The Latin America animal feed additives market is set to grow from an estimated USD 4,875.5 million in 2025 to USD 10,237.0 million by 2035, with a compound annual growth rate (CAGR) of 7.7% during the forecast period from 2025 to 2035.

| Attributes | Value |

|---|---|

| Estimated Latin America Industry Size (2025E) | USD 4,875.5 million |

| Projected Latin America Value (2035F) | USD 10,237.0 million |

| Value-based CAGR (2025 to 2035) | 7.7% |

The Latin American aquaculture segment, specifically in Chile, Ecuador, and Brazil, is undergoing rapid development, being the main driver of the use of functional additives that the fish and shrimp consume to become healthier and have more growth and immunity.

The increasing danger of illness outbreaks and reduced water quality have resulted in the adoption rate of probiotics, prebiotics, and organic acids in fish feed that is higher than ever before. Furthermore, the\u00a0inclusion of omega-3 supplements and probiotic microorganisms in aquatic animals' diets along with these dietary&enzymes, which are based on the plant's Cellulase and Xylanase, is claimed to reduce the environmental impact of aquaculture and thus it will be more sustainable and cost-efficient.

Meat, poultry, and dairy products are among the key items being provided by Latin America, where Brazil, Argentina, and Mexico are the leading contributors. Farmers who are looking for alternative sources of protein and who also want to be more sustainable are turning to these probiotics aimed at achieving better production results are required by exporters, who are also interested in environmentally friendly farming.

Infusion of probiotics, besides the proven fact that they cause intestinal colonization of pathogenic bacteria in fish and shrimp that, practically, relates to the health of fish and shrimp, is the mechanism that will particularly take off this season.

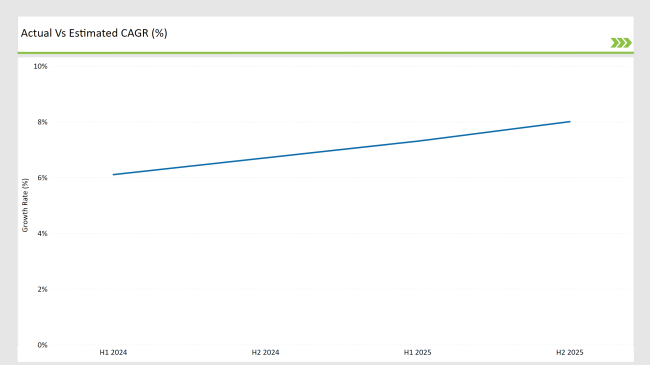

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the Latin America animal feed additives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

For the Latin America animal feed additives market, the is predicted to grow at a CAGR of 6.1% during the first half of 2024, with an increase to 6.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly increase to 7.3% in H1 and is expected to rise to 8.0% in H2. This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| November 2024 | Kemin Industries introduced Toxfin ® Care, a solution designed to safeguard animal feed from mycotoxins. This product enhances the immune system, protects vital organs, and helps maintain performance and productivity levels. |

| June 2024 | ProNuvo , a Costa Rica-based animal feed company specializing in insect-based feed, received a USD 2 million investment from the International Finance Corporation (IFC). The funding was allocated for constructing a new insect feed plant with a capacity to produce 4,000 metric tonnes of feed additives annually. |

Increasing Focus on Aquaculture-Specific Additives in Latin America

The aquaculture industry in Chile, Ecuador, and Brazil is not only powering but leading the rise of feed additives that have special ingredients to promote the fish and shrimp growth, immunity, and disease resistance.

The sector is the one which is enriching fish meal factories with the use of emulsifiers and nutritional enhancers to enhance the conversion ratio of feed (FCR) and the efficiency of digestion in fish which in turn leads to higher yields and profits.

Moreover, there is a higher demand for functional proteins, omega-3 supplements, and probiotics since farmers are looking for natural ways to better gut health and limit the use of antibiotics. Probiotic-based products are particularly becoming popular because they play a role in enhancing disease resistance and promoting a healthier aquatic environment.

These innovations are crucial in this regard as Latin America consolidates its position as one of the competitive global seafood markets, which in turn creates the need for the high quality, nutritionally enhanced aquafeed formulations.

Innovations in Feed Preservation: Extending Shelf Life & Enhancing Nutrient Absorption

The Latin American feed industry has been increasingly integrating preservatives and emulsifiers to achieve stability, avoid spoilage, and extend the shelf life of such feed in particular for ruminants and poultry. The producer's quest to find the optimum solution to the fluctuating feed ingredient price has made it a necessity to invest in the new technology that mainly focuses on the chaff storage transit and preservation.

Furthermore, enzymes and emulsifiers have been incorporated into animal feed formulations to enhance nutrient absorption, promote digestion, and reduce feed waste. These additives hydrolyze feed components and thus increase protein and fat digestibility.

Implementing this low-cost strategy is especially advantageous for producers who are looking to boost feed efficiency by fulfilling their sustainability objectives. In times of feed price volatility, the introduction of technologically superior additives is vital for the continued success of the livestock and poultry sectors in Latin America.

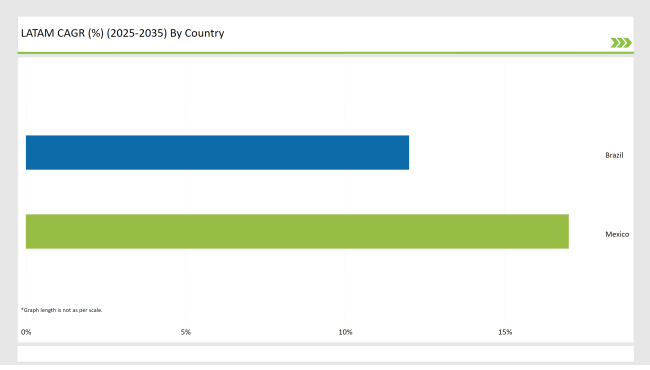

The following table shows the estimated growth rates of the top two markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

Brazil is currently the top country for beef and poultry exports in the world and the international demand fo antibiotic-free meat on the rise puts high-quality feed additives producers into the equation. The domestic meat consumption in the country is also climbing, especially for poultry and pork, causing farmers to involve nutritional additives, probiotics, and enzymes in the feed to increase feed efficacy, digestion, and animal health.

The direction of higher-quality meat export to European countries and China has played a role in the incitement to the request for functional feed components for growth promotion without antibiotics. In the context of this transition, the Ministry of Agriculture, Livestock, and Supply (MAPA) has launched strict measures stipulating the livestock antibiotic growth promoters be limited in use.

In response, more and more, the producers are opting for the natural alternatives to synthetics like using organic acids, probiotics, essential oils, and phytogenic feed additives. These plant-based solutions are in line with global sustainability goals; thus, the Brazilian meat has a competitive edge in the international markets.

The livestock of Mexico and the meat sector USMCA has significantly increased the trading livestock to both the USA and Canada. This, however, has triggered a series of strict regulations on feed quality and adequacy which the Mexican producers have to address.

As a result, they have switched to alternative methods such as phytogenic additives, organic acids, and probiotics to produce feed that is not based on antibiotics. In addition, by complying with the safety and sustainability measures which apply throughout North America, a faster response is being seen in technological investments which are of nature feeding efficiency enhancing, as an act of keeping the exports competitive.

On another front, the Mexican government is focusing on aquaculture with particular attention to tilapia and shrimp farming, which in turn, demands functional feed additives. The application of probiotics, omega-3 supplements, and mycotoxin binders which on their part causes the fish to grow, besides being strong against diseases and improving the water quality is now being increased. This not only helps people fishery businesses yield more but is also beneficial to them in terms of market standing in the international seafood export sector.

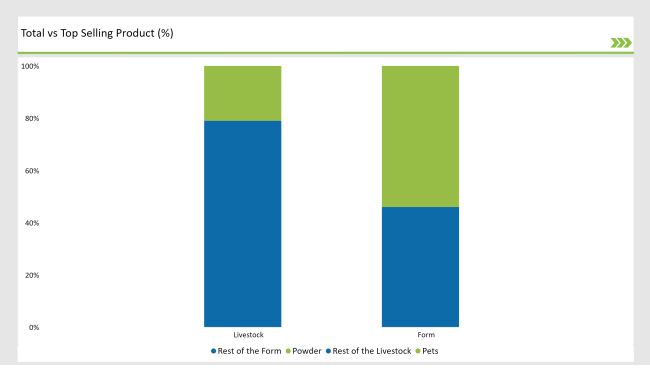

% share of Individual categories by Form and Livestock in 2025

Powdered feed additives have the advantage of having better storage stability and durability so that they are better used in the tropical and humid areas of countries such as Brazil, Mexico, and Argentina. Different from liquid additives, powdered preservatives, emulsifiers, and acidifiers keep their action power alive for long ensuring that feed is fresh and nutritionally intact during its transport and storage.

The former is crucial in the context of big livestock operations where feed must be held for long time epochs without its quality being compromised. Latin American feed players, meanwhile, are also upping their premix formulations using powdered amino acids, enzymes, and probiotics for specific livestock requirements.

Multi-ingredient powdered premixes in poultry, ruminant, and aquaculture sectors have made a huge difference in on-farm feed mixing as it ensures balanced nutrition, optimizes feed digestibility, and reduces the feed waste issue. This cost-effective, flexible model has incited much increase of pellet feed additives in all these situations, chicken, ruminant, and aquaculture.

The pet food industry in Latin America is now experiencing a surge in demand as it increasingly makes specialized pet diets that address the specific needs of different breeds, ages, and health conditions. Pet owners are generally looking for functional additives in the pet food formulations such as glucosamine for joint health, taurine for heart function, and amino acids for muscle development.

Also, hypoallergenic and grain-free diets refuse to go away, since the means of animal protein sources (insect-based, fish proteins) together with enzyme-based additives to improve digestibility and nutrient absorption are implanted in the service of pet food producers. Alongside, there are also functional pet feeds, which are veterinarian-recommended, curcing a place in the market.

Nutritionists working with pets and veterinarians are inducing these immune-boosting and anti-inflammatory feed additives which have become widely used leading to drug companies, these are pharmaceutical backed supported brands. These formulations are integrated with probiotics, prebiotics, omega-3 fatty acids, and antioxidants, promoting the health of the digestive system as well as the immunity and the overall pet well-being.

2025 Market share of Latin America Animal Feed Additives Manufacturers

Note: above chart is indicative in nature

The Latin American market for farm animal feed additives is at a moderately high level of consolidation and industrial giants like DSM, BASF, and Cargill have taken the lead in terms of research, production, and distribution. Furthermore, these corporations exploit their research and development capacities and sustainable innovation to create efficient goods while tackling the challenges with costs.

On the other hand, regional players such as Adisseo, Kemin Industries, and Nutreco are focused on specific types of livestock and offer customized nutritional solutions according to their local market's needs. Meanwhile, the growth in aquaculture and pet nutrition has grown the special product development, and it is the reason for the Latin American feed industry to be competitive both in the local and the foreign market.

As per Additive Type, the industry has been categorized into Technological Additives (Preservatives, Emulsifiers, and Others), Sensory Additives (Sweeteners, Lutein, and Others), and Nutritional Additives.

As per Form, the industry has been categorized into Powder, Granules, and Liquid.

As per Livestock, the industry has been categorized into Ruminant, Poultry, Swine, Aquaculture, and Pets.

Industry analysis has been carried out in key countries of Brazil, Mexico and Rest of Latin America.

The Latin America animal feed additives market is projected to grow at a CAGR of 7.7% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 10,237.0 million.

Leading manufacturers include DSM, BASF SE, Cargill, Incorporated, Evonik Industries AG, and Alltech, Inc.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Latin America Joint Compound Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Latin America In-mold Labels Market Size and Share Forecast Outlook 2025 to 2035

Latin America Rigid Industrial Packaging Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Sanitizer Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hand Soap Market Size and Share Forecast Outlook 2025 to 2035

Latin America Hydraulic Filtration Market Size and Share Forecast Outlook 2025 to 2035

Latin America Automotive HVAC Market Size and Share Forecast Outlook 2025 to 2035

Latin America Frozen Ready Meals Market Insights – Demand & Forecast 2025–2035

Latin America Fish Protein Market Trends – Size, Growth & Forecast 2025–2035

Latin America Collagen Peptide Market Report – Trends, Size & Forecast 2025–2035

Latin America Bubble Tea Market Outlook – Growth, Trends & Forecast 2025–2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Latin America Cultured Wheat Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Fructo-Oligosaccharides Market Report – Trends & Forecast 2025–2035

Latin America Starch Derivatives Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Sports Drink Market Analysis – Demand, Size & Forecast 2025–2035

Latin America Calf Milk Replacer Market Insights – Size, Growth & Forecast 2025–2035

Latin America Non-Alcoholic Malt Beverages Market Trends – Growth & Forecast 2025–2035

Latin America Fungal Protein Market Outlook – Growth, Demand & Forecast 2025–2035

Latin America Bakery Mixes Market Report – Size, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA