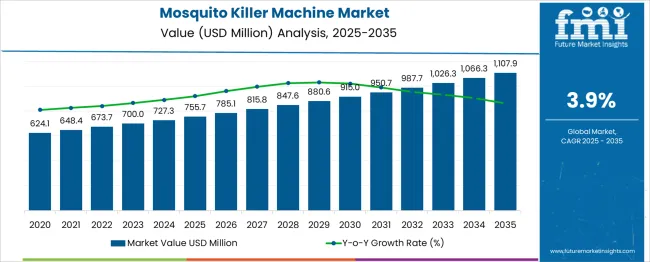

The mosquito killer machine market is estimated to be valued at USD 755.7 million in 2025 and is projected to reach USD 1107.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period. Outdoor toys represent 100% of their own category, focused on physical activity and open-air engagement. Within the overall toy and games market, their share is estimated at 5% to 10%, as indoor games and collectibles dominate total sales. In the children’s physical play equipment category, outdoor toys contribute around 10% to 15%, especially in ride-ons, trampolines, and climbers.

They hold approximately 15% to 20% of the broader sports and outdoor recreation equipment segment, given their alignment with physical activity and group play. Their presence in the general consumer outdoor goods market is limited to 3% to 5%, since the segment also includes furniture, grills, and tools. Demand is driven by seasonal cycles, backyard usage, and screen-free activity preferences. The market is expanding due to rising consumer preference for active play, backyard recreation, and experiential purchases. Major innovators include Razor, Little Tikes, Step2, VTech, Nerf, Tech Deck, and Schwinn. Toy makers are shifting toward durable designs, eco-friendly materials and integrated tech features such as app connectivity and motion sensors.

Trampolines, scooters, ride-on toys, and climbing sets dominate sales, with modular assembly kits gaining popularity. Brands collaborate with retailers to offer direct-to-consumer custom product bundles. Market momentum is driven by health consciousness, outdoor play campaigns, and the growth of suburban living, where families invest in home recreation equipment.

| Metric | Value |

|---|---|

| Mosquito Killer Machine Market Estimated Value in (2025 E) | USD 755.7 million |

| Mosquito Killer Machine Market Forecast Value in (2035 F) | USD 1107.9 million |

| Forecast CAGR (2025 to 2035) | 3.9% |

The skincare products market is supported by five core parent industries, each influencing demand and innovation. Personal care and beauty goods represent approximately 28% of total volume, supplying facial cleansers, moisturizers, and anti-aging serums. The natural and organic cosmetics segment accounts for around 22%, as consumers seek plant-based, minimal-ingredient formulations.

E-commerce and direct-to-consumer retail platforms contribute roughly 24%, enabling global brands to reach niche skincare audiences. Dermatology and clinical treatment services account for about 16%, where medical-grade skincare is prescribed for targeted skin conditions. Finally, specialty retailer and spa channels generate the remaining 10%, offering premium and experiential skincare lines. Together, these five sectors shape product development, regulatory compliance, ingredient preferences, and distribution strategies across the global skincare landscape.

Leading companies include L’Oréal, Unilever, Beiersdorf, Johnson & Johnson, Shiseido, Procter & Gamble, Coty and Estée Lauder. Major trends include AI and AR personalization platforms, microbiome-friendly probiotic formulations, vegan collagen and multifunctional products combining SPF hydration and anti-aging effects. Clean beauty has evolved to include sustainable sourcing waterless formats and refillable packaging across brand portfolios. Brands harness smart diagnostic tools such as virtual skin scanners and at-home LED therapy devices. Inclusive formulations for diverse skin tones and rising men’s skincare adoption further shape innovation strategies worldwide.

Rising urbanization, coupled with the expansion of residential and commercial spaces, has created a sustained demand for effective mosquito control solutions. Corporate announcements and product launches indicate that manufacturers are focusing on energy-efficient, chemical-free, and eco-friendly machines, which appeal to environmentally conscious consumers. Press releases and investor briefings from leading companies suggest that government campaigns on disease prevention and investments in public health infrastructure are further contributing to the adoption of mosquito killer machines.

Future growth is expected to be shaped by advancements in UV technology, improved portability, and integration of smart features, which are being actively promoted in industry news and annual reports. Sustainability initiatives and an increasing preference for safe, indoor-friendly devices are anticipated to continue strengthening the market’s upward trajectory in both developed and emerging regions.

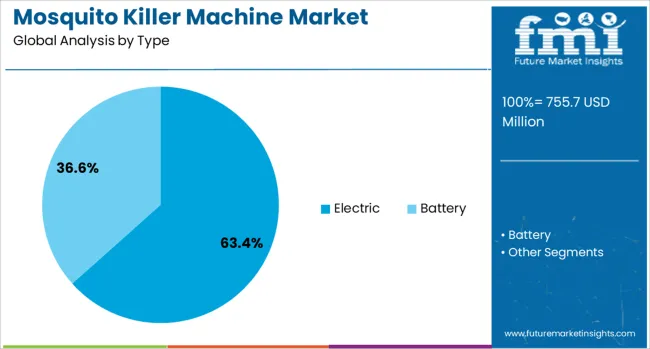

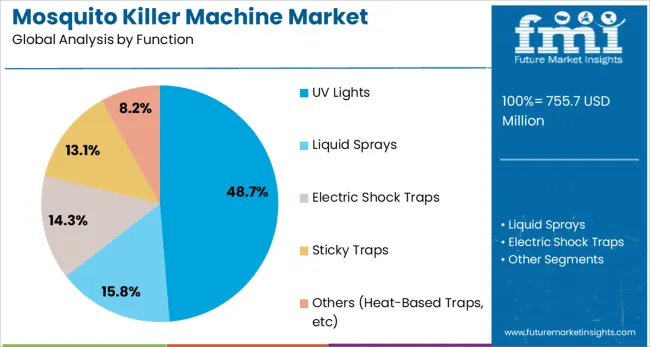

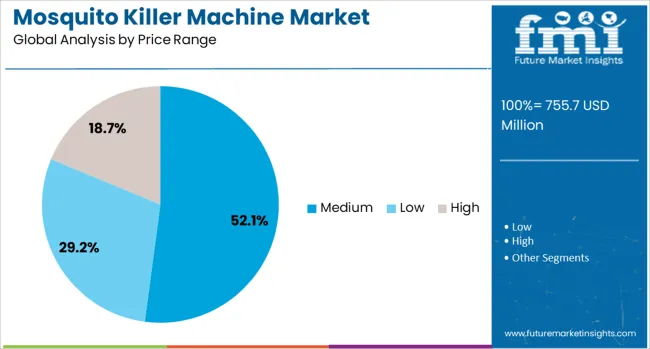

The mosquito killer machine market is segmented by type, function, price range, application, distribution channel, and geographic regions. By type of the mosquito killer machine market is divided into Electric and Battery. In terms of the function of the mosquito killer machine, the market is classified into UV Lights, Liquid Sprays, Electric Shock Traps, Sticky Traps, and Others (Heat-Based Traps, etc). Based on the price range, the mosquito killer machine market is segmented into Medium, Low, and High.

By application, the mosquito killer machine market is segmented into Residential and Commercial. The distribution channel of the mosquito killer machine market is segmented into Offline and Online. Regionally, the mosquito killer machine industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric type segment is projected to account for 63.4% of the Mosquito Killer Machine market revenue share in 2025, making it the leading type segment. This dominance is being driven by the efficiency, convenience, and reliability offered by electric mosquito killers as outlined in product datasheets and corporate updates. The electric type has been increasingly preferred for its ability to operate without harmful chemicals, making it suitable for indoor and outdoor use.

Its popularity has been reinforced by consistent improvements in design and durability, enabling longer product lifespans and reduced maintenance. Investor presentations have highlighted that consumers are choosing electric options for their ease of installation and immediate effectiveness in reducing mosquito presence.

Furthermore, product innovation focused on silent operation and enhanced safety features has strengthened consumer confidence. These factors have collectively established the electric type as the most widely adopted solution in the market.

The UV lights function segment is expected to hold 48.7% of the Mosquito Killer Machine market revenue share in 2025, maintaining its leadership among functional segments. This position has been reinforced by the growing consumer preference for chemical free and environmentally friendly solutions, as reported in trade journals and product announcements. UV light based machines have been valued for their ability to attract and eliminate mosquitoes efficiently while posing minimal health risks to humans and pets.

Annual reports and technology briefings have noted that advances in UV bulb longevity and energy efficiency have further boosted their appeal. The segment has also benefited from heightened demand in residential and hospitality environments where quiet, odorless operation is highly desired.

Corporate communications have emphasized that regulatory encouragement of non-toxic pest control methods has further validated the adoption of UV light technology. These factors combined have sustained the prominence of this segment in the overall market.

The medium price range segment is forecasted to command 52.1% of the Mosquito Killer Machine market revenue share in 2025, making it the largest segment by price. This dominance has been supported by its balance of affordability and quality, as highlighted in investor presentations and retail market insights.

Consumers have increasingly favored the medium price range for offering advanced features and durable construction at a reasonable cost. Product reviews and corporate statements have indicated that this segment aligns well with the budget expectations of middle class households and small businesses seeking effective yet cost efficient mosquito control.

Additionally, the medium price range has been strengthened by manufacturers offering competitive warranties, reliable after sales service, and appealing designs, as showcased in industry publications. These attributes have contributed to sustained consumer trust and preference for this segment, ensuring its leading position in the market.

Demand for mosquito killer machines has expanded notably across residential, commercial, and public health sectors due to rising awareness of vector-borne diseases. Approximately 42% of newly deployed units in 2024 were wall-mounted or ceiling-hung models suitable for indoor home use. Semi-industrial devices deployed in schools and clinics represented around 18 % of sales. Integrated UV light traps, automated fans, and low-noise performance have supported adoption.

Fear of mosquito-borne illnesses has driven household uptake of electrical mosquito-killing devices, especially in densely populated urban and peri-urban zones. Indoor device installations were chosen in 28% of apartments in mosquito-prone districts during peak season. Access to non-toxic UV-based killing methods and silent fan operation has been favored among families with children. Commercial establishments such as restaurants and resort lobbies have adopted these units to minimize chemical pesticide use. Integration with ambient light sensors has enabled automatic activation during evening hours, extending protective coverage and reducing manual operation requirements.

Performance has been affected in units lacking appropriate fan speed, leading to mosquitoes avoiding capture in about 9% of indoor scenarios. Replacement bulb and mesh filter costs have added up to 13% of annual operating expenses in high-use settings. Ineffective suction design or UV intensity in some low-cost models has resulted in inconsistent mosquito elimination, prompting dissatisfaction in 7% of user reviews. Product effectiveness has varied in regions where multiple species respond differently to light frequencies. Moreover, a lack of certification or validation in commercial settings has prevented adoption in school and hospital projects in certain jurisdictions.

Smart mosquito killer devices with occupancy or motion sensors have increased adoption in family homes and hospitality suites, capturing 16% of smart-home–enabled product sales. Models combining insecticide-free traps with fan modules and replaceable attractant pads have been deployed in schools and offices, where chemical usage is restricted. Timer-linked fan activation and humidity-based sensing algorithms have provided up to 24% energy savings over round-the-clock operation. Hybrid units that offer both UV traps and pheromone pads have gained traction in retail malls and clinics where two-zone protection is preferred. These designs support new service contracts for maintenance and consumable restocking.

Quiet fan blade designs operating below 45 dB are being installed in 38% of the latest residential models to minimize disruption. Modular panels, snap-in trap baskets, and quick-release lamps have improved user-replacement ease and reduced servicing time by 11%. Subscription-based refill services for attractant pads and lamp bulbs have been introduced by brands, enhancing customer retention and accounting for 22% of repeat orders in serviced regions. Mobile app integration offering device status and trap saturation alerts is being included in 17% of new smart models. Compact tournament-grade designs are being specified for outdoor event fences and garden pathways where aesthetic discretion and portability matter.

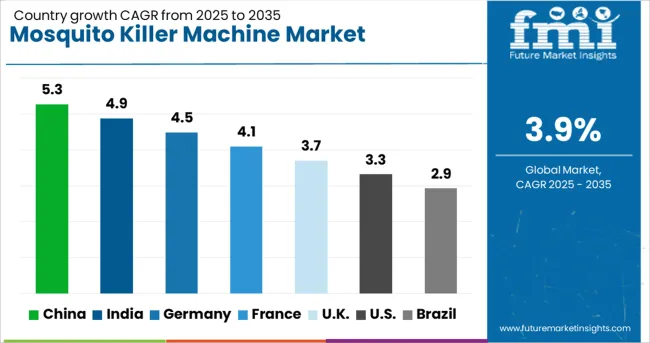

| Country | CAGR |

|---|---|

| China | 5.3% |

| India | 4.9% |

| Germany | 4.5% |

| France | 4.1% |

| UK | 3.7% |

| USA | 3.3% |

| Brazil | 2.9% |

The mosquito killer machine market is expected to grow at a global CAGR of 3.9% from 2025 to 2035. China leads the market with a CAGR of 5.3%, followed by India at 4.9%, and Germany at 4.5%. France is projected to grow at 4.1%, while the United Kingdom records 3.7%, and the United States shows a CAGR of 3.3%. The growth in China and India is driven by the high prevalence of mosquito-borne diseases and a growing awareness of health risks. Developed markets like France, the UK, and the USA are seeing steady demand, mainly driven by rising concerns about health and increasing adoption of advanced mosquito control technologies. The market is poised for growth due to innovations in mosquito-killing devices and increasing demand for effective solutions to combat mosquito-borne diseases.

China leads the market with a CAGR of 5.3%, supported by high levels of urbanization and rapid industrialization, which have contributed to the rise in mosquito-borne diseases. The government’s efforts to control diseases like malaria, Zika, and dengue are pushing for greater adoption of mosquito killer machines. Moreover, China’s growing awareness regarding public health and hygiene, particularly in large cities, is accelerating market growth. The increasing demand for effective mosquito control solutions is also linked to the rising affluence and growing focus on home and personal hygiene. With advancements in technology, the demand for more efficient and eco-friendly devices is expected to rise in the coming years.

India is projected to grow at a CAGR of 4.9% through 2035, driven by increasing concerns over mosquito-borne diseases like malaria, dengue, and chikungunya. The government’s focus on eradicating such diseases and providing safe living environments has resulted in the growing adoption of mosquito killer machines across the country. Additionally, the expanding middle class, particularly in urban centers, is creating demand for affordable and efficient mosquito control solutions. The rising awareness of health and sanitation issues in both urban and rural regions further drives this market. Furthermore, the increasing popularity of smart homes and automation systems is pushing for the integration of advanced mosquito control technologies.

The United Kingdom is projected to grow at a CAGR of 3.7% through 2035 in the mosquito killer machine market. Although the prevalence of mosquito-borne diseases in the UK is lower than in tropical regions, the market is still expanding due to increased consumer awareness of these diseases and the rising demand for effective mosquito control solutions. The growing focus on public health, particularly in urban areas, is driving this demand. Additionally, the increase in seasonal mosquito-related concerns, particularly in summer, is pushing households and businesses to adopt more efficient mosquito-killing technologies. The UK’s inclination towards eco-friendly and energy-efficient products is also influencing the demand for advanced mosquito control solutions.

France is projected to grow at a CAGR of 3.9% through 2035 in the mosquito killer machine market. Although mosquito-borne diseases are not as widespread as in tropical regions, the demand for mosquito control solutions is increasing due to the rising number of localized outbreaks. The government’s efforts to combat these diseases and provide solutions for residents are driving market growth. In addition, the increasing awareness of health risks associated with mosquitoes, particularly in urban and suburban areas, is contributing to the demand for efficient mosquito killer machines. The growing preference for smart and energy-efficient solutions is also a driving factor in the French market.

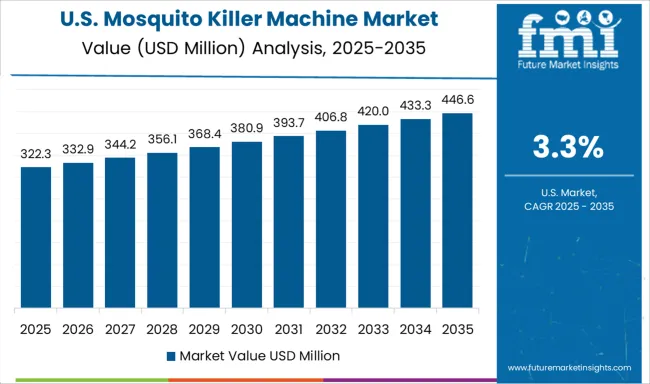

The United States is projected to grow at a CAGR of 3.3% through 2035 in the mosquito killer machine market. The demand for these devices in the USA is driven by increasing concerns over mosquito-borne diseases such as West Nile virus, Zika virus, and malaria. While these diseases are relatively less prevalent, localized outbreaks and growing awareness about the risks of mosquito-borne illnesses are pushing more consumers to adopt mosquito control solutions. Additionally, the rising trend of maintaining clean and safe living spaces, particularly in urban areas, is contributing to the adoption of mosquito killer machines. The USA market also sees demand from both residential and commercial sectors, where there is a focus on efficiency and effectiveness in pest control.

Brazil is expected to grow at a CAGR of 2.9% through 2035 in the mosquito killer machine market. The country faces a high prevalence of mosquito-borne diseases, such as dengue, malaria, and Zika virus, particularly during the rainy season. This has significantly increased the demand for mosquito killer machines in both residential and commercial sectors. The government and health organizations in Brazil have been working to control mosquito populations, and as a result, demand for mosquito control products, including electronic and chemical-based mosquito killer devices, continues to grow. The affordability of these products, along with growing awareness about the health risks associated with mosquitoes, is driving market adoption.

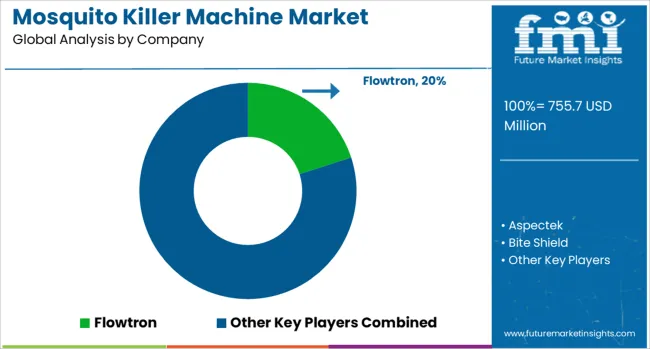

The mosquito killer machine market is driven by companies specializing in innovative solutions to control mosquito populations and prevent the spread of diseases. Flowtron is a major player, offering a range of high-efficiency mosquito traps known for their effectiveness and long-lasting performance. Aspectek provides technologically advanced mosquito killer devices, focusing on eco-friendly designs and safety features for both indoor and outdoor use.

Bite Shield and Black Flag offer reliable mosquito killer machines, with a focus on providing affordable and effective solutions for residential and commercial settings. Their products emphasize long-range attraction and safe usage for homes, patios, and gardens. Dynatrap is a key competitor, offering a variety of mosquito traps designed for large outdoor spaces, utilizing UV light and CO2 to attract and trap mosquitoes effectively.

Hi Care specializes in producing effective, compact mosquito killer machines for both residential and commercial use, emphasizing low maintenance and energy efficiency. Mosquito Magnet is known for its high-performance mosquito traps that utilize patented CO2 technology to attract and eliminate mosquitoes over large areas. Padmini Appliances and Pic Corporation provide mosquito killer devices that cater to different consumer needs, focusing on compact, portable designs and user-friendly features.

Toshiba Corporation also contributes to the market, leveraging its technological expertise to offer reliable, energy-efficient mosquito killer machines that are effective in controlling mosquito populations in both residential and industrial environments. Competitive differentiation in this market is driven by factors such as product efficiency, energy consumption, maintenance, safety features, and technology integration.

Barriers to entry include high manufacturing costs, stringent regulatory standards, and the need for continuous innovation in mosquito control technology. Strategic priorities include expanding product offerings, improving energy efficiency, and enhancing environmental sustainability in product designs.

| Item | Value |

|---|---|

| Quantitative Units | USD 755.7 Million |

| Type | Electric and Battery |

| Function | UV Lights, Liquid Sprays, Electric Shock Traps, Sticky Traps, and Others (Heat-Based Traps, etc) |

| Price Range | Medium, Low, and High |

| Application | Residential and Commercial |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Flowtron, Aspectek, Bite Shield, Black Flag, Dynatrap, Hi Care, Mosquito Magnet, Padmini Appliances, Pic Corporation, and Toshiba Corporation |

| Additional Attributes | Dollar sales by technology (RFID, NFC, QR/barcode, mobile apps) and application (public transport, events and venues, airlines), demand across smart cities transit, mass gatherings, and travel services, regional trends led by Asia‑Pacific with North America catching up, innovation in contactless mobile integration, multimodal ticketing platforms, tokenization and blockchain-based validation, and environmental impact via paperless ticketing, reduced physical passes, and integration into sustainable urban transport ecosystems. |

The global mosquito killer machine market is estimated to be valued at USD 755.7 million in 2025.

The market size for the mosquito killer machine market is projected to reach USD 1,107.9 million by 2035.

The mosquito killer machine market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types in mosquito killer machine market are electric and battery.

In terms of function, uv lights segment to command 48.7% share in the mosquito killer machine market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA