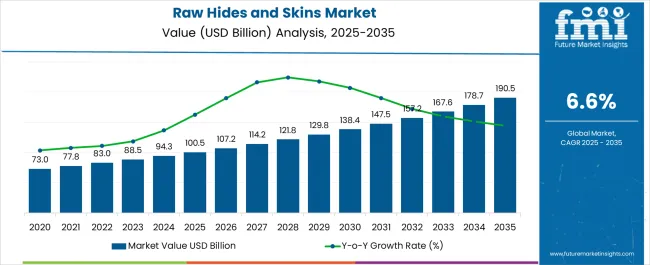

The raw hides and skins market, valued at USD 100.5 billion in 2025 and projected to reach USD 190.5 billion by 2035, is set to expand at a CAGR of 6.6%. From 2020 to 2024, the market progresses from USD 73.0 billion to USD 94.3 billion, supported by rising demand from the leather industry, driven by footwear, apparel, automotive upholstery, and luxury goods.

Annual increments highlight steady momentum, with USD 77.8 billion in 2021, USD 83.0 billion in 2022, USD 88.5 billion in 2023, and USD 94.3 billion in 2024, reflecting global expansion of leather processing hubs and sustained demand for premium quality hides. From 2025 to 2030, the market advances from USD 100.5 billion to USD 138.4 billion, contributing nearly 40% of the overall projected increase. Growth during this stage is reinforced by wider adoption of advanced preservation and processing technologies, expansion of livestock farming in developing economies, and rising exports from key producing nations.

The introduction of standardized grading systems and stricter traceability requirements also boost confidence in global supply chains. Between 2031 and 2035, the market rises from USD 147.5 billion to USD 190.5 billion, generating around 37% of total growth. This final phase is driven by increasing consumption of leather products in emerging economies, heightened demand for high-quality hides in luxury segments, and modernization of tanneries to improve efficiency and reduce waste. Overall, the raw hides and skins market demonstrates strong and sustained growth through 2035, underpinned by consumer demand, livestock expansion, and evolving processing technologies.

| Metric | Value |

|---|---|

| Raw Hides and Skins Market Estimated Value in (2025 E) | USD 100.5 billion |

| Raw Hides and Skins Market Forecast Value in (2035 F) | USD 190.5 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The raw hides and skins market holds a specialized yet significant role across various industries, with distinct shares depending on the downstream application and processing sector. Within the global leather value chain, raw hides and skins contribute approximately 20–22%, as they form the foundational material for tanning and leather manufacturing. In the broader livestock by-products segment, their share is estimated around 12–14%, since meat and dairy production dominate overall revenue. Within premium leather categories used for luxury goods such as handbags, footwear, and apparel, raw hides and skins account for nearly 8–10%, reflecting their reliance on quality grading and traceability standards. In the automotive leather segment, which emphasizes durability and aesthetic appeal, their contribution is about 6–7%, driven by increasing use in vehicle interiors.

Within the industrial leather sector, including gloves, belts, and saddlery, raw hides and skins maintain a 10–12% share, supported by consistent demand in traditional markets. Their role in regional tanning industries remains vital, particularly in Asia and parts of Europe, where processing hubs concentrate. Growth relevance is shaped by price fluctuations, animal husbandry practices, and international trade policies, which collectively determine competitiveness. Rising emphasis on traceable sourcing and waste reduction has further reinforced the value of raw hides and skins within the global leather supply ecosystem.

Increasing investments in livestock farming and improvements in slaughtering practices have enhanced the availability and quality of raw materials. Growing preference for high-grade hides in fashion, upholstery, and automotive leather applications has encouraged suppliers to adopt better preservation and processing techniques.

Regulatory frameworks promoting ethical sourcing and traceability are shaping procurement strategies, while advancements in tanning technologies are enabling more efficient and sustainable utilization of hides. Trade alliances and evolving supply chain logistics are further strengthening market reach in both developed and emerging economies.

The sector is also benefitting from stable livestock populations and a consistent demand base from export-oriented manufacturers. With rising attention to quality assurance, biosecurity measures, and processing innovations, the market is positioned for long-term stability and incremental value growth across multiple industrial segments.

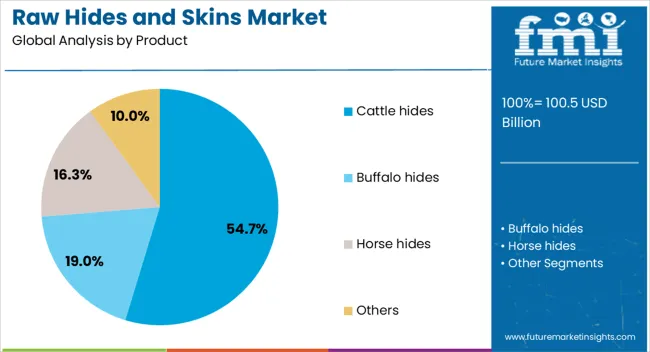

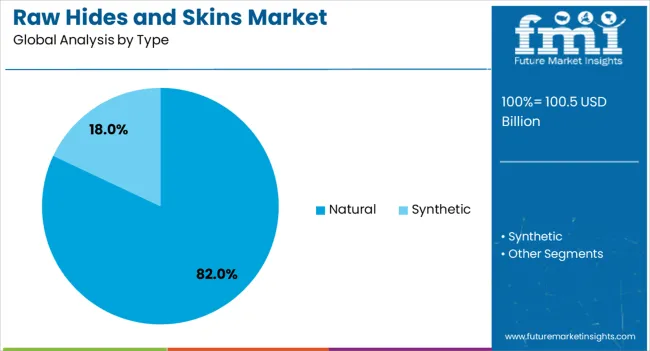

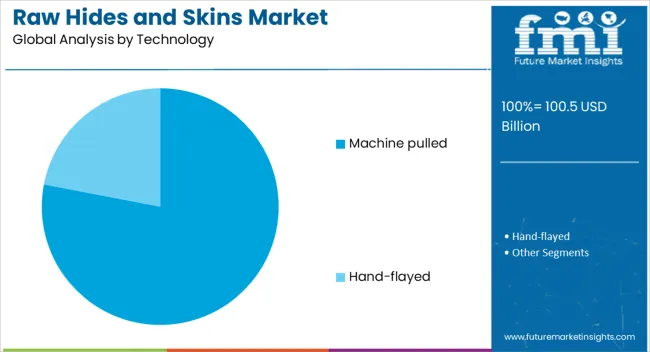

The raw hides and skins market is segmented by product, type, technology, application, and geographic regions. By product, raw hides and skins market is divided into Cattle hides, Buffalo hides, Horse hides, and Others. In terms of type, raw hides and skins market is classified into Natural and Synthetic. Based on technology, the raw hides and skins market is segmented into machine-pulled and Hand-flayed. By application, raw hides and skins market is segmented into Footwear, Clothing, Upholstery, and Others. Regionally, the raw hides and skins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cattle hides segment is projected to hold 54.70% of the Raw Hides and Skins market revenue share in 2025, making it the leading product category. This dominance has been attributed to the superior strength, durability, and versatility of cattle hides, which are preferred in the production of premium leather goods. Consistent supply from large-scale cattle farming operations and strong demand from the footwear, upholstery, and automotive industries have reinforced the segment’s growth.

Cattle hides also offer better yield and uniformity in texture, making them highly suitable for high-quality finished leather. The segment has further benefited from global trade networks that facilitate large-volume exports to leather manufacturing hubs.

Ethical sourcing practices and improved preservation techniques have enhanced the value proposition for cattle hides in competitive markets. As consumer preferences shift toward durable and sustainable leather products, the demand for cattle hides is expected to remain resilient, securing its continued leadership in the product segment.

The natural type segment is estimated to account for 82% of the Raw Hides and Skins market revenue share in 2025, solidifying its position as the leading type. Growth in this segment has been supported by the strong market appeal of untreated hides that preserve their original characteristics, making them suitable for premium leather applications. Demand has been driven by high-end fashion, furniture, and automotive leather markets, where natural hides are valued for their authenticity and superior finish after tanning.

Suppliers have adopted advanced preservation methods to maintain hide integrity during storage and transport, ensuring consistent quality for manufacturers. The natural type segment has also benefited from growing consumer interest in sustainable and less chemically processed materials.

Market stability is reinforced by reliable sourcing channels and established relationships between livestock producers and leather manufacturers As the premium leather segment continues to expand globally, natural hides are expected to maintain their dominance due to their unmatched quality and adaptability.

The machine pulled technology segment is expected to capture 78% of the Raw Hides and Skins market revenue share in 2025, making it the leading technology in hide removal. This dominance is linked to its efficiency, consistency, and ability to preserve hide quality during processing. The adoption of machine pulled methods has been accelerated by the need for high-volume processing in commercial slaughterhouses, where speed and precision are critical.

The technology minimizes damage to hides, ensuring higher yield and better grades for subsequent leather production. Improved mechanical designs and automation capabilities have further optimized performance, reducing labor dependency and operational costs.

The segment’s growth is also supported by regulatory standards that emphasize humane and efficient processing practices. With the leather industry demanding higher quality raw materials, machine-pulled technology has become the preferred method for large-scale producers seeking to meet stringent quality specifications while maintaining cost efficiency.

The raw hides and skins industry is influenced by global trade patterns, price volatility, regulatory frameworks, and downstream sector demand. Together, these dynamics shape competitiveness, supply stability, and long-term value creation across the industry.

Trade flows remain one of the most influential factors shaping the raw hides and skins industry. Export-oriented countries such as Brazil, India, and Australia dominate supply, providing large quantities of cattle hides to leather-processing hubs in Asia and Europe. Seasonal fluctuations in livestock slaughter directly impact availability, making supply volumes irregular. Price movements are often dictated by international demand from footwear, automotive, and luxury leather goods manufacturers. Tariff policies and restrictions on animal by-products influence export competitiveness. Currency variations in producing nations also affect profitability for global traders. The interdependence between livestock farming and global leather markets reinforces the strong trade-centric dynamics of raw hides and skins.

Price dynamics of raw hides and skins are highly sensitive to livestock cycles, feed costs, and disease outbreaks affecting cattle populations. Quality differentiation further influences pricing, as higher-grade hides used in premium leather goods command significant premiums. Lower-grade hides with visible scars, branding marks, or irregular textures are generally diverted toward industrial leather applications with less stringent aesthetic requirements. Fluctuations in consumer appetite for luxury goods or automotive leather interiors have direct consequences on hide values. Importing nations prioritize consistent supply of high-grade hides, reinforcing strict grading standards. Manufacturers continue to depend on reliable sourcing partnerships to maintain cost predictability in an otherwise highly volatile market.

Regulatory standards play a decisive role in shaping the competitiveness of the raw hides and skins industry. Importing regions such as the EU enforce stringent traceability and veterinary health certifications to minimize biosecurity risks. Exporters are required to meet hygiene, preservation, and environmental compliance measures before hides are shipped for tanning. Regulations around waste disposal and preservation chemicals such as salt and lime also create cost burdens for processors. Market accessibility is influenced by trade agreements that lower duties or simplify certification processes. These frameworks not only govern market entry but also enhance transparency in supply chains, reinforcing trust between suppliers, traders, and downstream leather manufacturers.

Performance requirements in downstream sectors such as footwear, apparel, furniture, and automotive interiors strongly shape demand patterns for raw hides and skins. The footwear industry remains the largest consumer, absorbing a dominant share of processed hides. Growth in furniture, leather upholstery, and luxury handbags has supported value creation for higher-grade hides. Automotive applications continue to provide steady demand, though alternative materials are gaining partial acceptance. Regional demand also differs, with Asia dominating footwear manufacturing, while Europe drives luxury leather consumption. The dependence of multiple industries on hide quality and availability ensures that shifts in these downstream sectors directly influence hide trading volumes and pricing.

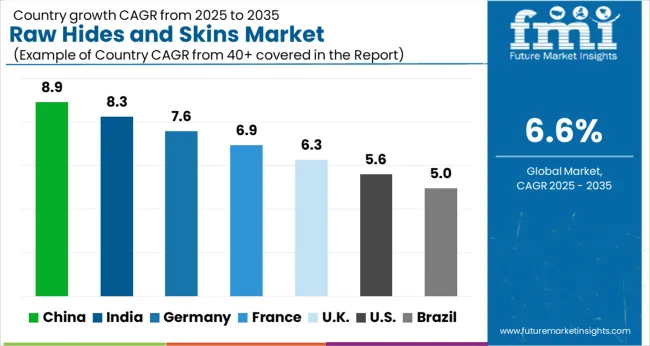

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

The raw hides and skins market is projected to grow globally at a CAGR of 6.6% from 2025 to 2035, driven by downstream demand in footwear, automotive, and premium leather goods manufacturing. China leads with a CAGR of 8.9%, supported by its strong position as a global tanning hub and consistent supply from large livestock volumes. India follows at 8.3%, with growth driven by robust livestock availability and expanding export opportunities in processed leather. France records a 6.9% CAGR, benefitting from high-value luxury leather demand across apparel and accessories. The United Kingdom achieves 6.3%, influenced by steady consumption in furniture and industrial leather applications. The United States grows at 5.6%, where demand is sustained by automotive interiors, leather footwear, and upholstery segments, though growth remains moderate compared to Asian markets.

The CAGR for the raw hides and skins market in the United Kingdom was measured at 5.2% during 2020–2024 and then improved to 6.3% between 2025 and 2035, reflecting stronger momentum in downstream demand. The early phase was marked by moderate growth due to reduced livestock output and subdued exports in the aftermath of shifting trade regulations. In the next stage, accelerated demand from furniture, footwear, and industrial leather segments supported a more optimistic trajectory. Improved trade integration within Europe and stable processing capacity also played a role in reinforcing growth. Evolving demand for premium hides for luxury goods positioned the UK as a key European participant in this category.

China’s CAGR for the raw hides and skins market was calculated at 7.6% during 2020–2024 and advanced to 8.9% for 2025–2035, signaling resilience in its leather supply chain. Early growth stemmed from consistent livestock production and high utilization in domestic tanning hubs. As consumer appetite for luxury leather goods rose, demand for higher-grade hides created long-term momentum. The later phase showed acceleration due to stronger exports of processed leather, supported by China’s dominance in global footwear and automotive upholstery production. The country’s ability to balance both raw hide processing and export has positioned it as the strongest global growth center.

The CAGR for the Indian raw hides and skins market was tracked at 7.1% in 2020–2024 and increased further to 8.3% in 2025–2035, showcasing a rising trajectory. Growth in the earlier period was supported by abundant livestock resources but restricted by infrastructural limitations in processing. Over the next stage, export opportunities into Asia and Europe enhanced utilization rates. Stronger domestic demand from footwear and apparel industries added to the momentum, with large-scale processing facilities increasing productivity. The ability to meet global quality standards and leverage its livestock availability ensured that India’s hide and skin exports remained competitive and cost-effective.

France’s CAGR for the raw hides and skins market was 5.9% during 2020–2024 and later improved to 6.9% from 2025 to 2035, highlighting a strengthening outlook. The early growth period was guided by moderate consumption in domestic tanneries, with leather supply largely focused on apparel and footwear. During the later phase, high-value luxury fashion and accessory brands increased their procurement of premium hides, boosting demand consistency. The influence of French luxury houses sustained price premiums for higher-grade hides, which enhanced profitability. Investments in advanced tanning methods ensured quality improvements, reinforcing France’s importance in the European luxury leather ecosystem.

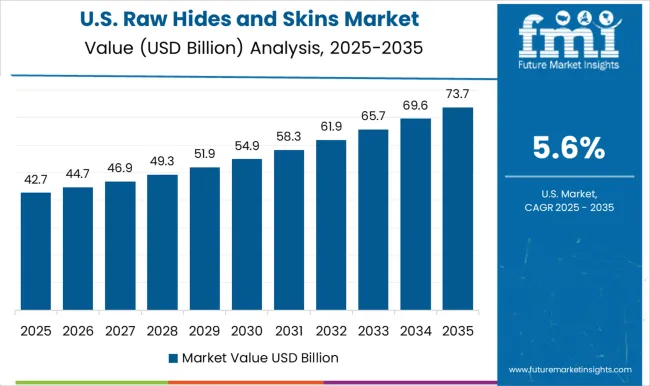

The CAGR for the USA raw hides and skins market was recorded at 4.8% in 2020–2024 and moved up to 5.6% in 2025–2035, showing a gradual recovery trend. In the initial stage, weaker exports and declining livestock processing volumes restricted momentum. The next phase, however, benefited from greater consumption in the automotive and furniture sectors, where leather remains a preferred material. Premium footwear brands also boosted demand for select higher-grade hides. Efforts to modernize tanneries and invest in efficient preservation technologies further improved competitiveness. Despite slower growth compared to Asia, the USA retained a strong position as a supplier to global tanning hubs.

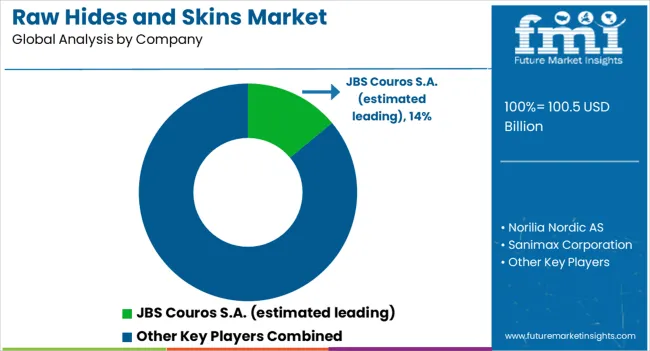

The raw hides and skins market is highly competitive, encompassing leading global players alongside regional specialists that maintain strong connections with local tanning industries. JBS Couros S.A. is estimated as the leading supplier, with large-scale operations integrating livestock by-products into leather supply chains worldwide. Norilia Nordic AS leverages its Nordic livestock resources and sustainability-driven traceability systems to deliver consistent raw hides for European leather manufacturers. Sanimax Corporation plays a key role in North America with a diversified portfolio in rendering, recycling, and hide collection. Texpac Hide & Skin Ltd. serves as a prominent supplier, specializing in hide procurement and exports to international tanning hubs.

J & E Sedgwick & Co. Ltd. has established its presence through premium bridle leather and heritage craftsmanship, catering to luxury applications. OZ-YUKSEL Leather Company contributes through its focus on quality raw materials and exports across multiple geographies. Koktaslar Leather supports the competitive landscape with strong sourcing networks in Turkey, while Siddiq Leather Works Pvt. in South Asia provides reliable supplies for both domestic consumption and export. AI Bravo Leather Industries strengthens the market with regional specialization, catering to industrial leather applications. Competitive differentiation within this sector is driven by traceable sourcing practices, grading accuracy, and the ability to meet stringent quality standards. Global players rely on integrated supply networks, while regional firms capitalize on agility, price competitiveness, and strong trade relationships to maintain their market positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 100.5 Billion |

| Product | Cattle hides, Buffalo hides, Horse hides, and Others |

| Type | Natural and Synthetic |

| Technology | Machine pulled and Hand-flayed |

| Application | Footwear, Clothing, Upholstery, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | JBS Couros S.A. (estimated leading), Norilia Nordic AS, Sanimax Corporation, Texpac Hide & Skin Ltd., J & E Sedgwick & Co. Ltd., OZ-YUKSEL Leather Company, Koktaslar Leather, Siddiq Leather Works Pvt., and AI Bravo Leather Industries |

| Additional Attributes | Dollar sales, share by region, product grade, and end-use, trends in export-import flows, pricing fluctuations, livestock availability, regulatory standards, and competitor sourcing strategies. |

The global raw hides and skins market is estimated to be valued at USD 100.5 billion in 2025.

The market size for the raw hides and skins market is projected to reach USD 190.5 billion by 2035.

The raw hides and skins market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in raw hides and skins market are cattle hides, _full grain leather, _top grain leather, _genuine leather, _split leather, buffalo hides, _full grain leather, _top grain leather, _split leather, horse hides, _horse leather (chrome-tanned), _horse leather (vegetable tanned), _horse hides suede and others.

In terms of type, natural segment to command 82.0% share in the raw hides and skins market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Raw, fresh and frozen dog food Market Analysis - Size, Share & Forecast 2025 to 2035

Trawler Boat Market Size and Share Forecast Outlook 2025 to 2035

Drawplate Market Size and Share Forecast Outlook 2025 to 2035

Drawer Warmers Market - Size, Share and Forecast 2025 to 2035

Crawler Excavator Market Growth - Trends & Forecast 2025 to 2035

Draw Heat Setting Winder Market Growth – Trends & Forecast 2025 to 2035

Crawler Drilling Machine Market

Straw Market Size and Share Forecast Outlook 2025 to 2035

LoRaWAN Market Size and Share Forecast Outlook 2025 to 2035

Strawberry Seed Oil Market Analysis by Application, End-use, Distribution channel and Region Through 2035

Leading Providers & Market Share in the Straw Industry

Straw Paper Market Trends - Growth & Sustainability 2025 to 2035

Caraway Seeds Market

Strawless Lids Market

4K Drawing Tablet with Screen Market Size and Share Forecast Outlook 2025 to 2035

Evaluating Cold Drawn Seamless Steel Pipes Market Share & Provider Insights

Horse Drawn Farming Equipment Market Size and Share Forecast Outlook 2025 to 2035

Fiber Drawing Machine Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Seabed Crawler Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA