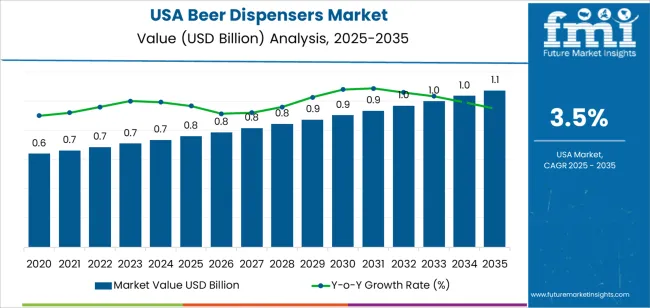

The demand for beer dispensers in the USA is expected to grow from USD 0.8 billion in 2025 to USD 1.1 billion by 2035, reflecting a CAGR of 3.5%. The growing popularity of craft beer, rising consumer demand for convenience, and the growing trend toward at-home entertainment are driving demand for beer dispensers. Consumers are increasingly seeking ways to enjoy bar-quality beer experiences at home, contributing to the adoption of advanced beer dispensing technologies. The growing focus on energy-efficient and eco-friendly appliances is driving innovation in the beer dispenser industry. With improvements in product design, user experience, and technology, beer dispensers are becoming more accessible to a wider consumer base, further fueling demand.

The beer dispenser industry in the USA will also benefit from innovations in product features and design, such as touchless dispensing systems, temperature control, and automatic cleaning features. These advancements cater to the growing demand for convenience and quality in the at-home beer consumption experience. As consumers continue to explore different beer styles and brewing techniques, beer dispensers will also evolve to accommodate the needs of diverse beer preferences. The growth of microbreweries, craft beer bars, and other specialty establishments is driving the adoption of commercial-grade beer dispensers, adding to the overall growth of the industry.

From 2025 to 2030, the industry is expected to grow from USD 0.8 billion to USD 0.9 billion, adding USD 0.1 billion in value. This phase will contribute strongly to industry expansion, driven by rising demand for craft beer and the growing popularity of home entertainment setups. Consumers will continue to seek premium beer experiences at home, fueling the demand for advanced beer dispensing solutions. The increased focus on energy-efficient and innovative beer dispensers will drive consumer interest, making it an attractive option for households. As the trend of home beer consumption continues to grow, this phase will mark significant increases in product availability and industry penetration.

From 2030 to 2035, the industry will grow from USD 0.9 billion to USD 1.1 billion, contributing USD 0.2 billion in value. This phase will see continued growth, though at a slower rate compared to the earlier period. As the industry matures, growth will be more incremental, driven by the increasing adoption of beer dispensers across both residential and commercial sectors. The demand for advanced features, such as customization options and greater user control, will remain strong, but the industry will experience a gradual transition to a more stable demand cycle. The slower growth will be a result of industry saturation, with earliest adopters already equipped with beer dispensers. Product innovation and the continuous rise of beer-related trends will ensure steady industry demand throughout the forecast period.

| Metric | Value |

|---|---|

| Demand for Beer Dispensers in USA Value (2025) | USD 0.8 billion |

| Demand for Beer Dispensers in USA Forecast Value (2035) | USD 1.1 billion |

| Demand for Beer Dispensers in USA Forecast CAGR (2025-2035) | 3.5% |

The demand for beer dispensers in the USA is growing as the popularity of craft beer, home brewing, and at-home entertainment continues to rise. Beer dispensers, which are commonly used in bars, restaurants, and home settings, provide a convenient and efficient way to serve beer, ensuring that it is dispensed at the ideal temperature and carbonation level. As consumers seek more authentic and premium beer-drinking experiences, the demand for high-quality beer dispensers is increasing across both commercial and residential sectors.

A major driver of this growth is the rise of the craft beer industry in the USA. As the number of microbreweries and craft beer options expands, consumers are increasingly seeking ways to enjoy a variety of beers at home or in casual settings. Beer dispensers offer a way to serve beer in optimal conditions, maintaining its freshness and flavor. This trend is particularly popular in home bars, where consumers prefer professional-level dispensing equipment for the best beer-drinking experience.

The growing emphasis on sustainability and reducing waste is driving the adoption of beer dispensers, as they help minimize the use of bottles and cans, aligning with the eco-conscious values of modern consumers. Advancements in beer dispenser technology, such as improved designs for temperature control and ease of cleaning, are making these devices more attractive to both commercial establishments and home users. As the demand for craft beer and premium beer experiences grows, the industry for beer dispensers in the USA is expected to expand steadily through 2035.

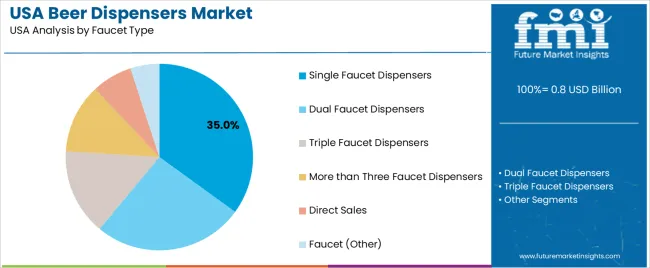

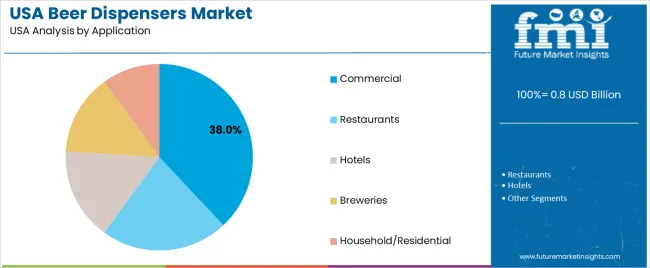

Demand for beer dispensers in the USA is segmented by faucet type, application, kegs, and sales channel. By faucet type, demand is divided into single faucet dispensers, dual faucet dispensers, triple faucet dispensers, more than three faucet dispensers, and others. The demand is also segmented by application, including commercial, restaurants, hotels, breweries, and household/residential, with the commercial sector leading at 38%. In terms of kegs, demand is segmented into 1 keg, 2 kegs, 3 kegs, 4 kegs, more than 5 kegs, and others. Sales channel segmentation includes hypermarkets/supermarkets, direct, convenience stores, indirect, and exclusive stores. Regionally, demand is divided into West USA, South USA, Northeast USA, and Midwest USA.

Single faucet dispensers account for 35% of the demand for beer dispensers in the USA. Their popularity is driven by their simplicity, affordability, and versatility, making them the ideal choice for small to medium-sized establishments and home use. Single faucet dispensers are perfect for serving a single type of beer, and their compact design allows for easy installation in a variety of settings, including home bars, small restaurants, and other commercial spaces. These dispensers are generally more cost-effective compared to their multi-faucet counterparts, contributing to their widespread use, particularly in smaller operations. Single faucet dispensers require less maintenance and are easier to clean, making them a practical option for users seeking convenience. The increasing trend of home brewing and small-scale craft beer operations also supports the growing demand for single faucet dispensers, ensuring their continued dominance in the beer dispenser industry.

The commercial sector, which includes bars, restaurants, hotels, and breweries, holds the largest share at 38% of the demand for beer dispensers in the USA. This demand is driven by the need for efficient, high-capacity dispensers to serve large numbers of customers in high-traffic environments. Commercial establishments typically require dispensers that can handle multiple kegs and provide fast, consistent pours to keep up with customer demand. The growing craft beer culture has also spurred demand for specialized dispensers, allowing bars and restaurants to offer a variety of beers on tap. In addition, the commercial sector's demand for dispensers is bolstered by the increasing trend of customers seeking unique beer experiences, such as sampling different beers. As the food and beverage industry continues to grow and diversify, the demand for beer dispensers in commercial applications will remain strong, driven by the need for both functionality and quality service.

Demand for beer dispensers in the USA is increasing as more consumers and businesses, such as bars, restaurants, and home brewers, seek efficient ways to serve and store beer. The rise of craft beer culture and the growing popularity of home brewing are major factors contributing to this growth. Beer dispensers provide convenience, temperature control, and better preservation of beer quality, making them an essential product for both commercial and personal use. As outdoor and at-home entertainment grow in popularity, there is a greater demand for portable and user-friendly dispensers. High upfront costs, maintenance requirements, and competition from traditional methods of serving beer may limit broader adoption.

Demand is rising as consumers and businesses look for ways to improve beer serving experiences. Craft beer’s rise in popularity is a significant driver, as it requires careful temperature control to maintain quality, something beer dispensers offer. In bars and restaurants, dispensers enable faster service, while home users are increasingly investing in them to replicate the bar experience. Technological advances such as self‑pour systems and smart dispensers, which allow for better control over temperature, foam, and pour rates, further enhance their appeal. An increasing interest in hosting gatherings at home is making beer dispensers a popular choice for convenience and presentation.

Innovations in beer dispenser technology are playing a crucial role in driving demand in the USA. Self‑pour beer dispensers, which allow customers to serve themselves, are gaining traction in both commercial and residential spaces. These systems reduce wait times and improve service efficiency, which is particularly important in high‑traffic establishments. Smart dispensers with temperature controls, flow rate adjustments, and even app-based controls are making it easier to maintain beer quality and enhance the customer experience. These technological advancements are increasing the demand for dispensers across various sectors, especially with the rise of automation in food and beverage services.

While demand is growing, several challenges could limit broader adoption. High initial costs and ongoing maintenance can be deterrents for smaller businesses or individual consumers. The complexity of installation and upkeep may discourage some potential users. There is also the risk of industry saturation in commercial settings, especially in areas with many bars and restaurants offering similar services. The need for regular cleaning and compliance with health regulations may also pose challenges. Lastly, the shift in consumer preferences toward other alcoholic beverages like hard seltzers and wine could reduce the focus on beer, limiting the potential industry for dispensers.

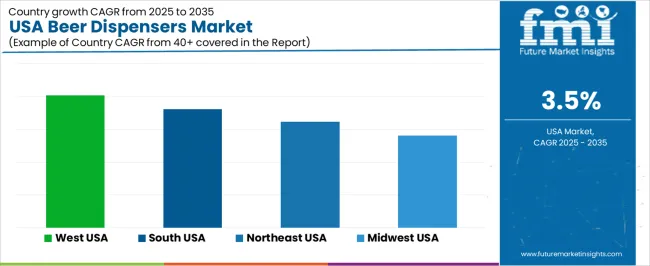

| Region | CAGR (%) |

|---|---|

| West USA | 4.0% |

| South USA | 3.6% |

| Northeast USA | 3.2% |

| Midwest USA | 2.8% |

Demand for beer dispensers in the USA is steadily growing, with West USA leading at a 4.0% CAGR, driven by a strong craft beer culture and the popularity of homebrewing. South USA follows at a 3.6% CAGR, supported by the region’s vibrant bar and restaurant culture, coupled with growing home bar trends. Northeast USA shows a 3.2% CAGR, fueled by the region’s craft beer industry, beer festivals, and an increasing number of taprooms and breweries. Midwest USA experiences a 2.8% CAGR, with steady demand driven by local beer culture and the growth of home bars. As the craft beer industry continues to expand and consumers seek diverse, high-quality beer experiences, the demand for efficient, durable, and energy-efficient beer dispensers is expected to rise across all regions.

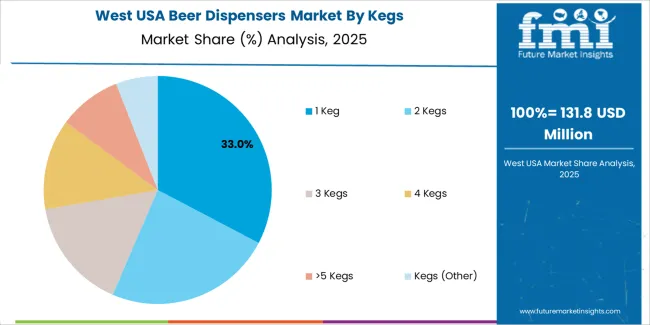

West USA leads the demand for beer dispensers, growing at a 4.0% CAGR. The region’s strong craft beer culture, especially in California, Oregon, and Washington, is a major driver of this growth. The West is home to numerous microbreweries, taprooms, and bars that require high-quality dispensers to serve a variety of craft beers. The increasing popularity of beer festivals and tasting events has created a strong demand for efficient, reliable beer dispensers. As homebrewing and the trend of personal home bars continue to rise, many consumers are opting for professional-quality beer dispensers for their own use. With the craft beer industry expanding and the region’s focus on sustainability, energy-efficient dispensers are in high demand. As more consumers prioritize unique, high-quality beer experiences, West USA will continue to lead the industry for beer dispensers.

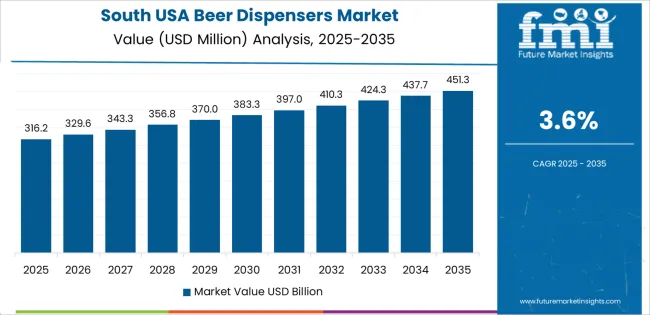

South USA is experiencing steady demand for beer dispensers, with a 3.6% CAGR. The region’s vibrant bar and restaurant culture, particularly in states like Texas, Florida, and Georgia, drives the need for efficient and high-quality beer dispensers. The increasing popularity of craft beer and the growing number of microbreweries in the South are contributing to this demand. As more establishments focus on providing diverse beer offerings, having high-performance dispensers becomes essential. The growing trend of home entertainment, with consumers setting up home bars and hosting parties, also boosts demand for beer dispensers. The South’s warm climate encourages outdoor dining and drinking, where dispensers are often needed for large-scale service. With craft beer gaining popularity and the region’s focus on quality beverages, demand for beer dispensers remains strong in the South, both in commercial settings and private homes.

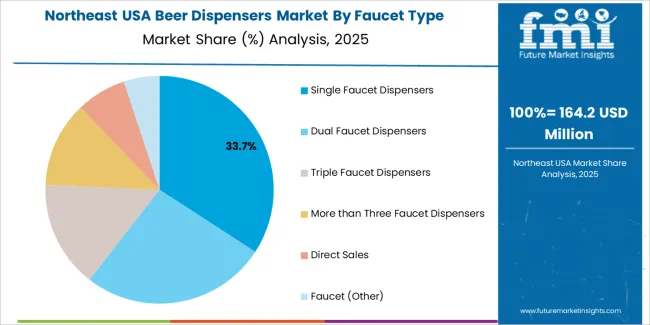

Northeast USA is seeing moderate growth in demand for beer dispensers, with a 3.2% CAGR. The region’s strong craft beer industry, particularly in states like New York and Pennsylvania, plays a key role in driving demand for dispensers in bars, restaurants, and breweries. As craft beer continues to grow in popularity, establishments are investing in efficient dispensers that can handle various beer styles. The increasing number of taprooms, beer festivals, and brewery tours is further supporting the demand. The Northeast’s vibrant nightlife and dining culture contributes to a steady need for beer dispensers in commercial settings. The growing trend of home bars, especially in urban areas, is also driving demand for smaller, residential beer dispensers. As consumers continue to seek unique beer experiences, the industry for beer dispensers in Northeast USA is expected to grow steadily, offering both functional and premium options for commercial and personal use.

Midwest USA is experiencing steady demand for beer dispensers, with a 2.8% CAGR. The region has a well-established beer culture, particularly in states like Michigan, Wisconsin, and Ohio, where breweries, taverns, and bars play a central role in local economies. The growth of craft beer in these areas has contributed to a consistent need for efficient, durable beer dispensers. The region’s preference for home entertainment and backyard gatherings has increased the demand for home bars, driving the industry for smaller, residential beer dispensers. Beer festivals and local brewery tours also contribute to demand, as event organizers require multiple dispensers for large-scale beer service. Although demand in Midwest USA is slower compared to other regions, the continued interest in beer culture and the consistent use of beer dispensers in both commercial and home settings ensures steady growth in this industry.

The demand for beer dispensers in the USA is increasing due to the growing popularity of craft beer, the expansion of breweries, and the rise of home brewing and draft beer systems. Beer dispensers are essential in the foodservice and hospitality industries, enabling establishments to serve beer efficiently while maintaining quality. With the growing trend of at-home entertainment and craft beer consumption, the industry for beer dispensers is seeing strong growth, particularly for both commercial and residential applications. The need for dispensers that are easy to use, maintain, and customize is fueling demand across various sectors.

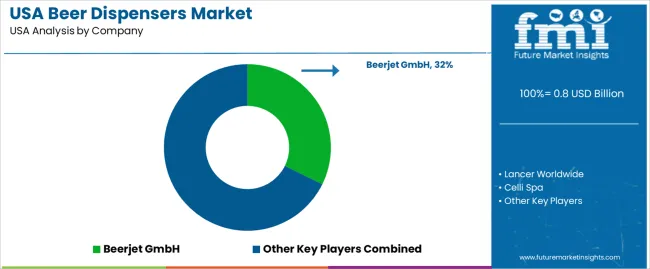

Leading companies in the beer dispenser industry in the USA include Beerjet GmbH, Lancer Worldwide, Celli Spa, Kegco Brewing & Draft, and Micro Matic AS. Beerjet GmbH holds the largest industry share of 32.3%, offering advanced beer dispensing solutions known for their efficiency and quality. Lancer Worldwide provides innovative beer dispensing systems widely used in bars, restaurants, and events. Celli Spa is a major player in the European industry and has a growing presence in the USA, offering high-quality dispensing systems for the hospitality and beverage industries. Kegco Brewing & Draft specializes in both commercial and home draft beer systems, while Micro Matic AS offers a range of beer dispensing products, including systems designed for breweries and bars.

Competition in the beer dispenser industry is driven by the need for efficient, durable, and customizable solutions for both commercial and residential customers. Companies compete by offering products that ensure consistent quality, reduce wastage, and are easy to maintain. Innovations in user-friendly design, including temperature control, pour consistency, and energy efficiency, are key differentiators.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Kegs | 1 Keg, 2 Kegs, 3 Kegs, 4 Kegs, >5 Kegs, Kegs (Other) |

| Faucet Type | Single Faucet Dispensers, Dual Faucet Dispensers, Triple Faucet Dispensers, More than Three Faucet Dispensers, Faucet (Other) |

| Application | Commercial, Restaurants, Hotels, Breweries, Household/Residential |

| Sales Channel | Hypermarkets/Supermarkets, Direct, Convenience Stores, Indirect, Exclusive Stores |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Beerjet GmbH, Lancer Worldwide, Celli Spa, Kegco Brewing & Draft, Micro Matic AS |

| Additional Attributes | Dollar sales by keg type, faucet type, application, and sales channel; regional CAGR and adoption trends; demand trends in beer dispensers; growth in commercial and residential sectors; technology adoption for beer dispensing systems; vendor offerings including kegs, faucets, and related accessories; regulatory influences and industry standards |

The demand for beer dispensers in USA is estimated to be valued at USD 0.8 billion in 2025.

The market size for the beer dispensers in USA is projected to reach USD 1.1 billion by 2035.

The demand for beer dispensers in USA is expected to grow at a 3.5% CAGR between 2025 and 2035.

The key product types in beer dispensers in USA are 1 keg, 2 kegs, 3 kegs, 4 kegs, >5 kegs and kegs (other).

In terms of faucet type, single faucet dispensers segment is expected to command 35.0% share in the beer dispensers in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Demand for Beer in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA