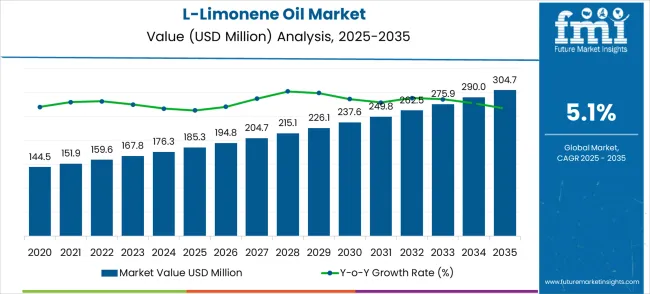

The L-limonene oil market is expected to experience steady growth over the next decade, with a compound annual growth rate (CAGR) of 5.1%. Starting at USD 185.3 million in 2025, the market is projected to reach USD 304.7 million by 2035. In the 2025-2030 period, the market will witness gradual expansion, with values increasing from USD 185.3 million to USD 236.5 million by 2030. L-limonene, a key natural solvent and flavoring agent derived from citrus fruits, is becoming increasingly popular due to its multifaceted applications across various industries, including food and beverage, cosmetics, and cleaning products. The market is also benefiting from the rising demand for natural ingredients in products such as perfumes, air fresheners, and cleaning agents. As consumers increasingly shift toward more natural and eco-friendly alternatives, L-limonene's non-toxic, biodegradable, and renewable nature further positions it as a key player in the market.

The adoption of L-limonene oil is also being driven by growing awareness regarding the health benefits of plant-based ingredients, particularly in the food and beverage sector. As a natural antimicrobial and anti-inflammatory agent, L-limonene is finding use in both functional foods and supplements. Its antioxidant properties are being increasingly highlighted in the beauty and skincare markets, where it is used for its soothing and cleansing effects. The market will see further adoption as industries move away from synthetic chemicals and seek more natural alternatives to satisfy consumer preferences. Its potential in various industrial applications, such as cleaning products and degreasers, will continue to bolster its growth. As the market for L-limonene oil continues to expand, its versatility and natural appeal will remain a driving force for sustained growth, making it an integral part of the broader shift toward cleaner, greener alternatives in various sectors.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 185.3 million |

| Forecast Value in (2035F) | USD 304.7 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The L-limonene oil market has gained traction as a versatile and natural product across multiple industries. Within the essential oils market, this segment holds a share of approximately 5.6%, reflecting its use in aromatherapy and personal care applications. The natural fragrance market records a contribution of around 6.2%, as L-limonene oil is often used for its citrus aroma in perfumes and air fresheners. The organic chemicals market accounts for 4.9%, with L-limonene being a widely utilized bio-based solvent in industrial applications. In the personal care ingredients market, the share is 7.3%, as this oil is incorporated into cosmetic and skincare products for its refreshing scent and antioxidant properties. The food and beverage flavoring market contributes around 6.8%, given the demand for natural citrus flavoring in various products. Altogether, these parent markets represent 30.8%, illustrating the increasing importance of L-limonene oil across multiple sectors due to its natural, non-toxic, and versatile applications. The market is considered pivotal in driving natural alternatives in flavoring, fragrances, and chemical formulations.

Market expansion is being supported by the rapid increase in demand for natural and sustainable ingredients worldwide and the corresponding need for eco-friendly alternatives to synthetic chemicals. Modern consumer products rely on L-limonene oil for its dual functionality as both a flavoring agent and cleaning solvent, making it essential across food, cosmetic, and household product applications. The compound's biodegradable properties and FDA GRAS status ensure regulatory compliance while meeting consumer preferences for recognizable ingredients.

The growing complexity of formulation requirements and increasing focus on environmental sustainability are driving demand for high-quality L-limonene oil from certified suppliers with appropriate extraction technology and quality assurance. Food and beverage manufacturers are increasingly requiring natural citrus compounds that can provide authentic flavor profiles while maintaining product shelf life and stability. Regulatory requirements and industry standards are establishing standardized purity specifications that require advanced extraction processes and quality control systems.

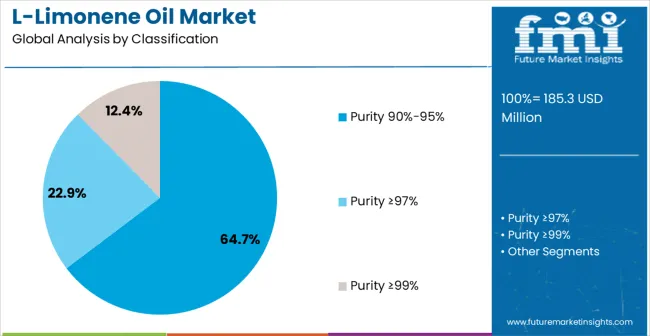

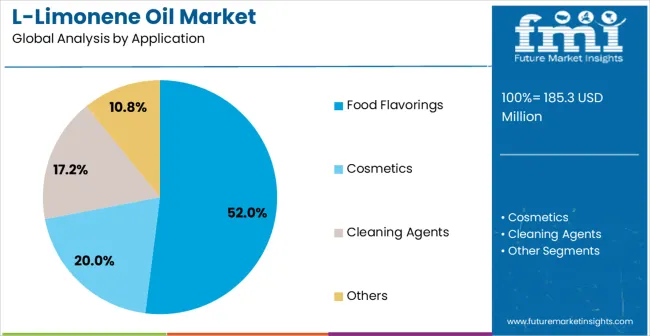

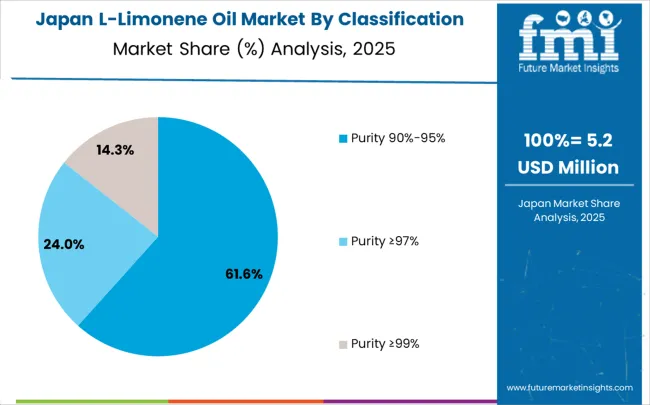

The market is segmented by purity level, application, and region. By purity level, the market is divided into Purity 90%-95%, Purity ≥97%, Purity ≥99%, and others. Based on application, the market is categorized into food flavorings, cosmetics, cleaning agents, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia Pacific, Latin America, and Middle East & Africa.

Purity 90%-95% L-limonene oil is projected to account for 64.7% of the L-Limonene Oil market in 2025. This leading share is supported by the widespread adoption of this purity grade in food flavoring applications, which represent the majority of current market demand. Mid-range purity provides optimal cost-effectiveness while maintaining sufficient quality for most commercial applications including beverages, confectionery, and household cleaning products. The segment benefits from established extraction procedures and comprehensive supplier availability from multiple citrus processing facilities. This grade offers balanced performance characteristics for diverse industrial applications while ensuring consistent quality standards across production batches and maintaining competitive pricing.

Food flavorings applications are expected to represent 52% of L-limonene oil demand in 2025. This dominant share reflects the extensive use of citrus flavoring in beverage, confectionery, and processed food manufacturing that requires natural taste enhancement solutions. Modern food products increasingly feature multiple applications for L-limonene oil including flavor enhancement, preservation assistance, and natural antimicrobial properties for extended shelf life benefits. The segment benefits from growing consumer preference for natural ingredients and increasing regulatory requirements for clean label food formulations. Market expansion continues as manufacturers seek sustainable alternatives to synthetic flavoring compounds.

The L-limonene oil market is experiencing steady growth driven by increasing demand for natural solvents, fragrances, and cleaning agents. Its applications in food & beverages, cosmetics, and pharmaceuticals are expanding as consumers seek more natural, eco-friendly alternatives to synthetic chemicals. Trends indicate rising interest in L-limonene’s use in green chemistry, especially in solvent and extraction processes. However, challenges related to supply chain volatility, high production costs, and inconsistent quality remain as barriers to broader adoption in industrial applications.

The L-limonene oil market is experiencing notable trends, particularly the growing use of this natural solvent in green chemistry applications. In opinion, its role in eco-friendly extraction processes for essential oils, biofuels, and natural compounds has become a focal point. Companies are increasingly turning to L-limonene due to its biodegradability and non-toxic properties, making it an attractive alternative to harmful synthetic solvents. As industries seek more sustainable and safer solutions for chemical processing, the demand for L-limonene is expected to grow, especially in food, cosmetics, and pharmaceuticals. The trend toward environmentally conscious production processes is driving the expansion of this market.

The L-limonene oil market faces significant challenges, notably supply chain volatility and high production costs. In opinion, the market is dependent on citrus fruit cultivation, particularly orange production, making it vulnerable to fluctuations in agricultural yields and climate change. These factors can cause price volatility and disruptions in the availability of raw materials. Moreover, the extraction process of L-limonene oil requires significant energy and processing infrastructure, contributing to higher costs compared to synthetic alternatives. These challenges, combined with issues of quality inconsistency, may limit the widespread adoption of L-limonene in some industrial applications.

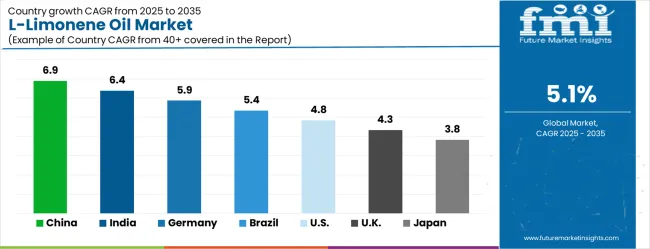

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| Brazil | 5.4% |

| United States | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

The L-limonene oil market is growing rapidly, with China leading at a 6.9% CAGR through 2035, driven by massive food processing expansion, growing consumer preference for natural ingredients, and comprehensive citrus cultivation programs. India follows at 6.4%, supported by expanding essential oil industry and increasing pharmaceutical applications requiring natural compounds. Germany records 5.9%, emphasizing precision extraction technology, advanced quality control, and stringent food safety standards. Brazil grows at 5.4%, leveraging abundant citrus resources and established processing infrastructure. The United States shows 4.8% growth, focusing on premium applications and organic certification. The United Kingdom and Japan demonstrate steady growth at 4.3% and 3.8% respectively, driven by specialty food applications and high-value cosmetic formulations. The report covers an in-depth analysis of 40+ countries; the top-performing countries are highlighted below.

The L-limonene oil market in China is growing at a CAGR of 6.9%, supported by increasing demand for natural flavoring and fragrance agents in food, cosmetics, and cleaning products. As China continues its industrial growth and enhances its focus on sustainability, the adoption of natural ingredients such as L-limonene oil in various consumer goods is gaining traction. The country's rising health consciousness and preference for plant-based ingredients also contribute to market expansion. Moreover, China’s large-scale production of citrus fruits provides an abundant supply of raw materials, further driving growth.

The L-limonene oil market in India is projected to grow at a CAGR of 6.4%, driven by rising demand for natural food additives, cosmetics ingredients, and cleaning solutions. India’s growing middle class and increasing consumer awareness of health and wellness are contributing to the adoption of natural and eco-friendly products. The country’s agricultural base, particularly citrus farming, continues to offer a steady supply of raw materials for L-limonene oil production. Government policies promoting the use of natural products further support market growth.

The L-limonene oil market in Germany is growing at a CAGR of 5.9%, with strong demand from the food, pharmaceutical, and cosmetic industries. Germany’s focus on sustainable, eco-friendly, and natural ingredients in product formulations drives the adoption of L-limonene oil. The country’s strict regulations on chemical ingredients in consumer products further enhance the demand for natural alternatives. L-limonene oil’s versatile applications in cleaning, as well as in fragrance and flavoring agents, support its steady growth in Germany’s market.

The L-limonene oil market in Brazil is projected to grow at a CAGR of 5.4%, driven by expanding demand in food and beverage, personal care, and cleaning products. Brazil’s rich agricultural base, particularly citrus fruit production, supports the availability of raw materials for L-limonene oil. The country’s growing preference for natural and organic ingredients in consumer goods fuels the demand for this product. The rise in middle-class income and the focus on green, eco-friendly products continue to support L-limonene oil market growth in Brazil.

The L-limonene oil market in the United States is growing at a CAGR of 4.8%, fueled by increasing demand for natural fragrances, cleaning agents, and food additives. The USA market emphasizes sustainability, and L-limonene oil fits into the growing trend for green products. The country’s increasing focus on wellness and natural ingredients in cosmetics, household products, and health-related goods continues to drive the adoption of L-limonene oil. Furthermore, the rise in eco-conscious consumer behavior supports its growth in various applications.

The L-limonene oil market in the United Kingdom is growing at a CAGR of 4.3%, with adoption increasing in personal care, food, and cleaning products. The UK’s focus on sustainability and eco-friendly alternatives supports the use of L-limonene oil in various industries. The demand for natural ingredients in cosmetics, fragrances, and household products continues to rise as consumers become more conscious of the products they use. As regulations surrounding chemical ingredients in consumer goods tighten, L-limonene oil’s natural properties make it an attractive option.

The L-limonene oil market in Japan is expanding at a CAGR of 3.8%, supported by increasing demand for natural cleaning agents, food additives, and cosmetic ingredients. Japan’s growing focus on wellness, health, and sustainability is enhancing the market for L-limonene oil. The country’s strict consumer product regulations, favoring natural and safe ingredients, further promote the adoption of L-limonene oil. The market remains steady, with key drivers coming from demand in personal care and home cleaning products.

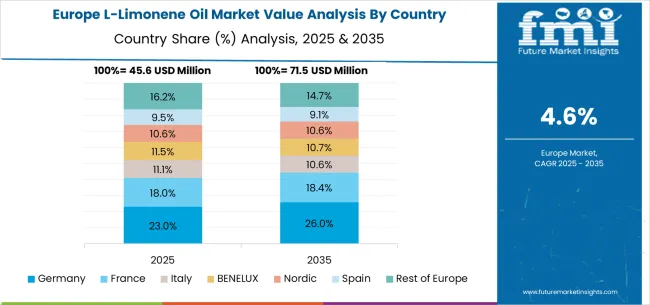

The L-limonene oil market in Europe is projected to grow from USD 52.4 million in 2025 to USD 78.9 million by 2035, registering a CAGR of 4.2% over the forecast period. Germany is expected to maintain its leadership with a 28.5% share in 2025, supported by its extensive food processing industry and advanced extraction technology capabilities.

France is projected to hold 19.7% market share, followed by Italy at 16.3%. The United Kingdom and Spain account for 12.8% and 10.4% respectively. The Rest of Europe region represents 12.3% of the market, attributed to growing natural ingredient adoption in Eastern European countries and expanding organic food production capacity.

The L-limonene oil market is defined by competition among specialized citrus processors, essential oil manufacturers, and natural ingredient suppliers. Companies are investing in advanced extraction technologies, quality assurance systems, organic certification capabilities, and supply chain optimization to deliver consistent, high-quality, and sustainable L-limonene oil solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Arora Aromatics Private Limited, India-based, offers high-quality L-limonene oil with focus on purity consistency, sustainable sourcing, and technical expertise. Norex Flavours, operating regionally, provides comprehensive L-limonene solutions integrated with flavor and fragrance ingredient systems. Citrus Oleo, Brazil, delivers technologically advanced extraction services with standardized procedures and quality integration. Kelvin Natural Mint Pvt. Ltd., India, emphasizes natural ingredient sourcing and comprehensive coverage for food and cosmetic applications.

Ganpati Agri Business Pvt. Ltd., India, offers L-limonene oil solutions integrated with comprehensive agricultural processing operations. Silverline Chemicals, India, provides specialized extraction equipment and technical capabilities. Vdh Organics Pvt. Ltd., India, delivers L-limonene oil alongside organic ingredient solutions. Hindustan Mint & Agro and F&F International offer specialized L-limonene oil expertise, standardized production procedures, and service reliability across regional and international networks.

L-limonene oil, a naturally occurring monoterpene derived primarily from citrus peels, represents a high-value bio-based chemical with applications spanning food flavoring, cosmetics, cleaning agents, and industrial solvents. With the market valued at $185.3 million in 2024 and projected to reach $304.7 million by 2030 at a 5.1% CAGR, this sector is driven by consumer demand for natural ingredients, sustainability initiatives, and the circular economy utilization of citrus processing waste. Success requires coordination between citrus processors, extraction technology providers, end-user industries, and regulatory bodies to ensure quality, supply stability, and market expansion.

How Governments Could Enhance Value Chain Development?

How Industry Associations Could Strengthen Market Infrastructure?

How Technology Providers Could Advance Processing Capabilities?

How Suppliers Could Navigate Market Dynamics?

How End-User Industries Could Optimize Utilization?

How Investors Could Support Market Evolution?

| Item | Value |

|---|---|

| Quantitative Units (2025) | USD 185.3 million |

| Purity Level | Purity 90%-95%, Purity ≥97%, Purity ≥99%, Others |

| Application | Food Flavorings, Cosmetics, Cleaning Agents, Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Arora Aromatics Private Limited, Norex Flavours, Citrus Oleo, Kelvin Natural Mint Pvt. Ltd., Ganpati Agri Business Pvt. Ltd., Silverline Chemicals, Vdh Organics Pvt. Ltd., Hindustan Mint & Agro, F&F International |

| Additional Attributes | Dollar sales by purity level and application segments, regional demand trends across Asia-Pacific, North America, and Europe, competitive landscape with established processors and emerging specialty suppliers, customer preferences for organic versus conventional grades, integration with sustainable sourcing initiatives and circular economy platforms |

The global l-limonene oil market is estimated to be valued at USD 185.3 million in 2025.

The market size for the l-limonene oil market is projected to reach USD 304.7 million by 2035.

The l-limonene oil market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in l-limonene oil market are purity 90%-95%, purity ≥97% and purity ≥99%.

In terms of application, food flavorings segment to command 52.0% share in the l-limonene oil market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA