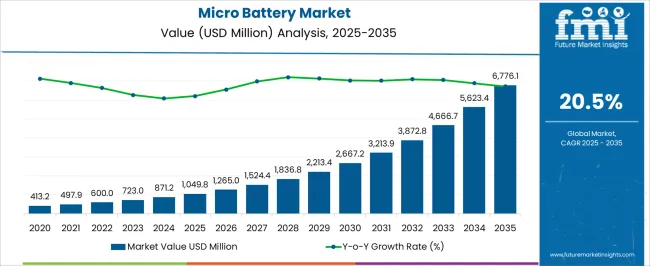

The micro battery market is valued at USD 1,049.8 million in 2025 and is projected to reach USD 6,776.1 million by 2035, reflecting an absolute dollar opportunity of USD 5,726.3 million over the forecast period. From 2021 to 2025, the market is projected to grow from USD 413.2 million to USD 1,049.8 million, with annual increments of USD 497.9 million, USD 600.0 million, USD 723.0 million, and USD 871.2 million. This growth is driven by increasing demand for micro batteries in consumer electronics, medical devices, and wearables, where small, high-efficiency power sources are critical.

Advancements in battery technologies, including solid-state and lithium-based innovations, fuel market expansion during this period. Between 2026 and 2030, the market is expected to expand further, from USD 1,049.8 million to USD 2,213.4 million, progressing through USD 1,265.0 million, USD 1,524.4 million, USD 1,836.8 million, and ultimately reaching USD 2,213.4 million. This phase is characterized by the rapid adoption of microbatteries in IoT devices, smart sensors, and electric vehicles, where high energy density in compact sizes is becoming increasingly essential. From 2031 to 2035, the market is expected to reach USD 6,776.1 million, passing through intermediate values of USD 2,667.2 million, USD 3,213.9 million, USD 3,872.8 million, USD 4,666.7 million, and USD 5,623.4 million. This final phase sees a surge in demand from emerging applications in renewable energy storage and autonomous systems, contributing to the substantial dollar opportunity in the market.

| Metric | Value |

|---|---|

| Micro Battery Market Estimated Value in (2025 E) | USD 1049.8 million |

| Micro Battery Market Forecast Value in (2035 F) | USD 6776.1 million |

| Forecast CAGR (2025 to 2035) | 20.5% |

The consumer electronics market is the largest contributor, accounting for approximately 35-40% of the market. Micro batteries are widely used in compact devices such as hearing aids, smartwatches, and fitness trackers, where their small size and long-lasting power are crucial. The medical devices market contributes around 25-30%, as micro batteries are essential in powering medical devices like pacemakers, glucose monitors, and portable diagnostic tools, where reliability and size constraints are important factors. The automotive market adds about 15-18%, with the growing use of micro batteries in electric vehicles (EVs) for powering smaller components, such as sensors, key fobs, and wireless systems, as well as in hybrid vehicle applications.

The Internet of Things (IoT) market holds roughly 10-12%, as the demand for wireless, low-power devices connected to IoT networks increases, driving the need for small, efficient energy storage solutions. The industrial applications market contributes around 5-8%, where micro batteries are used in sensors, monitoring devices, and remote controls for various industrial and commercial operations.

The micro battery market is witnessing steady expansion, driven by the proliferation of compact and portable electronic devices requiring reliable, long-lasting, and high-performance energy solutions. Demand growth is being shaped by advancements in miniaturization across consumer electronics, medical devices, and IoT-enabled systems, where consistent power output and extended operational life are critical.

The market’s current trajectory is supported by increasing adoption in wearable health monitors, hearing aids, and smart sensors, with innovations in flexible and thin-profile designs further expanding application scope. Material advancements, especially in lithium-based chemistries, have enhanced energy density and recharge cycles, reinforcing market competitiveness.

The future outlook remains positive, underpinned by the growing integration of micro batteries into energy-harvesting systems and next-generation electronics. Strategic investments in manufacturing capabilities and ongoing R&D in solid-state technology are also expected to drive market maturity, positioning micro batteries as a cornerstone component in the evolving landscape of compact power storage solutions.

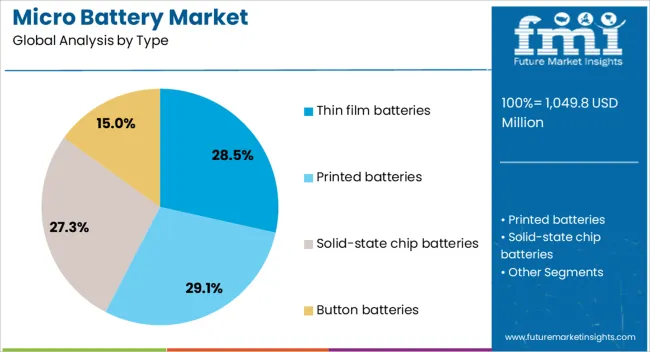

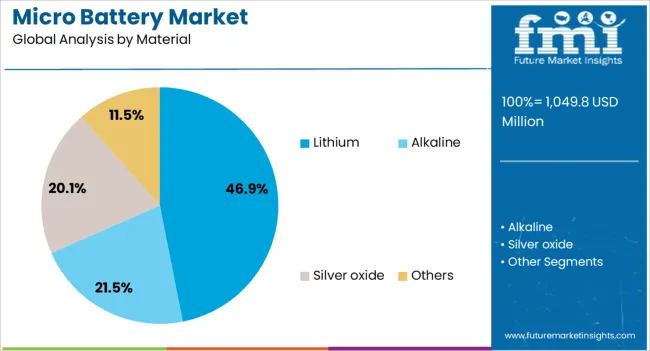

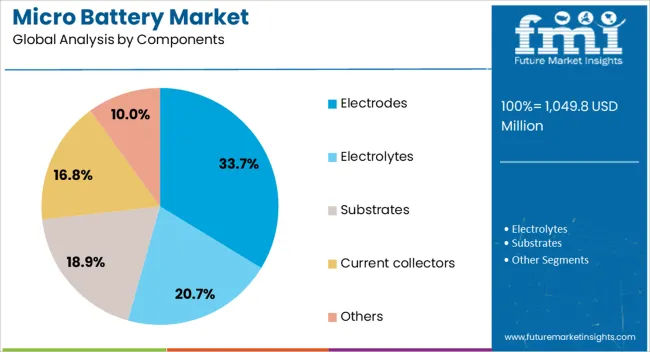

The micro battery market is segmented by type, material, components, capacity, rechargeability, and geographic regions. By type, micro battery market is divided into Thin film batteries, Printed batteries, Solid-state chip batteries, and Button batteries. In terms of material, micro battery market is classified into Lithium, Alkaline, Silver oxide, and Others. Based on components, micro battery market is segmented into Electrodes, Electrolytes, Substrates, Current collectors, and Others. By capacity, micro battery market is segmented into 10 to 100 mAh, Below 10 mAh, and Above 100 mAh. By rechargeability, micro battery market is segmented into Secondary and Primary. Regionally, the micro battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The thin film batteries segment accounts for approximately 28.5% of the micro battery market, reflecting its strong appeal in ultra-compact device applications. Growth in this segment has been driven by its lightweight structure, minimal thickness, and compatibility with flexible substrates, enabling integration into a wide range of wearable and implantable devices. Thin film technologies provide stable voltage output and long shelf life, attributes essential for low-drain, high-reliability applications.

Advancements in solid-state electrolytes and manufacturing scalability have improved the segment’s performance and cost efficiency, fostering wider adoption. The increasing focus on energy storage for wireless sensor networks and smart cards has further contributed to demand.

Additionally, the segment benefits from environmental advantages, as it can be produced with reduced material waste and minimal hazardous components. Given its synergy with ongoing trends in device miniaturization and next-generation electronics, the thin film batteries segment is projected to maintain a solid growth trajectory throughout the forecast period.

The lithium segment leads the micro battery market by material, holding approximately 46.9% of the share. This dominance is linked to lithium’s superior electrochemical properties, including high energy density, low self-discharge rates, and wide operating temperature ranges, making it ideal for high-performance miniature devices. The segment has been bolstered by its suitability for both primary and rechargeable micro batteries, serving applications across medical implants, portable electronics, and IoT devices.

Ongoing advancements in lithium metal and solid-state configurations have enhanced safety profiles and cycle life, supporting broader market penetration. Furthermore, established manufacturing infrastructure and global supply networks have sustained lithium’s leadership, while emerging chemistries continue to complement its core market position.

The rising prevalence of connected devices and the push for longer-lasting, maintenance-free power solutions further reinforce the segment’s growth. Lithium’s proven reliability and adaptability position it to remain the primary material choice for micro battery production in the coming years.

The electrodes segment represents approximately 33.7% of the micro battery market by components, driven by its critical role in determining battery efficiency, cycle life, and overall performance. In micro battery systems, electrode materials and architectures directly influence energy density, charge rates, and thermal stability. The segment has gained from rapid innovation in nanostructured and composite electrode materials, which enhance ion transport and mechanical stability in miniaturized designs.

Demand is further supported by the shift toward solid-state and thin-film battery architectures, where precise electrode engineering is essential for optimizing capacity and reducing degradation. Electrodes also play a vital role in enabling compact form factors without compromising power output, making them indispensable in advanced wearables, implantable medical devices, and IoT sensors.

The ongoing emphasis on lightweight, high-efficiency energy storage solutions continues to drive electrode development. With sustained R&D investments and integration into next-generation battery technologies, the electrodes segment is expected to maintain robust growth momentum over the forecast horizon.

The micro battery market is expanding rapidly due to the increasing demand for compact, high-energy storage solutions across a range of applications, including wearable devices, medical implants, and IoT (Internet of Things) devices. Demand is driven by the need for smaller, longer-lasting, and more efficient energy sources for portable electronics, with an emphasis on high power-to-size ratios and reliability. Challenges include the high cost of miniaturization, performance limitations in certain applications, and competition from alternative energy sources. Opportunities lie in the development of solid-state batteries, advancements in energy density, and the integration of micro batteries with wireless technologies. Trends highlight the growing role of micro batteries in healthcare, consumer electronics, and smart sensors.

The demand for micro batteries is being driven by the increasing miniaturization of electronic devices and the need for more efficient power sources in compact applications. With the proliferation of wearable devices, medical implants, and sensors, there is a need for energy solutions that do not compromise on size, performance, or longevity. Micro batteries are increasingly seen as a key enabler for devices that require long-lasting power without increasing device size. Healthcare applications, such as smart medical implants and diagnostic devices, are rapidly adopting micro batteries for their reliability and performance. As the Internet of Things (IoT) ecosystem grows, the need for efficient, miniature energy sources for interconnected devices is further fueling demand for micro batteries.

The materials used in micro batteries, such as lithium, cobalt, and other rare earth elements, can be expensive and subject to supply chain fluctuations. Additionally, the need for specialized equipment and expertise in micro-battery design and production adds to the costs. Regulatory constraints related to the safe disposal and recycling of micro batteries also play a role, especially in the context of hazardous chemicals used in some battery types. Performance limitations in terms of energy density and charge cycles in certain applications may also hinder growth, especially as consumers demand more power from smaller devices. Manufacturers must focus on cost-effective production techniques and innovation to overcome these challenges.

The demand for advanced energy storage solutions is also rising in healthcare applications, particularly for implantable medical devices that require high-reliability and low-power consumption. The integration of micro batteries with IoT applications is a key growth area, as these batteries power the growing number of connected devices, including smart sensors, wearables, and asset trackers. As industries explore wireless technologies and the potential for self-charging systems, micro batteries are poised to play a central role in powering next-generation IoT solutions and advancing medical technology. Suppliers that focus on developing energy-dense, safe, and durable micro batteries are well-positioned to capitalize on these emerging opportunities.

As device miniaturization continues, manufacturers are focusing on producing smaller batteries with higher energy output to meet the growing demand for powerful, compact devices. Advances in wireless charging technology are also expected to transform the micro battery landscape, providing more convenience and longer-lasting energy solutions for wearables and IoT devices. Researchers are increasingly exploring alternative battery chemistries and energy storage solutions, such as lithium-sulfur and solid-state batteries, to enhance performance. These trends, combined with the increasing adoption of micro batteries in healthcare, automotive, and consumer electronics, position the market for continued growth. Manufacturers who innovate to provide high-performance, cost-effective micro batteries will lead in capturing market share in the rapidly evolving industry.

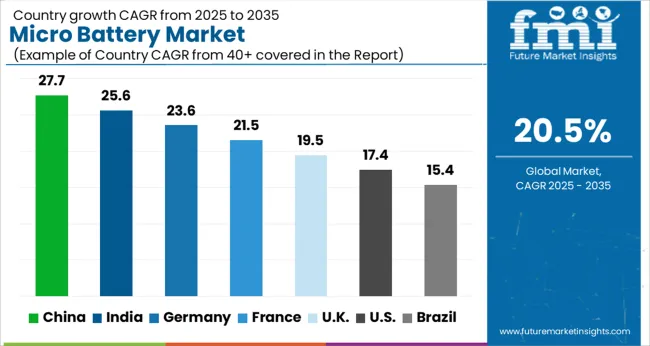

| Country | CAGR |

|---|---|

| China | 27.7% |

| India | 25.6% |

| Germany | 23.6% |

| France | 21.5% |

| UK | 19.5% |

| USA | 17.4% |

| Brazil | 15.4% |

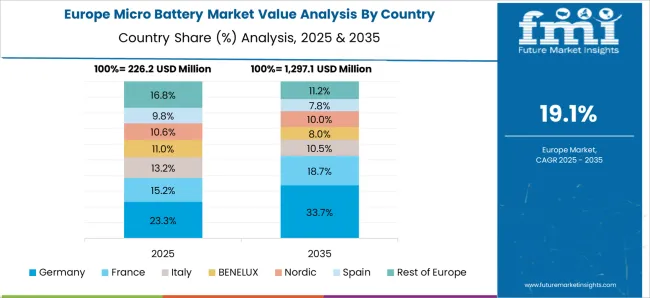

The global micro battery market is projected to grow at a CAGR of 20.5% from 2025 to 2035, with China leading at 27.7%, followed by India at 25.6% and France at 21.5%. The market is driven by demand in sectors such as portable electronics, wearables, electric vehicles, and IoT applications. Government initiatives, such as those supporting clean energy and digital infrastructure, are further accelerating market growth. As technological advancements continue and energy-efficient solutions gain momentum, countries across the globe are increasing investments in micro batteries, with key markets like China, India, and France seeing the most significant expansion. The analysis includes over 40+ countries, with the leading markets detailed below.

The micro battery market in China is expected to grow at a CAGR of 27.7% from 2025 to 2035, largely driven by the country’s booming electronics and electric vehicle (EV) sectors. As one of the world’s largest manufacturers of mobile phones, wearables, and consumer electronics, China is seeing a surge in demand for high-performance, small batteries. The government’s efforts to push for green energy solutions and technological innovation are fueling the expansion of micro batteries. The rapidly growing electric vehicle market in China is also playing a significant role in driving demand for compact and efficient batteries. With major advancements in battery technology and the ongoing development of a robust domestic manufacturing base, China is well-positioned to maintain its leadership in the micro battery sector.

The micro battery market in India is projected to grow at a CAGR of 25.6% from 2025 to 2035, driven by the increasing adoption of mobile phones, smart devices, and wearables. As one of the largest mobile phone markets globally, India’s demand for micro batteries continues to rise, with a growing consumer base for portable electronics. The government’s push towards electric vehicles is also contributing to the increased need for compact and high-efficiency batteries. Along with this, the burgeoning IoT and wearables market in India is expanding rapidly, creating new opportunities for the micro battery sector. The ongoing improvements in India’s battery manufacturing capabilities are set to boost market growth. The country’s shift towards smart city solutions and digital infrastructure is expected to further accelerate demand for advanced micro batteries.

The micro battery market in France is projected to grow at a CAGR of 21.5% from 2025 to 2035, driven by increasing demand for portable electronics, wearables, and advanced energy storage solutions. France is seeing significant advancements in the field of clean energy and energy efficiency, which in turn is driving the adoption of micro batteries in energy solutions. The French automotive industry, with its increasing focus on electric vehicles, is another key driver for the market, as these vehicles require compact and efficient batteries.The country’s emphasis on digital innovation, such as smart city projects, is boosting the demand for micro batteries. The French government’s policies encouraging green technologies and energy efficiency are expected to further stimulate the market for micro batteries.

The UK micro battery market is expected to grow at a CAGR of 19.5% from 2025 to 2035. The rise in demand for portable electronics, including smartphones, tablets, and wearables, is contributing to the rapid expansion of the market. As the UK embraces the digital transformation, the need for micro batteries in IoT devices and connected solutions continues to grow. The growing electric vehicle market is increasing the demand for small and efficient energy storage systems. The UK government’s continued push for green energy and smart infrastructure projects, including smart cities, is expected to further boost the micro battery market. The UK is also witnessing a growing interest in energy-efficient technologies, which is spurring demand for compact batteries in sectors like energy storage and healthcare devices. As technological advancements continue, the UK is set to become a prominent player in the global micro battery market.

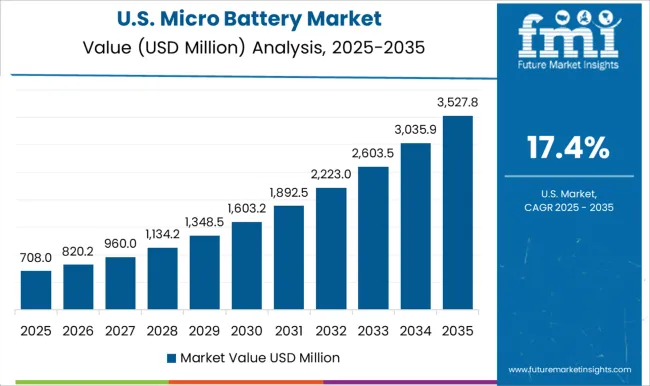

The USA micro battery market is projected to grow at a CAGR of 17.4% from 2025 to 2035, driven by the growing demand for portable electronics, medical devices, and IoT applications. The widespread adoption of smart technologies and energy-efficient solutions is boosting demand for micro batteries, particularly in consumer electronics and healthcare sectors. Additionally, the rising popularity of electric vehicles in the USA is further increasing the need for compact and efficient energy storage systems. The USA is also home to several leading manufacturers and innovators in the battery industry, which is driving technological advancements and creating opportunities for market growth. The increasing focus on renewable energy solutions, smart cities, and digital infrastructure is expected to contribute to the continued growth of the micro battery market.

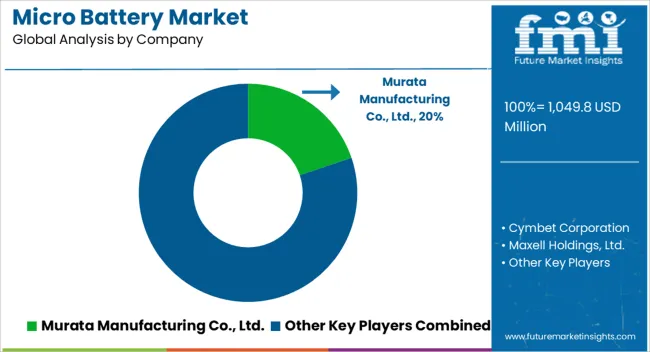

In the micro battery market, competition is driven by the demand for compact, high-performance power solutions in sectors like IoT, wearable devices, medical applications, and automotive. Murata Manufacturing Co., Ltd. leads with its advanced thin-film and solid-state micro batteries, known for their small size, long cycle life, and reliability, catering primarily to the wearable tech and automotive industries. Cymbet Corporation stands out in the energy storage space, offering solid-state batteries that are highly durable and suited for energy harvesting applications, often used in remote sensing and wireless devices. Maxell Holdings, Ltd. competes by offering lithium-ion-based micro batteries, focusing on high energy density and low self-discharge, which are ideal for compact consumer electronics and medical devices. Panasonic Corporation enters the market with robust lithium micro batteries, emphasizing energy efficiency and long-lasting power, primarily targeting the consumer electronics, automotive, and healthcare sectors. TDK Electronics AG competes with its broad range of micro battery solutions, including high-capacity and thin-film technologies, tailored for IoT, RFID, and wireless sensor applications. Ultralife Corporation provides compact, reliable power sources for military, medical, and industrial sectors, focusing on both primary and rechargeable micro batteries with long operational life. VARTA AG is a significant player with its high-performance micro batteries used in hearing aids, wearables, and medical devices, offering small form factors and superior energy efficiency. Strategic differentiation is achieved through product innovation, miniaturization, and specialized applications. Murata, Cymbet, and TDK emphasize cutting-edge technologies like solid-state and thin-film batteries, while Maxell, Panasonic, and VARTA focus on providing high energy density and long-lasting power for consumer and medical devices. Product brochures emphasize characteristics like long cycle life, rapid charge times, compact size, and integration with IoT ecosystems. Companies in this market continue to innovate, targeting growing industries where miniaturization and reliability are paramount.

| Item | Value |

|---|---|

| Quantitative Units | USD 1049.8 Million |

| Type | Thin film batteries, Printed batteries, Solid-state chip batteries, and Button batteries |

| Material | Lithium, Alkaline, Silver oxide, and Others |

| Components | Electrodes, Electrolytes, Substrates, Current collectors, and Others |

| Capacity | 10 to 100 mAh, Below 10 mAh, and Above 100 mAh |

| Rechargeability | Secondary and Primary |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Murata Manufacturing Co., Ltd., Cymbet Corporation, Maxell Holdings, Ltd., Panasonic Corporation, TDK Electronics AG, Ultralife Corporation, and VARTA AG |

| Additional Attributes | Dollar sales by battery type (solid-state, lithium, nickel-metal hydride), application (wearable electronics, healthcare devices, industrial IoT, automotive), and form factor (coin cells, thin-film, micro-packages). Demand dynamics are driven by the growth of wearable tech, healthcare devices, and IoT solutions. Regional growth is prominent in North America, Europe, and Asia-Pacific, fueled by advancements in consumer electronics, healthcare technology, and automotive electrification. |

The global micro battery market is estimated to be valued at USD 1,049.8 million in 2025.

The market size for the micro battery market is projected to reach USD 6,776.1 million by 2035.

The micro battery market is expected to grow at a 20.5% CAGR between 2025 and 2035.

The key product types in micro battery market are thin film batteries, printed batteries, solid-state chip batteries and button batteries.

In terms of material, lithium segment to command 46.9% share in the micro battery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Microfilm Readers and Scanners Market Size and Share Forecast Outlook 2025 to 2035

Micron CBN Powder Market Size and Share Forecast Outlook 2025 to 2035

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

Micro-Dosing Sachet Fillers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Microbial Growth Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Micro Hotel Market Forecast and Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Micro-energy Harvesting System Market Size and Share Forecast Outlook 2025 to 2035

Micro CHP Market Size and Share Forecast Outlook 2025 to 2035

Micro Irrigation System Market Size and Share Forecast Outlook 2025 to 2035

Micro Flute Paper Market Size and Share Forecast Outlook 2025 to 2035

Microcrystalline Cellulose Market Size and Share Forecast Outlook 2025 to 2035

Micro Balances Market Size and Share Forecast Outlook 2025 to 2035

Micro Perforated Films Packaging Market Size and Share Forecast Outlook 2025 to 2035

Microbial Coagulants Market Size and Share Forecast Outlook 2025 to 2035

Microserver IC Market Size and Share Forecast Outlook 2025 to 2035

Microplate Handling Instruments Market Size and Share Forecast Outlook 2025 to 2035

Microsclerotherapy Treatment Market Size and Share Forecast Outlook 2025 to 2035

MicroLED Photoluminescence Inspection System Market Size and Share Forecast Outlook 2025 to 2035

Micro-Scale VFFS Modules Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA