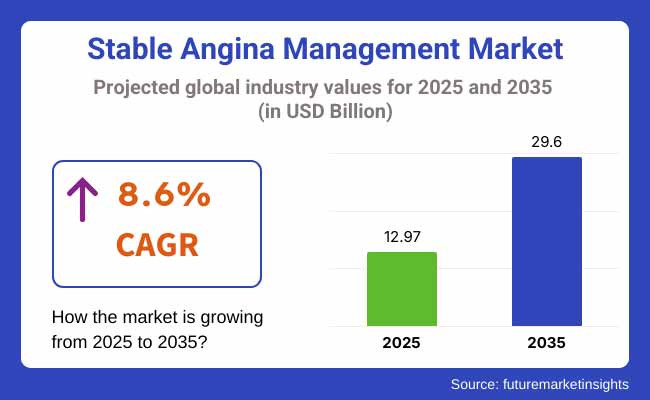

The global Stable Angina Management Market is valued at USD 12.97 Billion in 2025. It is expected to grow at a CAGR of 8.6% and reach USD 29.60 Billion by 2035. New regulatory approvals of novel drugs would further drive growth alongside the growing adoption of digital health solutions.

By the year 2035, a paradigm shift is anticipated as the industry may lean toward precision medicines and gene therapies, possibly redefining the understanding of stable angina management. Pharmaceutical giants actively pursued strategic collaborations to develop the most targeted therapies, especially in personalized medicine.

The availability of affordable generics in developing countries further opened access for patients. However, drug shortages in some regions coupled with price pressure have slightly hampered industry development. In 2024, the Stable Healthcare Management for the Angina Industry underwent considerable changes due to improvements in treatment methods, the increasing prevalence of cardiovascular diseases, and regulatory changes that favor novel therapies.

Some major changes with respect to this industry. In 2024 the increased adoption of combination therapies, especially of beta-blockers and the new antianginal agents, which were more effective in improving patient outcomes. Also, many calcium channel blockers and late sodium current inhibitors were prescribed because they were effective for chronic stable angina.

The industry for Stable Angina Management has strong growth potential due to increasing rates of cardiovascular diseases, the improvement of drug therapies, and the growing trend toward the personalized treatment approach. Pharmaceutical and biotech companies will thus benefit from the demand for novel therapies.

On the other hand, generic drug manufacturers will benefit as cheaper alternatives expand the patient industry. However, price erosion, regulatory challenges, and supply chain disturbances can pose some risks to profitability for select players in the industry.

Over the forecast period 2025 to 2035, the beta blockers segment will continue to dominate the Stable Angina Management Industry. These drugs are used for managing stable angina and decrease myocardial oxygen demand and control heart rate. Ongoing studies being done on second-generation beta blockers having better safety profiles and lesser side effects are expected to augment their usage.

Calcium antagonists on vasodilatory property will account for a significant share of patients who are intolerant to beta blockers. The physicians' tendency to prescribe will enhance with newer formulations that improve bioavailability toward better treatment outcomes.

The major role played by anti-coagulants in preventing complications that arise from stable angina will be most evident in high-risk patients with comorbidities. The expanding shift for newer oral anticoagulants (NOACs) vis-a-vis the traditional warfarin will drive this segment further.

Antiplatelets would still be a major part of stable angina treatment, and further compared to existing monotherapy, will bring new combination therapies that are expected to increase their treatment activity. Further strengthening of industry growth will be provided by increasing adoption rates of DAPT in use.

Hospital pharmacy will be the most influential distribution channel to stable angina management drugs. The first port of call for patients undergoing symptomatic evaluation for cardiovascular diseases is the hospital. This provides a steady stream of prescription supplies at the hospitals.

The number of patients who will be hospitalized to seek treatment and management of cardiovascular complications will increase and supplement this section. Thus, retail pharmacy is expected to grow vigorously as more patients turn to outpatient long-term therapy for stable angina.

Availability of branded and generic products in local pharmacies will ensure that access to drugs is increased especially in emerging economies. This segmentation is going to witness rapid growth accelerated by e-commerce penetration and telemedicine services.

Patients trying to look for cheaper and more convenient purchasing methods will contribute to the segment, especially in developed industries where the adoption of digital health is high. Further evidence of the expanding trend toward self-care management over time is home delivery services for chronic disease management.

Invest in Next-Generation Therapies

Stakeholders should prioritize R&D investments in novel anti-anginal drugs, personalized medicine, and AI-driven diagnostics to improve treatment outcomes. Expanding the pipeline for combination therapies and gene-based treatments will create a competitive edge and long-term industry leadership.

Enhancing Industry Access and Affordability

Aligning with regulatory shifts and payer expectations is critical to ensure widespread adoption of new therapies. Companies must develop pricing strategies that balance affordability with profitability, particularly in emerging industries where cardiovascular disease prevalence is rising.

Expand Digital and Omni-Channel Distribution

The increasing shift toward telemedicine, e-commerce, and AI-driven prescription management requires a robust digital-first distribution strategy. Strengthening partnerships with online pharmacies, hospital networks, and digital health platforms will drive industry penetration and brand visibility.

| Risk | Probability-Impact |

|---|---|

| Regulatory Delays in Drug Approvals | High-High |

| Pricing Pressures and Reimbursement Challenges | Medium-High |

| Supply Chain Disruptions for Key Drug Ingredients | Medium-Medium |

| Priority | Immediate Action |

|---|---|

| Accelerate R&D for Novel Therapies | Fast-track clinical trials for next-gen beta blockers and NOACs |

| Optimize Global Supply Chain Resilience | Diversify API sourcing to mitigate geopolitical risks |

| Expand Digital Health and E-Pharmacy Reach | Strengthen partnerships with leading telemedicine platforms |

To stay ahead in the Stable Angina Management Industry, stakeholders must accelerate R&D investments, optimize drug affordability strategies, and expand digital health partnerships. With cardiovascular disease incidence rising globally, securing regulatory approvals for innovative therapies and ensuring supply chain resilience should be top priorities.

Companies that integrate AI-driven diagnostics, telehealth distribution, and precision medicine solutions into their portfolios will dominate industry share over the next decade. Now is the time to move beyond incremental improvements and redefine how stable angina is managed worldwide.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across pharmaceutical manufacturers, healthcare providers, regulatory authorities, and distributors in North America, Europe, East Asia, and South Asia.)

Drug affordability and patient access emerged as the top priority, with 79% of stakeholders emphasizing the need for cost-effective medications to improve global access. Pharmaceutical manufacturers are under pressure to balance innovation with affordability, particularly in emerging industries.

Regulatory compliance remains a major concern, as 71% of stakeholders cited evolving guidelines on cardiovascular drug safety and efficacy as a critical factor influencing R&D and industry entry strategies.

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

Consensus:

Variance:

Shared Challenges:

Regional Differences:

Manufacturers:

Distributors:

Healthcare Providers & End-Users:

Alignment:

Divergence:

High Consensus:

Key Variances:

A one-size-fits-all approach will not succeed in this industry. Regional adaptation is essential-AI-based innovations in North America, sustainable production in Europe, and cost-effective generics in Asia will shape long-term growth.

| Country/Region | Key Policies, Regulations & Mandatory Certifications |

|---|---|

| United States | The FDA (Food and Drug Administration) enforces stringent approval processes for cardiovascular drugs, requiring New Drug Applications (NDAs) and Biologics License Applications (BLAs). The Inflation Reduction Act (2022) is putting pressure on drug pricing, affecting industry access for high-cost angina therapies. Medicare and Medicaid reimbursement policies heavily influence drug adoption. |

| European Union | The EMA (European Medicines Agency) mandates compliance with Good Manufacturing Practices (GMP) and EU Pharmacovigilance Regulations (Directive 2001/83/EC). The European Green Deal is pushing pharmaceutical companies to adopt sustainable production processes, impacting manufacturing costs. Pricing and reimbursement decisions are country-specific but generally favor cost-effective drugs over premium therapies. |

| United Kingdom | The MHRA (Medicines and Healthcare Products Regulatory Agency) governs drug approvals post-Brexit, requiring separate submissions from the EU. The National Institute for Health and Care Excellence (NICE) evaluates the cost-effectiveness of new therapies before NHS reimbursement. The UK government is incentivizing R&D tax credits for innovative cardiovascular drugs. |

| China | The National Medical Products Administration (NMPA) requires all angina drugs to pass China’s Drug Registration Regulation (2020). The “4+7” bulk procurement program has led to aggressive price cuts for cardiovascular drugs, favoring generics over branded medications. Foreign pharmaceutical companies face local clinical trial mandates before entering the industry. |

| Japan | The Pharmaceuticals and Medical Devices Agency (PMDA) enforces a rigorous approval process under the Japanese Pharmaceutical and Medical Device Act. Pricing negotiations with the Central Social Insurance Medical Council (Chuikyo) impact industry entry for premium drugs. Mandatory Post-Marketing Surveillance (PMS) is required for all new cardiovascular drugs for up to 10 years post-approval. |

| India | The Central Drugs Standard Control Organization (CDSCO) regulates drug approvals under the Drugs and Cosmetics Act (1940). The government’s Price Control Order (DPCO 2013) caps prices on essential cardiovascular medicines, limiting profit margins for manufacturers. Indian Good Manufacturing Practices (Schedule M) certification is mandatory for all pharmaceutical firms. |

| South Korea | The Ministry of Food and Drug Safety (MFDS) governs drug approvals, with a preference for biosimilars and generics. Reimbursement policies under the National Health Insurance (NHI) system significantly impact drug pricing. The Pharmaceutical Affairs Act mandates strict local trials before imported drugs gain industry approval. |

| Brazil | The Brazilian Health Regulatory Agency (ANVISA) follows Resolution RDC 200/2017, which imposes strict requirements on cardiovascular drug registration. Brazil’s Unified Health System (SUS) promotes local generic production, limiting premium drug imports. GMP certification from ANVISA is essential for manufacturers. |

| Gulf Cooperation Council (GCC) Countries | The GCC Drug Registration System harmonizes approvals across Saudi Arabia, UAE, Qatar, and others, but local agencies like the Saudi FDA (SFDA) and UAE’s Ministry of Health enforce national-level pricing controls. Drugs must comply with GMP standards recognized by WHO and ICH guidelines. |

| Company | Market Share & Competitive Positioning |

|---|---|

| AstraZeneca | Holds approximately 14-16% of the global industry, driven by its Brilinta (ticagrelor) sales. Expansion in Europe and North America due to favorable reimbursement policies has strengthened its industry position. Strong focus on R&D and AI-driven drug discovery for cardiovascular treatments. |

| Pfizer Inc. | Commands a 12-14% industry share, leveraging its antiplatelet and anticoagulant portfolio, including Eliquis (apixaban). Pfizer's partnerships with digital health firms are enhancing its remote patient monitoring capabilities for angina management. |

| Sanofi | Holds a 9-11% share, focusing on anticoagulants and beta blockers. Expansion in emerging industries, particularly Asia and Latin America, has driven growth. Sanofi’s shift toward precision medicine in cardiovascular disease is a key differentiator. |

| Bayer AG | Captures 8-10% of the industry, primarily due to the global success of Xarelto (rivaroxaban). Strategic collaborations with healthcare providers in Europe and the USA are expanding patient access. Investment in sustainable drug manufacturing is an emerging priority. |

| Novartis AG | Holds 7-9% industry share, leveraging its innovative pipeline of next-generation beta-blockers and calcium antagonists. Recent investments in AI-powered diagnostics for stable angina detection are setting Novartis apart in the digital therapeutics space. |

| Boehringer Ingelheim | With a 6-8% share, the company focuses on anticoagulants and heart failure treatments that intersect with angina management. Expansion in South Asia and Latin America through strategic distribution partnerships has helped increase accessibility. |

| Merck & Co., Inc. | Holds 5-7% industry share, leveraging its cardiovascular drugs and research in lipid-lowering therapies. Increased focus on partnerships with biotech firms to accelerate drug discovery instable angina management. |

The USA stable angina management industry is set to grow at a CAGR of 9.2% from 2025 to 2035, fueled by high cardiovascular disease prevalence, strong R&D investments, and AI-driven diagnostics. The FDA’s regulatory framework supports innovative treatments, with AstraZeneca, Pfizer, and Novartis leading in beta-blockers, antiplatelets, and anticoagulants.

The Inflation Reduction Act introduces drug pricing controls, impacting profit margins but improving patient access. The adoption of telemedicine and remote monitoring is accelerating, enhancing patient management. The industry is expected to benefit from precision medicine advancements and digital health integration, making the USA one of the most lucrative regions for stable angina treatment innovation.

The UK stable angina management industry is projected to grow at a CAGR of 7.8% from 2025 to 2035, slightly below the global average due to NHS cost-control measures and strict NICE drug approvals. However, the UK has a strong pharmaceutical sector, with AstraZeneca and GSK leading cardiovascular research.

Government investment in precision medicine and AI diagnostics is improving treatment efficacy. The adoption of digital health solutions and remote patient monitoring is increasing, particularly in urban areas. Public-private partnerships and value-based healthcare models are expected to drive cost-effective angina management solutions, ensuring steady industry expansion.

The French stable angina management industry is set to grow at a CAGR of 8.1% from 2025 to 2035, supported by universal healthcare coverage and increasing chronic disease prevalence. The Haute Autorité de Santé (HAS) regulates drug pricing and reimbursement, making cost-effective treatments a priority.

Pharmaceutical giants like Sanofi and Servier are expanding their cardiovascular portfolios, focusing on innovative anticoagulants and beta-blockers. The French government is investing in AI-driven diagnostics and telemedicine, improving early angina detection. A rising emphasis on preventive healthcare and personalized medicine is expected to fuel steady industry growth.

Germany’s stable angina management industry is projected to grow at a CAGR of 8.5% from 2025 to 2035, close to the global average, due to strong healthcare infrastructure and government-backed R&D initiatives. The Federal Joint Committee (G-BA) controls drug approvals, with a focus on cost-effectiveness and innovation.

Companies like Bayer and Boehringer Ingelheim lead the industry with advanced antiplatelet and anticoagulant drugs. Germany is at the forefront of digital healthcare integration, including AI-powered risk assessment and personalized treatment plans. A rising elderly population and increasing use of wearable health technologies are expected to sustain industry expansion.

The Italian stable angina management industry is forecasted to grow at a CAGR of 7.9% from 2025 to 2035, driven by rising cardiovascular disease cases and healthcare system modernization. The Agenzia Italiana del Farmaco (AIFA) regulates drug pricing, leading to a preference for cost-effective generic drugs alongside innovative therapies.

Pharmaceutical firms like Chiesi Farmaceutici and Menarini are expanding their cardiovascular drug offerings. The Italian government is investing in telemedicine and AI-assisted diagnostics, particularly in rural areas. Increasing awareness programs on cardiovascular health and growing collaborations with European healthcare organizations will support steady industry growth.

New Zealand’s stable angina management industry is expected to grow at a CAGR of 7.6% from 2025 to 2035, slightly below the global average due to a small but aging population and government cost-containment policies. The Pharmac agency controls drug pricing and access, leading to a preference for generic medications.

Despite cost pressures, innovative therapies are gaining traction, with Beta-blockers and antiplatelets being the most prescribed drugs. The government’s investment in telehealth services and AI-driven cardiovascular diagnostics is improving early detection. Collaboration with Australia and European pharmaceutical firms is expected to enhance industry accessibility and innovation.

The South Korean stable angina management industry is projected to grow at a CAGR of 8.3% from 2025 to 2035, supported by rapid digital health advancements and rising heart disease prevalence. The Ministry of Food and Drug Safety (MFDS) ensures strict regulatory approval, focusing on innovative yet cost-effective treatments.

Pharmaceutical leaders like Daewoong Pharma and Celltrion are expanding into cardiovascular drug development, emphasizing biologics and AI-powered diagnostics. The South Korean government is heavily investing in smart hospitals and digital therapeutics, improving patient monitoring and personalized care. The growing penetration of wearable health technology is also expected to drive long-term industry expansion.

Japan’s stable angina management industry is anticipated to grow at a CAGR of 7.7% from 2025 to 2035, slightly below the global average due to stringent pricing controls by the Ministry of Health, Labour, and Welfare (MHLW). Despite cost constraints, a rapidly aging population and high chronic disease rates create sustained demand for angina management solutions.

Domestic players like Takeda and Daiichi Sankyo are leading in anticoagulants and calcium antagonists. The government is expanding AI-powered healthcare and digital monitoring technologies, improving treatment adherence. Japan’s shift toward preventive cardiovascular care and personalized medicine is expected to drive gradual but steady industry growth.

The Chinese stable angina management industry is projected to grow at a CAGR of 9.5% from 2025 to 2035, surpassing the global average due to rising cardiovascular disease prevalence and strong government healthcare reforms. The National Medical Products Administration (NMPA) is fast-tracking approvals for innovative treatments, attracting multinational pharmaceutical companies.

Leading domestic firms like China Resources Pharmaceutical and Jiangsu Hengrui Medicine are expanding into cardiovascular drug development. The Healthy China 2030 initiative is boosting public health awareness and early disease detection. A rapidly growing middle-class population, increasing healthcare spending, and AI-driven medical innovations are expected to drive strong industry growth.

Australia’s stable angina management industry is expected to grow at a CAGR of 8.2% from 2025 to 2035, supported by government-funded healthcare initiatives and increasing cardiovascular disease prevalence. The Pharmaceutical Benefits Scheme (PBS) regulates drug affordability, ensuring broad patient access to essential medications.

Companies like CSL Limited and Mayne Pharma are advancing cardiovascular drug development. The Australian Digital Health Agency is promoting telehealth and AI-driven diagnostics, enhancing early detection. Increased research collaborations with the USA and European pharmaceutical firms and growing public awareness of preventive cardiovascular care are expected to sustain industry expansion.

Beta Blockers, Calcium Antagonists, Anti-coagulants, Antiplatelets

Hospital Pharmacy, Retail Pharmacy, Online Pharmacy

North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa

The growing prevalence of cardiovascular diseases, increasing awareness of early diagnosis, and advancements in drug formulations are driving the demand. Additionally, an aging population and lifestyle-related risk factors like obesity and hypertension contribute to the rising need for effective treatment options.

The most widely used drug classes include beta blockers, calcium antagonists, anticoagulants, and antiplatelets. These medications help improve blood flow, reduce heart workload, and prevent clot formation, providing effective symptom relief for patients

Hospital pharmacies continue to dominate due to the availability of specialized care, while retail pharmacies remain a key source for prescription fulfillment. Online pharmacies are witnessing rapid growth due to increased digital healthcare adoption and the convenience of home delivery services.

Regulatory bodies such as the FDA and EMA enforce strict approval processes to ensure the safety and efficacy of medications. Compliance with Good Manufacturing Practices (GMP) and adherence to guidelines on cardiovascular treatments are crucial for companies to gain approvals and expand treatment accessibility.

North America and Europe lead in adoption due to advanced healthcare infrastructure and strong regulatory frameworks. However, Asia-Pacific, particularly China and India, is witnessing the fastest growth, driven by increasing healthcare investments, rising patient awareness, and improving access to treatment.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: South Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 15: South Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 16: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: East Asia Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 18: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 19: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Oceania Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 21: Oceania Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 22: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: MEA Market Value (US$ Million) Forecast by Drug Class, 2018 to 2033

Table 24: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 13: Global Market Attractiveness by Drug Class, 2023 to 2033

Figure 14: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 28: North America Market Attractiveness by Drug Class, 2023 to 2033

Figure 29: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Drug Class, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 58: Europe Market Attractiveness by Drug Class, 2023 to 2033

Figure 59: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: South Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 62: South Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 63: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: South Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 70: South Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 73: South Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 74: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 75: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 77: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 78: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: East Asia Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 85: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Drug Class, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: Oceania Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 92: Oceania Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: Oceania Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 100: Oceania Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 103: Oceania Market Attractiveness by Drug Class, 2023 to 2033

Figure 104: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 105: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 106: MEA Market Value (US$ Million) by Drug Class, 2023 to 2033

Figure 107: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: MEA Market Value (US$ Million) Analysis by Drug Class, 2018 to 2033

Figure 113: MEA Market Value Share (%) and BPS Analysis by Drug Class, 2023 to 2033

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Drug Class, 2023 to 2033

Figure 115: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 116: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 118: MEA Market Attractiveness by Drug Class, 2023 to 2033

Figure 119: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Unstable Angina Therapeutics Market Insights - Size, Share & Forecast 2025 to 2035

Stable Cell Line Development Market Size and Share Forecast Outlook 2025 to 2035

Nestable Drums Market Insights – Growth & Forecast 2024 to 2034

Tax Management Market Size and Share Forecast Outlook 2025 to 2035

Key Management as a Service Market

Adjustable Gripping Hand Tools Market

Compostable Pouch Market Size and Share Forecast Outlook 2025 to 2035

Compostable Foodservice Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cash Management Supplies Packaging Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Compostable Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Risk Management Market Size and Share Forecast Outlook 2025 to 2035

Compostable Adhesives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compostable Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Compostable Tableware Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Compostable Straws Market Growth - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA