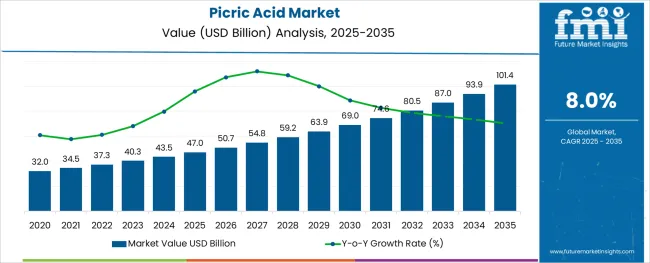

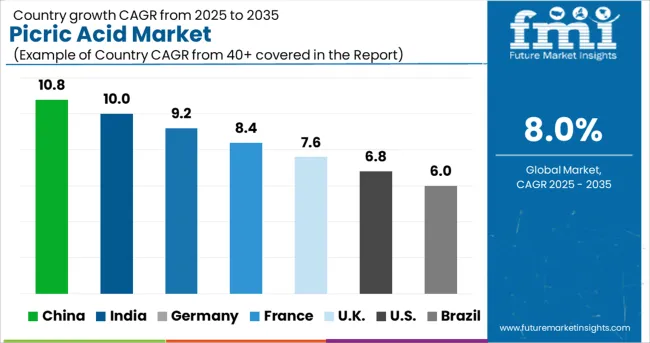

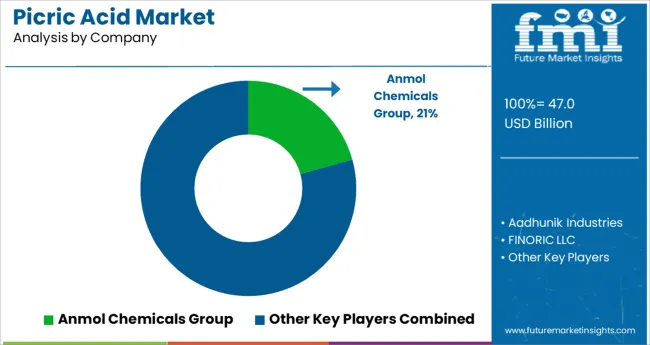

The Picric Acid Market is estimated to be valued at USD 47.0 billion in 2025 and is projected to reach USD 101.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The picric acid market is witnessing steady expansion driven by its critical role in the explosives and munitions industry. High purity picric acid is increasingly sought after due to its superior chemical reactivity and stability, which are essential for producing reliable energetic compounds. Industrial demand is further supported by stringent quality requirements and safety regulations that favor materials with consistent purity levels.

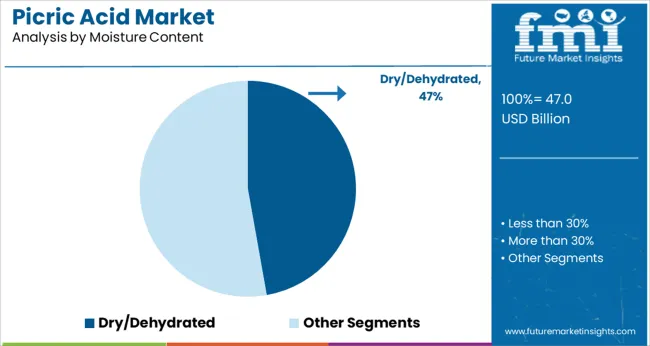

The dry or dehydrated form of picric acid has become preferred due to its enhanced stability and longer shelf life, making it more suitable for storage and transportation in sensitive applications. Additionally, the ongoing modernization of military and defense sectors worldwide has led to increased procurement of high-quality raw materials for explosives manufacturing.

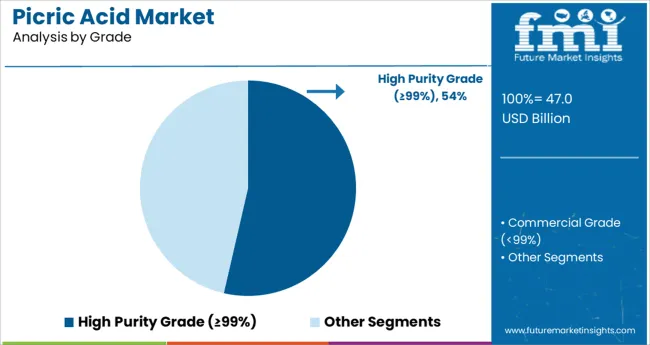

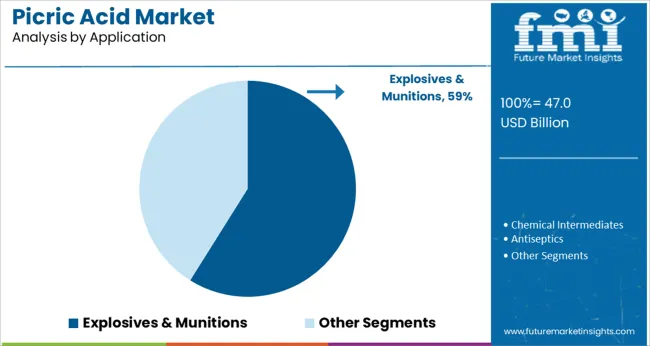

Looking ahead, market growth is expected to be driven by advancements in synthesis methods and expanding applications in specialized industries. The High Purity Grade segment, Dry/Dehydrated moisture content category, and Explosives & Munitions application are forecasted to dominate the market share.

The market is segmented by Grade, Moisture Content, Application, and End User and region. By Grade, the market is divided into High Purity Grade (≥99%) and Commercial Grade (<99%). In terms of Moisture Content, the market is classified into Dry/Dehydrated, Less than 30%, and More than 30%.

Based on Application, the market is segmented into Explosives & Munitions, Chemical Intermediates, and Antiseptics. By End User, the market is divided into Defence/Ballistics, Pharmaceuticals, Agrochemicals, Textile, and Mining. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The High Purity Grade (≥99%) segment is projected to account for 53.6% of the picric acid market revenue in 2025, maintaining its leadership position. This segment’s growth is attributed to the demand for chemically pure picric acid that ensures high performance and reliability in explosive formulations. The use of high purity grade material minimizes impurities that could affect sensitivity and stability, which is critical in defense applications.

Manufacturers prioritize this grade to comply with strict industry standards and enhance product safety. Moreover, high purity picric acid finds use in specialized chemical synthesis and laboratory applications, broadening its market demand.

As quality control becomes increasingly important in explosives production, the preference for high purity picric acid is expected to sustain market dominance.

The Dry/Dehydrated moisture content segment is projected to hold 47.2% of the market revenue in 2025, leading the moisture content categories. The dry form is preferred due to its improved chemical stability and reduced risk of decomposition during storage and handling.

Dry picric acid is easier to transport safely and less prone to moisture-related degradation, making it suitable for critical applications such as explosives manufacturing. The handling and safety protocols associated with dry picric acid have contributed to its adoption as the standard form in the industry.

Additionally, the dry form’s consistent performance in reactive processes has strengthened its position as the preferred moisture content segment. Continued focus on safe and stable material handling will support the growth of the Dry/Dehydrated segment.

The Explosives & Munitions segment is expected to generate 58.9% of the picric acid market revenue in 2025, leading the application segments. Growth in this segment is driven by the ongoing demand for high-performance energetic materials in military and defense sectors. Picric acid’s explosive properties make it a critical ingredient in munitions and demolition explosives.

Defense modernization programs and increased geopolitical tensions in certain regions have contributed to higher procurement levels. The need for reliable and stable explosive compounds has led to stringent quality and purity standards in production, supporting the market demand for picric acid.

Beyond defense, this segment also serves industrial demolition and mining applications, expanding its market scope. As the demand for advanced energetic materials continues, the Explosives & Munitions segment is poised to maintain its leading share in the picric acid market.

Increased acquisition of ammunition and explosive equipment in the defence and military sectors has resulted in an increase in the sales of picric acid. Demand for explosives and munitions, which is expected to boost the demand for picric acid.

The mining sector, which uses industrial grade explosives, is also a large consumer for spiking the sales of picric acid, resulting in an increased demand for picric acid.

Additionally, the rising agrochemical sector is projected to benefit the sales of picric acid. The combination of general purpose drugs is also likely to benefit the sales of picric acid. Demand from the textile industry is also likely to drive up demand for picric acid colour formulation.

However, due to picric acid's toxicity, end users are seeking other alternatives in response to growing environmental concerns hence impacting sales of picric acid. With growing awareness of environmental pollution and safety, the number of strict environmental rules has increased. The reasons stated above may limit the growth and sales of picric acid to a certain extent.

Demand for picric acid is predicted to grow significantly in the Asia Pacific area over the long term, owing to established sectors such as textiles, pharmaceuticals, and agrochemicals.

Sales of picric acid will be high in regions such as Europe and North America, particularly in the defence and military, as well as mining industries.

The expansion of the mining, pharmaceutical, and agrochemical industries in Latin America, as well as the Middle East and Africa, would jointly create an opportunity for the picric acid market, which is presently in its infancy.

BASF SE, DowDuPont Inc., Innospec, Odyssey Organics, Aadhunik Industries, Anmol Chemicals Group, Hefei TNJ Chemical Industry Co., Ltd., Spectrum Chemicals, Loba Chemie Fine Chemicals, Merck KGaA, Ricca Chemical Company, and Mubychem Group are some of the leading participants in the picric acid market

Recent developments of the Picric Acid Market:

In October 2020, The Mosaic Company (United States) introduced Aspire, a new type of potassium. Aspire with Boron is a micronutrient-enhanced potassium granular fertiliser that has been shown to boost yields. Each granule of Aspire with Boron contains potassium and boron, ensuring consistent dispersion of both minerals throughout an acre. This product introduction aided the corporation in expanding its premium fertiliser range.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 8% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis, |

| Segments covered | Grade, moisture content, application, end user, region |

| Regional scope | North America; Western Europe; Eastern Europe; Middle East; Africa; ASEAN; South Asia; Rest of Asia; Australia and New Zealand |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | BASF SE; DowDuPont Inc.; Innospec; Odyssey Organics; Aadhunik Industries; Anmol Chemicals Group; Hefei TNJ Chemical Industry Co.; Ltd.; Spectrum Chemicals; Loba Chemie Fine Chemicals; Merck KGaA; Ricca Chemical Company; and Mubychem Group |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. |

The global picric acid market is estimated to be valued at USD 47.0 billion in 2025.

It is projected to reach USD 101.4 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are high purity grade (≥99%) and commercial grade (<99%).

dry/dehydrated segment is expected to dominate with a 47.2% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Acid Filling and Leveling Machine Market Size and Share Forecast Outlook 2025 to 2035

Acid Chlorides Market Size and Share Forecast Outlook 2025 to 2035

Acid-Sensitive APIs Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

Acid Dyes Market Growth - Trends & Forecast 2025 to 2035

Acidity Regulator Market Growth - Trends & Forecast 2025 to 2035

Acid Proof Lining Market Trends 2025 to 2035

Acid Citrate Dextrose Tube Market Trends – Growth & Industry Outlook 2024-2034

Acid Orange Market

Antacids Market Analysis – Size, Trends & Forecast 2025 to 2035

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Feed Acidifier Market Analysis Size Share and Forecast Outlook 2025 to 2035

Food Acidulants Market Growth - Key Trends, Size & Forecast 2024 to 2034

Nylon Acid Dye Fixing Agent Market Size and Share Forecast Outlook 2025 to 2035

Boric Acid Market Forecast and Outlook 2025 to 2035

Folic Acid Market Size and Share Forecast Outlook 2025 to 2035

Oleic Acid Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA