet strict quality validation for BFS syringe formats, which increases development timelines and regulatory documentation workload. BFS systems require specialized filling and molding machinery that involve significant investment, limiting rapid expansion among smaller domestic players. Some regional clinics prefer traditional syringe-and-vial combinations because staff are more familiar with established handling procedures. These operational and cost challenges create gradual transition rather than rapid replacement across medical settings.

Shift toward polymer syringes compatible with biologics, increased unit-dose adoption in emergency and home care and rising demand from vaccine production define key trends.

Japanese pharmaceutical companies focus on polymer BFS syringes that provide chemical stability for biologics and temperature-sensitive therapies. Emergency medical services and home-care nursing teams use prefilled BFS syringes to reduce medication errors and improve mobility during field operations. Vaccine manufacturers expand BFS capacity to support scalable production for routine and outbreak responses. Hospitals emphasize traceability features, including barcoding directly molded into the syringe body to improve tracking through digital records. These trends indicate steady, safety- and efficiency-driven demand for BFS syringes across Japan’s healthcare system.

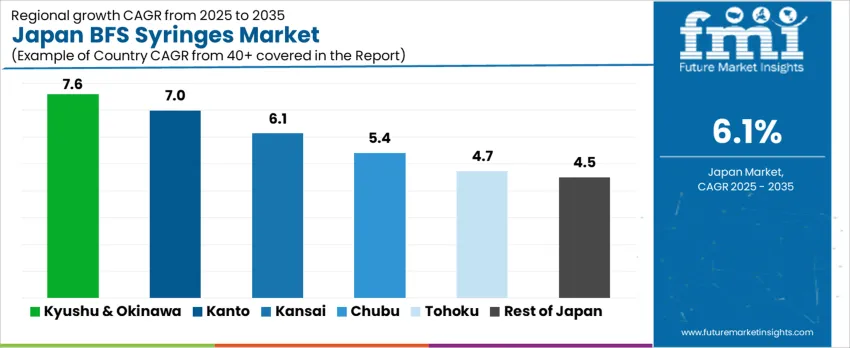

Demand for Blow-Fill-Seal (BFS) syringes in Japan is influenced by sterile injectable requirements across hospital networks, vaccine distribution, and home-care administration. Each region’s growth reflects healthcare infrastructure maturity, procurement priorities, and logistic efficiencies under strict pharmaceutical standards. Kyushu & Okinawa lead with a 7.6% CAGR, followed by Kanto (7.0%), Kansai (6.1%), Chubu (5.4%), Tohoku (4.7%), and the Rest of Japan (4.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 7.6% |

| Kanto | 7.0% |

| Kansai | 6.1% |

| Chubu | 5.4% |

| Tohoku | 4.7% |

| Rest of Japan | 4.5% |

Kyushu & Okinawa reach 7.6% CAGR, supported by expanding hospital service networks and vaccination programs requiring sterile, tamper-resistant packaging. Procurement teams prioritize BFS formats for minimizing contamination risk in high-humidity coastal environments. Medical distributors in Fukuoka facilitate rapid cold-chain delivery to smaller islands, ensuring availability for routine immunization and chronic disease management. Public health outreach supports increased access to injectable treatments where home-care use depends on easy-handling prefilled units. Bioscience initiatives in local universities evaluate BFS technologies for biologics compatibility, influencing clinical procurement confidence. Infection-control policies continue raising usage standards for single-dose sterile delivery.

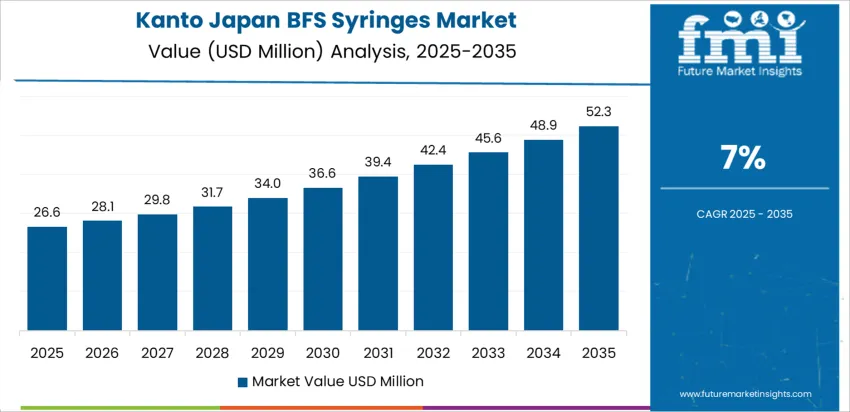

Kanto posts 7.0% CAGR due to Tokyo’s concentration of hospitals, pharmaceutical distributors, and clinical research centers. BFS syringes support large-scale vaccination activities that require standardization of dose safety and speed of deployment. Cold-chain warehouses near Narita and Yokohama ports accelerate import flows for specialized pharmaceutical-grade polymers used in BFS containers. University hospitals evaluate BFS for biologics and high-volume injectable therapies that favor unit-dose sterility. Automation advancements in syringe handling and distribution reduce staffing strain and ensure precision in inventory planning. Procurement also supports disaster-readiness stockpiles across metropolitan areas.

Kansai shows a projected 6.1% compound annual rise in BFS syringe utilisation, shaped by Osaka and Kobe’s pharmaceutical plants, specialist hospitals, and regional distribution hubs. Tertiary care centres employ BFS formats for supportive injectables, contrast agents, and emergency medicines where standardised single doses help reduce administration errors. Regional drug manufacturers evaluate BFS technology for ophthalmic and inhalation related products that require high sterility assurance. Hospital pharmacy departments appreciate reduced need for vial handling, reconstitution, and transfer, which lessens workload and contamination exposure. Procurement committees review long term supply contracts covering stability data, container closure performance, and compatibility with existing sharps disposal workflows. Training programmes for nurses and technicians emphasise correct storage, inspection, and disposal routines, ensuring BFS syringes integrate smoothly into everyday clinical practice across busy urban facilities and satellite clinics. Together these drivers support steady, sustainable expansion of BFS solutions within Kansai’s healthcare system.

In Chubu, BFS syringe demand is estimated to grow at about 5.4% per year, reflecting the region’s mix of large hospitals in Nagoya and smaller facilities across surrounding prefectures. Acute care institutions adopt BFS formats for vaccines, analgesics, and routine injectable to streamline preparation in emergency and outpatient departments. Industrial health services linked to automotive and machinery plants favour prefilled syringes that support predictable dosing during workplace medical programmes. Logistics networks moving medical products through central Japan value robust container closure performance that withstands vibration and temperature fluctuation. Purchasing teams emphasize supplier reliability, documentation quality, and alignment with national guidance on sterile packaging. As inventory planning systems become more data driven, Chubu facilities align BFS ordering volumes with observed treatment patterns and seasonal vaccination peaks across urban and semi-rural catchment areas. This approach reduces surplus stock while maintaining adequate buffers for unplanned clinical demand.

Tohoku’s demand for BFS syringes is expanding at around 4.7% CAGR as hospitals and clinics seek packaging that supports reliable administration across dispersed communities. Facilities in Miyagi, Iwate, and Fukushima emphasize single dose sterility and reduced preparation steps, particularly in wards with limited staffing capacity. Mobile clinics and outreach teams value prefilled BFS syringes that simplify logistics when travelling between rural locations with constrained storage space. Cold winters require container materials and seals that remain stable under lower ambient temperatures during transport and short term storage. Procurement officers weigh product performance evidence and supplier service responsiveness when deciding on multiyear agreements. As regional healthcare networks continue quality improvement initiatives, BFS solutions become part of broader efforts to reduce medication errors and standardise injectable procedures in primary and secondary care settings across the northern prefectures, including both coastal and inland communities.

Across the rest of Japan, BFS syringe demand is rising at roughly 4.5% per year as smaller hospitals, clinics, and outpatient centres gradually integrate prefilled formats into standard practice. Many facilities operate with limited pharmacy compounding capacity, so unit dose BFS syringes reduce reliance on manual preparation. Community clinics adopt BFS products for vaccines, local anaesthetics, and common injectables used in minor procedures. Regional wholesalers manage distribution across mixed urban and rural territories, prioritising packaging that tolerates frequent handling and varied storage conditions. Procurement strategies focus on balancing acquisition cost with documented sterility performance and user friendly design. Clinical managers monitor error trends and staff feedback, then expand BFS usage where devices demonstrably support consistent dosing, reduce preparation time, and align with existing sharps disposal protocols in constrained treatment areas and community based treatment programmes across multiple prefectures and healthcare catchments.

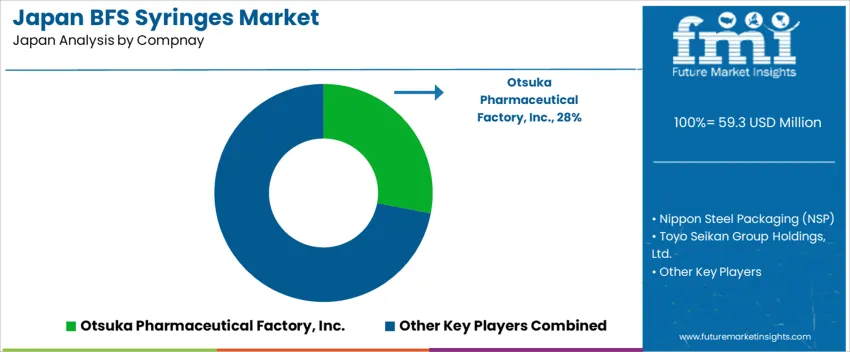

Demand for BFS syringes in Japan centers on sterile single-dose formats for injectable, ophthalmic preparations, and small-volume biologics. Otsuka Pharmaceutical Factory, Inc. holds an estimated 28.0% share, supported by established aseptic fill-finish capabilities and consistent distribution to hospitals and clinics. The company supplies reliable polymer-based syringe systems that meet domestic regulatory expectations for product sterility and container integrity.

Nippon Steel Packaging participates through polymer container solutions used in BFS-based injectable packaging, with controlled sealing quality and durable material performance. Toyo Seikan Group Holdings contributes with syringe-related BFS containers used in selected parenteral categories, supported by nationwide logistics coverage. Daikoku Seisakusho Co., Ltd. maintains supply in smaller container formats where flexible BFS tooling and validated cleanroom standards are required. Showa Denko Packaging Co., Ltd. adds competition through polymer engineering capabilities suited for sensitive formulations requiring stable barrier properties.

Competition in Japan focuses on seal-integrity reliability, dimensional precision, extractable and leachable control, and compatibility with existing hospital workflows. Demand continues as pharmaceutical suppliers expand fill-finish choices for patient-friendly administration and stable handling in domestic care environments.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Capacity | 1–3 ml, Above 3 ml, 0.5–1 ml |

| Material Type | Polypropylene (PP), Polyvinyl Chloride (PVC), Others (Polyethylene) |

| End Use | Pharmaceuticals and Healthcare, Personal Care and Cosmetics, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Otsuka Pharmaceutical Factory, Inc., Nippon Steel Packaging (NSP), Toyo Seikan Group Holdings, Ltd., Daikoku Seisakusho Co., Ltd., Showa Denko Packaging Co., Ltd. |

| Additional Attributes | Dollar demand by syringe capacity and polymer material; BFS technology penetration in aseptic drug delivery, prefilled formats, and single-use applications; alignment with Japan’s sterile packaging standards and biologics manufacturing; growth in ophthalmic, vaccine, and respiratory dose syringes; supply consolidation among domestic packaging and healthcare manufacturers; influence of traceability needs, unit-dose formats, and hospital procurement strategies across Japan’s regions. |

The demand for BFS syringes in Japan is estimated to be valued at USD 59.3 million in 2025.

The market size for the BFS syringes in Japan is projected to reach USD 107.0 million by 2035.

The demand for BFS syringes in Japan is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in BFS syringes in Japan are 1-3 ml, above 3 ml and 0.5-1 ml.

In terms of material type, polypropylene (pp) segment is expected to command 57.0% share in the BFS syringes in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BFS Syringes Market Analysis - Size & Growth Forecast 2025 to 2035

Demand for BFS Syringes in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

BFSI Security Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA