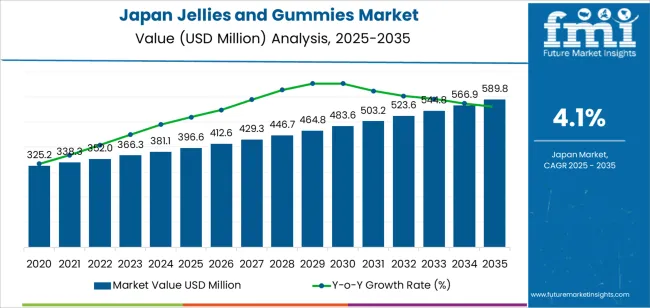

The Japan jellies and gummies demand is valued at USD 396.6 million in 2025 and is expected to reach USD 589.8 million by 2035, growing at a CAGR of 4.1%. Demand is supported by steady confectionery consumption, strong preference for chewy fruit-based snacks, and continued product innovation across flavor, texture, and functional formulations. Gummies remain popular among children and adults, driven by convenience, portion control, and broad distribution across supermarkets, convenience stores, and online channels.

Fruit-based products represent the leading segment due to their clean flavor profile, use of natural fruit concentrates, and compatibility with Japan’s preference for subtle sweetness and soft textures. These products align well with regional tastes and support premium and seasonal launches that rely on domestic fruit varieties. Expanding development of functional gummies, including vitamin-infused and fiber-enhanced formats, is adding momentum to the category.

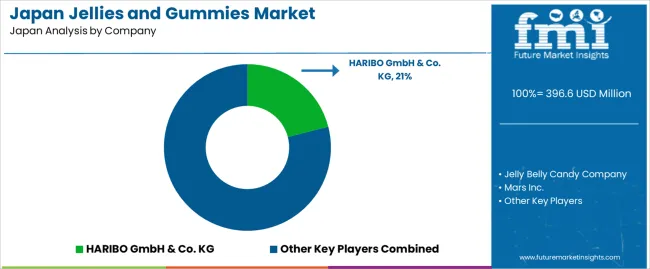

Demand is strongest in Kyushu & Okinawa, Kanto, and Kinki, supported by high retail density, diversified consumer demographics, and strong sales of packaged confectionery goods. Major players active in Japan include HARIBO GmbH & Co. KG, Jelly Belly Candy Company, Mars Inc., Mondelēz Global LLC, and Perfetti Van Melle Group B.V., focusing on flavor range, textural consistency, and product-line expansion.

Year-on-year growth analysis indicates a stable pattern shaped by steady confectionery consumption and the popularity of texture-focused products in the Japanese industry. Between 2025 and 2028, YoY growth will remain close to the long-term average as manufacturers expand flavor varieties, functional formulations, and portion-controlled packs. Consistent retail distribution across convenience stores and supermarkets will support predictable annual gains.

From 2029 to 2032, YoY growth may show minor variation due to price adjustments linked to gelatin, pectin, and sugar inputs, as well as shifts in consumer spending during economic cycles. Despite these changes, regular demand for gummies as impulse purchases and everyday snacks will maintain a steady baseline. Between 2033 and 2035, YoY growth is expected to stabilize as product lines mature and innovation centers on reformulation, reduced-sugar variants, and premium fruit-based offerings. The YoY pattern reflects a resilient confectionery category influenced by steady consumption habits, incremental product updates, and broad availability across national retail channels.

| Metric | Value |

|---|---|

| Japan Jellies and Gummies Sales Value (2025) | USD 396.6 million |

| Japan Jellies and Gummies Forecast Value (2035) | USD 589.8 million |

| Japan Jellies and Gummies Forecast CAGR (2025 to 2035) | 4.1% |

The demand for jellies and gummies in Japan is increasing as Japanese consumers show strong interest in confectionery items that combine taste with added value such as vitamins, minerals or functional ingredients. The ageing population and greater focus on health and wellness motivate adop tion of gummy vitamins and fortified jellies. Generational shifts and urban lifestyles support regular snack consumption and impulse purchases in convenience stores, supermarkets and online platforms. Manufacturers in Japan innovate with premium flavours, unique textures and attractive packaging to meet local expectations for quality and novelty.

Distribution channels including 24-hour convenience stores and e-commerce enable wide access and quick replenishment which drives frequency of purchase. The industry faces constraints such as heightened consumer sensitivity to sugar content and artificial additives, which prompts stricter regulation and reformulation efforts. Also cost inflation for raw materials and packaging may reduce margin and slow product launches. Domestic manufacturers must balance novelty and health considerations to maintain growth.

Demand for jellies and gummies in Japan is shaped by ingredient profiles, functional positioning, and demographic consumption patterns. Japanese buyers show strong interest in refined flavour balance, clean-label ingredients, and texture precision. Distribution across ingredient type, product type, and end-user groups reflects preferences for fruit-based confectionery, growing adoption of functional products, and distinct age-driven consumption patterns across retail environments.

Fruit-based jellies and gummies hold an estimated 44.0% share of demand in Japan, making them the dominant ingredient category. Their leadership stems from strong consumer preference for familiar fruit flavours, natural sweetness, and clean-label positioning. Fruit ingredients also support consistent texture and broad acceptance across retail and convenience-store channels. Vegetable-based variants account for 17.0%, serving niche buyers interested in natural colourants and plant-forward formulations. Liqueur-infused products hold 15.0%, used for adult-oriented offerings aligned with Japan’s premium gifting culture. Flowers and herbs represent 12.0%, reflecting interest in subtle botanical flavours. The remaining 12.0% includes mixed and specialty formulations found in limited-edition runs.

Key drivers and attributes:

Functional jellies and gummies account for an estimated 55.0% share of Japanese demand. Their growth is tied to rising interest in vitamin-enriched, collagen-based, probiotic, and fibre-enhanced formulations, which integrate confectionery format with wellness positioning. Functional products appeal to young adults and older consumers seeking convenient intake without tablet-style supplements. Traditional jellies and gummies hold 45.0%, driven by steady sales in supermarkets, convenience stores, and seasonal assortments. Their growth is slower due to competition from functional formulations that combine flavour variety with health-aligned claims appealing to lifestyle-conscious consumers.

Key drivers and attributes:

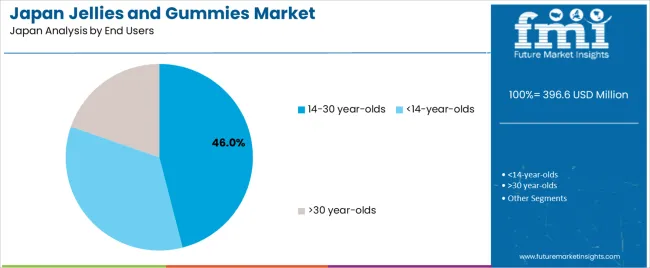

Consumers aged 14-30 years hold an estimated 46.0% share of demand in Japan, making them the leading user group. This demographic shows strong interest in novelty flavours, functional gummies, and products featuring premium textures. <14-year-olds account for 30.0%, driven by demand for fruit-flavoured and character-based assortments common in convenience and mass retail formats. Consumers aged >30 years represent 24.0%, supported by interest in functional gummies that incorporate collagen, vitamins, or soothing botanical blends. Consumption patterns reflect Japan’s preference for compact, flavour-balanced confectionery suited to quick, portion-controlled intake.

Key drivers and attributes:

Rising demand for convenient snacks, growth in functional confectionery, and strong appeal across age groups are driving consumption.

Demand for jellies and gummies in Japan is increasing as consumers seek portable and easy-to-consume treats suited to commuting, school, and workplace routines. Convenience stores and vending machines support steady purchases by offering a wide range of flavors, textures, and portion sizes. Functional gummies containing vitamins, collagen, or dietary ingredients are gaining popularity among adults who prefer confectionery formats that combine taste with perceived wellness benefits. Younger consumers continue to drive demand for novelty-based products that feature unique textures, layered fruit flavors, and character-themed packaging. Innovation in gelatin, pectin, and fruit-based formulations enhances product variety and strengthens category engagement across different demographic groups.

Health concerns, sugar reduction pressures, and a mature confectionery landscape are restraining faster growth.

Japanese consumers are increasingly attentive to sugar intake and calorie levels, which limits frequent purchases of traditional jellies and gummies. Brands face pressure to reformulate products while maintaining taste and texture, which increases development complexity. The confectionery sector in Japan is mature, with stable overall consumption levels and high competition from chocolate, rice-based snacks, and savory options. Regulatory requirements surrounding functional ingredients and product claims also add hurdles for companies intending to expand in the health-oriented gummy space. These conditions moderate category expansion despite stable underlying demand.

Growth in low-sugar and plant-based gummies, expanding functional formats, and wider distribution through online and specialty retail channels are shaping industry trends.

Manufacturers are introducing jellies and gummies with reduced sugar content, fruit-derived gelling agents, and natural flavor systems to meet health-conscious preferences. Functional gummies for beauty, energy, sleep support, and immune health continue to gain traction among adults seeking convenient supplement-style confectionery. Online platforms and subscription snack services are broadening access to premium and limited-edition products, which supports category experimentation. Seasonal releases, regional flavor variations, and collaborations with entertainment brands strengthen consumer interest and promote repeat purchases across the Japanese industry.

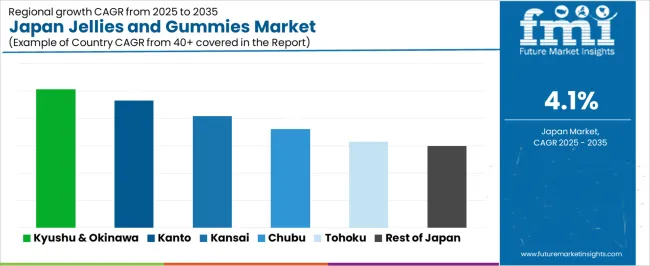

Demand for jellies and gummies in Japan is rising through 2035, supported by strong confectionery consumption, broader retail penetration, and increased product diversification across fruit-flavored, texture-variant, and reduced-sugar formats. Growth reflects regional population density, tourism activity, and distribution reach across convenience stores, supermarkets, and specialty confectionery outlets. Kyushu & Okinawa leads with a 5.1% CAGR, followed by Kanto (4.7%), Kinki (4.1%), Chubu (3.6%), Tohoku (3.2%), and the Rest of Japan (3.0%). Demand is reinforced by year-round purchasing patterns, seasonal releases, and strong household preference for soft-chew confectionery products.

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.1% |

| Kanto | 4.7% |

| Kinki | 4.1% |

| Chubu | 3.6% |

| Tohoku | 3.2% |

| Rest of Japan | 3.0% |

Kyushu & Okinawa grows at 5.1% CAGR, supported by strong retail activity, high confectionery consumption, and steady demand from tourism areas where packaged sweets remain popular. Convenience stores, supermarkets, and regional specialty shops maintain consistent turnover of fruit-flavored and assorted gummy products. Local consumers show preference for soft-chew varieties that suit warm climate conditions and diverse flavor profiles. Manufacturers supply assorted packs, seasonal flavors, and region-specific products that reinforce repeat purchases. Tourism-driven foot traffic in Okinawa and major Kyushu cities supports strong movement across gift-oriented confectionery items, expanding the regional industry for jellies and gummies.

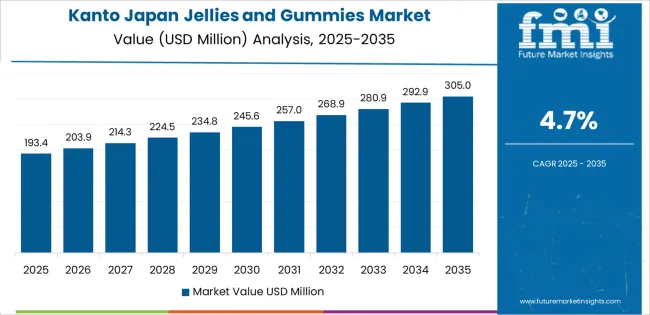

Kanto grows at 4.7% CAGR, supported by high population density, strong distribution networks, and widespread availability of gummies across convenience stores, department stores, and specialty confectionery retailers. Urban consumers in Tokyo, Kanagawa, and Chiba show steady interest in flavor-rich, texture-variant, and premium gummy assortments. Manufacturers introduce limited-edition flavors and multi-pack formats suited to high-frequency purchases. Online retail channels further strengthen demand due to fast delivery and broader assortment availability. Seasonal launches tied to holidays and promotional events support year-round category momentum across the region.

Kinki grows at 4.1% CAGR, supported by consistent confectionery consumption in Osaka, Kyoto, and Hyogo, where supermarkets and convenience stores maintain strong shelf presence for gummy and jelly products. Regional consumers prefer assorted fruit flavors, soft textures, and small-portion packs suited to frequent snacking. Tourism activity in Kyoto and other cultural centers strengthens demand for packaged confectionery items. Specialty retailers and gift shops introduce regionally themed gummy assortments, reinforcing seasonal and tourist-driven purchasing patterns. Stable retail distribution structures ensure regular turnover of mainstream and premium gummy varieties.

Chubu grows at 3.6% CAGR, supported by moderate confectionery demand across Aichi, Shizuoka, Nagano, and surrounding prefectures. Supermarkets and convenience stores maintain core distribution of classic gummy varieties, while regional specialty stores offer selected premium assortments. Demand rises during tourism seasons, particularly in mountain and coastal areas where packaged sweets remain common souvenirs. Local consumers show steady interest in soft-chew products, though growth is more gradual due to moderate population concentration and smaller retail networks compared with metropolitan regions.

Tohoku grows at 3.2% CAGR, supported by stable household consumption and steady demand for affordable packaged confectionery. Supermarkets and convenience stores in Miyagi, Fukushima, and Iwate maintain regular turnover of fruit-flavored and assorted gummies. Cooler climates encourage consumption of chewy sweets with year-round acceptance rather than strong seasonality. Tourism in hot spring destinations and scenic areas contributes to periodic increases in packaged confectionery sales. Growth remains modest due to smaller population density and limited expansion in specialty confectionery channels.

The Rest of Japan grows at 3.0% CAGR, supported by small urban centers, local supermarkets, and moderate confectionery consumption across rural prefectures. Demand is driven by core gummy varieties that appeal to family buyers and school-age consumers. Retailers maintain limited but steady assortments consisting mainly of standard flavors and small multipacks. Tourism in select rural destinations generates incremental sales of packaged sweets. Growth remains modest due to fewer specialty retail outlets and smaller population bases, yet category stability is maintained by consistent household purchasing patterns.

Demand for jellies and gummies in Japan is shaped by a group of established global confectionery producers supplying retail, convenience, and specialty channels. HARIBO GmbH & Co. KG holds the leading position with an estimated 21.0% share, supported by strong brand visibility, consistent texture profiles, and broad distribution through supermarkets and convenience chains. Its position is reinforced by dependable flavor uniformity and steady consumer preference for traditional gelatin-based gummies.

Jelly Belly Candy Company, Mars Inc., and Mondelēz Global LLC follow as notable participants, providing assorted gummies that align with established brand portfolios. Their competitive strengths include diversified flavor development, controlled ingredient quality, and placement across seasonal, premium, and impulse-purchase segments. These companies benefit from wide product rotation and established relationships with major retailers in Japan.

Perfetti Van Melle Group B.V. contributes additional breadth with gummies that emphasize balanced sweetness and familiar fruit profiles suited to Japanese consumer preferences. Its presence is supported by consistent supply and competitive positioning within mainstream confectionery assortments.

Competition across this segment centers on texture reliability, flavor accuracy, packaging convenience, and distribution reach. Demand remains steady due to sustained interest in fruit-flavored gummies, increasing availability of reduced-sugar formulations, and continued integration of gummies into everyday snacking habits across both adult and youth consumer groups.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Ingredient Type | Fruits, Vegetables, Liqueur, Flowers and Herbs, Others |

| Product Type | Functional Jellies and Gummies, Traditional Jellies and Gummies |

| End Users | <14-year-olds, 14–30 year-olds, >30 year-olds |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | HARIBO GmbH & Co. KG, Jelly Belly Candy Company, Mars Inc., Mondelēz Global LLC, Perfetti Van Melle Group B.V. |

| Additional Attributes | Dollar sales by ingredient type, product type, and end-user categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of gummy and jelly confectionery brands; developments in functional, reduced-sugar, and premium gummy formulations; integration with retail channels, convenience stores, and health-oriented confectionery trends in Japan. |

The global demand for jellies and gummies in japan is estimated to be valued at USD 396.6 million in 2025.

The market size for the demand for jellies and gummies in japan is projected to reach USD 589.8 million by 2035.

The demand for jellies and gummies in japan is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in demand for jellies and gummies in japan are fruits, vegetables, liqueur, flowers and herbs and others.

In terms of product type, functional jellies and gummies segment to command 55.0% share in the demand for jellies and gummies in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Jellies and Gummies Market Size and Share Forecast Outlook 2025 to 2035

Demand for Jellies and Gummies in USA Size and Share Forecast Outlook 2025 to 2035

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Ectoin Gummies Market Size and Share Forecast Outlook 2025 to 2035

Vitamin Gummies Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA CBD Gummies Market Trends – Growth, Demand & Innovations 2025-2035

ASEAN CBD Gummies Market Growth – Trends, Demand & Innovations 2025-2035

Europe CBD Gummies Market Insights – Size, Share & Industry Trends 2025-2035

Multivitamin Gummies Market Analysis by Source, End-user, Application, Sales Channel, Distribution Channel, and Region Through 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Dietary Fiber Gummies Market Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA