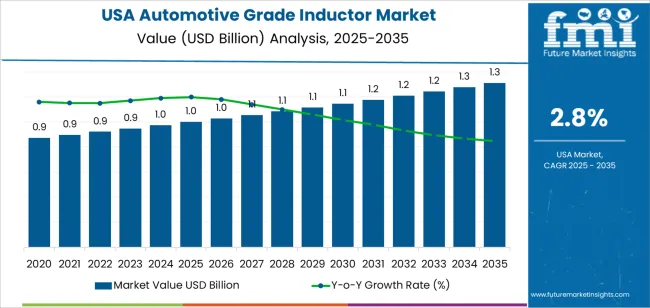

In 2025, demand for automotive grade inductors in the USA is valued at USD 1.0 billion and is projected to reach USD 1.3 billion by 2035 at a CAGR of 2.8%. Early growth is shaped by steady installation across engine control units, power steering modules, braking electronics, and infotainment systems. The USA vehicle mix remains heavily weighted toward pickup trucks and sport utility vehicles, which carry higher electronic content per unit than compact passenger cars.

Hybrid vehicles contribute incremental demand through power conditioning and noise filtering circuits. Original equipment demand dominates volumes, supported by domestic vehicle assembly in the Midwest and Southern manufacturing corridors. Aftermarket demand remains limited since inductors are rarely replaced outside full module servicing.

After 2030, market expansion in the USA becomes more architecture driven than volume driven. Electric vehicles support selective demand through onboard chargers, DC DC converters, and battery management systems, though full displacement of combustion platforms remains gradual. Value growth reflects rising unit prices tied to higher current ratings, thermal stability requirements, and miniaturized designs rather than sharp shipment increases.

Key suppliers include global passive component manufacturers with USA distribution and automotive qualification lines. Competitive strategy centers on vibration resistance, electromagnetic shielding performance, and long term supply commitments under strict automotive qualification programs. Platform based sourcing by OEMs and Tier 1 electronics suppliers sustains predictable demand through 2035.

The overall demand for automotive grade inductors in USA increases from USD 1.0 billion in 2025 to USD 1.1 billion by 2030, adding USD 0.1 billion in absolute value. This phase reflects structurally stable growth tied to steady electronic content expansion across power management units, infotainment modules, and basic ADAS architectures. Demand is anchored in conventional internal combustion and hybrid vehicle platforms where inductor usage per vehicle rises incrementally but without major architecture shifts. Pricing remains stable due to mature sourcing networks and standardized specifications. Growth during this period is volume anchored and closely linked to routine platform upgrades, regulatory compliance for electromagnetic interference control, and steady production of mid-range passenger vehicles.

From 2030 to 2035, the market expands from USD 1.1 billion to USD 1.3 billion, adding a larger USD 0.2 billion on a higher base. This back weighted acceleration reflects rising electrification intensity, higher onboard power conversion needs, and the growth of software-defined vehicle architectures that require more robust power conditioning and signal integrity components. Automotive inductors gain higher value density as silicon carbide inverters, DC-DC converters, and battery management systems become standard across a wider vehicle base. As a result, demand shifts from simple unit volume growth toward system-driven value expansion tied to next-generation electrical architectures.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 1.0 billion |

| Forecast Value (2035) | USD 1.3 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

The growth in demand for automotive-grade inductors in the USA has its roots in increasing electronic content across vehicles. As conventional internal combustion engine vehicles incorporated more subsystems from infotainment and connectivity modules to power-assist electronics the number of electronic control units per vehicle rose. Each ECU requires reliable inductors for power management, signal conditioning, and electromagnetic interference suppression. As a result, inductors became essential in modern vehicle electrical architectures. In the aftermarket, maintenance and replacement of worn or failed electronic subsystems added further demand. Earlier growth was steady, tied to rising automotive production and incremental electronics integration.

Going forward, demand for automotive inductors will grow more rapidly, driven by electrification, electronic safety systems, and power-electronics heavy architectures. Electric vehicles, hybrids, and 48-volt mild-hybrids require inductors for battery management, DC-DC conversion, and traction inverters. Advanced driver-assistance systems and connected-car features add more ECUs, sensors, and communication modules needing stable power regulation.

As automakers push for higher efficiency, lower emissions, and more autonomous and connected functions, inductors must meet stricter reliability, temperature and vibration resistance standards. Miniaturized, high-frequency and high-power-density inductors will see rising adoption. Challenges include tight qualification standards, volatility in raw materials, and supply chain pressures. Market evolution will depend on balance between innovation needs and cost-effective scaling.

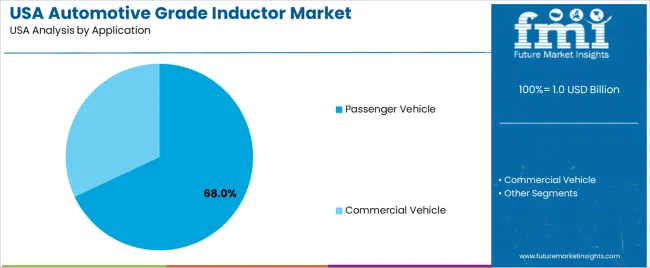

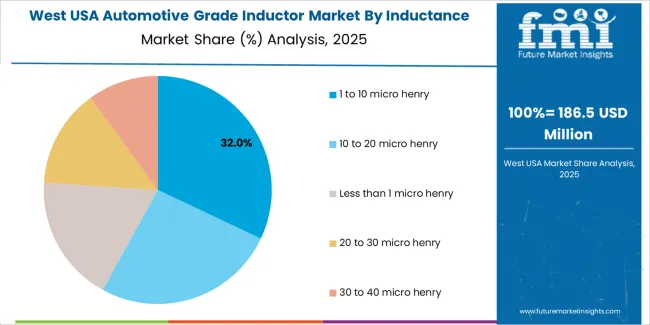

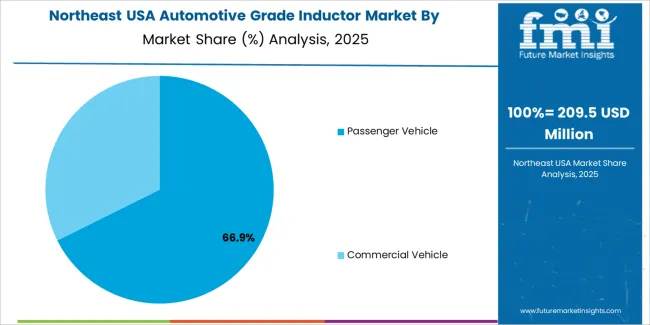

The demand for automotive grade inductors in the USA is structured by inductance range and application. Inductors in the range of 1 to 10 micro henry account for 32% of total demand, followed by 10 to 20 micro henry, less than 1 micro henry, 20 to 30 micro henry, and 30 to 40 micro henry segments. By application, passenger vehicles represent 68.0% of total consumption, while commercial vehicles account for the remaining share. Demand is shaped by power management requirements, electromagnetic compatibility standards, and the growing electronic content per vehicle. These segments reflect how circuit design needs and vehicle class dictate inductor specification across powertrain, infotainment, and safety systems in the USA.

The 1 to 10 micro henry range accounts for 32% of total automotive grade inductor demand in the USA. This leadership reflects its broad suitability for DC to DC converters, EMI suppression, signal filtering, and on board power regulation used across modern vehicle electronics. This inductance band provides an effective balance between size, current handling, and energy storage for compact control units and infotainment modules.

These inductors are widely used in engine control units, body control modules, advanced driver assistance systems, and digital clusters. Their compact footprint supports high density electronic packaging on automotive PCBs. Standardization across multiple modules also simplifies sourcing and inventory management for OEMs and tier one suppliers. These functional versatility and design compatibility advantages sustain the 1 to 10 micro henry range as the leading inductance segment across the USA automotive electronics supply chain.

Passenger vehicles represent 68.0% of total automotive grade inductor demand in the USA. This dominance reflects the high production volume of passenger cars and sport utility vehicles and the rising electrical content per vehicle. Modern passenger vehicles integrate multiple control units, displays, sensors, and communication modules that rely on stable power conditioning and signal filtering.

Start stop systems, electric steering, digital instrumentation, and connectivity features increase the number of inductors required per vehicle. Replacement demand from accident repairs and electronic module servicing further supports volume growth in this segment. Shorter model refresh cycles and higher feature density in passenger vehicles compared with commercial platforms also contribute to higher inductor intensity. These vehicle volume and electronics penetration factors position passenger vehicles as the primary driver of automotive grade inductor demand across the USA.

Demand for automotive grade inductors in the USA is driven by the rapid electrification of vehicle platforms and the rising electronic content per vehicle. Electric vehicles, hybrids, and advanced driver assistance systems rely on stable power conversion, filtering, and energy management, all of which depend on high-reliability inductors. Growth in onboard chargers, DC-DC converters, battery management systems, and high-current inverter modules directly increases inductor usage per vehicle. Expansion of domestic EV assembly and power electronics manufacturing further anchors OEM demand. These electrical architecture shifts make inductors a foundational passive component in USA automotive electronics.

Powertrain electrification in the USA requires multiple high-current and high-frequency inductors to manage voltage conversion between batteries, motors, and auxiliary systems. ADAS features such as radar, cameras, domain controllers, and sensor fusion modules rely on clean power conditioning, which increases use of shielded and low-loss inductors. Pickup trucks and large SUVs with advanced towing electronics and 48-volt subsystems further raise inductor content per vehicle. Ride-hailing fleets and commercial EVs add continuous duty cycles that reinforce demand for automotive-grade thermal stability and vibration-resistant inductor designs.

Automotive grade inductors face high qualification costs tied to AEC standards, lifetime validation, and thermal cycling requirements. Ferrite core material pricing, copper cost inflation, and precision winding requirements compress supplier margins. Long qualification timelines slow rapid design changes. Supply chain exposure to magnetics processing, often concentrated in limited regions, adds procurement risk. Platform consolidation among automakers restricts part diversity and squeezes pricing leverage. These cost, certification, and sourcing pressures moderate rapid volume acceleration even as electronic content per vehicle continues to rise.

Automotive inductors in the USA are shifting toward higher switching frequencies, smaller footprints, and lower core losses to support compact inverters and fast-charging architectures. Wide bandgap semiconductors drive demand for inductors that operate efficiently at elevated frequencies and temperatures. Molded power inductors with improved electromagnetic shielding reduce interference inside dense electronic modules. Integration of inductors into power modules also rises to save board space. These trends show automotive inductors evolving from discrete passive parts into tightly engineered components within high-density USA vehicle power electronics systems.

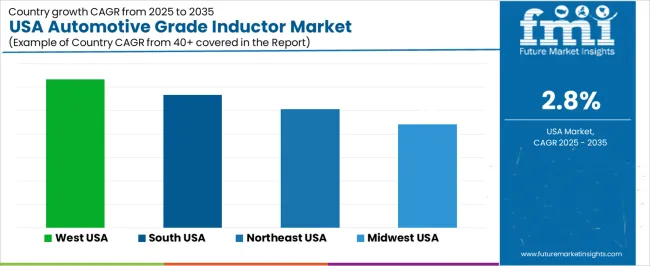

| Region | CAGR (%) |

|---|---|

| West USA | 3.2% |

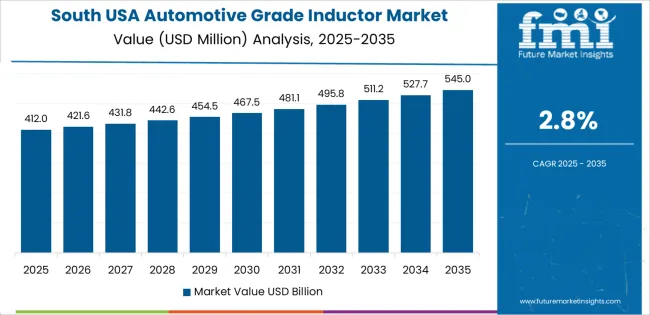

| South USA | 2.8% |

| Northeast USA | 2.5% |

| Midwest USA | 2.2% |

The demand for automotive-grade inductors in the USA is projected to grow across all regions, with the West leading at a 3.2% CAGR. This reflects increased integration of inductors in modern vehicle electronics such as power supply systems, infotainment, and EV components especially in regions with strong auto manufacturing and R&D presence. The South shows 2.8% growth, supported by expanding automotive assembly and parts production. The Northeast at 2.5% benefits from stable demand for replacement components and established supply-chain networks. The Midwest’s 2.2% growth reflects more modest automotive electronics upgrades and stable but slower demand growth.

Growth in the West reflects a CAGR of 6.8% through 2035 for maternity apparel demand, supported by higher average maternal age, strong fashion led retail adoption, and premium lifestyle spending across coastal urban centers. Expectant consumers show higher preference for stylish, functional, and sustainable fabric maternity wear. Work from home culture also supports demand for comfort focused apparel categories. Specialty maternity brands and online platforms dominate distribution. Demand remains design driven rather than purely necessity based, with higher repeat purchase behavior across pregnancy stages supported by influencer visibility and digital retail engagement.

The South advances at a CAGR of 2.8% through 2035 for maternity apparel demand, driven by higher birth rates, population migration, and expanding suburban retail infrastructure. Young family formation supports steady apparel turnover. Large format retail chains and private label brands remain the primary sales channels. Climate conditions favor lightweight and seasonal maternity clothing assortments. Price sensitivity remains moderate, with balanced demand across value and mid-range product segments. Demand growth remains volume driven rather than trend driven, supported by consistent population inflows and expanding regional residential development.

The Northeast records a CAGR of 5.4% through 2035 for maternity apparel demand, shaped by delayed parenthood trends, dual income households, and strong urban professional buyer concentration. Demand centers on functional workwear, casual office attire, and cold weather maternity outerwear. Compact living environments encourage efficient wardrobe replacement rather than bulk purchasing. Department stores, specialty boutiques, and ecommerce platforms share distribution. Demand remains driven by necessity and seasonal weather needs rather than fashion cycles, with steady replacement volumes across professional urban consumer segments.

The Midwest expands at a CAGR of 4.7% through 2035 for maternity apparel demand, supported by stable birth rates, family oriented communities, and steady brick and mortar retail presence. Practical clothing preferences dominate product selection, with comfort and durability guiding purchasing behavior. Online channels supplement physical stores in rural areas. Seasonal outerwear demand remains important due to extended winters. Demand remains necessity driven rather than fashion influenced, with predictable purchasing cycles aligned to pregnancy timelines rather than discretionary trend adoption across regional consumer households.

Demand for automotive grade inductors in the USA is rising as vehicles integrate more electronic systems, especially in electric vehicles (EVs), hybrids, and cars with advanced driver assistance systems (ADAS). Inductors are central to power management, noise suppression, and energy storage in power electronics, onboard chargers, battery management systems, and infotainment modules. As automakers priorities efficiency, reliability, and compact design, the need for inductors that can handle higher voltages, thermal stress, and electromagnetic interference increases. The growing share of EVs and hybrid vehicles, coupled with stricter safety and emissions standards, is boosting demand for inductors capable of meeting automotive grade durability and regulatory requirements.

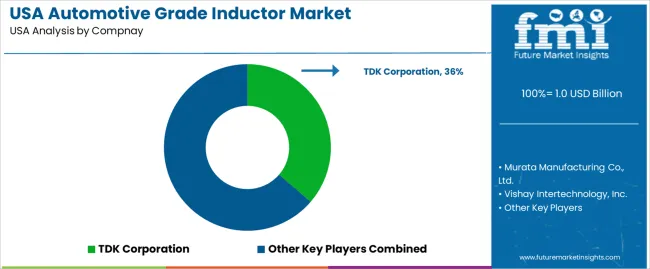

Leading suppliers active in the US automotive inductor sector include TDK Corporation, Murata Manufacturing Co., Ltd., Vishay Intertechnology, Inc., Panasonic Corporation, and Taiyo Yuden Co., Ltd. These companies bring expertise in passive components and offer inductors engineered for automotive environments high temperature, vibration, long life, and EMI filtering. Murata and TDK are notable for broad automotive qualified portfolios including multilayer inductors and power inductors. Vishay and Panasonic provide components for power electronics and electronic control units. Taiyo Yuden contributes compact inductor solutions for space constrained modules. Together these firms shape supply by offering reliable components that support electrification, connectivity, and increased electronics content in US vehicles.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Inductance Range | 1 to 10 micro henry, 10 to 20 micro henry, Less than 1 micro henry, 20 to 30 micro henry, 30 to 40 micro henry |

| Application | Passenger Vehicle, Commercial Vehicle |

| Sales Channel | OEM, Aftermarket |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | TDK Corporation, Murata Manufacturing Co., Ltd., Vishay Intertechnology, Inc., Panasonic Corporation, Taiyo Yuden Co., Ltd. |

| Additional Attributes | Dollar-value distribution by inductance range and application; regional CAGR projections; 1 to 10 micro henry inductors lead at 32% due to suitability for DC-DC converters, EMI suppression, and onboard power regulation; passenger vehicles dominate at 68% of total consumption due to higher electronic content; growth driven by electrification, ADAS, hybrid vehicle expansion, and onboard power electronics; value increase in 2030 to 2035 tied to EVs, DC-DC converters, battery management, silicon carbide inverters; OEM sourcing dominates, aftermarket demand limited; design factors include vibration resistance, thermal stability, EMI shielding, and miniaturization for high density packaging; regional adoption influenced by assembly hubs, EV production, and electronics R&D presence. |

The demand for automotive grade inductor in USA is estimated to be valued at USD 1.0 billion in 2025.

The market size for the automotive grade inductor in USA is projected to reach USD 1.3 billion by 2035.

The demand for automotive grade inductor in USA is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in automotive grade inductor in USA are 1 to 10 micro henry, 10 to 20 micro henry, less than 1 micro henry, 20 to 30 micro henry and 30 to 40 micro henry.

In terms of application, passenger vehicle segment is expected to command 68.0% share in the automotive grade inductor in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Grade Inductors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Grade Inductor Market Growth - Trends & Forecast 2025 to 2035

USA Automotive and Aircraft Interior Genuine Leather After Market Growth – Trends & Forecast 2025 to 2035

USA Automotive Airbag Market Analysis – Size, Share & Forecast 2025-2035

USA Automotive Composite Leaf Springs Market Analysis – Size & Industry Trends 2025-2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

5G Automotive Grade Product Market Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive UPS in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive NFC in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brackets in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Door Sills in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive AI Chipset in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Brake Tube in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Roof Rails in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Engine Valve in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Display Units in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Wheel Coating in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Air Compressor in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Convertible Top in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Automotive Dynamic Map Data in USA Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA