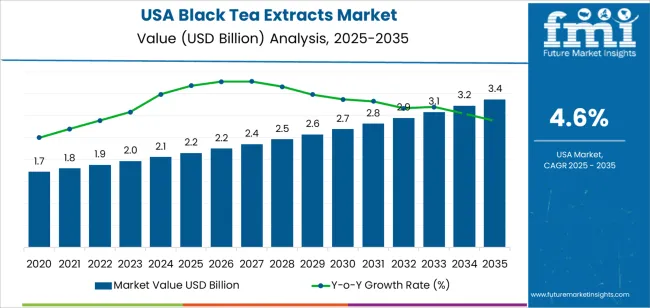

The demand for black tea extract in the USA is expected to grow from USD 1.7 billion in 2025 to USD 2.7 billion by 2035, with CAGR of 4.6%. Known for its antioxidant and anti-inflammatory properties, black tea extract is increasingly used in a wide range of industries, including food and beverage, cosmetics, and pharmaceuticals. Its popularity has surged, particularly in functional beverages, dietary supplements, and skincare products, due to the growing consumer demand for natural, plant-based ingredients that support wellness.

The rising awareness of the health benefits of black tea extract, such as improving digestive health, promoting heart health, and offering skin care benefits, will continue to drive its adoption. The increasing demand for clean-label and natural products in the health and wellness sector further supports its growth, as consumers opt for alternatives to synthetic chemicals in their daily products. In food and beverages, black tea extract is frequently used in teas, energy drinks, and smoothies for its flavor and health properties. Its use in cosmetics, especially in products targeting anti-aging and moisturizing benefits, contributes to its steady industry growth.

Between 2025 and 2030, the demand for black tea extract is expected to grow steadily, with incremental increases from USD 1.7 billion to USD 2.2 billion. The early phase of growth will be primarily driven by the increasing awareness of the health benefits of black tea extract, particularly in functional foods and natural supplements. Consumers continue to gravitate toward clean-label and herbal wellness products, fueling the adoption of black tea extract in teas, smoothies, and energy drinks. Its use in skin care products will also contribute to steady growth, as more companies focus on incorporating natural, effective ingredients into their beauty lines.

From 2030 to 2035, the demand for black tea extract will see more rapid growth, rising from USD 2.2 billion to USD 2.7 billion. The acceleration in growth will be fueled by increasing demand for wellness products, particularly those focused on immune support, anti-aging, and skin health. As the health and beauty industry embraces natural, eco-friendly ingredients, black tea extract will gain prominence as a key component in formulations. Trise of functional beverages and the growing trend of plant-based diets will further boost the demand for this extract in both food and personal care industries.

| Metric | Value |

|---|---|

| Demand for Black Tea Extracts in USA Value (2025) | USD 2.2 billion |

| Demand for Black Tea Extracts in USA Forecast Value (2035) | USD 3.4 billion |

| Demand for Black Tea Extracts in USA Forecast CAGR (2025-2035) | 4.6% |

The demand for black tea extracts in the USA is growing due to their increasing use in the food and beverage, nutraceutical, and cosmetics industries. Black tea extract, rich in antioxidants such as polyphenols, is valued for its health benefits, including improving heart health, boosting metabolism, and providing anti-aging properties. As consumers continue to prioritize natural, functional ingredients in their diets and personal care products, black tea extract is gaining popularity across multiple sectors.

A significant driver behind this growth is the increasing consumer demand for functional beverages and dietary supplements. With the rise of health-conscious consumers, there is growing interest in products that offer health benefits beyond basic nutrition. Black tea extract is often used in energy drinks, functional teas, and weight management supplements due to its ability to improve metabolic function and promote overall wellness. As more consumers turn to natural ingredients, black tea extract is seen as a preferred option for those seeking antioxidants and anti-inflammatory properties.

The expanding use of black tea extract in the cosmetics industry is also contributing to its rising demand. Its antioxidant properties make it a key ingredient in skincare products aimed at protecting the skin from environmental damage and reducing signs of aging. As consumers increasingly focus on holistic health and beauty, the demand for black tea extract in the USA is expected to grow steadily through 2035, driven by its versatility and proven health benefits.

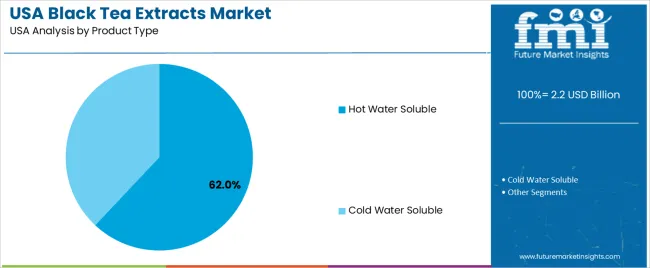

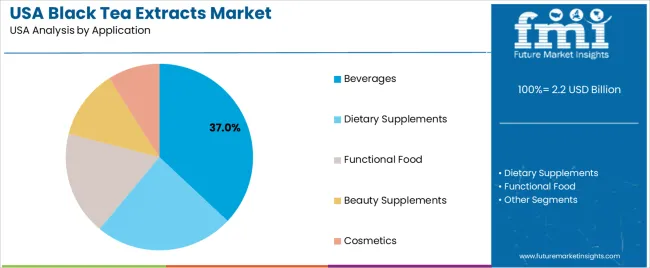

Demand for black tea extracts in the USA is segmented by product type, application, and form. By product type, demand is divided into hot water soluble and cold water soluble, with hot water soluble extracts leading the demand at 62%. The demand is also segmented by application, including beverages, dietary supplements, functional food, beauty supplements, and cosmetics, with beverages representing the largest share at 37%. In terms of form, demand is divided into powder, liquid, and encapsulated forms. Regionally, demand is spread across different regions, reflecting the widespread use of black tea extracts in various industries, especially in beverages and health-related products.

Hot water soluble black tea extracts account for 62% of the demand in the USA. This form is preferred because it easily dissolves in hot water, making it ideal for producing ready-to-drink tea products, functional beverages, and flavored drinks. Hot water soluble extracts retain the full flavor, aroma, and health benefits of black tea, which are highly valued for their antioxidant properties and ability to promote wellness. The convenience of dissolving easily in water without the need for additional processing makes this form highly practical for manufacturers. In the beverage industry, where speed and ease of production are crucial, hot water soluble extracts offer an efficient solution. As consumers continue to prioritize convenient, health-oriented drinks, the demand for hot water soluble black tea extract is expected to stay strong, reinforcing its leadership in the industry for tea and functional beverages.

Beverages account for 37% of the demand for black tea extracts in the USA. Black tea extract is widely used in the beverage industry, particularly for creating ready-to-drink teas, iced teas, wellness drinks, and functional beverages. The extract’s rich flavor and health benefits, including antioxidants and metabolism-boosting properties, make it a key ingredient in products designed for health-conscious consumers. As more people seek drinks that offer both refreshment and health benefits, black tea extract has gained popularity in functional beverages. The rising demand for functional drinks, including tea-based energy drinks, stress-relief beverages, and immunity-boosting formulations, drives this trend. The versatility of black tea extract in flavor and function further enhances its demand in the beverage industry. With the growing trend towards healthier, more natural beverage options, black tea extract will continue to lead the beverage application industry.

Demand for black tea extracts in USA is rising as food & beverage makers, nutraceutical companies, and personal‑care brands increasingly favour natural, plant‑based ingredients with perceived health benefits. Black tea extracts rich in antioxidants, polyphenols and flavonoids are used in functional drinks, supplements, flavored beverages, and ready‑to‑drink teas, supporting consumer demand for wellness‑driven offerings. The clean‑label trend and growing interest in “natural wellness” ingredients fuel adoption. On the restraint side, supply‑chain variability (raw‑tea sourcing, quality fluctuations), competition from other botanical extracts or synthetic additives, and regulatory or standardization requirements to substantiate health claims can limit uptake of black tea extracts, especially in regulated segments like dietary supplements or cosmetics.

Why is Demand for Black Tea Extracts Growing in USA?

In USA, demand for black tea extracts is growing because more consumers seek health‑oriented, antioxidant‑rich beverages and products. Black tea extract is valued for its potential benefits supporting metabolism, heart health, antioxidant support making it attractive for functional beverage makers, supplement brands, and wellness‑minded consumers. The rising popularity of ready‑to‑drink teas, functional beverages, and natural‑ingredient supplements, along with increased health awareness and preventive‑health trends, is expanding the industry. Personal‑care and cosmetic brands are incorporating black tea extracts for their antioxidant and anti‑inflammatory properties, broadening the application beyond beverages.

How are Technological and Industry Innovations Driving Growth of Black Tea Extracts Uptake in USA?

Technological and processing innovations are making black tea extracts more viable and scalable in USA. Advances in extraction, purification, and stabilization techniques yield high‑quality extracts rich in active polyphenols and flavonoids with consistent potency suitable for beverages, supplements, and cosmetics. Improved formats (powdered, liquid concentrates, encapsulated) offer flexibility for manufacturers to formulate a wide range of products such as drinks, dietary supplements, functional foods, and skincare items. Enhanced supply‑chain logistics and global sourcing facilitate reliable import, processing, and distribution helping domestic producers and brands access high‑grade black tea extracts for US industries.

What are the Key Challenges Limiting Wider Adoption of Black Tea Extracts in USA?

Despite strong growth, several factors limit broader adoption of black tea extracts in USA. First, raw‑material supply and quality can be inconsistent tea leaf yield depends on agricultural conditions which complicates standardization and reliable formulation. Second, competition from other botanical extracts or synthetic antioxidants may be preferred in cost‑sensitive or performance‑driven segments. Third, regulatory and labelling standards for functional ingredients, health claims and nutritional supplements can create barriers, requiring scientific substantiation and compliance. Finally, consumer education is still needed: many consumers may prefer traditional tea beverages over extracts, limiting demand for extract‑based products in some demographics.

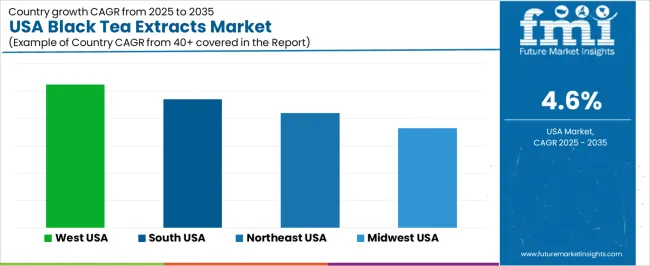

| Region | CAGR (%) |

|---|---|

| West USA | 5.2% |

| South USA | 4.7% |

| Northeast USA | 4.2% |

| Midwest USA | 3.6% |

Demand for black tea extracts in the USA is growing steadily, with West USA leading at a 5.2% CAGR, driven by the region’s strong health and wellness industry. Black tea extract is increasingly popular in beverages, supplements, and personal care products due to its antioxidant properties. South USA follows with a 4.7% CAGR, supported by the region's growing focus on natural and health-focused beverages. Northeast USA shows a 4.2% CAGR, driven by consumer demand for functional foods and wellness products, while Midwest USA experiences a 3.6% CAGR, with steady growth fueled by the increasing use of natural ingredients in food and beverages. As more consumers embrace wellness trends and natural ingredients, the demand for black tea extract is expected to continue rising across all regions.

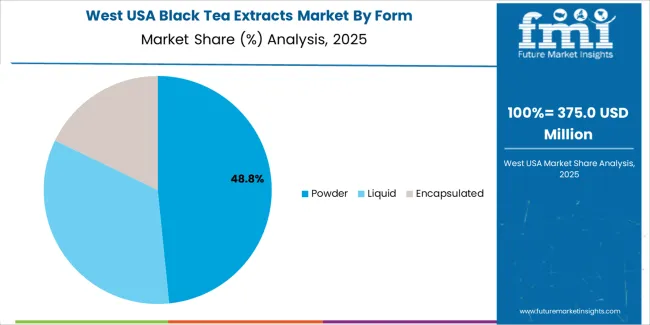

West USA is leading the demand for black tea extracts, growing at a 5.2% CAGR. The region's health-conscious population, particularly in California, has a growing preference for functional beverages and natural ingredients, making black tea extract a popular choice in the food and beverage industry. Black tea extracts are widely used for their antioxidant properties in beverages, dietary supplements, and personal care products. The demand for plant-based and organic ingredients continues to rise, further driving the adoption of black tea extract in various products. West USA's booming wellness and fitness industries are pushing for natural, antioxidant-rich ingredients that support immunity and overall health. As the focus on natural, clean-label products increases, the demand for black tea extracts in functional beverages like teas, energy drinks, and health supplements is expected to remain strong. With an emphasis on innovation and wellness trends, West USA will continue to lead in black tea extract consumption.

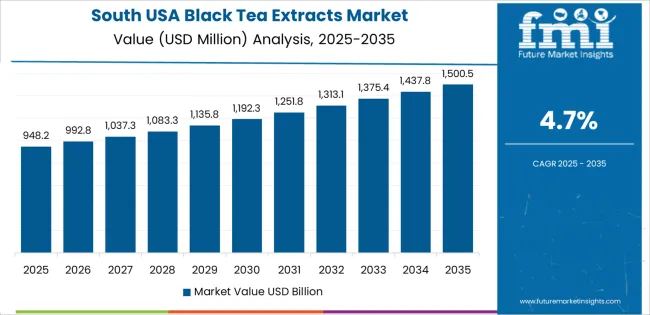

South USA is experiencing steady demand for black tea extracts, with a 4.7% CAGR, driven by the region’s strong food and beverage industry. The increasing popularity of health-focused beverages, such as ready-to-drink teas and functional drinks, is boosting the demand for black tea extract. Black tea extract’s antioxidant properties and health benefits, such as supporting heart health and boosting metabolism, align with growing consumer interest in natural and wellness-oriented products. The region’s focus on both traditional and modern herbal remedies is contributing to the adoption of black tea extract in a variety of health-focused products. South USA’s expanding industry for clean-label and organic products is further driving the demand for natural ingredients like black tea extract. As consumers continue to seek healthier, more natural alternatives in food, beverages, and supplements, black tea extract is expected to see sustained growth in the region. With its proven health benefits, black tea extract will continue to gain traction in South USA.

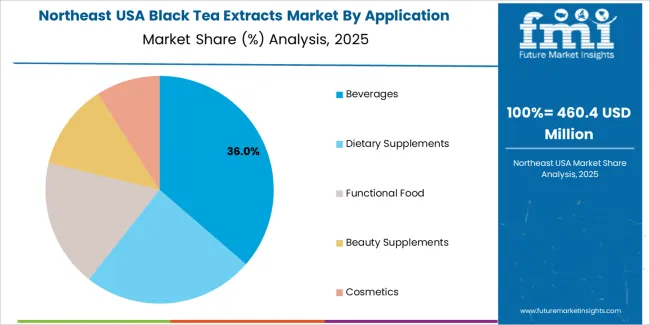

Northeast USA is seeing moderate growth in demand for black tea extracts, with a 4.2% CAGR. The region’s well-established consumer industry for functional foods, beverages, and dietary supplements is driving the adoption of black tea extract. Consumers in Northeast USA are increasingly looking for natural ingredients that offer health benefits such as antioxidant-rich properties, which black tea extract provides. The demand for black tea extract in beverages like iced tea, hot tea, and health drinks is growing as more people focus on healthier lifestyles and seek ingredients that promote immunity and cardiovascular health. The Northeast’s strong focus on clean-label, sustainable products in both food and personal care items is contributing to the rising use of black tea extract. As the region continues to embrace wellness trends and natural ingredients, the demand for black tea extract will grow steadily, especially in health-conscious and eco-conscious industries.

Midwest USA is experiencing moderate growth in the demand for black tea extracts, with a 3.6% CAGR. The region’s increasing focus on natural and functional ingredients in the food, beverage, and dietary supplement sectors is driving the adoption of black tea extract. While growth is slower compared to other regions, Midwest USA’s strong agricultural and food manufacturing base is supporting the demand for tea-based ingredients, particularly in beverages, snacks, and health products. The rise in health-conscious consumers and the growing preference for clean-label, natural ingredients are also fueling the steady demand for black tea extract in the Midwest. As consumers continue to focus on wellness and sustainability, the use of black tea extract in functional foods and beverages is expected to grow, though at a more moderate pace compared to other regions with higher consumer demand for natural health solutions.

The demand for black tea extracts in the USA is increasing due to their widespread use in the food, beverage, and dietary supplement industries. Black tea extract is valued for its potential health benefits, including antioxidant properties, improved heart health, and weight management support. As consumers become more health-conscious and seek functional beverages, black tea extracts are gaining popularity as a natural ingredient in a wide range of products, from ready-to-drink beverages to capsules and skin care products. The rising trend of wellness and natural ingredients is driving the industry for black tea extracts.

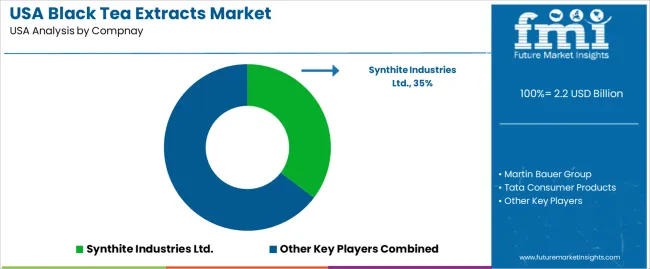

Leading companies in the black tea extract industry in the USA include Synthite Industries Ltd., Martin Bauer Group, Tata Consumer Products, Cymbio Pharma Pvt Ltd, and Kemin Industries. Synthite Industries Ltd. leads the industry with a significant share of 35.3%, providing high-quality black tea extracts used in various food and beverage applications. Martin Bauer Group offers a wide range of botanical extracts, including black tea, for the beverage, nutraceutical, and functional food industries. Tata Consumer Products, known for its tea brands, also supplies black tea extracts for use in beverages and supplements. Cymbio Pharma Pvt Ltd and Kemin Industries are key players, offering black tea extract solutions for the nutraceuticals and cosmetics sectors.

The competitive dynamics in the black tea extract industry are driven by consumer demand for natural and health-boosting ingredients. Companies compete by offering high-quality, standardized black tea extracts with high antioxidant content, targeting the growing wellness industry. Product innovation, sustainability, and sourcing practices are crucial differentiators in this competitive landscape. As more consumers seek functional beverages and natural ingredients, companies that can provide clean-label, sustainably sourced black tea extracts will continue to lead the industry.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Form | Powder, Liquid, Encapsulated |

| Application | Beverages, Dietary Supplements, Functional Food, Beauty Supplements, Cosmetics |

| Product Type | Hot Water Soluble, Cold Water Soluble |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Synthite Industries Ltd., Martin Bauer Group, Tata Consumer Products, Cymbio Pharma Pvt Ltd, Kemin Industries |

| Additional Attributes | Dollar sales by form, application, and product type; regional CAGR and adoption trends; demand trends in black tea extracts; growth in beverages, dietary supplements, and cosmetics sectors; technology adoption for extraction and formulation processes; vendor offerings including tea extract products and services; regulatory influences and industry standards |

The demand for black tea extracts in USA is estimated to be valued at USD 2.2 billion in 2025.

The market size for the black tea extracts in USA is projected to reach USD 3.4 billion by 2035.

The demand for black tea extracts in USA is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in black tea extracts in USA are powder, liquid and encapsulated.

In terms of application, beverages segment is expected to command 37.0% share in the black tea extracts in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Black Tea Extracts Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA and Canada Teak Veneer Sheet Market Analysis by Grade, Application, and End Use Forecast through 2035

Green Tea Extracts Market Analysis – Size, Share & Forecast 2025 to 2035

Bubble Tea Industry Analysis in USA - Size, Share, and Forecast 2025 to 2035

Demand for Blackout Fabric in USA Size and Share Forecast Outlook 2025 to 2035

Demand for Coffee Extracts in USA Size and Share Forecast Outlook 2025 to 2035

Blackout Fabric Laminate Market Size and Share Forecast Outlook 2025 to 2035

Tea Packaging Machine Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Seed Oil Market Size and Share Forecast Outlook 2025 to 2035

Tear Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

Black Maca Extract Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Blackcurrant Powder Market Size and Share Forecast Outlook 2025 to 2035

Black Treacle Market Size and Share Forecast Outlook 2025 to 2035

Tea Tree Oil Treatments Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA