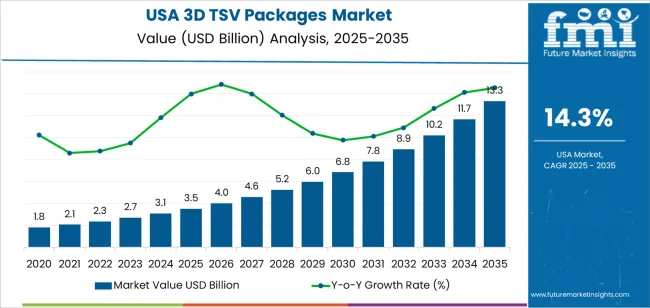

The demand for 3D TSV (Through-Silicon Via) packages in the USA is expected to grow from USD 3.5 billion in 2025 to USD 13.4 billion by 2035, demonstrating a CAGR of 14.3%. 3D TSV packages are critical in the development of advanced semiconductors, enabling the integration of multiple layers of chips for enhanced performance, smaller form factors, and reduced power consumption. These packages are widely used in industries like electronics, computing, and communications, supporting the growing demand for high-performance computing and data storage solutions.

Key drivers of growth for 3D TSV packages include the ongoing miniaturization of electronic devices, increasing demand for power-efficient semiconductors, and the rise of advanced computing technologies. As AI, cloud computing, and big data processing require more sophisticated computing power, the demand for 3D TSV packages will increase due to their ability to deliver high performance in compact, energy-efficient formats. The need for more innovative packaging solutions that support faster data transfer and improved chip density will also contribute significantly to industry expansion.

Between 2025 and 2030, the demand for 3D TSV packages in the USA will grow from USD 3.5 billion to USD 4.0 billion. This initial phase will see steady growth, driven by the increasing adoption of high-performance semiconductors in consumer electronics, smartphones, and data centers. The early acceleration will be fueled by advancements in 3D integration technologies and their ability to meet the increasing demands for smaller, more powerful devices with improved functionality. Industries such as mobile computing and networking will lead the demand, leveraging 3D TSV technology for faster, more efficient data processing and storage.

From 2030 to 2035, demand will experience a sharp increase, rising from USD 4.0 billion to USD 13.4 billion. This acceleration will be driven by the widespread integration of 3D TSV packages in next-generation electronics and AI-powered computing systems. The increasing use of AI, machine learning, and high-performance computing will demand more advanced semiconductor packaging technologies, with 3D TSV being critical in supporting high computational loads and energy efficiency. As autonomous systems, IoT, and 5G networks continue to expand, 3D TSV packages will become indispensable in meeting the rising need for integrated, miniaturized solutions with advanced computing power.

| Metric | Value |

|---|---|

| Demand for 3D TSV Packages in USA Value (2025) | USD 3.5 billion |

| Demand for 3D TSV Packages in USA Forecast Value (2035) | USD 13.4 billion |

| Demand for 3D TSV Packages in USA Forecast CAGR (2025-2035) | 14.3% |

The demand for 3D TSV packages in the USA is growing due to the increasing need for higher performance, smaller form factor, and more energy-efficient semiconductor packaging solutions. 3D TSV technology allows for the vertical integration of multiple layers of integrated circuits (ICs) in a single package, significantly enhancing performance, reducing the footprint, and improving the power efficiency of electronic devices. As industries such as consumer electronics, automotive, and telecommunications continue to push the boundaries of miniaturization and performance, the adoption of 3D TSV packages is expanding rapidly.

A major driver of this growth is the increasing demand for high-performance computing and memory solutions, especially in applications like data centers, cloud computing, and advanced mobile devices. 3D TSV packages are ideal for memory and processor integration, offering faster data transmission, higher bandwidth, and lower latency. As the demand for more powerful and efficient devices increases, especially with the rise of AI, IoT, and 5G, 3D TSV technology is becoming a key enabler of next-generation devices and systems.

The growing trend toward compact, high-performance electronic devices is contributing to the demand for 3D TSV packages. Smartphones, wearables, automotive electronics, and other consumer gadgets require smaller, more efficient components that offer enhanced functionality without increasing device size. 3D TSV packaging addresses these needs by providing higher integration, reduced power consumption, and improved thermal management. As the semiconductor industry continues to innovate and scale up production capabilities, the demand for 3D TSV packages in the USA is expected to grow steadily through 2035, driven by the need for more efficient, powerful, and compact devices.

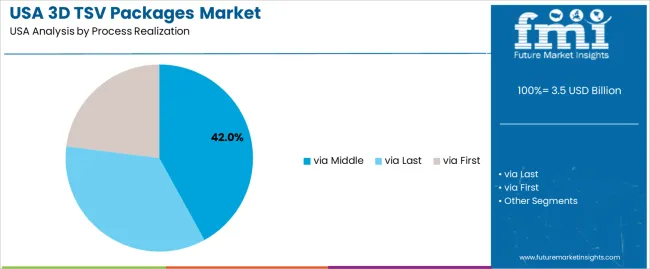

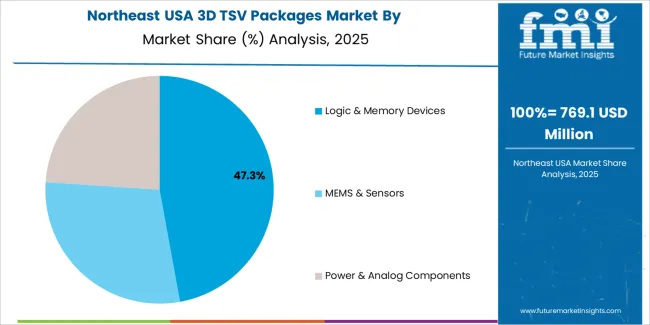

Demand for 3D TSV (Through-Silicon Via) packages in the USA is segmented by process realization, application, and end user. By process realization, demand is divided into via middle, via last, and via first. The demand is also segmented by application, including logic & memory devices, MEMS & sensors, and power & analog components. In terms of end users, demand is divided into consumer electronics, information & communication technologies, automotive, military & defense, aerospace, and medical. Regionally, demand is divided across the West USA, South USA, Northeast USA, and Midwest USA.

via middle accounts for 42% of the demand for process realization in 3D TSV packages in the USA. This method involves fabricating through-silicon vias (TSVs) in the middle of a silicon wafer, offering advantages in terms of efficiency and performance. The via middle process is particularly effective for integrating multiple layers of semiconductor devices, improving signal speed and reducing the footprint of electronic systems.

This process is widely used in the production of high-performance logic & memory devices, which require advanced packaging to meet the demands of modern computing and data storage. As the need for smaller, faster, and more powerful electronic devices continues to grow, via middle remains a dominant process in the production of 3D TSV packages, ensuring better performance and reliability in next-generation devices.

Logic & memory devices account for 47% of the demand for 3D TSV packages in the USA. These devices are central to modern computing, memory, and storage applications, and they require advanced packaging solutions to achieve higher performance and greater integration. 3D TSV technology allows for vertical stacking of semiconductor devices, significantly improving data transfer rates and reducing the physical size of the device.

This is crucial for logic & memory devices, which are integral to processors, DRAM, and flash memory in consumer electronics, servers, and high-performance computing systems. The growing demand for faster and more efficient devices, driven by advancements in cloud computing, artificial intelligence, and data processing, continues to fuel the demand for 3D TSV packages in the logic & memory sector. As electronics evolve, 3D TSV will remain a key enabler for logic & memory device innovation.

Demand for 3D TSV packages in USA is growing due to the increasing need for high‑performance, compact, energy‑efficient semiconductor solutions across industries like data centers, AI, consumer electronics, and automotive. 3D TSV technology allows for higher integration, shorter interconnects, and improved signal integrity compared to traditional 2D packages, enabling smaller and more efficient designs. The complexity of 3D TSV manufacturing, which requires advanced processes and tight quality control, can raise costs and manufacturing challenges. The higher thermal management requirements of stacked die configurations present a challenge in ensuring optimal performance.

In USA, demand for 3D TSV packages is growing because industries such as AI, cloud computing, and automotive are pushing for semiconductor chips that offer higher performance, lower power consumption, and smaller form factors. 3D TSV allows manufacturers to stack multiple semiconductor dies in a compact package, improving space efficiency and interconnect density. This is particularly beneficial for data centers, GPUs, and edge devices, where high processing power and low latency are critical.

The technology also meets the needs of the growing mobile, wearable, and automotive sectors, where compact, high‑performance chips are increasingly in demand. As applications requiring more computational power, such as AI and high‑definition video processing, become more prevalent, the need for 3D TSV packaging to handle these demands rises significantly.

Technological innovations are accelerating the adoption of 3D TSV packages in USA. Advances in wafer‑through etching, via filling technologies, and improved thermal dissipation materials are making 3D TSV packaging more reliable and efficient. The move toward heterogeneous integration combining different chips like memory, logic, and sensors into a single package is a key driver, particularly in industries like AI, automotive, and 5G.

New packaging techniques that enable higher density interconnects and enhanced heat management allow manufacturers to achieve better performance and reduced form factors. The development of scalable solutions by foundries and assembly/test firms is making 3D TSV technology more accessible, helping to drive broader adoption in high‑volume consumer applications and not just niche high‑end segments.

The primary obstacle is manufacturing complexity: creating highly accurate via formation, wafer bonding, and alignment requires sophisticated equipment and precise control. This increases production costs and can limit yield. Thermal management is another significant challenge, as stacked dies generate more heat, which can affect performance if not properly dissipated.

The high cost of producing 3D TSV packages makes them less attractive for price‑sensitive or high‑volume applications. Design complexity is another barrier; creating efficient, high‑performance chips for 3D packaging requires new design methodologies, increasing development time and cost. The lack of widespread ecosystem readiness and standardization can slow mass adoption of this advanced packaging technology.

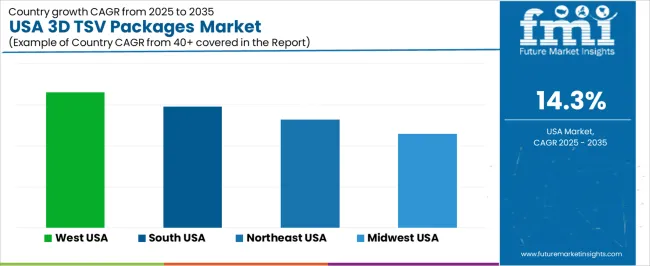

| Region | CAGR (%) |

|---|---|

| West USA | 16.5% |

| South USA | 14.8% |

| Northeast USA | 13.2% |

| Midwest USA | 11.5% |

Demand for 3D TSV packages in the USA is growing rapidly, with West USA leading at a 16.5% CAGR, driven by the region’s strong semiconductor industry and innovation in electronics and high-tech manufacturing. South USA follows with a 14.8% CAGR, fueled by the region’s growing semiconductor and electronics manufacturing sectors, which require high-density, space-saving packaging for mobile devices, automotive systems, and telecommunications. Northeast USA shows a 13.2% CAGR, with demand driven by advancements in telecommunications, consumer electronics, and healthcare industries, all requiring high-performance packaging solutions for next-generation devices. Midwest USA experiences an 11.5% CAGR, supported by growing adoption of 3D TSV in automotive, aerospace, and industrial applications.

West USA is leading the demand for 3D TSV packages, growing at a 16.5% CAGR. The region’s strong presence in the semiconductor, electronics, and high-tech industries is a key factor driving this growth. West USA, particularly in Silicon Valley, is home to major semiconductor manufacturers and innovative companies focusing on next-generation technologies, including 3D packaging solutions. The growing need for high-performance, space-saving, and power-efficient electronic components in smartphones, data centers, and consumer electronics is pushing demand for 3D TSV packages. As advancements in 5G, AI, and IoT continue, the demand for these advanced packaging solutions is expected to rise steadily, with West USA at the forefront of technological innovation in these sectors.

The region’s strong R&D investments and focus on miniaturization of electronic components contribute to the rapid adoption of 3D TSV technology. As West USA remains a hub for cutting-edge electronics, demand for these advanced packages is projected to grow significantly.

South USA is witnessing significant demand for 3D TSV packages, with a 14.8% CAGR. The region’s growing semiconductor industry, supported by increasing investments in manufacturing and technology, is a primary driver. South USA is home to semiconductor fabs and assembly plants that require high-performance packaging solutions like 3D TSV to meet the demands of industries such as telecommunications, consumer electronics, and automotive. The rise of data-intensive applications, especially with the expansion of 5G, cloud computing, and AI technologies, is fueling the adoption of 3D TSV packages in South USA.

The region’s strong industrial base in electronics manufacturing and increasing focus on high-density packaging for mobile devices and server components are contributing to the rise in demand for 3D TSV packages. As South USA continues to expand its tech infrastructure and manufacturing capacity, demand for these advanced packaging solutions is expected to grow, particularly with the increasing need for more compact, high-performance devices.

Northeast USA is experiencing steady growth in demand for 3D TSV packages, with a 13.2% CAGR. The region’s strong presence in industries such as telecommunications, consumer electronics, and healthcare is driving the adoption of advanced packaging technologies like 3D TSV. As devices become more compact and performance demands increase, the need for high-density, space-saving packaging solutions is rising. 3D TSV packages offer benefits such as improved performance, faster data processing, and reduced power consumption, making them ideal for applications in smartphones, wearables, and medical devices.

Northeast USA’s investment in R&D, particularly in high-tech sectors like IoT and AI, is pushing the demand for advanced packaging technologies. The region's focus on integrating these technologies into next-generation devices contributes to the growing adoption of 3D TSV packaging solutions. As innovation continues in the electronics and telecom sectors, demand for 3D TSV packages in Northeast USA is expected to rise steadily.

Midwest USA is seeing moderate growth in demand for 3D TSV packages, with an 11.5% CAGR. The region’s industrial manufacturing base, particularly in automotive, aerospace, and electronics, is contributing to this steady demand. As the automotive and industrial sectors increasingly adopt advanced technologies such as IoT, autonomous systems, and electric vehicles, the need for compact, high-performance packaging solutions like 3D TSV is rising. These solutions are crucial for applications that require small, powerful components with high-density interconnects.

The region's growing investment in electronics and semiconductor manufacturing, along with its strong presence in engineering and manufacturing, is driving the adoption of 3D TSV packages for high-performance applications. As industries in the Midwest embrace digital transformation and miniaturization in electronics, the demand for these advanced packaging technologies is expected to grow at a steady pace, supporting the region’s continued evolution in high-tech manufacturing.

The demand for 3D TSV (Through-Silicon Via) packages in the USA is growing as the semiconductor industry continues to innovate to meet the demands for smaller, more efficient, and higher-performance electronic devices. 3D TSV packaging is critical for advancing memory and logic integration, enabling faster data processing and reduced form factors for devices. With the increasing demand for high-performance computing, AI, and mobile devices, 3D TSV packages are becoming essential for advanced semiconductors used in sectors like consumer electronics, automotive, and data centers. The industry is expected to continue its growth as technology moves toward miniaturization and higher integration.

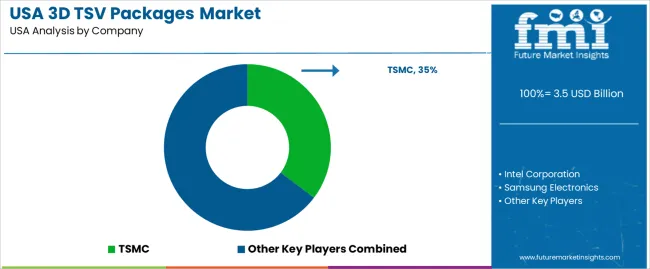

Leading companies in the 3D TSV packages industry in the USA include TSMC, Intel Corporation, Samsung Electronics, ASE Group, and Amkor Technology. TSMC holds the largest industry share of 35.3%, providing cutting-edge 3D TSV packaging solutions that are widely used in memory, logic, and system-in-package applications. Intel Corporation is another key player, offering advanced packaging technologies, including 3D TSV for high-performance computing and server applications. Samsung Electronics provides innovative 3D packaging solutions, focusing on mobile and memory applications. ASE Group and Amkor Technology are prominent providers in the semiconductor assembly and packaging industry, offering various 3D packaging solutions, including TSV for a range of electronic devices and systems.

The competitive dynamics in the 3D TSV packages industry are driven by the increasing need for smaller, faster, and more power-efficient semiconductor solutions across a wide range of industries. Companies compete by offering innovative packaging solutions that enable higher integration, better thermal management, and improved signal performance. As demand grows for more advanced semiconductors in applications like AI, IoT, and high-performance computing, the ability to offer scalable, reliable, and cost-effective 3D TSV solutions is crucial.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Process Realization | via Middle, via Last, via First |

| Application | Logic & Memory Devices, MEMS & Sensors, Power & Analog Components |

| End Users | Consumer Electronics, Information & Communication Technologies, Automotive, Military & Defense, Aerospace, Medical |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | TSMC, Intel Corporation, Samsung Electronics, ASE Group, Amkor Technology |

| Additional Attributes | Dollar sales by process realization, application, and end users; regional CAGR and adoption trends; demand trends in 3D TSV packages; growth in consumer electronics, ICT, automotive, and medical sectors; technology adoption for logic and memory devices; vendor offerings including packaging solutions and technologies; regulatory influences and industry standards |

The demand for 3D TSV packages in USA is estimated to be valued at USD 3.5 billion in 2025.

The market size for the 3D TSV packages in USA is projected to reach USD 13.3 billion by 2035.

The demand for 3D TSV packages in USA is expected to grow at a 14.3% CAGR between 2025 and 2035.

The key product types in 3D TSV packages in USA are via middle, via last and via first.

In terms of , logic & memory devices segment is expected to command 47.0% share in the 3D TSV packages in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

3D TSV Packages Market Analysis by Process Realization, Application, End Users, and Region through 2035

Demand for 3D Imaging Surgical Solution in USA Size and Share Forecast Outlook 2025 to 2035

3D Somatosensory Virtual Fitting Market Size and Share Forecast Outlook 2025 to 2035

3D Imaging Surgical Solution Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Industry Analysis in Middle East Size and Share Forecast Outlook 2025 to 2035

3D Printed Dental Brace Market Size and Share Forecast Outlook 2025 to 2035

3D Reverse Engineering Software Market Forecast and Outlook 2025 to 2035

3D Automatic Optical Inspection Machine Market Size and Share Forecast Outlook 2025 to 2035

3D Ready Organoid Expansion Service Market Size and Share Forecast Outlook 2025 to 2035

3D-Printed Prosthetic Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

3D NAND Flash Memory Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

3D Printing Metal Market Size and Share Forecast Outlook 2025 to 2035

3D Bioprinted Organ Transplants Market Size and Share Forecast Outlook 2025 to 2035

3D Mapping and Modeling Market Size and Share Forecast Outlook 2025 to 2035

3D Audio Market Size and Share Forecast Outlook 2025 to 2035

3D Printing in Aerospace and Defense Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

3D Printed Maxillofacial Implants Market Size and Share Forecast Outlook 2025 to 2035

3D Surgical Microscope Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA