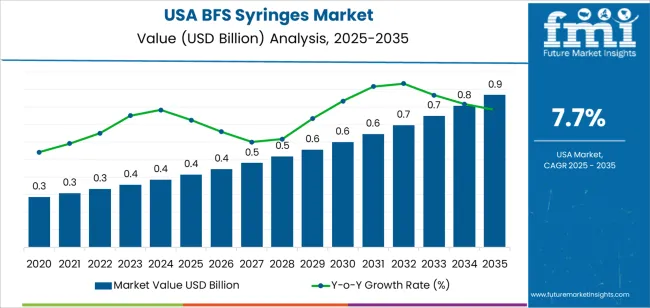

The demand for BFS (Blow-Fill-Seal) syringes in the USA is expected to grow from USD 0.4 billion in 2025 to USD 0.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.7%. BFS syringes, known for their sterile, efficient, and cost-effective design, are increasingly used in the pharmaceutical and biotechnology industries for packaging injectable drugs and vaccines. As demand for biologics, vaccines, and sterile injectable drugs continues to rise, the use of BFS technology is expected to grow due to its high throughput, reduced risk of contamination, and scalability.

The market will experience steady growth over the forecast period, starting at USD 0.4 billion in 2025 and rising to USD 0.4 billion in 2026, USD 0.5 billion in 2027, and USD 0.5 billion in 2028. By 2029, the market will rise to USD 0.6 billion, continuing its growth through the 2030s. By 2035, the demand for BFS syringes is projected to reach USD 0.9 billion, driven by the ongoing expansion of the pharmaceutical industry and increasing adoption of BFS technology for drug packaging.

By 2035, the demand for BFS syringes is expected to reach USD 0.9 billion, driven by the growing adoption of BFS technology in injectable drug packaging, the rise in biologic treatments, and increased regulatory support for sterile packaging solutions. The 5-year growth block analysis highlights steady, incremental growth in the demand for BFS syringes. In the first five years (2025-2029), the market will experience a gradual increase in demand, from USD 0.4 billion in 2025 to USD 0.6 billion by 2029. This reflects a steady 5-year growth rate driven by rising healthcare needs, increasing biologics production, and greater demand for sterile packaging in the pharmaceutical industry. The 5-year growth analysis suggests that, while the early years will see gradual increases, a slight acceleration in the growth rate will be evident as BFS syringes continue to capture a larger share of the injectable drug packaging market.

The second 5-year block (2029-2035) is expected to see continued steady growth, with demand reaching USD 0.9 billion by 2035. The stable increase in demand will be driven by the continued expansion of the pharmaceutical and biotechnology sectors, as well as the growing trend of using BFS systems for large-scale manufacturing of injectable drugs and vaccines. This steady growth trajectory underscores the expanding role of BFS technology in the pharmaceutical packaging market.

| Metric | Value |

|---|---|

| Industry Sales Value (2025) | USD 0.4 billion |

| Industry Forecast Value (2035) | USD 0.9 billion |

| Industry Forecast CAGR (2025-2035) | 7.7% |

Demand for BFS (blow fill seal) syringes in the USA is rising as the healthcare and pharmaceutical sectors increasingly prioritize sterility, safety, and efficiency in drug delivery. BFS syringes are manufactured, filled, and sealed in a fully automated process that reduces the risk of contamination. This feature becomes especially important for injectables, vaccines, biologics, and other sensitive medications where sterility and dosage accuracy are critical. The trend toward single use, prefilled, and ready to use injection systems supports growing adoption of BFS syringes among hospitals, clinics, and pharmaceutical companies. The broader demand for disposable syringes in the USA, driven by increasing chronic disease prevalence, growing immunization and therapy needs, and expansion of outpatient and home based care, also supports growth in the BFS segment.

At the same time, market forces and regulatory emphasis on safety and contamination prevention amplify demand for BFS syringes. The overall disposable syringes market in the USA is growing at a steady rate, reflecting the rising number of injections, surgeries, and therapeutic treatments requiring sterile delivery systems. Advances in syringe manufacturing technology, improvements in polymer materials, and increasing acceptance of prefilled/aseptic drug delivery solutions also encourage healthcare providers to prefer BFS syringes over conventional systems. As biologic drugs, vaccines, and specialty therapies expand, demand for reliable, single use sterile syringes such as those produced through BFS technology is likely to increase steadily over the coming years.

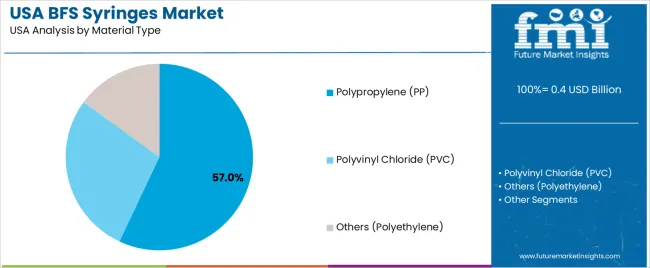

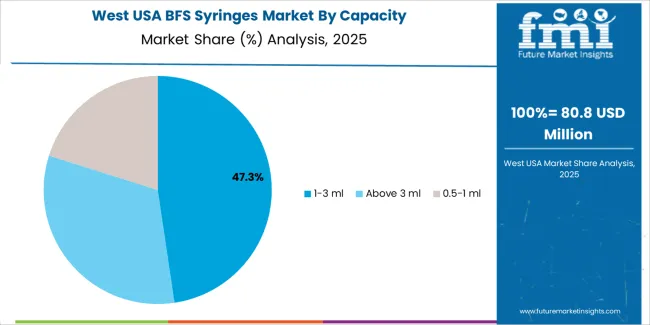

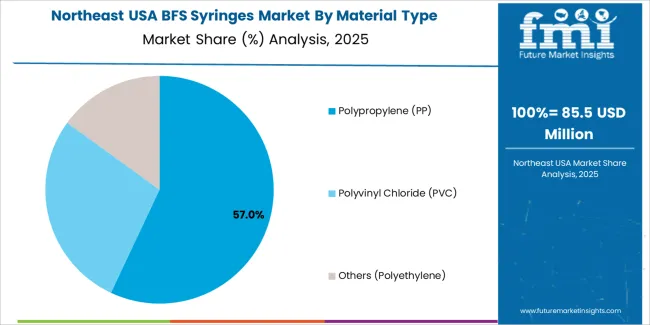

The demand for BFS (Blow-Fill-Seal) syringes in the USA is primarily driven by capacity and material type. The leading capacity is 1-3 ml, which accounts for 48% of the market share, while the dominant material type is polypropylene (PP), capturing 57% of the demand. BFS syringes are widely used in the pharmaceutical and healthcare industries for packaging sterile products, such as vaccines and injectable drugs. As the demand for safe, reliable, and high-quality medical packaging solutions grows, the adoption of BFS syringes continues to rise in the USA.

1-3 ml syringes lead the demand for BFS syringes in the USA, holding 48% of the market share. This syringe capacity is commonly used for administering vaccines, biologics, and small-dose injectable drugs. The 1-3 ml capacity is considered optimal for a wide range of applications, making it the preferred choice for medical professionals and pharmaceutical manufacturers. The versatility of this size allows for precise dosing, which is essential for both small and large-scale applications in the healthcare sector.

The demand for 1-3 ml BFS syringes is driven by their widespread use in critical healthcare applications, such as vaccinations and biologic therapies. With the increasing number of injectable vaccines and biologics being developed, particularly in response to health crises, the demand for 1-3 ml syringes remains strong. Their ability to deliver small, accurate doses while maintaining sterility and safety makes them a popular choice in both clinical and commercial settings. As the pharmaceutical and vaccine markets continue to expand, the demand for 1-3 ml BFS syringes is expected to remain a key segment in the USA.

Polypropylene (PP) leads the material type demand for BFS syringes in the USA, capturing 57% of the market share. Polypropylene is preferred for its excellent chemical resistance, low toxicity, and ability to maintain the integrity of the drug or vaccine being administered. It is a durable and cost-effective material that is commonly used for the production of medical packaging, particularly in the pharmaceutical and biotechnology industries. Polypropylene’s ability to withstand high temperatures and its compatibility with blow-fill-seal manufacturing processes make it an ideal choice for BFS syringes.

The demand for polypropylene BFS syringes is driven by the growing need for high-quality, sterile packaging solutions in the pharmaceutical industry. Polypropylene offers a high degree of clarity and strength while being chemically inert, ensuring that the contents of the syringes remain stable and safe. As the demand for biologics, vaccines, and other injectable drugs continues to increase, polypropylene BFS syringes are expected to maintain their dominance in the market, driven by their superior performance, safety, and cost-effectiveness.

Demand for BFS (blow-fill-seal) syringes in the USA is growing as the healthcare sector increasingly adopts prefilled syringes for drugs and biologics. The rise in self-administered therapies, the need for sterile delivery systems, and the growing demand for single-dose packaging contribute to this trend. BFS syringes are seen as convenient, reliable, and efficient, offering an alternative to traditional packaging. As the demand for injectable treatments, particularly biologics, continues to rise, BFS syringes are expected to see steady growth in both hospitals and home care settings.

What are the Drivers of Demand for BFS Syringes in the USA?

Key drivers include the increasing use of biologic drugs and vaccines, which require secure, sterile packaging. The rise of self-administration and home-based care, particularly for chronic conditions, boosts the demand for prefilled, easy-to-use syringes. Healthcare providers are also focusing on reducing errors and improving efficiency, which makes BFS syringes an attractive option. Additionally, advancements in production technology and materials have reduced costs and improved the scalability of BFS syringes, allowing for wider adoption across various therapeutic areas.

What are the Restraints on Demand for BFS Syringes in the USA?

Despite growth, there are several restraints. The higher cost of BFS syringes compared to traditional vials and multi-dose formats can limit adoption, especially in cost-sensitive segments. Regulatory and quality control requirements for ensuring sterility and compliance can also create barriers for new manufacturers. Not all drugs are suitable for prefilled syringes, limiting their use in some treatments. Additionally, concerns about waste management and single-use plastics may push some to consider reusable alternatives instead of disposable BFS syringes.

What are the Key Trends Influencing Demand for BFS Syringes in the USA?

Key trends include the increasing shift toward injectable biologics and vaccines, which require reliable and sterile delivery systems like BFS syringes. The rise of self-injection therapies, especially in home care, is driving demand for prefilled syringes. There is also growing interest in using plastic over glass, due to cost and durability advantages. Automation in manufacturing has improved the efficiency and scalability of BFS syringes, making them more accessible. Regulatory requirements focused on patient safety and contamination reduction continue to push the industry toward adopting BFS syringes.

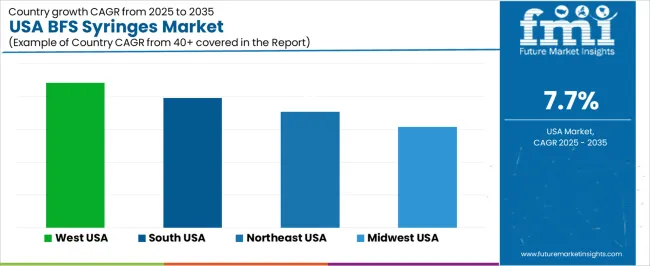

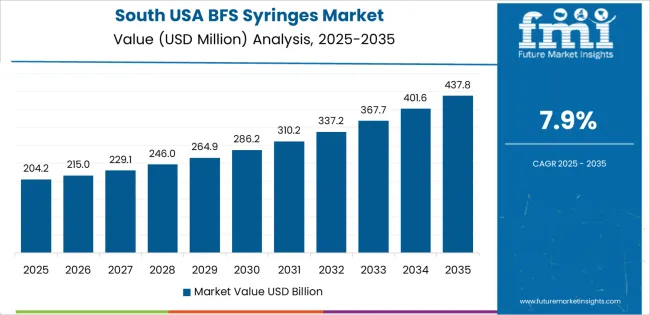

The demand for BFS (Blow-Fill-Seal) syringes in the USA is expected to grow steadily across all regions, with the West USA leading at a CAGR of 8.8%. The South USA follows closely with a CAGR of 7.9%, driven by the expanding pharmaceutical and healthcare sectors. The Northeast USA is projected to grow at 7.1%, while the Midwest USA shows a slightly lower growth rate of 6.2%. These regional variations are influenced by the presence of healthcare infrastructure, pharmaceutical manufacturing, and increasing demand for safe, cost-effective drug delivery systems.

| Region | CAGR (%) |

|---|---|

| West USA | 8.8 |

| South USA | 7.9 |

| Northeast USA | 7.1 |

| Midwest USA | 6.2 |

In the West USA, the demand for BFS syringes is expected to grow at a CAGR of 8.8%. The region is home to a large number of pharmaceutical manufacturers and biotech companies, driving the need for advanced drug delivery systems like BFS syringes. The growing focus on patient safety, cost efficiency, and reducing the risk of contamination in drug delivery contributes to the increasing adoption of BFS technology. BFS syringes are particularly appealing for the production of biologics and vaccines, sectors that are rapidly growing in the West. Additionally, the region’s strong healthcare infrastructure and the presence of major healthcare facilities further support the demand for BFS syringes. As the pharmaceutical industry in the West continues to expand, the demand for efficient, aseptic, and reliable drug delivery solutions like BFS syringes is expected to rise significantly.

In the South USA, the demand for BFS syringes is projected to grow at a CAGR of 7.9%, driven by the region’s expanding pharmaceutical and healthcare industries. The South has seen significant growth in manufacturing and distribution facilities, particularly for injectable drugs and vaccines, which require high-quality, contamination-free delivery systems. BFS syringes are gaining popularity due to their efficiency, safety, and suitability for mass production. With the rise of biologics and injectable drug therapies, the demand for BFS syringes in the South is likely to increase, particularly in states like Texas and Florida, where pharmaceutical and biotech manufacturing is thriving. Additionally, the region's focus on healthcare modernization and innovations in drug delivery technologies is further supporting the adoption of BFS syringes.

In the Northeast USA, the demand for BFS syringes is expected to grow at a CAGR of 7.1%, with the region’s strong pharmaceutical and healthcare infrastructure playing a key role. The Northeast, including states like Massachusetts and New Jersey, has a high concentration of pharmaceutical companies, research institutions, and healthcare providers, making it a key market for BFS syringes. The increasing demand for biologics, vaccines, and other injectable drug products is a major factor driving the adoption of BFS technology. As the industry increasingly moves toward sterile and efficient drug delivery systems, BFS syringes are becoming the preferred solution for their ability to reduce human intervention and minimize the risk of contamination. The region’s established manufacturing base and robust healthcare sector ensure continued growth in the BFS syringe market.

In the Midwest USA, the demand for BFS syringes is projected to grow at a CAGR of 6.2%, driven by the region’s expanding healthcare and pharmaceutical sectors. The Midwest, which has a significant presence of pharmaceutical manufacturing facilities, is experiencing steady demand for advanced drug delivery systems like BFS syringes. The region’s healthcare industry is adopting more efficient and reliable delivery systems, including BFS syringes, to meet the growing demand for biologic drugs and vaccines. While the Midwest has seen slightly slower adoption compared to other regions, the increasing focus on patient safety, cost efficiency, and the need for sterile drug delivery systems are expected to fuel steady demand growth for BFS syringes in this region. As pharmaceutical production in the Midwest expands and innovation in healthcare delivery continues, the market for BFS syringes will see consistent growth.

The demand for BFS syringes in the USA is rising. This growth is driven by increasing preference for aseptic, single dose injectable packaging. BFS syringes offer a fully automated process in which containers are blown, filled and sealed in one step, reducing contamination risk and improving sterility. This appeal has led manufacturers and healthcare providers to adopt BFS syringes more widely for vaccines, biologics and liquid pharmaceuticals.

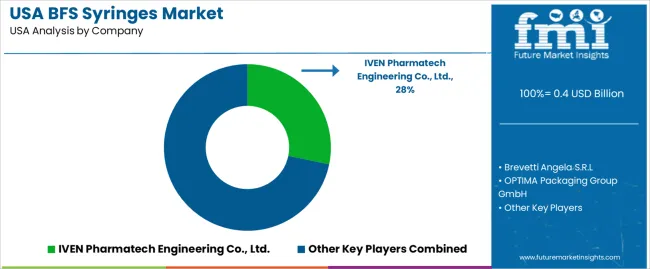

In that environment, certain firms emerge as leading suppliers. Among them, IVEN Pharmatech Engineering Co., Ltd. holds about 28.2 % of the market share. Other key competitors include StraPack, Inc., OPTIMA Packaging Group GmbH, Vanrx and AST, Inc. These companies differentiate through technology, scale and specialization. Some emphasize advanced BFS machinery capable of high-throughput fill finish suitable for large scale biologic production. Others target niche or small batch injectable production or contract manufacturing operations. Product brochures and spec sheets highlight sterile single dose delivery, reduced operator contact, flexible container design and improved safety. Competition remains dynamic as demand grows for aseptic syringes for vaccines, chronic disease therapies and biologics in the USA.

| Items | Details |

|---|---|

| Quantitative Units | USD Billion |

| Regions Covered | USA |

| Capacity | 1-3 ml, Above 3 ml, 0.5-1 ml |

| Material Type | Polypropylene (PP), Polyvinyl Chloride (PVC), Others (Polyethylene) |

| End Use | Pharmaceuticals and Healthcare, Personal Care and Cosmetics, Others |

| Key Companies Profiled | IVEN Pharmatech Engineering Co., Ltd., Brevetti Angela S.R.L, OPTIMA Packaging Group GmbH, Vanrx, AST, Inc. |

| Additional Attributes | Dollar sales by capacity, material type, and end use show strong demand for BFS syringes in pharmaceuticals and healthcare, with 1-3 ml syringes leading. Polypropylene (PP) and PVC are the dominant materials. Key players include IVEN Pharmatech and OPTIMA Packaging. |

The demand for BFS syringes in USA is estimated to be valued at USD 0.4 billion in 2025.

The market size for the BFS syringes in USA is projected to reach USD 0.9 billion by 2035.

The demand for BFS syringes in USA is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in BFS syringes in USA are 1-3 ml, above 3 ml and 0.5-1 ml.

In terms of material type, polypropylene (pp) segment is expected to command 57.0% share in the BFS syringes in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

BFS Syringes Market Analysis - Size & Growth Forecast 2025 to 2035

BFSI Security Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Syringes and Injectable Drugs Packaging Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

Syringes Market Analysis - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA