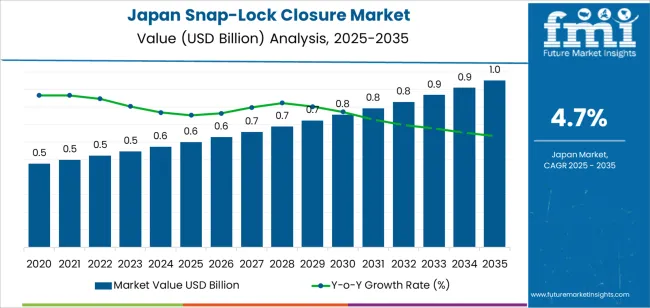

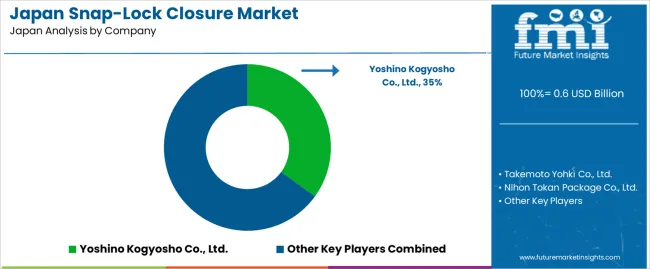

The Japan snap-lock closure demand is valued at USD 0.6 billion in 2025 and is forecasted to reach USD 1.0 billion by 2035, reflecting a CAGR of 4.7%. Demand is driven by increasing consumption of packaged food, beverages, household chemicals, and personal-care products requiring resealable pack formats. Convenience, spill-prevention, and extended product usability reinforce continued utilization of closure systems across retail packaging. Plastic closures lead due to compatibility with PET and HDPE containers, lightweight construction, and established manufacturing capacity for custom geometries. Growth is supported by hygiene considerations and the expansion of consumer goods offered in portable or multi-serve packaging. Design updates include improved grip, tighter sealing profiles, and reduced resin usage to support recycling objectives.

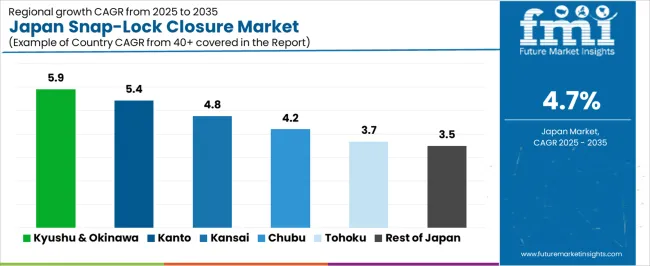

Kyushu & Okinawa and Kanto record the highest usage because of their concentration of food-processing facilities, bottling lines, and logistics networks aligned with high-volume consumer distribution. These regions also reflect accelerated adoption of recyclable packaging components in response to brand and regulatory sustainability requirements. Key suppliers include Yoshino Kogyosho Co., Ltd., Takemoto Yohki Co., Ltd., Nihon Tokan Package Co., Ltd., Nissei Plastic Industrial Co., Ltd., and Albéa Japan. Their products support beverages, condiments, household-care goods, and personal-care formulations with closures designed for repeat opening while maintaining product protection across storage and transport conditions.

Demand for snap-lock closures in Japan reflects a mix of acceleration linked to packaging-design updates and deceleration tied to industry maturity in high-volume consumer categories. Early-period growth is driven by product safety priorities in food and household goods, where tamper-evident and child-resistant closures support incremental expansion. Convenience packaging in ready-to-use formats accelerates adoption, particularly within sauces, condiments, and personal-care refills. These applications introduce moderate upward movement in growth momentum as brands refresh closures to improve usability and prevent spillage.

Deceleration appears in segments where packaging redesign cycles are gradual and long replacement intervals limit rapid uptake. Strong recycling expectations encourage refill-station formats and lightweight alternatives that may reduce demand growth for new closure units. Industrial cost-efficiency initiatives also constrain frequent closure modification. The pattern therefore shows short bursts of acceleration when safety and convenience standards tighten, followed by slower phases as packaging-line upgrades stabilize. Growth remains steady but not rapid, highlighting a system where innovation timing and material-efficiency policies determine shifts in the rate of demand progression.

| Metric | Value |

|---|---|

| Japan Snap-Lock Closure Sales Value (2025) | USD 0.6 billion |

| Japan Snap-Lock Closure Forecast Value (2035) | USD 1.0 billion |

| Japan Snap-Lock Closure Forecast CAGR (2025-2035) | 4.7% |

Demand for snap-lock closures in Japan is increasing because food, personal care and household product manufacturers require packaging that is easy to open and securely resealable for everyday use. Single-person households and busy consumers prefer portioned and ready-to-use products where snap-lock closures help maintain freshness and prevent leakage after first opening. Growth in convenience foods, including chilled items and snack packs, supports wider use of rigid and semi-rigid containers featuring snap-lock systems. Retailers and e-commerce distributors favour packaging that withstands transport handling and offers reliable sealing without additional wrapping, which strengthens demand in logistics and delivery channels.

Packaging suppliers introduce lightweight closure designs and structures compatible with mono-material recycling streams, aligning with Japan’s circular economy goals and established sorting infrastructure. Manufacturers also adopt snap-lock closures in child-resistant packaging for health-and-wellness products where safety and compliance are essential. Constraints include higher tooling and unit cost compared with simple lids, as well as the need for specialized filling-line adjustments in existing facilities. Some brands delay conversion to snap-lock solutions until consumer testing confirms strong functional preference and packaging budgets allow the upgrade.

Demand for snap-lock closures in Japan reflects secure fastening needs across packaging, construction, and logistics settings. Performance priorities focus on repeatable locking strength, resistance to handling stress, and reliable sealing in humid conditions common in Japan’s distribution systems. Adoption in consumer goods emphasizes ease of opening and closing, while industrial users require durable fasteners that maintain assembly stability. Design flexibility, lightweight structure, and compliance with food-contact rules influence procurement in flexible packaging.

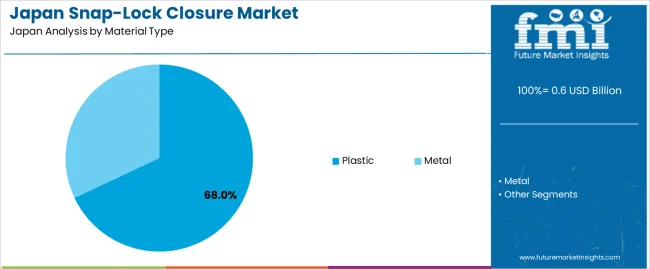

Plastic closures account for 68.0%, supported by molding flexibility, corrosion resistance, and productivity benefits in high-volume manufacturing. Plastic variants are widely used in consumer packaging and transport applications requiring secure resealability and weight reduction. Metal closures represent 32.0%, serving building components and industrial tasks that demand elevated mechanical strength and longer service life. Selection criteria in Japan emphasize compatibility with existing automation and green targets, including improved recyclability in polyolefin-based formats. Material decisions reflect end-use handling requirements and efficiency goals in manufacturing across automotive, electronics, and packaging industries.

Key points:

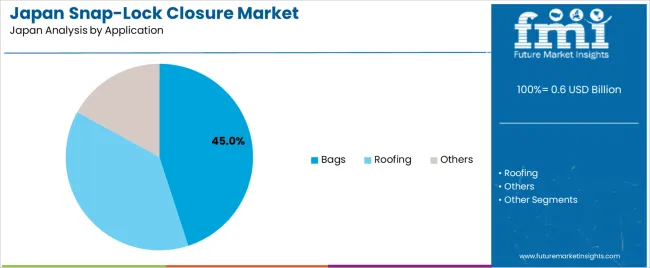

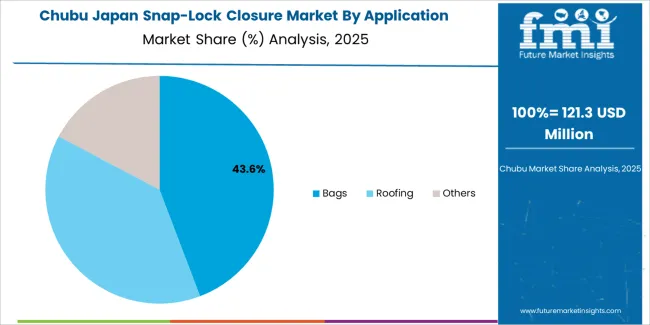

Bags represent 45.0%, driven by strong usage in retail packaging, household storage, and moisture-protected food wrapping. Japanese consumers value resealable closures that maintain freshness and prevent leakage during transport. Roofing accounts for 38.0%, supported by construction practices that depend on secure mechanical locking resistant to wind and water intrusion. Others represent 17.0%, applied in hardware, transport packaging, and assembly components requiring controlled fastening. Application demand reflects Japan’s emphasis on user convenience, durability in built environments, and reliable sealing performance across consumer and professional use cases.

Key points:

Growth of convenience packaging in beverages and condiments, increased product safety expectations and expansion of single-portion formats are driving demand.

In Japan, snap-lock closures support strong use in bottled teas, flavored waters and sports drinks that dominate convenience-store beverage sales. Consumers prioritize quick-open, spill-resistant caps for on-the-go consumption during commuting and travel, reinforcing demand for easy-seal closures. Condiment packaging such as sauces and dressings uses snap-lock closures to improve controlled dispensing in home kitchens where compact storage and cleanliness matter. Single-portion and refill bottles continue to gain popularity in urban households with limited space, sustaining consistent procurement among major bottlers. Manufacturers serving personal care and household cleaning categories rely on secure closures to prevent leakage during transport in densely packed retail environments and parcel delivery.

Pressure to reduce single-use plastics, limited recyclability for certain closure-bottle combinations and cautious adoption in premium categories restrain demand.

Japan’s resource recycling policies encourage container light weighting and simplified material structures, which can influence closure specifications. Some snap-lock designs use multiple materials that complicate sorting in municipal recycling streams, reducing alignment with green objectives. Premium cosmetics and high-end beverages often choose threaded or specialty dispensing closures to achieve more elegant aesthetics, limiting snap-lock use in value-differentiated product lines. Rising material costs linked to imported polymers may also slow replacement of existing closure systems in cost-sensitive offerings. These regulatory and industry influences create measured, category-specific adoption patterns.

Shift toward tethered closures for collection efficiency, increased customization for vending-machine compatibility and rising interest in closures optimized for refill pouches define key trends.

Manufacturers are advancing tethered closure designs that remain attached to bottles during disposal to improve recovery rates and meet recycling-sorting requirements. Beverage producers are adjusting closure geometry to function smoothly within Japan’s large vending-machine infrastructure, reducing misalignment during automated dispensing. Refill pouches for detergents, shampoos and liquid soaps are prompting demand for closures engineered for repeated opening and secure resealing, particularly in urban apartments where refilling reduces storage waste. Packaging teams also explore reduced-label bottle designs that coordinate with compatible closures to simplify recycling. These trends signal steady, ecofriendly-aligned demand for snap-lock closures across Japan’s beverage, household and personal care sectors.

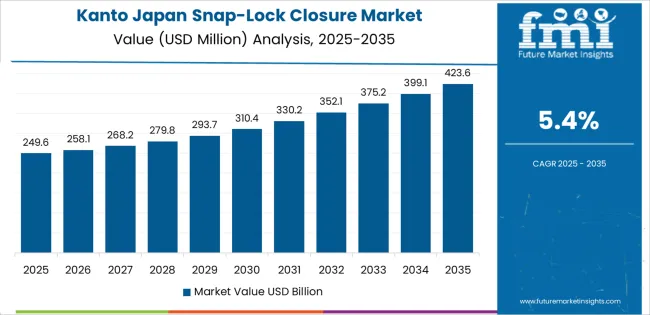

Demand for snap-lock closures in Japan reflects packaging needs in beverages, household liquids, health and beauty products, and pharmaceutical dispensing. Procurement decisions reflect sealing reliability, child-safe control features, and ease of re-closure in frequent-use categories. Material selection aligns with recyclability guidelines and compatibility with established bottling equipment. Kyushu & Okinawa leads at 5.9% CAGR, followed by Kanto (5.4%), Kinki (4.8%), Chubu (4.2%), Tohoku (3.7%), and Rest of Japan (3.5%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.9% |

| Kanto | 5.4% |

| Kinki | 4.8% |

| Chubu | 4.2% |

| Tohoku | 3.7% |

| Rest of Japan | 3.5% |

Kyushu & Okinawa posts 5.9% CAGR, supported by beverages, daily household liquid products, and travel-oriented retail channels. PET bottles with snap-lock closures remain common across convenience stores and vending locations where portable packaging supports hydration needs in warm climates. HDPE closures enable secure transport of detergents and cleaning liquids used in residential and hospitality sectors. Product safety influences closure preference for pharmaceutical and OTC liquid containers distributed through hospital-linked pharmacies. Packaging converters rely on reliable sealing geometry to maintain bottle-cap alignment during high-humidity storage and logistics. Procurement teams evaluate durability, hand-feel, and controlled-force opening to prevent unintended spillage in portable consumption. Resin sourcing through ports maintains stable supply for closure molding operations.

Kanto records 5.4% CAGR, driven by dense retail networks and high-volume filling lines supplying bottled beverages and personal-care products. Tokyo-area plants prioritize closures that enable rapid changeover and consistent sealing under automated conditions. Pharmacy channels distribute liquid supplements and hygiene solutions, requiring child-safe snap closures aligned with compliance protocols. Consumer preference for neat handling supports tight-fit closures designed to prevent leaks in handbags and commuter storage. Urban waste-sorting infrastructure promotes closure compatibility with PET and HDPE bottle recycling. Procurement standards focus on torque-free closure engagement, maintaining usability across diversified bottle neck sizes.

Kinki reaches 4.8% CAGR, supported by consumer goods manufacturing and household-care product distribution across Osaka and Kyoto. Personal-care packaging utilizes snap-lock closures for shampoos, lotions, and cleansers requiring dependable opening-force control. Grocery retail channels reinforce demand for family-size beverage bottles used in frequent-use settings. Buyers evaluate thread accuracy and repeatable closure tightness to prevent product degradation in high-touch environments. Packaging plants maintain existing closure feed-systems, favoring designs aligned with current capping machinery and minimal downtime.

Chubu posts 4.2% CAGR, influenced by packaging supply for food and drink consumed in industrial hubs across Aichi and Shizuoka. Hydration products for workers maintain PET closure needs tailored for portable use in factory settings. Household chemical bottling supports HDPE closure adoption with grip-friendly shapes enabling safe opening with gloves. Procurement emphasizes closure alignment performance during transport across long distribution distances. Product-safety features enhance sealing during temperature variation in warehouse storage.

Tohoku grows at 3.7% CAGR, driven by bottled beverages and personal-care items distributed over wide routes. Seasonal weather shifts require closures maintaining sealing security in cold storage. Municipal ecofriendly programs encourage lightweight closure models that reduce material use while preserving strength. Packaging teams validate closure performance for vending and kiosk placements in commuter areas.

Rest of Japan expands at 3.5% CAGR, supported by local retail channels and moderate beverage throughput. Buyers emphasize cost stability and compatibility with standard PET bottling. Retailers favor closures that maintain clean appearance under repeated customer handling. Material alignment with recycling collection systems informs closure specification.

Demand for snap-lock closures in Japan is guided by packaging-component suppliers supporting rigid containers used for sauces, personal care, and household-chemical products. Yoshino Kogyosho Co., Ltd. holds an estimated 35.0% share, supported by controlled hinge-molding precision and reliable closure engagement during repeated opening cycles. Its components provide uniform sealing pressure and smooth cap operation suited to Japan’s retail handling conditions. Takemoto Yohki Co., Ltd. maintains strong participation in personal-care packaging where stable dimensional accuracy and clean visual presentation are priorities for local consumer brands. Nihon Tokan Package Co., Ltd. contributes share through closures integrated into condiment and beverage packaging lines, ensuring consistent capping performance at high throughput speeds.

Nissei Plastic Industrial Co., Ltd. supports demand through proprietary molding technologies that deliver durable hinge structures and steady resin-flow control during mass production. Albéa Japan adds selective supply in premium personal-care closures designed for controlled snap engagement and enhanced product usability. Competition in Japan focuses on seal reliability, hinge durability, tactile opening response, alignment with recyclability systems, and dependable national distribution. Demand remains steady as Japanese fillers require precisely molded snap-lock components that maintain product protection and user convenience in domestic packaging applications.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Material Type | Plastic, Metal |

| Application | Bags, Roofing, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Yoshino Kogyosho Co., Ltd., Takemoto Yohki Co., Ltd., Nihon Tokan Package Co., Ltd., Nissei Plastic Industrial Co., Ltd., Albéa Japan |

| Additional Attributes | Adoption influenced by packaging automation in food and personal care sectors; demand growth from flexible packaging and resealable consumer goods; expansion in construction fasteners and roofing accessories using metal closures; alignment with eco-friendly trends and lightweight packaging initiatives in Japan’s FMCG sector. |

The demand for snap-lock closure in Japan is estimated to be valued at USD 0.6 billion in 2025.

The market size for the snap-lock closure in Japan is projected to reach USD 1.0 billion by 2035.

The demand for snap-lock closure in Japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in snap-lock closure in Japan are plastic and metal.

In terms of application, bags segment is expected to command 45.0% share in the snap-lock closure in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Case Closures and Sealers in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Yeast Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Green and Bio-based Polyol Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Japan Coated Fabrics Market Growth – Trends, Demand & Innovations 2025–2035

Japan Barite Market Growth – Trends, Demand & Innovations 2025–2035

Japan 1,4-Diisopropylbenzene Market Growth – Trends, Demand & Innovations 2025–2035

Japan Compact Construction Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA