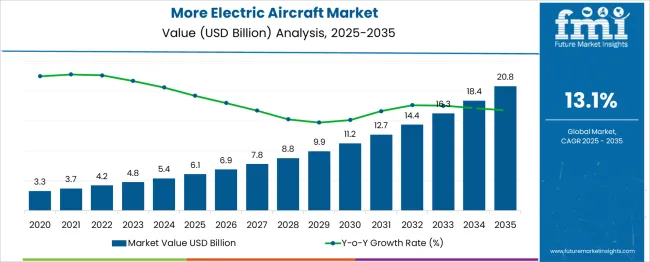

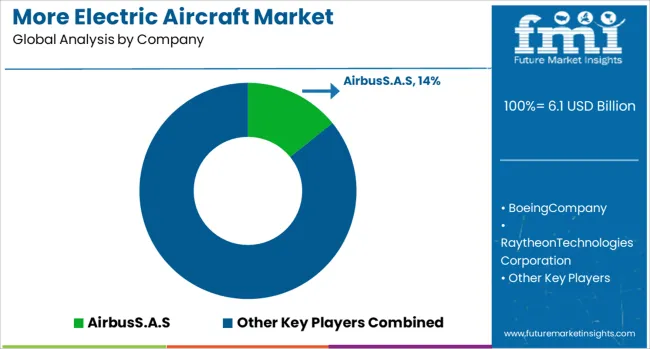

The more electric aircraft market, valued at USD 6.1 billion in 2025 and projected to reach USD 20.8 billion by 2035 at a CAGR of 13.1%, presents significant growth opportunities. Absolute dollar opportunity analysis shows that from 2020 to 2025, the market grows from USD 3.3 billion to USD 6.1 billion, creating an incremental revenue potential of approximately USD 2.8 billion. Early growth is driven by adoption of electric propulsion components, auxiliary power units, and lightweight aircraft systems. Initial investments focus on energy efficiency, system integration, and reducing operational costs, setting the stage for accelerated expansion in the next decade. Between 2025 and 2035, the market expands from USD 6.1 billion to USD 20.8 billion, generating an absolute dollar opportunity exceeding USD 14 billion. This phase is fueled by adoption across commercial and regional aircraft, government incentives for sustainable aviation, and continuous technological advancements in hybrid-electric and electric flight systems. Key investment years lie in the latter half of this period, where market penetration and innovation converge, offering substantial returns. The more electric aircraft segment is poised to become a transformative force in global aviation, reshaping fleet operations and energy efficiency standards.

| Metric | Value |

|---|---|

| More Electric Aircraft Market Estimated Value in (2025 E) | USD 6.1 billion |

| More Electric Aircraft Market Forecast Value in (2035 F) | USD 20.8 billion |

| Forecast CAGR (2025 to 2035) | 13.1% |

The more electric aircraft market is gaining significant traction as the aerospace industry intensifies its transition toward energy-efficient and environmentally sustainable technologies. Electrification of non-propulsive systems is being prioritized by both commercial and defense aviation sectors to minimize fuel consumption, reduce maintenance costs, and lower emissions. The growing emphasis on replacing hydraulic and pneumatic systems with electric alternatives is shaping the future architecture of next-generation aircraft.

Advancements in power distribution units, thermal management systems, and high-voltage electrical networks are enabling scalable electrification without compromising safety or performance. Initiatives by major aerospace OEMs to develop hybrid-electric and fully electric airframes have further accelerated the demand for modular, lightweight, and software-enabled electrical subsystems.

Additionally, regulatory targets focused on carbon neutrality, especially in North America and Europe, are compelling aircraft manufacturers to invest in more electric system architectures. The market outlook remains positive, supported by strong investments in aircraft modernization programs, advancements in electric propulsion components, and collaborative industry efforts to meet net-zero aviation goals.

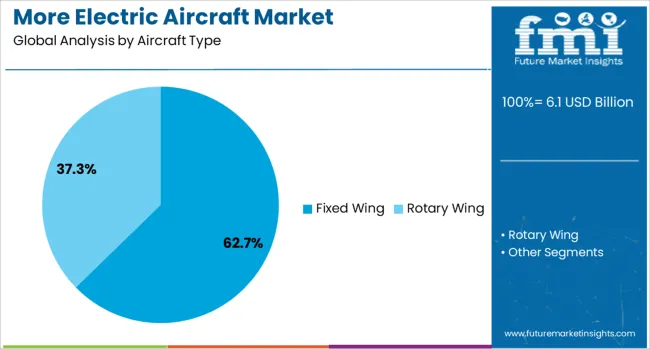

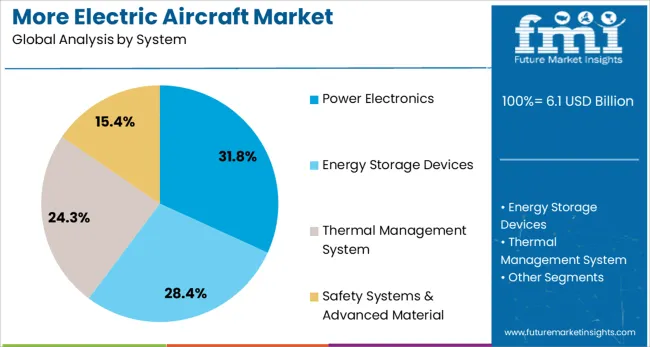

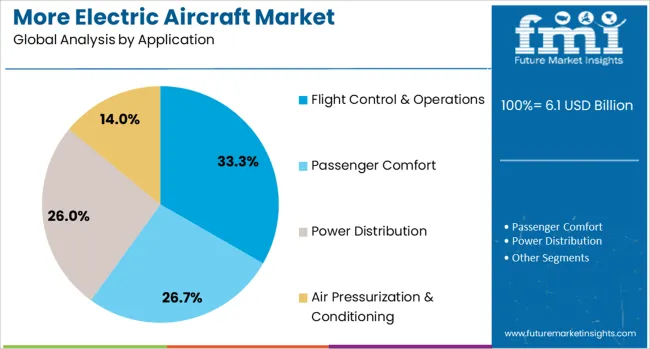

The more electric aircraft market is segmented by aircraft type, system, application, and geographic regions. By aircraft type, the market is divided into Fixed Wing and Rotary Wing. In terms of system, the market is classified into Power Electronics, Energy Storage Devices, Thermal Management Systems, Safety Systems, and Advanced Materials. Based on application, the market is segmented into Flight Control & Operations, Passenger Comfort, Power Distribution, and Air Pressurization & Conditioning. Regionally, the more electric aircraft industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed wing aircraft segment is anticipated to account for 62.7% of the overall revenue share in the more electric aircraft market in 2025, marking its dominance in the aircraft type category. This leadership is attributed to the widespread adoption of electrified systems in commercial jets, business aircraft, and military fixed wing platforms.

The large electrical load capacity and longer operational cycles of fixed wing aircraft have made them suitable candidates for integrating advanced electric subsystems. Increased emphasis on reducing hydraulic complexity, improving energy efficiency, and enabling real-time monitoring through electrified actuators and sensors has supported this segment's growth.

Technological developments in electric environmental control systems, electrical power generation units, and software-defined control architectures have further enhanced the operational reliability of fixed wing platforms. Moreover, rising passenger traffic and the demand for quieter, low-emission aircraft have prompted OEMs to focus on retrofitting existing fixed wing fleets with more electric functionalities, reinforcing the segment’s stronghold in the market.

The power electronics segment is expected to contribute 31.8% of the more electric aircraft market revenue in 2025, underscoring its critical role in enabling efficient electrical energy conversion and distribution. Power electronics components such as converters, inverters, and rectifiers are being integrated to manage and regulate high-voltage DC and AC systems across various aircraft subsystems.

The increased electrification of flight-critical systems has necessitated the adoption of robust power electronics architectures capable of delivering precise control and thermal stability. Growth in this segment has been further supported by advances in wide bandgap semiconductor materials like silicon carbide and gallium nitride, which offer improved efficiency, lightweight design, and higher power density.

These technologies have made it feasible to replace traditional hydraulic and pneumatic systems with reliable electric alternatives without compromising performance. As aircraft systems demand faster response times, lower losses, and intelligent power control, the role of power electronics is expected to expand across both current-generation and future hybrid-electric platforms.

The flight control and operations segment is projected to hold 33.3% of the total revenue share in the more electric aircraft market in 2025, reflecting its leading role in application areas. This segment has witnessed strong growth as aircraft manufacturers prioritize fly-by-wire and electro-mechanical systems to enhance maneuverability, reduce pilot workload, and eliminate the weight and complexity associated with hydraulic controls.

The integration of electric actuators, power management software, and advanced control algorithms has enabled safer and more responsive flight operations. Continuous innovations in control surface automation, real-time diagnostics, and electrical redundancy systems have strengthened the segment’s reliability and compliance with evolving aviation safety standards.

Additionally, the shift toward unmanned and optionally piloted aircraft has further elevated the importance of electric flight control systems. As aviation OEMs target optimized energy usage and streamlined avionics architecture, the segment is expected to maintain its dominant position, driven by growing investments in digital flight systems and electrified cockpit technologies.

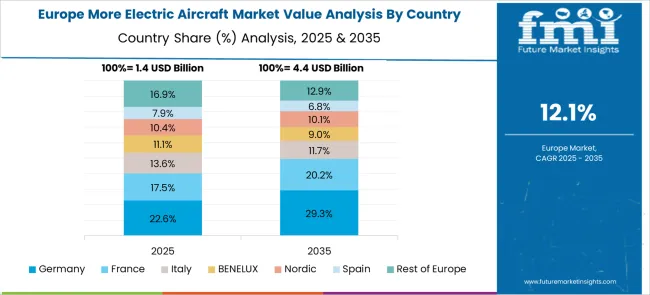

The more electric aircraft market is growing as airlines and manufacturers focus on efficiency, reduced fuel consumption, and lower maintenance costs. Replacing traditional hydraulic and pneumatic systems with electric alternatives enhances reliability, reduces weight, and improves operational performance. Rising demand for regional, urban, and short-haul aircraft drives adoption of electric and hybrid systems. North America and Europe lead due to regulatory support and infrastructure, while Asia-Pacific investments are increasing. Integration of advanced electric power distribution, energy storage, and propulsion systems supports safer, quieter, and more cost-effective aircraft operations.

The more electric aircraft market is expanding as airlines and manufacturers aim to improve fuel efficiency, reduce operational costs, and minimize environmental impact. Replacing traditional hydraulic and pneumatic systems with electric alternatives reduces aircraft weight and improves overall energy efficiency. Airlines increasingly seek aircraft that offer lower maintenance costs, quieter operations, and higher reliability, supporting the adoption of more electric architectures. Emerging regional aircraft and urban air mobility solutions are also driving interest in electric systems due to their scalability and flexibility. North America and Europe lead adoption due to stringent aviation emission regulations and supportive infrastructure, while Asia-Pacific is witnessing growing investments in electric propulsion technologies. Aircraft designers focus on integrating electric actuators, electric power distribution systems, and onboard energy management systems to enhance performance and safety, enabling broader acceptance of fully or partially electric aircraft.

More electric aircraft rely on integrated electric systems to replace conventional mechanical and hydraulic components, including flight controls, landing gear, and environmental control systems. Advanced power distribution, energy storage, and monitoring systems improve efficiency and reliability while reducing maintenance needs. Manufacturers are optimizing electric architectures to handle higher loads, ensure redundancy, and maintain safety under extreme conditions. Electric propulsion systems are being combined with hybrid engines to extend operational range, particularly for regional aircraft and emerging short-haul applications. Improved actuation technologies and lightweight wiring solutions further enhance performance and reduce aircraft weight. Integration of predictive maintenance and real-time monitoring enables airlines to track system health and optimize aircraft availability. Collaboration with research institutions and system suppliers ensures that electric aircraft meet stringent regulatory standards and operational requirements while maintaining performance comparable to conventional designs.

The adoption of more electric aircraft improves operational efficiency by reducing fuel consumption, maintenance downtime, and overall lifecycle costs. Electric systems offer precise control, lower heat generation, and reduced hydraulic fluid leakage, leading to safer and more reliable operations. Airlines benefit from increased aircraft availability and predictable maintenance schedules, improving fleet utilization. Electric power systems can be scaled for different aircraft sizes, allowing broader deployment across commercial and regional fleets. Additionally, lower noise levels and reduced emissions support compliance with airport environmental regulations and community noise standards. Enhanced energy management and regenerative braking technologies allow for energy recovery during taxiing and descent, further improving efficiency. These operational benefits make electric systems attractive to both established carriers and emerging urban air mobility providers.

Despite the benefits, the more electric aircraft market faces technical and operational challenges. High-power electric components must withstand extreme temperatures, vibrations, and electromagnetic interference while maintaining reliability. Energy storage solutions, such as batteries and supercapacitors, are limited by weight, capacity, and safety concerns. Certification processes for new electric architectures are lengthy and stringent, requiring extensive testing and validation. Integrating electric systems into legacy aircraft fleets can be complex and costly. Manufacturers must balance performance gains with weight reduction and redundancy requirements to meet aviation safety standards. Supply chain limitations for high-performance electric components may delay production timelines. Companies investing in modular, scalable architectures and robust testing protocols gain a competitive advantage, helping to accelerate adoption despite these hurdles.

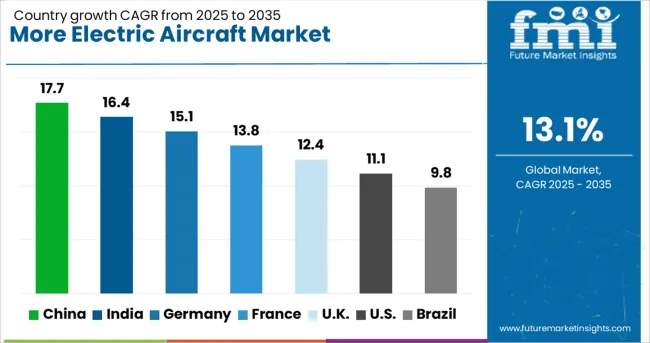

| Country | CAGR |

|---|---|

| China | 17.7% |

| India | 16.4% |

| Germany | 15.1% |

| France | 13.8% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The more electric aircraft market is expanding rapidly with a CAGR of 13.1%, driven by the push for efficiency and reduced operational costs in aviation. China leads with a 17.7% growth rate, fueled by government-backed aerospace programs and investments in electric propulsion technologies. India follows closely at 16.4%, reflecting growing interest in modernizing its aviation fleet and supporting domestic aerospace manufacturing. Germany shows 15.1% growth, leveraging its aerospace engineering expertise and strong R&D infrastructure. The United Kingdom records 12.4% growth, backed by initiatives to integrate electric systems into regional aircraft. The United States, with 11.1% growth, continues to focus on research, testing, and deployment of electric aircraft components in both commercial and defense sectors. This report includes insights on 40+ countries; the top countries are shown here for reference.

China leads the more electric aircraft market with a 17.7% growth rate. Expanding commercial aviation and government support for next-generation aircraft programs drive this surge. Compared to India, China benefits from large-scale aerospace manufacturing facilities and advanced component suppliers. Research initiatives focus on improving battery efficiency and lightweight electrical systems. Partnerships between domestic and international aerospace firms accelerate technology adoption. Rising airline demand for fuel-efficient aircraft further boosts market growth.

More electric aircraft market in India grows at 16.4%, supported by expanding aerospace manufacturing and government-backed programs. Compared to Germany, India emphasizes indigenous production of aircraft electrical components. Investments in research and development improve energy efficiency and reduce weight. Collaboration with global aerospace firms introduces advanced technologies into domestic production. Increasing regional airline activity boosts demand for electric propulsion systems and advanced avionics.

Germany maintains steady growth at 15.1% in the more electric aircraft market. Aerospace companies focus on high-performance electric systems for both commercial and regional aircraft. Compared to the United Kingdom, Germany emphasizes rigorous engineering and certification standards. Research investments aim to improve battery life and reliability. Collaboration with European aerospace partners supports joint development programs. Demand from advanced commercial aircraft projects ensures market resilience.

The United Kingdom’s more electric aircraft market grows at 12.4%, driven by government-backed innovation programs and commercial aircraft upgrades. Compared to the United States, the UK focuses on lightweight electrical systems and improved energy management. Investments in research enhance avionics and propulsion efficiency. Partnerships with aerospace startups promote rapid technology integration. Growing interest in environmentally efficient aircraft encourages adoption of electric systems.

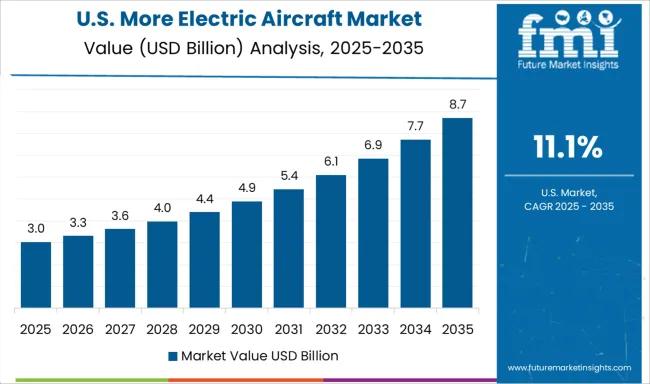

The United States advances in the more electric aircraft market at 11.1%, supported by large aerospace manufacturers and defense contracts. Compared to China, the US prioritizes advanced avionics and system integration for electric aircraft. Investments in battery technology and lightweight materials improve efficiency. Partnerships with private aerospace companies expand research capabilities. Increasing commercial and military aircraft orders maintain steady market growth.

The more electric aircraft (MEA) market is driven by aerospace and defense leaders focused on reducing aircraft weight, improving fuel efficiency, and integrating advanced electrical systems. Airbus S.A.S and Boeing Company spearhead this transition, implementing electric actuation, power distribution, and environmental control systems across next-generation commercial and military aircraft. Raytheon Technologies Corporation, along with General Electric and Rolls-Royce Holdings plc, provides high-performance electric propulsion components, generators, and integrated power systems, enabling enhanced aircraft efficiency and reliability.

Honeywell International Inc., Safran S.A., and United Technologies Corporation deliver avionics, electrical control units, and thermal management systems optimized for MEA platforms, emphasizing weight reduction and system redundancy. Lockheed Martin Corporation, BAE Systems Plc, and Thales Group focus on military applications, providing robust electric architectures for high-performance tactical and transport aircraft.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Aircraft Type | Fixed Wing and Rotary Wing |

| System | Power Electronics, Energy Storage Devices, Thermal Management System, and Safety Systems & Advanced Material |

| Application | Flight Control & Operations, Passenger Comfort, Power Distribution, and Air Pressurization & Conditioning |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Airbus S.A.S, Boeing Company, Raytheon Technologies Corporation, General Electric, Rolls-Royce Holdings plc, Honeywell International Inc., Safran S.A., Lockheed Martin Corporation, BAE Systems plc, Thales Group, Astronics Corporation, United Technologies Corporation, Liebherr-Elektronik GmbH, Bombardier, AgustaWestland |

| Additional Attributes | Dollar sales in the More Electric Aircraft Market vary by aircraft type including commercial, regional, and military, system type such as electrical propulsion, avionics, and actuation systems, and region covering North America, Europe, and Asia-Pacific. Growth is driven by demand for fuel efficiency, reduced emissions, and advancements in electric aircraft technologies. |

The global more electric aircraft market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the more electric aircraft market is projected to reach USD 20.8 billion by 2035.

The more electric aircraft market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in more electric aircraft market are fixed wing and rotary wing.

In terms of system, power electronics segment to command 31.8% share in the more electric aircraft market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Armored Vehicle Market

CCW Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Multi Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Neonatal Thermoregulation Market – Trends & Forecast 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Interlocked Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA