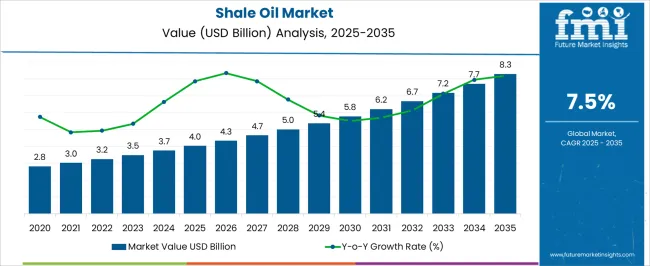

The Shale Oil Market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Shale Oil Market Estimated Value in (2025 E) | USD 4.0 billion |

| Shale Oil Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The shale oil market is gaining momentum as global energy demand continues to expand and the need for diversified supply sources intensifies. Technological advancements in extraction processes, particularly hydraulic fracturing and horizontal drilling, have significantly improved recovery rates, lowering production costs and making shale oil more commercially viable. Increasing energy security concerns and the strategic aim of reducing dependency on conventional crude supplies are encouraging wider adoption.

The growing role of shale oil in balancing energy demand, especially during periods of volatility in conventional oil markets, is also shaping the sector. Investments in infrastructure, refining capacity, and logistics are enhancing the scalability of shale oil production, while supportive policy frameworks in certain regions are further boosting market development.

As global economies prioritize reliable and cost-effective energy sources, shale oil is expected to remain a crucial component of the energy mix The future outlook is shaped by continuous technological improvements, regulatory support, and the ability of producers to maintain cost competitiveness while addressing environmental considerations.

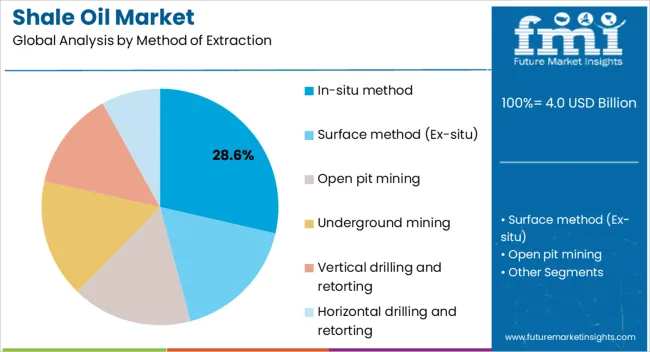

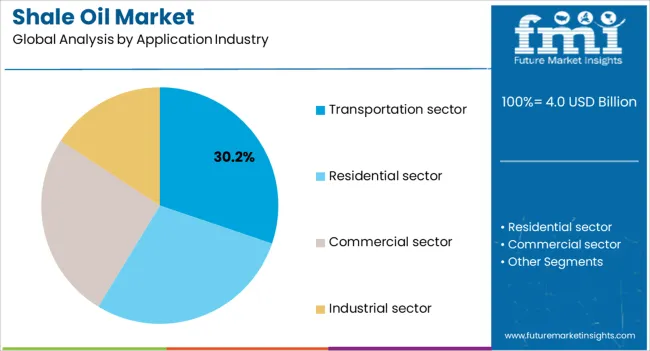

The shale oil market is segmented by method of extraction, application industry, and geographic regions. By method of extraction, shale oil market is divided into In-situ method, Surface method (Ex-situ), Open pit mining, Underground mining, Vertical drilling and retorting, and Horizontal drilling and retorting. In terms of application industry, shale oil market is classified into Transportation sector, Residential sector, Commercial sector, and Industrial sector. Regionally, the shale oil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The in-situ method is projected to account for 28.6% of the shale oil market revenue share in 2025, making it one of the most significant extraction techniques. This method’s prominence is being driven by its efficiency in accessing deep shale formations that are not easily recoverable using traditional surface mining methods. The in-situ process enables oil recovery through heating and extraction techniques carried out underground, reducing the need for extensive surface disruption and minimizing land use.

Its adoption is being supported by increasing investments in technological advancements that improve heat transfer efficiency and overall oil recovery rates. The ability to operate with lower surface environmental impact compared to conventional mining is also enhancing its attractiveness in regions with strict environmental regulations.

Furthermore, the in-situ method provides scalability for large reserves, offering long-term production potential while keeping costs competitive As demand for sustainable extraction grows alongside efficiency improvements, the in-situ method is expected to maintain a leading role in the overall development of the shale oil industry.

The transportation sector is anticipated to hold 30.2% of the shale oil market revenue share in 2025, establishing itself as the leading application industry. This dominance is being supported by the rising global demand for fuels such as gasoline, diesel, and jet fuel, which are critical for the mobility of goods and people. Shale oil, when refined, provides an important supply source to meet growing transportation energy needs while supporting price stability in fuel markets.

The sector is benefiting from expanding vehicle fleets, aviation growth, and logistical operations across emerging and developed economies. Refining technologies have improved the yield and quality of shale-derived fuels, enabling them to meet stringent performance and emissions standards. Additionally, the transportation industry’s dependence on consistent fuel supplies makes shale oil a valuable supplement to conventional crude production.

Investments in refining capacity and distribution infrastructure are also enhancing the availability of shale oil for transportation purposes As global mobility and trade continue to expand, the transportation sector is expected to remain the largest consumer of shale oil, reinforcing its leadership in the market.

The current market is growing at a moderate pace by registering a healthy CAGR during the foreseen time. The rising consumption of shale oil and growing end-use industries, including the petrochemical sector, are accelerating the demand for shale oil during the forecast period. The growing adoption of shale oil in the petrochemical industry due to producing chemical components and refining the fuel is increasing the shale oil market size.

Moreover, shale oil is a substitute for fuels, including LPG (Liquid Petroleum Gas), diesel, gasoline, and others, which is accelerating the demand for shale oil in recent years. Prominent company manufacturers are increasing the adoption of shale oil to produce several commercial products, such as sulfur and ammonia, during the forecast period.

The growing innovation and rising advanced technology, such as horizontal drilling, is anticipated to make reservoirs for shale oil and is thus increasing the market opportunities. However, the high cost and governments' strict regulation to control the adoption of shale oil as it pollutes the environment is declining the market growth.

In 2025, Reliance Industries invested around INR 700 Billion to set up a crude-to-chemical project in Gujarat. In addition, as an oil-to-chemical strategy, the company integrated petrochemical and petroleum refinery for petrochemical production. The growing investment by large-scale industries is increasing the market size during the forecast period.

North America dominates the global market by securing the maximum share during the forecast period. Rising production of shale oil, growing infrastructure, and the presence of key players are driving the North American shale oil market during the forecast period.

The US dominates the global market by producing 50% of the total market for shale oil during the forecast period. Several developing countries import shale oil from the US due to rising demand for shale oil for several purposes during the forecast period.

The number of prominent players plays a crucial role by contributing the maximum share by achieving their goals during the forecast period. These key players are focusing on petrochemical plants to fulfill the needs of end-user industries during the forecast period. However, these factors are likely to increase the sales of oil shale during the forecast period.

On the other hand, the market players are indulging in several marketing methodologies to uplift the market during the forecast period.

Oil shale contains organic matter which is converted into synthetic oil by pyrolysis and hydrogenation or thermal dissolution. USA. have the largest proved shale oil reserve followed by Russia. Despite of high production cost and low market price of oil, shale oil market accounted for more than 50% of total oil market in the USA. in 2025. USA. is the largest consumer and a major importer of oil.

Presently, around 35% of total US energy demands are fulfilled by petroleum products. In the USA. from Jan 2025- July 2025, total imports of crude oil have increased significantly. To fulfill its growing energy demand, the USA. is majorly dependent on Canada and OPEC. Canada’s energy demand have been constant but production has increased to meet US oil consumption.

In Nov 2025, OPEC reduced its oil prices and increased its production to discourage shale oil manufacturers of world, this resulted production freeze among shale producers. This caused a major setback for world shale oil market. This also drastically increased the number of drilled out uncompleted wells (DUCs).

These reasons forced American oil companies to become innovative and efficient. Now, Oil companies are cutting their production cost, deploying efficient oil rigs and increasing their production. Since July 2025, there has been 20% increase in oil rig counts. Oil producers have also increased their exports to India. These trends are declaring the redemption of USA. shale oil. Shale oil market is expected to gain momentum from mid-2025.

Reserves: USA. have significant proved shale oil reserves. Since 2010, there have been a regular increase in proved oil reserves. Presently the largest proved recoverable shale formation is the Monterey play in southern California (USA). The next largest recoverable shale oil plays are in Eagle Ford and Bakken.

Green River Formation in Colorado, Wyoming, and Utah, are among the biggest oil shale deposits in the world. But these deposits are not economically recoverable with current technology. In Canada, Bakken (stretches across southern Saskatchewan to Manitoba) and Cardium formation in Alberta are two shale oil plays.

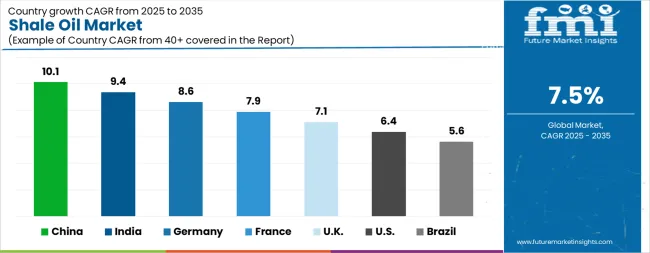

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

The Shale Oil Market is expected to register a CAGR of 7.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.1%, followed by India at 9.4%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.6%, yet still underscores a broadly positive trajectory for the global Shale Oil Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.6%. The USA Shale Oil Market is estimated to be valued at USD 1.4 billion in 2025 and is anticipated to reach a valuation of USD 2.6 billion by 2035. Sales are projected to rise at a CAGR of 6.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 188.1 million and USD 103.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Method of Extraction | In-situ method, Surface method (Ex-situ), Open pit mining, Underground mining, Vertical drilling and retorting, and Horizontal drilling and retorting |

| Application Industry | Transportation sector, Residential sector, Commercial sector, and Industrial sector |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

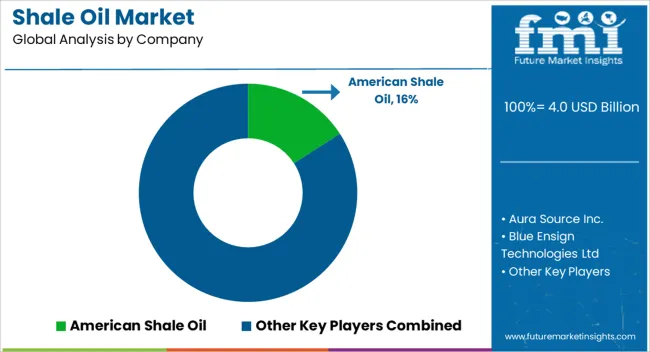

| Key Companies Profiled | American Shale Oil, Aura Source Inc., Blue Ensign Technologies Ltd, Chevron Corporation, Electro-Petroleum Inc., Exxon Mobil Corporation, Occidental Petroleum Corporation, Chesapeake, MARATHON OIL COMPANY, CotCabot Oil & Gas Corporation, and Halliburton Energy Services |

The global shale oil market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the shale oil market is projected to reach USD 8.3 billion by 2035.

The shale oil market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in shale oil market are in-situ method, surface method (ex-situ), open pit mining, underground mining, vertical drilling and retorting and horizontal drilling and retorting.

In terms of application industry, transportation sector segment to command 30.2% share in the shale oil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shale Gas Processing Equipment Market

Global Shale Gas Hydraulic Fracturing Market Outlook – Trends & Forecast 2025–2035

On Purpose Technologies Market Growth - Trends & Forecast 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Immersed Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Accumulator Market Size and Share Forecast Outlook 2025 to 2035

Oil Based Electric Drive Unit (EDU) Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA