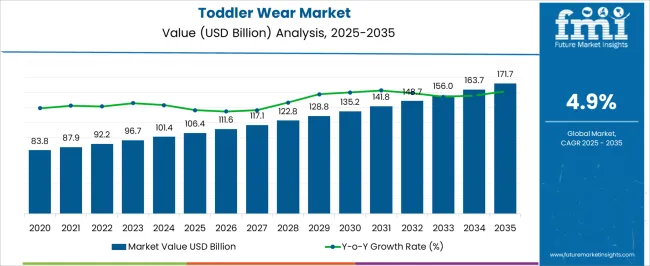

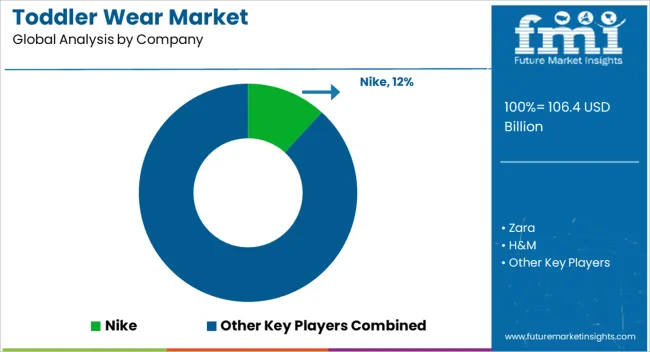

The toddler wear market is estimated to be valued at USD 106.4 billion in 2025 and is projected to reach USD 171.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

Between 2031 and 2035, the market progresses further, moving from USD 111.6 billion to USD 148.7 billion, with the expansion driven by diversified product offerings such as organic cotton wear, innovative fabrics designed for durability, and the increasing importance of fashion trends influencing toddler apparel. Enhanced customization options and the rise of subscription-based clothing models for children also gain traction during this period.

The market operates within global apparel manufacturing networks where safety regulations, comfort requirements, and developmental considerations determine design specifications across clothing categories serving children aged 1-4 years. Manufacturing facilities produce garments using specialized sizing systems, child-safe materials, and construction techniques that accommodate rapid growth patterns, active play behaviors, and safety standards mandated by consumer protection agencies. Suppliers collaborate with retailers, brand managers, and safety testing laboratories who require products that meet regulatory compliance, durability expectations, and comfort standards while addressing parents' preferences for quality, value, and style considerations.

Retail distribution channels encompass specialty children's stores, department stores, mass market retailers, and e-commerce platforms where parents evaluate toddler clothing based on practical considerations including ease of dressing, washability, and growth accommodation. Seasonal buying patterns reflect growth spurts, weather changes, and gift-giving occasions that create demand fluctuations throughout annual selling cycles. Brand positioning strategies emphasize safety certifications, organic materials, and developmental appropriateness that appeal to health-conscious parents while managing price sensitivity considerations that affect purchasing decisions across different income segments.

Manufacturing processes require specialized knowledge of toddler anatomy, movement patterns, and behavioral characteristics that influence garment design including wider necklines, snap closures, and reinforced stress points that accommodate frequent washing and active play. Quality control procedures verify safety compliance through testing for chemical restrictions, choking hazards, and flammability requirements that vary across different international markets. Construction techniques emphasize flat seams, tagless designs, and soft materials that prevent skin irritation while maintaining durability throughout repeated wear and washing cycles.

Safety regulatory frameworks including CPSIA in the United States, REACH in Europe, and similar standards worldwide establish restrictions on chemical content, small parts, drawstrings, and flammability that manufacturers must validate through third-party testing before market entry. Compliance documentation requires certificates of conformity, tracking labels, and batch identification systems that enable product traceability and recall procedures when safety issues arise. Testing costs and certification timelines affect production planning and pricing structures across different market segments and geographic regions.

| Metric | Value |

|---|---|

| Toddler Wear Market Estimated Value in (2025 E) | USD 106.4 billion |

| Toddler Wear Market Forecast Value in (2035 F) | USD 171.7 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The toddler wear market is witnessing sustained growth, supported by increasing disposable incomes, heightened awareness of child comfort and safety, and the growing influence of fashion trends on children’s clothing. Parents are prioritizing apparel that offers durability, softness, and easy maintenance, while brands are responding with improved fabric technology and eco-friendly manufacturing practices. The shift toward organized retail, combined with the rapid expansion of e-commerce platforms, has enhanced product accessibility and variety for consumers in both developed and emerging markets.

Cotton-based clothing, sustainable materials, and functional designs are gaining preference, reflecting a broader shift toward conscious consumerism. Global fashion brands and regional manufacturers are investing in seasonal collections and collaborative designs, further fueling market differentiation.

The growing adoption of personalized clothing options, coupled with digital marketing campaigns targeting young parents, is expected to accelerate product demand Over the coming years, the market will likely experience continued expansion through strategic product innovation and deeper penetration into untapped regional markets.

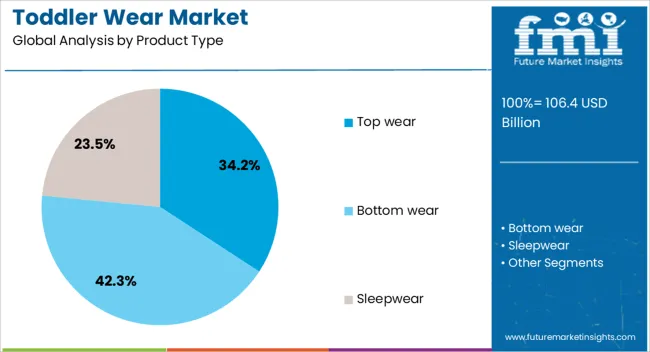

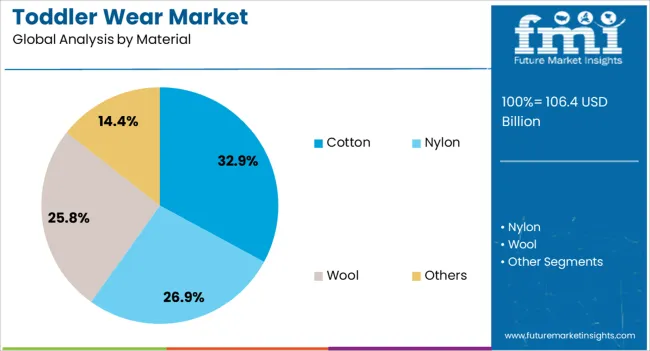

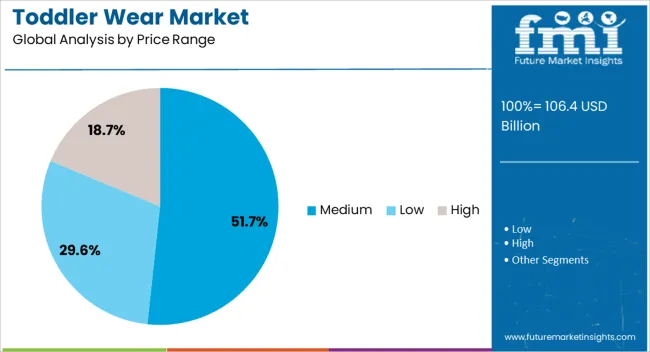

The toddler wear market is segmented by product type, material, price range, gender, distribution channel, and geographic regions. By product type, toddler wear market is divided into Top wear, Bottom wear, Sleepwear, Accessories, and Footwear. In terms of material, toddler wear market is classified into Cotton, Nylon, Wool, and Others. Based on price range, toddler wear market is segmented into Medium, Low, and High. By gender, toddler wear market is segmented into Girl and Boy. By distribution channel, toddler wear market is segmented into Offline and Online. Regionally, the toddler wear industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The top wear category is expected to account for 34.2% of the toddler wear market revenue share in 2025, making it the leading product type segment. This dominance is being driven by the high frequency of usage, seasonal demand variations, and greater replacement cycles compared to other apparel types. The segment benefits from its versatility, as top wear items can be paired with various bottom wear options, increasing their value in a toddler’s wardrobe.

Manufacturers are introducing a wide range of designs, prints, and functional features, such as easy fastening and stretchable fabrics, to meet both style and comfort requirements. The use of high-quality stitching and soft, skin-friendly fabrics ensures durability and safety, which are key priorities for parents.

Furthermore, the category’s adaptability to casual, festive, and outdoor wear occasions supports consistent demand across regions Strategic promotions, coupled with increased online retail penetration, have further reinforced the strong market position of top wear within toddler apparel.

The cotton segment is projected to hold 32.9% of the toddler wear market revenue share in 2025, retaining its position as the most preferred material. This preference is primarily due to cotton’s softness, breathability, and hypoallergenic properties, which are highly valued in toddler apparel. Cotton garments provide superior comfort, temperature regulation, and moisture absorption, making them suitable for varying climatic conditions.

The durability of cotton, combined with its easy-care nature, ensures longevity even with frequent washing, aligning with parental expectations for practicality and cost-effectiveness. Advances in textile processing have further enhanced cotton fabrics, making them more resistant to shrinkage and color fading.

The segment has also benefited from increasing awareness about natural and sustainable materials, with organic cotton gaining popularity among eco-conscious parents Retailers and brands continue to promote cotton-based clothing through marketing that emphasizes safety and comfort, solidifying its dominant role in the toddler wear market.

The medium price range category is anticipated to represent 51.7% of the toddler wear market revenue share in 2025, reflecting its broad appeal to middle-income consumers seeking a balance between quality and affordability. This segment has been strengthened by the availability of a wide variety of stylish and durable apparel at competitive prices, catering to both urban and semi-urban markets.

Manufacturers in this price bracket are able to offer premium-looking designs and quality materials without significantly increasing costs, thereby attracting a wider consumer base. The segment’s growth is also supported by promotional discounts, seasonal sales, and bundle offers that enhance perceived value.

With rising disposable incomes and an increasing focus on brand-conscious purchases, the medium price range has become a sweet spot for many consumers Its versatility in serving both everyday wear and occasion-specific clothing has ensured its continued dominance, with consistent demand projected across global markets.

The toddler wear segment has evolved into a dynamic part of global apparel, supported by fashion-driven demand, e-commerce growth, material safety, and competitive brand strategies. These dynamics continue to redefine consumer expectations and long-term industry positioning.

Fashion-driven preferences have been playing a pivotal role in the toddler wear segment, shaping how parents make purchase decisions. Comfort remains an essential factor, but there is an increasing emphasis on style, patterns, and seasonal trends to ensure toddlers are dressed in outfits that are both functional and visually appealing. Global and regional brands are introducing exclusive toddler collections that follow broader fashion cycles, incorporating vibrant colors, coordinated sets, and character-inspired apparel. Parents have been showing greater interest in matching outfits with siblings or parents, further increasing product diversity. The industry has responded with fast design cycles and limited-edition launches, positioning toddler wear as a highly dynamic category in the overall apparel industry.

E-commerce has established itself as a critical distribution channel for toddler wear, enabling brands to expand beyond traditional retail. Parents have been turning to online platforms for wider product choices, convenient delivery options, and access to size customization tools. Digital-native brands are making deeper inroads by targeting parents through influencer collaborations, social media campaigns, and curated subscription boxes. This shift has provided smaller labels an opportunity to compete with established retailers on equal ground, offering niche collections and personalized experiences. Loyalty programs and AI-based recommendation engines have enhanced digital shopping adoption. The direct-to-consumer approach has also provided valuable consumer insights, supporting agile production cycles that address shifting fashion needs in toddler clothing

Premiumization has emerged as a defining trend, as parents increasingly prefer higher-quality fabrics and durable toddler apparel. Organic cotton, blended fabrics, and hypoallergenic textiles are receiving attention due to their perceived comfort and safety. Safety certifications, eco-friendly dyes, and child-safe accessories have become selling points in premium segments. This focus on material safety has encouraged brands to differentiate themselves through quality assurance, while retailers emphasize value-added positioning. Growing disposable spending has made parents more willing to invest in premium toddler clothing, treating it as an extension of personal lifestyle. Premium toddler wear is also marketed as longer-lasting and more resilient, with higher resale or reuse potential, strengthening its role within higher-value apparel brackets.

The toddler wear space has been shaped by highly competitive strategies adopted by global and regional brands. Retailers are deploying exclusive partnerships, celebrity endorsements, and designer collaborations to capture consumer attention. Marketing campaigns highlighting aspirational lifestyles and family-centric values have contributed to brand differentiation. Mass-market retailers are leveraging economies of scale to balance cost pressures while offering fashionable toddler lines at affordable prices. At the same time, boutique brands are targeting niche audiences with limited-edition collections and customization options. This dual market approach has made toddler wear a vibrant and segmented category. With growing customer loyalty programs and direct consumer engagement, brand positioning has been elevated into a key success factor.

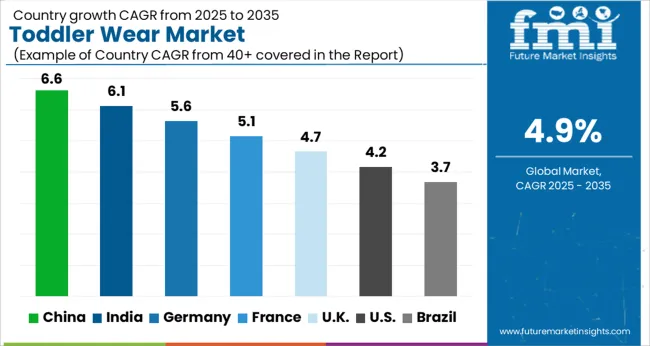

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The toddler wear market is projected to expand globally at a CAGR of 4.9% between 2025 and 2035, driven by increasing parental focus on premium clothing, e-commerce adoption, and seasonal fashion demand. China leads with a CAGR of 6.6%, supported by its strong manufacturing base, evolving lifestyle trends, and high consumer spending on premium kidswear. India follows at 6.1%, where rising disposable income and greater adoption of organized retail formats are propelling sales across urban and semi-urban markets. France posts 5.1%, backed by luxury fashion influence and strong positioning of premium toddler clothing brands. The United Kingdom records 4.7%, reflecting steady adoption of e-commerce channels and diversified retail distribution. The United States grows at 4.2%, influenced by steady consumer demand for comfort-driven, safety-certified toddler apparel. The analysis highlights Asia-Pacific as the dominant region, while Europe and North America maintain significant contributions through premium apparel innovation and expanding digital retail presence.

China is forecasted to achieve a CAGR of 6.6% during 2025–2035, rising from approximately 5.8% in 2020–2024, maintaining its lead above the global toddler wear average of 4.9%. The improvement has been fueled by higher parental expenditure on premium apparel, strong online retail penetration, and the presence of large-scale domestic manufacturing hubs that accelerate supply efficiency. Seasonal collections, festive outfits, and character-themed toddler apparel have boosted repeat purchases. Both luxury and mass-market players have adopted diversified pricing models to appeal to a wide consumer base. Rising disposable income and increased awareness of high-quality fabrics have positioned China as the key contributor to toddler wear expansion.

India is projected to post a CAGR of 6.1% during 2025–2035, up from about 5.4% in 2020–2024, which places it above the global 4.9% average. Growth has been supported by rising organized retail penetration, the popularity of branded kidswear, and evolving consumer patterns across urban and semi-urban regions. E-commerce has become a major driver, expanding access to toddler wear even in smaller towns. Digital-first brands and influencer-driven campaigns have built strong loyalty among aspirational parents. Premiumization has gained ground, with parents seeking higher-quality fabrics and trend-driven designs. India’s large young population base offers scale advantages, encouraging international and domestic players to diversify portfolios and expand their retail footprint.

France is forecasted to post a CAGR of 5.1% between 2025–2035, up from nearly 4.5% in 2020–2024, reflecting its slightly above-average growth compared with the global 4.9%. Premium fashion houses have been active in toddler wear launches, introducing curated collections with exclusive designs. French parents are highly brand-oriented, favoring premium clothing categories for toddlers. Boutique retailers specializing in toddler accessories and seasonal apparel continue to stimulate repeat buying cycles. The mix of aspirational luxury-driven purchases and everyday essentials has created a balanced market structure. France remains an important European hub where premium toddler apparel drives category value, while mid-segment products maintain consistent adoption.

The United Kingdom is expected to register a CAGR of 4.7% between 2025–2035, rising from about 4.1% during 2020–2024, remaining slightly below the global toddler wear CAGR of 4.9%. The improvement reflects stronger adoption of e-commerce platforms, wider product availability, and collaborative brand launches. Parents in the UK are increasingly seeking affordable yet stylish toddler wear, driving the growth of the affordable premium category. Online marketplaces have made global brands more accessible, while local players continue to deliver value-driven offerings. The rise in CAGR highlights how online sales momentum and mid-tier brand diversification have pushed growth upward. The market remains steady but moderately paced compared with Asian peers.

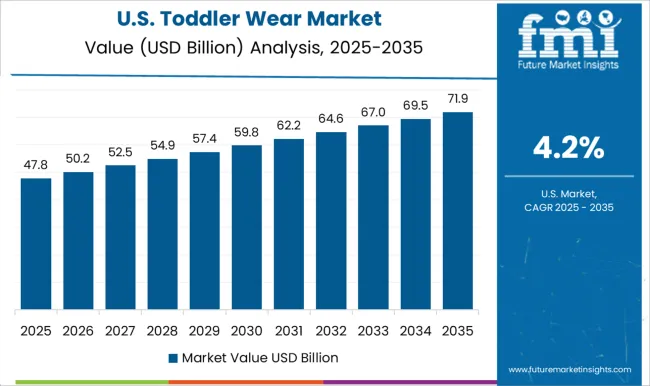

The United States is projected to record a CAGR of 4.2% during 2025–2035, up from nearly 3.7% in 2020–2024, remaining slightly below the global toddler wear growth trajectory of 4.9%. Demand has been fueled by consistent spending on comfort-oriented and safety-tested toddler wear, with steady appetite for everyday essentials. Branded retailers have adapted by strengthening digital strategies, curating toddler-specific collections for e-commerce platforms and direct-to-consumer channels. While premium categories have expanded gradually, the market continues to be dominated by affordable clothing lines. The CAGR improvement underscores how stable consumer behavior, expanding online retail, and diversified brand strategies have contributed to moderate yet steady progress in the United States.

The toddler wear market is driven by global apparel leaders and lifestyle brands focusing on comfort, safety, and design innovation. Carter’s Inc. and The Children’s Place Inc. lead in North America with value-oriented essentials and coordinated collections for infants and toddlers. Their strength lies in affordability, brand trust, and strong omnichannel retail networks. Gap Inc., through GapKids and OshKosh B’gosh, emphasizes durable, comfort-focused apparel, catering to middle-income families with timeless, casual designs.

H&M Group and Zara (Inditex) dominate the fast-fashion segment, offering trend-driven toddler wear at accessible prices. Both utilize agile supply chains and digital storefronts to deliver frequent style refreshes. Nike Inc. and Adidas AG bring athletic design to toddler clothing, focusing on breathable, movement-friendly materials that blend functionality with brand-driven appeal.

In the premium and luxury segments, Ralph Lauren Corporation, Burberry Group plc, and Petit Bateau target affluent consumers seeking quality fabrics, craftsmanship, and distinctive aesthetics. Marks & Spencer Group plc integrates toddler wear into its broad apparel range, maintaining a strong family retail presence in Europe. Gerber Childrenswear LLC provides trusted, safety-certified basics for infants and toddlers.

Niche players such as Patagonia Inc., J.Crew Group (crewcuts), and Next plc focus on sustainability, design individuality, and lifestyle-driven collections. Competition in the toddler wear market revolves around digital expansion, sustainable materials, and agile design cycles, with leading brands scaling e-commerce and personalization to capture evolving global consumer preferences.

| Item | Value |

|---|---|

| Quantitative Units | USD 106.4 Billion |

| Product Type | Top wear, Bottom wear, Sleepwear, Accessories, and Footwear |

| Material | Cotton, Nylon, Wool, and Others |

| Price Range | Medium, Low, and High |

| Gender | Girl and Boy |

| Distribution Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Carter’s Inc., The Children’s Place Inc., Gap Inc. (GapKids and OshKosh B’gosh), H&M Group, Zara (Inditex), Nike Inc., Adidas AG, Ralph Lauren Corporation, Gerber Childrenswear LLC, Marks & Spencer Group plc, Petit Bateau, Burberry Group plc, Patagonia Inc., J.Crew Group (crewcuts), and Next plc. |

| Additional Attributes | Dollar sales, share, growth rates, consumer buying trends, pricing strategies, regional demand patterns, retail distribution shifts, competitive brand moves, premiumization impact, and e-commerce penetration. |

The global toddler wear market is estimated to be valued at USD 106.4 billion in 2025.

The market size for the toddler wear market is projected to reach USD 171.7 billion by 2035.

The toddler wear market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in toddler wear market are top wear, _t-shirts, _shirts, _jackets, _sweaters, _others, bottom wear, _pants, _shorts, _skirts, _others, sleepwear, _onesies, _nightgowns, _others, accessories, _hats, _socks, _gloves, _others, footwear and _others (party wear, etc.).

In terms of material, cotton segment to command 32.9% share in the toddler wear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wearable Fall Detector Market Size and Share Forecast Outlook 2025 to 2035

Wearable Industrial Exoskeleton Devices Market Size and Share Forecast Outlook 2025 to 2035

Wear Grade PEEK Polymer Market Size and Share Forecast Outlook 2025 to 2035

Wearable Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sensor Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Wearable Beauty Market Size, Growth, and Forecast for 2025 to 2035

Wearable Medical Robots Market - Trends & Forecast 2025 to 2035

Wearable Computing Market Trends – Growth & Forecast 2025 to 2035

Wearable Blood Pressure Monitor Market Trends and Forecast 2025 to 2035

Wearable Pregnancy Devices Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA