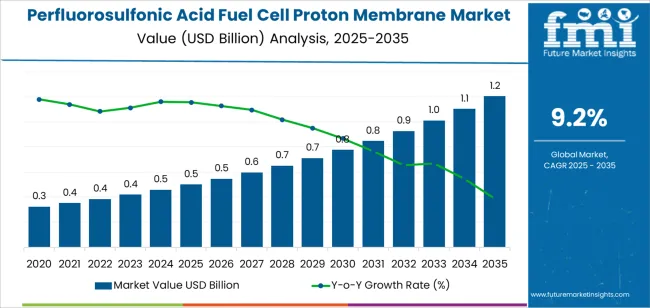

The perfluorosulfonic acid (PFSA) fuel cell proton membrane market is valued at USD 0.5 billion in 2025 and is expected to reach USD 1.3 billion by 2035, advancing at a CAGR of 9.2%. Market growth is driven by the accelerating adoption of hydrogen fuel cells in transportation, stationary power generation, and portable energy systems. Rising investments in hydrogen infrastructure and the global push toward zero-emission energy solutions continue to strengthen demand for high-performance proton exchange membranes that ensure efficiency, durability, and chemical stability under extreme conditions.

Extrusion molding membranes represent the leading segment due to their structural uniformity, consistent ion conductivity, and mechanical resilience during extended fuel cell operation. These membranes offer low hydrogen permeability and high thermal resistance, making them suitable for automotive fuel cells and industrial-scale energy systems. Ongoing advancements in membrane reinforcement, hydration stability, and cost reduction are expanding their applicability across emerging hydrogen-based technologies.

Asia Pacific leads global market growth, driven by hydrogen vehicle deployment and fuel cell production in China, Japan, and South Korea. Europe and North America sustain demand through renewable energy integration and government-supported clean energy initiatives. Key players include Chemours, Solvay, DOW, AGC, Gore, Asahi Kasei, and Ballard, focusing on membrane performance optimization, scalable manufacturing, and long-term durability enhancement.

Growth rate volatility analysis indicates a moderate-to-high fluctuation pattern during the early forecast years, followed by gradual stabilization as fuel cell technology gains commercial maturity. From 2025 to 2028, volatility will remain elevated due to variability in hydrogen infrastructure investment, fuel cell vehicle deployment rates, and raw material costs associated with perfluorinated polymers. Government incentives and pilot-scale production will create intermittent growth surges during this phase.

Between 2029 and 2035, the volatility index is expected to decline as large-scale fuel cell manufacturing and steady demand from automotive, stationary power, and portable energy sectors improve market predictability. Standardization of proton exchange membrane (PEM) designs and advances in chemical durability will further reduce growth fluctuations. While regional adoption rates will vary, the market’s long-term stability will be supported by increasing hydrogen economy investments and emission reduction targets. The overall volatility trend demonstrates an early phase of dynamic expansion transitioning toward a stable growth environment driven by technology standardization and sustained policy support.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.5 billion |

| Market Forecast Value (2035) | USD 1.3 billion |

| Forecast CAGR (2025-2035) | 9.2% |

The PFSA proton exchange membrane market is expanding as demand rises for efficient electrolytes in hydrogen fuel cells and water-electrolysis systems. These membranes enable proton conduction in polymer electrolyte fuel cells, facilitating conversion from chemical to electrical energy with improved efficiency and durability. Growing governmental commitments to decarbonisation and the development of hydrogen infrastructure support the adoption of PFSA membranes in automotive, stationary power and industrial power applications.

Advances in membrane materials including reinforced PFSA and hybrid structures enhance key performance metrics such as conductivity, mechanical stability and gas barrier properties, bolstering technical viability for large-scale deployment. Expanded investment in mobility, renewable integration and hydrogen generation further drives volume growth. Constraints include high material cost, dependency on fluoropolymer raw materials and challenges in scaling manufacturing to meet demand. Competition from alternative membrane technologies and regional variations in regulatory support moderate growth pace.

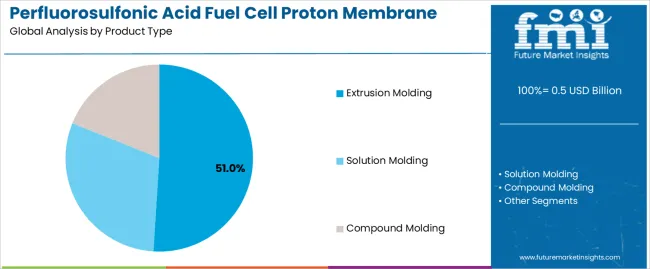

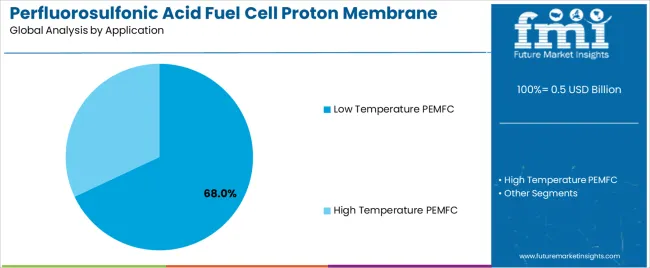

The Perfluorosulfonic Acid (PFSA) fuel cell proton membrane market is segmented by product type and application. By product type, the market is divided into extrusion molding, solution molding, and compound molding. Based on application, it is categorized into low temperature PEMFC and high temperature PEMFC. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

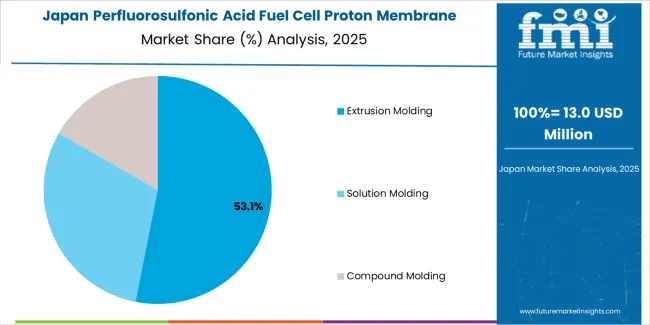

The extrusion molding segment holds the leading position in the PFSA fuel cell proton membrane market, representing an estimated 51.0% of total market share in 2025. Extrusion-molded membranes are widely utilized due to their uniform thickness, excellent mechanical strength, and superior proton conductivity. This method enables high production consistency and scalability, making it suitable for mass manufacturing of membranes used in both automotive and stationary fuel cell systems.

The dominance of this segment is supported by its compatibility with advanced PFSA materials that provide excellent chemical stability and durability under long-term electrochemical operation. Extrusion molding also offers lower defect rates and improved membrane performance across varying humidity and temperature conditions. The solution molding segment, estimated at 32.0%, is primarily adopted in research and specialty fuel cell applications due to its ability to produce thinner, more flexible membranes. The compound molding category, accounting for about 17.0%, serves emerging applications combining composite reinforcement for enhanced mechanical and thermal properties.

Key factors supporting the extrusion molding segment include:

The low temperature PEMFC (Proton Exchange Membrane Fuel Cell) segment accounts for approximately 68.0% of the PFSA fuel cell proton membrane market in 2025. Low temperature PEMFCs operate typically below 100°C and rely heavily on PFSA membranes for efficient proton transport, chemical durability, and water management. Their primary use in transportation, residential power generation, and portable fuel cell systems supports strong demand for high-quality PFSA membranes with superior conductivity and mechanical stability.

The high temperature PEMFC segment, estimated at 32.0%, is expanding gradually due to increased adoption in industrial and stationary applications requiring higher tolerance to impurities and reduced cooling complexity. These systems utilize modified PFSA membranes or composite variants capable of maintaining performance above 120°C, supporting broader operational flexibility.

Primary dynamics driving demand from the low temperature PEMFC segment include:

Rapid growth of hydrogen fuel-cell and electrolyser deployment, pressure for durable high-performance membranes, and supportive clean-energy policy drive adoption.

The PFSA membrane market is propelled by expanding fuel-cell vehicle programmes, stationary hydrogen-generation plants and large-scale green-hydrogen electrolysis installations. Membranes based on perfluorosulfonic-acid polymers offer high proton conductivity, chemical stability and operational reliability at low-temperature proton-exchange membrane fuel cells (PEMFCs). Government incentives for hydrogen infrastructure, carbon-emission reduction mandates and accelerating commercialisation of PEM technologies strengthen demand for PFSA membranes. These factors combine to increase licensing, production and application of PFSA membrane materials across automotive, energy-storage and industrial sectors.

High material and manufacturing cost, competition from alternative membrane technologies and supply-chain constraints limit acceleration.

PFSA membranes are made from advanced fluoropolymers that involve energy-intensive manufacturing, strict quality controls and limited producer base, leading to elevated unit costs and long qualification times for new suppliers. Research in non-fluorinated or composite membranes presents potential substitutes that could limit long-term dominance of PFSA chemistries. Global supply-chain volatility in fluoropolymer raw materials and certification hurdles for fuel-cell stack integration create barriers for rapid scale-up. These factors restrain broad, cost-sensitive adoption especially in emerging markets.

Trend toward next-generation PFSA membranes with enhanced durability, regional expansion in Asia-Pacific and integration in multi-market applications define future direction.

Suppliers are developing reinforced PFSA membrane grades that offer higher chemical and mechanical stability for demanding applications like electric buses, industrial electrolysers and offshore power units. The Asia-Pacific region is emerging as a key growth zone driven by major hydrogen-economy initiatives in China, Japan and South Korea, strong manufacturing bases and increasing commercial fuel-cell deployments. Beyond automotive fuel cells, PFSA membranes are gaining traction in water-electrolysis, chlor-alkali and advanced battery systems, reflecting broader market diversification into energy-conversion and industrial sectors.

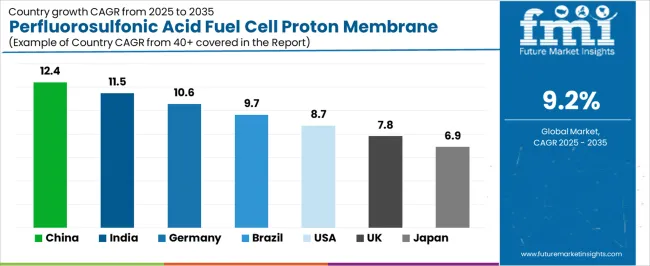

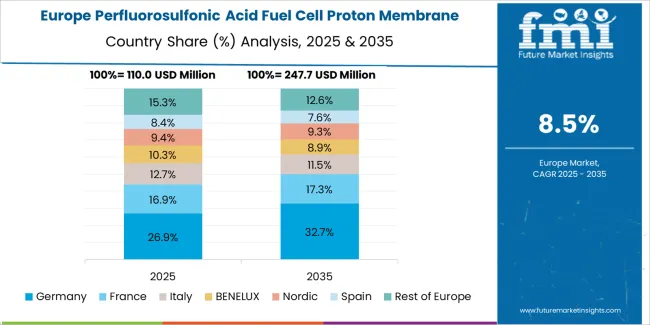

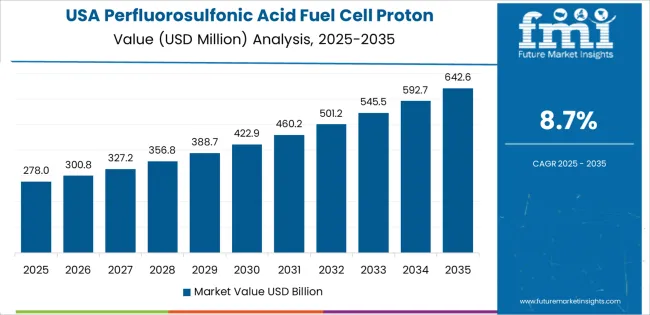

The global perfluorosulfonic acid (PFSA) fuel cell proton membrane market is expanding strongly through 2035, driven by decarbonization policies, electric mobility initiatives, and the scaling of hydrogen infrastructure. China leads with a 12.4% CAGR, followed by India at 11.5%, reflecting rapid advancement in fuel cell manufacturing and hydrogen energy projects. Germany grows at 10.6%, supported by renewable integration and automotive innovation. Brazil records 9.7%, driven by clean transport initiatives and regional energy diversification. The United States grows at 8.7%, emphasizing hydrogen hubs and stack performance research, while the United Kingdom (7.8%) and Japan (6.9%) maintain growth through technology refinement and commercial fuel cell applications.

| Country | CAGR (%) |

|---|---|

| China | 12.4 |

| India | 11.5 |

| Germany | 10.6 |

| Brazil | 9.7 |

| USA | 8.7 |

| UK | 7.8 |

| Japan | 6.9 |

China’s PFSA fuel cell proton membrane market grows at 12.4% CAGR, supported by national hydrogen energy strategies and vehicle electrification programs. Under the 14th Five-Year Plan, large-scale hydrogen production and fuel cell vehicle (FCV) deployment are driving demand for high-efficiency proton exchange membranes. Domestic companies are scaling PFSA membrane manufacturing for automotive, industrial, and stationary applications. Research institutions collaborate with chemical manufacturers to improve membrane durability, ion conductivity, and cost reduction through localized raw material synthesis. The combination of state funding and commercial adoption accelerates China’s global leadership in membrane production capacity.

Key Market Factors:

India’s market grows at 11.5% CAGR, driven by hydrogen roadmap implementation, clean mobility initiatives, and industrial decarbonization. The National Green Hydrogen Mission supports domestic R&D and pilot-scale membrane manufacturing. Collaborations between public research bodies and private chemical firms aim to develop cost-efficient PFSA membranes suited for tropical conditions. The adoption of fuel cells in public transport and backup power systems is increasing, supported by state-level renewable energy programs. Startups focusing on polymer science and stack integration contribute to early commercialization.

Market Development Factors:

Germany’s market grows at 10.6% CAGR, supported by strong hydrogen infrastructure development and automotive industry integration. The National Hydrogen Strategy and H2Global initiative encourage fuel cell deployment in vehicles and stationary systems. German chemical firms are producing next-generation PFSA membranes with enhanced proton conductivity and mechanical stability. Integration with renewable hydrogen generation projects aligns with the Energiewende transition framework. Advanced testing centers and EU-funded research programs facilitate technology standardization and system reliability improvements across the value chain.

Key Market Characteristics:

Brazil’s market grows at 9.7% CAGR, driven by renewable resource availability, clean transport initiatives, and energy diversification programs. The National Hydrogen Program (PNH2) supports early-stage hydrogen and fuel cell projects. Universities and energy firms are conducting pilot programs integrating PFSA-based fuel cells with ethanol reformers and biohydrogen systems. Domestic research focuses on durability and thermal resistance improvements for tropical operation. The government’s renewable strategy encourages fuel cell adoption for distributed power generation in remote and industrial regions.

Market Development Factors:

The United States grows at 8.7% CAGR, supported by federal hydrogen policies, advanced research programs, and industrial demonstration projects. The Hydrogen Shot Initiative under the Department of Energy (DOE) promotes cost reduction in hydrogen production and fuel cell components. Chemical manufacturers are developing high-conductivity PFSA membranes for heavy-duty vehicles and aerospace applications. R&D focuses on membrane hydration stability and reduced fluoropolymer waste. Growing hydrogen hub development and fuel cell bus fleet deployment further sustain market momentum.

Key Market Factors:

The United Kingdom’s market grows at 7.8% CAGR, supported by national hydrogen policy and decarbonization objectives. The UK Hydrogen Strategy prioritizes low-carbon fuel cell technology for transport, power, and heating applications. Local material science firms are advancing PFSA membrane development through R&D funding under Innovate UK. Industrial pilot programs for hydrogen buses and marine systems are expanding. Collaboration with European chemical manufacturers supports scaling and cost optimization. Policy consistency and funding continuity maintain steady adoption across mobility and power sectors.

Market Development Factors:

Japan’s market grows at 6.9% CAGR, supported by its long-standing leadership in fuel cell R&D and commercialization. The Strategic Roadmap for Hydrogen and Fuel Cells emphasizes residential, transport, and stationary deployment. Domestic firms are improving PFSA membrane chemical resistance and thin-film durability. Integration in polymer electrolyte fuel cells (PEFCs) used in vehicles and cogeneration units continues to expand. Material engineering efforts target low-humidity operation and high proton conductivity stability. Collaboration between universities and industrial partners strengthens Japan’s export capability for premium membrane technology.

Key Market Characteristics:

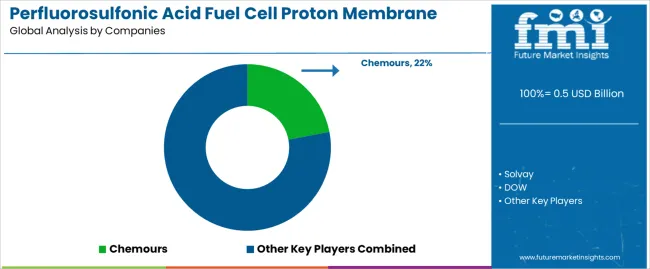

The perfluorosulfonic acid (PFSA) fuel cell proton membrane market is moderately consolidated, dominated by a few global chemical and membrane technology companies supplying materials for hydrogen fuel cells and electrolysis applications. Chemours leads the market with an estimated 22.0% global share, supported by its Nafion™ product line, which serves as the industry benchmark for high proton conductivity, chemical stability, and mechanical durability. Its leadership is reinforced by extensive production capacity, established relationships with fuel cell system manufacturers, and continuous innovation in thinner, more efficient membrane structures.

Solvay, DOW, and AGC follow as major competitors, leveraging strong fluoropolymer chemistry expertise and large-scale material production. Their competitive strengths lie in development of PFSA membranes with enhanced hydration stability, lower resistance, and extended operational lifespans for both PEM fuel cells and water electrolyzers. Gore and Asahi Kasei hold important positions through proprietary composite membrane technologies offering improved gas barrier performance and dimensional stability under high-temperature operating conditions.

Ballard and Fumatech BWT GmbH serve as integrated solution providers, focusing on membrane-electrode assembly (MEA) development and application-specific customization for automotive and stationary fuel cell systems. Shandong Dongyue Future Hydrogen Energy Materials represents a rapidly growing Chinese manufacturer, expanding regional capacity and contributing to global supply diversification.

Competition in this market is defined by ion conductivity, durability, chemical resistance, and cost efficiency. Market growth is driven by accelerating adoption of hydrogen fuel cells in transportation and renewable energy sectors, where PFSA membranes remain critical to achieving long-term performance and system reliability.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Product Type | Extrusion Molding, Solution Molding, Compound Molding |

| Application | Low Temperature PEMFC, High Temperature PEMFC |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Chemours, Solvay, DOW, AGC, Gore, Asahi Kasei, Ballard, Fumatech BWT GmbH, Shandong Dongyue Future Hydrogen Energy Materials |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of proton exchange membrane and fuel cell component manufacturers; advancements in perfluorosulfonic acid membrane durability and conductivity; integration with hydrogen energy systems and next-generation PEMFC technologies. |

The global perfluorosulfonic acid fuel cell proton membrane market is estimated to be valued at USD 0.5 billion in 2025.

The market size for the perfluorosulfonic acid fuel cell proton membrane market is projected to reach USD 1.2 billion by 2035.

The perfluorosulfonic acid fuel cell proton membrane market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in perfluorosulfonic acid fuel cell proton membrane market are extrusion molding, solution molding and compound molding.

In terms of application, low temperature pemfc segment to command 68.0% share in the perfluorosulfonic acid fuel cell proton membrane market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA