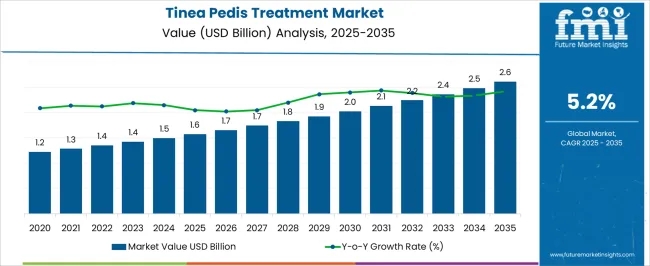

The Tinea Pedis Treatment Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The tinea pedis treatment market is progressing steadily, supported by the rising global incidence of fungal infections and increased consumer awareness regarding foot hygiene. Medical journals and pharmaceutical updates have reported a consistent rise in dermatophyte infections, particularly in warm and humid regions, fueling demand for effective antifungal therapies.

Healthcare providers have emphasized early diagnosis and adherence to treatment regimens, resulting in a higher prescription rate for topical and over-the-counter formulations. In addition, lifestyle factors such as prolonged use of occlusive footwear, increased participation in sports, and expanding geriatric populations have contributed to the market’s expansion.

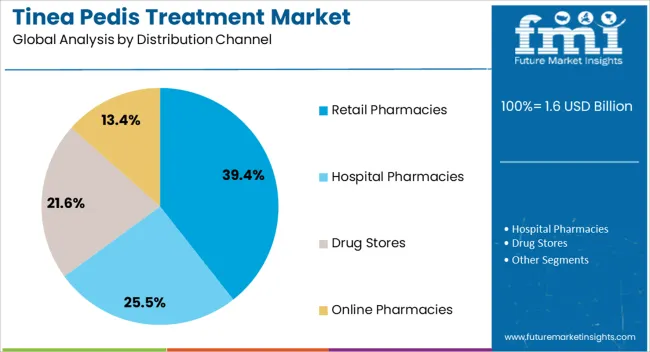

Pharmaceutical companies are actively introducing enhanced topical therapies with improved skin penetration and reduced side effects. Distribution networks have also become more streamlined, especially across retail and e-commerce channels, improving treatment accessibility. Looking forward, market growth is expected to be shaped by product innovations, combination therapy trends, and rising self-medication practices, particularly in emerging economies. Segmental growth is expected to be led by Interdigital Tinea Pedis as the most commonly diagnosed subtype, Topical as the preferred route of administration, and Retail Pharmacies as the primary distribution channel due to convenience and consumer trust.

| Metric | Value |

|---|---|

| Tinea Pedis Treatment Market Estimated Value in (2025 E) | USD 1.6 billion |

| Tinea Pedis Treatment Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The market is segmented by Disease Indication, Route of Administration, Distribution Channel, and Drug Class and region. By Disease Indication, the market is divided into Interdigital Tinea Pedis, Plantar Tinea Pedis, and Vesicular Tinea Pedis. In terms of Route of Administration, the market is classified into Topical, Gel, Cream, Spray, Lotion, Powder, and Oral. Based on Distribution Channel, the market is segmented into Retail Pharmacies, Hospital Pharmacies, Drug Stores, and Online Pharmacies. By Drug Class, the market is divided into Antifungals and Combinations. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Interdigital Tinea Pedis segment is projected to account for 47.6% of the tinea pedis treatment market revenue in 2025, maintaining its leadership due to its high clinical prevalence. This growth has been driven by the frequent diagnosis of fungal infections between the toes, especially in individuals exposed to excessive moisture, sweating, and prolonged footwear use.

Dermatology clinics and healthcare reports have indicated that interdigital tinea pedis is often the initial presentation of foot fungal infections, leading to earlier treatment initiation. Its recognizable symptoms such as itching, scaling, and maceration make it more likely to be self-identified and treated with over-the-counter topical agents.

Public health data has linked this subtype to increased occurrence in athletic populations and aging demographics with compromised skin barriers. With growing foot care awareness and targeted product formulations, the Interdigital Tinea Pedis segment is expected to sustain its stronghold within the overall treatment market.

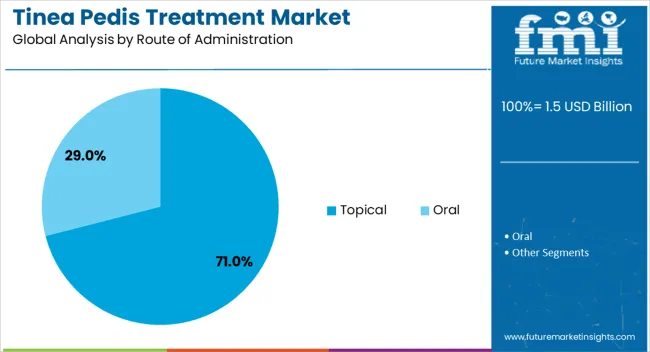

The Topical segment is projected to hold 71.0% of the tinea pedis treatment market revenue in 2025, establishing itself as the dominant route of administration. This leadership is attributed to the effectiveness of topical antifungals in treating superficial infections with minimal systemic absorption.

Medical guidelines have supported the use of creams, gels, sprays, and ointments for managing mild to moderate tinea pedis cases due to their localized action and ease of application. Pharmaceutical companies have launched innovative formulations with enhanced permeability and patient comfort, boosting product compliance.

The over-the-counter availability of many topical treatments has further broadened consumer access and allowed for immediate intervention at early stages of infection. Moreover, topical therapies have presented lower risk profiles compared to oral alternatives, making them suitable for repeated and long-term use in recurrent cases. As consumers increasingly seek non-invasive, affordable, and accessible treatment options, the Topical segment is expected to remain the primary choice across various healthcare settings.

The Retail Pharmacies segment is expected to generate 39.4% of the tinea pedis treatment market revenue in 2025, leading the distribution landscape. This growth has been influenced by the role of pharmacies as accessible points for both prescription and over-the-counter antifungal products.

Retail chains have increasingly stocked a wide array of topical and oral medications, along with foot care solutions, enhancing consumer convenience. Pharmacist recommendations and in-store promotions have further contributed to product uptake, especially for self-diagnosed cases.

Consumer behavior studies have shown a preference for retail pharmacies due to their ease of access, trusted interactions, and immediate product availability. Additionally, partnerships between pharmaceutical brands and retail chains have enabled better visibility and targeted marketing of antifungal therapies. With expanding pharmacy networks, particularly in urban and semi-urban regions, and rising footfall from health-conscious consumers, the Retail Pharmacies segment is expected to remain a key revenue generator in the tinea pedis treatment market.

Rising Awareness about Fungal Infections

Rising awareness about fungal infections, including tinea pedis, is a significant trend shaping the global athlete’s foot (tinea pedis) treatment market. As awareness about fungal infections grows among both healthcare professionals and the general population, there is an increased demand for effective treatment options for conditions like tinea pedis.

The heightened awareness prompts individuals experiencing symptoms such as itching, redness, and scaling on the feet to seek medical attention and pursue appropriate treatment. This will continue to provide impetus for industry growth through 2035.

With increased awareness and self-recognition of tinea pedis symptoms, there is a growing demand for over-the-counter (OTC) antifungal products for self-treatment. Consumers can seek accessible and convenient solutions for managing mild cases of tinea pedis at home without the need for a prescription.

Continuous Innovations in Antifungal Medications

Innovations in antifungal medications for tinea pedis have been significant in recent years, with new formulations and delivery methods enhancing efficacy and patient compliance. According to a review article published in MDPI, azoles, and allylamines have been found to be superior to placebo in treating tinea pedis, with allylamines potentially being superior to azoles.

New topical antifungals, such as luliconazole, have fungicidal action against Trichophyton species similar to or more than that of terbinafine. Luliconazole is available in a 1% cream formulation and is effective with once-daily application for 1 to 2 weeks for dermatophytic infections.

Luliconazole has a favorable safety profile and is approved by the United States Food and Drug Administration for the treatment of tinea cruis, interdigital tinea pedis, and tinea corporis. Availability of these novel medications is contributing to sales growth.

Growing Preference for Natural and Alternative Therapies

Consumers are seeking out natural and alternative therapies for various health conditions, including fungal infections like tinea pedis. This trend is driven by a desire for products perceived as safer, with fewer side effects compared to conventional medications.

Natural treatments are often viewed as gentle on the body and may align better with holistic approaches to healthcare. Growing preference for natural treatments might limit global athlete’s foot (tinea pedis) treatment market growth to a certain extent during the assessment period.

Traditional antifungal medications, whether topical or oral, sometimes have side effects such as skin irritation, allergic reactions, or interactions with other medications. In contrast, natural remedies derived from plant-based sources are perceived to have few adverse effects, making these appealing to individuals seeking a gentler treatment option.

Herbal extracts have a long history of use in traditional medicine systems such as Ayurveda, Traditional Chinese Medicine (TCM), and Native American herbalism. The growing demand for natural treatments has led to the development of botanical formulations specifically targeted at tinea pedis.

The natural formulations often combine multiple herbal extracts, essential oils, and plant-based antifungal agents to create synergistic effects and enhance efficacy. Shifting preference towards these treatments will negatively impact industry development.

Hospital Pharmacies Remain the Leading Distribution Channel

The hospital pharmacies segment is projected to hold 33.4% of the market share of tinea pedis treatment industry in 2025. Further, the segment will likely register a CAGR of 3.9% from 2025 to 2035.

Hospital pharmacies offer a comprehensive range of prescription antifungal medications tailored to patients' needs. Rapid integration within healthcare facilities ensures seamless coordination between healthcare providers, pharmacists, and patients, facilitating optimal treatment outcomes.

Hospital pharmacies also provide specialized care and ancillary services such as compounding and patient counseling, enhancing the treatment experience. This is estimated to further boost growth through 2035.

The global tinea pedis treatment industry registered a CAGR of 4.1% from 2020 to 2025. For the next ten years (2025 to 2035), a CAGR of 5.2% has been estimated for the target industry, depicting a spike of 1.1% CAGR from the historical growth rate.

Consumer preference for OTC products is a significant driver in tinea pedis treatment industry. OTC products for tinea pedis offer consumers the convenience of immediate access to treatment without the need for a prescription or a visit to a healthcare provider.

The convenience offered by OTC drugs is especially attractive for individuals with busy lifestyles. For instance, people who may not have the time or inclination to schedule a doctor's appointment for a mild fungal infection find OTC medications appealing.

OTC antifungal creams, sprays, powders, and ointments are widely available at pharmacies, supermarkets, and online retailers, making these easily accessible to consumers. This accessibility ensures that individuals can purchase treatment options quickly and conveniently whenever they experience symptoms of tinea pedis.

A study published in the Journal of the American Academy of Dermatology found that OTC antifungal products containing ingredients like clotrimazole, miconazole, and terbinafine are effective for treating mild to moderate cases of tinea pedis. The cure rates range from 60% to 80% when used as directed.

OTC antifungal products are generally more affordable than prescription medications or healthcare provider visits. This is making the products a cost-effective option for consumers, especially those without health insurance or with high out-of-pocket expenses. This affordability encourages individuals to self-treat mild cases of tinea pedis rather than seek professional medical care.

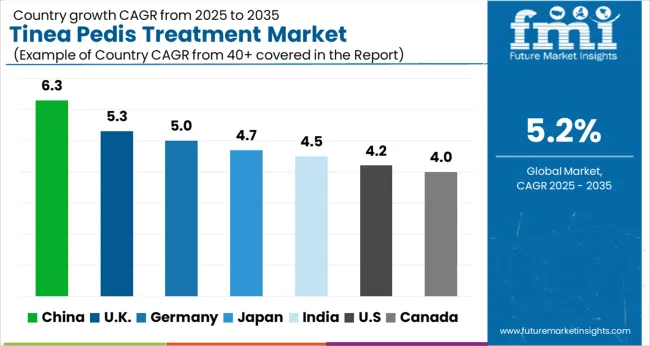

The following table offers an analysis of the tinea pedis treatment industry in leading nations. China and the United Kingdom are set to exhibit high CAGRs of 6.3% and 5.3%, respectively, through 2035. The section also provides a regional analysis of tinea pedis treatment market. The report further discusses tinea pedis treatment sector’s latest trends in several nations.

North America is experiencing strong growth owing to high prevalence of fungal infections and availability of novel therapies. The tinea pedis treatment market in Asia Pacific is set to benefit from growing health awareness and favorable government support.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 4.2% |

| China | 6.3% |

| Japan | 4.7% |

| Germany | 5% |

| United Kingdom | 5.3% |

The United States tinea pedis treatment market is poised to exhibit a CAGR of 4.2% during the assessment period. By 2035, total revenue in the nation is anticipated to reach USD 710 million, owing to high prevalence of tinea pedis.

Tinea pedis is becoming a common fungal infection in the United States, especially among athletes and geriatric population. This, in turn, is creating significant demand for tinea pedis treatments, thereby boosting industry growth.

The United States pharmaceutical industry is renowned for its robust research and development capabilities, enabling the creation of cutting-edge medications and therapies for tinea pedis. The country also has a well-established regulatory framework, ensuring the safety and efficacy of treatments, which creates confidence among healthcare providers and patients.

The tinea pedis treatment industry in Germany is projected to rise at a CAGR of 5% during the assessment period, totaling a value of USD 2.6 million by 2035. This is attributable to a combination of factors, including increasing diagnostic screening and availability of diverse treatment options.

Germany has a highly developed pharmaceutical industry with a focus on dermatological products. This industry produces a wide range of effective antifungal medications specifically designed for treating tinea pedis.

The novel medications are often the result of extensive research and clinical trials, ensuring efficacy and safety. Germany benefits from a comprehensive healthcare infrastructure that provides widespread access to treatment for individuals suffering from tinea pedis.

The tinea pedis treatment market forecast in China looks optimistic, creating remunerative opportunities for tinea pedis treatment providers. This is due to growing awareness about the risks of complications associated with tinea pedis. Sales in the country are projected to soar at 6.3% CAGR through 2035.

There is an increasing awareness of dermatological conditions like tinea pedis among Chinese consumers, leading to a growing demand for effective treatments. Similarly, China’s pharmaceutical industry is growing and becoming more innovative. Domestic and international companies are hence investing in research and development of new antifungal medications.

The section contains information about the leading segments in the industry. The interdigital tinea pedis segment is set to hold a dominant value share of 63.4% in 2025. By route of administration, the topical segment will likely account for a revenue share of 71.4% in 2025.

| Segment | Interdigital Tinea Pedis (Disease Indication) |

|---|---|

| Value Share (2025) | 63.4% |

When it comes to disease indication, the interdigital tinea pedis segment is projected to register a CAGR of 4.6% during the assessment period. It will likely hold a dominant industry share of 63.4% in 2025, owing to high prevalence of this health condition.

Interdigital tinea pedis accounts for a significant portion of the tinea pedis cases globally. Its high prevalence, coupled with growing need for early treatment, will continue to generate demand for treatments over the assessment period.

Interdigital tinea pedis can lead to secondary bacterial infections if left untreated. This encourages patients to opt for treatments like antifungal medications, thereby further boosting segment growth.

Pharmaceutical companies are continually innovating to develop effective antifungal medications, both topical and oral. This will help firms address the specific symptoms and underlying fungal infection associated with interdigital tinea pedis.

As the incidence of interdigital tinea pedis remains prevalent worldwide, particularly in regions with hot and humid climates, the demand for treatments continues to rise. Hence, the target segment is set to retain its dominance through 2035.

| Segment | Topical (Route of Administration) |

|---|---|

| Value Share (2025) | 71.4% |

The topical segment is estimated to account for a value share of 71.4% in 2025, owing to the ease of access and use of topical medications. Patients with tinea pedis often opt for topical solutions like antifungal creams, lotions, and sprays for treatment purposes.

Topical administration route has become popular globally, and the trend is likely to persist through 2035. This is due to its direct application to the affected area, ease of use, reduced systemic absorption, wide availability, and potential for combination therapies.

Topical antifungals also have few side effects, which is contributing to the growing popularity and demand. Thus, the convenience, effectiveness, and safety of topical medications will continue to make these a preferred choice for both healthcare providers and patients.

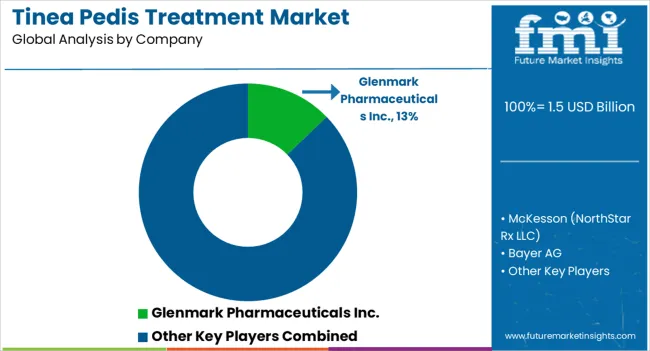

The tinea pedis treatment industry encompasses a diverse and dynamic competitive landscape. Leading tinea pedis drug manufacturing companies are focusing on research and development to develop novel treatment options, including more effective antifungal medications.

New drug forms like creams, sprays, and lotions are being constantly introduced to tackle the burden of tinea pedis globally. Several players are launching campaigns and awareness programs to raise awareness about tinea pedis and the importance of early treatment.

Certain companies are collaborating with healthcare professionals and public health organizations to increase audience and boost sales. Similarly, strategies like acquisitions, partnerships, distribution agreements, and mergers are becoming popular as players look to strengthen footprint.

Industry Updates

As per disease indication, the industry has been categorized into interdigital tinea pedis, plantar tinea pedis, and vesicular tinea pedis.

Based on route of administration, the report is segmented into topical and oral. The topical segment is further divided into gel, cream, spray, lotion, and powder.

Different distribution channels include hospital pharmacies, retail pharmacies, drug stores, and online pharmacies.

In terms of drug class, the industry is categorized into antifungals and combinations.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The global tinea pedis treatment market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the tinea pedis treatment market is projected to reach USD 2.6 billion by 2035.

The tinea pedis treatment market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in tinea pedis treatment market are interdigital tinea pedis, plantar tinea pedis and vesicular tinea pedis.

In terms of route of administration, topical segment to command 71.0% share in the tinea pedis treatment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Treatment-Resistant Hypertension Management Market Size and Share Forecast Outlook 2025 to 2035

Treatment-Resistant Depression Treatment Market Size and Share Forecast Outlook 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Pretreatment Coatings Market Size and Share Forecast Outlook 2025 to 2035

Air Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

CNS Treatment and Therapy Market Insights - Trends & Growth Forecast 2025 to 2035

Seed Treatment Materials Market Size and Share Forecast Outlook 2025 to 2035

Acne Treatment Solutions Market Size and Share Forecast Outlook 2025 to 2035

Scar Treatment Market Overview - Growth & Demand Forecast 2025 to 2035

Soil Treatment Chemicals Market

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Algae Treatment Chemical Market Forecast and Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Burns Treatment Market Overview – Growth, Demand & Forecast 2025 to 2035

CRBSI Treatment Market Insights - Growth, Trends & Forecast 2025 to 2035

Water Treatment Polymers Market Growth & Demand 2025 to 2035

Asthma Treatment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA