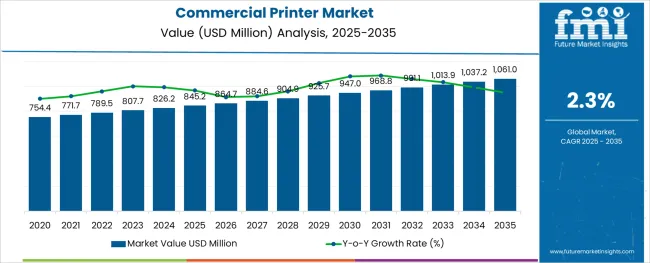

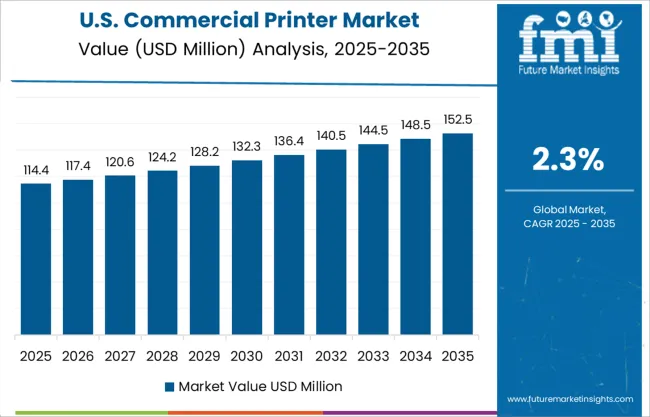

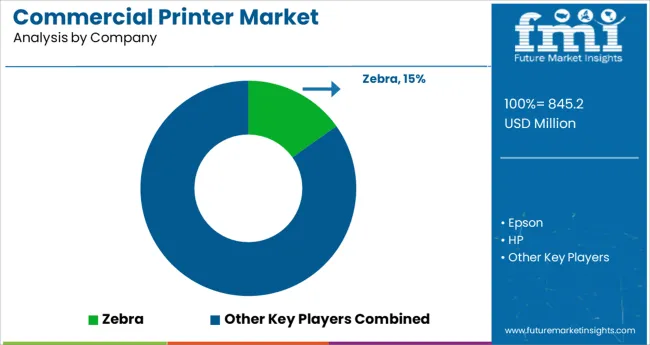

The Commercial Printer Market is estimated to be valued at USD 845.2 million in 2025 and is projected to reach USD 1,061.0 million by 2035, registering a compound annual growth rate (CAGR) of 2.3% over the forecast period.

The commercial printer market is advancing steadily, propelled by the increasing need for high-resolution output, efficient workflow integration, and scalable printing solutions across corporate, publishing, and marketing environments. As businesses prioritize speed, precision, and print consistency, manufacturers are investing in technologies that combine energy efficiency, automation, and color management enhancements.

The resurgence of demand for promotional materials and packaging prints is supporting hardware innovation and software-platform integration, enabling faster print runs with minimal setup time. Additionally, commercial printers are being enhanced with cloud connectivity, centralized monitoring, and predictive maintenance capabilities, which support enterprise-level productivity goals.

Sustainability-focused transitions are also influencing material usage, ink technology, and energy optimization. Going forward, demand is expected to be driven by hybrid workplaces, print-on-demand services, and sector-specific requirements in education, retail, and healthcare, making the market poised for steady and diversified growth.

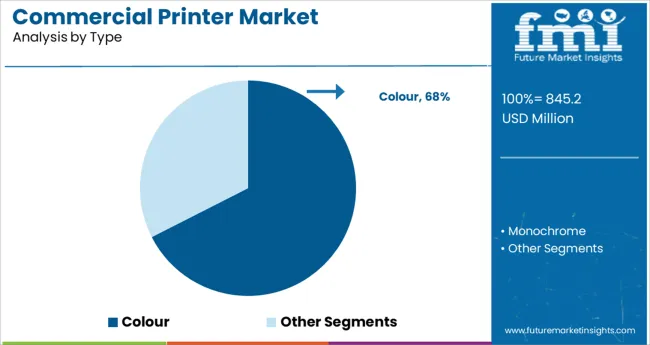

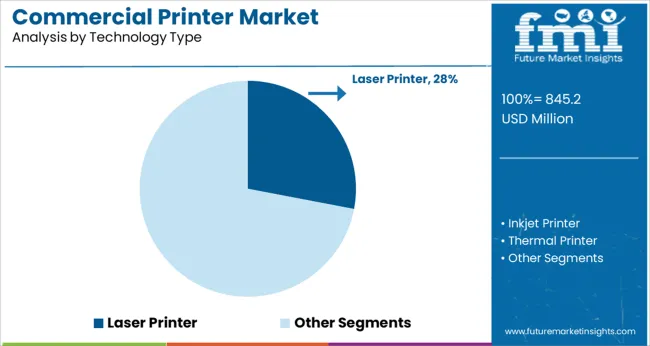

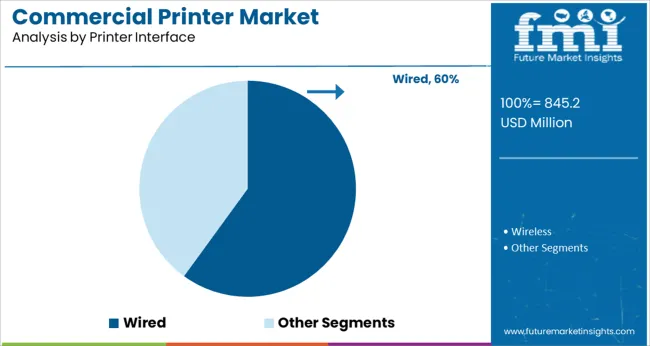

The market is segmented by Type, Technology Type, Printer Interface, and Application and region. By Type, the market is divided into Colour and Monochrome. In terms of Technology Type, the market is classified into Laser Printer, Inkjet Printer, Thermal Printer, LED Printer, and Dot Matrix Printer. Based on Printer Interface, the market is segmented into Wired and Wireless.

By Application, the market is divided into Office, Publishing Industry, Advertising Industry, and Other Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The colour printing segment is projected to account for 67.5% of the total commercial printer market revenue in 2025, making it the leading type segment. This dominance is being driven by the increasing demand for high-quality visual outputs across sectors such as advertising, publishing, packaging, and corporate communications.

Colour printers have become essential tools for creating impactful marketing collateral and professional-grade documents. Continuous advancements in colour matching technology, ink consistency, and resolution capabilities have enhanced their appeal.

Businesses are also leveraging colour outputs to reinforce brand identity and improve customer engagement. Moreover, the ability to print in full colour without compromising on speed or cost-efficiency has positioned colour printers as a strategic investment for high-volume printing environments, supporting their sustained market leadership.

Laser printers are expected to hold a 28.0% revenue share in the commercial printer market by 2025, leading among the various technology types. Their dominance can be attributed to superior print speed, precision, and reliability in high-volume printing operations.

Laser technology has gained preference for its lower per-page cost, minimal maintenance, and excellent text clarity, particularly in office and document-intensive settings. Innovations such as energy-efficient toner usage, compact designs, and wireless capabilities have expanded their usability across diverse commercial applications.

The reduction in operating costs over time, coupled with increased output capacity, has made laser printers a preferred choice among enterprises seeking cost-effective yet high-performance print solutions. These advantages have reinforced the segment’s prominence within the commercial printer market.

The wired interface segment is anticipated to contribute 60.0% of the commercial printer market revenue in 2025, positioning it as the dominant connectivity type. This leadership is being driven by the need for stable, secure, and high-speed data transmission in professional print environments.

Wired connections have proven more reliable for large-format and continuous print jobs, where consistency and bandwidth are critical. Many organizations continue to favor wired interfaces for networked printers due to enhanced cybersecurity, reduced signal interference, and lower latency.

Additionally, integration with existing LAN infrastructures and compatibility with legacy systems have sustained wired printer adoption in sectors like finance, healthcare, and government. These factors collectively support the continued preference for wired solutions in commercial printing operations.

The investment in technology and automation, high-resolution printing, improved clarity, and smoothness of prints, boost the demand for commercial printers. Moreover, technological proliferation and increasing applications across various end-use segments are expected to cause a plunge in printing costs.

The main drivers of the commercial printer market growth are the expanding need for advertising in businesses throughout the globe and rapid technological development. Commercial printers are being used by businesses more frequently since they are more economical and effective for printing in mass. It is also anticipated that green commercial printers, which support waste reduction and reuse by employing eco-friendly paper, inks, coatings, and chemicals, fuel the commercial printer market expansion.

Small businesses are able to outperform the competition and provide superior local services in a certain product category. The industry profitability for manufacturers and service providers is being hampered by declining sales and falling unit selling prices. To be competitive and hold steady market shares, many businesses need large initial investments. Digital media are replacing print media more and more. Commercial printing has decreased as a result of decreased consumer spending and advertising budgets worldwide.

In addition, these businesses require large upfront expenditures to sustain their competitiveness and stable commercial printer market shares. Growing ePaper adoption, global financial instability, and macroeconomic conditions, including fluctuating currency exchange rates and economic hardships, are some of the primary obstacles facing the commercial printer market.

Due to increasing adoption in various organizations, North America is anticipated to hold the greatest market share of 21% for the commercial printer industry through 2035. Early adopters of technology, like the United States and Canada, are thought to have a positive effect on the North American regional economy.

Effective sales operations are closely related to a company's profitability. Huge businesses gain an edge as they can serve large consumers with the local or national demand for a commercial printer. Buying resources like ink and paper more cheaply and using expensive printing machinery more effectively offers higher potential in the market.

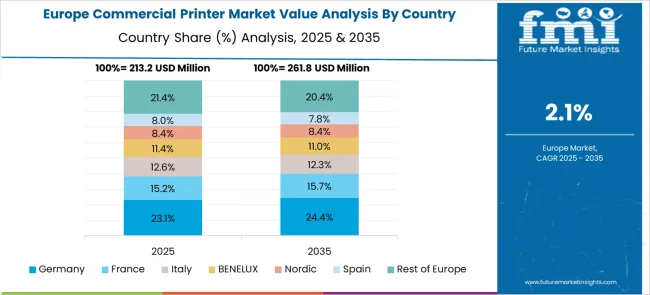

With a market share of 26%, Europe has the fastest-growing market for commercial printers. This is due to commercial printers being more adaptable and responsive. To build a sustainable environment, European nations have mostly concentrated on developing eco-friendly products and procedures. As a result, these nations promote the use of energy-efficient printing techniques.

With the environment changing, startups are now focused on zero-waste solutions. There are numerous opportunities in the commercial printer market due to the requirement to produce unique and innovative products with the intention of high-sales printing.

An online marketplace called Printee, founded in 2024 serves as a link between buyers and sellers, as well as printing and delivery businesses. The marketplace also facilitates the production of personalized and distinctive tees and goods by connecting artists, brands, creatives, and companies.

The Pager technology is a zero-waste method that prints books, posters, and pamphlets from unused portions of the paper.

Key participants have launched new products to improve the sales of commercial printers. Additionally, the market players are concentrating on increasing investment to bring the best technology and have a competitive advantage.

Recent mergers and product launches:

Key players:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 2.3% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Product Type, Technology, Sales Channel, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; The Asia Pacific excluding Japan; Japan; The Middle East and Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Argentina, Germany, The UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, GCC Countries, South Africa |

| Key Companies Profiled | Canon; HP Inc; Seiko Epson; Brother Industries; Kyocera; Lexmark; Fujitsu; Ricoh; Apple Inc; Honeywell International; Xerox; Lexmark; PrinterOn; Epson Zebra Technologies |

| Customization | Available Upon Request |

The global commercial printer market is estimated to be valued at USD 845.2 million in 2025.

It is projected to reach USD 1,061.0 million by 2035.

The market is expected to grow at a 2.3% CAGR between 2025 and 2035.

The key product types are colour and monochrome.

laser printer segment is expected to dominate with a 28.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial and Industrial Rotating Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Baking Rack Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA