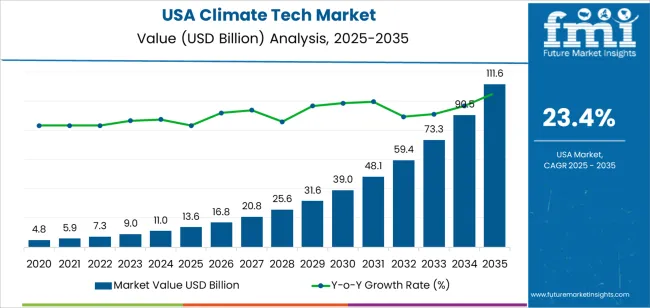

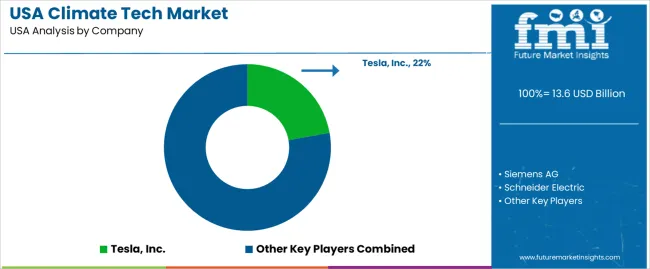

The demand for climate tech in the USA is expected to reach USD 111.4 billion by 2035, reflecting an absolute increase of USD 97.8 billion over the forecast period. Starting at USD 13.6 billion in 2025, the demand is expected to grow at a robust CAGR of 23.4%. Climate tech encompasses technologies and solutions that address climate change through eco-consciousness, energy efficiency, and carbon reduction, including renewable energy, energy storage, electric vehicles, and smart grids.

The primary drivers of this growth include increased government initiatives and policies to reduce carbon emissions, private investments in clean energy solutions, and rising consumer demand for environmentally responsible products and services. As the climate crisis intensifies, both public and private sectors are expected to ramp up investments in climate tech, making it a significant area of economic growth over the next decade. The trend toward decarbonization and eco-friendly practices will continue to drive the need for new and innovative solutions, positioning climate tech as a critical component of the global economy.

Technological advancements, particularly in renewable energy production, energy storage, and carbon capture technologies, will contribute to the rapid growth of climate tech. The transition to a low-carbon economy will accelerate, with the adoption of energy-efficient technologies across industries, particularly in sectors like transportation, manufacturing, and agriculture.

From 2025 to 2030, the demand for climate tech is projected to rise from USD 13.6 billion to USD 16.8 billion, growing by USD 3.2 billion. This early phase represents gradual adoption as industries begin to integrate climate tech solutions and eco-friendly practices into their operations. The pace of growth will be influenced by the adoption of renewable energy, energy storage systems, and electric vehicles. Though the growth rate is strong, it remains moderate in this phase as the industry transitions from early innovation to mainstream adoption.

From 2030 to 2035, the demand will rise sharply, from USD 16.8 billion to USD 111.4 billion, adding USD 94.6 billion. This represents an acceleration in industry adoption driven by large-scale investments in climate tech by both public and private sectors. Increased regulatory pressure, coupled with greater consumer demand for eco-friendly products and services, will contribute to a surge in adoption. Technologies such as renewable energy sources, carbon capture systems, and smart grids will mature and expand rapidly, creating an environment for widespread deployment across industries.

| Metric | Value |

|---|---|

| USA Climate Tech Sales Value (2025) | USD 13.6 billion |

| USA Climate Tech Forecast Value (2035) | USD 111.4 billion |

| USA Climate Tech Forecast CAGR (2025 to 2035) | 23.40% |

The demand for climate tech in the USA is surging as businesses, governments, and utilities intensify efforts to reduce greenhouse gas emissions and adapt to climate change. Technologies that support decarbonization such as renewable energy systems, energy storage, carbon capture, and grid‑digitization tools are gaining priority as regulatory mandates and corporate eco-conciousness commitments ramp up. With the introduction of large‑scale incentive frameworks and increased investment, climate tech solutions are becoming integral to infrastructure transformation.

Private‑sector initiatives and public‑policy support is converging to drive growth. Major corporations are setting net‑zero targets and embedding climate‑technology procurement into their supply chains, while federal programs are boosting deployment of advanced clean‑tech solutions. Innovations in digital platforms, IoT sensors, AI‑driven analytics, and materials science are making climate tech more capable and cost‑competitive. These technological advances reduce barriers to adoption and accelerate uptake across sectors like energy, transport, manufacturing, and agriculture.

Thee rising demand for resilience in the face of extreme weather events, climate‑driven disruptions, and evolving risk profiles is fueling interest in adaptation technologies another facet of climate tech. As organizations seek solutions that not only reduce emissions but also enhance climate resilience and operational flexibility, the climate‑tech sector is poised for robust growth in the USA through 2035.

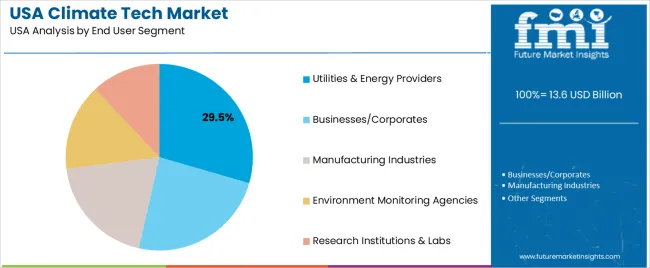

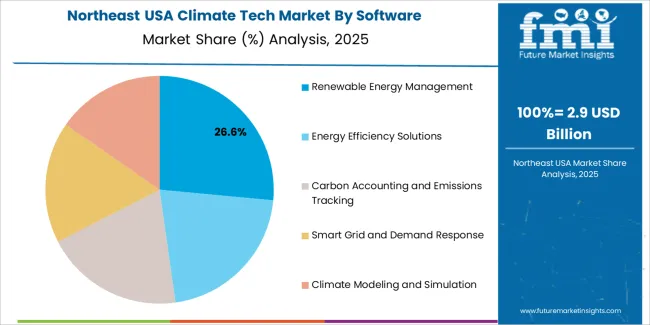

Demand is segmented by hardware, software, and end-user segment. By hardware, demand is divided into renewable energy devices, energy storage systems, waste management and recycling technologies, carbon capture and storage (CCS) technologies, and building and construction technologies. In terms of software, categorized into renewable energy management, energy efficiency solutions, carbon accounting and emissions tracking, smart grid and demand response, and climate modeling and simulation. Demand is also segmented by end-user, including utilities & energy providers, businesses/corporates, manufacturing industries, environment monitoring agencies, and research institutions & labs. Regionally demand is divided into West, South, Northeast, and Midwest

Renewable energy devices account for 24% of the demand for climate tech hardware in the USA. These devices include solar panels, wind turbines, and other technologies designed to harness natural resources for clean energy production. The demand for renewable energy devices is driven by the increasing adoption of renewable energy as part of efforts to reduce greenhouse gas emissions and transition away from fossil fuels.

The focus on eco-conciousness, coupled with government incentives and growing environmental awareness, has contributed to the rising adoption of renewable energy devices in residential, commercial, and industrial applications. The push for decarbonization, energy independence, and cost-effective energy solutions further drives the demand for these technologies. As energy generation shifts towards renewables, the demand for renewable energy devices will continue to grow, making them a key component of the climate tech sector.

Renewable energy management software accounts for 26.1% of the demand for climate tech software in the USA. This software helps utilities, businesses, and other organizations optimize the integration and distribution of renewable energy sources like solar and wind power. Renewable energy management software allows for real-time monitoring, forecasting, and control of energy production and consumption, ensuring efficient use and maximizing the value of renewable resources.

The increasing reliance on renewable energy and the need to balance energy supply with demand in real-time have led to the widespread adoption of renewable energy management software. This technology plays a crucial role in grid management, helping integrate variable renewable energy sources into the grid without compromising stability. As the shift to renewable energy accelerates and smart grid systems expand, the demand for renewable energy management software will continue to grow, enabling more efficient energy distribution and contributing to eco-conciousness goals.

Utilities & energy providers account for 29.5% of the demand for climate tech in the USA. These organizations are at the forefront of the transition to renewable energy, energy storage, and other climate technologies. They are responsible for the generation, distribution, and management of electricity, making them key adopters of climate tech solutions aimed at reducing emissions and improving energy efficiency.

The growing shift towards renewable energy sources, coupled with the need to modernize energy infrastructure, drives the demand for climate tech within utilities and energy providers. Technologies like energy storage systems, smart grids, and carbon capture technologies are essential for utilities to improve grid reliability, enhance energy efficiency, and meet eco-conciousness targets. As energy providers seek to reduce their environmental impact and comply with regulatory requirements, their demand for climate tech solutions is expected to continue rising, making them the largest end-user segment in this industry.

Demand for climate tech in the USA is intensifying as corporations, utilities, and governments invest in solutions to reduce emissions, enhance resilience, and accelerate the transition to cleaner infrastructure. These technologies deliver advanced features such as renewable energy generation, energy storage, smart-grid optimization, and carbon removal analytics. Key drivers include federal policy incentives, rising corporate net-zero commitments, increased awareness of climate risk, and the electrification of industry and transport. Restraints include high upfront capital costs, regulatory uncertainty, and the challenge of scaling nascent technologies.

Demand for climate tech in the USA is growing due to increasing pressure on businesses and public-sector entities to address climate risks and reduce carbon emissions. The need to modernize aging infrastructure, manage tight power grids, and enhance resilience against extreme weather events is driving investments in smart, low-carbon technologies. Federal legislation, such as tax incentives, and state-level programs are helping to reduce the cost of deploying clean technologies, spurring both public and corporate adoption. Innovations in hardware and software are opening up new use cases, from distributed energy storage to carbon removal platforms, making climate tech more accessible and driving its growth across various sectors.

Technological innovations are accelerating the growth of climate tech in the USA by enhancing performance, reducing costs, and enabling novel business models. Advances in battery storage, power electronics, AI-driven energy optimization, modular hydrogen systems, and carbon removal engineering are broadening the scope of climate technologies. As these solutions mature, they move from pilot phases to large-scale deployment, driving economies of scale and fostering wider adoption in industrial, commercial, and utility sectors. The rise of digital platforms, data analytics, and automation is improving system efficiency, minimizing operational risks, and making climate tech more appealing to investors, further driving the transition to eco-friendly energy.

What are the Key Challenges Limiting Adoption of Climate Tech in the USA?

The adoption of climate tech in the USA faces several key challenges despite strong growth. High capital expenditures for advanced clean-tech infrastructure remain a significant barrier, with long payback periods in certain sectors. Regulatory and permitting frameworks are often fragmented across federal, state, and local levels, leading to delays and uncertainties in implementation. Supply chain issues, especially around critical minerals and rare-earth elements, threaten the scalability of many technologies. While some climate tech solutions are commercially viable, others are still in demonstration stages, causing hesitation among investors and stakeholders concerned about technology risk, reliability, and performance.

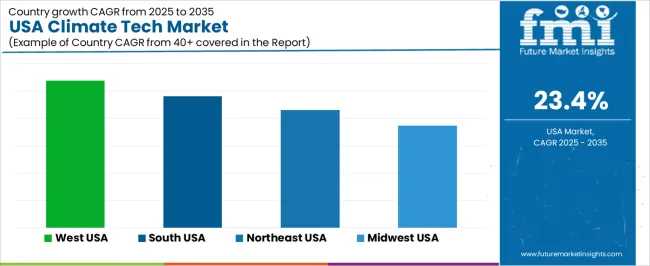

| Region | CAGR (%) |

|---|---|

| West | 26.9% |

| South | 24.1% |

| Northeast | 21.5% |

| Midwest | 18.7% |

The demand for climate tech in the USA is growing rapidly across all regions, with the West leading at a 26.9% CAGR. This growth is driven by strong investments in renewable energy, carbon capture, and green infrastructure. The South follows with a 24.1% CAGR, supported by its large industrial base and increasing adoption of energy-efficient technologies. The Northeast shows a 21.5% CAGR, with a growing focus on clean energy and climate resilience. The Midwest experiences a moderate 18.7% CAGR, driven by the region’s industrial shift toward green practices and energy solutions.

The West is experiencing the highest growth in demand for climate tech, with a 26.9% CAGR. This is largely due to the region’s leadership in clean energy innovations, such as solar power, wind energy, and electric vehicles. Major hubs like California have set ambitious climate goals, investing heavily in green technologies and renewable energy infrastructure. Cities like San Francisco and Los Angeles are becoming central players in climate tech, with a high concentration of startups and tech companies focusing on eco-conciousness solutions.

In addition to strong state-level policies promoting climate-friendly technologies, the West benefits from a progressive consumer base that values eco-friendly products and services. The region’s push for carbon neutrality and investments in green infrastructure across urban and rural areas further drive demand for climate tech. As more industries, including tech, transportation, and agriculture, adopt climate-friendly practices, the West will remain at the forefront of climate tech innovation and adoption.

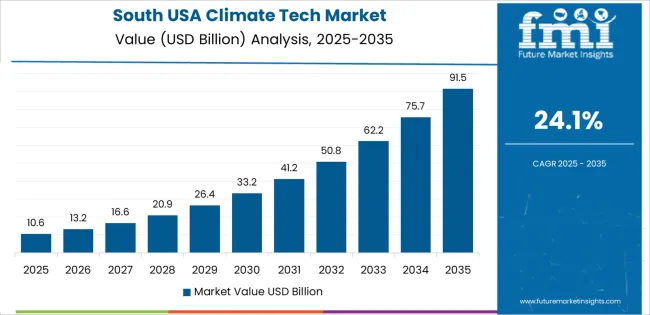

The South is experiencing strong growth in demand for climate tech, with a 24.1% CAGR. This growth is driven by the region’s increasing adoption of energy-efficient technologies and eco-friendly infrastructure, particularly in industries like oil and gas, manufacturing, and agriculture. As companies in the South begin to recognize the economic and environmental benefits of climate tech solutions, there is a significant rise in the implementation of renewable energy systems, carbon capture technologies, and energy storage solutions.

The South’s energy sector is undergoing a transformation, with a growing focus on cleaner energy sources and reducing carbon emissions. States like Texas, Florida, and Georgia are investing in large-scale renewable energy projects, such as wind and solar power, which are further driving the demand for climate tech. The region’s industrial strength, combined with state-level incentives and federal support for eco-friendly development, positions the South for continued growth in the climate tech sector. As industries and governments push for climate resilience, the South’s adoption of climate technologies will accelerate.

The Northeast is witnessing steady growth in demand for climate tech, with a 21.5% CAGR. The region’s strong focus on clean energy solutions and climate resilience is a key factor driving this growth. With states like New York, Massachusetts, and Connecticut implementing progressive climate policies, including renewable energy mandates and greenhouse gas reduction targets, the Northeast is becoming a hub for climate tech innovation and adoption. The region’s emphasis on energy-efficient building technologies, electric vehicle infrastructure, and renewable energy sources is fueling the demand for climate-friendly solutions.

In addition to state and local government policies supporting climate action, the Northeast’s well-established financial and research sectors are investing heavily in green technologies. Universities, research institutions, and venture capital firms in the region are leading the charge in developing climate tech innovations, including carbon capture, green hydrogen, and eco-friendly agriculture solutions. As the region continues to implement climate resilience measures and transition to a cleaner economy, the demand for climate tech in the Northeast is expected to grow at a steady pace.

The Midwest is experiencing moderate growth in demand for climate tech, with an 18.7% CAGR. The region’s shift toward eco-friendlier practices, particularly in agriculture, manufacturing, and transportation, is driving the demand for climate tech. As more companies in the Midwest look to reduce emissions and adopt renewable energy solutions, there is growing interest in energy efficiency technologies, including smart grids, eco-friendly farming practices, and electric vehicle adoption.

Midwestern states like Illinois, Michigan, and Ohio are investing in renewable energy projects, such as wind and solar power, to transition away from traditional fossil fuels. The region’s industrial base, which includes manufacturing giants, is also gradually adopting energy-saving technologies and carbon reduction strategies, leading to increased demand for climate tech solutions. With federal and state support for eco-friendly development, and a growing awareness of the economic benefits of clean energy, the Midwest is expected to continue its steady adoption of climate tech in the coming years.

Demand for climate‑tech solutions in the USA is surging as businesses and governments push harder toward decarburization, clean‑energy deployment, and climate resilience. With heightened awareness of climate risks, coupled with regulatory incentives and sizeable investment programmers, American industries are increasingly adopting technologies that support renewable generation, energy‑efficiency, grid modernization, carbon management and eco-friendly infrastructure. The expanding "climate tech" domain encompasses hardware (such as wind turbines, solar panels, battery systems), software (for energy‑asset management, emission tracking) and services.

In the USA demand environment, Tesla, Inc. holds an estimated 22.2% share, reflecting its substantial role in electric‑vehicle technology and energy‑storage systems, both of which are core components of the USA climate‑tech transition. Other major players include Siemens AG, Schneider Electric, General Electric (GE) and Vistas Wind Systems, each contributing distinct capabilities from grid‑scale infrastructure and smart‑energy platforms to wind‑power hardware and industrial‑efficiency systems that match the breadth of demand across sectors.

Key drivers of USA demand include government‑backed incentives for clean energy, increasing corporate commitments to net‑zero emissions, the growth of electrification in transport and industry, and urgent needs to modernize aging infrastructure in the face of climate hazards. At the same time, challenges such as supply‑chain bottlenecks, the high up‑front cost of advanced systems, and evolving regulatory and permitting landscapes remain. Nonetheless, the broader outlook for climate‑tech adoption in the United States remains robust, with demand expected to accelerate as the country pursues ambitious climate goals and businesses seek resilient, low‑carbon solutions.

| Items | Values |

|---|---|

| Quantitative Unit | USD billion |

| Hardware | Renewable Energy Devices, Energy Storage Systems, Waste Management & Recycling Technologies, Carbon Capture & Storage (CCS) Technologies, Building and Construction Technologies |

| Software | Renewable Energy Management, Energy Efficiency Solutions, Carbon Accounting and Emissions Tracking, Smart Grid & Demand Response, Climate Modeling and Simulation |

| End Users | Utilities & Energy Providers, Businesses/Corporates, Manufacturing Industries, Environment Monitoring Agencies, Research Institutions & Labs |

| Regions Covered | West, South, Northeast, Midwest |

| Key Players Profiled | Tesla, Inc., Siemens AG, Schneider Electric, General Electric (GE), Vestas Wind Systems |

| Additional Attributes | Dollar sales by hardware, software, and end-user sectors, with a focus on renewable energy, energy storage, and environmental eco-conciousness trends |

The global demand for climate tech in USA is estimated to be valued at USD 13.6 billion in 2025.

The market size for the demand for climate tech in USA is projected to reach USD 111.6 billion by 2035.

The demand for climate tech in USA is expected to grow at a 23.4% CAGR between 2025 and 2035.

The key product types in demand for climate tech in USA are renewable energy devices, energy storage systems, waste management and recycling technologies, carbon capture and storage (ccs) technologies and building and construction technologies.

In terms of software, renewable energy management segment to command 26.1% share in the demand for climate tech in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Climate resilient Coffee Beans Market Size and Share Forecast Outlook 2025 to 2035

Climate Credit Analytics Market Insights - Growth & Forecast 2025 to 2035

Climate Tech Market by Hardware, by Software, By End User & Region Forecast till 2035

Automotive Climate Control Market Size and Share Forecast Outlook 2025 to 2035

Demand for Climate Tech in Japan Size and Share Forecast Outlook 2025 to 2035

Tech Savvy Hotel Chains Market Size and Share Forecast Outlook 2025 to 2035

Technical Films Market Size and Share Forecast Outlook 2025 to 2035

Technical Insulation Market Size and Share Forecast Outlook 2025 to 2035

Technical Textile Production Equipment Market Size and Share Forecast Outlook 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Technical Textiles Market Growth - Trends & Forecast 2025 to 2035

Analyzing Technical Films Market Share & Industry Leaders

Technical Fluids Market

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Edtech Market Size and Share Forecast Outlook 2025 to 2035

Catecholamines Market Size and Share Forecast Outlook 2025 to 2035

Catechins Market Trends - Growth & Industry Forecast 2025 to 2035

Adtech Market Growth - Size, Trends & Forecast 2025 to 2035

Global Catecholamine Market Analysis – Size, Share & Forecast 2024-2034

HR Tech Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA