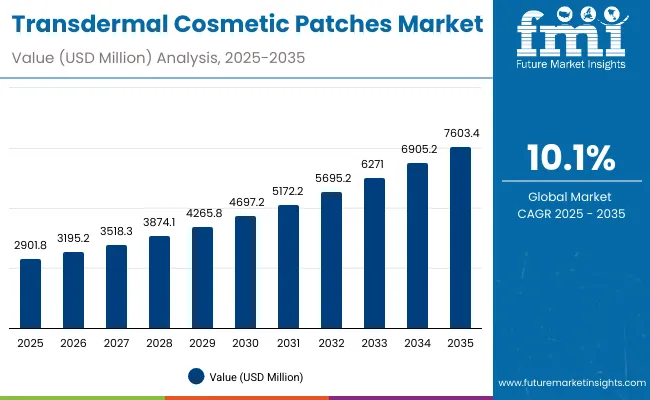

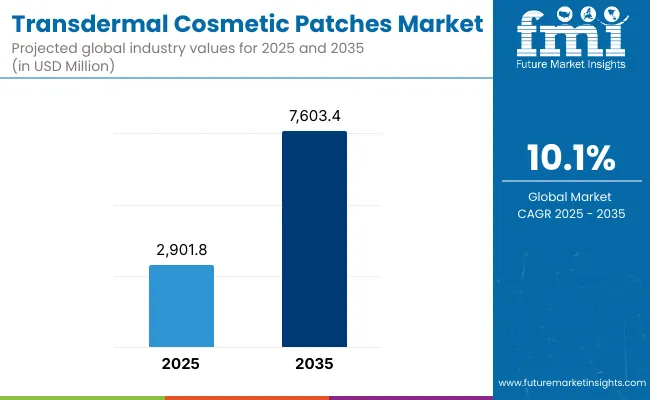

The Transdermal Cosmetic Patches Market is expected to record a valuation of USD 2,901.8 million in 2025 and USD 7,603.4 million in 2035, with an increase of USD 4,701.6 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 10.1% and a 2X increase in market size.

Transdermal Cosmetic Patches Market Key Takeaways

| Metric | Value |

|---|---|

| Transdermal Cosmetic Patches Market Estimated Value in (2025E) | USD 2,901.8 million |

| Transdermal Cosmetic Patches Market Forecast Value in (2035F) | USD 7,603.4 million |

| Forecast CAGR (2025 to 2035) | 10.1% |

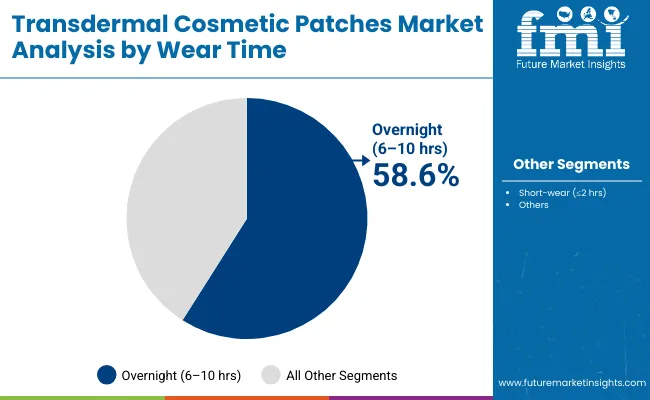

During the first five-year period from 2025 to 2030, the market increases from USD 2,901.8 million to USD 4,697.2 million, adding USD 1,795.4 million, which accounts for 38.2% of the total decade growth. This phase records steady adoption across e-commerce channels, specialty beauty retail, and drugstores, driven by consumer demand for acne, wrinkle, and brightening solutions. Overnight wear patches (6-10 hrs) dominate this period as they cater to over 58.6% of applications requiring sustained active delivery.

The second half from 2030 to 2035 contributes USD 2,906.2 million, equal to 61.8% of total growth, as the market jumps from USD 4,697.2 million to USD 7,603.4 million. This acceleration is powered by widespread deployment of premium skincare patches, AI-driven personalized beauty solutions, and expansion in emerging markets such as China and India. Hydrogel-based formats and occlusive adhesives together capture a larger share above 95% by the end of the decade. Brand D2C and digital-first retail platforms add recurring revenue streams, increasing the online-driven sales share beyond 60% in total value.

From 2020 to 2024, the Transdermal Cosmetic Patches Market grew steadily, driven by rising demand for targeted skincare solutions such as acne patches, wrinkle/fine-line reducers, and brightening formulations. During this period, the competitive landscape was dominated by Asian skincare leaders and innovation-driven startups, with companies like Amorepacific, COSRX, and ZitSticka capturing strong consumer adoption. Competitive differentiation relied on patch material technology (hydrogel, occlusive adhesives), efficacy of actives, and price accessibility across mass, masstige, and premium tiers. Service-based personalization (such as AI-driven patch recommendations) had minimal traction, contributing less than 10% of the total market value.

Demand for Transdermal Cosmetic Patches will expand to USD 2,901.8 million in 2025, and the revenue mix will shift as premium and digitally enabled solutions grow to over 25% share. Traditional patch leaders face rising competition from digital-first D2C brands offering AI-driven skin diagnostics, subscription-based replenishment models, and cloud-enabled personalized skincare ecosystems. Major incumbents are pivoting to hybrid models, integrating dermatological expertise with consumer-facing digital platforms to retain relevance. Emerging entrants specializing in microdart/microneedle technology, AR/VR-driven skin visualization, and personalized actives are gaining share. The competitive advantage is moving away from patch material innovation alone to ecosystem strength, personalization scalability, and recurring subscription revenue streams.

The emergence of microdart and microneedle-based patches is significantly accelerating market expansion, especially in premium skincare. These formats enable deeper transdermal delivery of actives such as peptides, retinol, and hyaluronic acid, ensuring visible results for wrinkles, fine lines, and pigmentation.

Unlike conventional topicals, they bridge the gap between cosmetics and minimally invasive dermatology treatments, appealing to consumers seeking clinical-grade efficacy without downtime. This differentiation is prompting rapid adoption in developed Asian and Western markets, elevating average selling prices.

The growth of digitally native D2C beauty brandsleveraging AI-driven skin diagnostics, subscription models, and social commerceis transforming patch distribution and personalization. Companies like Peace Out Skincare, ZitSticka, and COSRX are using e-commerce-first strategies to capture millennial and Gen Z consumers who value convenience and tailored regimens.

Integration of mobile apps that recommend patch types based on real-time skin assessments is enhancing consumer loyalty and repeat purchases. This shift is expanding accessibility in both mature and emerging economies, fueling consistent double-digit growth.

The Transdermal Cosmetic Patches Market is segmented by patch type, active focus, wear time, distribution channel, price tier, and region. Patch types include microdart/microneedle patches, hydrogel patches, and occlusive adhesive patches, representing the core technologies shaping adoption. Active focus classification covers acne/blemish care, wrinkle/fine line reduction, depuff/eye care, and brightening/spot care, reflecting targeted skin concerns. Based on wear time, the market is divided into overnight (6-10 hours) and short-wear (≤2 hours) formats, catering to different consumer routines.

Distribution channels include e-commerce marketplaces, brand D2C platforms, specialty beauty retail, and drugstores/pharmacies, highlighting the shift toward omnichannel availability. By price tier, categories encompass mass, masstige, and premium, capturing affordability differences across consumer bases.

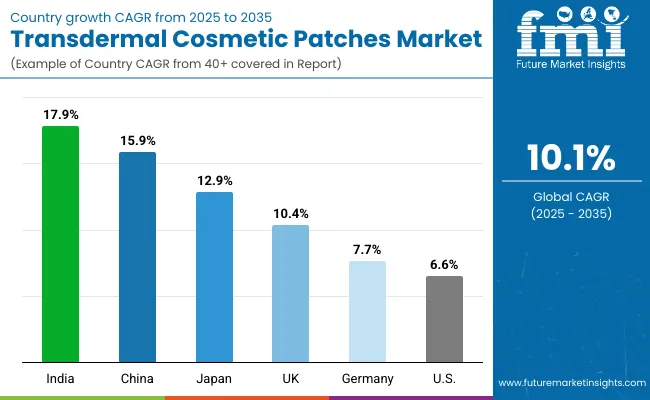

Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa. Within this, high-growth countries such as China (15.9% CAGR), India (17.9% CAGR), and Japan (12.9% CAGR) drive accelerated expansion, while the USA market provides steady incremental growth.

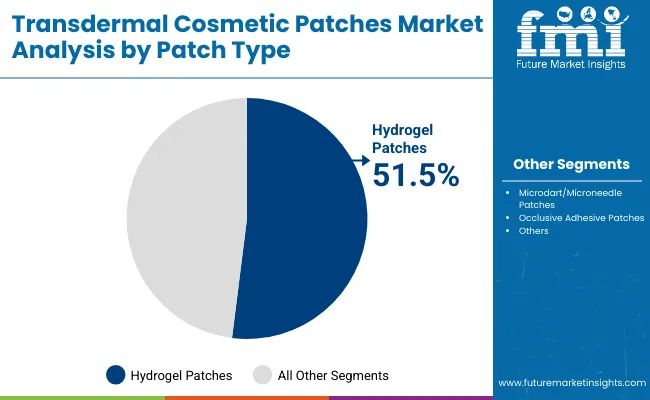

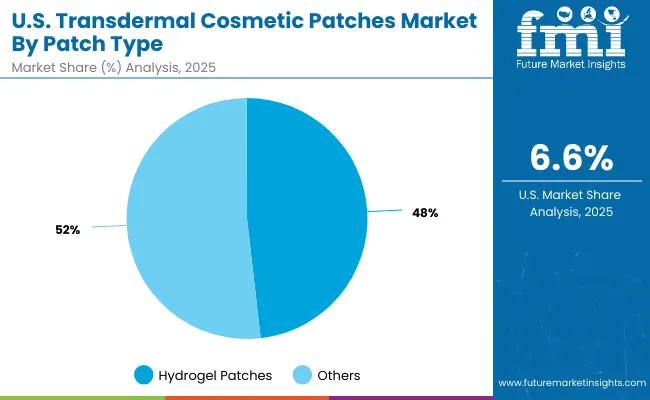

| Patch Type | Value Share % 2025 |

|---|---|

| Hydrogel patches | 51.5% |

| Others | 48.5% |

The hydrogel patches segment is projected to contribute 51.5% of the Transdermal Cosmetic Patches Market revenue in 2025, maintaining its lead as the dominant patch category. This leadership is driven by the widespread use of hydrogel formulations for acne treatment, wrinkle reduction, and brightening applications, as they ensure better adherence, cooling effects, and enhanced transdermal delivery of active ingredients.

The segment’s growth is also supported by the rising preference for overnight wear formats, where hydrogel patches improve moisture retention and sustained release of actives. With advancements in biocompatible materials and dermatologically tested formulations, hydrogel patches are positioned to remain the backbone of transdermal cosmetic applications, while microdart/microneedle patches emerge as a premium, high-growth complement.

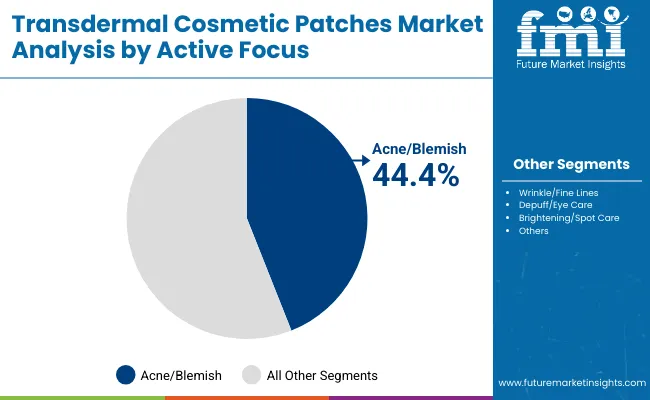

| Active Focus | Value Share % 2025 |

|---|---|

| Acne/blemish | 44.4% |

| Others | 55.6% |

The acne/blemish segment is forecasted to hold 44.4% of the market share in 2025, led by its application in addressing breakouts, blackheads, and blemishes with targeted delivery of actives such as salicylic acid, tea tree oil, and niacinamide. These patches are favored for their fast-acting, discreet, and hygienic design, making them ideal for daily skincare regimens and quick spot treatment.

Their compact, easy-to-apply formats have facilitated widespread adoption across teenagers, young adults, and increasingly, working professionals seeking on-the-go solutions. The segment’s growth is bolstered by social media-driven beauty trends and dermatologists endorsing hydrocolloid-based patches as effective first-line treatments. As skincare continues to prioritize clear-skin solutions, acne/blemish patches are expected to retain their dominance within the active focus category.

| Wear Time | Value Share % 2025 |

|---|---|

| Overnight (6-10 hrs ) | 58.6% |

| Others | 41.4% |

The overnight wear segment is projected to account for 58.6% of the Transdermal Cosmetic Patches Market revenue in 2025, establishing it as the leading wear-time category. Overnight patches are preferred for their ability to deliver active ingredients gradually over several hours, enhancing efficacy for acne treatment, wrinkle reduction, and skin hydration.

Their suitability for deep-acting formulations and convenience in integrating with night-time skincare routines have made them popular among consumers seeking visible results with minimal effort. Developments in hydrogel and occlusive technologies have further improved moisture retention and skin penetration efficiency. Given their balance of convenience, effectiveness, and consumer compliance, overnight patches are expected to maintain their leading role in the Transdermal Cosmetic Patches Market.

Rising Adoption of Personalized Skincare Solutions

The increasing demand for personalized and targeted skincare of the transdermal cosmetic patches marketis a major driver. Unlike conventional creams, patches deliver precise dosages directly to problem areas such as acne, wrinkles, or under-eye puffiness. This targeted efficacy resonates with consumers seeking faster, visible results while minimizing product wastage. With AI-powered skin diagnostic tools and subscription-based models growing, patches are emerging as a preferred premium format, especially among Gen Z and millennials who prioritize customized regimens and convenience-driven skincare innovations.

Expansion of D2C and Digital Beauty Ecosystems

The shift toward direct-to-consumer (D2C) models and digital-first retail platforms is fueling market growth. Brands like ZitSticka, Peace Out Skincare, and COSRX are leveraging social media, influencer marketing, and e-commerce to directly engage consumers, cutting out traditional distribution barriers. This ecosystem not only ensures faster adoption but also drives recurring revenues through subscription replenishment. Digital diagnostics integrated with app-based recommendations further enhance consumer loyalty. As a result, digital-native beauty brands are reshaping accessibility and affordability, expanding patch adoption across developed and emerging markets simultaneously.

Limited Clinical Validation and Regulatory Ambiguity

Lack of standardized clinical validation and regulatory clarity for cosmetic patches is one limitation of tis market. While hydrocolloid and hydrogel formats are widely accepted, microdart/microneedle patches blur the line between cosmetics and medical devices, raising regulatory scrutiny. Variability in patch performance, adhesive quality, and skin compatibility across markets hinders universal trust. This creates hesitation among dermatologists and cautious consumers, especially in premium segments. Without robust scientific backing and consistent compliance frameworks, certain innovations may face slower adoption and fragmented market acceptance globally.

Premiumization through Microdart and Microneedle Technologies

The premiumization of skincare patches through microdart and microneedle technology is a key trend shaping the industry. These innovations allow deeper transdermal delivery of active ingredients like peptides, retinol, and hyaluronic acid, replicating near-clinical outcomes without invasive procedures. Positioned between cosmetics and dermatological treatments, they appeal to consumers demanding higher efficacy. Major brands and startups alike are launching microneedle-based patches for wrinkle reduction, brightening, and intensive hydration. This technology is increasingly marketed as an at-home alternative to professional treatments, boosting premium patch sales worldwide.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 15.9% |

| USA | 6.6% |

| India | 17.9% |

| UK | 10.4% |

| Germany | 7.7% |

| Japan | 12.9% |

The global Transdermal Cosmetic Patches Market shows pronounced regional disparities in adoption speed, strongly influenced by skincare culture, premiumization, and digital-first retail ecosystems. Asia-Pacific emerges as the fastest-growing region, anchored by China at 15.9% CAGR and India at 17.9% CAGR.

This acceleration is driven by strong demand for acne, brightening, and wrinkle-care patches, rapid penetration of premium K-beauty and J-beauty formats, and government focus on cosmeceutical innovation and domestic manufacturing. China’s regulatory framework promoting functional cosmetics accelerates hydrogel and microneedle patch adoption. India’s trajectory reflects the rise of affordable masstige patches, propelled by e-commerce and D2C expansion into Tier II/III cities.

Europe maintains a strong growth profile, led by Germany at 7.7% CAGR and the UK at 10.4% CAGR, supported by stringent cosmetic safety compliance, sustainability-driven packaging mandates, and rising consumer preference for eco-friendly formulations. Premium brands emphasizing anti-aging and depuff/eye care patches are gaining traction across Western Europe.

North America shows moderate expansion, with the USA at 6.6% CAGR, reflecting market maturity and slower incremental growth compared to Asia. Growth in the USA is increasingly service-driven, shaped by D2C digital subscription models, AR/VR skin diagnostics, and influencer-led marketing rather than volume expansion. Japan, at 12.9% CAGR, benefits from its role as a R&D hub for microneedle innovation, with strong demand for wrinkle and brightening patches. Local champions such as KAO and Amorepacific Japan are boosting premiumization while exporting innovations regionally.

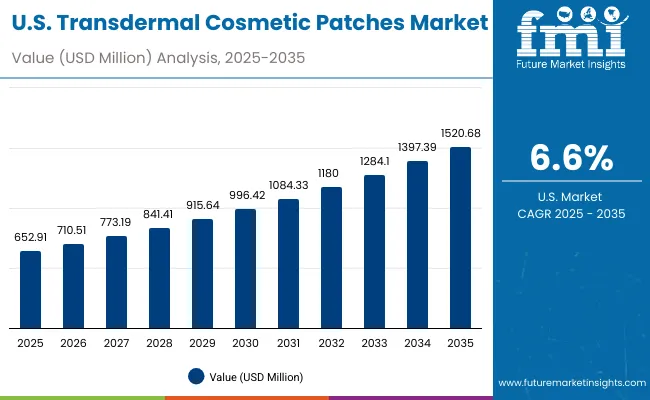

| Year | USA Transdermal Cosmetic Patches Market (USD Million) |

|---|---|

| 2025 | 652.91 |

| 2026 | 710.51 |

| 2027 | 773.19 |

| 2028 | 841.41 |

| 2029 | 915.64 |

| 2030 | 996.42 |

| 2031 | 1084.33 |

| 2032 | 1180.00 |

| 2033 | 1284.10 |

| 2034 | 1397.39 |

| 2035 | 1520.68 |

The Transdermal Cosmetic Patches Market in the United States is projected to grow at a CAGR of 6.6% from 2025 to 2035, driven by rising consumer preference for convenient, non-invasive skincare solutions. Hydrogel patches dominate the market with a 48.2% share in 2025 (USD 314.7 million), reflecting strong demand for acne care, depuffing, and anti-wrinkle applications. Growth is further supported by brand D2C expansion, with companies leveraging social media-driven marketing and subscription models. Increasing adoption of overnight patches (6-10 hrs) highlights consumer preference for extended efficacy formats.

The Transdermal Cosmetic Patches Market in the United Kingdom is expected to grow at a CAGR of 10.4% from 2025 to 2035, supported by rising consumer interest in anti-aging, depuffing, and brightening solutions. Premium skincare adoption is accelerating, with hydrogel and microneedle patches gaining traction across specialty retail and online D2C platforms. The UK’s strong cosmetic regulatory framework and consumer focus on safety and sustainability are shaping innovation in eco-friendly packaging and clinically validated formulations. Growth is also driven by an expanding masstige segment, making patches accessible to wider demographics.

India is witnessing rapid growth in the Transdermal Cosmetic Patches Market, which is forecast to expand at a CAGR of 17.9% through 2035. A sharp increase in adoption across tier-2 and tier-3 cities is being driven by affordable masstige launches and rising awareness of skincare benefits among millennials and Gen Z consumers. Local and regional brands are leveraging e-commerce platforms to penetrate underserved markets, while premium international players are focusing on urban centers with high disposable income. Demand is also supported by India’s growing dermatology and aesthetic clinics sector, which is integrating microdart and hydrogel patches as part of advanced skincare regimens.

The Transdermal Cosmetic Patches Market in China is expected to grow at a CAGR of 15.9%, the highest among leading economies. This momentum is driven by the rapid uptake of acne and blemish care patches, supported by younger consumers seeking fast-acting, affordable skincare solutions. Domestic beauty brands are aggressively competing with international players, offering hydrogel and brightening patches at competitive price points through e-commerce platforms like Tmall and JD.com. Municipal policies supporting functional cosmetics innovation and rising demand for premium microneedle patches are further strengthening growth. China’s leadership in cross-border e-commerce and social commerce livestreaming is also accelerating consumer access and awareness.

| Country | 2025 Share (%) |

|---|---|

| USA | 23.2% |

| China | 11.9% |

| Japan | 6.9% |

| Germany | 15.3% |

| UK | 8.0% |

| India | 4.8% |

| Country | 2035 Share (%) |

|---|---|

| USA | 20.6% |

| China | 12.8% |

| Japan | 8.3% |

| Germany | 13.3% |

| UK | 7.2% |

| India | 5.9% |

The Transdermal Cosmetic Patches Market in Germany is projected to grow at a CAGR of 7.7% from 2025 to 2035, underpinned by its strong position in premium skincare and regulatory-driven cosmetics innovation. German consumers are highly conscious of product safety, dermatological testing, and sustainability, which is encouraging manufacturers to focus on eco-friendly hydrogel formulations and recyclable packaging.

Adoption is being accelerated by pharmacies and drugstores, which are the leading retail channels, alongside a gradual expansion in specialty beauty retail. Premium patches targeting wrinkle/fine-line care and depuff/eye treatment dominate demand, while masstige players are expanding reach with affordable acne patches for younger demographics.

| USA By Patch Type | Value Share % 2025 |

|---|---|

| Hydrogel patches | 48.2% |

| Others | 51.8% |

The Transdermal Cosmetic Patches Market in the United States is projected at USD 652.9 million in 2025, expanding steadily at a CAGR of 6.6% through 2035. Hydrogel patches account for 48.2% of the market, reflecting strong consumer demand for acne, depuffing, and wrinkle-reduction solutions. The USA market shows a clear value shift toward D2C-driven subscription models and digital-first retail, where brands leverage personalized skincare apps, AR try-ons, and influencer ecosystems to build loyalty.

Growing emphasis on overnight wear patches highlights consumer preference for convenience and sustained efficacy. In parallel, premium microneedle innovations are carving a niche in dermatology clinics and high-end beauty retail. Regulatory oversight from the FDA on cosmeceutical claims ensures credibility, making clinically backed products more attractive to consumers. The competitive landscape is increasingly defined by ecosystem strengthsubscription kits, recurring refills, and bundled servicesrather than one-time patch purchases.

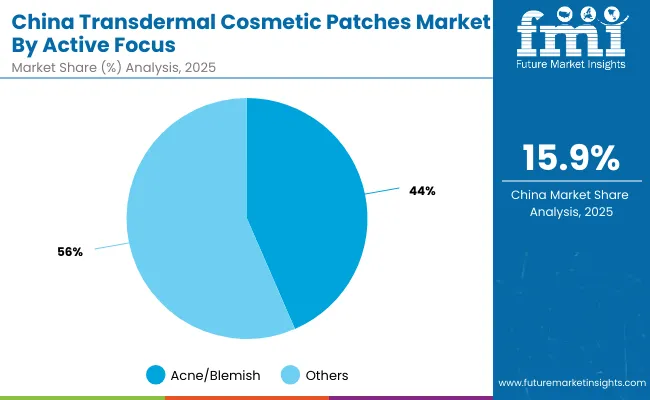

| China By Active Focus | Value Share % 2025 |

|---|---|

| Acne/blemish | 43.5% |

| Others | 56.5% |

The Transdermal Cosmetic Patches Market in China is valued at USD 343.9 million in 2025, with acne/blemish patches holding a 43.5% share, followed by brightening, wrinkle-care, and depuff solutions at 56.5%. The dominance of acne patches reflects the country’s young, urban consumer base, where demand for fast-acting, discreet skincare aligns with beauty trends amplified by social commerce platforms like Douyin and Xiaohongshu. This segment benefits from affordability and high-volume adoption, particularly in Tier I and II cities.

This advantage positions acne patches as the gateway category for first-time patch users, creating opportunities for cross-selling premium formats such as microneedle wrinkle patches and overnight hydrogel solutions. Brightening and spot-care patches are also gaining momentum due to strong consumer interest in skin tone correction and K-beauty inspired regimens. With China’s regulatory support for functional cosmetics innovation and domestic manufacturing scale, companies are well-positioned to capture both mass and premium opportunities.

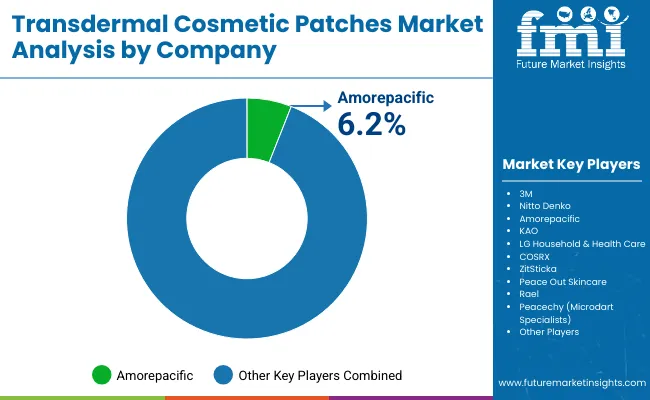

| Company | Global Value Share 2025 |

|---|---|

| Amorepacific | 6.2% |

| Others | 93.8% |

The Transdermal Cosmetic Patches Market is moderately fragmented, with global beauty giants, mid-sized innovators, and niche-focused specialists competing across acne care, anti-aging, and brightening applications. Leading players such as Amorepacific, KAO, and LG Household & Health Care hold significant shares, driven by strong R&D pipelines, premium positioning, and integration of hydrogel and microneedle technologies.

Their strategies emphasize dermatologist-backed claims, sustainability in packaging, and digital-first retail models, making them highly competitive in both Asia and Western markets. Mid-sized brands including COSRX, ZitSticka, and Peace Out Skincare cater to younger consumers seeking acne and blemish patches with fast-acting results. Their success stems from D2C-first approaches, social media campaigns, and subscription kits, which ensure strong visibility and repeat purchases. These companies are particularly strong in e-commerce marketplaces and masstige pricing segments.

Specialist providers such as Peacechy (microdart experts) and Rael focus on innovation-driven niches, including microneedle wrinkle patches and natural/clean-label hydrogel formulations. Their strength lies in customization, influencer-led positioning, and tapping into emerging skincare subcultures rather than competing on global scale. Competitive differentiation is shifting away from basic hydrocolloid patch functionality toward ecosystem-driven offerings, where brands bundle personalized AI-driven skin diagnostics, AR try-on tools, and subscription refills. The winning players will be those who combine scientific validation, consumer trust, and digital engagement to scale adoption globally.

Key Developments in Transdermal Cosmetic Patches Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,901.8 Million |

| Patch Type | Microdart /microneedle patches, Hydrogel patches, Occlusive adhesive patches |

| Active Focus | Acne/blemish, Wrinkle/fine lines, Depuff /eye care, Brightening/spot care |

| Wear Time | Overnight (6-10 hrs ), Short-wear (≤2 hrs ) |

| Distribution Channel | E-commerce marketplaces, Brand D2C, Specialty beauty retail, Drugstore/pharmacy |

| Price Tier | Mass, Masstige , Premium |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | M, Nitto Denko, Amorepacific , KAO, LG Household & Health Care, COSRX, ZitSticka , Peace Out Skincare, Rael, Peacechy ( microdart specialists) |

| Additional Attributes | Dollar sales by patch type and active focus, adoption trends in e-commerce and D2C channels, rising demand for hydrogel and microneedle patches, segment-specific growth in acne/blemish and anti-aging care, revenue segmentation by mass, masstige , and premium tiers, integration with AI-driven skin diagnostics and AR try-on tools, regional trends influenced by cosmeceutical regulations and digital-first retail ecosystems, and innovations in hydrogel technology, occlusive adhesives, and microdart /microneedle delivery systems. |

The global Transdermal Cosmetic Patches Market is estimated to be valued at USD 2,901.8 million in 2025.

The market size for the Transdermal Cosmetic Patches Market is projected to reach USD 7,603.4 million by 2035.

The Transdermal Cosmetic Patches Market is expected to grow at a 10.1% CAGR between 2025 and 2035.

The key Patches types in Transdermal Cosmetic Patches Market Microdart/microneedle patches, Hydrogel patches, and Occlusive adhesive patches.

In terms of wear time, the Overnight (6–10 hrs) segment is set to command a 58.6% share of the Transdermal Cosmetic Patches Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transdermal Ultrasound Surgery Market

Cosmetic Pigment Market Forecast and Outlook 2025 to 2035

Cosmetic Product Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Dropper Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jars Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Filling Machines Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Sucrose Cocoate Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Ingredients For Hair Removal Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Jar Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tube Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Nanoencapsulation Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Kaolin Powder Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Wax Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Pencil & Pen Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Implants Market Size and Share Forecast Outlook 2025 to 2035

Cosmetic Tubes Market by Material Type & Application from 2025 to 2035

Cosmetic Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cosmetics ODM Market Analysis – Size, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA