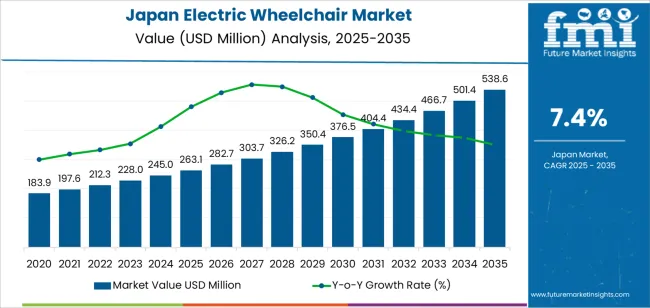

The Japan electric wheelchair demand is valued at USD 263.1 million in 2025 and is forecast to reach USD 538.6 million by 2035, reflecting a CAGR of 7.4%. Demand is shaped by increased utilisation of powered mobility devices among ageing individuals, patients with neuromuscular conditions, and users requiring long-term mobility assistance. Expanded reimbursement support, adoption of assistive technologies in home-care settings, and continued upgrades in rehabilitation infrastructure add further momentum. Rising prioritisation of user comfort, manoeuvrability, and accessibility within residential and community environments also influences product selection.

Rear-wheel-drive systems lead the product landscape. These devices are selected for stable outdoor performance, predictable handling, and suitability for users who require consistent traction on varied surfaces. Improvements in battery efficiency, motor torque, ergonomic seating, and control-interface design continue to support adoption across rehabilitation centres and home-care programmes.

Kyushu & Okinawa, Kanto, and Kinki record the highest utilisation levels due to the concentration of hospitals, rehabilitation clinics, and long-term care facilities. These regions also maintain strong distribution networks for powered mobility equipment and related service providers. Key suppliers include Invacare Corporation, Permobil AB, Pride Mobility Products, Sunrise Medical LLC, and Drive DeVilbiss Healthcare. These companies provide rear-wheel-drive, mid-wheel-drive, and front-wheel-drive models with clinical seating configurations used in rehabilitation and assistive-mobility applications.

The acceleration and deceleration pattern shows a strong early-phase rise between 2025 and 2029, supported by growing mobility needs in an ageing population and steady adoption of compact, indoor-outdoor electric models. Hospitals, rehabilitation centres, and assisted-living facilities will expand procurement as users shift from manual chairs to powered mobility solutions. Improvements in battery efficiency, mid-wheel drive stability, and lightweight frame designs will contribute to this early acceleration.

From 2030 to 2035, the segment moves into a moderated deceleration phase as adoption becomes more uniform across care settings and annual purchasing aligns with predictable replacement cycles. Growth remains positive but steadier, guided by incremental upgrades in navigation controls, suspension systems, and ergonomic seating rather than broad increases in user volumes. Home-based mobility programs and public-accessibility initiatives will sustain baseline demand without generating rapid surges. The pattern reflects a transition from early adoption driven by demographic and clinical needs to a mature phase shaped by lifecycle management and stable utilisation across Japan’s mobility-assistive ecosystem.

| Metric | Value |

|---|---|

| Japan Electric Wheelchair Sales Value (2025) | USD 263.1 million |

| Japan Electric Wheelchair Forecast Value (2035) | USD 538.6 million |

| Japan Electric Wheelchair Forecast CAGR (2025-2035) | 7.4% |

Demand for electric wheelchairs in the USA is growing because an ageing population and rising incidence of mobility-related disabilities increase the need for powered mobility solutions. Home-care settings and rehabilitation centres prioritise devices that enhance independence, provide intuitive controls and integrate with smart home technologies. Technological advances such as improved battery performance, compact designs and connected health features allow users and caregivers to manage mobility more efficiently.

Insurance coverage, government subsidies and evolving healthcare policy support acquisition of advanced mobility devices. Lifestyle expectations for greater mobility and inclusivity in public and private spaces also influence growth. Constraints include high purchase cost and maintenance requirements for electric wheelchairs, complex regulatory and reimbursement environments and distribution challenges linked to customised fitting and post-sales support. Some users may choose manual wheelchairs or delay acquisition until mobility needs intensify or support becomes available.

Demand for electric wheelchairs in Japan reflects mobility needs associated with ageing populations, disability support, rehabilitation, and extended home-care requirements. Product-type preferences vary by manoeuvrability, terrain handling, and seating configuration. End-user distribution reflects how medical institutions, home-care environments, and specialised sports programs integrate electric mobility devices into daily support and rehabilitation workflows.

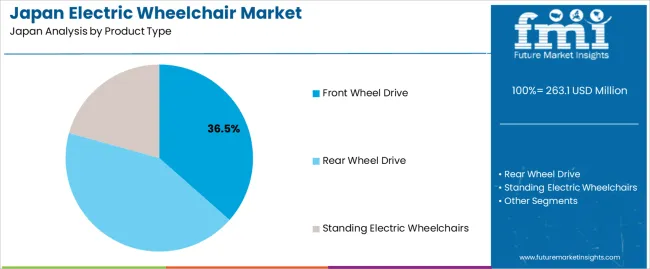

Rear-wheel-drive electric wheelchairs hold 42.8% of national demand and represent the leading product-type category in Japan. Their stability, straight-line control, and suitability for outdoor surfaces make them preferred for users requiring predictable handling across varied environments. Front-wheel-drive systems represent 36.5%, supporting tighter turning radii and improved indoor navigation in homes, clinics, and care facilities.

Standing electric wheelchairs hold 20.7%, serving users who require assisted standing for circulation support, functional reach, and clinical rehabilitation. Product-type distribution reflects differences in turning performance, centre-of-gravity design, and therapeutic requirements across users with mobility impairment. Each configuration supports specific clinical goals, daily routines, and independence levels within both residential and institutional care systems.

Key drivers and attributes:

Hospitals and clinics hold 46.2% of national demand and form the largest end-user segment. These facilities use electric wheelchairs for inpatient mobility support, post-surgical rehabilitation, and assisted movement during diagnostic or therapeutic visits. Home-care settings represent 41.5%, reflecting Japan’s ageing demographic and widespread in-home management of chronic mobility limitations. Users rely on electric wheelchairs for daily movement, personal independence, and ongoing home-based rehabilitation. Sports conditioning accounts for 12.3%, supporting adaptive sports programs, conditioning routines, and therapeutic training. End-user distribution reflects differences in care intensity, rehabilitation frequency, and support needs across medical facilities, households, and specialised activity environments.

Key drivers and attributes:

Japan’s rapidly aging society means that the number of individuals with reduced mobility and longer lifespans is increasing. This demographic shift creates a larger base of potential users for electric wheelchairs as independence and mobility become more central to quality of life. Advances in home-care services, outpatient rehabilitation, and long-term care facilities support industry uptake of powered mobility devices suited for both indoors and outdoors. Technological improvements, such as lighter batteries, joystick controls, compact frames for narrow Japanese living spaces, and improved safety features, enhance the attractiveness of electric wheelchairs to both users and caregivers.

Electric wheelchairs command significantly higher prices than manual models due to motors, batteries and control systems. This may limit access for users with limited budgets unless subsidies or reimbursements are available. Although Japan has supportive disability and elderly-care policies, eligibility for subsidies or insurance coverage may remain restrictive, slowing adoption for some users. In dense urban environments and older homes, space for manoeuvring, storage and charging of powered wheelchairs can be limited, which may reduce use in certain residential settings. Social and cultural factors such as reluctance to adopt visible devices may further moderate growth.

Manufacturers are designing electric wheelchairs tailored for Japanese users, including narrow-width models, lightweight folding frames, and improved indoor/outdoor transition capabilities, which align with urban living and apartment layouts. Smart features, such as Bluetooth connectivity, usage tracking, battery-monitoring apps and terrain-adaptation controls are gaining adoption, supporting premium device segments. Growth in retail and online distribution channels for assisted-mobility devices means users can access more models, accessories and service options, including rentals and subscription services. These developments contribute to continued, though moderate, expansion of the electric-wheelchair industry in Japan.

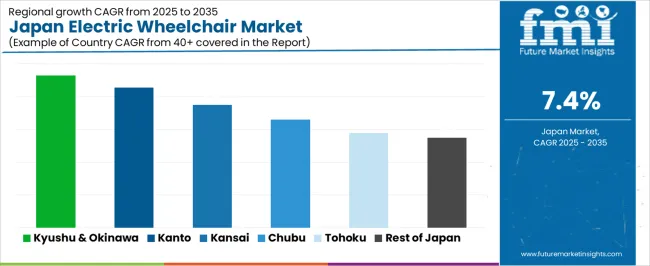

Demand for electric wheelchairs in Japan is rising through 2035 as hospitals, rehabilitation centers, home-care networks, and mobility-equipment distributors expand support for aging adults and individuals with chronic mobility limitations. Electric wheelchairs are used for independent indoor movement, community mobility, and long-term functional assistance across elderly-care facilities and home settings. Growth is shaped by demographic aging, increased orthopedic and neurological conditions, and expanding insurance-supported assistive-device programs. Regional variations reflect rehabilitation-facility density, home-care service availability, and welfare-equipment distribution networks. Kyushu & Okinawa leads with a 9.3% CAGR, followed by Kanto (8.5%), Kinki (7.5%), Chubu (6.6%), Tohoku (5.8%), and the Rest of Japan (5.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 9.3% |

| Kanto | 8.5% |

| Kinki | 7.5% |

| Chubu | 6.6% |

| Tohoku | 5.8% |

| Rest of Japan | 5.5% |

Kyushu & Okinawa grows at 9.3% CAGR, supported by strong usage across elderly-care centers, orthopedic clinics, public hospitals, and long-term rehabilitation facilities in Fukuoka, Kagoshima, Kumamoto, and Okinawa’s island regions. Many patients require electric wheelchairs for chronic mobility challenges linked to stroke recovery, degenerative joint conditions, and neurological disorders.

Home-care agencies supply powered wheelchairs for community mobility, while rehabilitation therapists provide device-fitting, seating assessment, and mobility-training services. Municipal welfare programs support equipment rental and periodic replacement. Island communities depend on electric wheelchairs for accessible transportation across compact urban and residential areas. Consistent clinical demand and high aging rates reinforce continuous adoption.

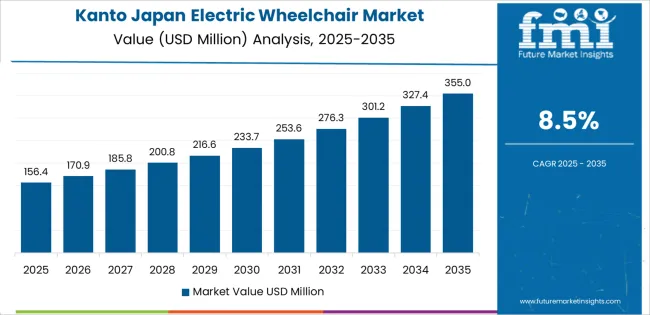

Kanto grows at 8.5% CAGR, driven by the country’s largest concentration of hospitals, specialty clinics, long-term care centers, and welfare-equipment distributors in Tokyo, Kanagawa, Saitama, and Chiba. Rehabilitation facilities prescribe electric wheelchairs for severe mobility restrictions requiring powered seating systems and postural support. Hospitals treat high volumes of stroke, spinal injury, and musculoskeletal cases requiring long-term mobility assistance. Home-care providers integrate powered wheelchairs into care plans for elderly patients living independently. Retailers maintain large inventories of adjustable, indoor-outdoor, and transportable powered wheelchairs. Dense urban populations and extensive support services ensure steady long-term demand.

Kinki grows at 7.5% CAGR, supported by regular adoption across hospitals, rehabilitation centers, and elderly-care facilities in Osaka, Kyoto, and Hyogo. Clinics recommend electric wheelchairs for individuals with chronic lower-limb weakness, neurological disorders, or age-related functional decline. Rehabilitation centers perform seating assessments and mobility training for patients transitioning from inpatient care to home settings. Assisted-living facilities rely on powered wheelchairs to support residents with limited ambulation. Public-welfare programs help subsidize equipment access, increasing usage among older adults. Moderate hospital density and stable treatment volumes ensure ongoing demand across the region.

Chubu grows at 6.6% CAGR, supported by balanced demand across Aichi, Shizuoka, and Mie. Rehabilitation hospitals prescribe powered wheelchairs for patients with progressive mobility loss. Clinics rely on diagnostic and assessment tools to determine seating needs and mobility-range requirements. Industrial-region populations with orthopedic injuries contribute additional usage. Home-care providers use electric wheelchairs for elderly individuals requiring safe indoor movement. Retail mobility-equipment suppliers maintain diverse inventories of standard powered wheelchairs and compact travel models. Although population density is moderate, essential long-term care needs sustain consistent growth across the region.

Tohoku grows at 5.8% CAGR, supported by regional hospitals, rehabilitation centers, and elderly-care facilities in Miyagi, Fukushima, and Iwate. Facilities prescribe electric wheelchairs for chronic mobility impairment caused by stroke, musculoskeletal degeneration, and long-term neurological disease. Community clinics rely on powered chairs for patients with limited ambulation requiring regular outpatient visits. Rural settings benefit from powered wheelchairs that enable mobility across dispersed communities. Welfare-equipment rental programs support access despite lower population density. Stable aging trends sustain recurring use of powered mobility devices.

The Rest of Japan grows at 5.5% CAGR, supported by small hospitals, community clinics, home-care agencies, and elderly-care facilities in rural and semi-rural prefectures. Electric wheelchairs provide essential mobility support for elderly patients with chronic functional limitations. Clinics use electric wheelchairs to support individuals with long-term musculoskeletal and neurological disorders. Welfare-equipment suppliers maintain essential inventories of basic powered wheelchairs despite lower volume. Rural communities rely heavily on electric wheelchairs for accessible mobility across long distances and varied terrain.

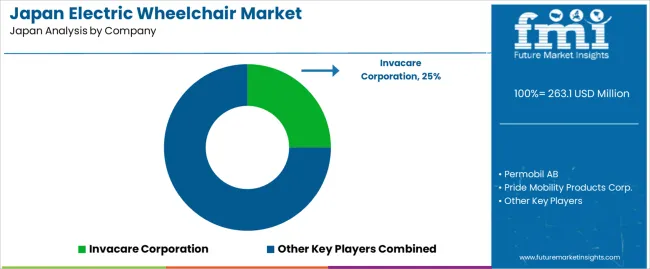

Demand for electric wheelchairs in Japan is shaped by a concentrated group of mobility-equipment manufacturers supporting home-care users, rehabilitation centres, and long-term-care facilities. Invacare Corporation holds the leading position with an estimated 25.0% share, supported by controlled engineering standards, stable motor performance, and long-standing distribution across Japan’s clinical and home-care networks. Its position is reinforced by predictable battery reliability and consistent manoeuvrability in indoor and outdoor settings.

Permobil AB and Pride Mobility Products Corp. follow as major participants, offering advanced mid-wheel and rear-wheel drive systems suited to users with complex mobility requirements. Their strengths include dependable suspension systems, controlled turning dynamics, and broad compatibility with seating and positioning components used in rehabilitation programmes. Sunrise Medical LLC maintains a significant presence through compact and transport-friendly electric wheelchairs used widely in community and home environments, emphasising stable frame construction and consistent driving efficiency. Drive DeVilbiss Healthcare contributes additional capability with cost-efficient models serving long-term-care providers and home-care users seeking reliable daily-use mobility solutions.

Competition across this segment centers on motor efficiency, battery endurance, seating adaptability, indoor manoeuvrability, outdoor stability, and long-term maintenance reliability. Demand remains steady due to Japan’s aging population, growing emphasis on home-based care, and continued adoption of powered mobility systems that support safe, reliable movement for individuals with reduced lower-limb function across diverse residential and community settings.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Front Wheel Drive, Rear Wheel Drive, Standing Electric Wheelchairs |

| End Users | Hospitals & Clinics, Home Care, Sports Conditioning |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Invacare Corporation, Permobil AB, Pride Mobility Products Corp., Sunrise Medical LLC, Drive DeVilbiss Healthcare |

| Additional Attributes | Dollar sales by product type and end-user categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of powered mobility device manufacturers; advancements in compact indoor models, all-terrain drive systems, battery efficiency, and posture-support standing wheelchairs; integration with hospital rehabilitation units, elderly home care, and adaptive sports programs in Japan. |

The global demand for electric wheelchair in japan is estimated to be valued at USD 263.1 million in 2025.

The market size for the demand for electric wheelchair in japan is projected to reach USD 538.6 million by 2035.

The demand for electric wheelchair in japan is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in demand for electric wheelchair in japan are front wheel drive, rear wheel drive and standing electric wheelchairs.

In terms of end users, hospitals & clinics segment to command 46.2% share in the demand for electric wheelchair in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA