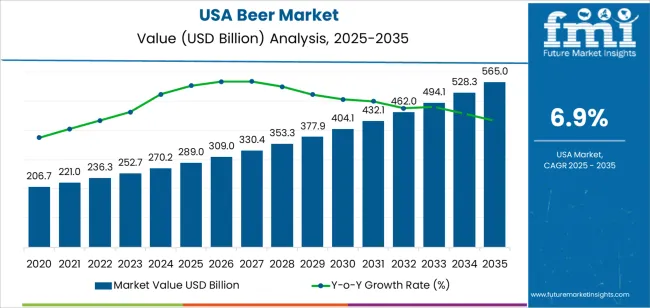

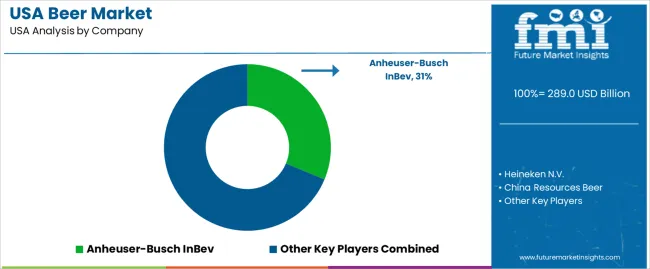

In 2025, demand for beer in the USA is valued at USD 289.0 billion and is projected to reach USD 565.0 billion by 2035 at a CAGR of 6.9%. Early growth reflects strong pricing power, premium brand performance, and steady on-trade recovery across urban and suburban markets. Domestic lagers continue to anchor volume, while imported and craft brands lift value through higher unit pricing. Multipack retail formats remain central to off-trade sales, supported by national grocery and club store networks. Draft beer consumption regains ground through sports venues, live events, and casual dining chains. Regional production hubs across the Midwest and West Coast sustain distribution efficiency.

From 2030 onward, value expansion becomes more mix driven than volume driven. Demand rises from about USD 404.1 billion in 2030 toward USD 565.0 billion by 2035 as premium, flavored, and specialty styles account for a larger revenue share. Low-alcohol and functional adjacent beer formats gain shelf space in wellness oriented retail channels. Direct to consume alcohol delivery platforms support higher purchase frequency in urban zones. Craft consolidation stabilizes pricing across regional portfolios. Key demand concentration remains in California, Texas, Florida, New York, and the Midwest corridor. Competitive positioning focuses on brand equity, distribution strength, and portfolio breadth rather than pure production scale.

The overall demand for beer in USA increases from USD 289.0 billion in 2025 to USD 309.0 billion by 2030, adding USD 20.0 billion in absolute value. This phase reflects steady consumption expansion supported by stable on-trade recovery, continued strength of at-home consumption, and premium segment resilience. Demand growth is shaped by higher penetration of craft beer, flavored malt beverages, and low-alcohol variants across urban and suburban markets. Pricing power remains moderate as brands compete on taste profiles and packaging innovation rather than aggressive volume discounting. Growth during this period is consumption anchored, supported by consistent social drinking patterns, sports-driven demand spikes, and expanding distribution across convenience and direct retail channels.

From 2030 to 2035, the market expands from USD 309.0 billion to USD 565.0 billion, adding a significantly larger USD 256.0 billion in the second half of the decade. This back weighted acceleration reflects a structural shift toward higher value per unit through premiumization, wider adoption of functional and non-alcoholic beer variants, and rising experiential consumption tied to taprooms and event-driven sales. The mix shifts toward craft, imported, and specialty brews with higher margins. At the same time, digital alcohol delivery platforms and private-label premium beer lines expand reach and pricing flexibility, shifting demand from volume-led growth toward value-led consumption expansion.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 289.0 billion |

| Forecast Value (2035) | USD 565.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The demand for beer in the USA has been built on long standing social habits, broad retail availability, and large scale domestic brewing capacity. Historically, beer served as the default alcoholic beverage for casual consumption due to its affordability, wide flavor neutrality, and strong presence in sports, dining, and regional traditions. Large breweries established national distribution networks that made beer accessible across convenience stores, supermarkets, bars, and entertainment venues. On premise consumption in restaurants and stadiums reinforced its role in social gatherings. Seasonal patterns such as summer grilling, holidays, and sporting calendars sustained predictable consumption cycles. This wide cultural integration created a stable base of recurring demand across multiple age groups and income segments.

Future demand for beer in the USA will be shaped by changing consumer preferences rather than volume driven expansion. Younger adults are drinking less frequently and experimenting across spirits, ready to drink beverages, and alcohol free options. Traditional mass market beer faces pressure as premium, craft, flavored, and low alcohol offerings capture greater interest. Health awareness, calorie sensitivity, and moderation trends are influencing both product formulation and serving occasions. At the same time, economic pressure affects discretionary spending on alcoholic beverages. Barriers include regulatory controls, shifting social attitudes, and competition from alternative beverage categories. The beer sector will continue to evolve through product positioning, premiumization, and diversification rather than broad growth in total consumption.

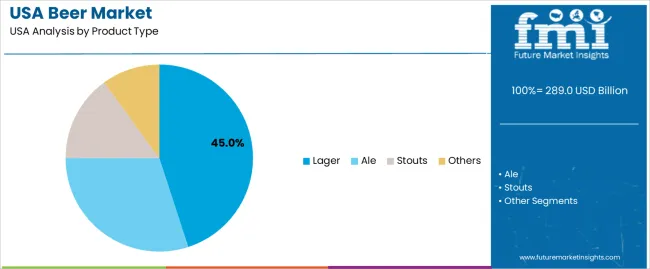

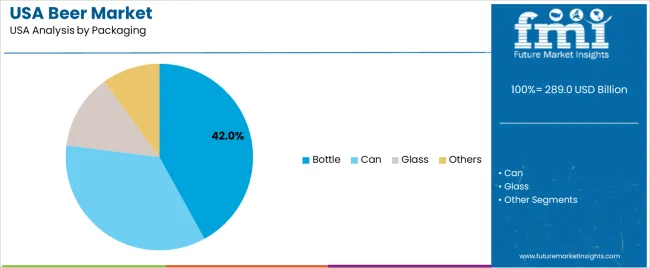

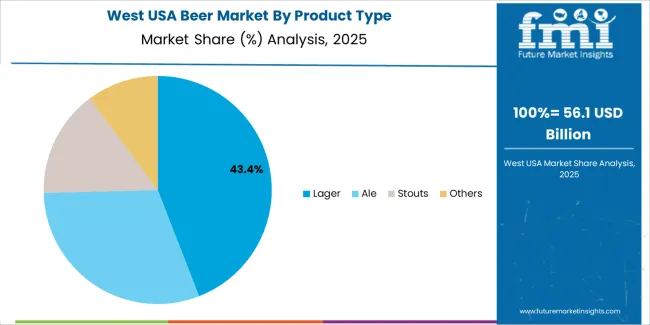

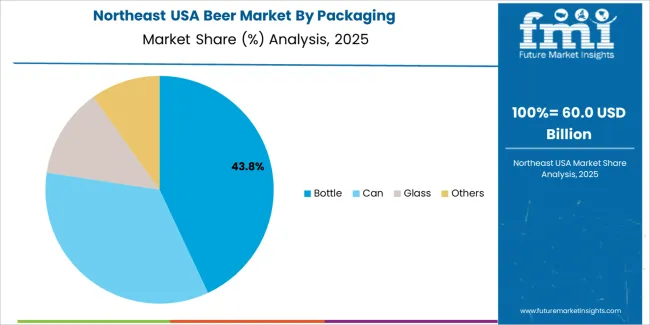

The demand for beer in the USA is structured by product type and packaging format. Lager accounts for 45% of total demand, followed by ale, stouts, and other specialty variants. By packaging, bottles represent 42.0% of total consumption, followed by cans, glass-based specialty formats, and other packaging types. Demand patterns are shaped by taste preferences, alcohol strength expectations, shelf life, portability, and retail distribution efficiency. These segments reflect how consumption occasions, storage conditions, and on-premise versus off-premise purchasing continue to influence beer demand patterns across different consumer groups in the USA.

Lager accounts for 45% of total beer demand in the USA due to its mild flavor profile, low bitterness, and broad drinkability across age groups. Its clean finish supports frequent consumption in social settings such as sports events, casual dining, and large gatherings. Lagers perform strongly across supermarkets, convenience stores, bars, and restaurants. The style aligns well with warm-weather consumption patterns and high-volume sales environments. Consistency in taste also supports brand loyalty across national and regional consumer bases.

Lager production is supported by established large-scale brewing infrastructure that allows efficient batch processing and stable quality control. Brewing economics favor lagers due to predictable fermentation cycles and high output efficiency. Wide availability across economy, mainstream, and premium tiers supports large market coverage. National distribution networks prioritize lager inventory due to steady turnover rates. These production scale, distribution strength, and consumption frequency factors together sustain lager as the leading product type within the USA beer industry.

Bottle packaging accounts for 42.0% of total beer demand in the USA due to its extensive use across retail and hospitality environments. Bottles provide strong protection for carbonation and flavor stability when stored under controlled conditions. Their form factor supports standardized single-serve portions commonly used in bars and restaurants. Bottles remain widely accepted across both mass-produced and craft beer categories. Their durability during handling and transport supports long-distance distribution across national beverage supply chains.

Bottles also provide strong branding advantages through label design, embossing, and glass color variation. Hospitality venues favor bottles for portion control, inventory tracking, and consistent serving presentation. Glass recycling infrastructure across many states supports recovery and reuse programs. Premium and imported beers continue to rely heavily on bottle formats to convey quality perception. These handling, branding, recycling, and service-related advantages sustain bottles as the dominant packaging format for beer consumption in the USA.

Demand for beer in the USA is driven by deep cultural integration, broad availability across retail and foodservice, and strong social consumption patterns tied to sporting events, dining, and entertainment. Beer remains the most widely consumed alcoholic beverage by volume due to its price accessibility and session drinking appeal. Large-scale distribution through supermarkets, convenience stores, and on-premise outlets sustains continuous movement. Seasonal events such as summer travel, holidays, and festivals reinforce peak demand cycles. The category also benefits from consistent mainstream consumption that cushions volatility seen in higher-priced alcoholic segments.

Beer demand in the USA is shaped by a wide segmentation between light lagers, craft beers, imports, flavored malt beverages, and non-alcoholic beer. Light beer dominates high-volume consumption due to calorie awareness and broad social use. Craft beer maintains strong regional loyalty tied to local brewing identity and taproom culture. Flavored and fruit-infused beers attract younger demographics seeking sweeter profiles. Non-alcoholic beer adoption grows among health-focused consumers and designated drivers. These layered preferences create a diversified demand base rather than reliance on a single dominant beer style.

Beer consumption growth in the USA faces pressure from alcohol moderation trends, rising health awareness, and competition from spirits, wine, and ready-to-drink cocktails. Inflation in packaging, distribution, and raw materials narrows promotional flexibility at retail. State-level alcohol regulations, taxation structures, and distribution controls affect pricing and availability across regions. Younger consumers show greater interest in wellness-oriented beverages and functional alternatives. These economic, regulatory, and behavioral factors do not collapse beer demand, but they limit rapid consumption growth compared with prior decades.

Beer demand in the USA is evolving through experimentation in flavor profiles, brewing methods, and alcohol content. Craft brewers focus on hazy IPAs, sour beers, barrel-aged styles, and small-batch seasonal releases to maintain engagement. Low-alcohol and alcohol-free beers gain space in retail and foodservice menus as social norms shift toward moderation. Taproom-based direct sales and brewery-led events enhance brand loyalty. Packaging shifts toward slim cans and variety packs to match modern consumption habits. These trends show beer demand moving toward diversification rather than purely volume expansion.

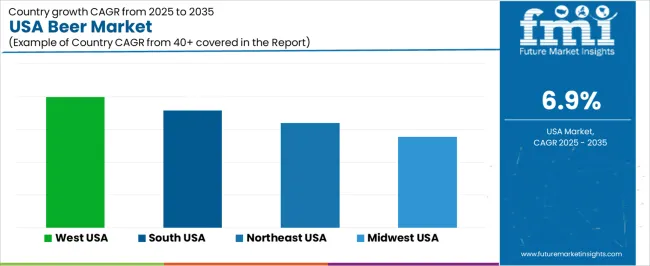

| Region | CAGR (%) |

|---|---|

| West | 8.0% |

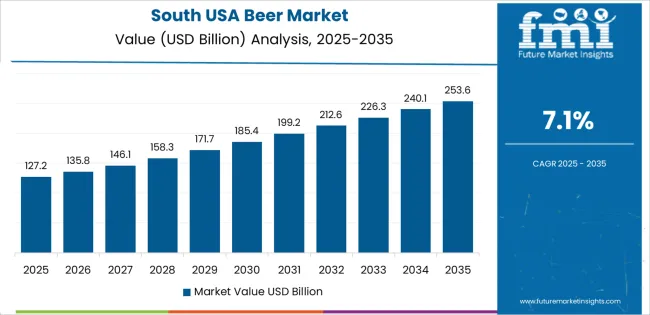

| South | 7.1% |

| Northeast | 6.4% |

| Midwest | 5.5% |

The demand for beer in the USA shows steady regional variation, with the West leading at an 8.0% CAGR. This growth is supported by strong craft beer culture, expanding premium and flavored beer segments, and high consumption across urban centers and tourism-driven markets. The South follows at 7.1%, driven by population growth, rising disposable income, and expanding retail and on-premise beer sales. The Northeast records 6.4% growth, supported by a mature beer consumption base, strong presence of craft breweries, and steady demand from restaurants and sports venues. The Midwest shows the slowest growth at 5.5%, reflecting a more stable and traditional beer market with slower shifts toward premium and specialty beer categories.

Expansion in the West reflects a CAGR of 8.0% through 2035 for beer demand, supported by strong craft brewery concentration, lifestyle consumption patterns, and high tourism driven on premise sales. California, Oregon, and Washington maintain dense networks of microbreweries that sustain premium and specialty beer volumes. Outdoor recreation culture supports steady off premise retail demand. Urban populations favor low alcohol, flavored, and experimental beer styles. Distribution remains diversified across taprooms, convenience retail, and direct to consumer channels, sustaining consistent demand across premium and mass market beer categories.

The South advances at a CAGR of 7.1% through 2035 for beer demand, driven by population growth, strong sports culture, and expanding casual dining and entertainment venues. Warm climate conditions sustain year round beer consumption across social gatherings and foodservice outlets. Large scale breweries maintain high capacity production to serve mass market lagers and flavored malt beverages. College towns and festival driven tourism support seasonal demand surges. Retail distribution remains anchored by convenience stores and large format beverage outlets across expanding suburban and semi urban markets.

The Northeast records a CAGR of 6.4% through 2035 for beer demand, shaped by strong urban bar culture, established regional breweries, and consistent demand for imported and craft beer styles. Seasonal tourism, especially in coastal and city destinations, adds steady incremental consumption. Higher disposable income supports premium beer purchasing across metropolitan consumers. Cold winters concentrate beer consumption into indoor hospitality settings. Demand remains brand and style driven rather than volume led, with steady reorder cycles across bars, restaurants, and specialty liquor retail formats.

The Midwest expands at a CAGR of 5.5% through 2035 for beer demand, supported by longstanding regional breweries, strong sports viewership culture, and steady packaged beer consumption. Lager remains the dominant category supported by high volume retail sales. Community events and local festivals maintain seasonal demand spikes. Rural and semi urban retail networks contribute steady off premise consumption. Demand remains volume driven rather than premium driven, with purchasing behavior shaped by price sensitivity and brand loyalty across regional beer consumers.

Demand for beer in the USA reflects a mix of long standing cultural habits, evolving consumer preferences, and shifting market trends. Beer remains a go to beverage for socializing, casual dining, sport events, and gatherings. Despite some decline in overall volume in recent years, a significant portion of consumers continue to drink beer weekly, supporting baseline demand. Interest in variety-craft beers, imports, lagers, low alcohol options, and premium brands-drives manufacturers to offer diverse styles, packaging, and pricing. Changing lifestyle patterns, including home consumption and convenience retail growth, support consistent beer demand even when on premise sales fluctuate.

Major global and multinational brewers shape the USA beer market landscape. Anheuser Busch InBev remains a dominant force with a strong footprint, supported by popular brands across price segments. Heineken N.V. and Molson Coors Beverage Company contribute through both domestic and imported beer portfolios, targeting both mainstream and niche segments. Carlsberg Group and China Resources Beer also supply imported and international style beers, catering to diverse consumer tastes. These firms influence market direction through brand strength, production and distribution scale, and ability to adapt portfolios to emerging trends such as premiumization, imports, and alternative beer styles.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Lager, Ale, Stouts, Others |

| Packaging | Bottle, Can, Glass, Others |

| Production | Macro-brewery, Craft Brewery, Microbrewery, Other |

| Distribution Channel | Hypermarkets/Supermarkets, Convenience Stores, Online Retailers, Specialty Stores, Independent Retailers, Direct, Indirect |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Anheuser-Busch InBev, Heineken N.V., China Resources Beer, Carlsberg Group, Molson Coors Beverage Company |

| Additional Attributes | Dollar by production type, packaging, and distribution channel; regional CAGR projections; lager leads product type at 45% due to mild flavor and broad drinkability; bottles dominate packaging at 42% due to retail and hospitality adoption; macro-breweries maintain largest production share; early phase growth driven by domestic lagers and craft beer adoption; 2030–2035 growth is back-weighted, led by premium, flavored, and functional beer formats; demand remains mix-driven with premiumization, digital delivery, and experiential taproom consumption; key regions: California, Texas, Florida, New York, Midwest corridor. |

The demand for beer in USA is estimated to be valued at USD 289.0 billion in 2025.

The market size for the beer in USA is projected to reach USD 565.0 billion by 2035.

The demand for beer in USA is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in beer in USA are lager, ale, stouts and others.

In terms of packaging, bottle segment is expected to command 42.0% share in the beer in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Beer Dispensers in USA Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

Beer Fermenter Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

Beer Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Beer Bottles Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

Beer Dispensers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

Beer Pasteurization Equipment Market Size and Share Forecast Outlook 2025 to 2035

Beer Glass Chillers Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA