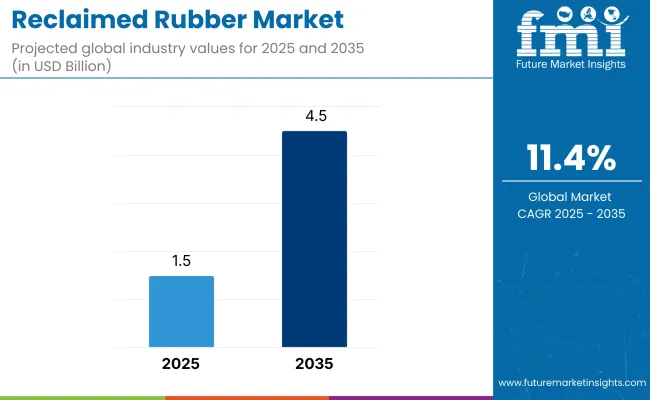

The reclaimed rubber market reached a value of USD 1.54 billion in 2025 and is slated to attain USD 4.52 billion by 2035, growing at a robust CAGR of 11.4% during the forecast period. This surge in market value is indicative of a broader shift within the global materials industry toward sustainable and cost-efficient alternatives to virgin rubber.

Reclaimed rubber, derived primarily from end-of-life tires and industrial rubber waste, is increasingly being seen as a viable and eco-friendly replacement across a range of applications. Its economic advantage, combined with increasing environmental awareness and regulatory incentives, has propelled it into the spotlight as a sustainable material solution.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1.54 billion |

| Industry Value (2035F) | USD 4.52 billion |

| Value-based CAGR (2025 to 2035) | 11.4% |

The global outlook for reclaimed rubber has strengthened over the past few years due to multiple trends. One of the primary drivers is the growing international emphasis on circular economy principles and resource efficiency. Governments in regions such as the European Union and North America are enforcing stricter environmental regulations that promote recycling and limit landfill usage, thereby creating favorable conditions for reclaimed rubber.

Moreover, policies such as the EU Deforestation-free Regulation (EUDR) and mandates for recycled content in manufacturing practices have further pushed companies to adopt reclaimed materials. Simultaneously, rising raw material costs and instability in the supply of natural and synthetic rubber have made reclaimed rubber an economically attractive choice for manufacturers aiming to reduce production costs without compromising performance.

Another major driving factor is the rapid advancement in rubber recycling technologies, especially in devulcanization and micronization processes. These innovations have significantly enhanced the quality, durability, and consistency of reclaimed rubber, making it suitable for more demanding industrial applications.

Key industry players such as Bolder Industries, Lehigh Technologies, Liberty Tire Recycling, and Scandinavian Enviro Systems have made substantial investments in research and development to produce high-quality reclaimed rubber that competes closely with virgin rubber. With rising demand for green materials, ongoing innovation, and favorable regulatory frameworks, the market is poised for sustained growth over the next few years.

The reclaimed rubber market is segmented by machine type into whole tire reclaim rubber, butyl reclaim rubber, EPDM reclaimed rubber, and others (natural reclaim rubber, nitrile reclaim rubber, and chlorobutyl reclaim rubber). By end-use, the market includes automotive & aircraft tires, re-treading, belts & hoses, footwear, moulded rubber goods, and others (mats, gaskets, vibration dampeners, and seals). Regionally, the market is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Butyl reclaim rubber is estimated to grow the fastest, with a CAGR of 12% from 2025 to 2035. This strong growth is attributed to its superior impermeability, heat resistance, and chemical stability, making it ideal for manufacturing inner tubes, tire inner liners, sealants, and automotive sound insulation materials. As the automotive and industrial sectors focus on enhancing product longevity and performance under high-pressure or high-temperature conditions, demand for butyl-based reclaimed rubber continues to rise sharply.

Whole tire reclaims (WTR) rubber holds the largest share of the market due to its versatility, wide availability, and cost-efficiency. Made from end-of-life tires, WTR is used in a diverse range of applications, including retread tires, molded rubber goods, automotive components, conveyor belts, and rubber mats. Its balanced mechanical properties, such as tensile strength, abrasion resistance, and elasticity, make it a reliable substitute for virgin rubber in both industrial and commercial uses.

EPDM reclaimed rubber is gaining steady attention for applications that demand high weather, ozone, and temperature resistance, especially in automotive weather stripping, roofing membranes, and industrial gaskets. Although its market share is currently smaller than WTR or butyl reclaim rubber, EPDM's use is growing due to the rising focus on outdoor durability and insulation performance.

The other segment includes a range of specialized reclaimed rubber types tailored for specific or high-performance applications, such as natural reclaim rubber, nitrile reclaim rubber, and chlorobutyl reclaim rubber. These materials are commonly used in specialty industrial products, mechanical goods, and rubber sheets.

| Machine Type | CAGR (2025 to 2035) |

|---|---|

| Butyl Reclaim Rubber | 12% |

The automotive & aircraft tires stand out as the fastest-growing segment. This segment is projected to register a CAGR of 12.5% during the forecast period, driven by the global automotive industry's increasing focus on sustainability, cost efficiency, and regulatory compliance.

Reclaimed rubber is widely used in tire production due to its ability to lower manufacturing costs, improve processability, and meet environmental mandates related to the use of recycled materials. As electric vehicles and sustainable transportation trends gain momentum, tire manufacturers are under pressure to integrate more eco-friendly materials, further boosting demand for reclaimed rubber.

The re-treading segment also holds a significant share in the market, as it provides a cost-effective and resource-efficient solution for extending the lifespan of tires. Reclaimed rubber plays a crucial role in the retreading process, which is especially important in commercial vehicle fleets, aviation, and public transportation systems seeking to reduce operational costs without compromising safety or performance.

In the belts & hoses segment, reclaimed rubber is increasingly being utilized in the production of industrial belts, automotive hoses, and tubing. This is largely due to its resilience and flexibility, which are necessary for handling high-stress environments in manufacturing and mechanical systems. Cost savings and recyclability further contribute to its appeal in this application.

The footwear segment benefits from reclaimed rubber’s flexibility, abrasion resistance, and low cost, making it suitable for producing soles and casual footwear. Brands focused on sustainable fashion and reducing their environmental footprint are incorporating reclaimed rubber as a marketing and functional advantage.

The moulded rubber goods and other segments include items such as mats, gaskets, vibration dampeners, and seals. These applications value the material's customizability and mechanical performance. Although these segments grow at a slower pace compared to tires, they provide steady demand, especially in the construction and consumer goods industries.

| End-use | CAGR (2025 to 2035) |

|---|---|

| Automotive & Aircraft Tires | 12.5% |

Future Market Insights also carried out a detailed survey among the major players in the industry of reclaimed rubber, such as manufacturers, suppliers, and users.The report presents a high level of confidence in the industry growth curve based on a rise in eco-awareness and a quest for cheaper alternatives to virgin rubber. Notably, the survey highlighted a sharp spike in demand coming from the automotive industry, where recovered rubber is widely used in tire manufacturing for sustainable and economic advantages.

Technological advancements in devulcanization processes were also mentioned by stakeholders as essential in enhancing the functionality and quality of reclaimed rubber. These advancements have expanded the applications of the material beyond the traditional, penetrating the construction and consumer products.

In spite of such achievements, though, there are still challenges facing the industry, such as ensuring uniform quality due to variations in raw material sources. In order to correct this, the respondents underlined the necessity of possessing good quality control processes and established strong supply chains.

The Industry was also pinpointed by the survey to be driven by stringent environmental regulations as well as growing demand for green products. Governments worldwide are mandating regulations for the use of recycled materials, hence leading manufacturers to incorporate in their products. The economic benefits of reclaimed rubber, such as reduced production costs, have also motivated its use in several industries.

To get a deeper insight and to understand strategic opportunities in the recovered rubber industry, we request you to refer to the complete report by Future Market Insights.

Government regulations and mandatory certifications significantly influence the industry, varying by country and region. The table below outlines the impact of these policies and required certifications across different nations:

| Country/Region | Government Regulations and Policies |

|---|---|

| European Union | Implementation of the EU Deforestation-free Regulation (EUDR), banning imports of products linked to deforestation including rubber. This regulation affects exports from countries like Brazil to the EU. Adoption of stringent environmental regulations aimed at minimizing landfill waste and promoting recycling, influencing the industry. |

| Brazil | Subject to the EU's EUDR, which could impact exports of rubber and related products to the European Union. |

| Thailand | Government initiatives to support rubber farmers, including financial aid and proposals to purchase rubber products to stabilize prices. |

| Global | Increasing emphasis on sustainable practices and environmental regulations influencing the Industry. |

| Country/Region | Mandatory Certifications |

|---|---|

| European Union | Compliance with the EU Deforestation-free Regulation (EUDR) is mandatory for companies exporting rubber to the EU. |

| Brazil | No specific mandatory certifications identified for production within Brazil. |

| Thailand | No specific mandatory certifications identified for production within Thailand. |

| Global | Certification by the Programme for the Endorsement of Forest Certification (PEFC), the world's largest forest certification system, is recognized in 47 countries. While not mandatory, PEFC certification demonstrates commitment to sustainable sourcing. |

It's important to note that while some certifications like PEFC are not legally required, they are often pursued by companies to demonstrate adherence to sustainable practices and to meet the expectations of environmentally conscious consumers and business partners.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

|

|

|

|

|

|

|

|

|

|

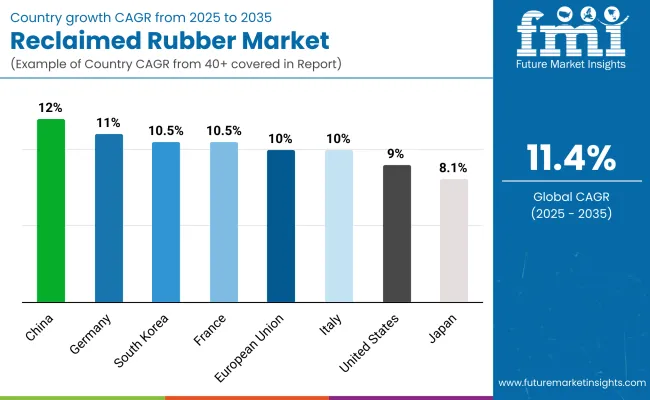

The USA industry is expected to expand at approximately 9% CAGR over the period of 2025 to 2035, marginally lower than that of the globe. The factors driving the development are the sound automotive and building sectors of the country, large consumers of recovered rubber. Positive government backing in the United States towards sustainability practices and recycling is favoring the industry as well.

However, the growth can be tempered by issues such as unstable raw material prices and substitutes from synthetic products. However, innovation in recycling technology and higher consumer awareness towards eco-friendly products are expected to favor the market for recycled rubber in the decade ahead.

In the UK, the industry for reclaimed rubber is projected to grow at a CAGR of nearly 10% during 2025 to 2035, in sync with the world average. High environmental standards and efforts to reduce carbon footprint in the UK have contributed to greater usage of reclaimed rubber, particularly in manufacturing and automotive industries.

Increasing popularity of circular economy and government initiatives in favor of green products also contribute to market growth. Economic volatility and possible post-Brexit trade tensions pose threats to the growth of industry. Despite all such challenges, the UK’s emphasis on innovation and sustainability will surely propel consistent growth in the industry of recycled rubber.

The French reclaimed rubber industry is expected to grow at a CAGR of approximately 10.5% over the period from 2025 to 2035, slightly above the world average. The country's strong automotive industry and stringent environmental policies are some of the reasons for this growth.

France's drive towards minimizing industrial waste and maximizing recycling is also in line with the objectives of the industry. Also, research institutes and industry stakeholders collaborating to innovate sophisticated recycling technology are expected to propel market growth. High operational costs and rivalry from low-cost producers might, however, be an issue. Nevertheless, France's focus on sustainability and innovation will continue to support the growth trend.

Germany is expected to record a CAGR of around 11% in its reclaimed rubber market during 2025 to 2035, higher than the global average. As the biggest auto manufacturer in Europe, Germany's demand for recycled rubber is great. The country's stringent environmental regulations and focus on green production processes also spur expansion.

R&D investments to improve recycling technology and product quality are large. Still, issues such as rising labor costs and strict compliance procedures may affect market dynamics. Owing to such factors, the leadership of Germany in automotive sustainability and innovation will drive the market for reclaimed rubber.

Italy's industry will grow at approximately 10% CAGR from 2025 to 2035. Its well-established automobile and fashion sectors, both heavy consumers of rubber material, are to blame for this increase. Italy's emphasis on sustainability and following European Union environmental directives makes the use of reclaimed rubber easier. Economic uncertainty and competition from other materials may be a hindrance, however. Italy's emphasis on quality and sustainability should increase steadily in the reclaimed rubber market, though.

The market for recycled rubber in South Korea is forecast to develop at a CAGR of approximately 10.5% from 2025 to 2035. The country's advanced automobile and electronics industries and government encouragement of recycling and sustainability are the reasons for this development. Investment in technology development to make rubber recycling more efficient is impressive.

But dependency on foreign raw materials and competition in the industry may pose some challenges. In spite of these factors, South Korea's focus on innovation and environmental sustainability is likely to drive the growth of the reclaimed rubber.

The Japanese is likely to expand at a CAGR of around 8.1% during 2025 to 2035, marginally lower than the global average.The nation's established automobile sector and emphasis on high-quality production add to the demand for reclaimed rubber. Government initiatives toward manufacturing innovation and eco-friendliness also drive the industry.

Nevertheless, an aging population and economic stagnation may hinder growth. Nevertheless, Japan's commitment to technology development and sustainability is expected to continue driving the reclaimed rubber industry growth.

China is expected to record a strong CAGR of around 12% in its industry for reclaimed rubber during the period 2025 to 2035, surpassing the world average. China being the largest automaker and car consumer in the world, demand for reclaimed rubber is high there.

Recycling-friendly and green-friendly policies of the government also encourage growth. Infrastructure and manufacturing investments also create higher demand for rubber products. Yet, issues of saturation and environmental compliance may affect dynamics. In spite of these, China's emphasis on sustainability and industrialization are likely to drive the market.

In 2024, the reclaimed rubber business saw major strategic moves as companies attempted to secure their product bases and increase their global presence. Of particular interest, some of the major players entered into mergers and acquisitions to enhance their capabilities and industry coverage. For example, Goodyear and Continental made strategic business decisions in order to set themselves up for future growth.

These strategic actions reflect a larger industry shift toward consolidation with the aim of increasing operating efficiencies and leveraging synergies. Through the consolidation of resources and know-how, companies seek to more effectively service the emerging demand for sustainable rubber solutions across diverse industries such as automotive, construction, and manufacturing.

With regards to market share, the industry is dominated by a combination of global and regional companies. As per Future Market Insights (FMI) report, leading players are Bolder Industries, Lehigh Technologies (subsidiary of Michelin), Liberty Tire Recycling, Marangoni Tread North America, ReRubber, Eldan Recycling, Scandinavian Enviro Systems, Global Rubber Industries, Peterborough Industrial Rubber, Rajoo Engineers, GTR Recycled Rubber, and Kraton Polymers.

These companies have been actively pursuing the strategies of technology development, capacity expansion, and alliances to maintain competitive edges. For example, Bolder Industries has been focusing on new recycling technologies to produce eco-friendly rubber materials in line with the industry's shift towards green processes.

In addition, the industry has experienced heightened emphasis on research and development to improve the quality and performance of products reclaimed from rubber. Companies are investing in advanced processing techniques to meet stringent end-user requirements, particularly in the automotive sector, where materials are needed that can perform at a high level.

Overall, the 2024 business has been typified by consolidation plans, innovation, and perpetual focus on sustainability. These tendencies reflect the intent of the business to look forward to environmental problems and come back to the continuous evolving needs of industries.

The market for reclaimed rubber is a part of the sustainable materials and circular economy segment, which is closely associated with industry such as automotive, construction, footwear, and industrial production. Being a segment of the global rubber and recycling industry, it is affected by macroeconomic variables including inflation, supply chain, availability of raw materials, and sustainability regulatory policies.

At the macroeconomic level, worldwide economic growth, industrial growth, and growing environmental issues propel the industry. The initiative towards net-zero carbon emissions and strict government policies encouraging recycled content have strongly pushed the use of reclaimed rubber, specifically in the developed economies of the USA, EU, and Japan. Developing economies such as China and India are also seeing higher demand owing to fast industrialization and higher vehicle manufacturing.

Supply chain disruptions, changing crude oil prices, and geo-political conflicts affect the costs of reclaimed rubber, since virgin rubber and synthetics alternatives rely on these factors. Also driving industry development is investment in recycling technology and environmental manufacturing methods. With businesses continually looking to minimize costs and live sustainably, the industry is primed for sustained growth, as firms focus on technology advancement, reduced waste, and improved product performance to keep them competitive.

Investment in High-Tech Recycling Technologies

Innovative devulcanization processes and high-efficiency processing need to be prioritized by stakeholders to improve product quality and consistency. Industry leaders such as Michelin (Lehigh Technologies) and Scandinavian Enviro Systems have already made a benchmark with the inclusion of micronized rubber powder (MRP) technology in production. Automation and artificial intelligence-based sorting systems can further optimize material recovery and cost efficiency.

Expansion into High-Growth Regions

The Asia-Pacific industry, specifically China and India, offers high-growth prospects as a result of fast industrialization, increased automobile manufacturing, and government-driven sustainability policies. Businesses need to invest in local production units and strategic alliances with local rubber recyclers to improve supply chain strength and lower logistics expenses. The European industry too is promising due to the aggressive EU directives for circular economy measures.

Improving OEM Alliances for Sustainable Tire Production

Leading tiremakers are turning progressively towards sustainable source material, boosting demand for first-class reclaimed rubber. Players ought to emphasize extended supply deals with automotive and tire OEMs, as well as invest in specially designed product solutions meeting durability and performance needs. Collaboration-based R&D partnership with tire companies can lead to greater innovation as well as protect competitiveness.

With respect to machine type, the industry is classified into whole tire reclaim rubber, butyl reclaim rubber, EPDM reclaimed rubber, and others.

In terms of end-use, it is segmented into automotive & aircraft tires, re-treading, belts & hoses, footwear, moulded rubber goods, and others.

In terms of region, it is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and MEA.

Sustainability objectives, cost reduction, and government policies increase its use.

It provides comparable durability at a reduced price with environmental advantages.

Automotive, footwear, construction, and industrial manufacturing industries.

Consistency of quality, stability of supply chain, and competition from virgin rubber.

Next-generation recycling technologies, renewable-based additives, and hybrid rubber compounds.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End-use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End-use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End-use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by End-use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by End-use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by End-use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by End-use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Machine Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Machine Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End-use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 16: Global Market Attractiveness by Machine Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 34: North America Market Attractiveness by Machine Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Machine Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Machine Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Machine Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Machine Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Machine Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Machine Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Machine Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Machine Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Machine Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by End-use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Machine Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Rubber Track for Defense and Security Market Size and Share Forecast Outlook 2025 to 2035

Rubber Frame Monitors Market Size and Share Forecast Outlook 2025 to 2035

Rubber Coating Market Size and Share Forecast Outlook 2025 to 2035

Rubber Anti-Tack Agents Market Size and Share Forecast Outlook 2025 to 2035

Rubber to Metal Bonded Articles Market Analysis Size and Share Forecast Outlook 2025 to 2035

Rubber-to-Metal Adhesion Market Analysis - Size, Share, and Forecast Outlook 2025-2035

Rubber Coatings Market Growth - Trends & Forecast 2025 to 2035

Rubber Conveyor Belt Market Size, Growth, and Forecast 2025 to 2035

Rubber Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Rubber Tapes Market Trends - Growth & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Rubber Molding Market Growth – Trends & Forecast 2024-2034

Rubber choppers Market

Gas Scrubber Market Size and Share Forecast Outlook 2025 to 2035

Air Scrubbers Market

Europe Rubber Derived Unrefined Pyrolysis Oil Market Size and Share Forecast Outlook 2025 to 2035

Sleeve Rubber Stopper Market Growth – Demand & Forecast 2024-2034

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Plastic-Rubber Composite Market Trend Analysis Based on Product, Application, and Region 2025 to 2035

Snap on Rubber Stopper Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA