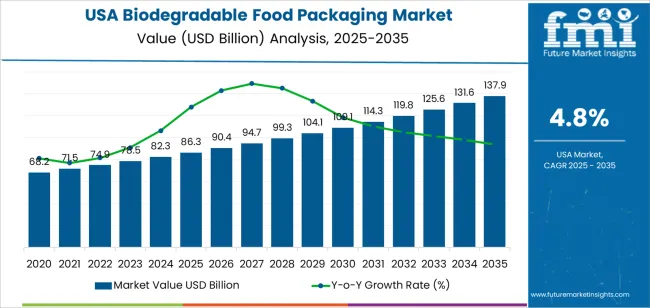

Biodegradable food packaging demand in the USA stands at USD 86.3 billion in 2025 and is projected to reach USD 137.9 billion by 2035 at a CAGR of 4.8%. Market expansion in the first half of the decade is driven by rapid material substitution across prepared foods, fresh produce, dairy, and foodservice packaging rather than by overall food volume growth. Compostable trays, films, wraps, and coated paper containers gain wide acceptance in grocery retail and institutional catering. Large food processors accelerate conversion as national retailers standardize packaging specifications across private label and branded assortments. Adoption is further supported by procurement mandates from universities, hospitals, and corporate campuses that prioritize compostable serviceware and primary food contact packaging.

After 2030, growth in the USA becomes more supply chain integrated than regulation led. Demand rises from about USD 109.1 billion in 2030 toward USD 137.9 billion by 2035 as domestic resin compounding, film extrusion, and conversion capacity expand in closer proximity to food manufacturing centers. Performance thresholds for grease resistance, heat tolerance, and barrier stability drive material upgrades rather than simple volume substitution. Frozen foods, microwave meals, and high-fat deli items account for an increasing share of value as higher-spec biodegradable structures replace legacy laminated plastics. Long-term contracts between food brands, packaging converters, and resin suppliers become the dominant procurement model, stabilizing pricing and ensuring material consistency across national distribution networks.

Biodegradable food packaging in USA is moving from an environmentally positioned alternative into a structurally embedded materials category within mainstream food supply chains. Demand increases from USD 86.3 billion in 2025 to USD 90.4 billion by 2030, adding USD 4.1 billion in absolute value. This phase reflects steady conversion across fresh produce, quick-service restaurants, dairy, bakery, and ready-meal packaging where compostable trays, films, and containers replace conventional plastics. Growth is driven by retailer packaging mandates, brand compliance with extended producer responsibility frameworks, and procurement standards tied to waste reduction targets. Value growth during this period remains controlled as converters focus on volume deployment and cost parity with legacy materials rather than margin expansion.

From 2030 to 2035, the market expands from USD 90.4 billion to USD 137.9 billion, adding a substantially larger USD 47.5 billion in the second half of the decade. This back weighted acceleration reflects full industrialization of biodegradable packaging across national foodservice chains, institutional catering, and large-scale processed food manufacturers. Higher material performance, heat resistance, and barrier functionality allow biodegradable formats to enter frozen foods, liquid packaging, and long-shelf-life products. As composting infrastructure scales and regulatory enforcement tightens, biodegradable packaging shifts from selective adoption to default material choice across large food volume categories, driving sustained value expansion through 2035.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 86.3 billion |

| Forecast Value (2035) | USD 137.9 billion |

| Forecast CAGR (2025–2035) | 4.8% |

Demand for biodegradable food packaging in the USA evolved as environmental awareness, consumer preferences, and regulatory pressures gradually shifted the packaging landscape. Historically, food producers relied heavily on conventional plastic films and containers because these offered low cost, reliable barrier properties, and ease of mass production. Over time growing concerns around plastic pollution, landfill waste, and marine litter pushed regulators, retailers, and consumers to consider alternatives. Early adopters included specialty food brands, eco-conscious retailers, and artisan producers who marketed biodegradable packaging as part of a responsible brand identity. This niche base helped raise awareness and demonstrated the feasibility of using biodegradable substrates in real-world food supply chains.

The next wave of growth will depend on three interconnected factors: regulatory momentum, material innovation, and consumer demand. More states and municipalities are imposing single-use plastic restrictions, which compels foodservice outlets and retailers to switch packaging formats. Advances in compostable films, plant-based polymers, and bio-resins improve performance and broaden applications beyond dry goods to perishable foods, fresh produce, and ready meals. Consumers show growing interest in sustainability claims and clean labels, motivating brands to adopt biodegradable packaging even without regulation. However challenges remain. Ensuring that biodegradable packaging meets food-safety, barrier, shelf-life, and supply-chain durability standards remains difficult. Costs are higher than conventional plastics, and composting or disposal infrastructure is uneven across regions. Market growth will depend on balancing environmental credentials, cost efficiency, and material performance to make biodegradable packaging a viable mainstream alternative.

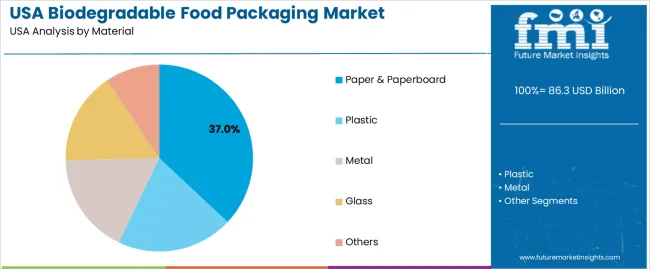

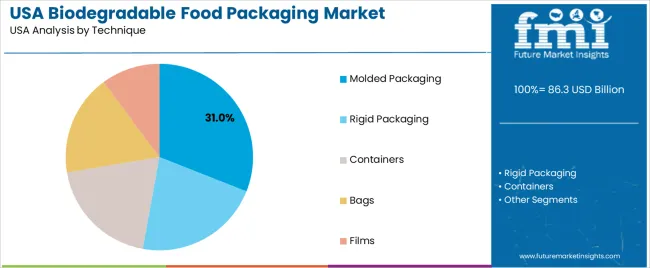

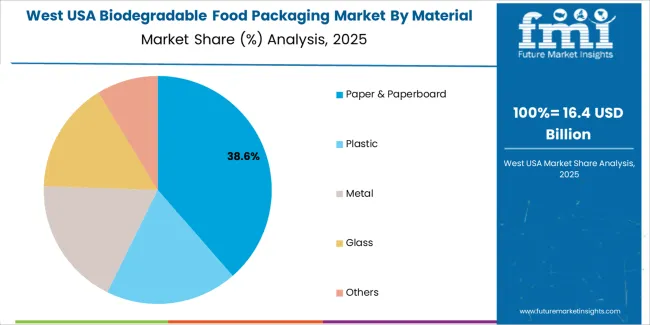

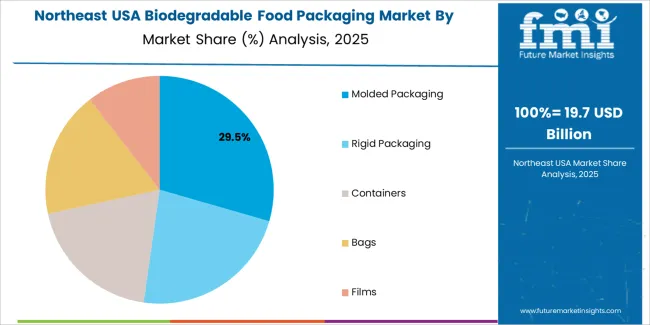

The demand for biodegradable food packaging in the USA is structured by material type and packaging technique. Paper and paperboard account for 37% of total demand, followed by biodegradable plastics, metal, glass, and other alternative materials. By technique, molded packaging represents 31.0% of total consumption, followed by rigid packaging, containers, bags, and films. Demand behavior is shaped by compostability requirements, food safety compliance, barrier performance, and compatibility with automation in food processing and foodservice operations. These segments reflect how material selection and forming methods guide adoption across quick service restaurants, retail food packaging, institutional catering, and ready meal manufacturing in the USA.

Paper and paperboard account for 37% of total biodegradable food packaging demand in the USA due to their wide compostability acceptance, recyclability infrastructure, and compatibility with dry and semi moist food products. These materials are widely used for cartons, cups, trays, wraps, and clamshells serving bakery items, snacks, takeaway meals, and quick service food applications. Their breathability supports product freshness for items such as bread and fried foods where moisture control is critical. Paper based packaging also supports grease resistant coatings that improve suitability for fast food service.

Paper and paperboard benefit from strong domestic pulp supply and well established converting infrastructure. State level packaging regulations and municipal waste programs encourage fiber based alternatives to conventional plastic. Branding and printability advantages further support market adoption. These regulatory alignment, supply availability, and functional performance factors collectively sustain paper and paperboard as the leading material segment in the USA biodegradable food packaging demand structure.

Molded packaging accounts for 31.0% of total biodegradable food packaging demand in the USA due to its ability to produce rigid, form fitting structures from paper pulp and biodegradable fibers. Molded trays, bowls, cups, and clamshells provide strong impact resistance and thermal stability for hot and cold food service applications. These structures are widely used in institutional catering, airline meals, fast food chains, and retail ready meal packaging where shape retention and stacking strength are required. Molded formats also reduce the need for secondary supports during transport.

Molded packaging supports high speed automated forming and filling lines, which improves processing efficiency for large foodservice operators. Tooling customization allows product specific designs without heavy material wastage. Compostability under commercial waste systems further strengthens adoption. These strength, manufacturing efficiency, and end of life handling advantages position molded packaging as the dominant technique in the USA biodegradable food packaging demand structure.

In the USA, biodegradable food packaging demand is increasingly driven by legal exposure management rather than only sustainability positioning. State and city regulations targeting single-use plastics place restaurants, food processors, and retailers at direct compliance risk. Packaging decisions are now shaped by local enforcement thresholds, labeling definitions, and inspection penalties. National food chains adopt biodegradable formats to avoid regional packaging fragmentation across store networks. This legal-operational pressure turns packaging selection into a governance decision rather than a marketing one. Demand follows rule enforcement boundaries more closely than consumer preference curves in many urban regions.

Prepared meals, cloud kitchens, and takeout-focused food operations are now the core demand engines for biodegradable food packaging in the USA. These food models depend on disposables for bowls, trays, wraps, and cutlery across millions of daily transactions. Heat retention, grease resistance, and condensation control matter more than shelf life. Ghost kitchens prioritize stackability and thermal performance during transport rather than in-store display. Multi-restaurant food halls also standardize biodegradable packaging across tenants to simplify waste handling. These logistics-driven usage patterns anchor steady volume demand outside traditional grocery packaging.

Biodegradable food packaging in the USA faces technical limits in wet strength, heat resistance, and shelf stability under high humidity and long hold times. Starch-based clamshells deform under steam. Molded fiber absorbs oils without barrier coatings. Compostable films tear more easily than petroleum-based plastics. These performance gaps force selective use by food type rather than universal replacement. Cost exposure also remains high due to biopolymer resin volatility and limited domestic production scale. Large foodservice buyers cap adoption in price-sensitive menu categories to protect operating margins.

Biodegradable packaging demand in the USA increasingly depends on whether used packaging is actually captured and processed as intended. Universities, stadiums, airports, and corporate campuses drive demand through closed-loop composting contracts tied directly to waste haulers. These buyers require certified material traceability and contamination control. Outside these closed environments, adoption slows due to disposal ambiguity. Some restaurant groups now link packaging procurement directly to regional hauling partnerships rather than broad national sourcing. This indicates that biodegradable packaging demand is migrating toward controlled waste ecosystems rather than assuming open public compost infrastructure.

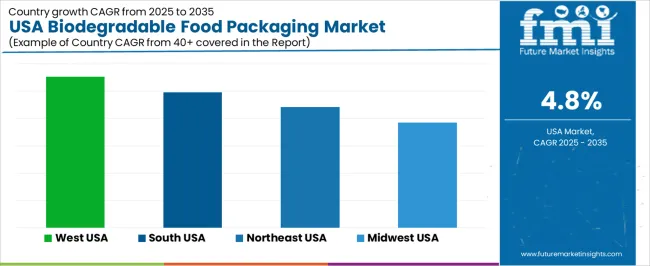

| Region | CAGR (%) |

|---|---|

| West | 5.5% |

| South | 5.0% |

| Northeast | 4.4% |

| Midwest | 3.8% |

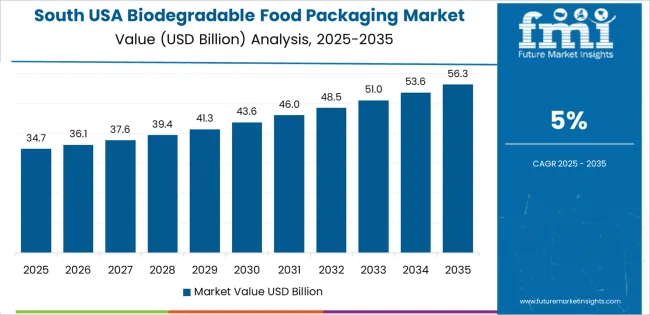

The demand for biodegradable food packaging in the USA is rising steadily across regions, with the West leading at a 5.5% CAGR. Growth in this region is supported by strict packaging regulations, strong retailer mandates on alternative materials, and high consumer awareness toward eco-friendly food packaging. The South follows at 5.0%, driven by expanding packaged food production, growth in quick service restaurants, and increasing adoption of compostable packaging formats by regional brands. The Northeast records 4.4% growth, supported by urban foodservice demand, municipal waste reduction programs, and institutional procurement. The Midwest shows comparatively moderate growth at 3.8%, reflecting gradual adoption by food processors and continued cost sensitivity in high volume food packaging applications.

Expansion in the West reflects a CAGR of 5.5% through 2035 for biodegradable food packaging demand, supported by municipal packaging regulations, strong adoption by organic food brands, and high penetration across foodservice chains. Urban grocery outlets and quick service restaurants rely on compostable trays, wraps, and takeaway containers to meet policy compliance. Meal kit providers and premium food startups add steady application demand. Retail compliance programs dominate procurement decisions. Demand remains regulation and brand positioning driven, with continuous reorder cycles across coastal retail, hospitality, and prepared food distribution networks.

The South advances at a CAGR of 5.0% through 2035 for biodegradable food packaging demand, driven by expanding food processing, supermarket chain growth, and rising takeaway food volumes. Produce packaging, deli containers, and fresh meal trays remain the main application formats. Policy enforcement varies by state, but private retailer sustainability standards guide consistent adoption. Poultry and seafood processors add secondary demand. Demand remains volume driven and price sensitive, with converters focused on cost balanced bio based materials to support high throughput packaging lines across regional food manufacturing corridors.

The Northeast records a CAGR of 4.4% through 2035 for biodegradable food packaging demand, shaped by dense urban retail networks, early regulatory adoption, and high consumer compliance. Cafes, institutional cafeterias, and grocery stores show strong replacement cycles for compostable food containers. Universities, hospitals, and municipal food programs contribute predictable bulk demand. Cold climate storage places focus on moisture and grease resistance. Demand remains compliance led rather than branding led, with stable ordering patterns across compact distribution networks serving high density metropolitan foodservice and retail markets.

The Midwest expands at a CAGR of 3.8% through 2035 for biodegradable food packaging demand, supported by gradual retailer conversion, school meal programs, and regional food distributors. Policy driven adoption moves slower than coastal regions, but national grocery chains drive steady material substitution. Meat processing, bakery packaging, and institutional catering add moderate application volume. Price sensitivity remains a central constraint on rapid scale up. Demand remains transition driven and stable, aligned with phased replacement of conventional plastic packaging across regional retail and foodservice supply chains.

Demand for biodegradable food packaging in the USA is growing as food producers, retailers, and consumers place greater emphasis on reducing plastic waste and environmental impact. Regulatory pressure on single use plastics and growing consumer preference for “eco friendly” brand credentials motivate adoption. Foodservice, fresh produce, ready to eat meals, and takeaway segments especially favour packaging that decomposes more easily or uses renewable feedstocks. Advances in biopolymer materials, compostable coatings, and barrier technologies enable biodegradable packaging to meet shelf life and safety requirements that traditional plastics provided. Ease of disposal, alignment with sustainability goals, and corporate supply chain commitments also encourage broader use.

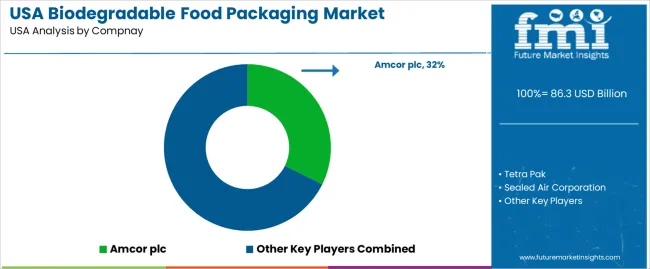

Key firms influencing this market include Amcor plc, Tetra Pak, Sealed Air Corporation, Mondi Group, and WestRock Company. Amcor and Sealed Air offer scalable packaging solutions for retail, foodservice, and processed food producers adapting to biodegradable formats. Tetra Pak integrates sustainable cartons and packaging with renewable or recyclable materials. Mondi and WestRock supply paper and fiber based packaging alternatives, often combining compostable liners or coatings for food packaging. These companies leverage global supply networks, material science capabilities, and regulatory expertise to support the shift from traditional plastics to biodegradable packaging across the US food value chain.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Material | Paper & Paperboard, Plastic, Metal, Glass, Others |

| Technique | Molded Packaging, Rigid Packaging, Containers, Bags, Films |

| End-use Application | Retail Food Packaging, Institutional Catering, Ready Meals, Foodservice |

| Region | Northeast USA, West USA, Midwest USA, South USA |

| Countries Covered | USA |

| Key Companies Profiled | Amcor plc, Tetra Pak, Sealed Air Corporation, Mondi Group, WestRock Company |

| Additional Attributes | Dollar by sales by material, Dollar by sales by technique, Dollar by sales by end-use, Dollar by sales by region, Regional CAGR, Regulation-driven adoption, Supply chain integration, Material performance thresholds, Closed-loop waste handling reliance |

The demand for biodegradable food packaging in USA is estimated to be valued at USD 86.3 billion in 2025.

The market size for the biodegradable food packaging in USA is projected to reach USD 137.9 billion by 2035.

The demand for biodegradable food packaging in USA is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in biodegradable food packaging in USA are paper & paperboard, plastic, metal, glass and others.

In terms of technique, molded packaging segment is expected to command 31.0% share in the biodegradable food packaging in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Biodegradable Food Packaging Market Size, Share & Forecast 2025 to 2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

USA Food Service Industry Analysis from 2025 to 2035

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

USA Food Stabilizers Market Analysis – Size, Share & Forecast 2025–2035

USA Food Service Equipment Market Insights – Demand, Size & Industry Trends 2025–2035

USA Food Hydrocolloids Market Trends – Size, Share & Growth 2025-2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Tester Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Market Size, Share & Forecast 2025 to 2035

Market Share Breakdown of Food Packaging Film Providers

Food Packaging Equipment Market

Food Tub packaging Market Size and Share Forecast Outlook 2025 to 2035

USA Bird Food Market Insights - Trends & Demand 2025 to 2035

USA Superfood Powder Market Report – Trends, Demand & Outlook 2025-2035

USA Stick Packaging Market Analysis – Growth, Trends & Forecast 2025-2035

Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Seafood Packaging Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA