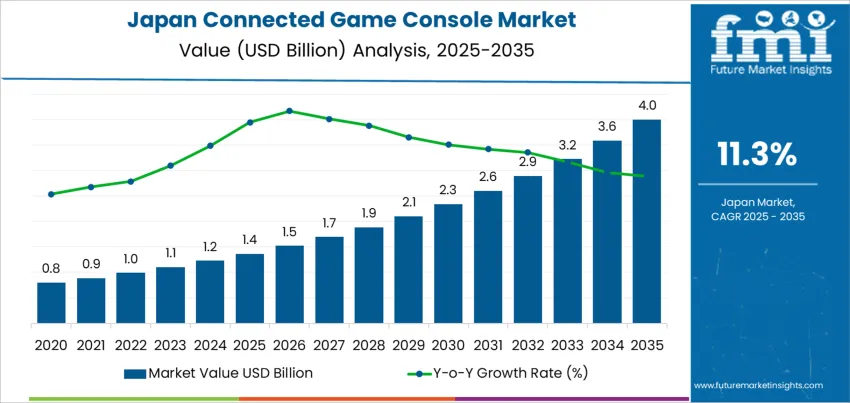

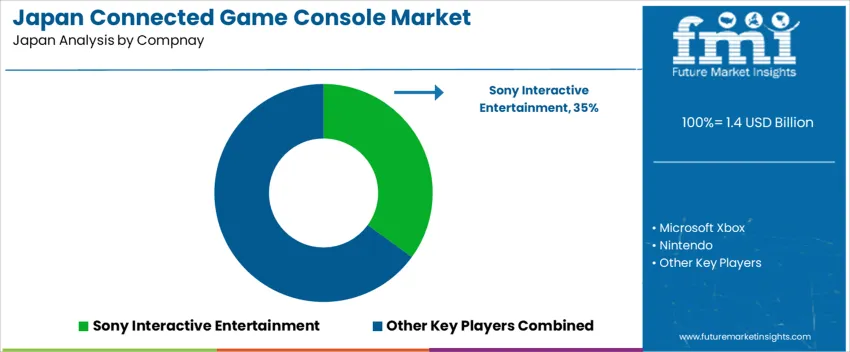

The demand for connected game consoles in Japan is projected to grow from USD 1.4 billion in 2025 to USD 4.0 billion by 2035, driven by a compound annual growth rate (CAGR) of 11.3%. The increasing popularity of online gaming, coupled with advancements in gaming technology, is driving significant growth in the demand for connected game consoles. Consumers are increasingly attracted to features such as multiplayer capabilities, downloadable content, and cloud gaming services, which are reshaping the gaming experience. With the integration of these consoles into smart home ecosystems and their compatibility with other connected devices, demand for connected game consoles is set to expand.

The growing adoption of 5G technology in Japan is expected to further accelerate demand for connected gaming. High-speed internet will enable seamless cloud gaming experiences, making connected consoles even more appealing to both casual and hardcore gamers. The growing focus on immersive experiences, including virtual reality (VR) and augmented reality (AR), will contribute to the demand for next-generation gaming consoles that offer enhanced graphics, interactivity, and connectivity.

The rise of eSports and online gaming communities in Japan is another major driver. With more gamers engaging in multiplayer online games and competitive tournaments, the demand for high-performance, connected game consoles that support these experiences is increasing. The broader availability of game streaming services, including those offering access to entire libraries of games, will continue to fuel the adoption of connected game consoles.

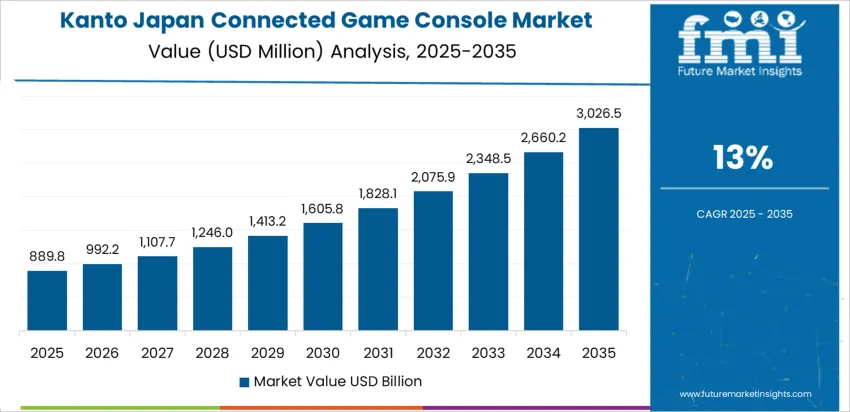

From 2025 to 2030, demand for connected game consoles in Japan is expected to grow from USD 1.4 billion to USD 2.6 billion, contributing USD 1.2 billion in value. This phase will see significant growth, driven by increasing consumer interest in connected gaming platforms and the rise of cloud gaming. The integration of game consoles into home entertainment systems and the wider adoption of 5G will further stimulate demand. As online gaming becomes more mainstream, consumers will seek consoles that provide seamless connectivity, multiplayer options, and access to vast gaming libraries.

From 2030 to 2035, the demand will continue to grow from USD 2.6 billion to USD 4.0 billion, contributing USD 1.4 billion in value. While growth will slow somewhat as the industry matures, the continued rise of immersive gaming technologies such as VR and AR, coupled with the sustained popularity of eSports and streaming services, will drive steady demand. The evolving gaming landscape, with innovations in gaming experiences and continued advancements in console technology, will ensure that demand for connected game consoles remains strong throughout this period. Despite the maturation of the industry, ongoing consumer interest in high-quality gaming experiences will support consistent growth.

| Metric | Value |

|---|---|

| Demand for Connected Game Console in Japan Value (2025) | USD 1.4 billion |

| Demand for Connected Game Console in Japan Forecast Value (2035) | USD 4.0 billion |

| Demand for Connected Game Console in Japan Forecast CAGR (2025-2035) | 11.3% |

The demand for connected game consoles in Japan is growing as the gaming industry continues to evolve with advancements in internet connectivity, cloud gaming, and immersive digital experiences. Connected game consoles allow users to access online multiplayer games, streaming services, and downloadable content, providing a more interactive and versatile gaming experience. The shift toward digital entertainment, particularly within the gaming community, is significantly contributing to the rise in demand for these consoles.

A major driver of this growth is the increasing adoption of digital gaming and cloud services, which allow gamers to access a wide variety of games and content without the need for physical media. The growing popularity of subscription-based gaming services, such as Xbox Game Pass and PlayStation Plus, has created a shift in the way consumers interact with games, driving the demand for consoles that support online features and connectivity. As gamers increasingly prioritize seamless, connected experiences, the demand for connected game consoles is expected to continue expanding.

The growing interest in esports, streaming platforms, and multiplayer online games in Japan is contributing to the rise of connected game consoles. These consoles offer enhanced online features such as live streaming, social connectivity, and cross-platform play, which are crucial for esports and gaming enthusiasts. With continued advancements in gaming technology and internet speeds, the demand for connected game consoles in Japan is projected to grow rapidly through 2035.

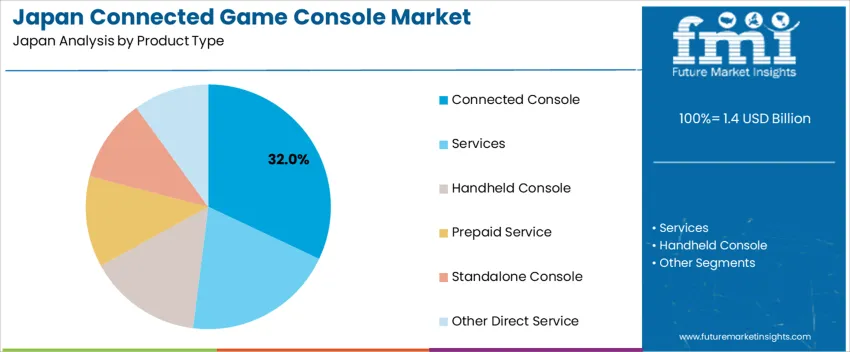

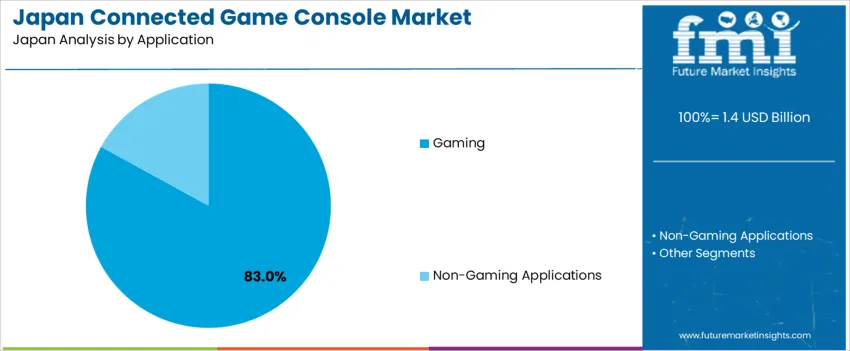

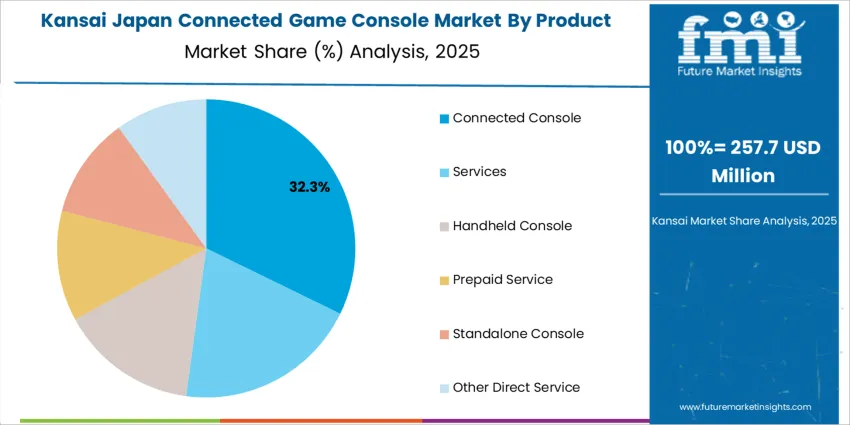

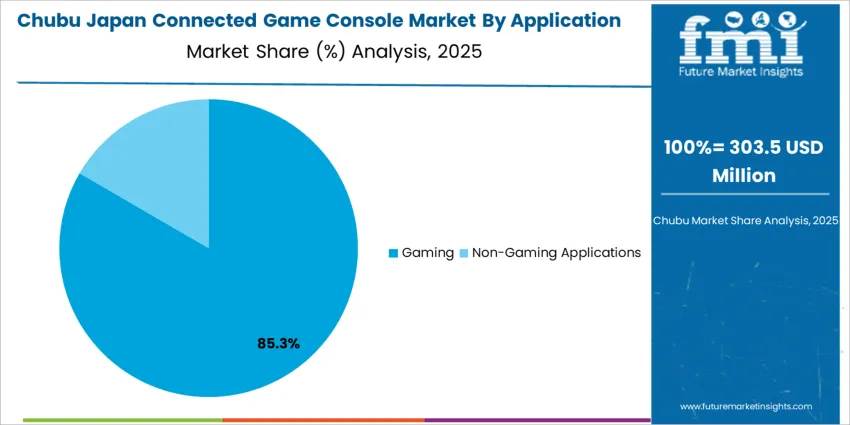

Demand for connected game consoles in Japan is segmented by product type, application, and region. By product type, demand is divided into connected consoles, services, handheld consoles, prepaid services, standalone consoles, and other direct services, with connected consoles holding the largest share at 32%. The demand is also segmented by application, including gaming and non-gaming applications, with gaming leading at 83%. Regionally, demand is spread across Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, and the Rest of Japan.

Connected consoles account for 32% of the demand for game consoles in Japan, primarily due to their ability to provide online connectivity, digital content access, and multiplayer experiences. These consoles enable gamers to connect to the internet for game downloads, streaming services, and social interaction, which has become an integral part of modern gaming. The growing demand for interactive and online gaming experiences, including online multiplayer modes and downloadable content, has driven the popularity of connected consoles. As digital content consumption and gaming communities expand, connected consoles are essential for accessing the latest games, updates, and services. With Japan's strong gaming culture and the increasing integration of online features in gaming, the demand for connected consoles continues to rise, solidifying their position as the dominant product type in the industry.

Gaming accounts for 83% of the demand for connected game consoles in Japan, reflecting the nation's strong gaming culture and high participation in both casual and competitive gaming. The demand is driven by the popularity of video game titles, online multiplayer gaming, and the increasing availability of digital content. Connected consoles provide seamless access to a vast library of games and gaming services, allowing players to engage in immersive experiences and connect with other gamers worldwide. The increasing availability of subscription-based services, such as game streaming and cloud gaming, further fuels the demand for connected consoles. Japan's gaming industry continues to evolve with the rise of eSports and mobile gaming, pushing the demand for consoles that can support both traditional gaming and online multiplayer platforms. The dominance of gaming applications ensures that connected game consoles remain at the forefront of the industry.

Japanese consumers show strong interest in immersive entertainment, and connected consoles enable access to streaming platforms, downloadable games, subscription services, and continuous software updates. Growth in esports, demand for high-performance graphics, and expanding gaming communities further encourage adoption. The shift toward digital gaming rather than disc-based models also supports demand for consoles that stay connected to online networks. High device prices, recurring subscription costs, and competition from mobile gaming and PC gaming can act as restraints, especially for younger or cost-conscious users.

Why is Demand for Connected Game Consoles Growing in Japan?

Demand for connected game consoles is growing as players increasingly value gaming experiences that go beyond single-player or offline play. Japanese gamers are highly engaged in online multiplayer modes, downloadable content, digital libraries, and cross-platform gaming, making connectivity a core expectation. Cloud-based content updates and subscription services allow access to vast game catalogs without physical storage, adding convenience and value. The popularity of esports and competitive gaming communities also promotes higher adoption of connected consoles to enable online team play and communication. Connected consoles support streaming entertainment, making them multifunctional home entertainment hubs, which further encourages purchase decisions among families and young adults.

How are Technological & Industry Innovations Driving Connected Game Console Demand in Japan?

Technological advancements are significantly boosting demand for connected game consoles in Japan. New-generation consoles offer enhanced graphics, faster processing, and smoother gameplay through high-speed internet connectivity. Features like cloud gaming, cross-platform play, virtual reality compatibility, and AI-driven performance optimization elevate the gaming experience. Subscription-based gaming services offer unlimited game libraries, making consoles more accessible to players who prefer digital ownership. Ongoing system updates and downloadable expansions extend the life cycle of consoles and games, ensuring long-term engagement. These innovations bridge social, competitive, and entertainment experiences, making connected consoles an appealing choice for both casual and dedicated gamers in Japan.

What are the Key Challenges and Risks That Could Limit Connected Game Console Demand in Japan?

Some challenges could impact long-term demand for connected game consoles in Japan. High upfront pricing for new-generation consoles and recurring subscription fees for online gaming services or digital libraries may discourage adoption among price-sensitive consumers. Strong competition from mobile gaming and PC gaming which often require lower cost investment may also divert players away from consoles. Reliable high-speed internet is essential for smooth online gaming, and inconsistent connectivity in certain regions can affect user experience. Concerns regarding data privacy, account hacking, and gaming addiction may also impact household purchasing decisions. Supply shortages or long product life cycles can slow replacement demand, affecting overall growth.

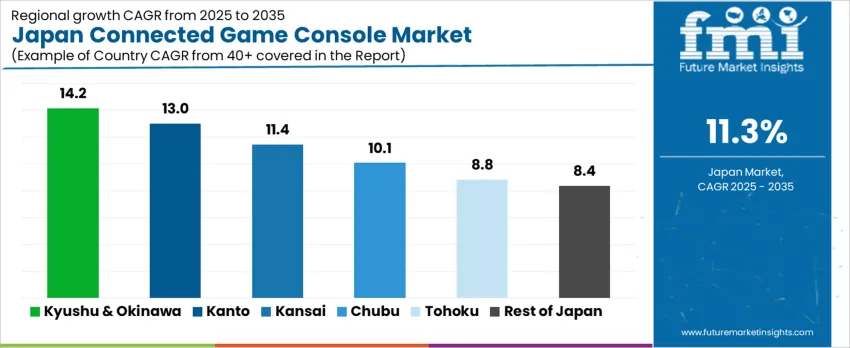

| Region | CAGR (%) |

|---|---|

| Kyushu & Okinawa | 14.2% |

| Kanto | 13.0% |

| Kansai | 11.4% |

| Chubu | 10.1% |

| Tohoku | 8.8% |

| Rest of Japan | 8.4% |

Demand for connected game consoles in Japan is growing rapidly, with Kyushu & Okinawa leading at a 14.2% CAGR, driven by the region’s growing interest in digital entertainment and gaming events. Kanto follows at a 13.0% CAGR, supported by its large urban population and thriving gaming culture. Kansai shows a steady 11.4% CAGR, driven by the region’s strong retail sector and expanding esports industry. Chubu experiences a 10.1% CAGR, fueled by the region’s increasing adoption of gaming consoles in both urban and suburban areas. Tohoku and the Rest of Japan show moderate growth at 8.8% and 8.4% CAGR, respectively, with growing local interest in gaming and expanding access to gaming platforms.

Kyushu & Okinawa leads the demand for connected game consoles, with a 14.2% CAGR. This growth is largely driven by the region’s increasing interest in digital entertainment and the expansion of gaming communities. The younger population in Kyushu & Okinawa, along with a growing number of tourists seeking gaming-related experiences, is contributing significantly to the rise in demand for connected consoles. Large-scale gaming events, local tournaments, and the increasing availability of multiplayer online games are fueling this growth. As e-commerce platforms continue to expand in the region, more consumers are gaining access to the latest gaming technology, further driving demand. The region’s growing emphasis on sustainable living and eco-friendly packaging is reflected in the increasing preference for energy-efficient gaming consoles. As gaming becomes more integrated into everyday entertainment, the demand for connected consoles in Kyushu & Okinawa is expected to continue its rapid expansion.

Kanto is experiencing steady demand for connected game consoles, growing at a 13.0% CAGR. The region's large population, particularly in Tokyo, is a major factor driving the demand. Kanto is a hub for both casual and competitive gaming, with many gamers seeking high-performance consoles for immersive experiences and online multiplayer gaming. The high concentration of event venues, gaming stores, and e-commerce platforms in Kanto further supports the industry growth. Tokyo’s reputation as a global center for technology and innovation fosters demand for connected consoles with the latest features, such as 4K resolution and cloud gaming capabilities. As more households adopt connected devices for entertainment, gaming is becoming a more prominent activity in urban areas. The rise in gaming content, digital subscriptions, and virtual reality experiences is further contributing to demand. As Kanto’s gaming culture continues to thrive, demand for connected game consoles will remain strong.

Kansai is seeing steady demand for connected game consoles, growing at an 11.4% CAGR. The region’s growing gaming community, particularly in cities like Osaka, drives demand for connected consoles as more consumers seek interactive and multiplayer experiences. Kansai’s strong retail sector, including gaming stores and e-commerce platforms, ensures widespread availability of connected game consoles. The region is also home to many tech enthusiasts and young families, contributing to the increasing adoption of gaming consoles for home entertainment. Kansai’s focus on providing high-quality entertainment experiences, coupled with the popularity of esports tournaments and local gaming events, is further propelling demand for consoles. The increasing availability of online multiplayer games and digital subscriptions is also influencing growth in demand for connected consoles. As the region's gaming culture becomes more diverse and mainstream, the demand for connected game consoles is expected to continue to rise steadily.

Chubu is experiencing steady demand for connected game consoles, with a 10.1% CAGR. The region’s expanding industrial base, including large cities like Nagoya, is contributing to the rise in demand for gaming consoles. As gaming has become an increasingly popular form of entertainment, more consumers in Chubu are opting for connected consoles for immersive gaming experiences, particularly in multiplayer and online formats. The rise of digital content platforms, combined with Chubu’s growing interest in esports, is driving the adoption of connected game consoles. The region’s growing e-commerce presence ensures that consumers have easier access to the latest gaming technology. Chubu’s strong logistics and distribution networks also facilitate quick delivery and availability of game consoles in both urban and suburban areas. As the region continues to embrace digital entertainment and online gaming culture, demand for connected game consoles will remain robust and continue its steady growth.

Tohoku is seeing moderate demand for connected game consoles, with an 8.8% CAGR. The region's smaller but growing gaming community, especially among younger generations, contributes to this rise in demand. As local interest in gaming increases, more consumers in Tohoku are adopting connected game consoles for both casual and competitive play. The region’s growing access to e-commerce platforms and retail stores selling game consoles makes it easier for consumers to purchase and experience the latest gaming technology. The rise of gaming-related events and tournaments in Tohoku is helping to expand the local gaming scene. As broadband infrastructure improves, the demand for connected consoles, particularly for online multiplayer experiences, is also increasing. While demand in Tohoku is growing more slowly compared to other regions, it is expected to rise steadily as the region’s gaming culture becomes more integrated into the entertainment landscape.

The Rest of Japan is experiencing steady demand for connected game consoles, with an 8.4% CAGR. Although the industry is smaller compared to major urban regions, the rise in local gaming interest and the increasing availability of consoles in rural areas is contributing to this demand. Consumers in smaller cities and towns are embracing gaming as a form of entertainment, driving the need for connected consoles. The expansion of broadband internet and digital gaming content availability in the Rest of Japan is also facilitating this growth. The region’s interest in esports and online gaming experiences is further encouraging adoption. As more families and individuals in rural and suburban areas discover the benefits of connected gaming, demand for consoles will continue to rise steadily. Local retailers and e-commerce platforms are playing a significant role in making these products accessible, ensuring consistent growth in demand.

The demand for connected game consoles in Japan is growing as gaming continues to be a dominant form of entertainment, particularly with the increasing popularity of online gaming, cloud gaming services, and multiplayer experiences. The integration of connected consoles with digital ecosystems, allowing seamless access to games, updates, and social interaction, is a major factor driving industry growth. As Japan's gaming culture remains one of the most vibrant globally, the competition among connected game consoles is intensifying, with companies striving to provide immersive and high-quality gaming experiences.

Leading companies in the connected game console industry in Japan include Sony Interactive Entertainment, Microsoft Xbox, Nintendo, Google Stadia, and NVIDIA GeForce Now. Sony Interactive Entertainment holds the largest industry share of 35.0%, offering the PlayStation consoles, known for their robust online services, exclusive games, and superior graphics. Microsoft Xbox is a close competitor, offering powerful consoles with cloud gaming integration and a wide array of games available through its Game Pass service. Nintendo remains a major player with its unique hybrid console, the Switch, known for its versatility and extensive game library.

Google Stadia and NVIDIA GeForce Now offer cloud-based gaming services, allowing users to play without the need for dedicated hardware, thus appealing to those seeking flexibility and convenience. Competition in the connected game console industry is driven by factors such as exclusive game content, gaming performance, online services, and the integration of cloud gaming. Companies compete by offering enhanced gaming experiences, faster load times, superior graphics, and unique multiplayer features.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Connected Console, Services, Handheld Console, Prepaid Service, Standalone Console, Other Direct Service |

| Application | Gaming, Non-Gaming Applications |

| Region | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Countries Covered | Japan |

| Key Companies Profiled | Sony Interactive Entertainment, Microsoft Xbox, Nintendo, Google Stadia, NVIDIA GeForce Now |

| Additional Attributes | Dollar sales by product type and application; regional CAGR and adoption trends; demand trends in connected game consoles; growth in gaming and non-gaming applications; technology adoption for connected and handheld consoles; vendor offerings including prepaid services and standalone consoles; regulatory influences and industry standards |

The demand for connected game console in Japan is estimated to be valued at USD 1.4 billion in 2025.

The market size for the connected game console in Japan is projected to reach USD 4.0 billion by 2035.

The demand for connected game console in Japan is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in connected game console in Japan are connected console, services, handheld console, prepaid service, standalone console and other direct service.

In terms of application, gaming segment is expected to command 83.0% share in the connected game console in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Connected Game Console Market Analysis by Product Type, Application, and Region through 2035

Game Consoles Market Size and Share Forecast Outlook 2025 to 2035

Japan Connected TV Market Growth – Demand, Trends & Forecast 2025-2035

Game IP Licensed Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Connected Sensors Market Size and Share Forecast Outlook 2025 to 2035

Connected Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Game Creation Service Platform Market Size and Share Forecast Outlook 2025 to 2035

Connected RHM (Remote Healthcare Monitoring) Market Size and Share Forecast Outlook 2025 to 2035

Connected Aircraft Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Connected Packaging Market Size and Share Forecast Outlook 2025 to 2035

Connected Living Room Market Size and Share Forecast Outlook 2025 to 2035

Connected Toys Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA