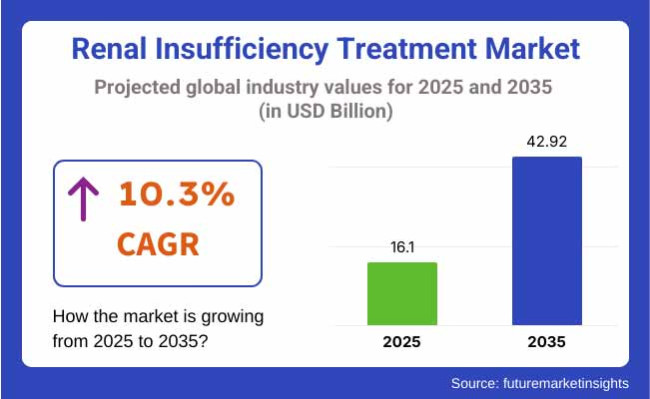

The global Renal Insufficiency Treatment Industry is valued at USD 16.10 Billion in 2025. It is expected to grow at a CAGR of 10.3% and reach USD 42.92 Billion by 2035. The renal insufficiency remedy market is projected to expand considerably between 2025 and 2035 by utilizing all possible means, such as further advancements in technology for dialysis, novel drugs via innovative therapies, and a growing integration of artificial intelligence in nephrology patient care.

The intensified global challenge imposed by chronic kidney disease (CKD), primarily fueled by a growing incidence of diabetes and hypertension, will always continue to push the demand for effective treatment solutions.

It is expected that developing regions will adopt home and wearable dialysis devices to improve patient convenience and adherence to treatment. Cutting-edge nephroprotective drugs, including SGLT2 inhibitors and newly emerging antifibrotic therapies, will usher in a paradigm shift in managing the disease-velocity deceleration of CKD.

Transplantation will remain a core element of treatment. Developmental research on bioengineered kidneys and xenotransplantation continues to explore additional long-term options.

Diagnostic services and tele-nephrology services that drive AI will soon increase their contribution to earlier disease detection and remote patient monitoring devices, making specialized care more widely available. At the same time, strategic partnerships between pharmaceutical companies and tech firms will speed up the development of personalized medicines for better patient outcomes.

The renal insufficiency treatment industry is set for the high growth because of the increased prevalence of chronic kidney disease (CKD) that have already been diagnosed, advancements in dialysis technology, and the emergence of newer nephroprotective drugs.

The demand always is likely to increase among the pharmaceutical companies, medical equipment and device manufacturers as well as telehealth service providers, yet it could be the opposite for healthcare systems in underdeveloped countries having limited pressing issues of accessibility and affordability.

The increased investments in AI-driven diagnostics and personalized treatments are fast paving the way towards the next decade of sustained growth for this industry.

Dialysis centres offer patients access to specialized medical care and support from a team of healthcare professionals, including nephrologists, nurses, and dialysis technicians.

These centres are equipped with advanced dialysis technology and are staffed by trained healthcare professionals who can monitor patients closely and adjust their treatment as needed. Thus, dialysis centres are expected to possess 45% market share for renal insufficiency treatment market in 2025.

The renal insufficiency treatment arena will demonstrate significant growth across the spectrum of dialysis, medications, and transplantation between 2025 and 2035. Dialysis will remain the leading treatment modality, with increasing shifting preference towards home and portable dialysis.

Progress in haemodialysis and peritoneal dialysis technology could improve patient comfort and treatment efficacy. The pharmaceutical companies will now also be willing to work on combination therapies for better management of chronic kidney disease. Transplantation will still be advocated for as a long-term solution, with organ scarcity giving rise to much interest in bioengineered kidneys and xenotransplantation.

There will be advances in immunosuppressive therapies that favourably impact transplant success and graft longevity, thus providing a larger population of patients who will find transplantation a probable option within the timeline of our forecast.

While there will be changes in the end-user landscape of renal insufficiency treatment for healthcare institutions to provide better infrastructure and patient care, unarguably, dialysis centres will broaden their services to incorporate AI-powered monitoring systems, thereby making treatment more efficient. The infusion of home dialysis will also motivate centres to provide extensive remote monitoring, which, in turn, will ensure patient compliance.

Hospitals and clinics will remain important to the industry, particularly in relation to kidney transplant and critical care for end-stage renal disease patients. In such institutions, the implementation of robotic-assisted surgical procedures will increase to enhance transplant outcome.

Research and academic centres will provide a strong backbone for innovation, especially for regenerative medicine, gene therapy, and development of artificial kidneys. Funding for nephrology research will increase in support of new treatments that may change the landscape of renal care in the coming years. Academia, along with biotech firms, will expedite the translation of research into industry-ready therapies.

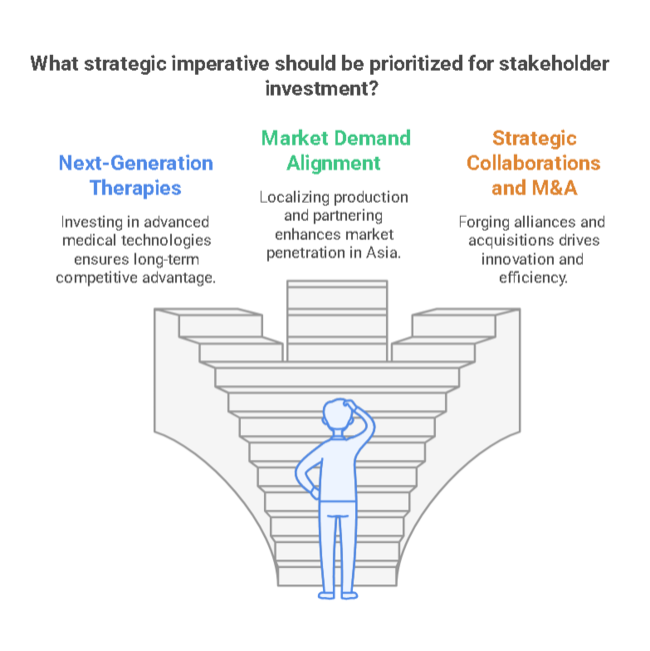

Invest in Next-Generation Therapies

Executives should allocate resources toward the development and commercialization of next-generation nephroprotective drugs, wearable dialysis devices, and bioengineered kidneys. Prioritizing R&D in regenerative medicine, AI-assisted diagnostics, and personalized treatment plans will ensure long-term competitive advantage in an evolving industry.

Align with Emerging Market Demand

To capitalize on growing demand in South and East Asia, companies must enhance affordability and accessibility by localizing production and distribution. Partnering with regional healthcare providers and leveraging government incentives will help navigate regulatory landscapes and expand industry penetration.

Expand Strategic Collaborations and M&A

Strengthening distribution networks, forging alliances with AI and biotech firms, and pursuing targeted acquisitions will drive innovation and operational efficiency. Mergers with digital health companies will enhance tele-nephrology capabilities, improving patient engagement and expanding service offerings.

| Risk | Probability - Impact |

|---|---|

| Regulatory Uncertainty | High - High |

| Organ Shortages for Transplants | Medium - High |

| Cost Barriers in Emerging Markets | High - Medium |

| Priority | Immediate Action |

|---|---|

| Scaling AI-Assisted Nephrology | Launch pilot programs with hospitals for AI-based CKD diagnostics |

| Expansion in Asia-Pacific | Form local partnerships to accelerate regulatory approvals and industry entry |

| Advanced Dialysis Solutions | Invest in R&D for wearable and portable dialysis devices |

Executives must act swiftly to integrate AI, regenerative medicine, and advanced dialysis technologies into their long-term strategy. The rapid evolution of nephrology care demands proactive investment in next-generation therapies, telehealth solutions, and emerging industry expansion.

A focus on strategic partnerships-particularly with biotech and digital health firms-will accelerate innovation and expand industry reach. Stakeholders should also anticipate regulatory shifts and healthcare cost pressures, ensuring adaptive pricing models and localized production for affordability. By aligning with these transformative shifts, companies can sustain leadership, drive industry expansion, and future-proof their renal care portfolio.

(Surveyed Q1 2025, n=500 stakeholder participants evenly distributed across pharmaceutical companies, medical device manufacturers, healthcare providers, and regulatory bodies in North America, Europe, South Asia, and East Asia.)

The survey revealed that 79% of global stakeholders consider improving access to advanced renal treatments as a top priority, especially in regions where dialysis remains underdeveloped. Pharmaceutical companies are prioritizing drug innovation, with 68% stating that combination therapies and nephroprotective medications will be their primary R&D focus.

Regional Differences:

The survey highlighted a growing shift toward AI and digital healthcare solutions, though adoption rates vary by region. AI-assisted diagnostics and tele-nephrology services are gaining traction, with 56% of healthcare providers already using or piloting such technologies.

Regional Trends:

Dialysis remains the dominant treatment method, but innovation in medications and kidney transplantation is reshaping the industry. 68% of nephrologists expect biologics to become a breakthrough in CKD treatment by 2035.

Regional Preferences:

A large majority (82%) cited rising treatment costs as a major concern, with key differences across regions.

Leasing and financing models for dialysis equipment are gaining popularity, with 48% of hospitals exploring partnerships to offset capital costs.

Manufacturers:

Healthcare Providers:

Global stakeholders are aligning investments with technological advancements and treatment affordability.

High Consensus:

Key Regional Variances:

Strategic Insight:

A one-size-fits-all approach will not succeed. Companies must tailor technology adoption, pricing models, and R&D focus to regional needs for long-term growth.

| Country/Region | Key Policies & Regulations |

|---|---|

| United States | The FDA's Center for Devices and Radiological Health (CDRH) regulates dialysis equipment, requiring 510(k) premarket clearance or PMA approval for new devices. The CMS (Centers for Medicare & Medicaid Services) provides reimbursement policies for dialysis, favoring home-based treatments, influencing industry growth. The ESRD Treatment Choices Model incentivizes providers to prioritize transplantation and home dialysis. |

| European Union | The EU Medical Device Regulation (MDR 2017/745) imposes strict safety and efficacy standards on dialysis machines and nephrology drugs, requiring CE certification. The EU Green Deal promotes sustainable healthcare manufacturing, affecting dialysis equipment production. The Pharmaceutical Strategy for Europe pushes for faster drug approvals for chronic diseases, including CKD. |

| United Kingdom | The Medicines and Healthcare Products Regulatory Agency (MHRA) follows post-Brexit medical device approval guidelines, requiring a UKCA (UK Conformity Assessed) mark for dialysis equipment. The National Health Service (NHS) focuses on expanding home dialysis programs, influencing procurement trends. |

| China | The National Medical Products Administration (NMPA) enforces stringent approval processes for imported dialysis equipment and CKD drugs. The Healthy China 2030 initiative emphasizes increased local manufacturing of medical devices, pushing foreign companies to establish local partnerships. |

| Japan | The Pharmaceutical and Medical Device Act (PMDA) requires a unique Shonin (approval) process for nephrology drugs and dialysis equipment. The Japan Health Insurance System prioritizes reimbursement for peritoneal dialysis and kidney transplantation over long-term hemodialysis. |

| India | The Central Drugs Standard Control Organization (CDSCO) regulates medical devices, requiring dialysis machines to be classified as Class C or Class D (high-risk medical devices) with mandatory licensing. The Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) expands insurance coverage for dialysis, increasing patient access. The Production Linked Incentive (PLI) Scheme for medical devices encourages local manufacturing of dialysis equipment. |

| Brazil | The Brazilian Health Regulatory Agency (ANVISA) enforces rigorous safety requirements for dialysis machines, following GMP (Good Manufacturing Practice) standards. The Unified Health System (SUS) funds public dialysis treatment but faces budget constraints, limiting growth. |

| Middle East (UAE, Saudi Arabia) | The Gulf Cooperation Council (GCC) Medical Device Regulation harmonizes dialysis device approvals across the region. Saudi Arabia's Vision 2030 promotes private-sector participation in healthcare, expanding the dialysis industry. The UAE’s Ministry of Health and Prevention (MOHAP) fast-tracks approvals for innovative CKD treatments. |

| Company Name | Market Share & Competitive Positioning |

|---|---|

| Fresenius Medical Care | Holds the largest global industry share (~35%), dominating both dialysis services and equipment manufacturing. Strong presence in North America and Europe, with continued expansion in home dialysis solutions. |

| Baxter International Inc. | Commands approximately 18% of the industry, leading in peritoneal dialysis (PD) solutions and portable dialysis devices. Strong foothold in emerging industries due to its affordable and scalable solutions. |

| DaVita Inc. | A major dialysis service provider with ~15% industry share, focusing on expanding home dialysis options and patient-centric nephrology services. Increasing investments in digital healthcare integration. |

| B. Braun Melsungen AG | Holds around 10% industry share, with a strong focus on hemodialysis equipment and consumables. Recently expanding into AI-driven dialysis solutions for improved patient outcomes. |

| Medtronic plc | Controls ~8% of the industry, primarily driven by its innovative dialysis devices and nephrology-focused drug delivery systems. Strategic partnerships with hospitals for integrated renal care. |

| Nipro Corporation | Accounts for 6-7% of the industry, with a strong presence in Asia, particularly in Japan. Leading provider of dialysis consumables and blood purification systems. |

| Asahi Kasei Corporation | It holds ~5% of the industry, specializing in advanced filtration technology for dialysis and blood purification. Strong R&D investments in bioengineered kidney treatments. |

| Company(s) Involved | Key Development |

|---|---|

| Fresenius Medical Care & DaVita Inc. | Announced a strategic joint venture to expand home dialysis accessibility across North America, focusing on cost-effective peritoneal dialysis solutions. |

| Baxter International & Medtronic | Entered into a collaborative agreement for the development of AI-driven dialysis monitoring technology to enhance patient safety and treatment efficiency. |

| B. Braun Melsungen AG & Nipro Corporation | Formed a manufacturing partnership to increase the production capacity of dialysis consumables, targeting emerging industries in South Asia and Africa. |

The United States is expected to witness a strong CAGR of 11.2% in the renal insufficiency treatment industry from 2025 to 2035, driven by a rising prevalence of chronic kidney disease (CKD), growing adoption of home dialysis, and government-backed reimbursement policies.

The Centers for Medicare & Medicaid Services (CMS) plays a crucial role in shaping the dialysis industry by covering a substantial portion of treatment costs, particularly for patients with End-Stage Renal Disease (ESRD). Advancements in wearable and portable dialysis machines are gaining traction, with companies such as Baxter and Medtronic investing heavily in automated peritoneal dialysis (APD) systems.

Additionally, the USA is witnessing a surge in kidney transplantation procedures, supported by initiatives like the Organ Procurement and Transplantation Network (OPTN). However, the industry faces challenges due to high treatment costs, leading many companies to explore cost-effective solutions.

The rise of telehealth-enabled dialysis monitoring is another key trend, allowing patients to receive continuous care at home. The presence of industry leaders such as Fresenius Medical Care, DaVita, and Baxter solidifies the USA as the largest renal insufficiency treatment industry globally. Increasing public-private partnerships and FDA approvals for novel CKD drugs are set to further accelerate industry expansion over the next decade.

The UK renal insufficiency treatment industry is poised to grow at a CAGR of 9.5%, supported by strong government initiatives under the National Health Service (NHS) and the increasing burden of CKD. The UK Renal Registry indicates a steady rise in dialysis patients, prompting the NHS to expand access to home-based peritoneal dialysis (PD).

The UKCA (UK Conformity Assessed) certification post-Brexit has introduced new regulatory requirements for imported dialysis equipment, but this has also encouraged local manufacturing.

Kidney transplantation rates are expected to rise as the NHS prioritizes organ donation awareness programs. Additionally, the UK government is pushing for AI-driven kidney disease prediction models in partnership with biotech firms, facilitating early diagnosis and better disease management.

However, funding challenges within the NHS may limit the adoption of premium dialysis technologies. Companies like B. Braun, Fresenius, and Baxter are actively investing in the UK industry, particularly in integrated dialysis service models. The country is also emphasizing sustainability in dialysis equipment manufacturing, aligning with the broader Net Zero NHS goal.

The renal insufficiency treatment industry in France is projected to grow at a CAGR of 9.8%, fuelled by increasing government support for early CKD detection programs and widespread health insurance coverage under Sécurité Sociale. France has one of the highest rates of dialysis patients opting for home-based treatments, primarily due to government-backed reimbursement policies for peritoneal dialysis (PD).

The French healthcare system also encourages innovative CKD drug development, with companies such as Sanofi and Novartis investing in next-generation nephrology drugs. France has also been at the forefront of bioengineered kidney research, with leading universities collaborating on 3D-printed kidney models.

However, regulatory barriers under the EU MDR framework pose challenges for international companies looking to enter the French industry. The adoption of eco-friendly dialysis machines is rising, with the government incentivizing the use of low-water consumption equipment.

Germany is expected to witness a CAGR of 10.1%, driven by its robust universal healthcare system and technological leadership in dialysis innovation.

The country has the highest number of dialysis patients in Europe, and with increasing investments in hospital infrastructure, the demand for advanced haemodialysis machines is growing. The German Health Insurance System (GKV) ensures high reimbursement rates for CKD treatments, making innovative therapies more accessible.

Germany is home to Fresenius Medical Care, the largest dialysis service provider globally, giving it a significant advantage in domestic industry penetration. The industry is also benefiting from the integration of AI-powered nephrology solutions, allowing real-time monitoring of dialysis patients.

However, Germany faces a shortage of nephrologists, which is driving higher adoption of tele-nephrology services. The government is also encouraging sustainable dialysis solutions, with mandates to reduce medical waste and energy consumption in dialysis centers.

Italy’s renal insufficiency treatment industry is set to expand at a CAGR of 9.2%, supported by its universal healthcare system (SSN) and rising CKD prevalence. Government-funded dialysis centres dominate the industry, but there is a growing shift towards private dialysis clinics due to long wait times in public hospitals.

Italy is investing in kidney disease prevention programs, promoting earlier diagnosis through AI-driven analytics. The adoption of wearable dialysis devices is rising, although regulatory approvals under EU MDR standards have slowed industry penetration.

Italian medical device firms are also focusing on biocompatible dialysis filters, which improve treatment efficiency and reduce side effects. The government is pushing for greater organ donation awareness, aiming to boost kidney transplantation rates.

Japan’s renal insufficiency treatment industry is expected to grow at a CAGR of 8.8%, driven by a rapidly aging population and high incidence of diabetes-related CKD. The Pharmaceutical and Medical Device Act (PMDA) enforces stringent dialysis equipment approvals, leading to a preference for locally manufactured devices from companies like Nipro and Asahi Kasei.

Japan has one of the highest rates of hemodialysis dependence, but government-backed initiatives are encouraging peritoneal dialysis (PD) adoption. The country is also at the forefront of robot-assisted dialysis treatments, integrating automation and AI-driven patient monitoring. However, rural access to dialysis services remains a major challenge, prompting investments in mobile dialysis units.

China is projected to witness a CAGR of 11.5%, the highest in the Asia-Pacific region, driven by government healthcare reforms under Healthy China 2030. The National Medical Products Administration (NMPA) is fast-tracking approvals for foreign dialysis companies entering the Chinese industry, increasing competition.

The rise of private dialysis centers is reshaping the industry, with companies like Fresenius and Baxter expanding partnerships with local hospital chains. China is also heavily investing in AI-driven CKD detection platforms to improve early diagnosis rates. However, rural CKD treatment accessibility remains a challenge, creating demand for affordable, portable dialysis devices.

Both Australia and New Zealand have high dialysis adoption rates, with government-backed programs ensuring universal access to CKD treatments. The Pharmaceutical Benefits Scheme (PBS) in Australia and Pharmac in New Zealand regulate drug pricing, ensuring affordability for renal insufficiency medications.

Both countries are seeing a surge in home-based dialysis adoption, driven by telehealth advancements. The rise of indigenous health programs is addressing CKD concerns in Maori and Aboriginal populations, creating targeted dialysis care models. However, the high cost of imported dialysis equipment remains a key challenge.

Dialysis, Medication, Kidney Transplantation

Dialysis Centres, Hospitals & Clinics, Research & Academic Institutes

North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa

The increasing prevalence of chronic kidney disease (CKD), advancements in dialysis technology, and the development of innovative medications are key factors contributing to the expansion of renal insufficiency treatments. Additionally, improved healthcare infrastructure and government support for kidney disease management are accelerating adoption.

Dialysis is becoming more patient-friendly with the introduction of home-based treatment options, wearable dialysis devices, and AI-powered monitoring systems. These innovations enhance convenience, reduce hospital visits, and allow for better real-time disease management.

Kidney transplantation remains the most effective long-term treatment for end-stage renal disease. Efforts to increase donor availability, advancements in transplant immunology, and innovations like bioengineered kidneys are improving success rates and accessibility.

New medications targeting CKD progression, anemia management, and electrolyte balance are significantly improving patient outcomes. Breakthroughs in precision medicine and gene therapy are also paving the way for more personalized treatment approaches.

High treatment costs, limited organ availability for transplantation, disparities in healthcare access, and regulatory barriers pose significant challenges. Efforts to enhance affordability, improve early diagnosis, and expand dialysis infrastructure are critical to addressing these issues.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Treatment Type, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Treatment Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Treatment Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Europe Market Attractiveness by Treatment Type, 2023 to 2033

Figure 59: Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 74: South Asia Market Attractiveness by End User, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Treatment Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Treatment Type, 2023 to 2033

Figure 104: Oceania Market Attractiveness by End User, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Treatment Type, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Treatment Type, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Treatment Type, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Treatment Type, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: MEA Market Attractiveness by Treatment Type, 2023 to 2033

Figure 119: MEA Market Attractiveness by End User, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Renal Denervation Catheter Market Size and Share Forecast Outlook 2025 to 2035

Renal Function Test Market Growth - Trends & Forecast 2025 to 2035

Renal Biomarker Market Report – Trends & Forecast 2024-2034

Renal Cyst Treatment Market Size and Share Forecast Outlook 2025 to 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Advance Renal Cell Carcinoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Continuous Renal Replacement Therapy Market Growth – Trends & Forecast 2025-2035

Congenital Adrenal Hyperplasia Treatment Market Analysis and Forecast by Type, Treatment, End User, and Region through 2035

Bioartificial Renal Assist Devices Market

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA